Conversational AI Market Size, Share, Trends and Forecast by Component, Type, Technology, Deployment, Organization Size, End User, and Region, 2025-2033

Conversational AI Market Size and Share:

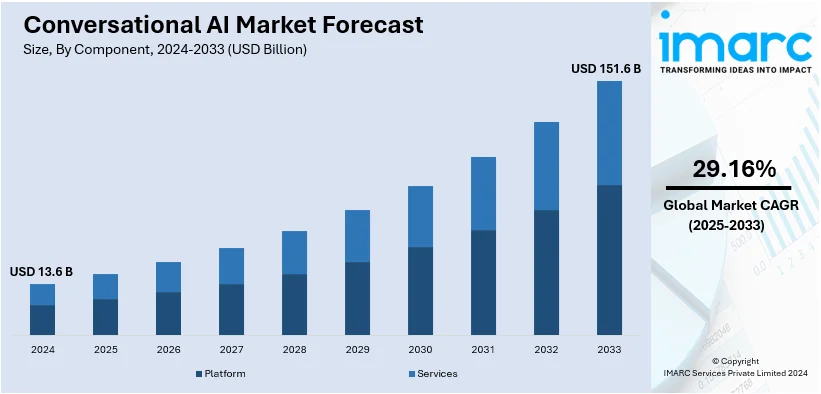

The global conversational AI market size was valued at USD 13.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 151.6 Billion by 2033, exhibiting a CAGR of 29.16% from 2025-2033. North America currently dominates the market, holding a market share of over 28.6% in 2024. The rising automation of business operations, burgeoning e-commerce industry, and the growing adoption of omnichannel deployment methods represent some of the key factors shaping the market demand and trends.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 13.6 Billion |

|

Market Forecast in 2033

|

USD 151.6 Billion |

| Market Growth Rate 2025-2033 | 29.16% |

The market for conversational AI is expanding rapidly as more businesses integrate AI-powered chatbots and virtual assistants to enhance customer engagement and streamline operations. These tools have capabilities that allow them to offer support at any time, cut expenses, and improve customer experience through increased focus and customization. Advances in natural language processing, machine learning, and cloud computing are driving demand, along with the rise of voice-enabled devices and smart home systems. Companies are also using conversational AI to better understand customer behavior, boost sales, and make smarter decisions. As consumers expect more seamless interactions, organizations across industries are investing in conversational AI to stay ahead in the digital age.

The United States conversational AI market is growing due to its widespread adoption across industries like retail, healthcare, and banking, where businesses seek to enhance customer service and optimize operations. For instance, in July 2024, JPMorgan Chase, a U.S. based bank, introduced LLM Suite, an AI generative technology designed for its asset and wealth management department. This tool, similar to ChatGPT, supports tasks such as writing, idea generation, and document summarization. Developed in-house to meet strict data security regulations, it is now accessible to 50,000 employees, representing one of Wall Street’s largest AI implementations. AI-driven chatbots and virtual assistants are widely used for personalized interactions, cost efficiency, and 24/7 availability. Advances in natural language processing and machine learning are improving conversational AI's accuracy and responsiveness, increasing its adoption. The growing reliance on voice-activated devices, such as smart speakers, and the need for real-time communication in customer service further fuel demand. Additionally, businesses are leveraging conversational AI to analyze consumer behavior, improve decision-making, and gain a competitive edge, making it an essential tool in the evolving digital economy.

Conversational AI Market Trends:

Diversifying Application Areas of Conversational AI

The growing adoption of AI-powered customer support services to save time and costs associated with hiring employees is offering a favorable market outlook. In addition, the increasing utilization of conversational AI to aid businesses in adopting new techniques to communicate with their targeted audience is propelling the conversational AI market growth. Apart from this, the increasing online shopping activities of individuals, coupled with the burgeoning e-commerce industry across the globe, is contributing to the expansion of the conversational AI market size. According to Sellers Commerce, approximately 33% of the global population shops online. The rising adoption of omnichannel deployment methods, along with the decreasing cost of chatbot applications, is also supporting the growth of the market. Moreover, the increasing employment of conversational AI in the healthcare industry to gather patient data and scale and glean actionable insights that are necessary for healthcare professionals to improve patient experience and offer personalized care and support is strengthening the market growth. Furthermore, the increasing demand for conversational AI in the BFSI industry for automating repetitive processes or tasks that typically take a bank employee much longer to complete is bolstering the market growth.

