Continuous Subcutaneous Insulin Infusion Market Size, Share, Trends and Forecast by Product, Patient Type, End Use, and Region, 2025-2033

Continuous Subcutaneous Insulin Infusion Market Size and Trends:

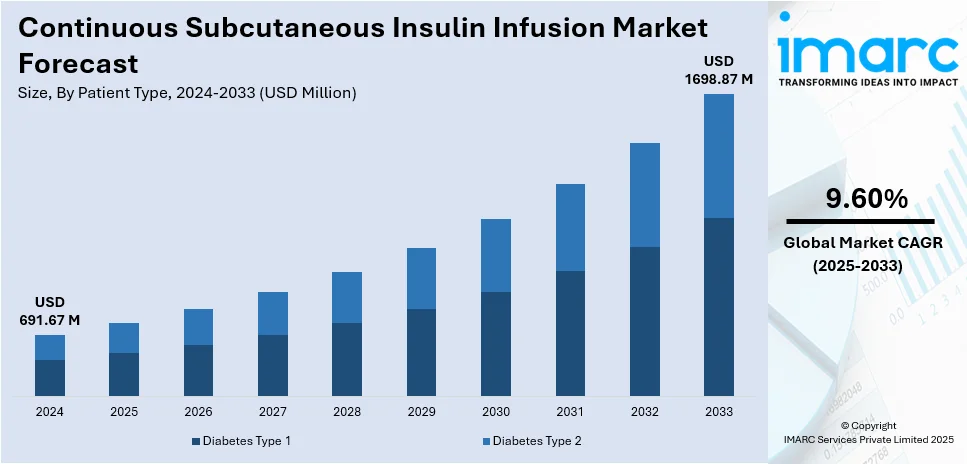

The global continuous subcutaneous insulin infusion market size was valued at USD 691.67 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1698.87 Million by 2033, exhibiting a CAGR of 9.60% from 2025-2033. North America currently dominates the market, holding a market share of over 37.5% in 2024. The market is driven by rising diabetes prevalence, technological advancements like artificial intelligence (AI) and the Internet of Things (IoT) integration, increasing awareness of diabetes management options, expanding insurance coverage, and growing demand for personalized and user-friendly insulin delivery solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 691.67 Million |

| Market Forecast in 2033 | USD 1698.87 Million |

| Market Growth Rate (2025-2033) | 9.60% |

Insulin pumps offer a significant advantage over traditional injection methods by providing continuous insulin delivery, closely mimicking the body's natural insulin release. This continuous delivery can lead to more stable blood glucose levels, reducing the frequency of hypoglycemic and hyperglycemic episodes. The integration of advanced technologies, such as continuous glucose monitoring (CGM) systems and smartphone connectivity, further enhances user convenience. For instance, the U.S. Food and Drug Administration (FDA) approved the Beta Bionics iLet Bionic Pancreas system in May 2023, which uses an adaptive algorithm to streamline insulin management, eliminating adjustments manually and introducing a meal announcement functionality to evaluate the intake of carbohydrates. Additionally, the global prevalence of diabetes continues to rise, increasing the demand for effective management solutions like CSII. According to the World Health Organization (WHO), over 830 million people across the world are affected with diabetes, with a maximum number of individuals living in low- and middle-income nations, and about 50% of people lacking access to proper treatment.

In 2024, United States emerged as a major market disruptor with a share of 81.20% in North America. This can be attributed to various factors such as rising prevalence of diabetes in the country, rapid advancements in technology, and a hike in focus on geriatric and pediatric patients. As per a report by the Center for Disease Control and Prevention (CDC), around 16 percent of American adults are currently suffering from diabetes. Every one in six individuals have diabetes in the country. Moreover, there is a growing focus on managing diabetes that can be especially tricky for certain age groups, like kids and older adults. Insulin pumps provide a solution that can be programmed to deliver insulin in a way that accounts for the unique needs of these demographics. As families and healthcare providers look for ways to ensure better outcomes for these vulnerable populations, CSII is becoming an increasingly attractive choice in the country.

Continuous Subcutaneous Insulin Infusion Market Trends:

Integration of Artificial Intelligence (AI) and the Internet of Things (IoT)

The incorporation of AI and IoT technologies into insulin pumps is revolutionizing diabetes management. AI algorithms enable predictive analytics for insulin dosing, while IoT facilitates real-time data sharing between devices and healthcare providers. This integration helps augment personalized treatment plans and enhances patient outcomes. For instance, the Medtronic MiniMed 780G insulin pump, approved by the FDA in April 2023, features a meal detection feature that offers automatic insulin adjustments every five minutes, demonstrating the impact of AI in CSII devices.

