Corn Oil Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2026-2034

Corn Oil Market Size and Share:

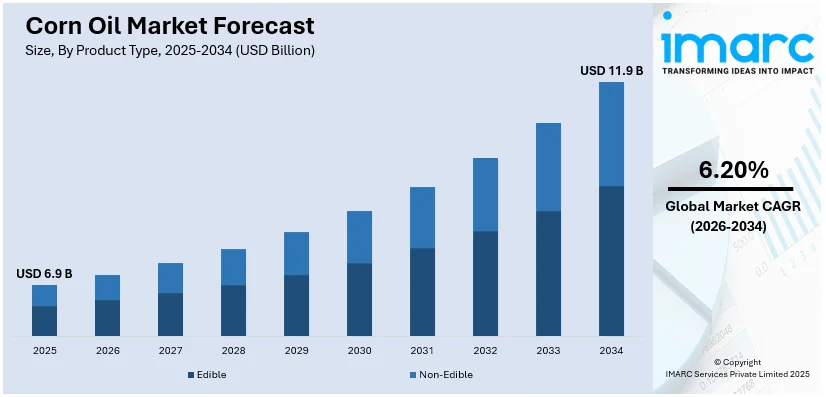

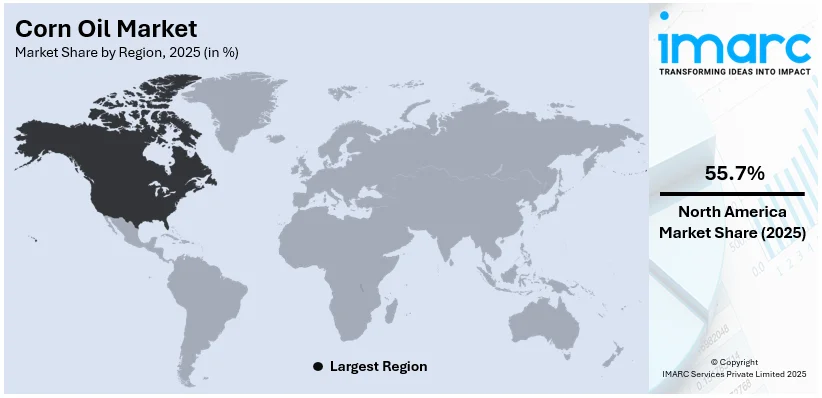

The global corn oil market size was valued at USD 6.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 11.9 Billion by 2034, exhibiting a CAGR of 6.20% during 2026-2034. North America currently dominates the market, holding a significant market share of over 55.7% in 2025. The corn oil market share is experiencing robust growth, driven by the escalating health consciousness among consumers, rising product demand in the biofuel sector, growing impact of urbanization and economic development, continuous technological advancements in extraction and processing techniques, and burgeoning innovations in the food industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 6.9 Billion |

|

Market Forecast in 2034

|

USD 11.9 Billion |

| Market Growth Rate (2026-2034) |

6.20%

|

The growing demand for healthy frying oils, rising awareness regarding the health benefits related to corn oil, and its wide range of applications in the food sector fuel the market for corn oil. Corn oil is high in polyunsaturated fatty acids, hence it is sought after by consumers who are health-conscious. It also has a high smoking point, making it suitable for frying, thereby escalating its market demand. The increase in consumption of processed food, as well as the growing foodservice market, is a major contributor to the growth of the market. Moreover, the application of corn oil in biodiesel manufacture as a renewable fuel is becoming increasingly popular, in sync with the demand for eco-friendly substitutes. Additionally, research in the agricultural and food industry, including better extraction technologies and product diversification, also augments the growth factors. The growing world population and increasing disposable incomes also favor the growing demand for corn oil across the globe.

