Copper Pipes and Tubes Market Report by Finish Type, Outer Diameter, End-User, and Region 2025-2033

Copper Pipes and Tubes Market Size and Share:

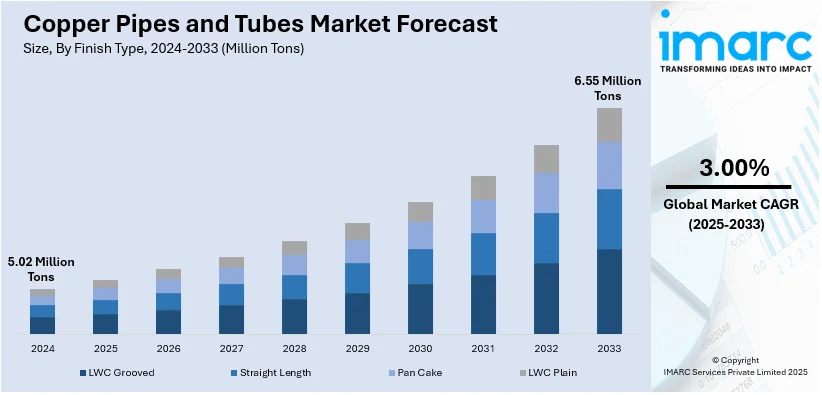

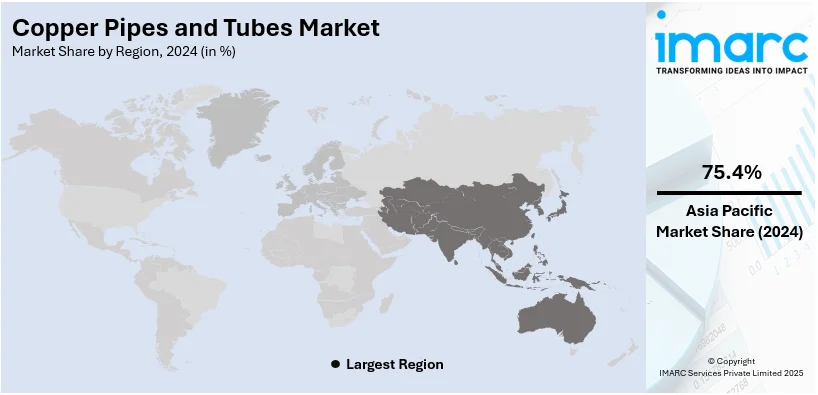

The global copper pipes and tubes market size was valued at 5.02 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 6.55 Million Tons by 2033, exhibiting a CAGR of 3.00% from 2025-2033. Asia Pacific currently dominates the copper pipes and tubes market share. The demand in this region is driven by the increasing industrialization, rapid urbanization, and increased demand from the construction, and plumbing sectors, driven by large-scale infrastructure development projects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

5.02 Million Tons |

|

Market Forecast in 2033

|

6.55 Million Tons |

| Market Growth Rate 2025-2033 | 3.00% |

The global copper pipes and tubes market growth is primarily fueled by the accelerating urbanization, which boosts construction activities, along with rising investments in infrastructure globally. Moreover, the increasing preference for copper in plumbing applications, owing to its durability and resistance to corrosion, is contributing to the market's expansion. Moreover, the expansion in renewable energy (RE) projects boosts the demand for copper in solar and geothermal systems, providing an impetus to the market. Besides this, the rising healthcare infrastructure enhances the need for copper tubing in medical gas distribution, strengthening the market share. Additionally, the automotive industry's transition to electric vehicles (EVs) is boosting the demand for copper tubes in cooling and electrical systems, further propelling the market's growth.

The United States copper pipes and tubes market share is fueled by the modernization of aging water infrastructure, requiring durable and efficient materials. In line with this, the growth in residential and commercial real estate developments drives the market demand for copper in plumbing and heating, ventilation, and air conditioning (HVAC) systems. Besides this, ongoing advancements in manufacturing technologies enhance copper tube production efficiency, lowering costs and increasing adoption, which is enhancing the market outlook. Concurrently, the rising focus on energy-efficient solutions in heat exchangers and green building initiatives is fueling the market demand. Also, the increased oil and gas exploration activities demand copper tubing for fluid transport, aiding the market growth. Apart from this, federal investments in infrastructure projects are expanding construction and utility applications, thereby propelling the market forward.

