Crash Barrier Systems Market Size, Share, Trends and Forecast by Type, Technology, Application, and Region, 2025-2033

Crash Barrier Systems Market Size and Share:

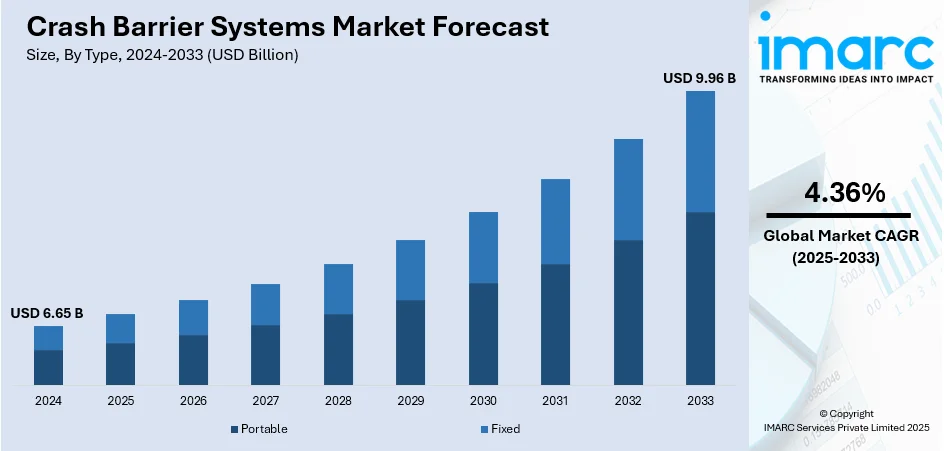

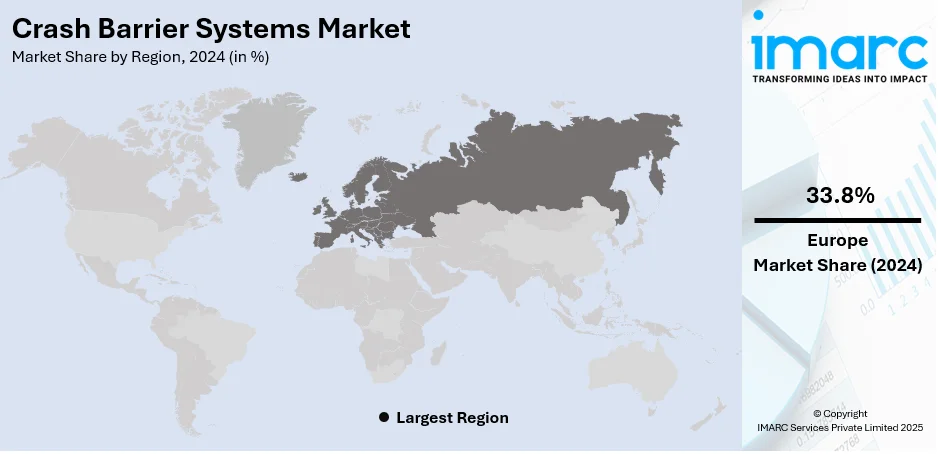

The global crash barrier systems market size was valued at USD 6.65 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.96 Billion by 2033, exhibiting a CAGR of 4.36% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 33.8% in 2024. This dominance is driven by stringent road safety regulations, advanced infrastructure, and high vehicle density across the region. Key countries like Germany, France, and the UK significantly contribute to Europe’s crash barrier systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.65 Billion |

|

Market Forecast in 2033

|

USD 9.96 Billion |

| Market Growth Rate 2025-2033 | 4.36% |

The market is experiencing robust growth due to increasing investments in highway expansion projects and the modernization of transportation infrastructure in emerging economies. For instance, as per industry reports, India has the second-largest road network, covering 5.89 million kilometers. Roads carry 64.5% of all goods across the nation and serve 90% of India’s total passengers. Rising concerns regarding vehicular safety and passenger protection are compelling governments to implement stricter safety norms, necessitating advanced barrier installations. Technological innovations, including energy-absorbing and movable barrier systems, are gaining prominence for their superior impact mitigation capabilities. Additionally, the growing trend toward smart transportation networks is encouraging the integration of intelligent safety features in crash barriers. Increased urbanization and the proliferation of high-speed roadways further accelerate demand, as ensuring public safety in densely trafficked areas becomes an infrastructure planning priority.

