Crime Risk Report Market Size, Share, Trends and Forecast by Type, Deployment, Application, and Region, 2025-2033

Crime Risk Report Market Size and Overview:

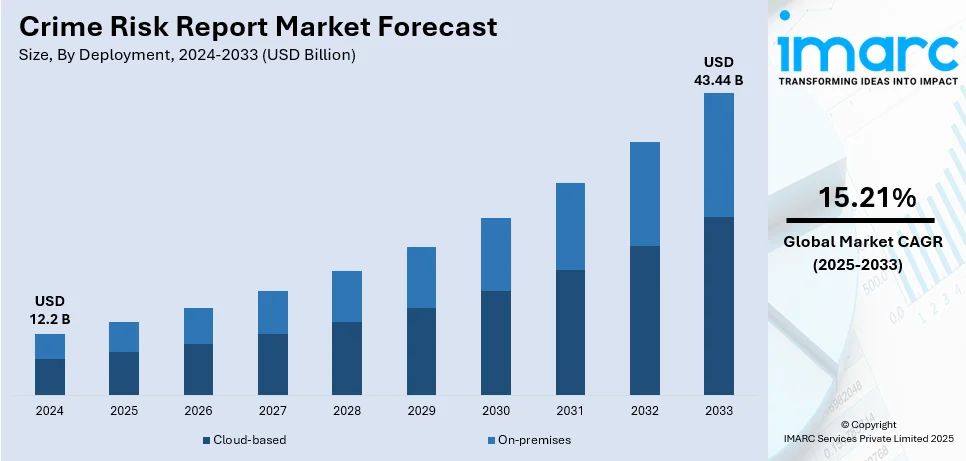

The global crime risk report market size was valued at USD 12.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 43.44 Billion by 2033, exhibiting a CAGR of 15.21% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.2% in 2024. The rising demand for crime risk reports in the BFSI industry, the growing adoption of cloud-based solutions, and the recent development of advanced predictive analytics represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.2 Billion |

| Market Forecast in 2033 | USD 43.44 Billion |

| Market Growth Rate (2025-2033) | 15.21% |

The crime risk report market growth is driven by several factors, including the rise in cybercrime, financial fraud, and physical crimes across various sectors. As businesses increasingly digitalize, the need to safeguard sensitive data and mitigate risks such as identity theft, hacking, and financial fraud grows. Government regulations and compliance standards, especially in industries like banking, healthcare, and retail, push organizations to implement crime risk reports for proactive risk management. Additionally, advancements in data analytics, artificial intelligence, and machine learning enhance the precision of crime risk assessments, making them more effective for detecting and preventing threats. Rising concerns about public safety and asset protection also drive the demand for detailed crime reports from both government agencies and private enterprises. The factors, collectively, are creating a crime risk report market outlook across the globe.

The crime risk report market in the United States is driven by the increasing prevalence of cybercrime, financial fraud, and regulatory compliance needs. According to industry reports, identity theft accounted for 18% of recorded fraud, while impostor schemes accounted for 15%. The key way that identity theft occurred was through credit card fraud. In total, there were 18,327 identity theft reports, and Maryland lost $164.3 million due to fraud. As digital transactions and online services expand, the risk of identity theft, data breaches, and financial fraud rises, creating a growing demand for comprehensive risk assessments. Government and law enforcement agencies rely on crime risk reports to enhance public safety and manage criminal activity, which is facilitating the crime risk report market demand. Additionally, businesses across sectors, including banking, healthcare, and retail, are compelled to meet regulatory requirements, such as data protection laws, leading to increased reliance on crime risk analytics. Advancements in technology, such as AI and machine learning, improve the accuracy and predictive capabilities of crime risk reports, further boosting adoption. The rise in urbanization and public safety concerns also contribute to market growth.

Crime Risk Report Market Trends:

Technological Advancements in Crime Prevention

Artificial intelligence (AI) and machine learning (ML) integration is changing crime risk management. With AI, a threat can be detected in real-time, predicting and automatically taking responses that better enable the prevention and addressing of crimes. AI, in sectors like law enforcement, finance, and retail, scans large data to find patterns or predict possible actions by criminals and offers alerts on time to prevent crime. Surveillance systems, ranging from facial recognition to behavioral analysis, have significantly improved the detection of high-risk areas and thereby prevented more crime. Another use of automated drones and robots to patrol and secure public spaces is now increasingly practiced, thus increasing the efficiency of detecting crime. These will be followed by more sophisticated means of predicting and responding to real-time crime risks, thereby contributing to increased public safety in general and lower crime rates. In line with these advancements, in September 2024, Oracle launched a cutting-edge solution to help banks and fintech companies identify financial crime risks in advance, reduce compliance costs, and adhere to Anti-Money Laundering (AML) standards. The service uses granular reporting and role-based analytics to monitor and respond to financial crime risks, enhancing the ability to combat evolving crime tactics.

