Contract Packaging Market Size, Share, Trends and Forecast by Packaging Type, Material, Service, End Use Industry, and Region, 2025-2033

Contract Packaging Market Size and Share:

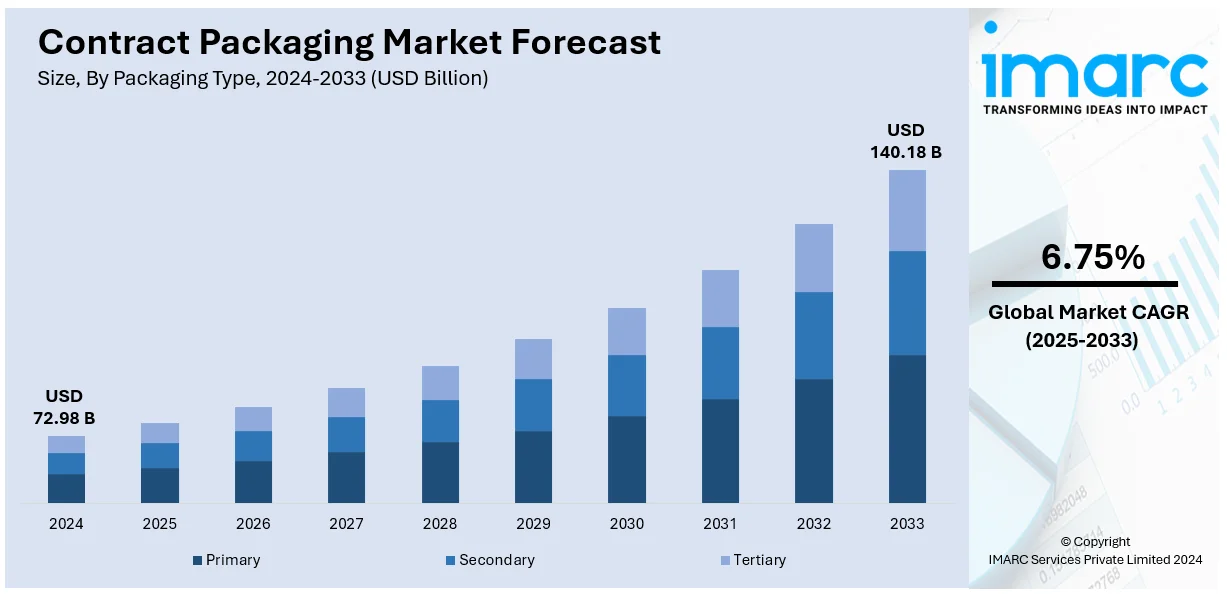

The global contract packaging market size was valued at USD 72.98 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 140.18 Billion by 2033, exhibiting a CAGR of 6.75% from 2025-2033. North America currently dominates the market in 2024. The growing number of e-commerce brands, increasing utilization of sustainable packaging, and rising integration of artificial intelligence (AI) and the Internet of Things (IoT) for streamlining processes and making packaging operations more efficient are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 72.98 Billion |

| Market Forecast in 2033 | USD 140.18 Billion |

| Market Growth Rate (2025-2033) | 6.75% |

Outsourcing packaging operations allows businesses to concentrate more on their primary competencies and gain enhanced productivity and efficiency. By assigning their packaging work to contract packagers, organizations could divert more of their resources toward research and development, marketing, and customer services. This focus has very high chances of improving the overall performance and competitiveness of that business in the market. The statistics from the current period are showing the importance of this practice. One recent report suggests that around 65 percent of firms would have hiked up yields owing to outsourcing non-primary functions including packaging. Outsourcing packaging improves internal efficiency and gives access to specialized expertise and technology. The contract packagers tend to be incorporated with new technologies and materials to reduce errors and improve the safety of products and compliance.

