Cosmetics Market Size, Share, Trends and Forecast by Product Type, Category, Gender, Distribution Channel, and Region, 2026-2034

Cosmetics Market Size and Share:

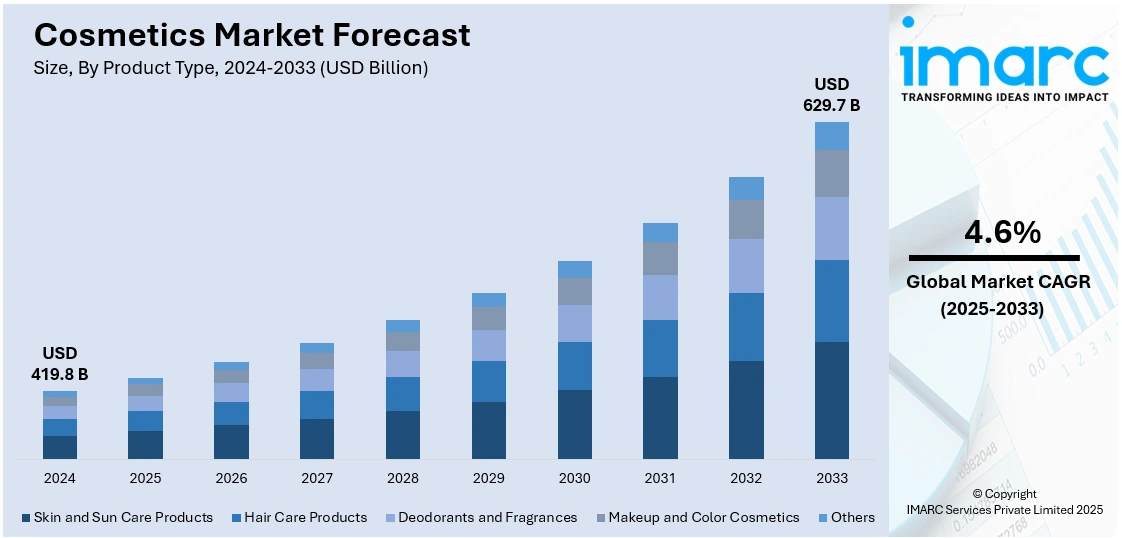

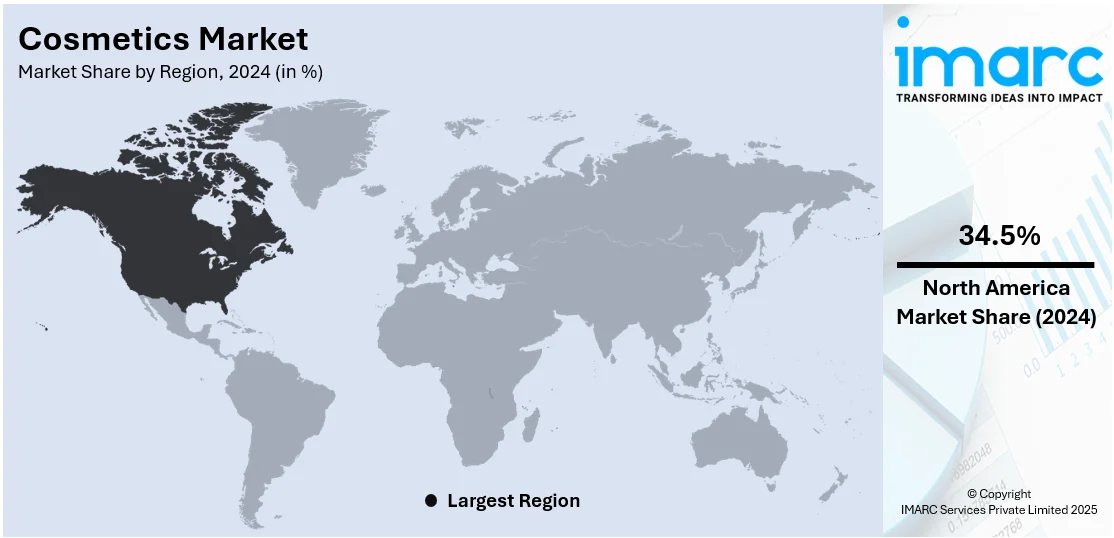

The global cosmetics market size was valued at USD 419.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 629.7 Billion by 2034, exhibiting a CAGR of 4.6% during 2026-2034. North America currently dominates the market. The growing emphasis on personal grooming, the introduction of advanced product variants, the escalating demand for vegan cosmetics, and the rising product availability on e-commerce platforms are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 419.8 Billion |

