Container Handling Equipment Market Report by Equipment Type (Forklift Truck, Stacking Crane, Mobile Harbor Crane, Rubber-tired Gantry Crane), Propulsion Type (Diesel, Electric, Hybrid), Handling (Automatic, Manual), and Region 2025-2033

Global Container Handling Equipment Market:

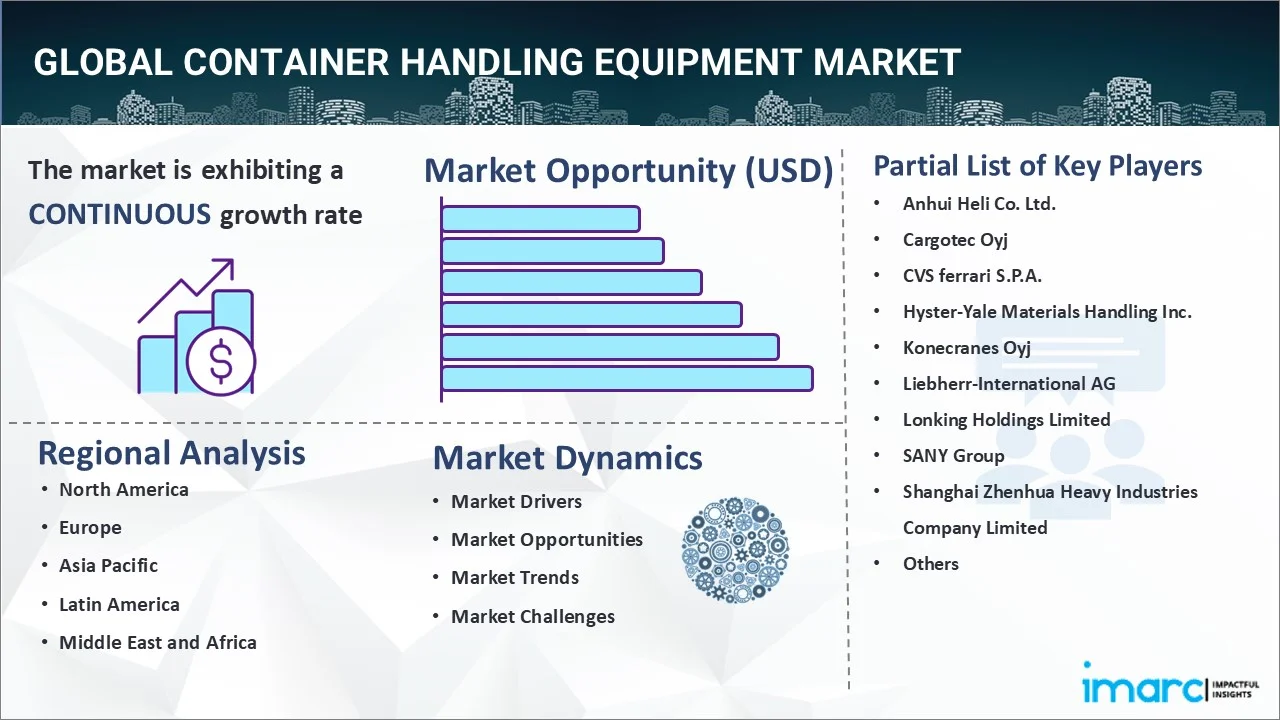

The global container handling equipment market size reached USD 8.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.49% during 2025-2033. The rising global trade expansion, port infrastructure development, booming e-commerce industry, and ongoing technological advancements are primarily propelling the market's growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.3 Billion |

| Market Forecast in 2033 | USD 11.5 Billion |

| Market Growth Rate (2025-2033) | 3.49% |

Container Handling Equipment Market Analysis:

- Major Market Drivers: There is a rise in the demand for freight transportation to facilitate the supply chain of food, automotive parts, electronics, flowers, vaccines, and medical supplies. This, along with the expanding logistics industry across the globe, represents one of the key factors driving the container handling equipment market growth.

- Key Market Trends: The rising utilization of automation in container handling equipment for real-time information of engine performance, fuel economy, tire pressure, heating, ventilation and air conditioning (HVAC), and maintenance and services is positively influencing the container handling equipment market share.

