Continuous Glucose Monitoring Systems Market Size, Share, Trends and Forecast by Component, Demographics, End User, and Region, 2025-2033

Continuous Glucose Monitoring Systems Market Size and Share:

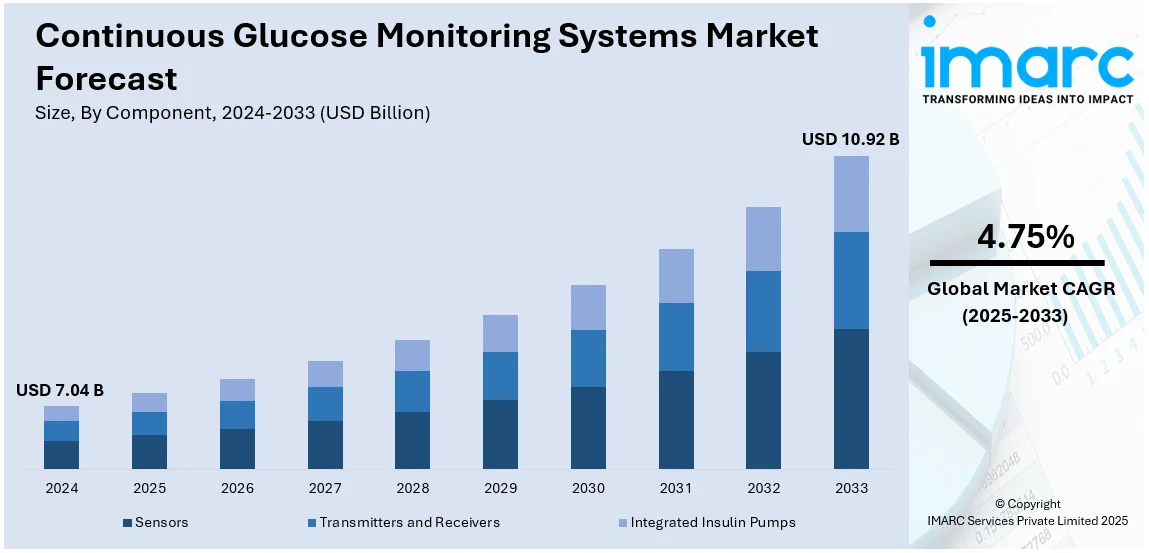

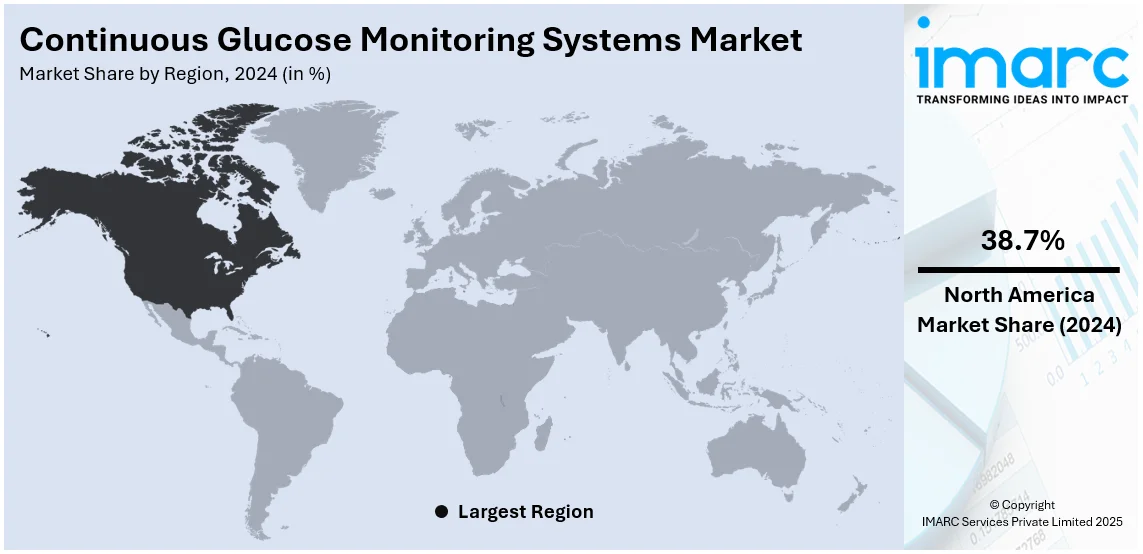

The global continuous glucose monitoring systems market size was valued at USD 7.04 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.92 Billion by 2033, exhibiting a CAGR of 4.75% from 2025-2033. North America currently dominates the market, holding a market share of over 38.7% in 2024. The increasing awareness and adoption of CGM devices, rising prevalence of diabetes, significant technological advancements in CGM devices, and ongoing shift towards preventive healthcare are some of the factors boosting the continuous glucose monitoring systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.04 Billion |

