Cosmetic Dyes Market Size, Share, Trends and Forecast by Type, Solubility Type, Application, and Region, 2025-2033

Cosmetic Dyes Market Size and Share:

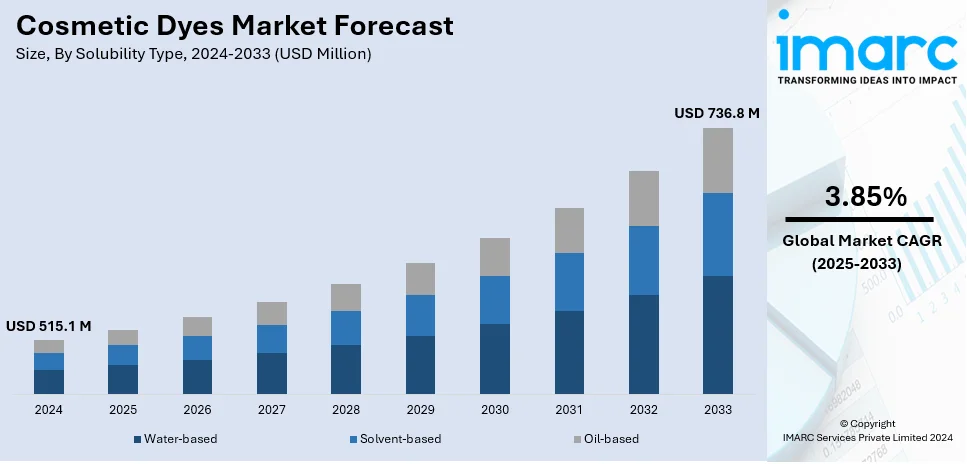

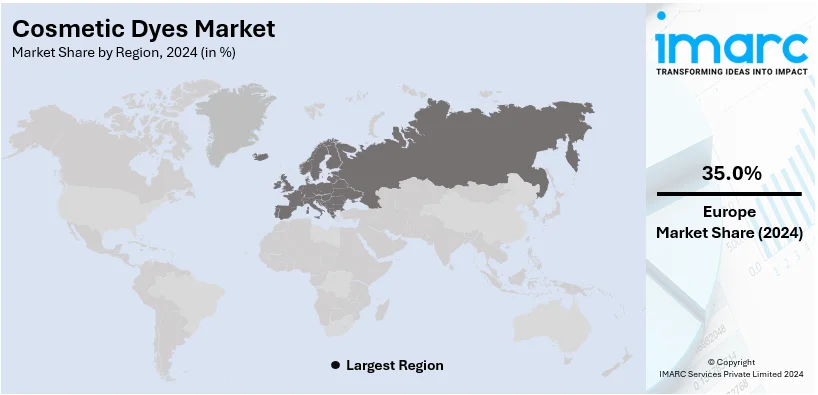

The global cosmetic dyes market size reached USD 515.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 736.8 Million by 2033, exhibiting a growth rate CAGR of 3.85% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 35.0% in 2024. The market in this region is experiencing steady growth driven by increasing consumer demand for diverse cosmetic products, growing middle-class population in emerging economies, and continuous technological advancements in dye formulation, such as nanotechnology and organic synthesis.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 515.1 Million |

|

Market Forecast in 2033

|

USD 736.8 Million |

| Market Growth Rate (2025-2033) | 3.85% |

The global cosmetic dyes market is experiencing robust growth, primarily driven by rising consumer demand for innovative beauty and personal care products. According to the IMARC Group, the global beauty and personal care products market size reached USD 529.5 Billion in 2024 and is forecasted to reach USD 802.6 Billion by 2033, exhibiting a CAGR of 4.2% during 2025-2033. The expanding cosmetics industry, propelled by increasing disposable incomes and evolving beauty trends, is encouraging manufacturers to introduce vibrant and customized color solutions. Additionally, advancements in dye formulation technology ensure better stability, safety, and compatibility with cosmetic formulations, further boosting adoption. Besides this, the rise in social media influence and beauty product marketing also plays a significant role, creating consistent demand for colorful and visually appealing cosmetic products.

To get more information on this market, Request Sample

The United States has emerged as a key regional market for cosmetic dyes due to the growing demand for premium beauty and personal care products, driven by rising disposable incomes and increasing consumer focus on aesthetics. The popularity of vibrant, customized makeup and hair care products is prompting manufacturers to innovate with safe, long-lasting dyes. A shift toward clean-label, natural, and organic dyes is also gaining popularity as eco-conscious consumers prioritize sustainability. Besides this, technological advancements in formulation ensure improved product safety and performance, further facilitating industry expansion.

