Corporate M-learning Market Size, Share, Trends and Forecast by Solutions, Application, User Type, and Region, 2025-2033

Corporate M-learning Market Size and Share:

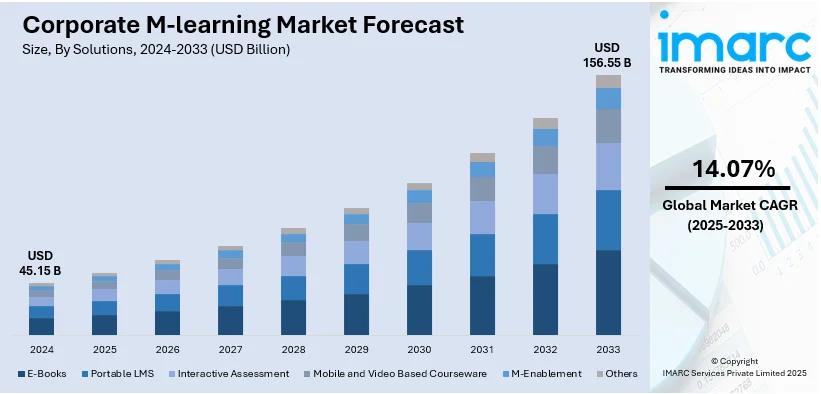

The global corporate m-learning market size was valued at USD 45.15 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 156.55 Billion by 2033, exhibiting a CAGR of 14.07% from 2025-2033. North America currently dominates the corporate m-learning market share by holding over 36.5% in 2024. The market in the region is driven by the increasing adoption of mobile-based training solutions, a growing remote workforce, and ongoing advancements in artificial intelligence (AI)-powered personalized learning platforms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 45.15 Billion |

|

Market Forecast in 2033

|

USD 156.55 Billion |

| Market Growth Rate (2025-2033) | 14.07% |

The global corporate m-learning market growth is driven by the rising adoption of remote and hybrid work models, as they are increasing the demand for flexible, mobile-based training solutions. In addition, ongoing advancements in AI and personalized learning enhance engagement and efficiency, aiding the market demand. For instance, Vista Equity Partners' decision to transfer control of Pluralsight to private lenders highlights the evolving dynamics within the education technology industry, with implications for corporate M-learning solutions. Moreover, the growing adoption of smartphones and high-speed internet enables seamless access to training materials, impelling the market growth. Besides this, the need for continuous skill development due to rapid technological advancements fuels corporate investment in M-learning, driving the market demand. Furthermore, regulatory compliance and certification requirements encourage companies to implement standardized mobile learning solutions, thus catalyzing the market growth.

The corporate m-learning market demand in the United States currently exhibits a share of 87.90%. The market is primarily driven by the increasing emphasis on diversity, equity, and inclusion (DEI) training, as they encourage companies to adopt scalable mobile learning solutions. In line with this, government initiatives promoting workforce upskilling drive the demand for digital training platforms, strengthening the market share. For example, the U.S. maintains a strong focus on science, technology, engineering, and management (STEM) education, providing a foundation for the development and adoption of advanced m-learning solutions in corporate training. Concurrently, the rise of gig and freelance work creates a need for on-the-go learning modules, supporting the market growth. Additionally, rising corporate sustainability goals push organizations to replace paper-based training with digital alternatives, fueling the market demand. Furthermore, cybersecurity awareness training is expanding due to growing cyber threats, which is providing an impetus to the market. Apart from this, the integration of gamification enhances employee engagement and retention in mobile learning programs, thereby propelling the market forward.

Corporate M-learning Market Trends:

Remote Workforce Training Demand

The increasing demand for remote workforce training solutions is influencing the corporate m-learning market trends. With the globalization of businesses and the rise of telecommuting, organizations are seeking flexible and accessible methods to educate their employees. According to an industrial report, 79% of top-performing companies utilize mobile learning, recognizing its effectiveness in bridging geographical gaps and providing training to employees regardless of their location. m-learning, delivered through smartphones, tablets, and laptops, enables companies to bridge geographical gaps and provide training to employees regardless of their location. The shift towards remote work, and the need for digital training solutions, is positively influencing the market. As companies are investing in m-learning platforms, they can deliver consistent training experiences, ensuring that employees stay updated with the latest industry trends and skills, ultimately boosting productivity and competitiveness. Therefore, the demand for remote workforce training is a significant driver impelling the growth of the market.

