Countertop Market Size, Share, Trends and Forecast by Material, Application, End User, and Region, 2025-2033

Countertop Market 2024, Size and Trends:

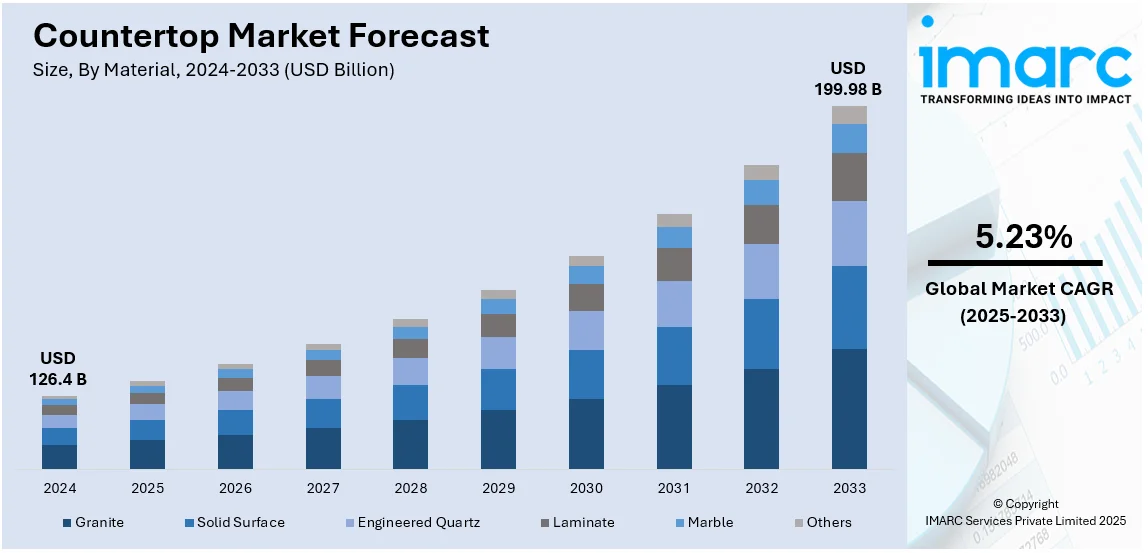

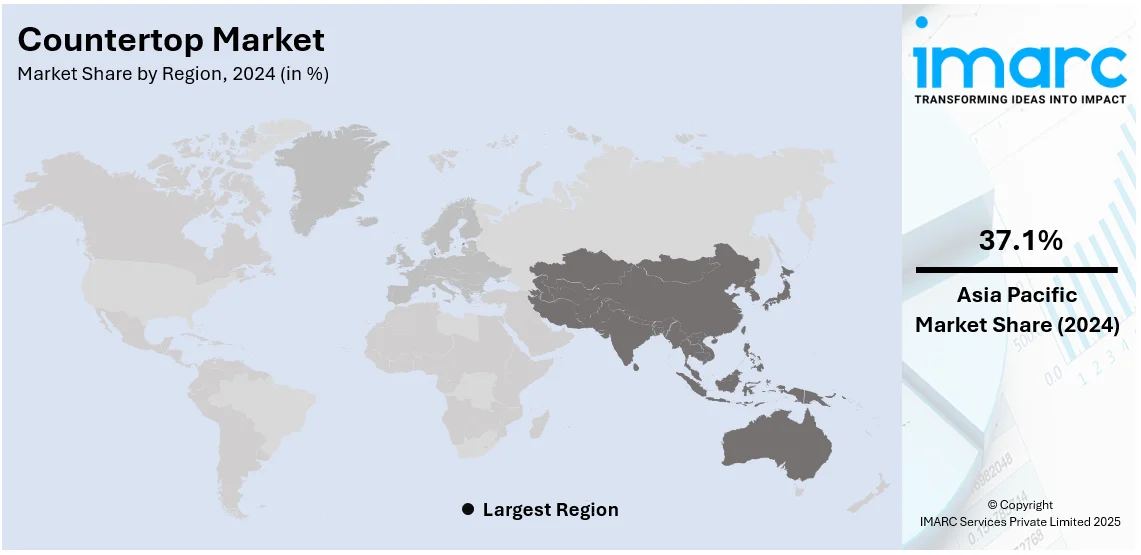

The global countertop market size was valued at USD 126.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 199.98 Billion by 2033, exhibiting a CAGR of 5.23% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 37.1% in 2024. The increasing popularity of modular kitchens and stylish shelves for bathroom toiletries, along with the rising use of decorative materials, are key drivers of market growth. Additionally, the surge in smart city developments is further boosting demand. The growth of the hospitality and commercial industries is also playing a significant role in shaping the global countertop market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 126.4 Billion |

| Market Forecast in 2033 | USD 199.98 Billion |

| Market Growth Rate (2025-2033) | 5.23% |

In 2023, the global hospitality sector was valued at roughly $4.7 trillion and is expected to reach about $5.5 trillion by 2024. This growth necessitates the construction and renovation of hotels and restaurants, increasing the demand for durable and aesthetically pleasing countertops. Similarly, the building construction industry, encompassing residential and non-residential segments, was valued at nearly USD 6.8 Trillion in 2024, with expectations to reach over USD 10.5 Trillion by 2033, growing at a rate of 4.9%. This surge includes commercial projects requiring high-quality countertops. The combined expansion of these sectors underscores a robust demand for countertops, as businesses seek materials that offer both functionality and visual appeal to attract customers.

The countertop market growth in the United States holds a total share of 87.8% and is expanding due to several important factors, such as a robust housing market, rising consumer spending on home renovations, and an increasing demand for premium, eco-friendly materials. According to the U.S. Census Bureau, residential construction has been on the rise, with the completion of new privately-owned housing units reaching 154400 in December 2024. This growth in construction is contributing to the rising demand for premium countertops, especially in kitchens and bathrooms, which are seen as key areas for home improvement. Additionally, the National Association of Home Builders (NAHB) reports that the average cost of home renovations reached $22,000 in 2022, highlighting a significant investment in upgrading home interiors. Another driving factor is the shift toward sustainable living. With increasing environmental awareness, U.S. consumers are opting for eco-friendly countertops made from recycled or renewable materials. These factors together support strong growth in the U.S. countertop market share.