To get more information on this market Request Sample

The United States stands out as a key market disruptor, driven by the abundant and cost-effective raw material supply, allowing for competitive pricing in the global market. The health-conscious consumption drive in the country has propelled the demand for corn oil, specifically because of its beneficial fatty acid profile, which is attractive to health-conscious consumers looking for a substitute for common oils. Additionally, the US has emerged as a major market for the biodiesel industry, utilizing corn oil as a raw material for producing renewable energy. This technology is transforming demand patterns, with clean energy solutions assuming greater significance. The US also possesses an established food processing and distribution system, facilitating efficient access to domestic and international markets. Through its large-scale production, technology, and focus on sustainability, the US continues to disrupt and mold the global market for corn oil.

Corn Oil Market Trends:

Rising health consciousness among consumers

The increasing health consciousness among consumers, leading to a shift towards oils that are perceived as healthy, is one of the major factors bolstering the market growth. In line with this, the growing adoption of corn oil due to its high unsaturated fat content and low levels of saturated fats that help in maintaining cholesterol levels and reducing heart disease risk, is fuelling the market growth. For instance, in 2021, 20.5 Million people died from a cardiovascular condition. Furthermore, corn oil contains essential fatty acids like linoleic acid that play a crucial role in various bodily functions, including supporting cellular health, maintaining brain function, and aiding in the regulation of inflammation. Besides this, the widespread product application in salad dressings, frying, baking, and non-food products like soaps and biofuels, is bolstering the corn oil market.

Burgeoning expansion in biofuel production

The burgeoning biofuel industry that utilizes corn oil as a feedstock for biodiesel production, is fuelling the market growth. According to International Energy Association, biofuel demand is set to expand 38 Billion litres over 2023-2028, a near 30% increase from the last five-year period. In line with this, the imposition of various governmental policies and mandates to promote sustainable energy solutions, thereby escalating the demand for corn oil, is favoring the market growth. Besides this, the widespread product integration in biofuel production to enhance energy security by diversifying the energy mix and reducing the reliance on oil imports is positively impacting the corn oil market share. In addition to this, the continuous advancements in biofuel technology that improve the efficiency and cost-effectiveness of corn oil-based biofuels are creating a positive outlook for the market growth.

Increasing focus on economic growth and urbanization

The rapid urban development and increased disposable incomes, boosting a shift in dietary preferences towards processed and convenience foods, are positively impacting the corn oil market outlook. According to the United Nations, 68% of the world population is projected to live in urban areas by 2050. In line with this, the widespread product utilization as a key ingredient owing to its favorable cooking properties, such as high smoke point and neutral flavor, is favoring the market growth. Along with this, the heightened expansion of food service industries, supermarkets, and hypermarkets, facilitating greater consumer access to a wide array of food products containing corn oil, is providing an impetus to the market growth. Besides this, the burgeoning fast-food sector and the extensive use of cooking oils for frying is enhancing the corn oil demand.

Rapid technological advancements in oil extraction and processing

The development of advanced extraction methods that enhance the efficiency and yield of corn oil production while making the process more cost-effective and environmentally friendly is providing a thrust to the corn oil market share. Along with this, the increasing adoption of modern technologies in refining, such as molecular distillation and winterization, to refine the quality of corn oil, remove impurities, and enhance its stability, flavor, and color, is bolstering the market growth. Moreover, rapid technological advancements in the preservation of corn oil to ensure longer shelf life, maintain freshness, and preserve the oil's nutritional attributes are supporting the market growth. Besides this, the rapid innovations in packaging, such as the use of light-blocking materials and nitrogen flushing to protect the oil from oxidation and degradation, are stimulating the market growth.

Widespread innovations in food industry applications

The increasing versatility of corn oil in various food products, such as cooking, frying, and the formulation of processed foods, condiments, and innovative culinary techniques, is a major factor catalyzing the market growth. According to India Brand Equity Foundation, the food processing sector allows 100% FDI under the automatic route and has recorded a cumulative FDI equity inflow of USD 12.81 Billion between April 2000-June 2024. Moreover, the rising popularity of plant-based diets, clean-label products, and functional foods that utilize corn oil due to its plant-based origin, relatively neutral flavor, and rich content of polyunsaturated fats is favoring the market growth. Additionally, the development of new food processing technologies and the formulation of novel food products that require oils with specific characteristics, such as a particular smoke point, stability, or nutritional profile, is enhancing the corn oil market share. Furthermore, the ongoing innovation in food science and technology, leading to the creation of new emulsions, coatings, and encapsulations that utilize corn oil as a key ingredient, is boosting the market growth.

