Consumer Electronics Repair and Maintenance Market Size, Share, Trends and Forecast by Product, Service Provider, and Region, 2025-2033

Consumer Electronics Repair and Maintenance Market 2024, Size and Trends:

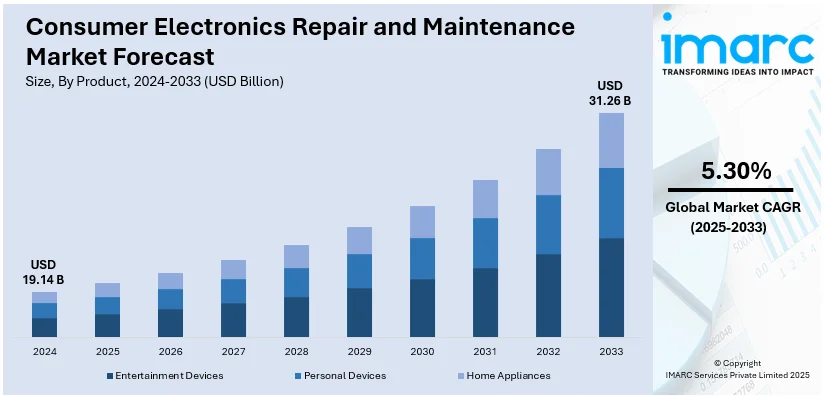

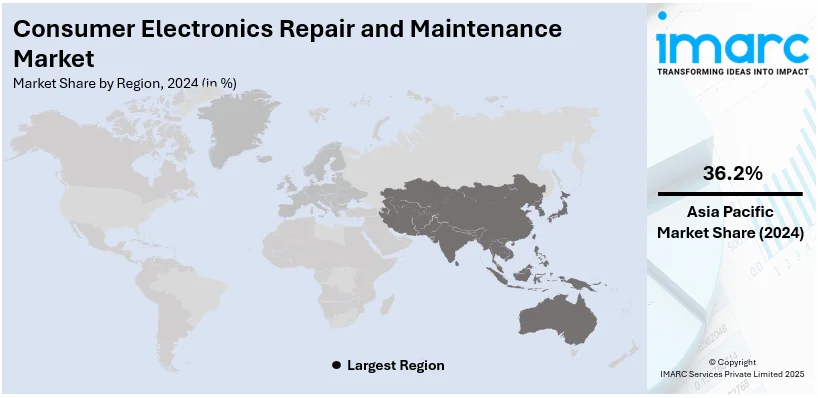

The global consumer electronics repair and maintenance market size was valued at USD 19.14 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 31.26 Billion by 2033, exhibiting a CAGR of 5.30% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 36.2% in 2024. The growth of the Asia Pacific region is driven by increasing consumer electronics demand, expanding technology adoption, a strong manufacturing base, and rising repair and maintenance service requirements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19.14 Billion |

| Market Forecast in 2033 | USD 31.26 Billion |

| Market Growth Rate (2025-2033) | 5.30% |

With the increasing cost of new electronic products, many people are opting for repair services as a more affordable solution to fix malfunctioning devices. Repairing electronics is often more economical than purchasing a brand-new device, especially for high-value products like smartphones, laptops, and home appliances. Moreover, modern electronics are becoming more advanced, with smarter features and integrated technologies. As these products evolve, they also become more complex and challenging to repair. This complexity is driving the demand for specialized repair services, with professional technicians required to handle intricate issues such as software malfunctions, hardware failures, or component replacements. Besides this, the rise of e-commerce platforms, online repair service bookings, and local repair centers is making repair services more accessible to a wider range of individuals.

