Counter-IED Market Size, Share, Trends and Forecast by Capability, Deployment Type, Application, and Region, 2025-2033

Counter-IED Market Size and Share:

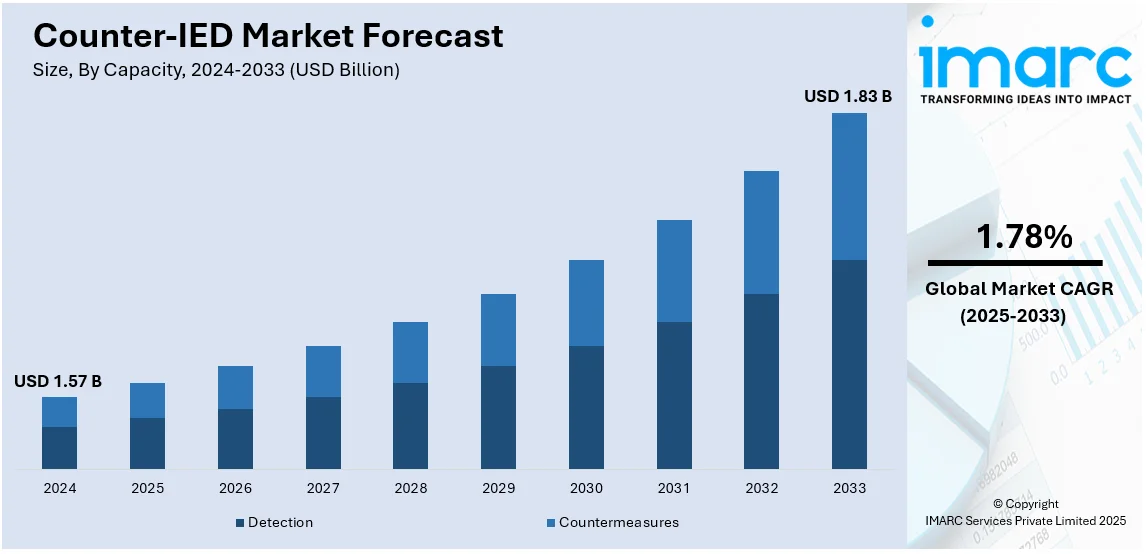

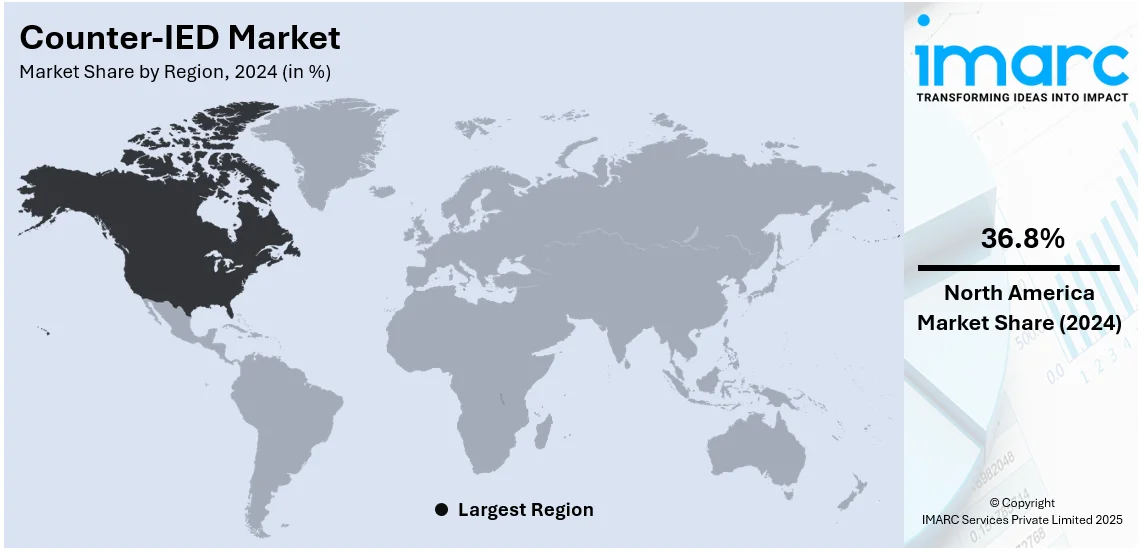

The global counter-IED market size was valued at USD 1.57 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.83 Billion by 2033, exhibiting a CAGR of 1.78% from 2025-2033. North America currently dominates the market, holding a market share of over 36.8% in 2024. The counter-IED market share is expanding, driven by the evolving global security threats, rising occurrence of asymmetric warfare and terrorism, and increasing integration of artificial intelligence (AI), big data analytics, and machine learning (ML).

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.57 Billion |

|

Market Forecast in 2033

|

USD 1.83 Billion |

| Market Growth Rate (2025-2033) | 1.78% |

The C-IED industry is experiencing major growth because of evolving global security threats, technological advancements, and increased defense expenditures. Improvised explosive devices (IEDs) are increasingly being used by non-state actors and terrorist organizations as low-cost weapons to create damage to military and civilian targets. The increasing use of IEDs in conflict zones has encouraged defense organizations to allocate enormous resources to combat these threats. As a result, governments and armed forces have increased investment in counter-IED technology. This encompasses detection systems, electronic countermeasures, and unmanned ground vehicles with neutralization capabilities. Evolving insurgent tactics require ever-changing adaptable proactive counter-IED solutions to prevent risks from IEDs.

The United States has emerged as the major region in the counter-IED market owing to several reasons. A primary driver of the market in the country is the evolving threat landscape characterized by widespread use of IEDs by non-state actors, terrorist factions, and insurgent groups. Technological development has been instrumental in determining the market in the US. Introducing AI, ML, and big data analytics integration has highly augmented the capability for real-time IED threat detection, analysis, and response. AI algorithms pattern recognition aids quickly identify a given threat with respect to extensive historical datasets derived from past events. In November 2023, the US Army hosted a joint counter IED exercise at its premier Pacific Northwest training facility. The U.S. Army's 53rd Ordnance Company (EOD) conducted joint, multicomponent, and interagency training at Yakima Training Center, Washington, in collaboration with the Washington National Guard's 319th EOD Company, the Oregon National Guard's 142nd Flight Wing Civil Engineer Squadron, the U.S. Air Force's 92nd Civilian Engineer Squadron, and U.S. Navy EOD Mobile Unit 11 Detachment Northwest.