Advent of Generative AI

The increasing adoption of generative AI technology exhibits a remarkable opportunity for conversational AI solutions, enabling them to provide more efficient, personalized, and human-like interactions. As per Eurostat, just 8% of European enterprises were utilizing AI technology in 2021. However, industry experts estimate that this figure has at least doubled by January 2023. In certain sectors, up to 75% of businesses are now incorporating AI technologies, a shift largely driven by the launch of tools like ChatGPT in the autumn of 2022. Generative AI technologies including Generative Pre-trained Transformer (GPT) solutions, have presented significant progress in analyzing and generating natural language, empowering conversational AI solutions to engage consumers in more dynamic and relevant conversations. By harnessing the potential of generative AI, conversational AI solutions can modify responses based on user preferences and behavior, thereby augmenting the overall interaction experience.

Integration with IoT Devices

The integration of conversational AI with IoT devices is expected to create more intelligent and interactive experiences, allowing users to interact with connected devices using natural language. According to IoT Analytics, currently there are more than 3,300 active IoT startups, a substantial increase from the 1,205 identified in 2021. Conversational AI can make IoT devices more user-friendly, convenient, and intuitive, empowering users to interact with them using voice commands. With the increasing prevalence of IoT devices, the integration of conversational AI is projected to play a significant role in shaping the dynamics of human-machine interaction in future. This trend is anticipated to drive innovation and create new opportunities for organizations across various industries.

Conversational AI Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global conversational AI market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, type, technology, deployment, organization size, and end user.

Analysis by Component:

- Platform

- Services

- Support and Maintenance

- Training and Consulting

- System Integration

Platforms are the leading component segment, serving as the foundation for deploying advanced AI applications such as chatbots, virtual assistants, and voice recognition systems. These platforms integrate natural language processing, machine learning, and cloud computing technologies to enable seamless interactions and real-time data analysis. Businesses across industries rely on conversational AI platforms to enhance customer engagement, streamline processes, and personalize user experiences. Platforms also offer robust customization and scalability, allowing organizations to tailor solutions to their specific needs. With growing demand for efficient and intuitive AI solutions, these platforms play a critical role in driving innovation and adoption, cementing their position as the cornerstone of the conversational AI ecosystem.

Analysis by Type:

- Intelligent Virtual Assistant (IVA)

- Chatbots

Chatbots lead the market with around 67.4% of market share in 2024. Chatbots are the leading type segment, widely adopted across industries to enhance customer engagement and streamline operations. These AI-powered tools provide 24/7 support, effectively handling queries, resolving issues, and offering personalized assistance. Their ability to process natural language enables intuitive and context-aware interactions, significantly improving customer satisfaction. Chatbots are extensively used in sectors like retail, banking, and healthcare for applications such as order tracking, account management, and appointment scheduling. They also reduce operational costs by automating routine tasks and freeing human resources for complex issues. With advancements in natural language processing and machine learning, chatbots continue to evolve, offering improved accuracy, multilingual support, and integration with enterprise systems, solidifying their position as a vital conversational AI solution.

Analysis by Technology:

- Machine Learning

- Deep Learning

- Natural Language Processing

- Automatic Speech Recognition

Natural language processing leads the market with around 47.8% of market share in 2024. Natural Language Processing (NLP) is the leading technology segment in the market, enabling AI systems to interpret, understand, and respond to human language effectively. NLP's ability to process both text and speech enhances conversational AI applications across industries, ensuring seamless and context-aware interactions. Businesses utilize NLP-powered chatbots and virtual assistants for customer support, personalized recommendations, and efficient issue resolution. This technology’s adaptability to multiple languages expands its global application, catering to diverse customer bases. Additionally, NLP provides valuable insights through sentiment analysis and behavioral understanding, helping organizations refine strategies and improve decision-making. As conversational AI evolves, NLP remains integral to delivering human-like communication and driving innovation in customer engagement.