To get more information on this market, Request Sample

The United States contract packaging market is experiencing robust growth, driven by several key factors. A significant driver is the increasing demand for sustainable packaging solutions. Consumers and regulatory bodies are placing greater emphasis on eco-friendly materials and practices, prompting companies to seek contract packaging services that offer biodegradable, recyclable, or sustainably sourced materials. This shift aligns with the broader trend toward environmental responsibility in the packaging industry. The pharmaceutical sector also contributes notably to market expansion. The U.S. pharmaceutical contract packaging market reached USD 5.9 billion in 2023. It is expected to reach USD 10.8 billion by 2032, growing at an annual rate of 6.98% between 2024 and 2032. Collectively, these factors underscore the dynamic growth of the U.S. contract packaging market, driven by sustainability initiatives, pharmaceutical industry expansion, and increased consumer spending in the food and beverage sector.

Contract Packaging Market Trends:

Rising number of e-commerce brands

At present, there is an increase in the number of e-commerce brands selling products online and delivering them to the doorstep of buyers. According to reports, in 2023, global eCommerce sales in the retail sector were projected to hit approximately USD 6,500 Billion, with experts forecasting a 47.6% increase to USD 9,600 Billion by 2027. This rise presents significant opportunities for contract packaging, driven by the growing demand for streamlined, scalable solutions. Additionally, the widespread utilization of smartphones and other mobile devices has made online shopping more accessible than ever, allowing consumers to browse and purchase products on the go. This increased connectivity is expanding the potential customer base for e-commerce brands, reaching individuals in both urban and remote areas. Moreover, advancements in secure payment gateways and improved online security are instilling greater confidence in consumers to conduct financial transactions online and boosting the e-commerce industry. Furthermore, the increasing number of e-commerce brands is positively influencing the demand for contract packaging around the world.

Increasing utilization of sustainable packaging

As consumers become more environmentally conscious, there is a rising demand for sustainable and eco-friendly packaging options. For instance, Berry Global Group Inc. agreed to be acquired by Amcor PLC for approximately USD 8.4 Billion in stock, signaling growth in sustainable packaging. This merger aims to enhance research and development capabilities, benefiting contract packaging by accelerating sustainable solutions. Many brands are actively seeking contract packaging companies that offer sustainable packaging solutions to align with their environmental commitments. This increasing demand for sustainable packaging is creating new opportunities for contract packagers to expand their service offerings and cater to a broader client base. Sustainable packaging allows brands to differentiate themselves in a competitive market by showcasing their commitment to environmental stewardship. Companies that partner with contract packagers offering sustainable options that is enhancing their brand reputation and appealing to environmentally conscious consumers, leading to increased brand loyalty and positive word-of-mouth marketing.

Growing demand for customization and personalization

The demand for customization and personalization is leading contract packagers to diversify their service offerings. They are equipped to handle a wide range of product variations, packaging designs, and labeling requirements. For instance, companies that incorporate personalization into their strategies often experience higher customer engagement, resulting in a 10-15% revenue increase. This trend benefits contract packaging by driving demand for tailored solutions and fostering stronger client relationships. This expanded capability allows brands to offer personalized packaging options to their customers without having to invest heavily in in-house packaging facilities. Moreover, customized packaging helps brands stand out in a crowded marketplace. Contract packagers that can provide unique packaging solutions contribute to enhancing brand differentiation for their clients. Customized and personalized packaging is creating a more engaging and memorable experience for consumers. When products are tailored to individual preferences or occasions, customers feel a stronger emotional connection to the brand. This heightened engagement is leading to increased customer satisfaction and repeat purchases.

Contract Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global contract packaging market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on packaging type, material, service, and end use industry.

Analysis by Packaging Type:

- Primary

- Secondary

- Tertiary

Primary contract packaging involves letting a third-party contract packaging company do the packing and assembly of a product's primary packaging of components. Primary packaging, being one of the protective layers, wraps directly around a product. The same packaging comes into direct contact with the product, and that layer is the one that first meets the customer. Primary contract packaging services are utilized by those companies that do not have the right facilities, equipment, or expertise to package their products well. While some rely on specialized contract packagers to get things done, companies that outsource primary package still focus on improving their core competencies.