|

Market Forecast in 2033

|

USD 10.92 Billion |

| Market Growth Rate (2025-2033) | 4.75% |

The increasing awareness and adoption of continuous glucose monitoring (CGM) systems are significantly contributing to the continuous glucose monitoring systems market demand. Patients and healthcare providers are recognizing the advantages of CGMs over traditional blood glucose monitoring methods, leading to a higher acceptance rate. Continuous Glucose Monitors provide real-time glucose data, empowering individuals to make well-informed choices for effective diabetes management. Real-time data is essential for keeping blood glucose levels within the target range, effectively reducing the risk of complications. The National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) highlights the significance of continuous glucose monitors in managing diabetes effectively. They note that CGMs help maintain target blood glucose levels while also enabling healthcare professionals and patients to make informed decisions about treatment plans. The growing body of evidence supporting the benefits of CGMs, coupled with increased patient education and awareness campaigns, has led to a surge in the adoption of these devices. With increasing awareness of the benefits of real-time glucose monitoring, the demand for continuous glucose monitoring (CGM) systems is anticipated to rise, driving further continuous glucose monitoring systems market growth.

The US continuous glucose monitoring (CGM) systems market share is witnessing substantial expansion due to key factors, including the high prevalence of diabetes and the impact of technological innovations that have significantly advanced the industry. Innovations such as non-invasive sensors, extended device wearability, and integration with smartphones have enhanced user convenience and monitoring accuracy. For instance, Abbott Laboratories reported a 22.8% increase in sales of their continuous glucose monitors, including the FreeStyle Libre and the newly launched Lingo, in the fourth quarter of 2024. Furthermore, the U.S. Food and Drug Administration's approval of over-the-counter CGM devices in 2023 has broadened access, allowing individuals without a prescription to monitor their glucose levels. This regulatory change has expanded the user base beyond diabetics to include health-conscious individuals seeking to manage their blood sugar levels proactively. Together, these factors are driving the expansion of the continuous glucose monitoring (CGM) market in the United States.

Continuous Glucose Monitoring Systems Market Trends:

Rising Prevalence of Diabetes

The rising global burden of diabetes is a pivotal driver of the Continuous Glucose Monitoring (CGM) Systems Market. With the increasing prevalence of diabetes, there is an increasing demand for advanced glucose monitoring solutions to improve disease management and minimize complications. The International Diabetes Federation projects that the number of adults with diabetes will increase by 46% and reach approximately 783 million people by 2045, with 1 in 8 adults affected worldwide. This alarming growth highlights the urgent need for effective and user-friendly monitoring tools like CGM systems, which provide real-time glucose level tracking, enabling timely interventions and better glycemic control. The widespread adoption of CGM devices across healthcare settings, due to their ability to enhance patient outcomes and prevent more severe health complications, is growing and eventually driving the market.

Technological Advancements in CGM Devices

Continuous developments in continuous glucose monitoring (CGM) devices are helping the market grow by increasing the level of user experience and improving management of disease. Advancements like minimally invasive sensors, smartphone integration and very fast sharing of real-time glucose data have made the use of CGMs much more functional and easy to use. The predictive alert, improved accuracy, and longer sensor life increase the attractiveness of systems towards both patients and physicians.

Moreover, an increasing number of cases of obesity and associated diseases increases the requirement for CGM systems. As per WHO, by 2025, nearly 167 million adults and children are expected to face worsening health conditions due to obesity. This increase in the risk factor is pushing the demand for a better management system for diabetes because obesity is the major risk factor for Type 2 diabetes. These factors altogether make CGM systems a crucial tool in addressing the escalating burden of diabetes and obesity worldwide.

Shift Towards Preventive Healthcare

The rising consumer awareness of preventive healthcare is significantly driving the demand for real-time monitoring tools like continuous glucose monitoring (CGM) systems. These devices enable individuals to monitor glucose levels continuously, supporting early interventions and lowering the risk of long-term diabetes-related complications, including cardiovascular diseases, neuropathy, and retinopathy.

Preventive healthcare initiatives have highlighted the importance of proactive disease management, increasing the adoption of advanced monitoring solutions. According to a report by the National Institute of Health (NIH), by 2035, 35.66% of the U.S. adult population aged 50 and above will have at least one chronic condition. This projection underscores the need for effective tools like CGM systems that enable better disease management, improve patient outcomes, and reduce healthcare costs. As more individuals prioritize health monitoring to mitigate chronic disease risks, the CGM market continues to expand, supported by innovations and increasing accessibility.

