Contact Lenses Market Size, Share, Trends and Forecast by Material, Design, Usage, Application, Distribution Channel, and Region, 2026-2034

Contact Lenses Market Size and Share:

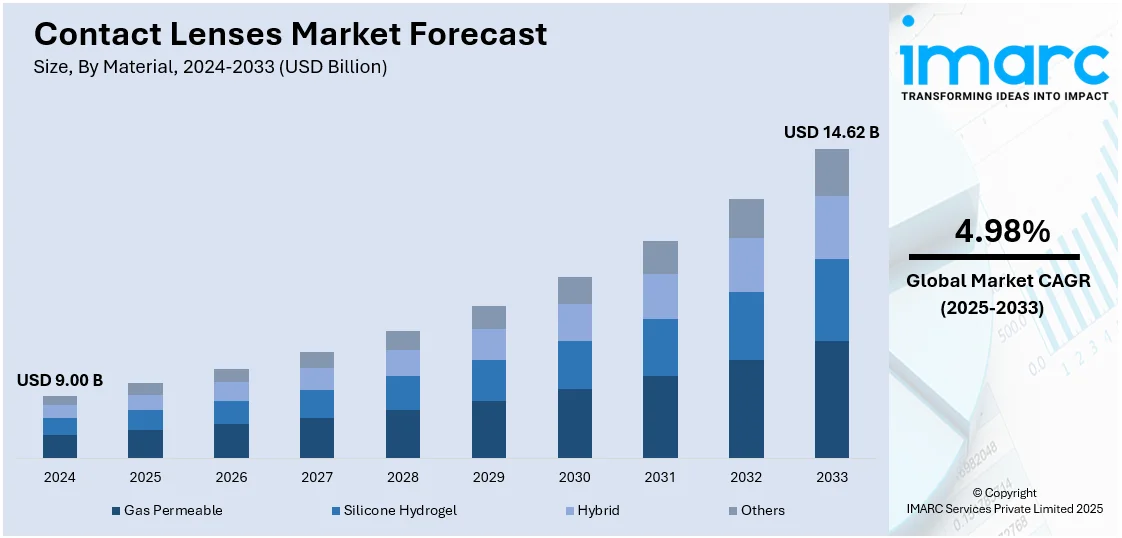

The global contact lenses market size was valued at USD 9.00 Billion in 2025. The market is projected to reach USD 14.62 Billion by 2034, exhibiting a CAGR of 4.98% from 2026-2034. North America currently dominates the market, holding a market share of over 38.0% in 2024. The market is driven due to rising advanced eye care infrastructure, high ocular health awareness, regular vision examinations, good retail and internet-based distribution channels, and increased demand for premium, daily disposable, and technology-enhanced lenses satisfying corrective and beauty purposes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 9.00 Billion |

| Market Forecast in 2034 | USD 14.62 Billion |

| Market Growth Rate 2026-2034 | 4.98% |

The global market for contact lenses is exhibiting steady growth based on the rise in prevalence of refractive disorders of vision, including myopia, hyperopia, and astigmatism, among a large population base. This is driven by changes in lifestyle factors, such as extended use of digital screens and decreased exposure to natural light, especially among youth. As consumers are highly looking for more comfortable, discreet, and convenient alternatives to regular eyeglasses, the demand for contact lenses is growing. Furthermore, accelerating urbanization in emerging economies is increasing access to eye care services, complementing market growth further. Increased focus on individual appearance and the aesthetics of eyes is promoting the use of colored and cosmetic lenses. The provision of different categories of products, such as extended wear lenses and daily disposables, provides customers with convenience and flexibility. For example, in November 2024, CooperVision introduced clariti® 1 day multifocal 3 Add in Canada—its newest daily wear lens with a 3 Add Binocular Progressive System®, WetLoc® Technology, and industry's widest multifocal power range (+8.00D to -12.00D). Additionally, worldwide awareness by way of internet portals and wider online shopping platforms is also allowing access to wider markets, synergistically supporting the upsurge path of the world contact lenses market.