Analysis by Material:

- Plastic

- Metal

- Glass

- Paper and Paperboard

Plastic includes various forms, such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and many others. Each type of plastic material has characteristics uniquely suitable for a wide range of applications in packaging. Such a feature allows contract packagers to make the right choice of plastics for different products. Interestingly, plastic is highly lighter than other common packaging materials like glass or metal. This particular factor reduces the cost of shipping and makes the handling and movement less cumbersome for both contract packagers and the end consumer. Plastic packaging extends a great deal of durability and safety to the packaged product. It adds impact, moisture & other environmental resilience, thus protecting it during transport & storage.

Analysis by Service:

- Bottling

- Bagging/Pouching

- Lot/Batch and Date Coding

- Boxing and Cartoning

- Wrapping and Bund

- Labelling

- Clamshell and Blister

- Others

Contract bottling services are the outsourcing process through which a manufacturer sends his liquid products to a specialized packaging company for filling, capping, and finally labeling in bottles for display on the shelf. Bottling contract companies usually belong to those specialized in their knowledge, skills, and equipment facility handling. They are qualified to handle many types of liquids and bottles for a precise and consistent fill. From this point, it was a great capital investment for brand owners who would be spending on the establishment of in-house bottling including machinery, training, and maintenance. Contract bottling lets the brands avoid some of the start-up costs in favor of a much cheaper route through outsourcing work to experienced packagers, with all the needed infrastructure for that already in place.

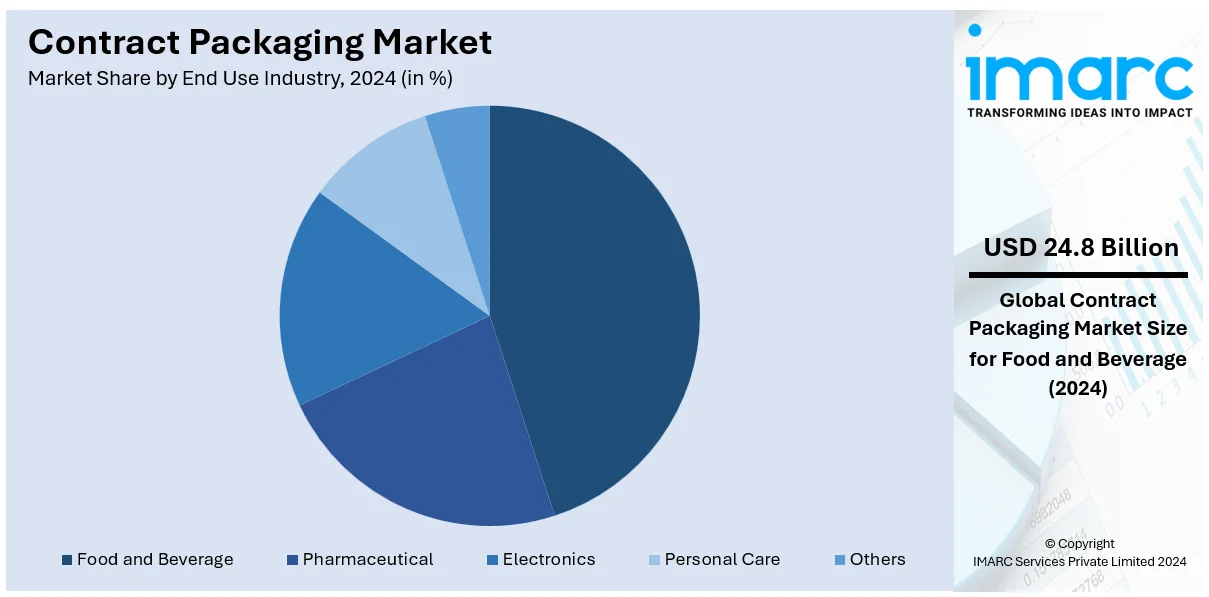

Analysis by End Use Industry:

- Food and Beverage

- Pharmaceutical

- Electronics

- Personal Care

- Others

Reducing operational costs is one of the most significant benefits that contract packaging provides to the food and beverage sector. Setting up an in-house packaging facility requires huge investments in machinery and equipment, labor and maintenance costs, which can be avoided by outsourcing the packaging to contract packagers and enjoying economies of scale achieved by specialized packaging companies. The demand in the food industry fluctuates mainly because of seasonality or through promotions or product launches. Production can also be scaled up or down at a moment's notice to meet specific consumer taste or even market requirements. During slack periods, packaging requirements can then be made to avoid managing any wasted capacity. Contract packaging companies are dedicated to this field of packaging and have an impressive amount of know-how dealing with a diverse portfolio of food and beverage products. They have also nurtured and applied some of the most efficient packaging processes with modern machinery to ensure that their products are well packaged, minimizing errors and defects.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Companies in different regions of North America outsource many of their operations, primarily to save on labor and capital for the construction of in-house facilities. Besides, the increase in the consumption of many types of convenience and ready-to-eat and drink foods is also helping the industry's growth. Furthermore, the demand for environmentally friendly packaging across multiple industries is also another factor responsible for the growth of the market. The region is predicted to grow even more in this area because of the emergence of increasing numbers of e-commerce brands that would sell products purely online. On top of that, further expansion is being warranted by the increased company focus on product quality.

Key Regional Takeaways:

United States Contract Packaging Market Analysis

The increasing adoption of contract packaging in the United States is mainly due to growing demand within the pharmaceutical sector. According to the reports, 2,325 pharmaceutical manufacturing businesses operate in the US as of 2023, which is a 7.8% increase compared to 2022, presenting an opportunity of around USD 2.3 Billion in terms of market for contract packaging. With more pharmaceutical products hitting the market, businesses need efficient, scalable, and compliant packaging solutions. Contract packaging allows companies to meet tight deadlines while maintaining product integrity and stringent regulatory standards. With more specialized treatments being developed, the pharmaceutical market has expanded, and so has the need for tailored, efficient packaging solutions. Moreover, contract packagers can deliver labelling, serialization, and tamper-evident packaging in order to provide pharmaceutical products that are not only safe for the end-user but also compliant with industry rules and regulations. Increased demand for pharmaceutical packaging, thus, has enhanced the contract packagers' status as supply chain players. They assist customers in streamlining their business processes while continuing to hold a high level of quality.

Europe Contract Packaging Market Analysis

The demand for contract packaging services is growing in Europe, driven by the rise in the food and beverages sector. According to research, there are around 445k companies in Europe in the Food & Drink Wholesaling industry, leading to a huge opportunity in the form of contract packaging, which drives demand in efficient, scalable packaging, suitable for different business operations. With changing consumer demands for greater convenience, variety, and sustainability, food and beverages companies face increased pressure for product packaging to meet and exceed those expectations. Outsource contract packaging to highly specialized providers that can deliver in terms of innovation, efficiency, and compliance with high standards for food safety regulatory compliance. Packaging solutions delivered by such providers are aimed at providing flexibility in managing different product sizes, and packaging material requirements, plus shelf life. Another trend that has brought contract packaging providers to increasingly use more sustainable practices and use biodegradable material is the growing trend for eco-friendly and sustainable packaging in Europe. As companies in the food and beverage sector continue to innovate and meet the demands of the market for better products and packaging, the need for effective, flexible, and environmentally conscious packaging solutions will likely increase, supporting continued growth in contract packaging adoption.