Increased Focus on Cybersecurity

Amid the rising menace of cybercrimes, companies worldwide are focusing more on cybersecurity. The speedy digital transformation in all industries and augmented cybercriminal activities have given massive cause for concern over data breaches, ransomware, phishing, and other malicious activities. Businesses are implementing advanced cybersecurity measures such as multi-factor authentication (MFA), encryption, firewalls, intrusion detection systems, and so on. Cybersecurity services that will include continuous monitoring, vulnerability assessment, and even response to incidents have created new needs. Governments are tightening data protection laws, leading businesses to enforce stronger cybersecurity frameworks, which also represents one of the key crime risk report market trends. For example, in 2023, the U.S. government spent billions of dollars on cybersecurity, including around USD 3 billion from the Department of Homeland Security for civilian cybersecurity and about USD 1.3 billion from the Department of Justice on cybersecurity initiatives. The fact that cybercriminals continue to adapt and exploit the vulnerabilities in the digital infrastructures will continue propelling the market for cybersecurity into the future. Increasingly, companies are investing in both preventive and reactive measures to protect sensitive data, prevent loss of their reputation, and minimize financial losses due to cybercrime.

Rising Demand for Crime Risk Insurance

Increasingly, frequent natural disasters, civil unrest, and cyberattacks have raised the demand for crime risk insurance. Companies and individuals have increased their vulnerability to crime, making them look for products that would comprehensively protect them from the various forms of risks involved. Cybercrime, theft, fraud, and vandalism are the biggest issues nowadays, causing companies to search for policies tailored to minimize losses incurred through criminal activity. Crime risk insurance is important to organizations to protect the operations due to increasing costs of crimes such as intellectual property theft and data breaches. In 2023, according to an industry report, the cost of non-health insurance fraud in the U.S. was estimated to be over USD 80 billion, further driving the need for such insurance. With an increase in civil unrest and political instability cases around the world, the idea of business loss through property damage, theft, and business interruption caused by crime has become one of the reasons organizations are purchasing insurance solutions. This trend highlights a growing awareness of crime risks and the need for proactive measures to ensure financial protection against unforeseen events.

Crime Risk Report Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global crime risk report market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, deployment, and application.

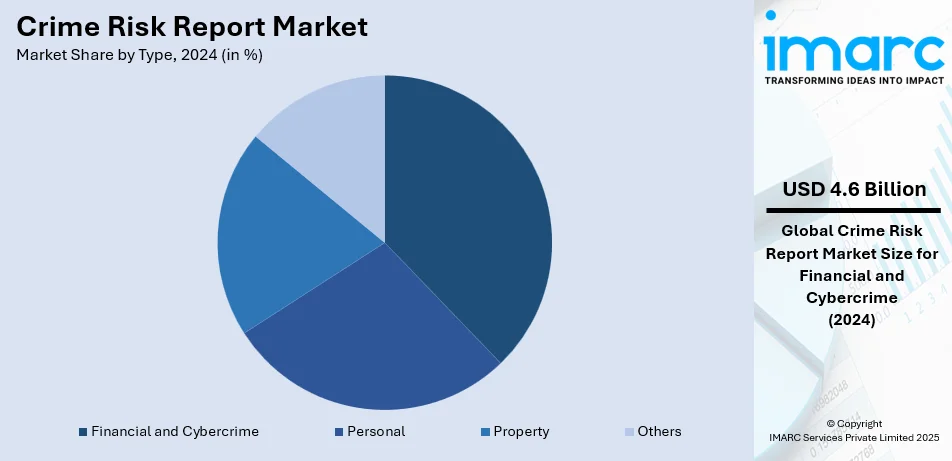

Analysis by Type:

- Financial and Cybercrime

- Personal

- Property

- Others

Financial and cybercrime leads the market with around 37.7% of crime risk report market share in 2024. Financial and cybercrime hold the largest share of the crime risk report market due to their increasing prevalence and significant impact on businesses and individuals. The rise of digitalization, online transactions, and remote work has expanded vulnerabilities to cyber threats such as data breaches, identity theft, and fraud. Financial crimes, including money laundering and embezzlement, further drive demand for detailed risk assessments. Organizations prioritize crime risk reports to safeguard assets, comply with regulatory requirements, and mitigate potential losses. As these crimes evolve in sophistication and frequency, businesses rely on comprehensive reporting to proactively address risks and enhance their security measures.