The United States plays a crucial role in the market, driven by the increasing availability of dedicated support services, including easy access to original equipment manufacturer (OEM) parts and expert assistance. This enhanced accessibility to high-quality parts and repair solutions helps extend the lifespan of appliances and electronics, improving client satisfaction. As more service providers offer specialized support and direct access to replacement parts, individuals are more likely to opt for repairs, thereby contributing to the market growth. In 2024, Encompass Supply Chain Solutions launched dedicated support for Beko appliance parts in the US, including a new website and toll-free hotline. This initiative offers clients easy access to OEM parts for Beko appliances, along with expert assistance. The move is aimed at enhancing the client experience and extending the lifecycle of Beko products in the US market.

Consumer Electronics Repair and Maintenance Market Trends:

Government Incentives to Promote Repair Over Replacement

The growing implementation of government incentives that encourage individuals to repair rather than discard electronic goods is offering a favorable market outlook. By providing financial assistance or subsidies for repairs, governments are directly tackling environmental issues linked to e-waste and fostering a culture of sustainability. These efforts not only lessen the environmental effects linked to e-waste but also enhance the accessibility and affordability of repair services for individuals. These programs typically include offering vouchers, tax credits, or various financial incentives to help subsidize some of the repair expenses, thus making it more affordable to prolong the lifespan of devices. Moreover, these initiatives spearheaded by the government aid local repair shops, fostering job growth and enhancing the repair network. For example, in December 2023, Austria introduced the Repair Bonus voucher program, providing up to €200 for repairing electronic items rather than throwing them away. This program, designed to minimize e-waste, assists individuals in lowering repair expenses and boosts local enterprises.

Strategic Partnerships Enhancing Service Accessibility

Strategic partnerships between tech companies and established service networks are significantly enhancing the accessibility and efficiency of consumer electronics repair and maintenance services. These collaborations leverage technology to streamline repair processes, making it easier for individuals to access reliable, professional service. By merging technological platforms with extensive networks of skilled technicians, companies can offer seamless client experiences, such as online booking systems, real-time tracking, and quicker response times. Such partnerships also enable the bundling of repair services with warranties or service contracts, further incentivizing people to maintain their electronics rather than replace them. This approach not only improves convenience for clients but also strengthens the repair ecosystem by ensuring that high-quality services are readily available. In 2024, Fixle, Inc. announced a partnership with Sears Home Services to enhance home appliance repair, upkeep, and support. This collaboration combines Fixle's technology with Sears' extensive network of technicians, offering homeowners easy access to repair services and home warranties. The partnership aims to simplify homeownership by providing comprehensive solutions for appliance management and repairs.

Expansion of Repair Networks

Smartphones and other digital devices are becoming essential tools for communication, education, and business, which is driving the need for accessible, reliable repair services. By establishing widespread repair centers and collaborating with device manufacturers, service providers can ensure that individuals have easy access to maintenance and support, particularly in underserved or remote areas. This network expansion not only addresses the growing demand for device repairs but also helps bridge the digital divide by improving device longevity and functionality. Furthermore, these initiatives often include training programs that enhance digital literacy, empowering users to better manage and maintain their devices. By supporting the broader adoption and continued use of digital technology, these repair networks contribute to the sustainability of electronics and foster market growth in the repair sector. For instance, in 2024, Vodacom Tanzania introduced after-sales service repair centers to enhance digital inclusion by offering convenient repair services nationwide. The initiative, collaborating with leading smartphone companies, seeks to improve client satisfaction and bolster the expanding smartphone market. Vodacom intends to grow these centers to address rising demand and enhance digital literacy.

Consumer Electronics Repair and Maintenance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global consumer electronics repair and maintenance market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and service provider.