| Market Forecast in 2034 | USD 629.7 Billion |

| Market Growth Rate 2026-2034 | 4.6% |

Increasing consumer awareness about health, sustainability, and environmental impact has significantly influenced the cosmetics market. Modern consumers are more informed about the potential harmful effects of synthetic chemicals and demand safer, natural, and organic alternatives. This shift is driven by concerns over skin sensitivity, allergies, and long-term health effects associated with conventional products. Brands are responding by reformulating their products and emphasizing clean ingredients, cruelty-free testing, and eco-friendly packaging. This trend has led to the rapid expansion of niche brands specializing in organic products, thereby intensifying competition. Regulatory bodies are also tightening standards for product labeling, reinforcing transparency and trust among consumers. As a result, natural and organic cosmetics are no longer a niche but a mainstream demand, pushing established brands to innovate and adapt. This transformation is expected to drive substantial market growth over the next decade.

To get more information on this market, Request Sample

A major driver in the United States cosmetics market is the increasing consumer preference for natural and organic products. As awareness about harmful chemicals and sustainability rises, consumers are shifting toward eco-friendly, cruelty-free, and clean-label cosmetics. Brands that emphasize transparency, ingredient traceability, and environmentally conscious practices have gained significant traction. Additionally, in Europe, regulatory standards play a pivotal role in shaping the cosmetics market. The European Union's stringent regulations around product safety and sustainability drive companies to invest in research and development to meet compliance while maintaining product innovation. The Chinese cosmetics market is primarily driven by rising disposable income and the growing middle class, resulting in higher spending on premium beauty products. The increasing importance of self-care and personal grooming, especially among younger demographics, fuels demand for both international and domestic brands.

Cosmetics Market Trends:

Growing emphasis on personal grooming

The increasing number of working women and rising consciousness regarding physical appearance among millennial women are the key factors driving the cosmetics market outlook. According to financial comparison service provider Mozo, the average Australian woman spends approximately USD 3,600 on beauty and personal care products annually. In addition to this, the rising awareness about the harmful effects of chemical compounds such as paraben and aluminum in the products is stimulating the growth of natural and organic facial cosmetic products on the market. Many international brands, like Revlon, Elle18 MAC, Sephora, L'Oreal, and Oriflame, are increasing their presence further by introducing more products in the market, particularly with convenient and attractive packaging types and vegan ingredients, to attract customers across the globe. As personal grooming becomes more important, the demand for cosmetic products across various categories is escalating. Consumers are increasingly seeking products with minimal synthetic chemicals, opting for natural and organic formulations, and various key market players are extensively investing to cater to this demand. For instance, in April 2022, Shiseido revealed a new skincare brand, Ulé. It sources pesticide-free botanicals from local vertical farms. Additionally, consumers are seeking eco-friendly, sustainable, and natural products that offer greater ingredient transparency. This, in turn, is stimulating the cosmetics market demand in hair care.

Introduction of advanced product variants

Advanced product variants are designed to target specific skincare concerns, haircare issues, or makeup preferences. Brands are creating formulations that address concerns such as aging, acne, hyperpigmentation, dryness, and sensitivity. For instance, L’Oréal Paris recently launched its Glycolic Bright Day Cream with SPF 17, which aims to reduce dark spots and shield skin from harmful UV rays to unveil bright skin. Moreover, various brands are providing choices in shades, finishes, coverage levels, and even allowing consumers to mix and match products to suit their preferences. For instance, in April 2023, personal care and beauty brand The Body Shop launched its 'activist' product range in the Indian market. The new line strengthens the brand's sustainable commitment in the country with a selection of skin products and color cosmetics. Additionally, the ongoing development of personalized cosmetics to enhance the consumer experience is also propelling the market growth. For instance, the L’Oréal Groupe launched Perso, a 6.5-inch beauty tech device that delivers personalized on-the-spot skincare and cosmetic formulas. It harnesses the power of artificial intelligence and optimizes the level of personalization over time as the system gathers more data about customer’s skin and personal preferences.

