Crop Insurance Market Size, Share, Trends and Forecast by Coverage, Distribution Channel, and Region, 2026-2034

Crop Insurance Market Size and Share:

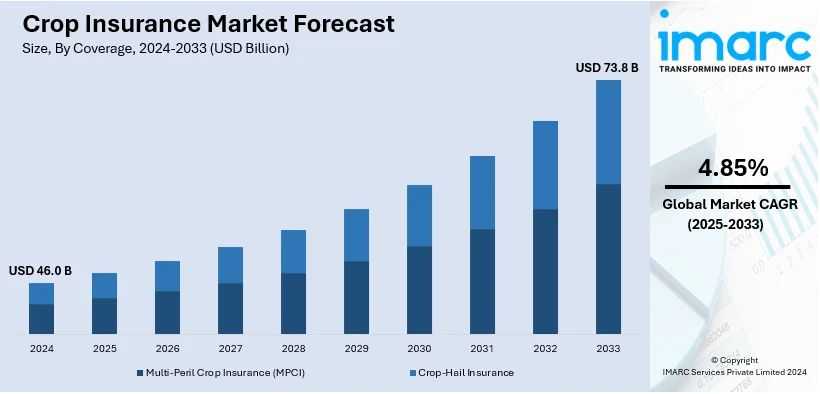

The global crop insurance market size reached USD 46.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 73.8 Billion by 2034, exhibiting a growth rate CAGR of 4.85% during 2026-2034. North America currently dominates the market, holding a market share of over 40% in 2024. The rising frequency of extreme weather conditions like droughts, floods and storms, increasing international trade of agricultural products, and growing introduction of mobile applications are some of the major factors propelling the market in North America.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 46.0 Billion |

|

Market Forecast in 2034

|

USD 73.8 Billion |

| Market Growth Rate (2026-2034) | 4.85% |

The growing incidence and intensity of extreme weather conditions, such as droughts, floods, and storms, have driven the growth of the crop insurance market. With global climate patterns now becoming more erratic, the likelihood of crop failure is much greater, which further jeopardizes the financial stability of the farmers. Crop insurance acts as a safety net that helps in the compensation of farmers' losses due to unfavorable weather conditions. With climate change likely to exacerbate weather extremes, crop insurance is increasingly in demand by regions that are at risk. It is in this context that the governments and private insurers have been prompted to design more specific and affordable insurance products that could help cushion the financial effects of unpredictable weather. As such, the crop insurance market is growing as farmers look for more reliable ways of insulating their livelihoods against an increasingly unpredictable nature.

To get more information on this market, Request Sample

The United States has emerged as a key regional market for crop insurance. This is due to the increased frequency of extreme weather events, such as floods, droughts, and hurricanes. Climate change is amplifying the weather patterns, which are becoming unpredictable and severe, threatening agricultural production. The farmers are increasingly exposed to these risks, leading to huge crop losses. Crop insurance is thus becoming a pivotal risk management tool. It provides protection for such unforeseen events, which helps farmers bounce back financially when disasters occur. The United States government is supporting this trend with subsidies and federal programs to make insurance more affordable and accessible. Therefore, this trend will entice more farmers to adopt crop insurance, further supporting the crop insurance market growth.

Crop Insurance Market Trends:

Increasing climate volatility and uncertainties

The increasing frequency of extreme weather events, such as droughts, floods, and storms, have led to the higher risks of agricultural yield, which, in turn, is escalating the demand for crop insurance. Additionally, the increasing susceptibility of crops to diseases and pests due to changing climate patterns is driving the demand for risk mitigation measures. Along with this, the rising awareness among farmers about the climate change impacts on agriculture is encouraging them to seek protection against yield uncertainties. Apart from this, the unpredictable rainfall patterns are impacting planting and harvesting seasons and elevating the need for financial protection against yield losses. Furthermore, data from the Copernicus Earth Observation Programme of the European Union shows that as of August 2024, the global average temperature anomaly is 0.70°C higher than the average from 1991 to 2020, which is the greatest for this period and 0.23°C warmer than the same period in 2023.

Technological advancements in agricultural practices

As per world bank data, agricultural advancement is one of the most effective means to eliminate extreme poverty, increase shared prosperity, and nourish an estimated 10 billion individuals by 2050. The increasing adoption of modern farming techniques like precision planting and data-driven practices is driving the need for innovative insurance solutions that cater to specific farm needs. Additionally, the rising use of advanced technologies is enabling accurate crop monitoring and allowing insurers to assess losses quickly and efficiently. Apart from this, the development of disease identification technology is enabling insurers to get timely compensation for disease-related losses. Furthermore, the integration of satellite data to track crop health and weather conditions is facilitating precise damage assessment and claims processing. Moreover, the introduction of mobile applications aids in simplifying insurance enrolment, claims submission, and communication between insurers and farmers.