Countertop Market Trends:

Sustainability and Eco-Friendly Materials

Consumers are increasingly shifting toward sustainable and eco-friendly materials for countertops as their preferences evolve. According to the U.S. Green Building Council (USGBC), more than 100,000 commercial and residential projects have earned LEED certification as of 2021, a significant increase in the adoption of green building practices. Since, on top of all, there is growing consciousness on environmental issues, consumers are now turning towards other alternatives rather than granite or marble. They rather choose countertops made from recycled or renewable materials. Its examples are recycled glass, bamboo, and composite quartz. Not only are these green materials attractive, but they also contribute to carbon footprints reduction, which makes consumers look for such eco-friendly products even more popular. Thus, the producers introduced technology to manufacture stronger and more durable countertops that meet no compromise on quality. Government rules and regulations have generally encouraged government incentives that boost interest in green countertops in commercial and residential construction sectors. Demand for the green countertops is likely to keep increasing as sustainability becomes the core of design and construction.

Customization and Personalized Designs

Consumers have begun to require custom designs that express their personality as the countertop market is also being driven by growing demand for customized and personalized designs. It has moved away from one-size-fits-all countertops as consumers increasingly try to build a unique and personal living or working space. As a result, there has been a greater variety of materials, colors, textures, and finishes available on the market. According to the U.S. Census Bureau's 2023 Characteristics of New Housing report, 2% of single-family homes built for sale in the West were constructed without air conditioning, indicating a high prevalence of certain custom features. This trend extends to countertops, where homeowners are increasingly opting for high-end materials like granite, quartz, and marble to elevate their kitchen and bathroom designs. The trend continues strong in high-end residential work where owners readily pay for those products that present high-end designs. Moreover, technological advancements such as 3D printing are enabling the creation of more detailed and complex designs. As consumer demand for individuality continues to grow, the countertop market should continue to expand in the customization space.