Focus on Pediatric and Geriatric Patients

Insulin pumps are particularly beneficial for pediatric and geriatric patients who may struggle with traditional insulin management methods. For instance, children with Type 1 diabetes often face challenges in keeping their blood sugar levels stable, particularly because their activity levels and eating habits are unpredictable. On the other side, older adults might struggle with the manual dexterity or cognitive load required for traditional insulin management. The adaptability and precision of CSII systems cater to the unique needs of these age groups, improving adherence and health outcomes. For instance, the Medtronic MiniMed 780G insulin pump is suitable for patients aged seven and above with type 1 diabetes, highlighting the focus on pediatric care.

Growing Availability of Insurance Coverage

Cost is often a major barrier to adopting advanced medical devices. This has encouraged several insurance providers and governments to recognize the long-term cost savings that are available through better diabetes management and offer insurance coverage for the same. For example, Medicare covers different diabetes-related services, such as no-cost screenings for up to two years, a diabetes prevention program for a lifetime, and self-management diabetes training with a 20 percent co-payment. It also covers equipment including insulin pumps and glucose with a 20 percent co-payment. This is in accordance with the awareness among providers that it is cheaper to help someone maintain steady blood sugar levels than to treat complications like amputations or heart disease down the line.

Continuous Subcutaneous Insulin Infusion Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global continuous subcutaneous insulin infusion market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, patient type, and end use.

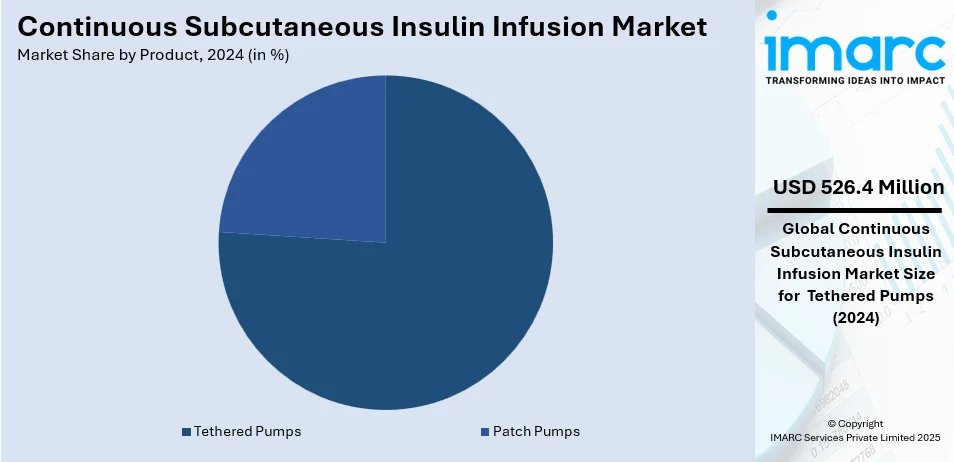

Analysis by Product:

- Patch Pumps

- Basal

- Bolus

- Basal and Bolus

- Tethered Pumps

- Insulin Reservoir or Cartridges

- Insulin Set Insertion Devices

- Battery

Tethered pumps lead the market share in 2024 with 76.1%. Its extensive use, sophisticated functioning, and dependability account for its popularity. These pumps are preferred for their programmability, integration with continuous glucose monitoring (CGM) systems, and capacity to handle intricate dosing schedules. They provide accurate insulin administration and are attached to the body by tubing. Their versatility makes them particularly popular among patients with Type 1 diabetes, driving significant market demand. Tethered pumps are also preferred for their ability to deliver both basal and bolus insulin doses with high accuracy, which is essential for maintaining optimal blood glucose levels. The availability of advanced models with smartphone connectivity and automated insulin adjustment features further enhances their appeal, solidifying their position as the largest segment in the CSII market.

Analysis by Patient Type:

- Diabetes Type 1

- Diabetes Type 2

In 2024, diabetes type 1 accounted for 81.6% of the market share. Due to their complete reliance on exogenous insulin, patients with Type 1 diabetes require precision insulin treatment, which is the major reason for the segment's appeal. Insulin pumps are particularly helpful for people with Type 1 diabetes because they lower the risk of hyperglycemia and hypoglycemia by delivering basal insulin continuously and enabling flexible bolus adjustments. The need for sophisticated CSII systems that interface with continuous glucose monitors for automated and real-time blood sugar monitoring has also increased due to the rising incidence of type 1 diabetes, especially in children and geriatric people. The segment's dominance is also influenced by developments in pump technology and rising patient and caregiver knowledge.