Analysis by Product:

- Entertainment Devices

- Televisions

- Audio Devices

- Others

- Personal Devices

- Mobiles and Tablets

- PCs

- Laptops/Notebooks

- Digital Cameras

- Others

- Home Appliances

- Refrigerators

- Washing Machines

- Grinder (Mixer)

- Dishwasher

- Microwaves and Oven

- Others

Home appliances stand as the largest component in 2024, holding 52.3% of the market share. Home appliances (refrigerators, washing machines, grinder (mixer), dishwasher, microwaves and oven, and others) due to rising user demand for durable, energy-efficient devices, increasing appliance usage, and the growing preference for repair over replacement to reduce costs and environmental impact. The increasing prevalence of these appliances in households is driving the demand for repair and maintenance services as people seek to prolong the lifespan of their investments. As these devices become more technologically sophisticated, they require specialized knowledge and tools for effective repair, further contributing to the market growth. Additionally, individuals are more inclined to repair malfunctioning appliances rather than replace them, given the cost-effectiveness and environmental benefits of repairing over discarding. Regular maintenance not only enhances the operational efficiency of appliances but also ensures energy savings and optimal performance, further encouraging people to seek professional services.

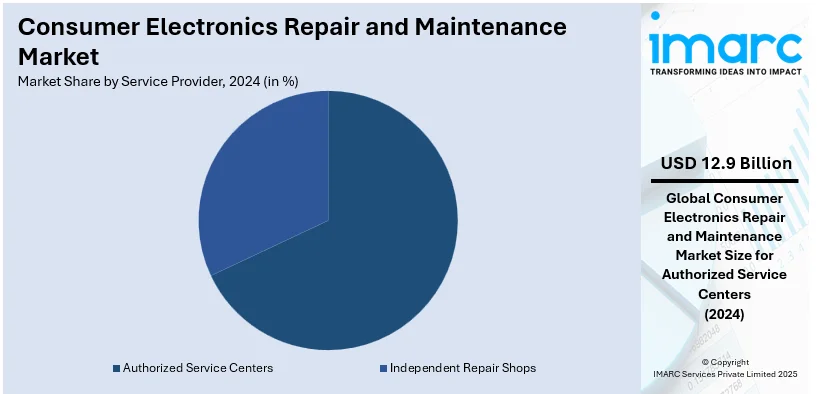

Analysis by Service Provider:

- Authorized Service Centers

- Independent Repair Shops

Authorized service centers represent the largest segment, holding a 67.2% share in 2024. Authorized service centers lead the market because of their ability to offer high-quality repairs using genuine parts, which ensures optimal performance and longevity of consumer electronics. These centers are equipped with specialized knowledge and tools to handle specific brand-related issues, maintaining the integrity of the manufacturer’s warranty. People often prefer authorized service centers because they provide trusted services that adhere to the strict standards set by the manufacturer. This reputation for reliability and precision helps to build client loyalty. Additionally, authorized centers often offer advanced diagnostic tools and training, which allow them to address even the most complex repairs effectively. The confidence in receiving expert care from technicians who are thoroughly trained on specific products further encourage user preference for authorized service centers. Moreover, with increasing concerns over the quality of repairs and the longevity of products, individuals are gravitating towards service providers who maintain a direct relationship with the brand.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, the Asia Pacific region held the largest market share, totaling 36.2%. The Asia Pacific region leads the market, supported by the growing demand for consumer electronics, broader technology acceptance, a robust manufacturing sector, and heightened needs for repair and maintenance services. The increasing usage of sophisticated consumer electronics, like smartphones, household devices, and personal tools, is fueling the demand for maintenance and repair services. Moreover, the Asia Pacific region is a major manufacturing center for consumer electronics, resulting in a robust network of authorized service centers and repair facilities. Furthermore, the focus on sustainability and minimizing electronic waste in numerous countries in the region is resulting in an increasing inclination towards repairs instead of replacements. For instance, in 2024, the Indian Department of Consumer Affairs introduced the "Right to Repair Portal" to assist individuals in obtaining product manuals, repair videos, and spare parts details. The portal aids the government's objective of fostering a circular economy by promoting repair and reuse, thereby minimizing e-waste. It includes fields such as automobiles, electronics, and consumer goods, providing important information for smart decision-making and eco-friendly usage.