The United States is witnessing significant growth of contact lenses market share of 86.50% in 2024, underpinned by high consumer awareness of ocular health and growing acceptance of lifestyle vision correction solutions. Geriatric population in the country is driving demand for enhanced corrective solutions, while the youth are turning to contact lenses due to their cosmetic benefits and ease of use. Increased use of digital devices is driving vision-related discomfort, resulting in heightened interest in lenses that prevent eye strain and filter out blue light. Amplified integration of telehealth services and digital optometry tools is enhancing access to eye exams and personalized prescriptions, accelerating product adoption further. Regular eye care and a robust network of optical professionals underpin regular usage and renewal. Moreover, the popularity of the daily disposable lenses is boosting because of their hygiene advantage and convenience. For instance, in November 2024, Alcon officially introduced PRECISION7 in the United States, the first one-week replacement contact lens with proprietary ACTIV-FLO technology, providing up to 16 hours of comfortable vision each day, even on day seven. Furthermore, these factors are collectively strengthening the United States' position as a dominant player in the global market for contact lenses.

Contact Lenses Market Trends:

Increasing Vision Correction Needs

Eye defects, including myopia (near sightedness), hyperopia (farsightedness), and astigmatism, strike millions of people globally. The World Health Organization (WHO) estimates that no less than 2.2 billion people around the world are affected by near or distance vision impairment, of which 30% are localized in the South-East Asia region, showing the huge vision disorder burden in this region. As the prevalence of such vision problems continues to increase with causes like, prolonged screen usage and genetics, so does the need for vision correction techniques like, contact lenses. Contact lenses are a handy, non-surgical option for people who want improved vision without using eyeglasses. The rising need for vision correction is a key factor propelling the market for contact lenses globally. Moreover, due to geriatric population, the incidence of age-related vision defects, such as presbyopia, is also rising. Contact lenses intended to counteract presbyopia have been in demand, targeting the target audience. Moreover, the contact lenses market growth is highly influenced by the rising incidence of vision disorders and the need for better comfort in vision.

Rapid Technological Advancements

Technological progress has been at the centre of the history of contact lenses. Advances in materials such as the silicone hydrogel materials have seen the lenses become more breathable, comfortable, and safe for extended wear. Further, the development of daily disposable lenses has made it easier to manage lens care procedures and decreased infections. Based on a survey conducted by Elsevier, daily disposable lens prescribing rose from 17.1% of daily wear soft lens fits, in 2000, to 46.7% in 2023 (p < 0.0001), as there was a strong consumer movement towards convenience and safety for the eyes. Smart contact lenses, with sensors and microelectronics, are another technological advancement. These lenses can potentially track health parameters like diabetics' blood glucose or pressure in glaucoma patients' eyes, creating new medical and consumer markets. Such technological advancements spur market growth as they attract technology-conscious consumers and broaden the usage of contact lenses beyond correcting vision. The outlook for the contact lenses market is optimistic due to technological advancements and increased healthcare applications.

Expanding Geriatric Population

The geriatric population across the globe is one major demographic trend that's propelling the demand for contact lenses. The world's population aged 65 years and above is likely to increase to 2.2 billion by the late 2070s, according to the United Nations, illustrating the long-term growth potential of the contact lenses market. As individuals grow old, their eyes become vulnerable to issues of vision like presbyopia and cataracts. Contact lenses meant to solve such age-related eye issues, such as multifocal and toric lenses, have become highly prominent. Furthermore, older people usually prefer contact lenses due to aesthetics and better comfort than glasses. The desire for an active life and the youthful look motivates the elderly population to adopt contact lenses. The geriatric population, especially in geographies like, North America and Europe, remains a large market driver for the contact lens vendors and vision correction practitioners. Market value of contact lenses is rising, driven by geriatric populations requesting advanced vision correction solutions.

Emerging Middle-Class in Developing Countries

Economies of developing countries, particularly Asia-Pacific and Latin America, are experiencing the emergence of a middle-class consumer base with rising disposable incomes. This socio-economic transformation is also coupled with altering lifestyle choices, such as rising interest in personal looks and convenience. Contact lenses provide a desirable option for consumers in place of glasses, since they are perceived to be more stylish and less conspicuous. The need to adopt a contemporary, active lifestyle and the image of contact lenses as a sign of sophistication fuel the demand in these new markets.