Continuous Glucose Monitoring Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global continuous glucose monitoring systems market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on the component, demographics, and end user.

Analysis by Component:

- Sensors

- Transmitters and Receivers

- Integrated Insulin Pumps

Sensors account for 41.0% of the continuous glucose monitoring (CGM) systems market, making them the largest and most crucial component segment. These devices are essential for continuously measuring glucose levels from interstitial fluid, delivering real-time data to both users and healthcare providers. This market dominance is driven by innovations in sensor technology, such as improved accuracy, extended wear duration, and minimally invasive (MI) designs. Leading players have introduced advanced sensors, featuring compact designs, factory calibration, and seamless smartphone integration. The demand for high-performance sensors is further fueled by the increasing preference for devices that support personalized diabetes management. Additionally, sensors with Bluetooth connectivity and cloud-based data sharing have strengthened their market presence, catering to both individual users and healthcare providers.

Analysis by Demographics:

- Child Population (≤14 years)

- Adult Population (>14 years)

As per continuous glucose monitoring systems market outlook, adults form the largest user group, influenced by the high prevalence of Type 2 diabetes and their higher purchasing power. This demographic benefits from advanced features, including real-time glucose tracking, integration with fitness apps, and customizable alerts. According to the CDC, diabetes prevalence is highest among adults aged 45 and older, accounting for a substantial share of CGM adoption. Adults are also more likely to adhere to regular glucose monitoring, further increasing demand. Additionally, the rising awareness of preventive health management in this group amplifies market growth.

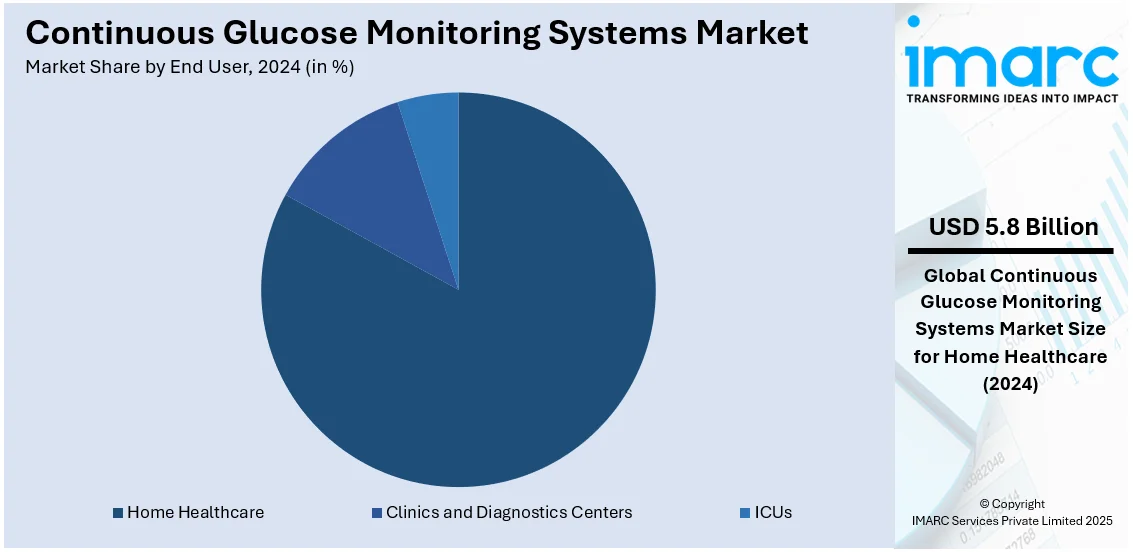

Analysis by End User:

- Clinics and Diagnostics Centers

- ICUs

- Home Healthcare

Based on the recent continuous glucose monitoring systems market forecast, home healthcare is the largest segment, commanding an impressive 82.5% market share. Increasing demand for self-monitoring solutions that are convenient, private, and add real-time data has influenced this market. Increased use of CGMs in home settings increases the trend to become a more personal health care where patients become easily involved in managing chronic conditions such as diabetes. Advancements in usability of devices such as easy sensor application, smartphone compatibility, and user-friendly interfaces have made CGMs more accessible for non-professional users. Companies have introduced devices specifically designed for patient-friendly use at home. The integration of CGMs with telehealth platforms allows real-time data sharing with healthcare providers, improving remote care and minimizing the need for frequent clinic visits.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the global continuous glucose monitoring (CGM) systems market, accounting for 38.7% of the share. This leadership is driven by the high prevalence of diabetes, advanced healthcare infrastructure, and widespread adoption of innovative healthcare technologies. According to the CDC, more than 37.3 million Americans were diagnosed with diabetes in 2022, highlighting the need for advanced glucose monitoring solutions. Advanced reimbursement dynamics, with growing insurance cover over CGM devices and, subsequently, increased access to this technology to a wider patient population base, benefit the region. Other important market players were present in the region. These companies heavily invest in research and development to ensure they introduce more accurate, user-friendly, and cost-effective devices for the needs of patients.