Advancements in Mobile Technology

Continuous advancements in mobile technology are strengthening the corporate m-learning market share. As smartphones and tablets are becoming more powerful and accessible, they provide an ideal platform for delivering training and educational content to employees. These devices offer a portable and convenient way for learners to access information, take courses, and engage with interactive materials, making learning more flexible and tailored as per individual schedules. Additionally, the proliferation of high-speed mobile internet connectivity ensures that learners can access M-learning content virtually anywhere, reducing barriers to participation and enhancing the learning experience. Furthermore, the integration of features like touchscreens, augmented reality (AR), and virtual reality (VR) into mobile devices is revolutionizing the way corporate training is delivered, making it more immersive and engaging.

Cost-Effective and Scalable Learning Solutions

Traditional in-person training and development programs can be expensive, involving expenses, such as travel, accommodation, venue rental, and printed materials. For instance, mobile learning can reduce training costs by up to 70%, underscoring its economic benefits. In contrast, m-learning eliminates many of these costs by delivering training content digitally. Companies can create, update, and distribute learning modules at a fraction of the cost associated with traditional methods. Furthermore, M-learning allows for easy scalability, accommodating the training needs of a growing workforce or expanding global operations without significant infrastructure investments. This scalability is essential in a business environment, where companies need to adapt quickly to changing industry demands. As organizations recognize the cost-saving potential and scalability advantages of m-learning, they increasingly embrace it as a strategic approach to employee development, enhancing the corporate m-learning market outlook.

Enhanced Employee Engagement and Retention

Traditional training methods often struggle to maintain the attention and interest of employees, leading to lower retention rates of essential information. In contrast, m-learning leverages interactive and engaging content formats, such as gamification, simulations, and multimedia presentations, to make learning enjoyable and memorable. This approach not only keeps employees more engaged but also improves their ability to retain and apply what they have learned. Engaged employees are more likely to feel valued and motivated, which can lead to increased job satisfaction and reduced turnover rates. Research indicates that mobile learning can increase knowledge retention rates by 25-60%, highlighting its effectiveness in enhancing learning outcomes. As businesses are recognizing the positive impact of M-learning on employee engagement and retention, they are investing in these solutions to foster a skilled and loyal workforce, thereby impelling the growth of the market.

Corporate M-learning Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global corporate m-learning market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on solutions, application, and user type.

Analysis by Solutions:

- E-Books

- Portable LMS

- Interactive Assessment

- Mobile and Video Based Courseware

- M-Enablement

- Others

E-books are currently dominating the market with a share of 35.8% as they offer convenient and portable access to training materials, making them a popular choice for learners looking for self-paced, text-based content. They are particularly favored for subjects that require extensive reading and reference materials. E-books can be easily downloaded and read on various devices, ensuring accessibility for employees with different learning preferences. Additionally, they support interactive features like annotations, hyperlinks, and search functions, enhancing user experience. As the largest segment, e-books play a pivotal role in corporate training, especially in knowledge-based industries where continuous learning, quick reference to updated information, and cost-effective content distribution are essential.

Analysis by Application:

- Simulation Based Learning

- Corporate Learning

- On-The-Job Training

Simulation-based learning is a significant segment within the market, offering immersive and practical training experiences. This application is particularly valuable in industries where hands-on experience is crucial, such as healthcare, aviation, and manufacturing. Simulation-based learning allows employees to practice real-world scenarios in a safe and controlled digital environment. It helps enhance decision-making skills, critical thinking, and problem-solving abilities by providing a risk-free space for employees to make mistakes and learn from them.