Rising Adoption of Cosmetic Contact Lenses

Cosmetic or colored contact lenses have gained immense popularity in recent years. These lenses allow wearers to change the color of their eyes, enhancing their overall appearance. They are due after by individuals with vision issues and by those looking to experiment with their looks or achieve specific aesthetic goals. Celebrities and influencers endorsing colored products on social media platforms contributed to the expansion of the global contact lens market size 2024. This trend aligns with the booming online beauty and personal care market, which reached USD 64.7 Billion in 2024. The IMARC Group projects this market to grow to USD 141.4 Billion by 2033, exhibiting a CAGR of 8.63% (2025-2033). Additionally, these lenses are used in the entertainment industry for theatrical and costume purposes, further fueling demand. The availability of a wide range of colors and designs, along with advancements in comfort and breathability, has made cosmetic contact lenses a sought-after fashion accessory. This trend is expected to continue driving contact lenses market industry, especially among younger consumers seeking versatility in their appearance.

Contact Lenses Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global contact lenses market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on material, design, usage, application, and distribution channel.

Analysis by Material:

- Gas Permeable

- Silicone Hydrogel

- Hybrid

- Others

In 2024, silicone hydrogel contact lenses hold a commanding 87.8% market share for contact lenses in the world, as they offer better oxygen permeability and greater comfort. These lenses transmit more oxygen to the cornea than regular hydrogel lenses, lessening the risk of hypoxia and overall good eye health. Their biocompatibility and high-water content make them well positioned for long-term and everyday wear, congruent with heightened consumer expectations for safety and convenience. With the trend moving towards high-performance and premium lens materials, silicone hydrogel is still the top choice of optometrists and consumers. The compatibility of the material with virtually all prescriptions and lens forms further enhances its extensive use in vision correction requirements. With new developments in production methods and a growing realization among consumers about the benefits of eye care, silicone hydrogel is well ensconced as the premier material in the world market for contact lenses.

Analysis by Design:

- Spherical

- Toric

- Multifocal

- Others

Spherical contact lenses currently occupy the biggest design segment market share in 2024 with 60.5% of the total global contact lenses market. Spherical contact lenses find extensive use for the correction of common refractive errors like myopia and hyperopia, rendering them extremely available and usable for a vast number of people. Their uncomplicated curvature facilitates ease of fitting and production, contributing to widespread availability and affordability. Consequently, spherical lenses continue to be the design of choice among first-time wearers as well as experienced users. The high need for vision correction, in combination with growing access to regular eye tests, is fueling steady growth in the segment. Moreover, improvements in lens materials and treatments are further improving the comfort and wearability of spherical lenses, solidifying their supremacy. As needs for corrective vision continue to be core to eye care services, spherical shapes remain the most prescribed lens form, validating their continued dominance of the worldwide market.

Analysis by Usage:

- Daily Disposable

- Disposable

- Frequently Replacement

- Traditional

Daily disposable contact lenses are accounting for 33.2% of the world market in 2024 and are the top usage category as consumers intensely seek hygiene, convenience, and comfort. These lenses dispose of the need for cleaning products and storage, minimizing the threat of infections and enhancing overall eye health. Their disposable aspect suits the active lifestyle, travel, or sensitivity to lens care protocols of the users. Optometrists increasingly prescribe daily disposables due to their lower complication rates and excellent compliance, which make them well suited for both first-time and back-to-school users. Growing health-conscious consumer trends and increased eye safety awareness are also speeding their adoption. Advances in manufacturing efficiency and wider distribution through online and retail outlets are making daily disposable lenses more accessible and affordable. With lifestyle trends trending toward easier routines and more vision health focus, the daily disposable segment of contact lenses continues to grow its dominance of the world contact lenses market.