Growth in the Residential Renovation Sector

The residential renovation market is growing remarkably, and this would directly affect countertop market demand. According to the 2022 U.S. Houzz Kitchen Trends Study, 91% of homeowners who renovated their kitchens upgraded their countertops, reflecting a rising preference for high-quality, durable materials. Growing disposable incomes along with changes in lifestyle and requirements to make residences more functional as well as appealing are some of the factors that fuel home improvement works. A big trend is really evident in renovation markets for kitchen and bathroom as countertops play the most important part in design along with practicality. Premium-quality countertops made of materials like granite, marble, or quartz are becoming focal points of various home renovations; these materials bring value to homes while also serving as durable with easier maintenance. The increased presence of social media platforms with home improvement projects has also encouraged homeowners to spend money on luxury materials and designs. The ongoing trend of home renovation projects is also likely to ensure the growth in demand for quality countertops, thereby fuelling this market segment further.

Countertop Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global countertop market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, application, and end user.

Analysis by Material:

- Granite

- Solid Surface

- Engineered Quartz

- Laminate

- Marble

- Others

As per the latest countertop market outlook, granite continues to be the dominant material in the global countertop market, holding a substantial share of 29.8%. This enduring popularity can be attributed to granite's exceptional durability, resistance to scratches, heat, and stains, making it ideal for high-traffic areas, particularly in kitchens and bathrooms. Additionally, its natural beauty, featuring a variety of colors and patterns, attracts homeowners and designers looking for both practicality and visual appeal. Granite's timeless look also makes it a preferred choice for high-end residential and commercial projects, contributing to its market dominance. As consumers continue to value long-lasting, high-quality materials, granite's reputation for both luxury and practicality helps it maintain its leading position. However, despite its widespread appeal, granite is facing competition from engineered stones like quartz, which offer similar durability and a broader range of customization options, yet granite remains the material of choice for those prioritizing natural stone's distinct characteristics.

Analysis by Application:

- Kitchen

- Bathroom

- Others

Based on the global countertop market forecast, the kitchen segment stands out as the largest application, capturing a dominant 63.8% of the market share. This is fueled by the crucial role countertops play in both the design and functionality of kitchens. The kitchen countertop is a focal point in both residential and commercial spaces, serving not only as a practical work surface for cooking and meal preparation but also as a visual centerpiece that defines the overall aesthetic of the space. As homeowners increasingly prioritize the renovation of their kitchens to reflect modern trends and enhance home value, the demand for premium materials like granite, quartz, and marble continues to rise. Moreover, the growing trend of open-concept kitchens, which integrate the kitchen with living and dining areas, has fueled demand for countertops that are both functional and visually appealing. As the kitchen remains central to home design, it is expected to continue holding the largest market share, driven by consumer desire for both style and practicality.

