Consumer Drone Market Size, Share, Trends and Forecast by Product, Technology, Distribution Channel, Application, and Region, 2025-2033

Consumer Drone Market Size and Share:

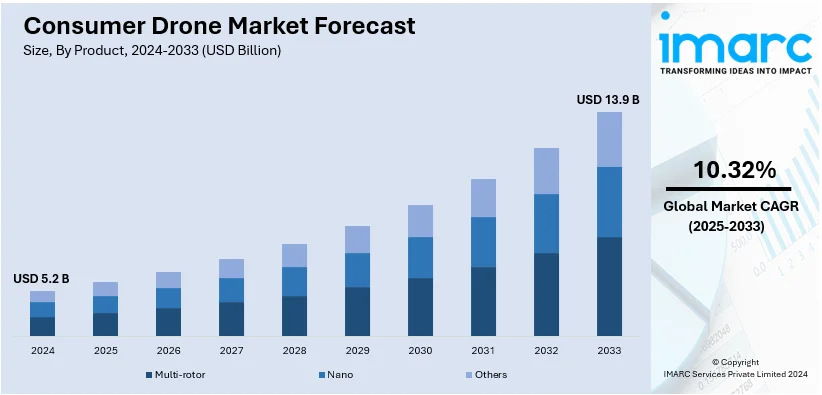

The global consumer drone market size reached USD 5.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.9 Billion by 2033, exhibiting a growth rate CAGR of 10.32% during 2025-2033. North America currently dominates the consumer drone market with a 37.6% share in 2024. This region’s dominance is driven by technological advancements, rising recreational use, strong regulatory support, and increasing demand for aerial photography and videography.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.2 Billion |

|

Market Forecast in 2033

|

USD 13.9 Billion |

| Market Growth Rate (2025-2033) | 10.32% |

The increasing adoption of drones for photography and videography applications is one of the crucial factors expanding the consumer drone market share. Technological advancements have enabled drones to capture high-resolution images and 4K videos, appealing to hobbyists, content creators, and professionals alike. The growing popularity of social media platforms has amplified the demand for aerial photography, enhancing user engagement with dynamic visuals. For instance, in April 2024, DJI unveiled the upgraded version of Avata 2 FPV drone, featuring enhanced imaging, improved safety, 23-minute battery life, 8.1-mile transmission range, and user-friendly controls, enabling immersive flight with effortless flips, rolls, and pro-level manoeuvrers. Additionally, improvements in drone stabilization, ease of use, and affordability have made these devices accessible to a broader consumer base. As recreational activities and creative industries continue to evolve, consumer drones are becoming essential tools for capturing unique perspectives and delivering innovative content.

To get more information on this market, Request Sample

The United States is a key player in the consumer drone market, driven by technological innovation, robust manufacturing capabilities, and increasing consumer demand. Leading companies in the US are actively advancing drone technologies with features like AI-powered navigation, improved battery life, and high-resolution cameras. Additionally, the growing popularity of drones for recreational use, photography, and videography fuels market expansion. Regulatory support from the Federal Aviation Administration (FAA), including clear guidelines for recreational drone operations, ensures safer skies and encourages adoption. For instance, in January 2024, the new Autel Alpha drone announced receival of FCC-approval for the US launch, featuring 35x optical zoom, dual thermal sensors, starlight night vision, 45-minute flight, 12-mile range, 360-degree obstacle avoidance, and IP55 protection. The US market continues to serve as a hub for innovation, accessibility, and product development in consumer drones.

Consumer Drone Market Trends:

Increasing Popularity of Aerial Photography

The increasing popularity of aerial photography is stimulating consumer drone market growth. According to an industry report, the worldwide drone photography services sector is anticipated to grow with a CAGR of 19.4% during 2023-2028. Aerial photography enthusiasts, content creators, and professionals seek to capture breathtaking vistas and unique perspectives that traditional photography methods cannot offer. Consumer drones that are equipped with high-resolution cameras and stabilize them during recording provide a simple yet fantastic way to record incredible aerial imagery. A huge following among hobby enthusiasts and large commercial applications make this industry very attractive: from real estate to travel, tourism, and commercials. With the allure to take photographs of landscapes, events, and architecture through creative angles, people in mass buy drones. As people discover the creative and commercial value of aerial photography, it drives the consumer drone market forward, fostering innovation and pushing the boundaries of visual storytelling.