Asia Pacific Contract Packaging Market Analysis

The adoption of contract packaging services in the Asia-Pacific region is increasingly driven by the growth of small and medium-sized enterprises (SMEs). For instance, the increasing number of micro, small, and medium enterprises (MSMEs) in India, totalling around 63 Million, presents significant opportunities for contract packaging, fostering business growth and supply chain efficiency. With more businesses entering the market and scaling their operations, the need for flexible and cost-efficient packaging solutions has grown. SMEs often face challenges in managing production costs, maintaining quality standards, and meeting consumer expectations. Contract packaging allows these companies to focus on core competencies while outsourcing the packaging process to experts. This collaboration enables SMEs to meet the demand for a diverse range of products across various industries, including pharmaceuticals, consumer goods, and cosmetics. Contract packaging providers offer customized solutions that cater to smaller production volumes, helping businesses remain competitive without investing heavily in infrastructure. As SMEs continue to thrive and expand across the region, the demand for contract packaging services is expected to increase, ensuring a more streamlined and scalable approach to packaging needs.

Latin America Contract Packaging Market Analysis

The rise of e-commerce in Latin America is contributing to the growing adoption of contract packaging services. For instance, the Latin America market with over 300 Million digital buyers and an expected 20% growth by 2027, presents significant opportunities for contract packaging, driving demand for efficient, scalable solutions to meet expanding consumer needs. The rapid expansion of online retail platforms has created new packaging challenges, as businesses need to ensure that products are securely packaged, efficiently stored, and easily shipped to customers. This demand is further amplified by the growing preference for home delivery services, especially in the wake of the pandemic. Contract packaging providers are well-positioned to address these challenges by offering solutions that streamline the packaging and fulfilment process. These services enable businesses to focus on core activities such as product development, marketing, and sales, while leaving the complexities of packaging logistics to professionals. As e-commerce continues to grow in the region, so does the need for efficient, scalable, and reliable packaging solutions that support fast and safe delivery to consumers.

Middle East and Africa Contract Packaging Market Analysis

Rising infrastructure development in the region has directly influenced the growing demand for packaging in electronics products and devices. As the market for consumer electronics continues to expand, the need for reliable and secure packaging solutions has become more pronounced. According to reports, the increase of 963,000 mobile connections (+4.8%) in the UAE from 2023 to 2024 signifies a rising demand for consumer tech, fostering opportunities for contract packaging companies to meet growing product volumes, valued at approximately USD 3.5 Million in packaging services. Packaging providers specializing in electronics have adopted advanced technologies to offer protection during transport, preventing damage from impacts and environmental conditions. The growing demand for sustainable packaging materials also plays a key role, as companies look to reduce their environmental footprint. Managed infrastructure services for packaging ensure that businesses in the electronics sector receive efficient, cost-effective solutions that meet the unique needs of high-value products, ensuring both safety and compliance with global standards.

Competitive Landscape:

Leading players in the contract packaging market are focusing on several strategic initiatives to maintain their competitive edge and capitalize on the market’s growth. Many companies are investing heavily in advanced technologies to enhance operational efficiency and meet the evolving demands of customers. This includes adopting automation, robotics, and digital printing technologies, which streamline packaging processes and ensure greater precision and speed. By integrating these innovations, companies can offer more customized packaging solutions, catering to the specific needs of industries such as food, pharmaceuticals, and consumer goods. Sustainability is another major focus for industry leaders. With growing consumer and regulatory pressure for eco-friendly solutions, contract packagers are prioritizing the use of sustainable materials, recyclable packaging, and energy-efficient production methods.

The report provides a comprehensive analysis of the competitive landscape in the contract packaging market with detailed profiles of all major companies, including:

- Aaron Thomas Company, Inc.

- ActionPak Inc

- Assemblies Unlimited, Inc.

- Co-Pak Packaging Corporation

- Kelly Products Incorporated

- Marsden Packaging

- Multi-Pack Solutions LLC

- ProStar Contract Packaging

- Reed-Lane, Inc.