Corporate learning represents a fundamental segment in the market, focusing on the broader training and development needs of employees. This application encompasses a wide range of topics, ranging from compliance training and soft skills development to leadership training and product knowledge. Corporate learning through M-learning platforms provides employees with access to a diverse array of courses and modules, often tailored as per the specific needs of the organization.

On-the-job training is a crucial segment in the market, emphasizing continuous learning and skill enhancement while employees perform their daily tasks. This application promotes learning in the flow of work, allowing employees to access relevant information and guidance exactly when they need it. On-the-job training through M-learning involves resources like quick reference guides, job aids, and microlearning modules that can be easily accessed via mobile devices.

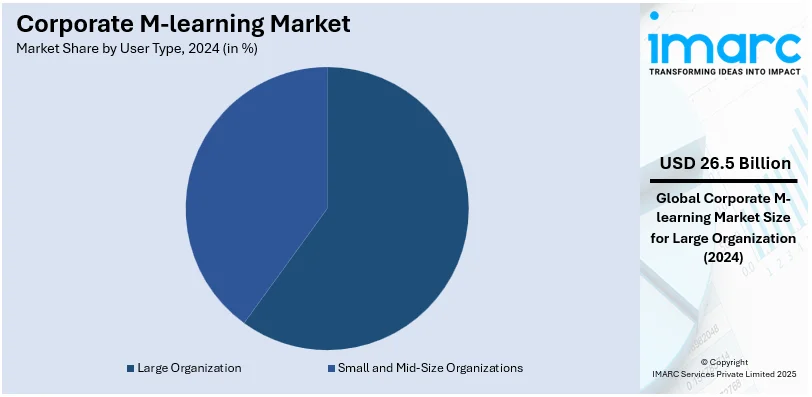

Analysis by User Type:

- Large Organization

- Small and Mid-Size Organizations

Large organizations play a significant role and are currently dominating the market 58.6% as they often have extensive employee bases and complex training needs. They invest in M-learning solutions to streamline their training processes, ensuring that employees across various departments and locations receive consistent and standardized training. They also leverage m-learning platforms to onboard new hires efficiently, provide ongoing professional development, and ensure compliance with industry regulations. The scalability of m-learning solutions allows them to adapt to the evolving needs of a sizable workforce, making it an essential tool for talent development and organizational growth. Additionally, m-learning enables real-time performance tracking, personalized learning paths, and cost savings by reducing the need for in-person training sessions and printed materials.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the market and currently holds 36.5% share driven by its tech-savvy workforce, early adoption of mobile technologies, and the presence of numerous large enterprises and tech companies. In North America, corporate organizations have been quick to embrace M-learning solutions to enhance employee training, onboarding, and skill development. The well-established infrastructure, high-speed internet connectivity, and a culture of innovation are further increasing the adoption of m-learning. Moreover, significant investments are reshaping the education technology landscape. For instance, KKR & Co's $4.8 billion acquisition of Instructure Holdings underscores the growing value and potential of m-learning platforms in the corporate sector. Moreover, the increasing emphasis on remote and hybrid work models has driven the need for adaptable, mobile-friendly learning solutions. Furthermore, increasing investments in AI-driven personalized learning, data analytics, and interactive content are fostering the market growth across various industries.

Key Regional Takeaways:

United States Corporate M-learning Market Analysis

The U.S. corporate m-learning market is gaining momentum as there is a high demand for digital transformation and upskilling within the workforce. The U.S. Bureau of Labor Statistics reports that corporate training expenditures in the United States reached approximately USD 100 billion in 2023, with a growing portion being allocated to mobile learning solutions. Enterprises are also embracing AI-driven adaptive learning, microlearning modules, and gamification to drive employee engagement. Key growth areas continue to be compliance training, leadership development, and technical skill-building. The leaders of the pack include Skillsoft and Coursera for Business, which are leading the expansion in the market with AI-based platforms and strategic collaborations. Increased pressure on adopting remote and hybrid work models will fuel the growth of mobile-based learning. Federal efforts to close the skill gap and corporate investment in continuous learning solutions will drive market growth continuously. The U.S. is also one of the biggest exporting countries to global enterprises and multinational corporations with corporate m-learning solutions.