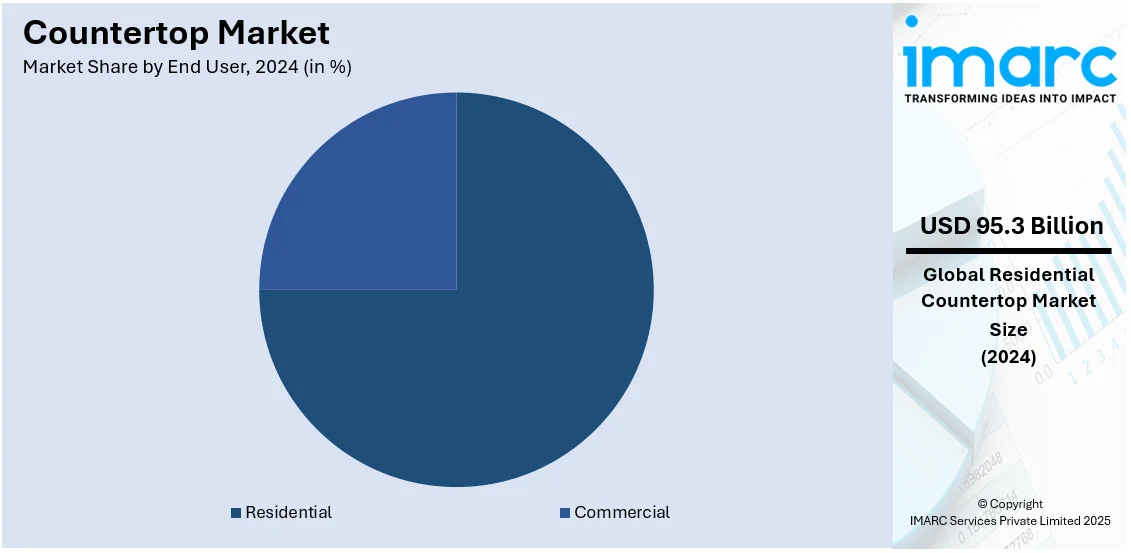

Analysis by End User:

- Residential

- Commercial

The residential sector dominates the global countertop market, with a commanding 75.4% share. This dominance is largely due to the growing trend of home improvement and remodeling projects, where countertops are seen as a significant investment in both functionality and aesthetic value. Homeowners are progressively choosing premium materials like granite, quartz, and marble to elevate their kitchens, bathrooms, and other living areas. This trend is further supported by the rise in new residential construction, particularly in developing regions, where modern homes often feature upgraded countertops as a standard inclusion. Additionally, the shift toward personalization and customization in home interiors has fueled demand for bespoke countertop designs, offering homeowners a chance to tailor their spaces to individual tastes. As consumer spending power increases and the desire for home personalization grows, the residential sector's dominance in the countertop market is likely to continue, with homeowners seeking to create stylish, functional, and durable spaces.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The Asia Pacific region holds the largest share of the global countertop market at 37.1%. This growth is driven by rapid urbanization, rising disposable incomes, and a growing middle class in major countries like China, India, and Japan. As the region experiences a construction boom, particularly in the residential and commercial sectors, demand for high-quality countertops is on the rise. Furthermore, the rising popularity of modern interior design trends, along with a growing preference for durable and visually striking materials like granite, quartz, and marble, is driving the expansion of the market. The Asia Pacific region is also witnessing a rise in luxury home construction, where premium countertops are seen as a hallmark of high-end design. In addition, growing awareness of environmental issues and a shift toward sustainable building materials are impacting purchasing choices, leading to increased demand for eco-friendly options. The region's diverse consumer preferences, coupled with rapid infrastructure development, position Asia Pacific as a key growth area for the global countertop market in the coming years.

Key Regional Takeaways:

North America Countertop Market Analysis

The countertop market in North America is expanding due to several key factors, such as a growing demand for home renovations, an increase in new residential construction, and a rising preference for high-quality materials. As homeowners continue to prioritize kitchen and bathroom upgrades, countertops are viewed as essential investments that add both functionality and aesthetic value to these spaces. The trend toward open-concept homes has further fueled this demand, as kitchen countertops become more integrated into living areas, requiring stylish and durable surfaces that match modern design trends. Additionally, North American consumers are increasingly drawn to high-quality, long-lasting materials like granite, quartz, and marble, which offer superior durability and a luxury appeal. Another factor contributing to market growth is the rise in disposable income, particularly in the U.S. and Canada, which allows consumers to spend more on home improvement projects. As sustainability becomes a more prominent concern, environmentally friendly countertop options made from recycled or sustainable materials are also gaining traction.

United States Countertop Market Analysis

The U.S. countertops market is being positively influenced by a healthy housing sector. New house sales reached around 683,000 units in March 2023, as indicated by the U.S. Census Bureau, which shows very high residential construction activity. This increases in direct proportion with the growth of demand for kitchen and bathroom countertops. The NAHB also reports that the average completion time for a single-family house in 2023 was about 10.1 months, meaning many of the homes completed in 2023 were started the previous year. This extended construction period underlines sustained demand for durable and high-quality countertop materials such as granite, quartz, and marble, which remain popular choices for new builds and renovations. As consumers increasingly prefer premium and environmentally friendly materials, Caesarstone and DuPont are positioned to meet that demand. And remodeling activity alone reached USD 425 billion in 2023, supporting this market's growth trajectory.