Key Regional Takeaways:

United States Continuous Glucose Monitoring Systems Market Analysis

The growing count of diabetes and prediabetes in the United States creates a huge opportunity for growth within the Continuous Glucose Monitoring systems market. According to the CDC and the U.S Department of Health & Human Services, it is estimated that in 2021, there were about 97.6 million adults aged 18 years or older with prediabetes. That is a dangerous figure further reflecting the pressure to have even the most sophisticated products in diabetes care that might include CGM systems for a more effective glycemic control and stop disease progression.

Also, the American Diabetes Association's report in November 2023 about Economic Costs of Diabetes in the U.S. included costs. The total diabetes cost in 2022 amounts to USD 412.9 Billion, covering direct medical expenditures of USD 306.6 Billion and indirect costs of USD 106.3 Billion. The increasing economic burden of diabetes underlines the need for CGM systems to lower healthcare expenditures by better management of the disease, improved patient outcomes, and reduced complications. This will drive the adoption of CGM technology in the United States.

Europe Continuous Glucose Monitoring Systems Market Analysis

The increasing incidence of diabetes in the WHO European Region is one of the major growth propellers for Continuous Glucose Monitoring (CGM) systems in Europe. According to estimates by the World Health Organization (WHO), as many as 74 million adults are living with diabetes, comprising 11.9% of males and 10.9% of females. This includes affecting about 300,000 children and adolescents, with type 1 diabetes burdened to the greatest extent in Europe globally.

The rising health crisis necessitates more advanced glucose monitoring solutions like CGM systems that track in real time and handle the disease much better. Widespread use of CGM devices will reduce most complications, such as cardiovascular disease, neuropathy, and kidney disease, associated with the disease. Preventive care and new technologies in governments and healthcare systems around Europe are more on the upsurge to further push CGM systems adoption. The growth of awareness and access to the devices is set to drive the expansion of the European CGM market significantly.

Asia Pacific Continuous Glucose Monitoring Systems Market Analysis

India and China lead the world in this diabetes epidemic. The Asia-Pacific region, therefore, remains an important growth engine for the Continuous Glucose Monitoring (CGM) systems market. India headed the world's list in 2022, with 212 million people having diabetes. Next in the queue was China with 148 million cases, as per reports. The enormous diabetic population, thus created, makes an urgent necessity to manage this disease effectively. That is driving demand for advanced technologies such as CGM systems.

This category of CGM devices ensures there is live tracking and superior glycemic control without the chance to develop other complicated conditions, which include cardiovascular issues and neuropathies. Such other factors increasing its adoption are digitized health, increased expenditure toward healthcare services and government schemes intended to eliminate diabetic conditions within nations. In addition, increased awareness about preventive healthcare and the integration of CGM systems with smartphone apps are enhancing accessibility and user convenience. With diabetes cases expected to rise, the Asia-Pacific CGM market is poised for robust growth, fueled by innovation and expanding healthcare infrastructure.

Latin America Continuous Glucose Monitoring Systems Market Analysis

A key growth enabler in the Latin America continuous glucose monitoring market is the continuously increasing incidence of diabetes in Brazil. An estimated five million are living with the disease in the country currently and is projected to be nearly double the number, as estimated by NIH, at around 11 million people by 2040. A growth in cases of diabetes brings out the ever-rising demand for management solutions like real-time glucose monitoring and superior glycemic control facilitated by a CGM system.

With the rise in the number of diabetics in Brazil, adoption of high technologies such as CGM will gain pace; individuals will have a chance to continuously monitor glucose levels and will not face any risk of developing complications such as cardiovascular diseases or neuropathy. Improvement in healthcare services, government activities, and the increase in preventive health awareness boost the adoption rate of CGM systems in this region. Therefore, Brazil is the hub for growth in the CGM market across Latin America.

Middle East and Africa Continuous Glucose Monitoring Systems Market Analysis

The rapid aging population in the Middle East and Africa is a principal growth driver in the Continuous Glucose Monitoring systems market. In view of the growing population aged 65 and older in eleven Arab countries, estimates by the WHO suggest that such a population shall increase at an annual rate of 4% to 5% from the year 2000 to the year 2050. Further, the National Institutes of Health report that annual growth rates shall stand higher than 5% for those aged 85 years and more.