Cosmetic Dyes Market Trends:

Rising consumer demand for cosmetic products

The increasing consumer demand for a wide range of cosmetic products is one of the primary factors boosting the market. The cosmetics industry is expanding globally, with a net worth of over € 250 Billion (USD 262 Billion) in 2022, as per a report by L’Oréal. With consumers growing more beauty-conscious and seeking to try out different looks, there is a subsequent rise in demand for a wide array of cosmetic products, including hair dye, lipstick shades, and eye shadows. This trend is visible more in the younger demographic, who prefer vibrant and customized colors. This is encouraging manufacturers to develop new and diverse cosmetic dyes, fostering the global cosmetic dyes market growth. Besides this, the increasing number of makeup bloggers is significantly influencing consumer trends and enriching trends, propelling the demand for popular products and facilitating industry expansion. In addition, increasing cosmetic dyes demand from the growing middle-class population in developing countries remains a notable a growth-inducing factor.

Technological advancements in dye formulation

Continuous advancements in dye formulation technology and application techniques are contributing substantially to the growth of the cosmetic dyes market. Innovations in nanotechnology, microencapsulation, and organic synthesis are pioneering the development of high-performance dyes that provide unmatched colour value, stability, and safety. These developments make colors more intense, everlasting, and allergy-free, promoting widespread use. According to the cosmetic dyes market research report, the demand for sustainable and environmentally conscious dye production processes is rising, with an increasing number of manufacturers transitioning toward producing biodegradable dyes as well as non-toxic variants, which contributes to the growth of the organic colorants segment. Moreover, the rising middle-class in developing economies has heightened the demand for cosmetic products, subsequently fostering growth in the cosmetic dyes industry. Based on World Bank statistics, by the conclusion of 2023, 108 nations were designated as middle-income, with per capita GDP ranging from USD 1,136 to USD 13,845 annually.

Regulatory frameworks and industry standards

Regulatory frameworks and industry standards are significantly influencing the cosmetic dyes market. Stringent regulations imposed by governments and regulatory bodies across the globe ensure the safety, efficacy, and quality of cosmetic dyes. Compliance with these laws requires rigorous testing and certification processes. International standards and guidelines have also been established to enforce best practices in manufacturing and quality control. As a result, manufacturers are innovating and developing dyes that are non-toxic, skin-friendly, and free from harmful chemicals, among others. Compliance with these regulations improves consumer confidence, particularly in premium markets where product safety is the paramount concern. Besides this, approvals for organic and natural products also contribute to increasing demand for clean-label cosmetic dyes. By aligning themselves with these standards, companies are improving market acceptability and expanding their presence in regions with well-defined regulatory systems.

Cosmetic Dyes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cosmetic dyes market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type, solubility type, and application.

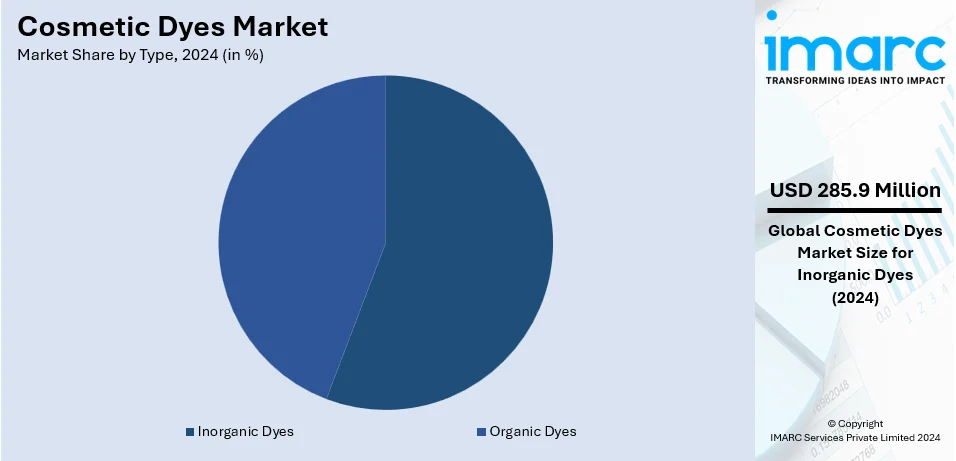

Analysis by Type:

- Organic Dyes

- Inorganic Dyes

Inorganic dyes lead the market with around 55.5% of the global cosmetic dyes market share in 2024. This dominance is largely due to their superior stability, durability, and cost-effectiveness. These dyes offer exceptional resistance to heat, light, and chemicals, making them ideal for long-lasting cosmetic applications such as foundations, lipsticks, and hair colors. Their ability to deliver consistent pigmentation without fading enhances their appeal to manufacturers and consumers. Moreover, inorganic dyes, such as iron oxides and titanium dioxide, are also widely preferred for their non-toxic and hypoallergenic properties, aligning with safety standards for sensitive skin. In addition to this, their affordability and ease of production make them a practical choice for large-scale cosmetic formulations, strengthening their market dominance.

Analysis by Solubility Type:

- Water-based

- Solvent-based

- Oil-based

Based on the solubility type, the market has been segregated into water-based, solvent-based, and oil-based. Water-based cosmetic dyes are widely used for their eco-friendliness, safety, and versatility in cosmetic formulations. They dissolve easily in water, making them ideal for products such as lotions, shampoos, and water-based foundations. These dyes are preferred for their non-toxic nature, minimal skin irritation, and ease of application. Growing demand for clean-label and natural beauty products has further increased the adoption of water-based dyes in the cosmetics industry.

Solvent-based cosmetic dyes are valued for their vibrant color payoff and excellent solubility in non-aqueous formulations. They are ideal for products such as lipsticks, nail polishes, and hair dyes, where high color intensity and long-lasting effects are essential. These dyes provide enhanced stability, ensuring consistent performance in a range of formulations. Their ability to deliver bold, fade-resistant shades makes them popular in premium and professional cosmetic applications.

Oil-based cosmetic dyes are essential for products with oil-rich formulations, including lip balms, creams, and oil-based foundations. These dyes blend seamlessly into oils and waxes, ensuring smooth, even pigmentation with excellent stability. Their ability to enhance the texture and longevity of oil-based cosmetics makes them highly desirable. As consumer demand for moisturizing and nourishing beauty products grows, oil-based dyes are witnessing increasing adoption, particularly in premium skincare and makeup products.

Analysis by Application:

- Hair Color Products

- Facial Makeup

- Eye Makeup

- Lip Products

- Nail Products

- Others

On the basis of the application, the market has been categorized into hair color products, facial makeup, eye makeup, lip products, nail products, and others. Hair color products are a dominant segment in the cosmetic dyes market, driven by growing trends in self-expression and gray coverage solutions. Vibrant and natural shades are widely sought, particularly among younger consumers and geriatric demographics. Advancements in formulations, including ammonia-free and plant-based dyes, ensure safety and long-lasting color. The rising popularity of temporary and semi-permanent hair dyes further supports market growth, making hair color products a key application segment.

Facial makeup applications, including foundations, blushes, and powders, significantly contribute to the cosmetic dyes market. The demand for high-performance dyes that offer smooth coverage, skin compatibility, and natural tones is driving innovation. Moreover, oil- and water-based formulations benefit from advanced dyes that ensure consistency, durability, and seamless blending. In addition, growing consumer interest in premium, customizable, and skin-friendly facial makeup continues to strengthen the importance of cosmetic dyes in this segment.

Eye makeup products, such as eyeshadows, eyeliners, and mascaras, rely heavily on cosmetic dyes for vibrant and long-lasting pigmentation. The segment benefits from the rising demand for bold, colorful, and smudge-resistant eye cosmetics. Moreover, advancements in dye formulations are enhancing safety, ensuring they are gentle on sensitive areas such as the eyes. With evolving beauty trends and increasing social media influence, eye makeup continues to be a dynamic and growing segment in the cosmetic dyes market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 35.0%. This dominance is largely due to its strong beauty and personal care industry, supported by high spending on premium and innovative products by individuals. The focus of the region on clean-label and sustainable formulations drives demand for natural and organic cosmetic dyes. Strict regulatory frameworks, such as the REACH regulations of the European Union, ensure product safety and quality, boosting consumer trust and encouraging innovation in dye formulations. Additionally, Europe is home to leading cosmetic brands and research hubs that invest in advanced technologies for vibrant, long-lasting dyes. The growing popularity of eco-friendly and cruelty-free products also aligns with the sustainability goals of the region, further enhancing market growth. Robust demand for facial makeup, hair coloring, and eye cosmetics also solidifies the leading position of Europe in the market.