Counter-IED Market Trends:

Rising Asymmetric Warfare and Terrorism Threats

The increasing incidence of asymmetric warfare and terrorism has been a major driver of the market growth. Non-state entities, insurgent groups, and terrorist organizations have increasingly resorted to IEDs as an inexpensive means to inflict significant damage on military personnel, security forces, and civilians. The frequent IED attacks in areas of conflicts have also made governments and defense organizations dedicate much time to counter-IED strategies. Another area of terror is domestic terrorism, which has increased the apprehension about homemade explosives. Moreover, the Gun Violence Archive, in 2024 reported more than 488 mass shootings in the US. These risks have led to increased investments in detection technologies, explosive disposal gear, and electronic countermeasures to minimize the dangers of IEDs. Military forces, law enforcement bodies, and homeland security entities continue to focus on counter-IED efforts within their broader counterterrorism and force protection strategies.

Advancements in Detection and Neutralization Technologies

Technological progress has greatly contributed to the improved effectiveness of the counter-IED operations. By integrating AI, ML, and big data analytics, real-time threat detection and analysis have significantly improved so that security forces can identify more explosive devices precisely. Advanced sensor technologies, like ground-penetrating radar (GPR), hyperspectral imaging, and infrared detection, allow for the more effective location of buried and hidden IEDs, thereby driving the counter-IED market demand. Besides, robotics and unmanned systems are involved in neutralizing IED threats with minimal human exposure. Unmanned aerial vehicles (UAVs) and unmanned ground vehicles (UGVs) equipped with sophisticated sensors and robotic arms have been widely deployed into bomb disposal and reconnaissance mission. In 2024, BAE Systems Australia introduced an advanced uncrewed ground vehicle today, providing military leaders with an additional tactical choice while protecting soldiers from danger.