Rising product availability on e-commerce platforms

E-commerce platforms have eliminated geographical barriers, enabling consumers to access a wide range of cosmetic products regardless of their location. According to the cosmetics market statistics, Rare Beauty by Selena Gomez was launched in June 2023 at Sephora India and is now available nationwide across all 26 Sephora stores and online at Sephora.nnnow.com. Consumers now have access to brands and products that were previously not readily available in their local stores. This has expanded the reach of cosmetic brands, allowing them to connect with a broader consumer base and penetrate new markets. For instance, Nykaa, India’s leading beauty and fashion destination, opened doors to the high-performing range of Natasha Moor Cosmetics. In addition to this, these platforms provide detailed product information, including ingredient lists, usage instructions, and customer reviews, which is anticipated to propel the overall cosmetics market revenue in the coming years.

Cosmetics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cosmetics market report, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on product type, category, gender, and distribution channel.

Analysis by Product Type:

- Skin and Sun Care Products

- Hair Care Products

- Deodorants and Fragrances

- Makeup and Color Cosmetics

- Others

Skin and sun care products leads the market. Consumers are becoming more aware about the importance of proper skincare routines, including protection from the harmful effects of the sun. Moreover, various leading brands are increasingly investing in research to develop and introduce advanced sun skin care protection products. According to the cosmetics market overview, Clarins‘a France-based beauty brand, launched the UV Plus Multi-Protection Moisturizing Screen SPF 50 that protects against five pollutants encountered in everyday life (atmospheric, blue light, pollen, photopollution, and indoor pollution). Similarly, Derma Co, a pioneer in dermatologist-backed skincare solutions, introduced its latest breakthrough – the Ultra-Light Zinc Mineral Sunscreen, in India. Besides this, the growing popularity of destination travel, and beach vacations is significantly contributing to the cosmetics market demand in skin care.

Analysis by Category:

- Conventional

- Organic

Conventional leads the market in 2024 as these products have been in the market for a longer period and have a well-established consumer base. These products have been used by consumers for years and have built trust and familiarity among a large portion of the population. Many consumers prefer to stick to familiar products that they have been using and trust for their beauty routines. Moreover, these products are widely available and easily accessible.

Analysis by Gender:

- Men

- Women

- Unisex

Women leads the market in 2024. The cosmetics market share offers a vast array of products specifically targeted towards women, ranging from skincare and makeup to haircare and fragrances. Moreover, the rising working-women population across the globe is significantly contributing to the growth in this segment. Among men and women, the women segment contributed to a larger market share of over 62.05% in 2022. Additionally, media, including advertising, plays a crucial role in shaping consumer behavior and preferences. Various leading brands are also targeting women in light to deep skin tones to promote inclusivity and expand their product portfolio. For instance, Lakme Cosmetics launched new lipstick shades suitable for Indian skin tones. The products include Lakme Absolute Matte Revolution Lip Color in blushing red, cheek color-nude, and MP18 Plum Pick. Women are often the primary target audience for cosmetic advertisements, featuring models and celebrities endorsing various products.