Analysis by End Use:

- Hospitals and Clinics

- Homecare

- Laboratories

In 2024, hospitals and clinics held a 44.7% market share, making them the largest segment. Their involvement in early diabetes diagnosis, education, and device training for insulin pump users is a major reason for this rise. These medical facilities provide the infrastructure and knowledge required to manage complicated diabetic situations, and they often serve as the initial point of contact for patients seeking treatment. For insulin pump initiation, hospitals and clinics are recommended because they offer complete care, including device modification and monitoring, guaranteeing safe and efficient use. These institutions' increasing usage of cutting-edge insulin pump technologies and the rise in endocrinologists' and diabetes specialists' recommendations for pump therapy underscore their status as the largest end-use market. Furthermore, their function in offering ongoing assistance and frequent follow-ups improves patient compliance and outcomes.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, 37.5% of the market share was held by North America, primarily due to the rising incidence of diabetes along with the existing advanced healthcare infrastructure and adoption of modern medical technology. The U.S. is leading the market with its vast insurance coverage of patients using insulin pumps and the increased prevalence of personalized diabetes management solutions. Heavy investments in research and development (R&D) have also been made by leading medical device companies, resulting in availability of advanced insulin pumps, which are paving the way for adoption. Awareness among patients as well as healthcare providers about improved diabetes treatment options that are coupled with government measures supporting diabetes care are further promoting North America's position as the leading market in the global CSII market.

Key Regional Takeaways:

United States Continuous Subcutaneous Insulin Infusion Market Analysis

United States is leading the North American market during the year 2024 with a staggering 81.20% market share. The market is led by the high diabetes prevalence and advanced healthcare infrastructure of the country. About 15.8% of adults in the USA had diabetes during the year 2023, where 11.3% of these adults had a diagnosis while 4.5% remained undiagnosed. Comparatively, men had higher rates of total diabetes (18.0 %) and diagnosed diabetes (12.9%) than women (13.7 % and 9.7%, respectively). As per the age, diabetes prevalence has been growing dramatically, reaching 27.3% of those aged 60 and above in the year 2023. Technological advancements such as the FDA-approved Medtronic MiniMed 780G insulin pump with meal detection technology are enhancing blood sugar control and contributing to market growth. The dominance of the country is also bolstered by higher healthcare spending and good insurance coverage. According to the American Diabetes Association, the healthcare costs related to diabetes have accrued to approximately $412.9 billion annually, sharpened with the financial ramifications of the disease. Innovations like smart insulin pumps with artificial intelligence-aided real-time glucose monitoring facilities are also amplifying the market demand. Additionally, the country benefits from extensive clinical research activities and FDA approvals on advanced insulin delivery systems, such as the Beta Bionics iLet Bionic Pancreas that got approved in 2023. Furthermore, rising access and patient support systems towards diabetes education boost the market growth.

Asia Pacific Continuous Subcutaneous Insulin Infusion Market Analysis

The Asia Pacific region is anticipated to experience substantial growth in the CSII market. Factors such as the rising incidence of diabetes in countries such as India, China and Japan have motivated this expected growth. According to the International Diabetes Federation (IDF), it is estimated that 9 out of 11 or 90 million diabetics are within Southeast Asia. In fact, it has been projected that the number of these adults will increase to about 113 million by the year 2030 and to about 151 million by 2045. Initiatives undertaken by governments to improve diabetes care coupled with increased availability of insulin pumps will drive growth. Moreover, local manufacturers have entered the field with commercially viable alternatives for insulin pumps thereby making them more affordable for the middle-income stratum of a population. In addition, the rising popularity of telemedicine and m-health is raising awareness regarding these systems and improving the availability of CSII in rural and underserved areas.

Europe Continuous Subcutaneous Insulin Infusion Market Analysis

In Europe, countries like Germany, the United Kingdom (UK), and France lead the CSII market due to high awareness and well-structured reimbursement systems. According to reports, 61 million people, or one in eleven adults, have diabetes in the region, which significantly increases the need for sophisticated treatment options. By 2030, this figure is expected to rise to 67 million, and by 2045, it will reach 69 million. Alongside this, almost one in three persons in this area with diabetes are undiagnosed. This has forced several European countries to enact laws encouraging the use of cutting-edge insulin pumps, making them accessible to a wider range of people. Additionally, collaborations between healthcare providers and device manufacturers are fostering the integration of CSII systems into routine care. Efforts to enhance diabetes awareness through campaigns and education initiatives also contribute to the market’s steady growth.