To get more information on this market, Request Sample

In the United States, the crash barrier systems market growth is driven by an aging roadway infrastructure requiring urgent upgrades to meet current federal and state safety standards. The surge in freight and commercial vehicle movement has heightened the need for durable and high-performance barrier systems along critical transportation corridors. Emphasis on reducing accident-related fatalities under national programs like Vision Zero is spurring the adoption of innovative barrier technologies. Additionally, government funding through initiatives such as the Infrastructure Investment and Jobs Act (IIJA) is enabling large-scale road safety enhancements. Urban development projects and increased investment in smart mobility corridors in the country are further shaping the crash barrier systems market outlook.

Crash Barrier Systems Market Trends:

Surge in Road Accident

The alarming rise in global road accidents and fatalities is significantly boosting the adoption of crash barrier systems. As per the United Nations Institute for Training and Research, 1.19 million people die annually due to road traffic incidents, with 20 to 50 million others sustaining injuries, many resulting in long-term disability. These staggering figures are prompting governments to invest in roadside safety infrastructure, including barriers, especially along accident-prone zones. Heightened public awareness of road safety and the physical consequences of collisions is encouraging the integration of crash barriers in both new and existing road networks.

Urbanization and Infrastructure Growth

Rising urbanization and the rapid expansion of transportation infrastructure are one of the key crash barrier systems market trends. Currently, over 50% of the global population lives in urban areas, a figure projected to reach two-thirds by 2050, according to UN forecasts. This demographic shift necessitates the construction and enhancement of high-capacity roadways, expressways, and bridges, where crash barriers play a vital safety role. In many nations, infrastructure upgrades include replacing outdated systems with modern barrier technologies to meet evolving safety standards. The continued push for urban mobility, smart city projects, and improved traffic flow is amplifying demand for advanced and modular crash barrier solutions, especially in densely populated and high-traffic regions, making infrastructure development a central trend shaping the market.

Regulatory Mandates and Smart Technologies Redefining Safety Standards

The global crash barrier systems market is undergoing transformation through the combined effect of regulatory mandates and technological innovation. In response to international targets such as the WHO's 50% reduction goal for road injuries and fatalities by 2030, numerous governments are enforcing laws that require crash barriers on highways, bridges, and hazardous curves. Simultaneously, technological advancements, like automatic crash detection, real-time data transmission, and impact-absorbing materials, are reshaping traditional barrier systems. Intelligent infrastructure is being promoted in smart cities, with barriers integrated into connected traffic systems. These innovations not only enhance protection but also facilitate faster emergency response. As public and private sectors align to improve road safety, regulatory enforcement coupled with digital innovation is emerging as a defining market trend.

Crash Barrier Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global crash barrier systems market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, and application.

Analysis by Type:

- Portable

- Fixed

Fixed stands as the largest type in 2024, holding around 63.8% of the market. The fixed segment dominates the crash barrier systems market due to its extensive application in permanent infrastructure such as highways, bridges, and urban road networks. Governments and transportation authorities widely adopt fixed barriers because of their proven durability, long service life, and ability to provide continuous protection against vehicle collisions. Unlike movable or temporary barriers, fixed systems require less maintenance once installed and offer higher strength in absorbing impact, making them a preferred choice for large-scale roadway safety projects. Their reliability in reducing accident severity and meeting stringent regulatory standards further reinforces the dominance of the fixed segment.

Analysis by Technology:

- Rigid

- Semi-Rigid

- Flexible

Rigid leads the market with around 47.6% of market share in 2024. The rigid segment dominates the crash barrier systems market due to its superior strength, durability, and ability to provide maximum protection in high-impact collisions. These barriers are widely installed on highways, bridges, and critical urban infrastructures where preventing vehicle penetration is essential for safety. Made from robust materials such as concrete and steel, rigid barriers effectively absorb and redirect impact forces, minimizing the risk of secondary accidents. Their low maintenance requirements, long service life, and compliance with stringent road safety regulations further support their extensive adoption. Consequently, rigid crash barriers remain the preferred choice for large-scale infrastructure projects.