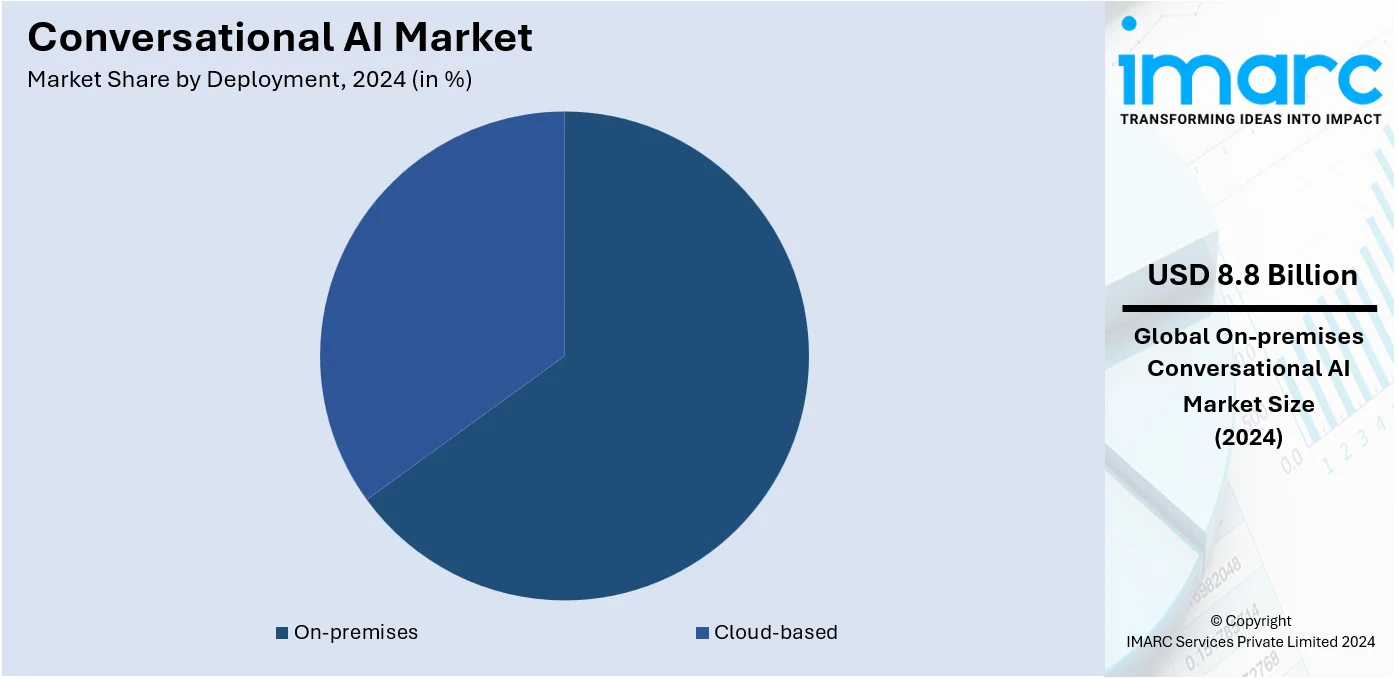

Analysis by Deployment:

- Cloud-based

- On-premises

On-premises leads the market with around 64.8% of market share in 2024. On-premises deployment is a leading segment, offering organizations enhanced control over data and infrastructure. This deployment model is particularly favored in industries such as healthcare, banking, and retail, where data privacy and regulatory compliance are critical. By hosting AI solutions on internal servers, businesses ensure secure handling of sensitive information while achieving greater customization and integration with existing systems. On-premises deployment supports scalability and operational flexibility, enabling companies to tailor conversational AI applications to meet specific business needs. Despite the growing adoption of cloud-based solutions, on-premises deployment remains essential for organizations prioritizing data sovereignty, security, and reliability in their AI-driven customer engagement and operational strategies. Its role in maintaining compliance and mitigating risks underscores its importance in the conversational AI market.

Analysis by Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises

In the global conversational AI market, both large enterprises and small and medium-sized enterprises (SMEs) play significant roles as organization size segments. Major corporations utilize conversational AI to improve customer interaction, optimize workflows, and manage large-scale interactions. They adopt sophisticated AI solutions, integrating them with enterprise systems to deliver personalized and efficient customer experiences. Their significant budgets allow for extensive customization and deployment across diverse applications.

Conversely, SMEs are increasingly adopting conversational AI to gain a competitive edge by improving customer service and automating routine tasks. These solutions are cost-effective and scalable, making them accessible to smaller organizations with limited resources. SMEs benefit from the efficiency and accessibility provided by AI-powered tools, enabling them to cater to growing customer demands. Both segments drive the demand for conversational AI, tailoring its adoption to their respective operational scales and requirements.