- Competitive Landscape: Some of the prominent market companies include Anhui Heli Co. Ltd., Cargotec Oyj, CVS ferrari S.P.A., Hyster-Yale Materials Handling Inc., Konecranes Oyj, Liebherr-International AG, Lonking Holdings Limited, SANY Group, Shanghai Zhenhua Heavy Industries Company Limited, and Toyota Industries Corporation, among many others.

- Geographical Trends: According to the container handling equipment market dynamics, the growing demand for automation in ports and the rise of e-commerce in North America are boosting the need for advanced container handling solutions in the region. Moreover, Asia-Pacific is home to some of the world’s largest and busiest container ports. The rapid growth in e-commerce, exports, and imports across the region is driving the demand for high-efficiency container handling equipment.

- Challenges and Opportunities: The high upfront cost of advanced container handling equipment, and the shortage of skilled labor are hampering the market container handling equipment share. However, the growing trend toward automation in ports and logistics hubs presents significant opportunities for CHE manufacturers.

Container Handling Equipment Market Trends:

Expanding E-Commerce Industry

The expanding e-commerce industry is one of the key factors driving the market's growth. For instance, according to IMARC, the global e-commerce market size reached US$ 21.1 Trillion in 2023. Looking forward, IMARC Group expects the market to reach US$ 183.8 Trillion by 2032, exhibiting a growth rate (CAGR) of 27.16% during 2024-2032. With the rise of e-commerce, companies are seeking faster, more efficient, and more reliable ways to move goods. This has led to an increase in demand for automated and semi-automated container handling equipment. These factors are expected to propel the container handling equipment market share in the coming years.

Rising Government Initiatives

Many governments, especially in developing countries, are investing heavily in maritime infrastructure. For instance, in February 2024, the Indian government intended to launch two huge projects in the Indian maritime sector worth over INR 83,000 Crore in Tamil Nadu and Maharashtra. One of these projects is the inauguration of the Outer Harbor Project at the Chidambaranar Port in Tamil Nadu. With a projected investment of INR 7,056 Crore, this project aims to increase port capacity by developing four births. These investments, including upgrading new ports, naturally increase the need for container handling equipment. These factors further positively influence the container handling equipment market size.

Shift Towards Environmental Sustainability

Stricter environmental regulations and sustainability goals are pushing ports and terminal operators to switch from diesel-powered to electric and hybrid container handling equipment. This shift is driven by efforts to reduce carbon emissions and meet green logistics standards. For instance, in September 2024, CMA CGM Kaohsiung Terminal Co. Limited ordered five hybrid Konecranes Rubber-Tired Gantry (RTG) cranes for container handling operations at Taiwan's principal port. This combination of diesel and electric power greatly reduces fuel consumption and pollutants, resulting in a cleaner and more economical operation, thereby boosting the container handling equipment market growth.

Global Container Handling Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global container handling equipment market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on equipment type, propulsion type, and handling.

Breakup by Equipment Type:

- Forklift Truck

- Stacking Crane

- Mobile Harbor Crane

- Rubber-tired Gantry Crane

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes a forklift truck, stacking crane, mobile harbor crane, and rubber-tied gantry crane.

According to the container handling equipment market share, in container handling facilities, forklifts are used to move palletized goods within container terminals, warehouses, and distribution centers, as well as for loading and unloading smaller containers. As containerized trade grows, the need for forklift trucks to support auxiliary container operations also increases. Moreover, as container volumes increase due to global trade, ports and container terminals need to expand their storage and handling capacity. Stacking crane is essential for high-density container storage, allowing more containers to be stored and moved efficiently in limited space. Besides this, mobile harbor cranes are versatile, multi-purpose cranes used in container handling at ports, especially in smaller or mid-sized terminals.

Breakup by Propulsion Type:

- Diesel

- Electric

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the propulsion type. This includes diesel, electric, and hybrid.