Corn Oil Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global corn oil market, along with forecasts at the global and regional levels from 2026-2034. The market has been categorized based on product type, application, and distribution channel.

Analysis by Product Type:

- Edible

- Non-Edible

Edible stands as the largest component in 2025, holding around 67.3% of the market. Edible corn oil driven by its widespread use in cooking, frying, and salad dressing. Moreover, the growing health consciousness among consumers who favor the oil due to its heart-healthy unsaturated fats is bolstering the market growth. Along with this, the extensive utilization of edible corn oil by food manufacturers in processed foods, snacks, and baked goods to enhance flavor and extend shelf life is providing a thrust to the market growth. Besides this, the widespread product application in the food service industry for frying, due to its cost-effectiveness and stable frying qualities, is enhancing the corn oil market share.

Non-edible corn oil is utilized in biodiesel production due to the sudden shift towards renewable energy sources and the need to reduce dependency on fossil fuels. It also finds applications in the cosmetic and pharmaceutical industries, owing to its moisturizing properties and fatty acid component. Additionally, the growing application of corn oil in the production of soaps, lubricants, and other industrial products is boosting the market growth.

Analysis by Application:

- Food

- Biofuel

- Industrial

- Others

Food leads the market with around 65.0% of market share in 2025. The food sector reflects the extensive utilization of corn oil across various culinary applications, such as cooking, frying, salad dressings, and as an ingredient in processed foods. In line with this, the growing product adoption in household kitchens and commercial food services owing to its high smoke point and neutral taste that aids in enhancing the flavor and quality of a wide array of dishes, is fueling the corn oil market share. Additionally, the rising consumer inclination towards healthier dietary choices, bolstering the demand for oil as it is perceived as a heart-healthy option that is rich in essential fatty acids, is promoting the market growth.

The biofuel segment utilizes corn oil as a feedstock in the production of biodiesel, which offers a sustainable alternative to conventional fossil fuels. Moreover, the imposition of supportive government policies, environmental regulations, and the increasing commercialization of bio-based fuels is enhancing the corn oil market share. Furthermore, the rising demand for clean energy to achieve sustainability and reduce the environmental impact of energy consumption is favoring the market growth.

According to the corn oil market trends, the industrial sector employs corn oil for a wide range of products, such as soaps, paints, inks, pharmaceuticals, and various other chemical products. Along with this, the growing product popularity due to its biodegradability and its status as a renewable resource is favoring the market growth.

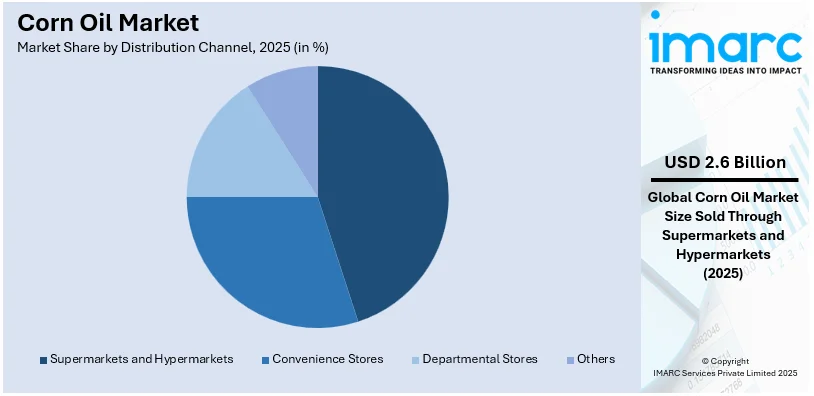

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Departmental Stores

- Others

Supermarkets and hypermarkets leads the market with around 40.5% of market share in 2025. Supermarkets and hypermarkets offer numerous brands and product varieties that cater to the diverse preferences of consumers. Moreover, their extensive reach and convenience, enabling customers to compare different brands, prices, and product qualities efficiently, is providing a thrust to the corn oil market share. Besides this, supermarkets and hypermarkets offer competitive pricing, promotional deals, and discounts, which attract a larger customer base. Additionally, their in-store experience, coupled with the assurance of product quality and availability that reinforces consumer loyalty and trust, is enhancing the market growth.