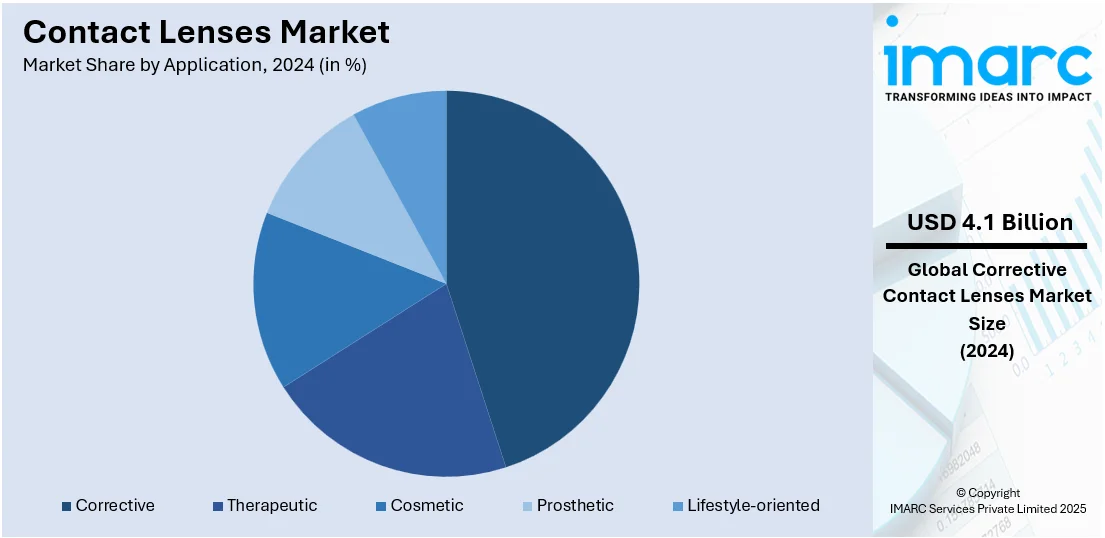

Analysis by Application:

- Corrective

- Therapeutic

- Cosmetic

- Prosthetic

- Lifestyle-oriented

Corrective contact lenses are dominating the application segment with 45.0% of the total contact lenses market size in 2024, accounting for continued demand for sure-shot vision correction options. The lenses are prescribed to treat refractive errors including myopia, hyperopia, astigmatism, and presbyopia, which are becoming more widespread among all age groups. The increase in exposure to digital screens and less outdoor activity is causing vision problems, especially among children, amplifying the demand for corrective lenses. Comprehensive eye checks and better access to optometric care are aiding early diagnosis and prompt prescription of corrective contact lenses. Their capacity to offer a broader field of view than eyeglasses, along with increased beauty and comfort, makes them the most desired option among users who want non-invasive vision correction. As awareness of eye health mounts in the general population, corrective lenses are holding strong, solidifying their leadership in the global market.

Analysis by Distribution Channel:

- E-Commerce

- Eye Care Practitioners

- Retail Stores

Retail outlets are leading the most significant percentage of the contact lenses distribution market in 2024, with a 45.8% share of the international market. Their dominance is spurred by customer faith in face-to-face eye care services, prompt availability of the product, and individualized help from optical specialists. Retail stores provide a wide variety of contact lenses and fitting services, a one-stop solution for the consumer who wants vision correction as well as expert advice. Most users still like the security of in-store consultation prior to purchase, especially for new lens types or prescriptions. Moreover, established retail chains are extending their presence in urban and suburban locales, making access easier. Promotion offers, in-store promotions, and post-sale services also lead to customer loyalty. Though e-commerce is increasing its hold, retail shops are still the preferred channel because of the value addition from personal assistance and brand presence, thus ensuring they remain market leaders in worldwide market distribution.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America is continuing to hold the leading regional position in the world contact lenses market report in 2024 with a share of 38.0%. This is underpinned by advanced healthcare infrastructure, high awareness levels about vision care, and easy access to optometric services. The region enjoys a huge base of well-educated consumers who actively participate in regular eye checks and are early adopters of new lens technologies. Its large population of sufferers of vision defects, such as myopia and presbyopia, is also creating steady demand for corrective care. North America further has highly developed retailing and internet sales channels, both guaranteeing convenience and availability at all points throughout the region. Growing screen time in all demographic segments is further adding to eyestrain as well as advocating lens usage. The area's strong investment in eye care education and aesthetics and lifestyle compatibility further enhances contact lens uptake, cementing the position of North America as the dominant regional market driver.