Key Regional Takeaways:

United States Consumer Electronics Repair and Maintenance Market Analysis

In North America, the United States represented 82.70% of the overall market share. The United States plays a vital role in the market, propelled by a substantial and varied user base. The growing demand for consumer electronics, along with an increasing emphasis on sustainability, is driving the need for repair services. The US enjoys a robust infrastructure, featuring an extensive system of repair facilities and skilled professionals, providing convenient access to high-quality services. As personal preferences move towards sustainability, awareness about the environmental effects of e-waste is growing, encouraging more individuals choosing repair instead of replacement. This cultural change is additionally backed by regulatory measures and the extensive access to cost-effective repair choices. Moreover, the increasing emphasis on product durability and the right-to-repair initiative are bolstering the market growth. Besides this, the rise of e-commerce platforms is simplifying the process for individuals to discover repair services, obtain parts, and schedule appointments online, thereby enhancing service accessibility and convenience. The IMARC Group forecasts that the US e-commerce sector will reach US$ 2,083.97 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.80% from 2024 through 2032.

Europe Consumer Electronics Repair and Maintenance Market Analysis

Europe's market is expanding consistently, supported by robust regulatory structures that encourage sustainability and minimize e-waste. Regulations requiring enhanced product repairability and recycling are increasing the need for repair services. These efforts, combined with a user community that is highly conscious of environmental sustainability, are encouraging a move towards repair instead of replacement. Furthermore, the area enjoys a solid network of repair facilities and skilled professionals, guaranteeing that individuals can easily access high-quality repair options. An instance of this trend is demonstrated by KitchenAid’s improved repair service introduced in 2024 for UK customers, collaborating with Trojan Electronics to provide repairs for both in-warranty and out-of-warranty items. This service intends to prolong the life of appliances, minimize waste, and offer replacement components, featuring color-matching choices for cases, in line with KitchenAid's dedication to sustainability and encouraging repairability to decrease e-waste.

Asia Pacific Consumer Electronics Repair and Maintenance Market Analysis

The Asia Pacific region is witnessing swift market expansion, mainly driven by its strong manufacturing and technological advancements. Nations such as China, Japan, and South Korea serve as centers for electronics manufacturing and repair services. The prevalent adoption of smartphones, wearable gadgets, and home appliances in the area is increasing the need for cost-effective repair options. Moreover, the rising number of government-sponsored programs aimed at enhancing the repairability of electronic items is supporting the market growth in the area. By implementing regulations that motivate manufacturers to create products considering repairability, these policies promote sustainability, minimize e-waste, and support a circular economy, while also improving people's access to repair services. For instance, in 2024, the Government of India disclosed intentions to introduce a "repairability index" for mobile devices and electronic items by December. The program aims to assist individuals in making knowledgeable buying choices and tackling e-waste by evaluating products in terms of repairability aspects such as disassembly simplicity and the availability of spare parts. The index seeks to foster more sustainable, easily fixable electronics and support a circular economy.

Latin America Consumer Electronics Repair and Maintenance Market Analysis

Latin America is experiencing a growing need for repair and maintenance services for consumer electronics, driven by the ongoing rise in technology adoption. The area is experiencing an increase in focus on sustainability and minimizing e-waste, which is benefitting the repair services market. Additionally, online marketplaces offer access to repair components, tools, and expert services, simplifying the process for people to discover budget-friendly options for their devices. E-commerce allows small and local repair services to access a larger client base, providing convenience and competitive rates. According to the IMARC Group, Mexico's e-commerce market size is projected to exhibit a growth rate (CAGR) of 12.40% between 2024 and 2032.

Middle East and Africa Consumer Electronics Repair and Maintenance Market Analysis

The Middle East and Africa region is experiencing rapid growth in the CERM market, driven by the increasing reliance on consumer electronics for daily activities. The market is supported by an expanding network of repair services, as well as a growing consumer interest in sustainability and reducing electronic waste. With increasing individual demand and the emergence of repair options, the market keeps growing, as local businesses provide specialized services to meet this escalating need. In addition, as stated in The Mobile Economy Middle East and North Africa 2024 report by GSMA, mobile technologies are facilitating digital transformation, with 50% of mobile connections expected to be equipped with 5G technology by 2030 in the area. This technological change increases the need for superior repair services as more sophisticated mobile devices need expert maintenance and repair options.