According to the container handling equipment market overview, diesel-powered equipment has long been the standard in container handling due to its power and ability to operate in demanding environments. Diesel engines provide the high levels of power and torque required for heavy-duty container handling operations, especially for larger equipment like reach stackers, mobile harbor cranes, and rubber-tired gantry cranes (RTGs). Moreover, the demand for electric-powered equipment is growing rapidly due to increasing environmental concerns, regulatory pressures, and advancements in battery technology. Electric container handling equipment is seen as a sustainable alternative to diesel engines, especially for ports aiming to reduce their carbon footprint. Besides this, hybrid solutions allow ports to meet the high power demands of container handling without fully relying on diesel. This makes hybrid equipment appealing in operations where electric power alone might not be sufficient for heavier lifts or continuous operations.

Breakup by Handling:

- Automatic

- Manual

The report has provided a detailed breakup and analysis of the market based on the handling. This includes automatic and manual.

Automatic or semi-automatic container handling equipment includes systems that require minimal human intervention and are often driven by advanced technologies like robotics, automation software, and sensors. A major driver for automatic equipment is the rising cost and shortage of skilled labor in many regions. While manual container handling equipment relies heavily on human operators to manage container movements. This includes traditional container cranes, forklifts, reach stackers, and other machinery that require skilled operators. Manual equipment is significantly less expensive upfront than automated systems, making it a more viable option for smaller ports, terminals, or operators with limited capital for investment in automation.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

Ports in North America are focusing on reducing their environmental footprint, leading to a shift toward electric and hybrid container handling equipment. According to the container handling equipment market statistics, Asia-Pacific is one of the largest markets for container handling equipment, driven by the massive volume of container trade passing through major ports like Shanghai, Singapore, and Shenzhen. The market in Europe is propelled due to its role as the manufacturing hub for a wide range of industries.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- Anhui Heli Co. Ltd.

- Cargotec Oyj

- CVS ferrari S.P.A.

- Hyster-Yale Materials Handling Inc.

- Konecranes Oyj

- Liebherr-International AG

- Lonking Holdings Limited

- SANY Group

- Shanghai Zhenhua Heavy Industries Company Limited

- Toyota Industries Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Container Handling Equipment Market Recent Developments:

- October 2024: Konecranes planned to acquire Rotterdam-based Peinemann Port Services BV and Peinemann Container Handling BV to expand its Port Solutions position.

- September 2024: CMA CGM Kaohsiung Terminal Co. Limited ordered five hybrid Konecranes Rubber-Tired Gantry (RTG) cranes for container handling operations at Taiwan's principal port.

- June 2024: Kalmar, part of Cargotec, introduced a new electric empty container handler. The Kalmar electric empty container handler is offered in a single-stacker configuration with 9 to10 ton capacities.

Container Handling Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Forklift Truck, Stacking Crane, Mobile Harbor Crane, Rubber-tired Gantry Crane |

| Propulsion Types Covered | Diesel, Electric, Hybrid |

| Handlings Covered | Automatic, Manual |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anhui Heli Co. Ltd., Cargotec Oyj, CVS ferrari S.P.A., Hyster-Yale Materials Handling Inc., Konecranes Oyj, Liebherr-International AG, Lonking Holdings Limited, SANY Group, Shanghai Zhenhua Heavy Industries Company Limited, Toyota Industries Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the container handling equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global container handling equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the container handling equipment industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The container handling equipment market was valued at USD 8.3 Billion in 2024.

The container handling equipment market is projected to exhibit a CAGR of 3.49% during 2025-2033.

The container handling equipment market is driven by global trade growth, port infrastructure development, and increasing container throughput. Advancements in automation, robotics, and digital technologies enhance operational efficiency. Additionally, rising demand for eco-friendly, fuel-efficient equipment and the need for faster cargo processing are key factors boosting market expansion.

Asia Pacific currently dominates the market, driven by the rising trade volumes, port modernization, and growing container shipping demands.

Some of the major players in the container handling equipment market include Anhui Heli Co. Ltd., Cargotec Oyj, CVS ferrari S.P.A., Hyster-Yale Materials Handling Inc., Konecranes Oyj, Liebherr-International AG, Lonking Holdings Limited, SANY Group, Shanghai Zhenhua Heavy Industries Company Limited, Toyota Industries Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)