Analysis by Deployment:

- Cloud-based

- On-premises

On-premises solutions hold the largest share of the crime risk report market due to their enhanced data security, control, and customization capabilities. Organizations handling sensitive information, such as financial institutions and government agencies, prefer on-premises deployments to ensure compliance with strict regulatory requirements and minimize risks of data breaches. These solutions offer greater control over data management and infrastructure, making them ideal for industries prioritizing confidentiality. Additionally, on-premises systems provide robust performance, reliability, and integration with existing frameworks. Despite the growth of cloud-based alternatives, on-premises deployments remain a preferred choice for enterprises seeking tailored, secure, and compliant crime risk management solutions.

Analysis by Application:

- BFSI

- Government

- Real Estate

- Others

Governments hold the largest share of the crime risk report market due to their critical role in maintaining public safety, enforcing laws, and combating various crimes, including financial and cyber threats. Government agencies rely on crime risk reports for strategic planning, resource allocation, and policy-making to address emerging threats effectively. These reports help in identifying high-risk areas, monitoring criminal activity, and ensuring regulatory compliance. Additionally, increasing investments in national security, law enforcement, and public safety infrastructure drive demand. Governments also collaborate with private sectors to access advanced crime analytics, reinforcing their reliance on comprehensive crime risk assessments to protect citizens and assets.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.2%. The crime risk report market in North America is driven by increasing concerns about financial and cybercrimes, such as data breaches, identity theft, and fraud, fueled by the rise of digitalization and online transactions. Government and law enforcement agencies, as well as private organizations, rely on crime risk assessments to enhance public safety and secure critical assets. Stringent regulatory requirements and compliance mandates, particularly in sectors like banking, healthcare, and retail, further boost demand. Advancements in data analytics and predictive technologies enhance the accuracy and usability of crime risk reports, driving adoption. Additionally, the growing need for business continuity planning and security in urban areas contributes to the market's expansion across the region.

Key Regional Takeaways:

United States Crime Risk Report Market Analysis

The U.S. crime risk report market is fueled by huge investments in security infrastructure and public safety programs. As reported by the White House, in 2024, the President's Budget has provided for a total of USD 385 million to be made available through FEMA for the Nonprofit Security Grant Program-an increase of USD 80 million above the FY 2023 budget. Funding under this program focuses on increasing the security for nonprofits, which may include improving detection and prevention crime technologies. The U.S. Department of Justice is investing more in sophisticated crime reporting systems, such as AI-based analysis tools for immediate crime analysis and risk management. The private sector, including the insurance and finance sectors, increasingly uses data-based crime risk reports for risk assessment and mitigation. The U.S. crime risk report market is growing continuously because of all these efforts.

Europe Crime Risk Report Market Analysis

The crime risk report market in Europe is growing gradually, with the increasing concerns over terrorism, cybercrime, and organized crime. The European Investment Bank (EIB) launched SESI in 2022 to support research and development in security infrastructure, cybersecurity, and other technologies. By June 2023, the EIB had increased its security and defense funding to EUR 8 billion (USD 8.84 billion). There are even stronger pressures from growing dependence on private companies, insurance providers, and financial institutions to provide estimates of the risk of crime. The significant investments made by governments in UK, Germany, and France into security infrastructure have all led to increasing the need for good assessments of the crime risk. AI and blockchain are increasingly being adopted for crime risk management, and companies such as Thales Group are at the forefront of developing secure reporting platforms. Europe's stringent data protection regulations also ensure a steady demand for secure and compliant crime reporting services.

Asia Pacific Crime Risk Report Market Analysis

The Asia Pacific crime risk report market is growing fast, influenced by urbanization, increased security risks, and advancements in technology. According to the National Bureau of Statistics (NBS) of China, in 2022, China spent approximately 1.45 trillion yuan (USD 230 billion) on public security, which indicates how much crime risk management is crucial. The National Bureau of Statistics shows that India allocated approximately USD 75 billion into its defense budget for 2023-2024. Under the "Make in India" initiative, India is committed to indigenous production. Japan and South Korea have also been investing in high technologies that help detect crime risks by means of AI-powered crime predictions as cybercrime and terrorism issues have been on the rise. Predictive analytics in crime reporting services is on the rise throughout the region, led by innovators like NEC Corporation. Government initiatives to enhance the public safety infrastructure are boosting the market even further in the Asia Pacific region.

Latin America Crime Risk Report Market Analysis

Rising crime rates and the demand for security solutions in Latin America have led to the growth of the crime risk report market. As per an industry report, Brazil allocated approximately BRL 137.9 billion (USD 28.40) to public security in 2023, leading to investments in technologies for analyzing and reporting on crime data. In addition, the International Trade Administration, in 2023, noted Brazil had more than 23 billion attempted cyberattacks; this trend represents the rising need for cybersecurity and crime risk management tools. Increasing crime worries within countries like Mexico and Colombia see increased reliance on private and public organizations to rely on data-driven crime reports in their risk mitigation measures. Increasing the use of mobile applications for reporting crime and increasing the use of AI in crime analytics are other factors contributing to crime risk report market growth. Companies such as Sesprom and InSight Crime are setting the pace by providing detailed crime risk reports and analysis. The market is also supported by international partnerships that improve local crime reporting systems.