Competitive Landscape:

Major participants in the market are concentrating on broadening their service networks and improving client interaction. They are allocating resources towards training initiatives to provide technicians with specialized expertise, guaranteeing top-notch repairs and compliance with manufacturer standards. Firms are also incorporating sophisticated diagnostic tools and technologies to enhance repair precision and effectiveness. Moreover, there is a focus on providing sustainable repair solutions that align with ecological issues and individual desires to minimize electronic waste. Participants are enhancing their service offerings by providing comprehensive maintenance plans, quick repairs, and warranties to increase customer satisfaction and promote brand loyalty. In 2024, Fnac Darty introduced a Digital Passport for home appliances, partnered with the non-profit sector. This tool, based on quick response (QR) codes, monitors the complete lifecycle of appliances, ranging from production to recycling, encouraging sustainable usage. The digital passport will first be offered for refurbished devices and will be broadened to additional products in 2025.

The report provides a comprehensive analysis of the competitive landscape in the consumer electronics repair and maintenance market with detailed profiles of all major companies, including:

- Cordon Group

- Ensure Services (Redington Group)

- ReWard Technologies

- TVS Electronics

- uBreakiFix

- Urban Company

Latest News and Developments:

- August 2024: Huawei announced spare parts and repair prices for the Nova Flip foldable smartphone, including special offers on the screen replacement. The most expensive parts are the screen (starting at 1999 yuan) and the motherboard (2299 yuan), with discounts available on refurbished screens. The company also offers affordable services for battery, camera, and accessory replacements, with prices ranging from 7 to 479 yuan.

- July 2024: uBreakiFix by Asurion and Samsung celebrated the success of their flagship repair locations, which deliver the highest client satisfaction scores in the network. These stores feature enhanced equipment, inventory, and trained technicians, improving repair quality and turnaround times. Flagship locations also support device recycling and offer loaner Galaxy devices during repairs.

- February 2024: Rightcliq.in launched its home care services in Bangalore, Mysore, Pune, and Hyderabad. The platform connects clients with trained professionals for various services like electronics and appliance repair, plumbing, and home cleaning, aiming for quick response times and 100% satisfaction. With over 250,000 satisfied clients since its inception in October 2021, Rightcliq.in is expanding its reach across major cities in India.

Consumer Electronics Repair and Maintenance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Service Providers Covered | Authorized Service Centers, Independent Repair Shops |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cordon Group, Ensure Services (Redington Group), ReWard Technologies, TVS Electronics, uBreakiFix, and Urban Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the consumer electronics repair and maintenance market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global consumer electronics repair and maintenance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the consumer electronics repair and maintenance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global consumer electronics repair and maintenance market was valued at USD 19.14 Billion in 2024.

The global consumer electronics repair and maintenance market is estimated to reach USD 31.26 Billion by 2033, exhibiting a CAGR of 5.30% from 2025-2033.

The global consumer electronics repair and maintenance market include increasing device usage, a growing demand for cost-effective solutions, rising electronic device complexities, and the trend of sustainability. Additionally, the shift towards a circular economy, where individuals prefer repairing over replacing, alongside advancements in repair technologies, contributes to the market growth and growing consumer awareness.

Asia Pacific currently dominates the market, holding a market share of over 36.2% in 2024. The growth of the Asia Pacific region is driven by increasing consumer electronics demand, expanding technology adoption, a strong manufacturing base, and rising repair and maintenance service requirements.

Some of the major players in the global consumer electronics repair and maintenance market include Cordon Group, Ensure Services (Redington Group), ReWard Technologies, TVS Electronics, uBreakiFix, and Urban Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)