Increasing Defense Budgets and Government Initiatives

Rising defense expenditures and government initiatives aimed at enhancing national security are offering a favorable counter-IED market outlook. Countries with ongoing active military engagements have significantly channeled vast sums of funds towards research and development (R&D) as well as procuring advanced anti-IED capabilities. Defense agencies are actively funding counter-IED programs to boost force protection capability. Law enforcement and homeland security agencies are increasing their spending in bomb detection as well as the disposal units that can counter prospective terrorist threats. Through cooperation between governments, defense contractors, and research institutions, the state-of-the-art counter-IED solutions have been developed. Additionally, multinational defense cooperation agreements allowed for the sharing of intelligence and best practices. By 2024, DAC approved the capital acquisition proposals, which include the acquisition of an Advanced Land Navigation System for the Armoured Fighting Vehicles of the Indian Army and 22 Interceptor Boats with state-of-the-art technology for the coat guards of India.

Counter-IED Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global counter-IED market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on capability, deployment type, and application.

Analysis by Capability:

- Detection

- Countermeasures

Detection holds 56.8% of the market share, thereby driving counter-IED market growth. The detection part of the counter-IED market is centered on developing technologies and systems that can identify and locate improvised explosive devices before they can cause damage. This section incorporates a variety of high-tech detection methods-such as ground-penetrating radar, infrared imaging, hyperspectral sensors, and electromagnetic induction-technologies into their structures. Artificial intelligence and machine learning have also advanced detection capabilities, enabling real-time threat analysis and pattern detection. Security personnel, military forces, and police agencies deploy handheld detectors, drones, robots, and sensors on vehicles to detect concealed explosives in cities, battlefields, and transportation centers. The ever-growing threat of IEDs in military and civilian environments has motivated significant research investments in improving the accuracy and efficiency of detection techniques.

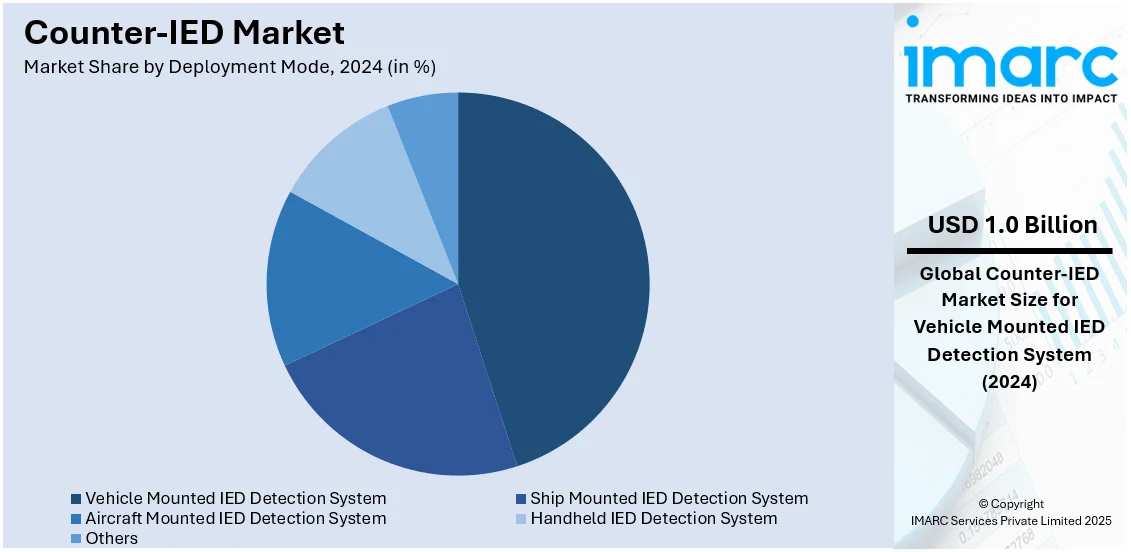

Analysis by Deployment Mode:

- Vehicle Mounted IED Detection System

- Ship Mounted IED Detection System

- Aircraft Mounted IED Detection System

- Handheld IED Detection System

- Others

Vehicle mounted IED detection system holds 44.5% of the market share. This vehicle-mounted IED detection system plays a pivotal part in bolstering the mobility and safety of military convoys, law enforcement units, and security forces carrying out operations in high-risk regions. These are mounted on armored personnel carriers (APCs), mine-resistant ambush-protected (MRAP) vehicles, and reconnaissance vehicles to have explosive detonation remotes along roadsides and in urban and conflict environments. Equipped with ground-penetrating radar, electromagnetic sensors, and infrared imaging, these detection systems identify real-time buried or concealed explosives and allow security personnel to take preventive action. The accuracy of these systems has further been improved through artificial intelligence and machine learning, which can automatically classify threats and reduce false alarms. The rising threat of roadside bombs and vehicle-borne IEDs (VBIEDs) has driven increased investments in vehicle-mounted counter-IED technologies.

Analysis by Application:

- Military

- Homeland Security

The military sector is the chief user of counter-IED technologies, given that improvised explosive devices continue to be among the most enduring dangers to armed forces in conflict areas and asymmetrical warfare situations. Armed forces globally depend on sophisticated detection and countermeasure technologies to recognize and eliminate explosive dangers in combat zones, urban conflict environments, and hazardous operational regions. Technologies like ground-penetrating radar (GPR), electronic countermeasures (ECM), unmanned ground vehicles (UGVs), and AI-driven threat analysis tools have greatly enhanced the military’s capability to effectively address IED threats.

The homeland security sector emphasizes thwarting and addressing IED dangers in civilian and domestic security contexts, such as urban areas, transit centers, public events, and essential infrastructure. Law enforcement organizations, bomb disposal teams, and counterterrorism units employ various technologies, including handheld explosive detectors, drone surveillance systems, and automated screening methods, to identify and eliminate threats before they inflict damage. The escalating threat of domestic terrorism, individual attacks, and organized crime utilizing homemade explosives has led to substantial investments in homeland security counter-IED initiatives.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds 36.8% of the market share. One of the primary drivers of the counter-IED market in North America is the persistent threat of asymmetric warfare and terrorism. While IEDs have traditionally been associated with conflict zones they are increasingly being used in domestic attacks within North America. The 2013 Boston Marathon bombing and other incidents involving homemade explosives have underscored the risks posed by lone-wolf attackers and extremist groups operating within national borders. Moreover, according to the Gun Violence Archive, almost 11,598 people have lost their lives due to gun violence in the US in 2024. Law enforcement agencies have heightened their focus on counter-IED measures, investing in detection systems, bomb disposal units, and intelligence-gathering capabilities to mitigate threats before they materialize. Robotics and unmanned systems have also played a crucial role in counter-IED efforts. Unmanned ground vehicles (UGVs) equipped with advanced sensors and robotic arms allow explosive ordnance disposal (EOD) teams to safely disarm or remove explosives from high-risk areas. Unmanned aerial vehicles (UAVs) are being increasingly utilized for reconnaissance and surveillance operations, particularly in monitoring border regions and conflict zones where IED threats may emerge.

Key Regional Takeaways:

United States Counter-IED Market Analysis

The United States hold 86.80% share in North America. The market in the United States is primarily driven by advancements in technology, increasing security threats, and military investments. The U.S. Department of Defense (DoD) continues to allocate substantial resources toward the development of counter-IED solutions, focusing on advanced detection, neutralization, and protection systems. The U.S. drone market, valued at US$ 6.8 Billion in 2023, is projected to grow to US$ 17.5 Billion by 2032, with a CAGR of 11.01% from 2024-2032, underscoring the role of unmanned aerial vehicles (UAVs) in enhancing counter-IED capabilities. UAVs, alongside robotic platforms, have become integral to counterterrorism efforts and military operations, offering new avenues for IED detection and neutralization. The U.S. military's emphasis on hybrid warfare and counterinsurgency operations further drives demand for these advanced technologies. Additionally, major defense players like Northrop Grumman, Lockheed Martin, and Raytheon lead in innovation, propelling the development of next-generation counter-IED systems. The continued growth of defense alliances and partnerships, both domestically and internationally, ensures the ongoing expansion of this market as nations strive to mitigate the impact of IED threats globally.