According to the corn oil market trends, convenience stores offer quick and easy access to essential grocery items, including corn oil. In line with this, the rising demand for speed and convenience among customers who prefer to make quick, impromptu purchases without the hassle of navigating larger retail formats is promoting the corn oil market share.

Departmental stores cater to middle and upper-middle-class consumers who seek a more curated shopping experience with a selection that includes premium or specialty corn oil brands. Besides this, the heightened availability of corn oil in departmental stores that complement the broader food and culinary product range is favoring the market growth.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 55.7%. North America is one of the largest producers and consumers of corn oil. Moreover, the presence of a well-established agricultural sector, heightened awareness regarding the health benefits of corn oil, and the widespread adoption of oil in various food applications are favoring the market growth. Additionally, the increasing product adoption in the biofuel industry as a feedstock for biodiesel production, to align with the region's growing emphasis on renewable energy and sustainable practices, is enhancing the corn oil market share. Furthermore, the presence of major market players, coupled with advanced technological infrastructure for efficient production and processing, is bolstering the market share.

According to the corn oil market trends, the Asia Pacific region is rapidly growing, fueled by increasing urbanization, rising income levels, and the ongoing shift in dietary preferences towards healthier cooking oils. Moreover, the burgeoning awareness about the health benefits of corn oil and the rising prevalence of lifestyle-related diseases are driving the market growth.

Europe represents a significant segment in the corn oil market, characterized by high consumer demand for healthy and high-quality food products. Along with this, the imposition of stringent food safety regulations that ensure high purity and quality standards is positively impacting the corn oil market share. Additionally, the increasing popularity of plant-based diets and the demand for non-genetically modified organisms (GMO) and organic food products are fueling the market growth.

According to the corn oil market trends, Latin America is growing steadily due to its significant corn production and the rising health awareness among the population. Moreover, the increasing urbanization, coupled with the expansion of the retail sector, which improves consumer access to various products, is providing a thrust to the market growth.

The Middle East and Africa (MEA) region is experiencing growth in the corn oil sector due to changing dietary habits, urbanization, and an increasing emphasis on healthier lifestyle choices. Along with this, the expanding hospitality and food service industries, driving the demand for high-quality corn oil, are providing an impetus to the market growth.

Key Regional Takeaways:

United States Corn Oil Market Analysis

In 2025, the United States accounted for over 89.30% of the corn oil market in North America. The growing adoption of corn oil in the United States is largely driven by the increasing health consciousness among consumers and their focus on maintaining a healthy diet. As per survey, almost 60% of America's diet consists of ultra-processed foods rich in refined grains, calories, sodium, added sugars and saturated fat, and are increasingly being chosen by consumers over nutritionally superior options. As awareness regarding the importance of consuming healthier fats rises, corn oil, being rich in unsaturated fats, is becoming a popular choice for consumers who are opting for healthier cooking oils. Additionally, the shift towards better nutritional practices and a greater emphasis on weight management are promoting the use of oils that provide health benefits without compromising flavor or taste. As consumers become more educated about the health advantages of corn oil, it continues to gain traction in various households and food establishments, reflecting a broader shift towards healthier food options. This trend is expected to continue as people prioritize their well-being and actively seek alternatives that align with their dietary goals.