Copper Pipes and Tubes Market Trends:

Rising Demand from the HVAC Industry

The HVAC industry is one of the key application areas, transforming the copper pipe and tube market outlook. Copper is extensively used in these systems because of its good heat transfer characteristics, strength, and resistance to corrosive environments. These properties make copper suitable for use in heat exchangers, condensers, and evaporators. Moreover, copper possesses inherent antibacterial and bacteriostatic qualities, which are useful in refrigeration and air conditioning units. This is important as these are bacteria breeding grounds. On copper surfaces the survival of multiple strains of pathogenic bacteria and fungi is reduced to non-detectable levels within several hours. Furthermore, this fact has a significant role in decreasing the number of diseases. According to the International Energy Agency (IEA), by 2050 nearly two-thirds of global households could have an air conditioner (AC). China, India, and Indonesia will jointly contribute to half of the total such cases. This enhancement in the acceptance of AC across the world is contributing to the market expansion.

Expansion of the Plumbing Industry

The expansion of the plumbing industry is another important aspect that is driving the growth of this market. Copper is used in plumbing because of its reliability, durability, and resistance to biofouling and corrosion. In addition, the construction of residential and commercial facilities over the years, especially in emerging nations has led to an increased need for reliable plumbing systems. For instance, the value of house sales in India’s residential real estate market stood at Rs. 3.47 lakh crore (USD 42 Billion) in FY23 which is 48% YoY higher. The sales volume also rose by 36 % to 379,095 units sold. Besides this, the shifting urbanization patterns are creating new residential complexes and reconstructing old buildings, which require modern plumbing. Copper's capacity to offer a safe and contaminant-free water supply makes it essential for these applications, thus bolstering the market forecast.

Growth in the Automotive Industry

The copper pipes and tubes market forecast is also driven by the automotive sector, as it is endowed with a strong growth trend, further enhancing the need for copper pipes and tubes. Copper is used in car radiators, brake systems, and cooling systems because of its excellent thermal and electrical conductivity. Furthermore, the new automobile industry is gradually moving to EVs, which are creating new opportunities for copper in this segment. According to a market report by IMARC Group, the market is growing at a rate of 34% per annum on average for EVs. It is anticipated to rise to 381.3 million units by the end of 2032. Additionally, EV manufacturing calls for 3-4 times the quantity of copper utilized in internal combustion engine (ICE) vehicles as a result of batteries, motors, and charging systems. This transition of the market towards EVs due to the efforts to curb carbon emissions is impelling the market growth.

Copper Pipes and Tubes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global copper pipes and tubes market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on finish type, outer diameter, and end-user.

Analysis by Finish Type:

- LWC Grooved

- Straight Length

- Pan Cake

- LWC Plain

Level wound coil (LWC) grooved accounts for the majority of the market share. They are highly popular because they are more flexible and easier to install when compared with their counterparts and are extensively used in the HVAC and plumbing industries. Furthermore, they are specifically intended to improve the mechanical interlock of the joints, thereby giving a leakproof and efficient connection, which is vital for systems that are expected to transport fluids effectively. Apart from this, the LWC grooved copper pipes in compact as well as coil form are easier to handle, store, and transport leading to less installation time and cost, thus driving the copper pipes and tubes market forward.

Analysis by Outer Diameter:

- 3/8, 1/2, 5/8 Inch

- 3/4, 7/8, 1 Inch

- Above 1 Inch

3/8, 1/2, and 5/8 inch holds the largest share of the industry. These sizes are predominantly used in the HVAC and plumbing industries due to their optimal balance between flexibility and strength, making them suitable for a wide range of applications. Moreover, they are commonly utilized in residential and commercial HVAC systems for refrigerant lines, as well as in water supply lines and gas distribution systems. Besides this, their ease of handling and installation, allowing for efficient routing through walls, ceilings, and confined spaces, is catalyzing the market growth.