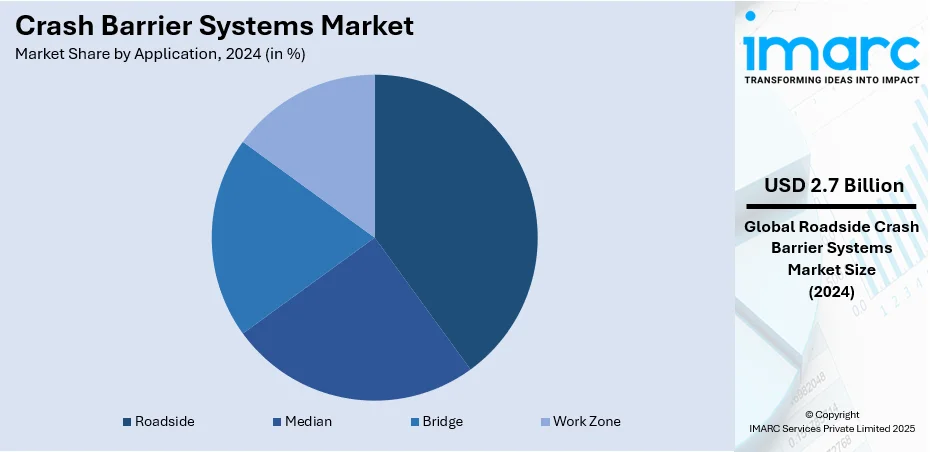

Analysis by Application:

- Roadside

- Median

- Bridge

- Work Zone

Roadside leads the market with around 40.0% of market share in 2024. The roadside segment dominates the crash barrier systems market due to its extensive deployment across highways, urban roads, and rural routes to enhance vehicle and pedestrian safety. Roadside barriers are critical in preventing vehicles from veering off the road, colliding with obstacles, or entering dangerous zones such as slopes, trees, or utility poles. Governments and transportation authorities prioritize roadside safety infrastructure as part of road expansion and modernization projects, driving large-scale installations. Rising vehicle ownership and accident rates further amplify demand. Continuous investments in infrastructure development and regulatory mandates ensure the widespread adoption of roadside crash barrier systems globally.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 33.8%. Europe dominates the crash barrier systems market due to its strict road safety regulations, high investment in transportation infrastructure, and strong enforcement of vehicle and pedestrian protection standards. For instance, in April 2025, the European Commission proposed new road safety and vehicle registration rules aimed at cutting road deaths by 50% by 2030 and achieving near-zero fatalities by 2050. Key measures include annual inspections for vehicles over 10 years old, advanced emissions testing, digital registration documents, and anti-fraud odometer tracking. The rules target unsafe, ageing, and high-emitting vehicles. The EU estimates these changes could save 7,000 lives and prevent 65,000 serious injuries between 2026 and 2050. Governments across the region prioritize reducing road fatalities through advanced safety measures, encouraging widespread installation of crash barriers on highways, urban roads, and bridges. The presence of established manufacturers and continuous technological innovation further strengthen market adoption. Additionally, ongoing upgrades to aging infrastructure, coupled with EU-driven initiatives for sustainable and safe mobility, ensure consistent demand. These factors collectively reinforce Europe’s leading position in the global crash barrier systems market.

Key Regional Takeaways:

United States Crash Barrier Systems Market Analysis

In 2024, the United States held a market share of around 83.70% in North America. The United States crash barrier systems market is witnessing substantial growth due to increased investments in highway modernization and infrastructure redevelopment projects. The surge in vehicle density and freight movement across interstate corridors has created a heightened need for advanced safety infrastructure, including high-performance crash barriers. In support of this, the American Trucking Associations projects that after two years of declines, truck volumes are expected to grow by 1.6% in 2025 and ultimately reach nearly 14 Billion Tons by 2035. This expected freight boom underscores the critical need for reinforced safety systems along highways and distribution routes. Additionally, the integration of smart technologies such as sensor-embedded barriers for real-time traffic monitoring is gaining momentum, enhancing the demand for intelligent barrier solutions. The expansion of urban transit systems and the redevelopment of aging roads and bridges are further driving installations across metropolitan and suburban areas. Furthermore, the growing implementation of traffic calming measures in urban planning, especially in pedestrian-heavy zones, is encouraging the adoption of energy-absorbing barrier designs. Environmental sustainability is also becoming a focal point, leading to the use of recyclable materials and eco-efficient barrier manufacturing processes.

