Controlled Release Fertilizer Market Report by Type (Condensation Products of Urea and Aldehydes, Coated and Encapsulated Fertilizers, and Others), Form (Granular, Liquid, Powder), Application (Grains and Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, Turf and Ornamentals, and Others), and Region 2025-2033

Controlled Release Fertilizer Market Overview:

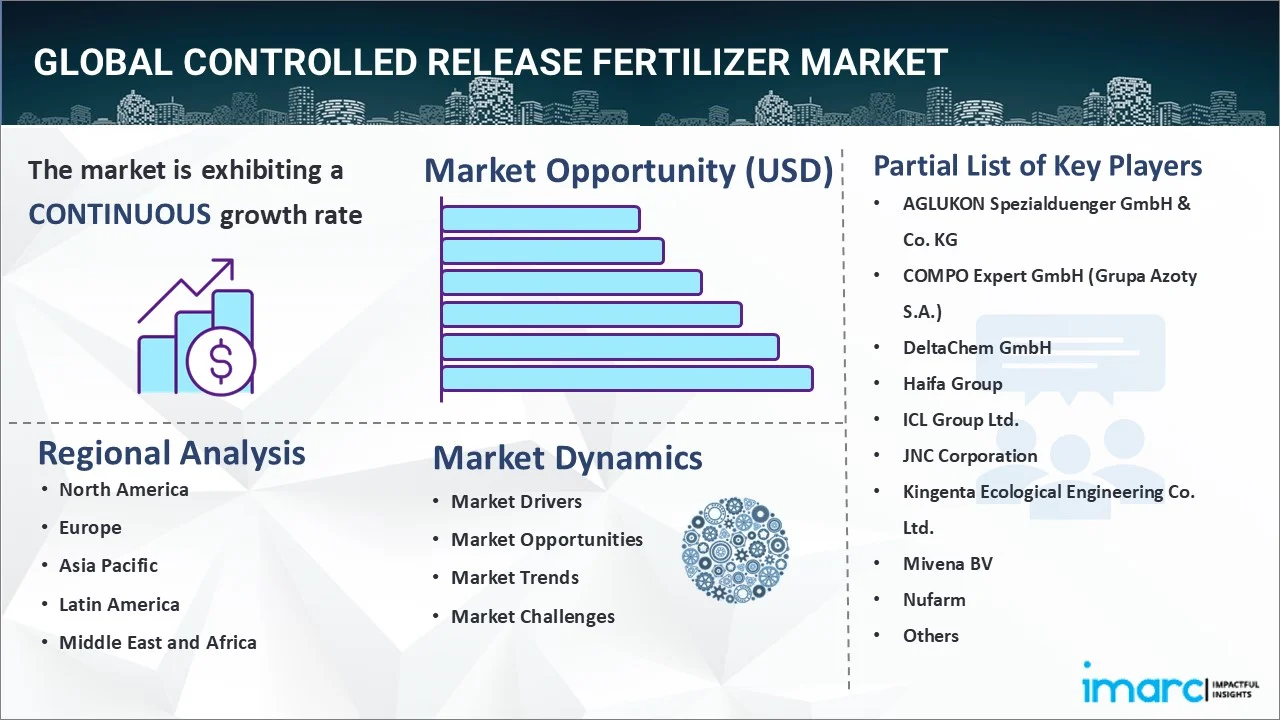

The global controlled release fertilizer market size reached USD 3.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.02% during 2025-2033. There are various factors that are driving the market, which include the rising adoption of modern agricultural practices like precision farming, integrated pest management, and sustainable farming techniques, increasing demand for a variety of food products, and various collaborations and partnerships among industry players.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.3 Billion |

|

Market Forecast in 2033

|

USD 5.2 Billion |

| Market Growth Rate 2025-2033 | 5.02% |

Controlled Release Fertilizer Market Analysis:

- Major Market Drivers: One of the key market drivers includes favorable government initiatives. Moreover, there is an increase in the focus on maintaining environmental sustainability, which is acting as another growth-inducing factor.

- Key Market Trends: The rising adoption of modern agricultural practices and increasing demand for a variety of food products are main trends in the market.

- Geographical Trends: North America exhibits a clear dominance, accounting for the biggest market share owing to the rapid adoption of advanced agricultural technologies.

- Competitive Landscape: Major market players in the controlled release fertilizer industry are AGLUKON Spezialduenger GmbH & Co. KG, COMPO Expert GmbH (Grupa Azoty S.A.), DeltaChem GmbH, Haifa Group, ICL Group Ltd., JNC Corporation, Kingenta Ecological Engineering Co. Ltd., Mivena BV, Nufarm, Sociedad Química y Minera de Chile S.A., The Mosaic Company, Yara International ASA., among many others.