Government support and agricultural policy initiatives

The regulatory bodies of different nations are undertaking various initiatives to increase awareness among farmers about the benefits of crop insurance policies. According to Economic Survey 2023-24 report, the Indian agriculture insurance sector is expected to expand after 2024 with a 2.5% increase in premiums, bolstered by technological innovations and government efforts. They are also offering premium subsidies to encourage participation in crop insurance programs. Additionally, they are streamlining regulatory frameworks to attract new insurers and enhance competition and innovation in crop insurance policies and claim processing. Along with this, they are continuously focusing on making crop insurance more accessible to farmers across diverse socio-economic backgrounds. Moreover, strategic collaborations between government agencies and insurers are facilitating data sharing and enabling accurate assessments and streamlined claims processing.

Crop Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global crop insurance market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on coverage and distribution channel.

Analysis by Coverage:

- Multi-Peril Crop Insurance (MPCI)

- Crop-Hail Insurance

Multi-peril crop insurance leads the market with around 75.0% of market share in 2024. The report has provided a detailed breakup and analysis of the market based on the coverage. This includes multi-peril crop insurance (MPCI) and crop-hail insurance. According to the report, multi-peril crop insurance holds the majority of the crop insurance market share as it offers protection against a wide range of perils, including adverse weather, pests, diseases, and other unforeseen events. Additionally, this comprehensive coverage resonates with farmers seeking a holistic risk management solution. Apart from this, it minimizes the financial impact of crop losses caused by unpredictable events and aids in promoting financial stability among farmers and supporting sustainable farming practices. Moreover, it simplifies the claims process by covering a spectrum of risks under a single policy and reduces administrative complexities for insurers and farmers. Furthermore, multi-peril crop insurance programs receive support and subsidies from government agencies.

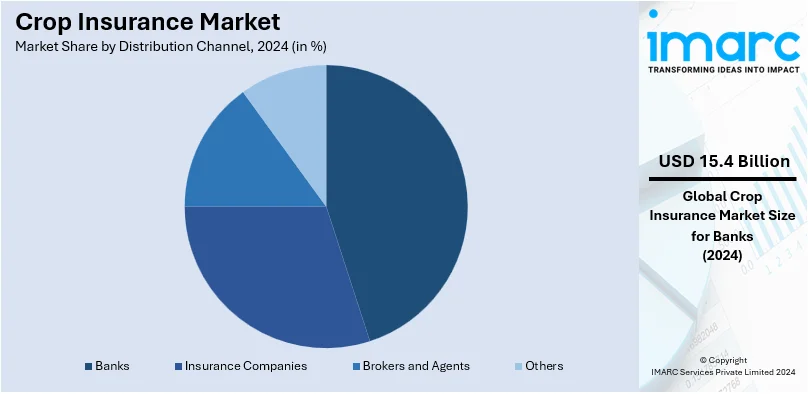

Analysis by Distribution Channel:

- Banks

- Insurance Companies

- Brokers and Agents

- Others

Banks leads the market with around 33.5% of market share in 2024. Banks offer crop insurance as an integrated part of their financial services portfolio. Additionally, banks promote insurance options during loan application processes by leveraging their existing relationships with farmers. Apart from this, banks provide a seamless way for farmers to secure insurance while managing their financial needs. Direct interaction with insurance companies allows farmers to customize coverage based on their specific needs. Insurance companies offer a range of policies catering to different crop types and risks. Additionally, insurance companies empower farmers to choose tailored solutions and ensure their protection aligns closely with their farming practices and risk exposure. Insurance brokers act as intermediaries between farmers and insurers, offering expert advice on policy selection and coverage nuances. Brokers have an in-depth understanding of various insurance offerings, enabling them to guide farmers in making informed decisions. Apart from this, agents offer personalized consultations, clarify doubts, and facilitate policy enrolment. They also bridge the gap between insurers and farmers, which makes insurance options more accessible and comprehensible within local contexts.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.0%. North America held the biggest crop insurance market share since the region has well-established financial institutions that facilitate seamless integration of crop insurance into financial planning and ensure ease of access. Additionally, the presence of a competitive private insurance sector alongside government programs enhances choices for farmers and promotes innovation and tailored coverage options. Apart from this, the agricultural heritage of the region cultivates an ingrained understanding of risk management in farming, further driving the demand for crop insurance to protect livelihoods. Furthermore, robust government-backed programs, like the Federal Crop Insurance Corporation (FCIC) in the U.S., provide substantial subsidies and incentives to farmers. This proactive support encourages high adoption rates among North American farmers.