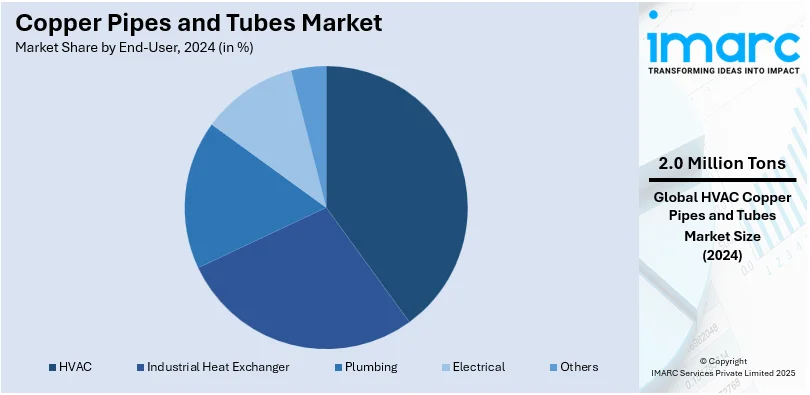

Analysis by End-User:

- HVAC

- Industrial Heat Exchanger

- Plumbing

- Electrical

- Others

HVAC represents the leading market segment and is significantly influencing the copper pipes and tubes market trends. The use of copper pipes and tubes in HVAC systems, is primarily driven by the metal’s high thermal conductivity, corrosion resistance, and durability. Moreover, copper products are extensively utilized in heating, ventilation, and air conditioning (HVAC) systems in both residential and commercial buildings, where they are essential for cooling and heating processes to ensure compliance with efficiency standards. Besides this, the growing consumption of air conditioning systems as a result of higher temperatures and improving urbanization is also driving the market revenue of copper pipes and tubes.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest copper pipes and tubes market share. This can be largely attributed to the increasing industrialization, rapid urbanization, and the region's growing economic development. In addition, the construction industry is growing rapidly, while investments in infrastructure projects also create a great demand for these pipes and tubes in HVAC, plumbing, and refrigeration. In confluence with this, the expanding automotive industry and the growth of the sector of EVs are also influencing the market growth. Furthermore, the implementation of government policies that involve efficiency improvement and sustainability development is thereby propelling the market forward.

Key Regional Takeaways:

North America Copper Pipes and Tubes Market Analysis

The North America copper pipes and tubes market demand is growing due to an increase in construction activities especially in the residential and commercial segment. The new constructions in the infrastructures aging in the region have created a high demand for copper since it is durable, does not corrode and also it is a good conductor of heat. However, the ever-increasing concern for energy efficiency and sustainability has fueled the use of copper pipes in HVAC systems, heat exchangers, and green building projects. The automotive industry also propels the market growth, as copper is used in fuel lines, brake lines, and EVs. Furthermore, the oil and gas industry requires copper tubing to carry fluids and to dissipate heat in the related equipment. Besides this, government policies that fund infrastructure development and upgrade of technology in producing firms are beneficial to the market growth. The U.S. remains the dominant market in the region, followed by Canada, with continued investment in industrial and residential development driving future opportunities.

United States Copper Pipes and Tubes Market Analysis

The increasing reliance on HVAC has spurred demand for copper pipes and tubes. Reports indicate that as of 2024, there are 114,157 Heating & Air-Conditioning Contractors businesses in the United States. These systems demand materials with superior thermal conductivity, durability, and corrosion resistance, making copper the material of choice. With advancements in building technologies and the push for energy-efficient infrastructure, the use of HVAC systems has surged. Copper pipes and tubes ensure efficient heat exchange, reduced energy losses, and long-lasting performance. These attributes have encouraged their widespread adoption in residential, commercial, and industrial construction. Modern HVAC designs also integrate smart temperature controls, enhancing the compatibility of copper materials with evolving system requirements. Innovations in copper alloys further contribute to their application in compact and high-performance cooling solutions, meeting growing construction and retrofitting needs.