- Challenges and Opportunities: Limited awareness among farmers represents a key market challenge. Nonetheless, advancements in coating technologies, coupled with the rising development of crop-specific formulations, are projected to overcome these challenges and provide market opportunities to industry investors.

Controlled Release Fertilizer Market Trends:

Rising Adoption of Modern Agriculture Practices

The need for controlled release fertilizers (CRFs) is being driven by the growing use of modern agricultural practices. Precision farming, integrated pest management, and sustainable farming methods are examples of modern agricultural practices. Global positioning systems (GPS), remote sensing, and data analytics are some of the technologies used in precision farming to maximize fertilizer application. CRFs are particularly well-suited for precision farming as they provide a steady nutrient supply, reducing the need for frequent applications and ensuring that nutrients are available when crops need them the most. In addition, CRFs help farmers maximize efficiency and minimize waste by aligning nutrient release with crop needs. This leads to cost savings on fertilizers and potentially higher crop yields due to improved nutrient management. The research report of the IMARC Group claims that the global precision agriculture market is expected to reach US$ 20.2 Billion by 2032.

Growing Demand for A Variety of Food Products

The Food and Agriculture Organization (FAO) of the United Nations (UN) reports that cereal production increased by 7.9 million tons in July of 2024 worldwide. The rising demand for a variety of food products due to changing dietary patterns of individuals is propelling the controlled release fertilizer market growth. Farmers are increasing crop yields and improving the quality of their products in order to satisfy the growing demand for a variety of food products among consumers. CRFs play a critical role in promoting plant growth and productivity by supplying a steady and accurate amount of nutrients. These fertilizers ensure that crops receive the nutrients they require at the right time by reducing nutrient losses and optimizing nutrient uptake. These fertilizers can also be customized to deliver particular nutrients that are necessary for the development of different crops. This customization helps in producing food with higher nutritional value.

Increasing Collaborations and Partnerships Among Key Players

The industry is growing as a result of several partnerships, collaborations, contracts, and mergers and acquisitions (M&As). Companies can strengthen their presence through these strategic alliances, thereby leading to the creation of creative and effective CRFS. Top players are also forming alliances or purchasing businesses in other regions. This regional diversification guarantees a larger consumer base and reduces the risks related to market volatility in particular locations. Besides this, they are entering into several contracts to commercialize their products. For instance, on 14 June 2024, Nousbo signed a Memorandum of Understanding (MOU) with SK leaveo at SKC's headquarters for the commercialization of its eco-friendly CRF. Additionally, Nousbo plans to utilize its expertise in planning, production, and marketing strategies to align with global fertilizer market trends.

Controlled Release Fertilizer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, form, and application.

Breakup by Type:

- Condensation Products of Urea and Aldehydes

- Urea Formaldehyde (UF)

- Isobutylidenediurea

- Crotonylidenediurea

- Coated and Encapsulated Fertilizers

- Sulfur-coated Fertilizers

- Polymer-coated Fertilizers

- Sulfur-polymer Coated Fertilizers

- Others

- Others

Coated and encapsulated fertilizers account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes condensation products of urea and aldehydes [urea formaldehyde (UF), isobutylidenediurea, and crotonylidenediurea], coated and encapsulated fertilizers (sulfur-coated fertilizers, polymer-coated fertilizers, sulfur-polymer coated fertilizers, and others), and others. According to the report, coated and encapsulated fertilizers represented the largest segment.

Coated and encapsulated fertilizers are coated with polymers or other materials that enable the nutrients to be released gradually over time as to meet the growth requirements of the plants. This technique is beneficial in enhancing nutrient usage efficiency by lowering nutrient loss from leaching and volatilization. Besides this, the rising focus on optimizing crop yield and maintaining sustainability is supporting the market growth.

Breakup by Form:

- Granular

- Liquid

- Powder

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes granular, liquid, and powder.

Granular fertilizers are among the most popular form of fertilizers because of their simplicity of application and progressive release of nutrients. They are widely used in large-scale farming operations and can be applied mechanically.

Liquid fertilizers offer precise dosing and are easily absorbed by plants. Both foliar feeding and fertigation can be done using these fertilizers. They are gaining traction in high-value crops where precision and rapid uptake of nitrogen are essential such as fruits and vegetables.

Powder fertilizers are utilized in greenhouse and nursery environment because they are easily absorbed in water and applied via irrigation systems. They offer versatility in nutritional formulation and rates of application. They are useful in regulated settings where particular nutrients are closely managed.