Key Regional Takeaways:

United States Contact Lens Market Analysis

United States contact lens industry is experiencing growing demand as there is heightened awareness regarding vision correct solutions and rise in the acceptance of advanced lens technologies. Parameters like an increasingly geriatric population, exposure to digital screens, and lifestyle choices are fueling the demand. A boom in daily disposable and silicone hydrogel lenses demand is also being experienced, thanks to these being convenient as well as comforting. In addition, developments like smart lenses and blue light-blocking features continue to widen the market. The primary force driving the growth is the rising incidence of digital eye strain, which is driving demand for lenses capable of alleviating eye fatigue and increasing visual comfort. The prevalence of self-reported digital eye strain in the United States is reported to range between 60-69% by Osmosis and is increasingly reported among females. This has resulted in a growing demand for blue light-filtering lenses, targeting users who spend long hours on the digital platform. As consumers spend more on eye care and demand both corrective and beauty lenses grow, propelling the market expansion.

Europe Contact Lenses Market Analysis

The Europe contact lenses market is developing steadily, driven by growing awareness of vision correction and amplifying demand for advanced lens materials. The market is supported by a move toward daily disposables and extended-wear lenses, favored due to their convenience and hygiene advantages. Additionally, the growing incidence of myopia and other refractive errors is driving market growth. Technological advances in contact lens technology, including moisture-holding and UV-shielding lenses, are also driving boosted adoption. Aesthetic and specialty lenses are similarly gaining traction, adding to market opportunities. Rising interest in eye health and lens design innovation is projected to continue driving the market's upward trend. Based on the Association of Optometrists, the services being delivered under the NHS General Ophthalmic Services contract return at least £2.1 Billion to society with an investment to the NHS worth £525 Million, a sizeable positive ROI on investment on primary eye care services. This places a large premium on increasing focus on vision care and access, which, in turn, provides further incentive towards growth for the contact lenses market in the area.

Asia Pacific Contact Lenses Market Analysis

The Asia Pacific contact lenses market is expanding due to urbanization and vision-enhancing preferences. Younger demographics demand colored and cosmetic lenses, while myopia incidence drives corrective lens adoption. Innovations in breathable materials and water-retentive technologies boost growth. Expanding retail and e-commerce channels expands lens options. The region's broader ophthalmic industry is also expanding, supporting the growth of the contact lenses market. According to IMARC Group, the Japan ophthalmic devices market size reached USD 1,691 Million in 2024 and is projected to reach USD 2,024 Million by 2033, growing at a CAGR of 2% from 2025 to 2033. This overall market expansion reflects rising investments in eye care technologies, improved access to vision correction solutions, and increasing awareness about ocular health.

Latin America Contact Lenses Market Analysis

The Latin America contact lenses market is witnessing considerable transformation with growing consumer interest in vision correction and cosmetic improvement. The market is becoming highly exposed to hybrid and scleral lenses, extended-wear lenses, environmental-friendly options, and technological innovations such as oxygen-enriched materials. The region is also witnessing increased emphasis on pediatric eye care solutions. As per MedRXIV, the estimated occurrence of blindness among children in Brazil is 4 per 10,000 children, necessitating vision correction interventions at an early stage. With rising awareness regarding eye care and retail network expansion, the penetration of contact lenses in the region is growing steadily, backed by advances in lens technology and changing consumer behavior.

Middle East and Africa Contact Lenses Market Analysis

The Middle East and Africa contact lenses market is experiencing growth due to changing consumer preferences and optical solutions. Moisture-infused lenses are gaining popularity, while specialty lenses like gas-permeable and orthokeratology are gaining traction. Color-enhancing lenses are also in high demand. Expanding distribution channels and increased awareness about advanced eye care solutions support market growth. The region’s broader ophthalmic industry is also witnessing substantial expansion. According to IMARC Group, the Saudi Arabia ophthalmic devices market reached USD 265.4 Million in 2024 and is expected to grow at a CAGR of 6.53%, reaching USD 469.0 Million by 2033. This rising investment in eye care infrastructure and technological advancements in vision correction are contributing to the increasing adoption of contact lenses in the region.

Competitive Landscape:

The contact lenses market has a highly competitive landscape with high product differentiation focus, innovation in lens material, and creation of niche lenses to cater to the wide range of consumers. There is a high emphasis on research and development by companies to launch innovative lenses, such as multifocal, toric, and colored versions for both corrective and cosmetic applications. Market players are extending their global reach by forming strategic alliances, distribution channels, and online platforms to increase accessibility and reach consumers. Rising expenditure on marketing and brand building is influencing consumer trends and reinforcing product visibility. There also has been a significant shift towards sustainable production practices and green packaging, which reflects rising environmental awareness. Increased usage of tailor-made and day-use disposable lenses is on the upswing as they are more and more prompted by convenience and hygiene needs. Improved digital diagnostic instruments and tele-optometry too are facilitating use and adoption. And a value-oriented pricing scheme is assisting with an expanded addressable market base. These efforts are set to positively influence the global contact lens market size 2025.