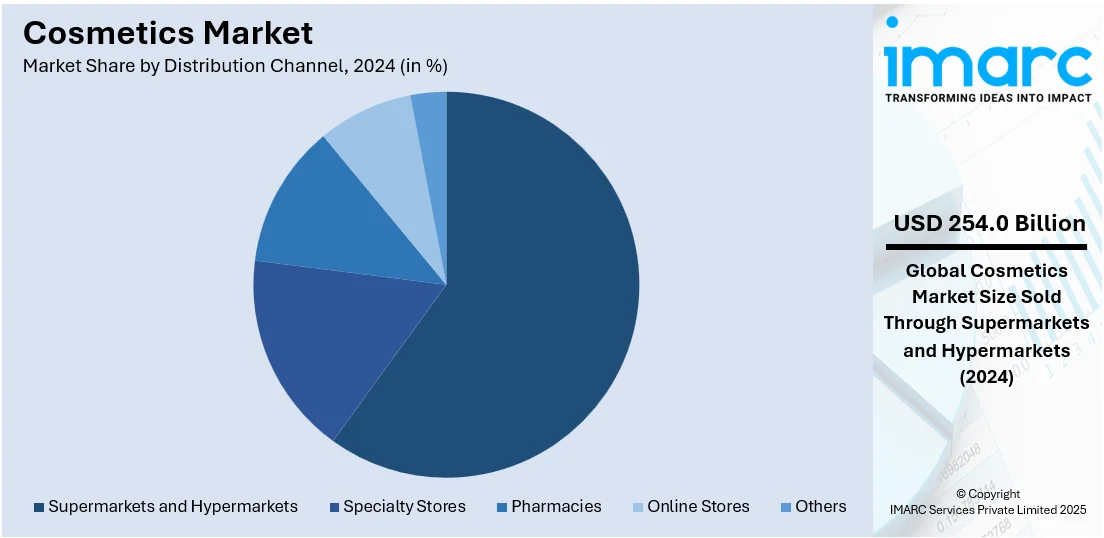

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies

- Online Stores

- Others

Supermarkets and hypermarkets lead the market in 2024. Supermarkets and hypermarkets offer consumers the convenience of finding a wide range of products in one location. A number of British supermarkets have been elevating their beauty offer in recent years, helping to transform them into more credible beauty retail destinations for consumers. For instance, Sainsbury has introduced a number of activations to improve its beauty offer in recent years, including the launch of new serum bars across 106 stores this summer. Moreover, supermarkets and hypermarkets are also offering competitive pricing for cosmetic products due to their ability to negotiate bulk purchasing and pass on cost savings to consumers.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share. North America, comprising the United States and Canada, is home to a sizable consumer population. The region has a high level of disposable income, which contributes to increased consumer spending on cosmetic products. The beauty & personal care market in North America is projected to generate a revenue of US$ 118.50 Billion in 2024. When compared globally, the United States stands out as the highest revenue-generating country. Moreover, various leading beauty brands are increasingly investing in marketing and advertising to create product awareness across the region. For instance, in 2022 L'Oreal invested US$ 3.04 Billion in advertising in the United States. The large consumer base provides a substantial market opportunity for cosmetic brands, making North America an attractive region for market penetration and growth.

Key Regional Takeaways:

United States Cosmetics Market Analysis

The United States is the largest cosmetics market in the world, led by consumer demand and innovation. Industry reports reveal that around 70% of the population uses cosmetics daily. This fact alone has been one of the factors behind the tremendous growth in the industry. In 2023, the market stood at USD 80 Billion, with skincare being the biggest category. More than 3,000 companies have catered to diverse consumer preferences, including Estée Lauder and L'Oréal USA. Examples include clean beauty and green packaging that more or less 25% of customers require; other figures indicated that in 2023, 45% sales on e-commerce were cosmetics sales. Personalized beauty has also emerged strongly, where more advanced AI is driving more demand for personalization, and there has been strong growth for American-based firms focused abroad in more recent years and exports contributing hugely to the growth in the industry. Favorable regulations and significant R&D investments ensure that the U.S. remains a key player in the global cosmetics industry.