Breakup by Application:

- Grains and Cereals

- Pulses and Oilseeds

- Commercial Crops

- Fruits and Vegetables

- Turf and Ornamentals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes grains and cereals, pulses and oilseeds, commercial crops, fruits and vegetables, turf and ornamentals, and others.

Due to the increased need for staple food items like wheat, rice, and corn, the grains and cereals segment plays a vital role. Consistent fertilizer input from CRFs improves quality and yield. The market segment is expanding owing to consumers' growing demand for premium food products.

Pulses and oilseeds require specific nutrients at different growth stages. CRFs ensure these crops receive the necessary nutrients in a timely manner, improving productivity and quality. Farmers are increasingly adopting these fertilizers to optimize the yield and quality of crops like soybeans, peanuts, and lentils.

Commercial crops such as cotton, sugarcane, and tobacco are high-value crops that benefit significantly from controlled release fertilizers. The use of CRFs in commercial crops contributes to higher economic returns due to improved crop performance and quality.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest controlled release fertilizer market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for controlled release fertilizer.

According to the U.S. Department of Agriculture (USDA), agriculture, food, and related industries contributed around US$ 1.530 Trillion to U.S. gross domestic product (GDP) in 2023. The increasing demand for high-quality agricultural products including grains, fruits, and vegetables among individuals in the North American region is impelling the market growth. In addition, North America, particularly the United States and Canada, is at the forefront of adopting advanced agricultural technologies and practices. This includes the extensive use of precision farming techniques, which optimize the application of fertilizers and enhance crop yields. Furthermore, stringent environmental regulations in North America mandate the reduction of nutrient runoff and pollution.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the controlled release fertilizer industry include AGLUKON Spezialduenger GmbH & Co. KG, COMPO Expert GmbH (Grupa Azoty S.A.), DeltaChem GmbH, Haifa Group, ICL Group Ltd., JNC Corporation, Kingenta Ecological Engineering Co. Ltd., Mivena BV, Nufarm, Sociedad Química y Minera de Chile S.A., The Mosaic Company, and Yara International ASA.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Top players are engaging in various strategies to strengthen their market position. They are expanding their operations in emerging markets by establishing new production facilities. They are focusing on developing new fertilizer formulations that provide more efficient nutrient release, addressing the specific needs of different crops. They are also investing in research and development (R&D) efforts that assist in creating products that improve crop yield and reduce environmental impact. For example, on 15 September 2023, ICL introduced eqo.x, a pioneering controlled release fertilizer (CRF) technology, which is a first-of-its-kind biodegradable coating for CRFs, specifically designed for open-field agriculture. It has an impressive nutrient use efficiency (NUE).

Controlled Release Fertilizer Market News:

- January 2023: Mivena announced the Durable CRF technology at the global horticultural trade fair IPM Essen, Mivena booth 3A82. It also stated that CRF brands are now based on the renewed unique low start and high-end release technology ‘Durable CRF’. The technology is biodegradable and is the most robust CRF technology. It also has biodegradable coating, unique low start and high-end release, no swelling and leaking pellets. Moreover, it has round and small 2-3mm pellets and no exponential release at higher temperatures.

Controlled Release Fertilizer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Forms Covered | Granular, Liquid, Powder |

| Applications Covered | Grains and Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, Turf and Ornamentals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGLUKON Spezialduenger GmbH & Co. KG, COMPO Expert GmbH (Grupa Azoty S.A.), DeltaChem GmbH, Haifa Group, ICL Group Ltd., JNC Corporation, Kingenta Ecological Engineering Co. Ltd., Mivena BV, Nufarm, Sociedad Química y Minera de Chile S.A., The Mosaic Company, Yara International ASA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the controlled release fertilizer industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The controlled release fertilizer market was valued at USD 3.3 Billion in 2024.

The controlled release fertilizer market is projected to exhibit a CAGR of 5.02% during 2025-2033.

The controlled release fertilizer market is driven by the growing demand for sustainable agriculture, enhanced crop yield, and efficient nutrient delivery. Increasing awareness about environmental impacts, rising adoption of precision farming, and the need for fertilizers that reduce nutrient runoff and improve soil health further fuel market growth.

North America currently dominates the market driven by the increasing demand for high-quality agricultural products including grains, fruits, and vegetables among individuals in the region.

Some of the major players in the controlled release fertilizer market include AGLUKON Spezialduenger GmbH & Co. KG, COMPO Expert GmbH (Grupa Azoty S.A.), DeltaChem GmbH, Haifa Group, ICL Group Ltd., JNC Corporation, Kingenta Ecological Engineering Co. Ltd., Mivena BV, Nufarm, Sociedad Química y Minera de Chile S.A., The Mosaic Company, Yara International ASA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)