Latin America Continuous Subcutaneous Insulin Infusion Market Analysis

Latin America is gradually embracing CSII systems as awareness of diabetes management options grows. The primary markets that provide the majority of the demand in the region are Brazil, Mexico, and Argentina. The region's governments are taking steps to give diabetes treatment top priority by expanding access to medical facilities and providing financial assistance for medical equipment. The expansion of insulin pump use among middle-class and wealthy populations is also greatly aided by private clinics.

Middle East and Africa Continuous Subcutaneous Insulin Infusion Market Analysis

The growing region of MEA is anticipated to become an emerging market for the CSII systems because of the prevalence of diabetes and healthcare improvements. Countries such as Saudi Arabia, the UAE, and South Africa are showing increasing demand for advanced outcomes of diabetes management. As of 2023, the type 2 diabetes affected nearly 28% of the adult population in Saudi Arabia, thus increasing the use of insulin pumps. Government and NGO-engaged campaigns and health programs are making great efforts to promote awareness on diabetes. However, affordability and access to specialized care keep patients away from adopting the technology in many areas of the region. This is sure to lead future growth with investment into healthcare. Partnerships with global manufacturers are also growing steps in establishing the product market in the region.

Competitive Landscape:

Key players in the market are focusing on advancing technology to improve insulin delivery and patient convenience. Recent innovations include insulin pumps with real-time glucose monitoring integration and automated adjustments based on blood sugar trends. These systems now incorporate features like adaptive algorithms for meal detection, reducing the need for manual intervention. Furthermore, a lot of focus is placed on designing devices that are easy to use, such as inconspicuous and compact equipment that link to smartphones. By creating more affordable solutions and obtaining regulatory clearances for usage with a range of age groups, including pediatric and elderly patients, businesses are also increasing accessibility. The increasing need for accurate and effective diabetes management tools is being met in part by this deliberate focus on improving functionality and simplicity.

The report provides a comprehensive analysis of the competitive landscape in the continuous subcutaneous insulin infusion market with detailed profiles of all major companies, including:

- B. Braun SE

- F. Hoffmann-La Roche Ltd

- Insulet Corporation

- Medtronic plc

- Ypsomed

Latest News and Developments:

- In August 2024, Insulet Corporation declared that Omnipod 5 Automated Insulin Delivery System will be available for use with type 2 diabetes people, who are above 18 years of age. Omnipod 5 AID system is the only first AID system for controlling type 1 as well as type 2 diabetes that received FDA approval.

- In July 2024, F. Hoffmann-La Roche Ltd received the CE Mark authorization for its Accu-Chek SmartGuide CGM system. The solution is for people who have type 1 or type 2 diabetes and are on flexible insulin treatment.

Continuous Subcutaneous Insulin Infusion Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Million |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Patient Types Covered | Diabetes Type 1, Diabetes Type 2 |

| End Uses Covered | Hospitals and Clinics, Homecare, Laboratories |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B. Braun SE, F. Hoffmann-La Roche Ltd, Insulet Corporation, Medtronic plc, Ypsomed, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the continuous subcutaneous insulin infusion market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global continuous subcutaneous insulin infusion market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the continuous subcutaneous insulin infusion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global continuous subcutaneous insulin infusion market was valued at USD 691.67 Million in 2024.

The market is estimated to reach USD 1698.87 Million by 2033, exhibiting a CAGR of 9.60% from 2025-2033.

The key factors driving the global continuous subcutaneous insulin infusion market include rising diabetes prevalence, technological advancements like smart pumps and AI integration, increasing awareness of advanced diabetes management, expanded insurance coverage, and growing demand for personalized and user-friendly insulin delivery solutions across diverse patient demographics.

North America currently dominates the global continuous subcutaneous insulin infusion market. The dominance is driven by a high prevalence of diabetes, strong healthcare infrastructure, significant awareness about diabetes management, and widespread adoption of advanced technologies.

Some of the major players in the global continuous subcutaneous insulin infusion market include B. Braun SE, F. Hoffmann-La Roche Ltd, Insulet Corporation, Medtronic plc, Ypsomed, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)