Europe Copper Pipes and Tubes Market Analysis

The automotive industry has become one of the major growth drivers for copper pipes and tubes mainly on account of their application in heat dissipation and effective fluid conveying systems. With the growth of car ownership, the demand for superior climate control systems and reliable fuel injection systems has grown, thus copper’s necessity in the production of long-lasting, high-performance materials is well warranted. The International Council on Clean Transportation placed the figures for new car registrations in the 27 Member States for 2023 at 10.6 million, 4 million above the figure for 2022. The automobile industry uses copper primarily because it has high thermal and corrosion characteristics which make it suitable for high-stress applications. The transition to EVs also supports copper requirements as it is used in battery cooling systems, electric motors and charging points. Additionally, lightweight copper alloys enhance fuel efficiency, aligning with industry trends toward reducing emissions. These advancements are positioning copper pipes and tubes as a cornerstone of modern vehicle designs.

Asia Pacific Copper Pipes and Tubes Market Analysis

The rising use of copper pipes and tubes in the electrical sector stems from their superior conductivity, malleability, and corrosion resistance. These qualities make copper indispensable in manufacturing wiring and components that support expanding power grids and renewable energy systems. As per the India Brand Equity Foundation, India's power consumption in FY23 saw a 9.5% increase, reaching 1,503.65 billion units (BU). As energy demands rise, installations of high-efficiency transformers, switchgear, and electrical circuits necessitate reliable materials like copper. Electrification of transportation and increasing smart grid projects boost copper use in energy storage and distribution infrastructure. Its role in ensuring stable electrical performance and safety has reinforced its position as a material of choice. With developments in energy-efficient appliances and power-saving technologies, copper tubes and pipes are playing a vital role in the next generation of electrical systems.

Latin America Copper Pipes and Tubes Market Analysis

The rapid pace of urbanization has played a key role in the growing use of copper pipes and tubes in plumbing applications. As reported by the United Nations Human Settlements Programme, 87% of Brazil's population resides in urban areas. As urban areas expand and new housing projects proliferate, the demand for reliable water and gas supply systems has increased. Copper's antimicrobial properties, along with its resistance to corrosion and high temperatures, make it an ideal choice for plumbing applications. Additionally, its flexibility and ease of installation enhance its attractiveness for both new construction and retrofitting projects. Plumbing systems in high-density residential and commercial buildings require materials that ensure leak-proof connections and long-term reliability, which copper effectively provides. This trend highlights the importance of copper in supporting urban infrastructure growth.

Middle East and Africa Copper Pipes and Tubes Market Analysis

The pace of industrialization has bolstered the demand for copper pipes and tubes, particularly in sectors like construction and manufacturing. According to reports, Saudi Arabia is witnessing rapid growth in its construction sector, with over 5,200 projects underway, valued at USD 819 Billion. These industries demand materials capable of withstanding high-pressure environments, which makes copper an ideal choice for a wide range of industrial processes. The material's role in refrigeration, air conditioning, and fluid transfer systems has grown in tandem with real estate development projects. Additionally, its compatibility with contemporary construction methods ensures that copper remains a vital material for ongoing infrastructure projects. With an emphasis on durable and sustainable materials, copper’s advantages in industrial and building applications continue to be a focal point, supporting the material's ongoing integration into complex systems.

Competitive Landscape:

Companies in the copper pipes and tubes industry are increasingly adopting strategic measures such as mergers, acquisitions, and partnerships to broaden their global presence and boost production capabilities. Key manufacturers are investing in cutting-edge technologies to enhance product efficiency, lower production costs, and address the rising demand for sustainable and energy-efficient solutions. Several players are also emphasizing research and development (R&D) activities to develop innovative copper alloys and corrosion-resistant products for niche applications. A key trend is the expansion of manufacturing facilities in emerging markets to better serve regional demand and minimize supply chain complexities. Additionally, companies are strengthening their focus on recycling and circular economy practices to align with sustainability goals and address environmental concerns.

The report provides a comprehensive analysis of the competitive landscape in the copper pipes and tubes market with detailed profiles of all major companies, including:

- Furukawa Electric Co. Ltd

- KME Germany GmbH

- Kobe Steel Ltd.