Key Regional Takeaways:

United States Cosmetic Dyes Market Analysis

In 2024, the United States accounts for over 80.50% of the cosmetic dyes market in North America. The flourishing beauty and personal care industry, worth more than USD 100 Billion annually, is propelling the United States market for cosmetic dyes, according to industry reports. Consumer preference for premium, natural-appearing, colourful cosmetics is driving demand for vibrant and safe dyes. Colour cosmetics such as lipsticks, eyeshadows, and hair colours have become increasingly popular, and consumers who are concerned about their health and the environment are particularly drawn to organic and vegan-friendly dyes. For instance, a study from the Vegan Society reports that 30,000 vegan cosmetic products were registered in 2023.

In addition to this, regulatory requirements for safe formulations are encouraging manufacturers to invest in natural and FDA-approved dye substitutes. Moreover, the United States is one of the biggest markets for beauty lessons on YouTube and Instagram, and the growth of influencer marketing and social media platforms has also increased consumer awareness. Sales of hair dye, particularly colorful and semi-permanent tints, have increased among younger populations, which has increased demand for high-performance cosmetic dyes. Besides this, technological innovations in cosmetic formulation, such as long-lasting pigments and microencapsulation, are expanding the range of uses for dyes, facilitating industry expansion.

Europe Cosmetic Dyes Market Analysis

The primary factors driving the cosmetics dyes market in Europe are strict regulations, consumer desire for environment-friendly products, and a well-established cosmetic industry. Cosmetics Europe estimates the European market for cosmetics and personal care products to have reached about € 96 Billion (USD 100 Billion) in the year 2023. EU regulations on synthetic chemicals and additives, such as the REACH rule, have hastened the shift toward safer, natural and organic colors. This is also very prominent in the hair care market where, for instance, henna-based formulas and ammonia-free hair colors are gaining popularity. Also, there is a strong demand for luxury cosmetics in France, Germany, and Italy, which is encouraging innovation in premium and long-lasting dyes. Plant-based colors are also more in use due to the regional focus on vegan and cruelty-free products. There is increasing demand for men's grooming products in Europe, such as hair and beard dyes. Along with that, there is a rising demand for sustainable and recyclable packaging, creating an opening for more eco-friendly formulas for dyes, making Europe the leader in sustainable cosmetics.

Asia Pacific Cosmetic Dyes Market Analysis

The largest and fastest-growing market for cosmetic dyes is in Asia-Pacific, mainly due to rapid urbanization, and inflating income levels of individuals. Key contributors to the region's beauty and personal care industry are China, Japan, South Korea, and India. The market size of the four countries is estimated at more than USD 190 Billion as of 2023, based on a report by BDA Partners, an investment advisory firm. Moreover, international beauty trends have resulted in young consumers embracing more colorful makeup and hair dye products in China. Furthermore, South Korea's dominance in K-beauty, which focuses on natural and innovative cosmetics, is increasing the demand for dyes that are plant-based and hybrid. Herbal as well as ayurvedic cosmetics in India are propelling consumers toward using natural dyes such as turmeric and sandalwood. Growing awareness with regard to clean products is consequently propelling the cosmetic market forward, which has also been augmented by a democratized and widened use of e-commerce.

Latin America Cosmetic Dyes Market Analysis

Factors driving growth in the Latin America cosmetic dyes market include the region's population of youth, rising discretionary incomes, and attraction to unconventional and colourful beauty trends. The beauty and personal care sector in the region is valued at more than USD 60 Billion in 2022 according to industry reports, in which Brazil and Mexico are the leading countries. Moreover, hair colour products account for over 20% of the industry for hair care, particularly in Brazil, as hair colour has become a very in-demand beauty product. In recent years, organic raw materials for natural products have gained popularity, which increased the demand for plant-based and eco-friendly dyes. Organic compositions are consequently being used by local companies that seek to attract environmentally cautious consumers. Besides this, social media sites also influence beauty trends, driving regional sales of new, vibrant cosmetics.