Asia Pacific Counter-IED Market Analysis

In the APAC region, the market is driven by rising defense budgets and growing security threats. Countries like India, China, and Japan are prioritizing advanced military technologies, with India’s unmanned aerial vehicle (UAV) market valued at USD 497 Million in 2023, expected to reach USD 1,517 Million by 2032, growing at a CAGR of 13.20% from 2024-2032. This growth is a result of the increasing use of UAVs for counter-IED operations, enhancing detection, neutralization, and surveillance capabilities. The persistent security challenges posed by insurgent and terrorist activities, particularly in regions like Afghanistan and Southeast Asia, further fuel the demand for advanced counter-IED systems. Additionally, defense cooperation and joint procurement initiatives among countries in the region strengthen their collective defense strategies, leading to increased adoption of cutting-edge counter-IED solutions. The integration of UAVs and robotics into military operations is pivotal in enhancing the region’s counter-IED capabilities.

Europe Counter-IED Market Analysis

The market in Europe is driven by the escalating threat of terrorism, military operations abroad, and ongoing advancements in defense technologies. European nations are increasingly focusing on counter-IED solutions to protect military personnel and critical infrastructure. The rapid development and adoption of artificial intelligence (AI) technologies, with the Europe AI market growing from USD 22.8 Billion in 2023 to USD 184.0 Billion by 2032, at a CAGR of 25.32%, significantly contribute to enhancing counter-IED capabilities. AI-driven systems, such as autonomous drones, robotics, and advanced sensors, are being integrated into counter-IED operations to improve detection, identification, and neutralization of threats. Collaborations within NATO and the European Union also foster the development of cutting-edge technologies and the sharing of best practices. Additionally, the rising number of military missions in conflict zones, particularly in the Middle East and Africa, underscores the need for more sophisticated counter-IED technologies. This growing demand for AI-powered solutions further drives innovation and market growth in Europe.

Latin America Counter-IED Market Analysis

In Latin America, the market is driven by increasing security concerns, particularly in countries like Chile and Brazil, which have seen a rise in terrorism over the past decade. However, the region, led by Peru and Paraguay, has noted significant enhancements in security. According to a 2024 report, South America has experienced 2,027 deaths from terrorism since 2007, making it the fourth lowest among global regions. This highlights the need for continued investment in counter-IED technologies to address evolving security threats and ensure the protection of both military and civilian infrastructure across the region.

Middle East and Africa Counter-IED Market Analysis

In the Middle East and Africa, the market is driven by ongoing conflicts and rising terrorism. Reports indicate that close to 2,000 individuals lost their lives in terrorist attacks in Burkina Faso from 258 events, representing nearly a quarter of all global fatalities due to terrorism. This underscores the critical need for advanced counter-IED technologies to address escalating threats. The region’s persistent security challenges, including insurgent and terrorist activities, highlight the importance of robust detection and neutralization systems. Collaborative defense efforts, along with international partnerships, further fuel the growth of the counter-IED market in the region.

Competitive Landscape:

Leading companies in the market are implementing various strategies to enhance their business, strengthen their market position, and develop more effective solutions to combat evolving explosive threats. Robotics and autonomous systems are also receiving increased attention in R&D efforts. Companies are developing UGVs and UAVs equipped with advanced sensors and robotic arms for remote bomb disposal operations. These innovations help minimize the risk to human personnel while enhancing the efficiency of counter-IED missions. To expand their capabilities and market reach, key players in the counter-IED industry are forming strategic partnerships with government agencies, defense organizations, and research institutions. Collaboration with military agencies and homeland security departments allows companies to better understand evolving threat landscapes and tailor their solutions accordingly. Leading market players are continuously expanding their product portfolios to address a broader range of counter-IED challenges. Companies are developing integrated solutions that combine multiple technologies, such as electronic countermeasures (ECM), explosives detection, and surveillance systems, into comprehensive security platforms.