Analysis by End User:

- BFSI

- Retail and E-commerce

- Healthcare and Life Science

- Travel and Hospitality

- Telecom

- Media and Entertainment

- Others

Retail and e-commerce leads the market with around 22.8% of market share in 2024. Retail and e-commerce are the leading end-user segments in the global conversational AI market, driven by the sector's need to enhance customer engagement and operational efficiency. AI-powered chatbots and virtual assistants are widely used for personalized customer interactions, 24/7 support, and efficient handling of inquiries, contributing to higher customer satisfaction and retention. Conversational AI also helps customers to give recommendations for products, track their orders, and get issues resolved regarding the product, thus makes the shopping process much easier. AI being integrated with advanced analytical tools helps businesses to understand customer behavior, maximize the effectiveness of marketing plans, and manage stock. While the global market for the purchasing of goods online advances, the use of conversational AI technologies in retailing and e-commerce must remain a critical success factor and market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 28.6%. North America leads the global conversational AI market, driven by widespread adoption across industries such as healthcare, retail, and financial services. The region benefits from advanced technological infrastructure and a high concentration of AI innovators, fostering continuous advancements in natural language processing and machine learning. Businesses in North America prioritize customer engagement and operational efficiency, making conversational AI integral to customer service, virtual assistants, and analytics-driven decision-making. The constant growth of smart devices and the advance of voice-enabled technologies also contribute to the demand. Regulatory frameworks supporting AI innovation and significant investments in AI research strengthen the region's dominance. North America's focus on scalability, multilingual support, and data security positions it as a key player in the conversational AI market.

Key Regional Takeaways:

United States Conversational AI Market Analysis

In 2024, United States accounted for 83.60% of the market shares in North America. With the rapid growth of new businesses and technological advancements, United States has thus emerged as a dynamic hub for conversational AI. According to U.S. Census Bureau Business Formation Statistics, nearly 5.5 Million businesses were started in 2023, a record high for startups. This increased entrepreneurship has created fertile ground for the adoption of conversational AI. Meanwhile, startups and established organizations are seeking innovative solutions to increase customer engagement. and improve operations, retail, healthcare, etc. Industries like BFSI were among the first that leverages AI to improve operational efficiency by providing a personalized experience. The proliferation of voice-activated virtual assistants such as Amazon Alexa and Google Assistant is further driving the market growth. Smartphone penetration is high. Robust cloud infrastructure and regulatory requirements, such as ADA compliance, are encouraging businesses to Integrate AI-powered accessibility solutions and conversational AI are increasingly being used in healthcare for virtual consultations and patient support. The presence of tech giants and a strong startup ecosystem accelerates innovation. while significant R&D investments and government-supported initiatives strengthen the market path. As businesses strive to compete in this thriving entrepreneurial landscape, and conversational AI plays a key role in making communication seamless, scalable, and efficient.

Asia Pacific Conversational AI Market Analysis

The widespread adoption of conversational AI across the region is attributed to the constant coming of digitalization and the dramatic advancements made in smartphone usage as now brings all of Asia-Pacific, ranging from Commonwealth nations like China and India, Japan, down to even the smallest island country. Improvements toward such technologies in various fields showed a significant impact-from e-commerce to banking and finally healthcare, personalized customer experiences said, businesses thrived across borders because of the difference in nationalities. In addition to NLP that innovative engineers can keep coming up with for autonomous AI solutions fitted in local languages to that internal requirement, such population diversity offers innovation benefits. Strong mobile penetration is playing an indispensable role-e.g. the GSMA raised its forecast for mobile penetration to be closer to 70 percent in Asia-Pacific by 2030, with this increased connectivity reinforcing the thriving network of an expanding 5G deployment. New government programs on digital transformation, along with an agile ecosystem of new start-ups, clearly creates yet another opportunity for growth. Enterprises in the region have well adopted AI-towards customer support automation and sales for operational efficiencies, thus ensuring scalable, seamless customer engagements. The investments directed towards AI research and advancement of technologies would continue to make the region a major innovation source and help sustain the market expansion of conversational AI into the near future.