Middle East and Africa Cosmetic Dyes Market Analysis

The Middle East and Africa cosmetic dyes market is experiencing growth due to increased demand for beauty and personal care products, driven by growing disposable incomes and increasing urbanization. A shift toward premium cosmetics, which includes bright makeup and hair care products, is increasing the demand for premium dyes. The young population in the region, particularly in countries such as Saudi Arabia and the UAE, has been adopting global beauty trends and bold color choices. Cultural significance of beauty and grooming in the region is further fostering market growth. As consumers seek safe and ethical products, the demand for halal-certified, natural, and clean-label dyes is rising. The growing e-commerce platforms and marketing through social media are further increasing accessibility and awareness that support the growing adoption of cosmetic dyes in this region.

Competitive Landscape:

Key players in the market are focusing on several strategic initiatives to maintain and enhance their market positions. The cosmetic dyes market forecast states that companies are investing in research and development (R&D) to develop new formulations for improved dyes that provide better color quality. This incorporates nanotechnology, microencapsulation, and organic synthesis technologies to develop high-performance, green dyes that meet consumer and regulatory demands. Moreover, players are increasingly diversifying their product portfolios to embrace all types of vibrant, unique colors that would suit the changing tastes of the beauty-conscious consumer base. Strategic partnerships and collaborations with cosmetics brands and beauty influencers further lend impetus to a product. Furthermore, companies are striving to meet stringent regulatory standards as well as global benchmarks of safety and quality standards, hence gaining consumer confidence and creating a positive cosmetic dyes market outlook overall.

The report provides a comprehensive analysis of the competitive landscape in the cosmetic dyes market with detailed profiles of all major companies, including:

- BASF Personal Care and Nutrition GmbH

- Chromatech Incorporated

- Dayglo Color Corporation

- DyStar Singapore Pte Ltd

- Goldmann Group

- Koel Colours Private Limited

- Neelikon Food Dyes And Chemicals Limited

- Proquimac

- Pylam Products Company, Inc.

- Sensient Cosmetic Technologies

Latest News and Developments:

- April 2024: Lucas Meyer Cosmetics, a company renowned for its proficiency in cosmetic chemicals and formulations, has been successfully acquired by Clariant. With this acquisition, the cutting-edge active ingredients, natural polymers, and emulsifiers of Lucas Meyer, which are in demand due to growing consumer interest in sustainable and natural beauty products, have been added to the personal care portfolio of Clariant.

- April 2024: Univar Solutions, a global specialty chemical and ingredient distributor, has announced that Koel USA Inc., under its parent company KCC Corporation Pvt Ltd., has appointed Univar to distribute their pigments and colorants used for cosmetic formulations as well as personal care items on exclusive arrangement basis.

Cosmetic Dyes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Organic Dyes, Inorganic Dyes |

| Solubility Types Covered | Water-based, Solvent-based, Oil-based |

| Applications Covered | Hair Color Products, Facial Makeup, Eye Makeup, Lip Products, Nail Products, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF Personal Care and Nutrition GmbH, Chromatech Incorporated, Dayglo Color Corporation, DyStar Singapore Pte Ltd, Goldmann Group, Koel Colours Private Limited, Neelikon Food Dyes And Chemicals Limited, Proquimac, Pylam Products Company, Inc., Sensient Cosmetic Technologies, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cosmetic dyes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cosmetic dyes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cosmetic dyes industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cosmetic dyes are color additives used to enhance the visual appeal of beauty and personal care products, including makeup, hair color, skincare, and nail polishes. These dyes provide vibrant, consistent pigmentation and are available in synthetic, natural, water-soluble, oil-soluble, and solvent-based forms. They are formulated to meet safety standards, ensuring compatibility with skin, hair, and other cosmetic applications.

The cosmetic dyes market was valued at USD 515.1 Million in 2024.

IMARC estimates the global cosmetic dyes market to exhibit a CAGR of 3.85% during 2025-2033.

The rising demand for vibrant and personalized beauty products, growing adoption of natural and organic cosmetic dyes, increasing popularity of hair coloring solutions, technological advancements in dye formulation, and expansion of the premium and luxury cosmetics segment are the primary factors driving the global cosmetic dyes market.

According to the report, inorganic dyes represented the largest segment by type due to their superior stability, durability, and resistance to heat, light, and chemicals.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global cosmetic dyes market include BASF Personal Care and Nutrition GmbH, Chromatech Incorporated, Dayglo Color Corporation, DyStar Singapore Pte Ltd, Goldmann Group, Koel Colours Private Limited, Neelikon Food Dyes And Chemicals Limited, Proquimac, Pylam Products Company, Inc., Sensient Cosmetic Technologies, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)