Key Regional Takeaways:

United States Crop Insurance Market Analysis

The United States accounts for over 88% of the crop insurance market in North America. The market is primarily fueled by increasing climate volatility and federal support. The USDA's Risk Management Agency administers the Federal Crop Insurance Program, which has expanded greatly, offering coverage for over 100 crops. The greater relevance of risk management to agriculture is reflected in the crop insurance industry in the United States reporting more than USD 13 Billion in premiums for 2023. Severe weather events occurring regularly, such as hurricanes, floods, and droughts, have made financial protections much more important. Droughts in the Midwest had an impact on maize and soybean output in 2022, increasing insurance claims. The market's reach has also been increased using speciality crop insurance for organic, fruit and nut crops. This also improves risk assessment and policy customization through the use of leading-edge technologies such as precision agricultural instruments and satellite photography. In 2023, for instance, it was estimated that about 90% of the cropland planted for some crops like cotton, corn, and soybeans were insured, showing how highly American farmers still rely on insurance to protect their profits from the vagaries of weather and market swings.

Europe Crop Insurance Market Analysis

Europe's crop insurance industry is being driven by growing risks from climate change and government support in the form of subsidies. The European Union's Common Agricultural Policy (CAP) will subsidize 15% of EU farms to purchase insurance policies that can provide them with financial incentives. The increasing frequency of droughts, such as those that hit Southern Europe in 2022, has made people more aware of the value of crop insurance. Adoption is led by countries with high-peril multi-peril crop insurance programs that provide coverage in cases of loss due to frost, hail, or extreme rainfall conditions. In the past, technology has boosted underwriting accuracy through improvement in weather forecasting and AI-based risk modeling. The market is also growing with the spread of insurance to high-value crops such as grapes and olives, and even organic farming. Still driven by Europe's emphasis on sustainability and food security, this is still creating a demand for creative and all-inclusive crop insurance products.

Asia Pacific Crop Insurance Market Analysis

The Asia-Pacific region contains large agricultural economies such as China and India that are driving fast expansion of the Asia-Pacific crop insurance market. Over 37 lakhs Rabi crop farmers and 2 crore Kharif crop farmers are covered by India's Pradhan Mantri Fasal Bima Yojana (PMFBY) program in 2024, as per the data by Ministry of Agriculture, Indian Government. The increased frequency of droughts, floods, and cyclones has raised the need for crop insurance in the area. Some of the staple crops such as rice, wheat, and maize have insurance schemes subsidized by the government to protect farmers from financial loss. The new technologies, such as weather analytics and drone-based agricultural monitoring, improve the effectiveness of policies. Southeast Asia's emerging economies are seeing a rise in the use of insurance, especially for rice farming. The agricultural sector and vulnerability to climate change will continue to fuel the crop insurance industry in the region, especially with support from public-private partnerships.

Latin America Crop Insurance Market Analysis

Growing climatic risks and export-oriented agriculture are propelling the crop insurance business in Latin America. With 35% to 45% of farmers' premiums covered by government subsidies in 2023, Brazil leads the region. The country's sugarcane and soybean industries rely mostly on insurance to reduce the dangers of pests and droughts. Argentina and Mexico are also adopting multi-peril insurance plans to protect themselves from severe weather and volatile global commodity prices. International insurers and rising foreign investments in agribusiness are boosting access to crop insurance. Despite uneven regional uptake, government-backed programs and initiatives are driving steady expansion of financial inclusion.

Middle East and Africa Crop Insurance Market Analysis

Increasing food security and climate variability concerns are driving the crop insurance business in the Middle East and Africa (MEA). Programs for drought-resistant insurance, including those funded by the African Risk Capacity (ARC), are crucial to reducing agricultural losses in Africa. The investment in crop insurance by Saudi Arabia and Egypt is improving the sustainability of agriculture in those countries because of water constraint in the Middle East. The use of index-based insurance based on temperature or rainfall thresholds is becoming common in rural areas. Crop insurance has become important for resilience as many African countries' GDP largely relies on agriculture.