Europe M-learning Market Analysis

The corporate m-learning market is growing in Europe because of initiatives for a digital workplace, a need for reskilling from the corporate environment, and statutory compliance training mandates. The European Commission has granted substantial funding toward upskilling the workforce in programs such as the European Social Fund Plus with more than €99 billion (USD 106.64 billion) under the 2021-2027 budgeted amount for the development of skills and Erasmus+ with more than €26.2 billion (USD 28.22) for vocational education and training. German, UK and French companies are adopting AI-based LMS and immersive technologies such as VR and AR to train their employees. Demand for structured mobile learning programs is increased by regulatory frameworks like GDPR and industry-specific compliance standards. The companies leading providers of adaptive learning solutions are SAP Litmos and Cornerstone OnDemand. Digital transformation initiatives undertaken by governments and EU-wide upskilling programs have sustained market growth. Besides, the increased number of multilingual mobile learning platforms supports a multilingual workforce in the region and makes Europe a strategic base for corporate m-learning innovation.

Asia Pacific M-learning Market Analysis

The Asia Pacific corporate m-learning market is rapidly expanding due to factors such as digital adoption, upskilling led by governments, and growing demands for training workforces. According to IMARC, the India e-learning market reached USD 7.3 billion in 2024 and is estimated to grow at a CAGR of 12% from 2025-2033 and reach USD 20.8 billion. Key government programs, such as Digital India and Skill India, are driving the adoption of mobile training among corporate houses. China is another major market, with large-scale employee training being conducted by companies utilizing AI-based mobile learning platforms. Japan and South Korea are at the forefront of implementing VR, AR, and gamification in the corporate learning space. BYJU and EdCast are examples of innovation through adaptive and personalization of learning solutions. Moreover, the penetration of 5G networks and smartphones supports the scalability of mobile learning, and Asia Pacific is expected to be a high-growth region in the corporate m-learning sector.

Latin America M-learning Market Analysis

The corporate m-learning market in Latin America is on the rise, driven by digital transformation initiatives, increasing demand for upskilling, and expanding internet penetration. Industrial reports show that, in 2022, there were approximately 337,940 companies and institutions legally registered in the educational sector in Brazil. Brazil leads the region in corporate training investments, with businesses integrating AI-driven and mobile-first learning solutions. Mexico and Argentina are increasingly adopting mobile learning platforms for compliance training and workforce development. Market growth is further fueled by government-backed programs in digital education, as well as partnerships between local firms and international e-learning providers. Companies such as Veduca and Crehana improve the usability of on-the-go corporate training opportunities. Additionally, increasing smartphone usage and improving connectivity infrastructure support the adoption of m-learning solutions, positioning Latin America as a key emerging market for corporate mobile learning innovation.

Middle East and Africa M-learning Market Analysis

The corporate m-learning market in the Middle East and Africa is growing due to government-led workforce development initiatives, digital transformation, and rising corporate investments in training programs. In the 2023 Training Industry Report, it was found that companies worldwide spent an average of USD 954 per employee on corporate training. Countries in the region like the UAE and Saudi Arabia lead the way through AI-powered and mobile learning platforms to upskill employees working in finance, health, and tech sectors. Digital learning tools such as in South Africa help skill gaps by building workforce productivity. Government programs of Saudi Vision 2030 for Saudi and the National In-Country Value Program for UAE point out that in-country training in corporations can further diversify economic growth. Increasing smartphone penetration and improved digital infrastructure further support the growth of mobile learning solutions, which makes this region an emerging market for innovative corporate m-learning.

Competitive Landscape:

Key players in the market are actively engaged in various strategic initiatives to maintain their competitive edge. They are investing in research and development (R&D) activities to enhance their m-learning platforms and content, making them more interactive, personalized, and aligned with industry-specific needs. These companies are also expanding their global reach by forming partnerships and collaborations with educational institutions, content providers, and corporate clients to deliver comprehensive learning solutions. Additionally, they focus on data analytics to provide insights into employee performance and engagement, enabling organizations to make informed decisions about training programs. Furthermore, key players are staying updated with technological advancements, such as augmented reality (AR) and virtual reality (VR), to create immersive learning experiences, ensuring their relevance and leadership in the rapidly evolving corporate m-learning landscape.