Asia Pacific Corn Oil Market Analysis

In the Asia-Pacific region, the growing adoption of corn oil can be attributed to the rise of supermarkets and hypermarkets, which serve as key distribution channels for various cooking oils. According to reports, there are 66,225 supermarkets in India as of January 23, 2025, which is an 3.88% increase from 2023. As these retail formats expand and gain popularity, they provide consumers with easy access to a wide range of corn oil brands and packaging sizes. The convenience of shopping in these large retail stores is fuelling the demand for corn oil, as shoppers seek healthier alternatives in cooking. Moreover, the increased availability of corn oil in supermarkets and hypermarkets enables consumers to make more informed purchasing decisions based on factors like nutritional content, price, and brand recognition. This growth in retail infrastructure is making it easier for corn oil to reach a broader consumer base, leading to a steady rise in its adoption across the region. The trend is further supported by growing disposable incomes and changing consumer preferences towards healthier cooking practices.

Europe Corn Oil Market Analysis

In Europe, the growing adoption of corn oil is driven by the expanding food and beverages processing industry. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages. As more food manufacturers shift towards using healthier cooking oils in their products, corn oil is becoming a favored choice due to its high smoke point, neutral flavor, and health benefits. The food processing sector's growing demand for versatile and cost-effective oils to enhance the quality of various products such as ready-to-eat meals, snacks, and baked goods is fuelling corn oil's adoption. Additionally, as consumer preferences continue to evolve towards cleaner labels and healthier ingredients, food producers are increasingly choosing corn oil for its reputation as a healthier alternative to other oils, including palm and sunflower oil. The growing trend of healthier eating habits, supported by both manufacturers and consumers, is boosting the demand for corn oil in Europe, particularly within the food and beverage sector.

Latin America Corn Oil Market Analysis

In Latin America, the adoption of corn oil is rising due to the increasing popularity of online e-commerce platforms and the growing disposable income of consumers. According to reports, the Latin America market currently boasts over 300 Million digital buyers. With the convenience of online shopping, consumers are increasingly turning to e-commerce platforms to purchase cooking oils, including corn oil, due to the wide selection, competitive prices, and ease of access. This trend is particularly notable in urban areas, where online platforms offer consumers a variety of corn oil brands and packaging options, making it easier for them to compare and select products that meet their dietary needs. As disposable incomes rise, more consumers are willing to invest in premium, healthier oil options like corn oil, further driving its adoption in the region.

Middle East and Africa Corn Oil Market Analysis

In the Middle East and Africa, the growing adoption of corn oil can be attributed to the increasing urbanization and the expanding tourism sector. According to UN Habitat, the proportion of people in the Arab region living in cities is 60% and is expected to reach 70% by 2050. As more people move to urban centers and experience higher standards of living, there is an increased demand for convenient and healthier food options. Corn oil, known for its health benefits, is gaining popularity as consumers in urban areas are more aware of the impact of diet on health. Additionally, the growing tourism industry is driving demand for corn oil in the hospitality sector, where it is used in restaurants and hotels to prepare a variety of dishes.

Competitive Landscape:

A number of firms in the corn oil industry are implementing a number of strategic initiatives to propel growth and enhance their market position. Top firms are emphasizing innovations in extraction technologies, including cold-pressing and sophisticated refining processes, to enhance the quality and nutritional content of corn oil. These innovations address the growing demand for healthier oils with greater polyunsaturated fat content and reduced cholesterol levels. In addition, large players are spending on research and development to expand their product lines, including organic and non-GMO corn oils, to attract health-conscious and environmentally conscious consumers. To reach more consumers, companies are expanding distribution channels through alliances with foodservice providers and retail chains. Due to the increasing pressure for eco-friendly solutions, companies are also investing in the biodiesel market using corn oil as a renewable resource. Moreover, major corn oil manufacturers are implementing marketing strategies in order to familiarize consumers with the health advantage of corn oil, thereby raising brand awareness and customer loyalty. With the growth of e-commerce websites, major players are also enhancing their online presence, providing direct-to-consumer sales and enhancing accessibility. All these are driving the growth of the corn oil market globally.