Europe Countertop Market Analysis

The European market of countertops is rising with a sound growth rate which is both in newly constructed and renovations. Eurostat reported that for the year 2022, the construction industries in the EU had a 4.2% growth level, which gave a boost for new countertops among homes and organizations. The European Commission's Renovation Wave approach helps the market, targeting at least 35 million buildings to be renovated by 2030, more than double the current annual rate of energy renovations within the EU. Upgrading residential and commercial environments will, therefore, increase demand for granite, quartz, and marble among other durable and aesthetic materials. The Cosentino and Caesarstone are capitalizing on this trend with sustainable and customizable countertop options. Growth in both construction and renovation sectors continues, so the European countertops market will expand long term.

Asia Pacific Countertop Market Analysis

The Asia Pacific region is also experiencing strong growth in the countertop market, driven by increasing demand in both the residential and commercial sectors. The Asian Development Bank (ADB) projected a growth rate of 4.2% for developing Asia's construction industry in 2022, directly influencing the demand for high-quality materials, such as granite, quartz, and solid surfaces. China is a great contributor to such growth, which has seen the finishing of 1.93 million housing units in dilapidated urban areas in the year 2023, an aspect that is witnessing a 6.63% increase from last year. Growing urban housing combined with increased disposable incomes and expanding middle-class consumption is fueling demand for high-end countertops. Consumers are keen on finding suitable options for home and business locations that are robust and pleasing. Construction activity in India is also increasing, further driving the demand for high-quality countertop materials. Manufacturers are taking advantage of the situation by providing a wide array of customizable, sustainable, and durable countertop solutions for the changing market.

Latin America Countertop Market Analysis

Latin America is seeing an ongoing expansion in the construction and renovation sectors, mainly in countries like Brazil, Mexico, and Argentina, and thus benefits the countertops market. The Brazilian construction industry, for instance, saw an annual increase of 6.8% in 2022, leading to an increased demand for quality materials such as granite and engineered stone countertops due to rising residential and commercial projects, as per reports. Renovation activity is also increasing, and Brazil is at the forefront of this trend. The consumers are now more interested in using durable and fashionable countertop materials, especially in remodeling projects. Mexico and Argentina, with their growing construction markets, are also contributing to this demand. The rising middle class in these countries, along with urbanization and changing consumer preferences, further stimulates the countertops market. With further development in the region, premium countertops will continue to gain demand, and Latin America will become a key market for countertop manufacturers.

Middle East and Africa Countertop Market Analysis

Countertops in the Middle East and Africa market have been experiencing steady growth both on residential and commercial grounds. According to an industrial report, in the luxury residential market in Dubai, Q1 2023 witnessed major growth as the prime property sales amount to approximately AED 6 billion, translating to about USD 1.63 billion, which is caused by high net worth individuals acquiring properties with an amount exceeding more than USD 10 million. As luxury real estate projects grow, the demand for more premium materials increases also, among which are countertops produced from granite, quartz, and solid surfaces. The same scenario occurs in Saudi Arabia and South Africa, where construction has picked up in metropolitans and large infrastructure sites. Demand for premium and durable materials fuels further demand in the countertops market. The region can also be expected to witness further economic growth and urban development, thus increasing the requirement for high-quality countertops, making the Middle East and Africa an attractive market for manufacturers.

Competitive Landscape:

As per the emerging countertop market trends, leading players are increasingly focusing on product innovation, sustainability, and expanding their market reach to maintain competitive advantage. Companies are diversifying their product offerings by introducing new materials such as quartz, recycled stone, and eco-friendly surfaces to meet growing consumer demand for durable, stylish, and environmentally conscious options. Some of the major players are investing heavily in research and development to enhance the quality and functionality of countertops, with innovations in texture, color variety, and ease of maintenance being key focal points. Strategic partnerships and acquisitions are also widely used by industry leaders as key tactics. By collaborating with designers, architects, and homebuilders, these companies are able to expand their distribution networks and penetrate emerging markets. Additionally, digital marketing and e-commerce platforms are being leveraged to reach a broader audience, including offering virtual design tools for a more interactive customer experience.