The report provides a comprehensive analysis of the competitive landscape in the corporate m-learning market with detailed profiles of all major companies, including:

- Adobe Inc.

- Allen Interactions

- Aptara Inc (iEnergizer)

- Blackboard Inc.

- D2L Corp

- dominKnow Inc

- Kallidus Ltd

- Learning Pool

- Meridian Knowledge Solutions (Visionary Integration Professionals)

- SumTotal Systems (Cornerstone OnDemand)

- Upside Learning Solutions Pvt. Ltd.

Latest News and Developments:

- October 2024: Adobe announced an expansion of its Digital Academy to enhance AI literacy, content creation, and digital marketing skills. The initiative aims to train 30 million learners globally by 2030, providing certifications and access to Adobe Express for workforce readiness.

- October 2024: D2L launched D2L for Business to address corporate skills gaps, and improve onboarding, sales enablement, and leadership development. According to D2L’s upskilling report, 92% of leaders acknowledge effective learning boosts employee retention. The platform supports workforce development in areas like Generative AI and product expertise.

- August 2024: Mitr Learning & Media acquired Upside Learning Solutions to expand its custom learning solutions for corporate clients. The deal enhances Mitr’s market position and learning consulting capabilities. Upside Learning’s team will integrate with Mitr, strengthening its ability to deliver tailored, performance-driven training solutions globally.

- July 2024: Anthology unveiled the latest Blackboard LMS, enhancing AI literacy, instructor efficiency, and student success. Features like AI Conversations and Video Studio support evolving educational needs, reinforcing its leadership in EdTech. The update addresses higher education challenges, emphasizing innovation and adaptability.

- December 2023: Upside Learning Solutions Pvt. Ltd. has introduced a new eBook exploring the concepts and applications of scenario-based learning. The eBook provides learning professionals with a valuable resource to use scenario-based learning for effective training experiences that engage learners.

Corporate M-learning Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered | E-Books, Portable LMS, Interactive Assessment, Mobile and Video Based Courseware, M-Enablement, Others |

| Applications Covered | Simulation Based Learning, Corporate Learning, On-The-Job Training |

| User Types Covered | Large Organization, Small and Mid-Size Organization |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adobe Inc., Allen Interactions, Aptara Inc (iEnergizer), Blackboard Inc., D2L Corp, dominKnow Inc, Kallidus Ltd, Learning Pool, Meridian Knowledge Solutions (Visionary Integration Professionals), SumTotal Systems (Cornerstone OnDemand), Upside Learning Solutions Pvt. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the corporate M-learning market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global corporate M-learning market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the corporate M-learning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The corporate M-learning market was valued at USD 45.15 Billion in 2024.

IMARC estimates the corporate M-learning market to exhibit a CAGR of 14.07% during 2025-2033, expecting to reach USD 156.55 Billion by 2033.

The corporate M-learning market is driven by the increasing adoption of remote and hybrid work models, advancements in AI-powered personalized learning, rising demand for cost-effective training solutions, the growing use of smartphones and high-speed internet, the need for continuous workforce upskilling, and regulatory compliance requirements across industries.

North America currently dominates the market fueled by the rising demand for the rising demand for mobile-based training, a tech-savvy workforce, strong internet infrastructure, AI-driven learning adoption, increasing remote work trends, and significant corporate investments in employee development and compliance training.

Some of the major players in the corporate M-learning market include Adobe Inc., Allen Interactions, Aptara Inc (iEnergizer), Blackboard Inc., D2L Corp, dominKnow Inc, Kallidus Ltd, Learning Pool, Meridian Knowledge Solutions (Visionary Integration Professionals), SumTotal Systems (Cornerstone OnDemand), Upside Learning Solutions Pvt. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)