The report provides a comprehensive analysis of the competitive landscape in the corn oil market with detailed profiles of all major companies, including:

- Archer Daniels Midland Company (ADM)

- ACH Food Companies

- Cargill, Inc.

- Abu Dhabi Vegetable Oil Company (ADVOC)

- Elburg Global

- Conagra Brands, Inc.

- Savola Group

Latest News and Developments:

- January 2025: ICM has launched a new website dedicated to the Brazilian market, marking its 30th anniversary. The platform highlights ICM's expertise in designing corn ethanol biorefineries, with a focus on ethanol, distillers grains, and corn oil production. The launch underscores ICM’s commitment to enhancing operational efficiency and customer support in the region.

- February 2025: CME Group is launching micro grain and oilseed futures contracts, pending regulatory approval. These cash-settled contracts will be one-tenth the size of existing corn, wheat, and soybean contracts, offering greater flexibility for market participants. Industry leaders, including Interactive Brokers and Saxo, have expressed support, citing increased accessibility for retail investors.

- November 2024: Godrej Agrovet Limited (GAVL) has partnered with Provivi to provide sustainable pest control solutions for maize and rice farmers in India. The collaboration will introduce eco-friendly YSB and FAW Eco-Dispensers to manage pests like Yellow Stem Borer and Fall Armyworm. This initiative supports India's agricultural economy, enhancing maize production, a key feedstock for ethanol, corn oil, and other industrial products. The partnership aims to promote environmentally responsible farming practices and address India's growing demand for biofuels.

- October 2024: IFF has launched its OPTIMASH® F200 and OPTIMASH® AX enzyme solutions to enhance corn oil recovery at fuel ethanol plants. This combination can boost corn oil recovery by up to 15%, supporting the biodiesel, renewable diesel, and animal feed industries. IFF has also introduced a proprietary oil mapping calculator to optimize dosing for maximum recovery, enabling ethanol producers to enter low-carbon intensity markets.

- May 2024: Alfa Laval will unveil groundbreaking separation technology at FEW 2024 in Minneapolis, designed to boost distilled corn oil (DCO) recovery by over 20%. This innovation promises higher oil yield and quality, with a 99% purity rate, marking a significant advancement in the ethanol industry's efficiency and sustainability. Alfa Laval's new technology, developed in close collaboration with customers, aims to enhance profitability and environmental stewardship in the corn ethanol sector.

- January 2024: Brazil's National Corn-Based Ethanol Industry reached a milestone with the opening of its 22nd facility in Maracaju (MS) on January 1, 2024. This facility will produce 266 Million litters of ethanol, 161,000 tons of DDGS, and 10,000 tons of corn oil annually. The expansion strengthens Brazil’s role in biofuel production, with corn-based ethanol now comprising over 20% of the nation's biofuel output.

Corn Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Edible, Non-Edible |

| Applications Covered | Food, Biofuel, Industrial, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Archer Daniels Midland Company (ADM), ACH Food Companies, Cargill, Inc., Abu Dhabi Vegetable Oil Company (ADVOC), Elburg Global, Conagra Brands, Inc., Savola Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the corn oil market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global corn oil market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the corn oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The corn oil market was valued at USD 6.9 Billion in 2025.

The corn oil market is projected to exhibit a CAGR of 6.20% during 2026-2034, reaching a value of USD 11.9 Billion by 2034.

Key drivers of the corn oil market include rising health consciousness, as consumers prefer oils with healthier fat profiles. Its versatility in cooking, high smoking point, and use in biodiesel production also fuel demand. Additionally, the growth of processed food consumption and innovations in production methods contribute to market expansion.

North America currently dominates the corn oil market, accounting for a share of 55.7%. The market is driven by high demand for healthier cooking oils and sustainable energy solutions. The US leads the market due to abundant corn production, contributing to both food and biodiesel industries.

Some of the major players in the corn oil market include Archer Daniels Midland Company (ADM), ACH Food Companies, Cargill, Inc., Abu Dhabi Vegetable Oil Company (ADVOC), Elburg Global, Conagra Brands, Inc., Savola Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)