Europe Conversational AI Market Analysis

Europe's conversational AI market is experiencing strong growth, driven by widespread digital transformation and the increasing adoption of automation across various industries. According to a 2023 report commissioned by Amazon Web Services (AWS), 33% of firms in Europe are using AI for production, a trend that one would expect to define such changes that are coming. This fast-tracking has been considerably strong in areas like retail, banking, and healthcare, where conversational AI jobs are improving customer experience, streamlining processes, and giving multilingual support. Data security and compliance with laws mainly in terms of the General Data Protection Regulation have also worked in shaping how and where secure AI solutions can be created and used. Europe’s diverse linguistic landscape further drives the demand for localized AI technologies, with advancements in natural language processing (NLP) enhancing the accuracy of AI interactions. Innovation and ethical application of AI are supported through the European AI Alliance and many other government initiatives. The fact that people are now integrating AI-powered virtual assistants and chatbots puts more emphasis on conversational AI, especially in customer support and public engagement. Europe is set to take the lead in AI advancements and maintain its competitive edge in the international marketplace.

Latin America Conversational AI Market Analysis

The conversational AI market in Latin America is growing rapidly, driven by digital transformation and mobile technology adoption. According to GSMA, mobile technologies generated 8% of GDP in the region in 2023, highlighting the importance of mobile connectivity in economic growth. This boost in mobile penetration is accelerating the adoption of AI-powered tools, such as chatbots and virtual assistants, particularly in retail, banking, and e-commerce. With expanding internet infrastructure and a tech-savvy consumer base, businesses are using conversational AI to enhance customer experiences and optimize operations. Continued investments in AI and mobile networks position the region for sustained market growth.

Middle East and Africa Conversational AI Market Analysis

The Middle East is witnessing rapid adoption of conversational AI, driven by increased mobile connectivity and digital transformation. Canalys research reveals that smartphone shipments in the region (excluding Turkey) reached 12.2 Million units in Q1 2024, marking a 39% year-on-year increase. This surge in smartphone usage is fueling the demand for AI-powered solutions like chatbots and virtual assistants across sectors such as retail, banking, and hospitality. As mobile penetration grows and 5G networks expand, businesses are increasingly adopting conversational AI to enhance customer engagement and improve operational efficiency in the region.

Competitive Landscape:

The conversational AI market is highly competitive, driven by technological advancements and growing demand across industries such as retail, healthcare, and banking. Established players focus on developing sophisticated AI platforms with enhanced natural language processing and machine learning capabilities to deliver human-like interactions. Emerging companies target niche applications, offering tailored solutions for specific industries. Collaborative alliances, mergers, and acquisitions are transforming the competitive environment, allowing businesses to broaden their services and extend their global presence. For instance, in December 2024, AKOOL, a U.S. based AI technology company, collaborated with LiveX AI, to revolutionize customer interactions. This partnership integrates LiveX AI’s accurate conversational agents with AKOOL’s dynamic avatar technology, delivering real-time, empathetic, and visually immersive support. The solution enhances customer experiences across industries, addressing AI limitations like errors, latency, and impersonal interactions, while improving satisfaction and loyalty. The increasing focus on seamless integration, multilingual support, and data security further intensifies competition. Furthermore, companies are also investing in innovation to address evolving customer expectations and strengthen their position in this rapidly growing market.

The report provides a comprehensive analysis of the competitive landscape in the conversational AI market with detailed profiles of all major companies, including:

- Amazon Web Services Inc. (Amazon.com Inc.)

- Artificial Solutions

- Avaamo Inc.

- Conversica Inc.

- Creative Virtual Ltd.

- Google LLC (Alphabet Inc.)

- Gupshup

- International Business Machines Corporation

- Jio Haptik Technologies Limited (Reliance Industries Limited)

- Kore.ai Inc.

- Nuance Communications Inc. (Microsoft Corporation)

- Oracle Corporation

- Rasa Technologies Inc.

- SAP SE

Latest News and Developments:

- December 2024: ElevenLabs has launched a new conversational AI platform enabling the creation of custom voice agents for applications such as customer service and interactive gaming characters. The platform supports 31 languages and integrates with major AI models, including Gemini, Claude, and GPT. The technology also features real-time interruption detection and turn-taking capabilities, enhancing the natural flow of conversations.