- Silgan Unicep

- Sonic Packaging Industries

- Sterling Contract Packaging, Inc

- We Pack Logistics

Latest News and Developments:

- December 2024: Sonoco will showcase its versatile packaging and contract manufacturing capabilities at Pharmapack 2025, highlighting innovations across its TEQ, Plastics, and Consumer divisions. The display will focus on pharmaceutical, medical device, consumer packaging, and contract manufacturing solutions, offering valuable insights into component assembly. This marks Sonoco's first participation at Pharmapack, underscoring its commitment to advancing packaging solutions.

- December 2024: LOG Pharma Primary Packaging announced plans to introduce its new Barrier Eco Line in Paris at the Pharmapack Europe 2025, offering cost reductions and optimized oxygen scavenging for eco-friendly barrier bottles. This innovative product line is highly beneficial for contract packaging, particularly for pharmaceutical companies seeking sustainable packaging solutions that enhance product integrity and reduce environmental impact. The new line supports both innovative and generic drug sectors, aligning with current industry demands for sustainability and efficiency.

- December 2024: Nexgen Packaging and Seaman Paper have partnered to expand their sustainable packaging solutions globally, focusing on reducing the fashion and footwear industries' reliance on single-use plastics. Their Vela product, an eco-friendly alternative to polybags, is paired with a fiberboard hanger from Ditto Hanging Solutions, promoting recycling and sustainability. This collaboration benefits contract packaging by offering innovative, recyclable solutions that meet growing demand for environmentally friendly alternatives in packaging.

- November 2024: Amcor and Berry Global announced a strategic merger, combining in an all-stock transaction to build a globally leading company in packaging solutions for consumer and healthcare sectors. The deal is planned to enable the shareholders of Berry to receive 7.25 Amcor shares per Berry share, with the shared company owning 63% and 37% of the entity, respectively. This merger will strengthen their flexible films, containers, and closures businesses while enhancing healthcare packaging offerings. The collaboration aims to drive innovation, sustainability, and growth in the packaging industry.

- January 2024: Novelis Inc. announced a new contract with Ardagh Metal Packaging USA Corp. to supply aluminum packaging sheets for beverages to Ardagh's North American metal production facilities. This agreement highlights Novelis' role as a leading provider of sustainable aluminum solutions. The partnership strengthens the supply chain for aluminum beverage can sheets, supporting Ardagh's commitment to sustainable packaging solutions.

Contract Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Primary, Secondary, Tertiary |

| Materials Covered | Plastic, Metal, Glass, Paper and Paperboard |

| Services Covered | Bottling, Bagging/Pouching, Lot/Batch and Date Coding, Boxing and Cartoning, Wrapping and Bund, Labelling, Clamshell and Blister, Others |

| End Use Industries Covered | Food and Beverage, Pharmaceuticals, Electronics, Personal Care, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aaron Thomas Company, Inc., ActionPak Inc, Assemblies Unlimited, Inc., Co-Pak Packaging Corporation, Kelly Products Incorporated, Marsden Packaging, Multi-Pack Solutions LLC, ProStar Contract Packaging, Reed-Lane, Inc., Silgan Unicep, Sonic Packaging Industries, Sterling Contract Packaging, Inc, We Pack Logistics, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the contract packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global contract packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the contract packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The contract packaging market was valued at USD 72.98 Billion in 2024.

IMARC Group estimates the market to reach USD 140.18 Billion by 2033, exhibiting a CAGR of 6.75% from 2025-2033.

The growing number of e-commerce brands, increasing utilization of sustainable packaging, and rising integration of artificial intelligence (AI) and the Internet of Things (IoT) for streamlining processes and making packaging operations more efficient are some of the major factors propelling the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global contract packaging market include Aaron Thomas Company, Inc., ActionPak Inc, Assemblies Unlimited, Inc., Co-Pak Packaging Corporation, Kelly Products Incorporated, Marsden Packaging, Multi-Pack Solutions LLC, ProStar Contract Packaging, Reed-Lane, Inc., Silgan Unicep, Sonic Packaging Industries, Sterling Contract Packaging, Inc, We Pack Logistics, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)