The report provides a comprehensive analysis of the competitive landscape in the contact lenses market with detailed profiles of all major companies, including:

- Alton Vision LLC

- Bausch & Lomb Incorporated

- Carl Zeiss AG

- Contamac Holdings Limited

- EssilorLuxottica SA

- Hoya Corporation

- Johnson & Johnson Services, Inc.

- Menicon Co. Limited

- SEED Co. Limited

- SynergEyes Inc.

- Cooper Companies Inc.

Latest News and Developments:

- June 2025: lcon introduced PRECISION1 daily disposable contact lenses in India, which could provide comfort for up to 16 hours. The lenses' SMARTSURFACE technology, which had a water content of over 80%, lessened dryness. The lenses promoted long-term eye health since they were made of breathable Verofilcon A.

- May 2025: Bausch + Lomb announced the launch of Zenlens Chroma HOA scleral contact lenses in the United States. The firm intended to address advanced higher-order aberrations and lessen symptoms, including glare and halos.

- May 2025: In a study published in the journal Cell, which included researchers from the University of Science and Technology of China, it was revealed that scientists developed infrared contact lenses that could improve night vision. The wearer could perceive various infrared wavelengths with the aid of these lenses. Users were able to see both visible and infrared light at the same time because they were transparent.

- April 2025: Bruno Vision Care LLC declared that the firm was given permission by the US Food and Drug Administration (FDA) to market FusionTechnologyTM's Deseyne® daily disposable contact lens in the US. The FusionTechnologyTM delivery method and the lens's substance were two patented technologies that were combined to make the Deseyne® lenses a breakthrough in contact lens technology.

- March 2025: XPANCEO showcased three new smart contact lens prototypes at MWC 2025 in Barcelona. These included a lens with biochemical sensors, an IOP sensor, and a wireless powering companion. The first prototype was a smart contact lens that delivered twice the range of the previous industry solutions.

Contact Lenses Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Gas Permeable, Silicone Hydrogel, Hybrid, Others |

| Designs Covered | Spherical, Toric, Multifocal, Others |

| Usages Covered | Daily Disposable, Disposable, Frequently Replacement, Traditional |

| Applications Covered | Corrective, Therapeutic, Cosmetic, Prosthetic, Lifestyle-Oriented |

| Distribution Channels Covered | E-Commerce, Eye Care Practitioners, Retail Stores |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alton Vision LLC, Bausch & Lomb Incorporated, Carl Zeiss AG, Contamac Holdings Limited, EssilorLuxottica SA, Hoya Corporation, Johnson & Johnson Services, Inc., Menicon Co. Limited, SEED Co. Limited, SynergEyes Inc., Cooper Companies Inc. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the contact lenses market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global contact lenses market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the contact lenses industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The contact lenses market was valued at USD 9.00 Billion in 2024.

The contact lenses market is projected to exhibit a CAGR of 4.98% during 2025-2033, reaching a value of USD 14.62 Billion by 2033.

The market is being propelled by the growing incidence of vision disorders, higher demand for corrective vision solutions that are aesthetic in nature compared to eyeglasses, amplified demand for daily wear lenses, lens technology advancements, growth in the geriatric population, increased access to eye care services, and heightening awareness of ocular health and corrective vision solutions.

North America currently dominates the contact lenses market, accounting for a share of 38.0%. The market is driven because of its superior healthcare infrastructure, high consumer knowledge of eye health, established presence of market leaders, extensive use of premium and daily disposable lenses, rising incidence of vision correction procedures and routine eye checks.

Some of the major players in the contact lenses market include Alton Vision LLC, Bausch & Lomb Incorporated, Carl Zeiss AG, Contamac Holdings Limited, EssilorLuxottica SA, Hoya Corporation, Johnson & Johnson Services, Inc., Menicon Co. Limited, SEED Co. Limited, SynergEyes Inc., Cooper Companies Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)