- September 2024: Redbird launched an AI chat platform that provides AI agents for advanced data analytics, securely integrated with an organization’s data ecosystem. Users can interact with these agents in natural language, requiring no technical expertise. This enables true self-serve analytics, addressing the limitations of rigid dashboarding tools like Tableau, Looker, and PowerBI, which have failed to fully deliver on similar capabilities.

- September 2024: Prodege has launched a conversational AI feature that enables scalable, real-time interactions and follow-ups with survey participants. The tool enhances qualitative research by providing deeper insights into participants' emotions, actions, and loyalties, bridging the gap between qualitative and quantitative analysis.

- February 2024: Sierra Technologies Inc., has launched a conversational AI platform to enhance customer interactions through AI agents capable of making recommendations, answering queries, and performing actions on behalf of employees. The platform aims to deliver seamless, intuitive customer experiences through 24/7 conversational interfaces. In a blog post, the company emphasized conversational AI's potential to transform customer engagement by prioritizing simple, dialogue-based interactions over traditional methods.

- December 2023: CoRover.ai, in partnership with Google Cloud, has launched BharatGPT, an indigenous generative AI platform supporting over 14 Indian languages in text, voice, and video. Leveraging Google Cloud's infrastructure, BharatGPT is scaling to provide reliable AI services while celebrating India's linguistic diversity and cultural heritage.

Conversational AI Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Types Covered | Intelligent Virtual Assistant (IVA), Chatbots |

| Technologies Covered | Machine Learning, Deep Learning, Natural Language Processing, Automatic Speech Recognition |

| Deployments Covered | Cloud-based, On-premises |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Users Covered | BFSI, Retail and E-commerce, Healthcare and Life Science, Travel and Hospitality, Telecom, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon Web Services Inc. (Amazon.com Inc.), Artificial Solutions, Avaamo Inc., Conversica Inc., Creative Virtual Ltd., Google LLC (Alphabet Inc.), Gupshup, International Business Machines Corporation, Jio Haptik Technologies Limited (Reliance Industries Limited), Kore.ai Inc., Nuance Communications Inc. (Microsoft Corporation), Oracle Corporation, Rasa Technologies Inc., SAP SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the conversational AI market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global conversational AI market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the conversational AI industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Conversational AI is a type of artificial intelligence that allows computers to understand and respond to human language in a natural and engaging way. It enables businesses to create interactive experiences with their customers, providing support, information, and even personalized recommendations.

The conversational AI market was valued at USD 13.6 Billion in 2024.

IMARC estimates the global conversational AI market to exhibit a CAGR of 29.16% during 2025-2033.

The global conversational AI market is booming, driven by factors like the increasing adoption of digital channels by businesses, the rising demand for personalized customer experiences, and the increasing availability of data to train AI models.

According to the report, platform represented the largest segment by component, facilitating seamless integration of AI capabilities into various applications. This segment enhances user interactions through natural language processing and machine learning, enabling businesses to automate customer support, improve engagement, and drive operational efficiency.

Chatbots leads the market by type, widely utilized for customer support and engagement. Their ability to provide instant responses and handle multiple inquiries simultaneously enhances user experience and operational efficiency.

According to the report, natural language processing represented the largest segment by technology, enabling machines to understand and interpret human language. NLP improves the effectiveness of chatbots and virtual assistants by facilitating accurate responses and contextual understanding.

On-premises leads the market by type, favored by organizations seeking enhanced control over their data and security. This approach allows businesses to customize their AI solutions according to specific needs while ensuring compliance with data protection regulations.

According to the report, e-commerce and retail represented the largest segment by end user. E-commerce businesses are leveraging AI-powered chatbots and virtual assistants to improve customer experience, provide personalized recommendations, and streamline order processing. These technologies improve customer engagement, boot sales, and create a more efficient online shopping environment.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Conversational AI market include Amazon Web Services Inc. (Amazon.com Inc.), Artificial Solutions, Avaamo Inc., Conversica Inc., Creative Virtual Ltd., Google LLC (Alphabet Inc.), Gupshup, International Business Machines Corporation, Jio Haptik Technologies Limited (Reliance Industries Limited), Kore.ai Inc., Nuance Communications Inc. (Microsoft Corporation), Oracle Corporation, Rasa Technologies Inc., SAP SE, etc.

The future of conversational AI will comprise the significant advancements in natural language processing, seamless integration with IoT devices, and the emergence of more human-like and empathetic AI assistants.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)