The report provides a comprehensive analysis of the competitive landscape in the counter-IED market with detailed profiles of all major companies, including:

- Allen-Vanguard Corporation

- BAE Systems Land & Armaments Inc.

- Chemring Group Plc

- Elbit Systems Ltd.

- L3 Technologies Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies (United Technologies Corporation)

- Rheinmetall Aktiengesellschaft

- Sierra Nevada Corporation

- Thales Group

Latest News and Developments:

- September 2024: BAE Systems announced its acquisition of Kirintec, a UK-based company specializing in counter-improvised explosive device (C-IED) and counter-uncrewed air system (C-UAS) technologies, as well as electronic warfare solutions. While financial details were not disclosed, the acquisition strengthens BAE’s capabilities in cyber and electromagnetic activities (CEMA) and multi-domain integration. Kirintec will become part of BAE’s Digital Intelligence business, expanding its portfolio in electronic warfare and force protection.

- November 2023: Bison Counter 2023 (BC23), a multinational C-IED exercise supported by the EDA, began on November 7 in Spain. Hosted by the Spanish Armed Forces, the exercise took place in Zaragoza (ground activities) and Cartagena (underwater activities), with 1,000 military personnel from 12 EU Member States and observers from Sweden, Latvia, Romania, and the United States. The exercise involved 300 vehicles, 28 K-9 dogs, and five speedboats.

- November 2023: Netline Communications Technologies unveiled an EW system designed to counter threats from both IEDs and hostile drones. The small, mobile, full-coverage EOD jamming device has been created for deployment by military and police units across various situations, such as counter-terrorism operations, and is set against the ongoing backdrop of IDF participation in intricate field activities.

- November 2023: Hundreds of vehicles, 1,000 personnel, 28 K-9 dogs, and five speedboats have been deployed to participate in Bison Counter 23 (BC23), a counter-IED exercise organized by the European Defence Agency (EDA) at two locations in Spain. BC23 will involve individuals from Austria, Belgium, Czech Republic, the Netherlands, France, Germany, Hungary, Italy, Portugal, Slovenia, Spain, and Finland, taking place in Zaragoza for on-land operations and Cartagena for underwater missions.

Counter-IED Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Capabilities Covered | Detection, Countermeasures |

| Deployment Types Covered | Vehicle Mounted IED Detection System, Ship Mounted IED Detection System, Aircraft Mounted IED Detection System, Handheld IED Detection System, Others |

| Applications Covered | Military, Homeland Security |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allen-Vanguard Corporation, BAE Systems Land & Armaments Inc., Chemring Group Plc, Elbit Systems Ltd., L3 Technologies Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies (United Technologies Corporation), Rheinmetall Aktiengesellschaft, Sierra Nevada Corporation, Thales Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the counter-IED market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global counter-IED market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the counter-IED industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The counter-IED market was valued at USD 1.57 Billion in 2024.

The counter-IED market is projected to exhibit a CAGR of 1.78% during 2025-2033, reaching a value of USD 1.83 Billion by 2033.

The counter-IED market is driven by rising asymmetric warfare and terrorism threats, increasing defense budgets, and advancements in detection and neutralization technologies. The integration of artificial intelligence (AI), machine learning (ML), robotics, and big data analytics has significantly enhanced counter-IED capabilities.

North America currently dominates the counter-IED market, accounting for a 36.8% share in 2024. The United States leads the market due to extensive military investments, technological advancements in counter-IED solutions, and increasing security threats. The integration of AI-driven threat analysis, UAVs, and electronic countermeasures has significantly strengthened the region’s counter-IED capabilities.

Some of the major players in the counter-IED market include Allen-Vanguard Corporation, BAE Systems Land & Armaments Inc., Chemring Group Plc, Elbit Systems Ltd., L3 Technologies Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies (United Technologies Corporation), Rheinmetall Aktiengesellschaft, Sierra Nevada Corporation, Thales Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)