Europe Cosmetics Market Analysis

Europe remains a global leader in the cosmetics market, valued at about USD 105.6 Billion in retail sales in 2023. According to Cosmetics Europe, Germany at USD 17.5 billion, France at USD 15.1 Billion, and Italy at USD 13.8 Billion are dominant in the regional market. As per Eurostat, the industry contributes annually USD 31.9 Billion to the socio-economic impact, with manufacturing being USD 12.1 billion and through the supply chain being USD 19.8 Billion. More than 3.5 million jobs are directly and indirectly supported, with 259,244 people directly employed in 2023. European consumers, 500 million strong, use cosmetics daily, with a high penetration rate. The region is innovative, with companies investing around 5% of their annual turnover in R&D, amounting to USD 2.6 billion. This research focus drives the development of functional and sustainable products, further enhancing the competitiveness of the sector. Europe's strength in infrastructure, consumer base, and commitment to innovation cements its position in the global cosmetics market.

Asia Pacific Cosmetics Market Analysis

Asia Pacific is the fastest-growing market for cosmetics, driven by increased disposable incomes and a beauty-conscious population. According to industry reports, 55% of the population use cosmetics regularly, and the market was valued at USD 120 billion in 2023. China leads the region, accounting for 40% of sales, followed by Japan and South Korea with strong consumer bases. The "K-beauty product" trend, characterized by innovative skincare products, significantly impacts global markets. It contains more than 7,000 cosmetic companies, with large names such as Shiseido and Amorepacific. E-commerce grew 60% in 2023 with support from platforms such as Tmall and Lazada. Government bodies are investing in local production and exports under schemes like China's "Made in China 2025". Growing recognition of natural and organic cosmetics is driving demand, however, Asia Pacific's leadership role in the global supply chain makes it an important player in the cosmetics industry as well.

Latin America Cosmetics Market Analysis

Cosmetics in Latin America continue growing. Urbanization and beauty's significant cultural emphasis have pushed cosmetics there upwards. The Brazilian Association of the Cosmetic Industry estimates that 80% of women and 40% of men apply cosmetics regularly. Brazil's is the largest market size: in 2023, with USD 30 billion and exceeding over 50% contribution of the regional industry. With 1,500 companies, Natura & Co is one of them. E-commerce sales rose by 35% in 2023. Platforms like MercadoLibre are supporting this growth. Increased awareness about organic and vegan products is changing consumer preference. Government initiatives, such as tax incentives to manufacture locally, help improve the industry. Regional exports, especially to North America, are increasing due to competitive pricing.

Middle East and Africa Cosmetics Market Analysis

The Middle East and Africa market for cosmetics is expanding with increased consumer spending and cultural changes. Reports state that 45% of women and 20% of men use cosmetics daily, with the market valued at USD 35 billion in 2023. The region has approximately 800 companies, including both international and local brands like Mikyajy. Premium and halal products are very much in demand, contributing to 40% of sales in 2023. The government initiatives, like Saudi Vision 2030, promoting local manufacturing and investment in the production of cosmetics also helps. Sales through e-commerce are also growing. The region's young population and growing interest in grooming products contribute to its steady market growth.

Competitive Landscape:

Key players in the cosmetics market are employing various strategies to strengthen their positions amidst intense competition. They are investing heavily in research and development (R&D) to innovate and meet evolving consumer preferences, focusing on natural ingredients, sustainable formulations, and personalized products. This aligns with growing demand for clean beauty and eco-friendly solutions. Strategic mergers and acquisitions are another common approach, enabling companies to expand their product portfolios and enter new geographic markets. Moreover, digital transformation is also crucial. Companies are enhancing their online presence, leveraging social media marketing, and adopting artificial intelligence (AI) for personalized recommendations. E-commerce partnerships and direct-to-consumer channels are being prioritized to reach a broader audience.

The report provides a comprehensive analysis of the competitive landscape in the cosmetics market with detailed profiles of all major companies, including:

- Amway Corp.

- Avon Products Inc. (Natura & Co)

- Beiersdorf AG

- Henkel AG & Co. KGaA

- Kao Corporation

- L’Oréal SA

- Oriflame Cosmetics AG

- Revlon Inc.

- Shiseido Company Limited

- Skinfood Co. Ltd

- The Estée Lauder Companies Inc.