- Luvata (Mitsubishi Materials Corporation)

- MetTube Sdn Bhd

- Mueller Industries Inc.

- KMCT Corporation

- Cerro Flow Products LLC

- Golden Dragon Precise Copper Tube Group Inc.

- Mehta Tubes Limited

- Qingdao Hongtai Metal Co. Ltd.

- Shanghai Hailiang Copper Tubes Co., Ltd.

Latest News and Developments:

- December 2024: Hisense is in discussions with contract manufacturer Epack for a minority stake, as Epack expands its manufacturing capacity. Established in 2002, Epack Durable produces RAC and SHA products across facilities in Dehradun, Bhiwadi, and Sri City. The new Sri City facility, opened in FY24, increased production capacity by 50%, including manufacturing copper tubing and heat exchangers.

- October 2024: Aurubis and COFICAB have renewed their multi-year contract, ensuring a stable supply of sustainably and responsibly produced copper wire rods for the automotive industry. By combining responsibly sourced primary copper with significant recycling efforts, the partnership supports high-quality production and promotes sustainability in the copper-based value chain.

- August 2024: The Copper Development Association (CDA) introduced ASTM B1029, a new standard for creating press-connect joints using seamless copper and copper alloy tubes. This standard aims to ensure consistent and high-quality installation practices in plumbing, mechanical, and HVAC/R applications. By standardizing press-connect technology, CDA enhances performance, safety, and reliability in copper piping systems.

- May 2024: The Copper Development Association (CDA) has welcomed Cambridge-Lee Industries LLC, a prominent manufacturer and supplier of copper tubes, as its newest member. This partnership highlights a shared dedication to advancing copper applications across industries, including plumbing, HVAC, and clean energy. Founded in 1939, Cambridge-Lee Industries brings expertise in copper tubing and alloys critical to infrastructure and energy transitions.

- March 2024: Adani Enterprises announced a USD 1.2 Billion investment to build a copper plant with a total capacity of 1 million tons, developed in two phases. The first phase, already underway, will produce 0.5 million tons of refined copper. The company aims to reach full capacity by the end of FY 2029. Additionally, Adani will launch a subsidiary, Kutch Copper Tubes, to expand its copper tube portfolio, catering to industries like HVAC and plumbing.

Copper Pipes and Tubes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Finish Types Covered | LWC Grooved, Straight Length, Pan Cake, LWC Plain |

| Outer Diameters Covered | 3/8, 1/2, 5/8 Inch, 3/4, 7/8, 1 Inch, Above 1 Inch |

| End-Users Covered | HVAC, Industrial Heat Exchanger, Plumbing, Electrical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Furukawa Electric Co. Ltd, KME Germany GmbH, Kobe Steel Ltd., Luvata (Mitsubishi Materials Corporation), MetTube Sdn Bhd, Mueller Industries Inc., KMCT Corporation, Cerro Flow Products LLC, Golden Dragon Precise Copper Tube Group Inc., Mehta Tubes Limited, Qingdao Hongtai Metal Co. Ltd., Shanghai Hailiang Copper Tubes Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the copper pipes and tubes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global copper pipes and tubes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the copper pipes and tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global copper pipes and tubes market was valued at USD 5.02 Million Tons in 2024.

IMARC Group estimates the market to reach 6.55 Million Tons by 2033, exhibiting a CAGR of 3.00% from 2025-2033.

Key factors driving the global copper pipes and tubes market include, rising construction and infrastructure projects, increasing demand for energy-efficient HVAC systems, the growing adoption of copper in plumbing due to its durability, expanding renewable energy projects, and advancements in electric vehicle manufacturing.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global copper pipes and tubes market include Furukawa Electric Co. Ltd, KME Germany GmbH, Kobe Steel Ltd., Luvata (Mitsubishi Materials Corporation), MetTube Sdn Bhd, Mueller Industries Inc., KMCT Corporation, Cerro Flow Products LLC, Golden Dragon Precise Copper Tube Group Inc., Mehta Tubes Limited, Qingdao Hongtai Metal Co. Ltd., Shanghai Hailiang Copper Tubes Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)