Middle East and Africa Crime Risk Report Market Analysis

The crime risk report market in the Middle East and Africa is increasingly on the demand list of the private and public sectors. It was reported that, according to African Union research, Africa spent around USD 10 billion in 2022 on security, underscoring how essential crime risk management must be to these sectors. Countries like the UAE and South Africa are investing in advanced crime reporting technologies, including smart surveillance systems and AI-driven crime analysis tools. The reliance on data-driven insights to manage risk in countries like Nigeria and Kenya is also opening up opportunities for crime risk report providers. Global players like Honeywell and Deloitte are collaborating with local governments to enhance the security infrastructure in the region, which also aims at improving crime reporting capabilities. As terrorism and organized crime become growing concerns, demand for crime risk reports is likely to grow steadily.

Competitive Landscape:

The crime risk report market is competitive, driven by the increasing demand for advanced analytics to mitigate financial, cyber, and physical crimes. Key players include LexisNexis Risk Solutions, FICO, Experian, IBM, and SAS, offering crime risk assessment tools with predictive analytics and AI-powered insights. These companies focus on innovation, integrating machine learning, real-time monitoring, and geospatial analysis to enhance report accuracy and usability. Strategic collaborations with government agencies, law enforcement, and private enterprises strengthen their market position. Regional players compete by providing customized, cost-effective solutions. The market is further shaped by investments in R&D, expanding product portfolios, and addressing emerging threats like cybercrime, making innovation and adaptability critical for maintaining competitive advantage.

The report has also provided a comprehensive analysis of the competitive landscape in the global crime risk report market. Some of the companies covered include:

- ACI Worldwide Inc.

- CAP Index Inc.

- Experian Information Solutions Inc. (Experian PLC)

- Fenergo Ltd.

- Fiserv Inc.

- Intelligent Direct Inc.

- Location Inc. (CoreLogic Inc.)

- NIice Ltd.

- Oracle Corporation

- Pinkerton Consulting & Investigations Inc. (Securitas Security Services USA Inc.)

- Refinitiv

- SAS Institute Inc.

Kindly note that this only represents a partial list of companies and the complete list has been provided in the report.

Recent Developments:

- September 2024: Oracle launched its Financial Crime and Compliance Management Monitor Cloud Service. This cutting-edge solution allowed banks and fintechs to identify financial crime risks in advance, reduce compliance costs, and adhere to AML standards by providing granular reporting and role-based analytics that could be effective in the compliant efforts in view of changing financial crime tactics.

Crime Risk Report Market Report Scope:

| Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Financial and Cybercrime, Personal, Property, Others |

| Deployments Covered | Cloud-based, On-premises |

| Applications Covered | BFSI, Government, Real Estate, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACI Worldwide Inc., CAP Index Inc., Experian Information Solutions Inc. (Experian PLC), Fenergo Ltd., Fiserv Inc., Intelligent Direct Inc., Location Inc. (CoreLogic Inc.), NIice Ltd., Oracle Corporation, Pinkerton Consulting & Investigations Inc. (Securitas Security Services USA Inc.), Refinitiv, SAS Institute Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the crime risk report market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global crime risk report market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the crime risk report industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The crime risk report market was valued at USD 12.2 Billion in 2024.

The crime risk report market is projected to exhibit a CAGR of 15.21% during 2025-2033, reaching a value of USD 43.44 Billion by 2033.

The crime risk report market is driven by the rise in cybercrime, financial fraud, and regulatory compliance requirements across industries. Advancements in data analytics and AI enhance report accuracy. Increased government and corporate focus on public safety, asset protection, and risk management further fuels the demand for crime risk assessments.

North America currently dominates the composite preforms market, accounting for a share of 35.2%. Increasing cybercrimes, financial fraud, regulatory requirements, advancements in data analytics, government and corporate demand for security, and compliance drive growth.

Some of the major players in the global crime risk report market include ACI Worldwide Inc., CAP Index Inc., Experian Information Solutions Inc. (Experian PLC), Fenergo Ltd., Fiserv Inc., Intelligent Direct Inc., Location Inc. (CoreLogic Inc.), NIice Ltd., Oracle Corporation, Pinkerton Consulting & Investigations Inc. (Securitas Security Services USA Inc.), Refinitiv, SAS Institute Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)