Europe Crash Barrier Systems Market Analysis

The Europe crash barrier systems market is expanding in response to growing initiatives for road network optimization and increased emphasis on commuter safety in high-speed transit zones. Rapid expansion of cross-border logistics and freight corridors across the Schengen area is accelerating the demand for effective roadside protection infrastructure. In a major funding initiative, the European Commission selected 94 transport projects to receive nearly approximately USD 3.03 Billion in EU grants under the Connecting Europe Facility (CEF), promoting greater integration of safety infrastructure across trans-European networks. Moreover, the adoption of aesthetic and modular barrier solutions is rising as urban development projects focus on harmonizing functionality with environmental and visual appeal. The integration of barrier systems into green infrastructure projects, such as noise-reducing road layouts and eco-bridges, is boosting market expansion, while rising demand for versatile crash barrier technologies is driven by mixed traffic innovations.

Asia Pacific Crash Barrier Systems Market Analysis

In the Asia Pacific region, the crash barrier systems market is experiencing robust growth driven by rapid urbanization and increased government expenditure on expressway expansion. With the proliferation of mega infrastructure projects, including flyovers, elevated corridors, and urban bypasses, the demand for specialized barrier systems to prevent vehicle run-offs and enhance multi-lane road safety is increasing. Significantly, the Ministry of Road Transport & Highways (India) reported that the budgetary allocation for road transport and highways has increased to approximately USD 36 Billion in 2024–25. This sharp rise in public spending is stimulating widespread deployment of crash barriers across key highway and expressway corridors. Furthermore, the rise in public-private partnerships is accelerating the rollout of safety infrastructure across both urban and rural regions. The development of new industrial corridors and port connectivity projects is also driving barrier installations in high-traffic zones.

Latin America Crash Barrier Systems Market Analysis

The crash barrier systems market in Latin America is growing steadily due to the development of interregional roadways and elevated concern for commuter safety in expanding metropolitan zones. The construction of bypasses and ring roads to alleviate congestion in major cities is generating demand for efficient barrier systems to manage increased vehicular flow. In Brazil, the World Bank has approved a USD 250 Million Green and Resilient SP Metro Line 2 Extension project to support sustainable public transport expansion in São Paulo, as per the World Bank. While focused on metro development, such large-scale urban mobility investments typically necessitate complementary surface-level safety infrastructure, including crash barriers for access to roads and feeder traffic zones. Rural connectivity programs and logistics hubs promote safety features along newly developed transport routes, while special economic zones encourage barrier systems for heavy commercial vehicle movement.

Middle East and Africa Crash Barrier Systems Market Analysis

The Middle East and Africa crash barrier systems market is gaining traction with the development of cross-border transport corridors and economic diversification strategies that emphasize logistics infrastructure. According to recent reports, the kingdom’s logistics market is expected to reach USD 38.8 Billion by 2026, growing at a CAGR of 5.85%, highlighting strong investments in freight and transport safety infrastructure. The increasing frequency of long-distance passenger and freight movement has highlighted the importance of highway safety enhancements, including energy-dissipating barriers. Additionally, growing investments in airport access roads, desert highways, and trade zone infrastructure are fueling the need for advanced barrier systems capable of withstanding extreme environmental conditions. Public sector-led urban mobility plans are also promoting the integration of crash barriers into newly constructed arterial roads and transit corridors.