- The Procter & Gamble Company

- Unilever PLC

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- November 2024: Shiseido has launched a free online beauty consultation service for its customers with hearing impairments. This initiative, which was launched on November 7, 2024, on the Online Beauty platform, offers sign language, lip-reading, and chat functions to provide a personalized beauty experience while eliminating barriers for the hearing impaired. Shiseido is also contributing to diversity in the beauty industry through its "Employment Expansion Project." The company has recruited people with disabilities, especially those who are knowledgeable in sign language. It has two Personal Beauty Partners, and it plans to expand the team with other beauty experts who are known in sign language. It will help Shiseido be successful in its mission, "BEAUTY INNOVATIONS FOR A BETTER WORLD," by making its services more accessible and available to everyone.

- November 2024: Unilever officially entered the luxury cosmetics market with the acquisition of cruelty-free premium cosmetic brand Hourglass in 2017. Its products will be sold via Unilever's segments for beauty, e-commerce portals, and department stores. For the first time, Unilever enters the prestige category in the same league as others such as Sephora, Estee Lauder, or Bobbi Brown.

- April 2024: The beauty company, Beiersdorf AG, announced that they are collaborating with Rubedo Life Sciences to develop highly innovative skincare products focused on anti-aging effects on cells. The partnership comes in perfect synergy with the cellular senescence and anti-aging research background of Rubedo. Beiersdorf also had a stake in Rubedo's recent Series A round through the Oscar & Paul Corporate Venture Capital Fund. This partnership seems like a strategic step by the company to advance its offering in the global cosmetics market pertaining to anti-aging products.

- March 2024: L’Oréal Groupe announced the launch of MelasylTM, a breakthrough molecule designed to address localized pigmentation issues that lead to age spots and post-acne marks.

- November 2023: Revlon, the beauty and cosmetics brand operating in India through its local partner, Modi-Mundipharma Beauty Products, is doubling its business to INR 400 crore in the current fiscal year. With plans to enhance its offline network, the company aims to increase the number of outlets from 300 to 600 and expand its presence from 1,000 to 4,000 department stores.

Cosmetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, Others |

| Categories Covered | Conventional, Organic |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amway Corp., Avon Products Inc. (Natura & Co), Beiersdorf AG, Henkel AG & Co. KGaA, Kao Corporation, L’Oréal SA, Oriflame Cosmetics AG, Revlon Inc., Shiseido Company Limited, Skinfood Co. Ltd, The Estée Lauder Companies Inc., The Procter & Gamble Company, Unilever PLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cosmetics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cosmetics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the cosmetics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cosmetics are products applied to the body to enhance or alter appearance, primarily focusing on the skin, hair, nails, and lips. They include a wide range of items such as makeup (foundation, lipstick, eyeshadow), skincare (moisturizers, cleansers, serums), hair care (shampoo, conditioner, hair dye), and personal care products (deodorants, perfumes). Cosmetics can serve various purposes, from cleansing and protecting the skin to adding color and fragrance. They are broadly categorized into decorative cosmetics (for aesthetic enhancement) and care products (for maintaining skin or hair health).

The cosmetics market was valued at USD 419.8 Billion in 2024.

IMARC estimates the global cosmetics market to exhibit a CAGR of 4.6% during 2025-2033.

The increasing number of working women, rising product availability on e-commerce platforms and introduction of advanced product variants is primarily driving the global cosmetics market.

According to the report, skin and sun care products represented the largest segment by product type, driven by rising consumer awareness about harmful effect of sun rays and growing emphasis on personal grooming.

Conventional products lead the market by category owing to its trust and familiarity among a large portion of the population.

Women dominate the market, driven by the rising number of working women.

Supermarkets and hypermarkets lead the market by distribution channel as they provide a wide range of products in one location.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global cosmetics market include Amway Corp., Avon Products Inc. (Natura & Co), Beiersdorf AG, Henkel AG & Co. KGaA, Kao Corporation, L’Oréal SA, Oriflame Cosmetics AG, Revlon Inc., Shiseido Company Limited, Skinfood Co. Ltd, The Estée Lauder Companies Inc., The Procter & Gamble Company, and Unilever PLC.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)