Competitive Landscape:

Leading companies are conducting workshops, webinars, and informational campaigns to educate farmers about the benefits and intricacies of crop insurance, which is empowering farmers to make informed decisions about their risk management strategies. Additionally, many insurers are working on climate-resilient insurance offerings that address the evolving risks associated with changing weather patterns and extreme events. Apart from this, many companies are offering user-friendly digital platforms for policy enrolment, claims submission, and communication to enhance the overall customer experience and make insurance processes more accessible and efficient for farmers. Furthermore, they are utilizing data analytics to create more precise risk assessment models and attract a wider consumer base.

The report provides a comprehensive analysis of the competitive landscape in the crop insurance market with detailed profiles of all major companies, including:

- Agriculture Insurance Company of India Limited

- AXA SA

- Chubb

- Farmers Mutual Insurance Agency Inc.

- FBL Financial Group, Inc

- Great American Insurance Company

- ICICI Lombard General Insurance Company Limited

- Kshema General Insurance Limited

- Progressive Ag

- Sompo International Holdings Ltd.

- Tokio Marine HCC

Latest News and Developments:

- December 2024: Indian Prime launched the Bima Sakhi Yojana, aimed at offering insurance to Indian women and enhancing their empowerment. With this initiative, women will have the opportunity to become Bima Sakhi (Insurance Sakhis), acting as community insurance agents. Women will receive training to market, oversee, and manage insurance products under this program, giving them a steady source of income and promoting financial inclusion in rural communities.

- December 2024: Agriculture Insurance Company of India (AIC) launched 'Fal Suraksha Bima,' an insurance product for banana and papaya crops, during its 22nd Foundation Day celebration. AIC also announced its initiative to adopt 22 villages under the “Sarba Bimit Gram” program to ensure comprehensive insurance coverage for rural households. The event highlighted AIC's dedication to farmer welfare and innovative crop protection solutions.

- November 2024: Lockton Re partnered with Verisk to develop innovative crop reinsurance products using advanced risk modeling solutions like MPCI and the Crop Hail Model. These models incorporate climate data and ENSO impacts, offering reinsurers data-driven tools to address increasing climate risks in agriculture. This collaboration aims to enhance risk transfer options in the growing US crop insurance market.

- October 2024: DAS came up with a geospatial crop insurance solution in Australia to address the $113 billion global crop protection gap. The solution uses machine learning and geospatial data to improve policy accuracy, reduce premium leakage, and enhance affordability for farmers. Australia serves as a test market, with plans for global expansion.

- June 2024: Kshema General Insurance launched a nationwide campaign to promote its crop insurance products, Sukriti and Prakriti, during the Kharif season. The campaign, led by Mudramax, uses TV, print, digital, and outdoor media to highlight affordable insurance starting at ₹499 per acre, protecting over 100 crops against climate risks. The initiative aims to enhance financial resilience for farmers facing frequent natural perils.

Crop Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Coverages Covered | Multi-Peril Crop Insurance (MPCI), Crop-Hail Insurance |

| Distribution Channels Covered | Banks, Insurance Companies, Brokers and Agents, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agriculture Insurance Company of India Limited, AXA SA, Chubb, Farmers Mutual Insurance Agency Inc., FBL Financial Group, Inc, Great American Insurance Company, ICICI Lombard General Insurance Company Limited, Kshema General Insurance Limited, Progressive Ag, Sompo International Holdings Ltd., Tokio Marine HCC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the crop insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global crop insurance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the crop insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Crop insurance is a type of coverage designed to protect farmers and agricultural producers from financial losses due to events that affect crop production, such as natural disasters, adverse weather conditions, or unexpected yield reductions. It typically comes in two main forms: yield-based insurance, which covers losses in the amount of crop yield, and revenue-based insurance, which compensates for losses in both yield and market price.

The crop insurance market was valued at USD 46.0 Billion in 2024.

IMARC estimates the global crop insurance market to exhibit a CAGR of 4.85% during 2025-2033.

The market is primarily driven by the growing worldwide trade of agricultural products, the increasing occurrence of extreme weather events like storms, floods, and droughts, and the expanding use of mobile applications.

In 2024, multi-peril crop insurance represented the largest segment as it protects against a wide range of hazards, such as bad weather, pests, infections, and other unforeseen events.

Banks leads the market as banks offer insurance solutions during loan applications by using their existing contacts with farmers.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global crop insurance market include Agriculture Insurance Company of India Limited, AXA SA, Chubb, Farmers Mutual Insurance Agency Inc., FBL Financial Group, Inc, Great American Insurance Company, ICICI Lombard General Insurance Company Limited, Kshema General Insurance Limited, Progressive Ag, Sompo International Holdings Ltd., Tokio Marine HCC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)