Competitive Landscape:

The competitive landscape of the crash barrier systems market is characterized by continuous innovation, regulatory compliance, and infrastructure investment. Companies compete by offering durable, cost-efficient, and technologically advanced solutions that meet stringent safety standards across highways, urban networks, and industrial zones. Partnerships with governments and construction contractors are central to securing large-scale projects. For instance, in August 2025, Safe Direction introduced the TALL42 Movable Barrier, a freestanding, concrete road barrier system developed by Moovop Inc., designed for dynamic traffic lane reconfiguration using a transfer machine. It meets MASH Test Level 3 and 4 standards and is ideal for contraflow and construction zones. Compatible with the QUASH crash cushion, TALL42 improves safety and reduces congestion during peak hours and roadworks. The system’s fast repositioning and glare-reducing height make it suitable for both temporary and permanent installations. With road safety remaining a policy priority worldwide, the crash barrier systems market forecast is projecting steady adoption, supported by modernization of transport infrastructure, smart city initiatives, and integration of advanced monitoring technologies to enhance accident prevention and minimize road fatalities.

The report provides a comprehensive analysis of the competitive landscape in the crash barrier systems market with detailed profiles of all major companies, including:

- Arbus Limited (ARBUS GROUP LTD)

- Avon Barrier Corporation Ltd (Tppg The Perimeter Protection Group AB)

- Hill Smith Holdings PLC

- Lindsay Corporation

- Nucor Corporation

- Pinax Steel Industries

- Roadsafe Traffic System,Inc.

- Tata Steel (Tata Group)

- Transpo Industries Inc.

- Valmont Industries, Inc.

- Valtir, LLC

Latest News and Developments:

- August 2025: Delta Scientific Corporation unveiled its latest innovation: the DSC50 “S” Barrier. This lightweight, crash-rated security solution is specifically designed for temporary deployment in high-traffic urban environments. The DSC50 “S” Barrier offers enhanced security for critical infrastructure and public spaces, providing robust protection while being easy to transport and install.

- June 2024: Lindsay Corporation installed its first TAU-XR Xpress Repair Crash Cushion, the latest innovation in its proven lineup of crash cushion systems. The TAU-XR is designed for swift installation and rapid repair, enhancing both efficiency and protection for road maintenance teams.

Crash Barrier Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Portable, Fixed |

| Technologies Covered | Rigid, Semi-Rigid, Flexible |

| Applications Covered | Roadside, Median, Bridge, Work Zone |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arbus Limited (ARBUS GROUP LTD), Avon Barrier Corporation Ltd (Tppg The Perimeter Protection Group AB), Hill Smith Holdings PLC, Lindsay Corporation, Nucor Corporation, Pinax Steel Industries, Roadsafe Traffic System,Inc., Tata Steel (Tata Group), Transpo Industries Inc., Valmont Industries, Inc. Valtir, LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the crash barrier systems market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global crash barrier systems market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the crash barrier systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The crash barrier systems market was valued at USD 6.65 Billion in 2024.

The crash barrier systems market is projected to exhibit a CAGR of 4.36% during 2025-2033, reaching a value of USD 9.96 Billion by 2033.

The market is driven by increasing road safety concerns, rising traffic volumes, and a surge in road accidents worldwide. Growing government initiatives like the WHO's Decade of Action for Road Safety (2021–2030) and stricter regulations mandating the installation of crash barriers on highways, bridges, and sharp turns are contributing to market growth. Additionally, urbanization, infrastructure development, and the integration of smart crash barrier technologies are further enhancing demand globally.

Europe currently dominates the crash barrier systems market, holding a significant share of over 33.8% in 2024. This leadership is attributed to its well-established transport infrastructure, strict safety regulations, and widespread adoption of advanced barrier technologies. The region also benefits from ongoing highway upgrades, government mandates, and a strong focus on vehicular and pedestrian safety.

Some of the major players operating in the crash barrier systems market include: Arbus Limited (ARBUS GROUP LTD), Avon Barrier Corporation Ltd (TPPG The Perimeter Protection Group AB), Hill & Smith Holdings PLC, Lindsay Corporation, Nucor Corporation, Pinax Steel Industries, Roadsafe Traffic Systems Inc., Tata Steel (Tata Group), Transpo Industries Inc., Valmont Industries, Inc., and Valtir, LLC, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)