With the increase in the elderly population, the prevalence of chronic disorders such as diabetes is also likely to surge, driving the demand for advanced healthcare solutions. Advanced imaging and other diagnostic modalities will improve glycemic control and provide continuous monitoring services in diabetes management for this aging population. This emphasis on healthcare innovations and investments, especially from regional governments, bodes well in the uptake and adoption of such CGM devices, leading toward better management and quality of care for elderly segments in the broader Middle East Africa region.

Competitive Landscape:

The key players within the continuous glucose monitoring systems market seek innovation, strategic partnerships, and expansion to stabilize the market. Much investment in R and D is towards devices that will have more precision with accuracy and comfort through user-friendly and advanced devices. For example, they include sensors from non-invasive and minimally invasive wearable devices with a potential integration of some wearable technology features plus enhanced data analysis for understanding immediate glucose values. Another feature is sensor life and better interoperability with smartphones and insulin pumps for smooth user experience. Strategic partnerships are used to attain expanded market reach while making it affordable for the patients with the healthcare providers, telehealth platforms, and insurance companies. Companies are also expanding their global markets by focusing on emerging economies where the incidence of diabetes is fast rising and are offering cost-effective solutions according to local needs.

The report provides a comprehensive analysis of the competitive landscape in the continuous glucose monitoring systems market with detailed profiles of all major companies, including:

- A. Menarini Diagnostics S.r.l.

- Abbott Laboratories

- DexCom Inc.

- F. Hoffmann-La Roche AG

- Glysens Incorporated

- LifeScan Inc. (Johnson & Johnson)

- Medtronic PLC

- Medtrum Technologies Inc.

- Nemaura Medical Inc.

- Novo Nordisk A/S

- Senseonics Holdings Inc.

- Waveform Technologies Inc.

Latest News and Developments:

- January 2024: Medtronic plc announced its flagship product, the MiniMed 780G system with a newly approved Simplera Sync sensor having received its CE Mark. The two-step insertion process was significantly simplified with the Simplera Sync sensor. In addition, it is 50% smaller in size than the prior versions. MiniMed 780G with Simplera Sync is expected to be launched across Europe in spring 2024, controlled; general commercial will start in summer 2024.

- December 2023: Dexcom, Inc. showcased how its Dexcom G7 Continuous Glucose Monitoring system could be seamlessly integrated with Tandem Diabetes Care's tslim X2 insulin pump as part of an effort to drive interoperability in diabetes management.

- October 2023: Dexcom, Inc. further expanded the company's business in Canada through the official launch of the company's Dexcom G7 CGM system to open glucose monitoring technologies for advanced consumer benefit in Canada.

Continuous Glucose Monitoring Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Sensors, Transmitters and Receivers, Integrated Insulin Pumps |

| Demographics Covered | Child Population (≤14 years), Adult Population (>14 years) |

| End Users Covered | Clinics and Diagnostics Centers, ICUs, Home Healthcare |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A. Menarini Diagnostics S.r.l., Abbott Laboratories, DexCom Inc., F. Hoffmann-La Roche AG, Glysens Incorporated, LifeScan Inc. (Johnson & Johnson), Medtronic PLC, Medtrum Technologies Inc., Nemaura Medical Inc., Novo Nordisk A/S, Senseonics Holdings Inc., Waveform Technologies Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the continuous glucose monitoring systems market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global continuous glucose monitoring systems market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the continuous glucose monitoring systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The continuous glucose monitoring systems market was valued at USD 7.04 Billion in 2024.

IMARC estimates the continuous glucose monitoring systems market to exhibit a CAGR of 4.75% during 2025-2033, reaching USD 10.92 Billion by 2033.

The increasing awareness and adoption of CGM devices, rising prevalence of diabetes, significant technological advancements in CGM devices, and ongoing shift towards preventive healthcare are some of the factors boosting the continuous glucose monitoring systems market share.

North America currently dominates the market, driven by several factors, including the region's high diabetes prevalence, advanced healthcare infrastructure, and robust adoption of innovative healthcare technologies.

Some of the major players in the continuous glucose monitoring systems market include A. Menarini Diagnostics S.r.l., Abbott Laboratories, DexCom Inc., F. Hoffmann-La Roche AG, Glysens Incorporated, LifeScan Inc. (Johnson & Johnson), Medtronic PLC, Medtrum Technologies Inc., Nemaura Medical Inc., Novo Nordisk A/S, Senseonics Holdings Inc., Waveform Technologies Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)