The report provides a comprehensive analysis of the competitive landscape in the countertop market with detailed profiles of all major companies, including:

- Aristech Surfaces LLC (Trinseo PLC)

- Asian Granito India Limited

- Caesarstone Ltd

- Cambria

- Cosentino S.A. (Grupo Cosentino S.L.)

- Dal-Tile Group Inc.

- DuPont de Nemours Inc.

- Pokarna Limited

- STRASSER Steine GmbH

- Vicostone

- Wilsonart LLC

Latest News and Developments:

- August 2024: Daltile introduced three extra-large quartz slabs – Outer Banks, Calacatta Bolt, and Telluride – featuring marble-inspired aesthetics, durability, and versatility for countertops, backsplashes, and walls. Available nationwide.

- In July 2024: Antolini introduces AzerocarePlus, a patented process enhancing the durability of natural stone surfaces like marble, onyx, quartzite, and travertine. It protects against etching, stains, and UV damage while maintaining the stone’s natural beauty. Suitable for food contact and available in various finishes, AzerocarePlus simplifies maintenance with mild soap and a washcloth. This innovation ensures stronger, long-lasting countertops and bathroom surfaces with no color alteration.

- In April 2024: Cosentino unveils EARTHIC® by Silestone®XM, a sustainable surface collection developed with Formafantasma. Launched as it features up to 30% recycled materials, including glass, PET, bio-resin, and Dekton® fragments, promoting eco-friendly design. Utilizing Cosentino's Hybriq+® technology, the collection uses 100% renewable energy and 99% recycled water. EARTHIC® aims to balance aesthetics with sustainability, reducing the need for new raw materials while offering distinctive, environmentally-conscious surfaces.

- May 2024: Cambria unveils Annaleigh™, MacBeth™, and MonTaaj™ quartz surfaces, emphasizing warmth, sophistication, and modern luxury. Complemented by new finishes, Cambria Luxe™ and Satin™, these innovations redefine style, durability, and elegance in quartz design.

- In November 2023: GTA Countertop Pro launched a new collection of quartz and granite kitchen countertops in Toronto, blending luxury with functionality. Designed to cater to diverse homeowner preferences, the collection aims to transform kitchens into stylish, dynamic spaces. Sales Manager Joyce emphasizes the brand’s commitment to personalizing countertops to match each home’s unique character. The latest range enhances both aesthetics and practicality, offering high-quality solutions for Toronto homeowners.

Countertop Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:·

|

| Materials Covered | Granite, Solid Surface, Engineered Quartz, Laminate, Marble, Others |

| Applications Covered | Kitchen, Bathroom, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aristech Surfaces LLC (Trinseo PLC), Asian Granito India Limited, Caesarstone Ltd, Cambria, Cosentino S.A. (Grupo Cosentino S.L.), Dal-Tile Group Inc., DuPont de Nemours Inc., Pokarna Limited, STRASSER Steine GmbH, Vicostone, Wilsonart LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the countertop market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global countertop market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the countertop industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The countertop market was valued at USD 126.4 Billion in 2024.

IMARC estimates the countertop market to exhibit a CAGR of 5.23% during 2025-2033, reaching USD 199.98 Billion by 2033.

The report provides historical and current market trends, market forecasts, and dynamics of the countertop market from 2019-2033.

The growing demand for modular kitchen and decorative shelves for toiletries in bathrooms, increasing adoption of attractive and fancy materials, and rising number of smart city projects represent some of the key factors driving the market.

Asia Pacific currently dominates the market, driven by rapid urbanization, rising disposable incomes, and a growing middle class in major countries like China, India, and Japan.

Some of the major players in the countertop market include Aristech Surfaces LLC (Trinseo PLC), Asian Granito India Limited, Caesarstone Ltd, Cambria, Cosentino S.A. (Grupo Cosentino S.L.), Dal-Tile Group Inc., DuPont de Nemours Inc., Pokarna Limited, STRASSER Steine GmbH, Vicostone, Wilsonart LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)