Rising Product Adoption in the Agriculture Sector

The rising adoption of consumer drones in agriculture is bolstering the market. According to an industrial report, worldwide agriculture industry is anticipated to grow tremendously with a CAGR of 7.7% during 2025-2028. Drones offer farmers and agricultural professionals valuable tools for precision farming and efficient land management. Equipped with sensors and cameras, drones can monitor crop health, detect diseases, assess irrigation needs, and create detailed maps of fields. This data-driven approach optimizes resource allocation, enhances yield, and reduces environmental impact. Moreover, drones enable timely interventions by pinpointing areas that require attention, such as pest infestations or nutrient deficiencies. As the agriculture sector seeks to improve productivity and sustainability, the adoption of drones has become crucial. The transformation of farming with efficiency and precision by using real-time aerial data in making decisions has been revolutionized in agriculture due to the introduction of drones. As a result, widespread usage and high contributions to market growth are evident for this technology.

Growing Integration of Artificial Intelligence (AI) and Machine Learning (ML) with Consumer Drones

The growing use of artificial intelligence (AI) and machine learning (ML) with consumer drones is fueling the market. AI and ML algorithms give drones the ability to process data, make autonomous decisions, and adapt to any scenario, which makes them a more effective tool. The use of AI-enabled object recognition enables drones to identify and track objects, making them a valuable tool in surveillance, search and rescue operations, and wildlife monitoring. ML algorithms analyze sensor data to improve flight stability and obstacle avoidance, ensuring safer and more efficient operations. Furthermore, AI-driven data analysis provides actionable insights for agriculture, mapping, and infrastructure inspection. Drones equipped with AI can identify crop diseases, assess construction progress, and create detailed 3D models with unprecedented accuracy. This synergy enhances operational efficiency, reduces human error, and expands the potential applications of consumer drones. The seamless integration of AI and ML elevates consumer drones from mere flying devices to intelligent systems capable of sophisticated tasks. As industries recognize the value of this convergence, the consumer drone market experiences rapid growth driven by their heightened capabilities, improved performance, and diverse applications. Many businesses are continuing to innovate by using AI and ML into drone technology. For example, to advance AI-driven drone technology, Phoenix AItech teamed up with ACL Digital, a multinational design and engineering firm, in February 2024. In order to improve capabilities across a range of industries, including logistics, agriculture, surveillance, and disaster management, the partnership intends to combine state-of-the-art artificial intelligence with drone technologies.

Consumer Drone Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global consumer drone market report, along with forecast at the global, regional and country levels from 2025-2033. The market has been categorized based on product, technology, distribution channel, and application.

Analysis by Product:

- Multi-rotor

- Nano

- Others

Multi-rotor leads the market with around 70.6% of the market share in 2024. With their versatility and maneuverability, multi-rotor drones can serve a variety of purposes from recreational flying to professional applications. Their ability to hover, take off, and land vertically makes them perfect for precision tasks, such as aerial photography, surveillance, and inspections. Their popularity is attributed to their ease of use, as they require minimal setup and can be flown in confined spaces. This makes accessibility appealing to novices as well as enthusiasts, accelerating adoption. Furthermore, in terms of battery technology development, longer flight times open up new possibilities for conducting longer and more productive missions. A multi-rotor drone represents a flexibility that has adopted agriculture, filmmaking, mapping and many other industries, spurring further demand. Additionally, they are at the center of popularizing the possibilities of consumer drones to a wider market. This enhances market growth significantly. Multi-rotor drones are among the key factors pushing the market forward.

Analysis by Technology:

- Autonomous Drone

- Semi-Autonomous Drone

- Remotely Operated Drone

The presence of advanced, self-sufficient autonomous drones is one of the primary factors influencing market expansion. Autonomous drones can perform many operations without human intervention, from lift-off to landing. Obstacle detection, GPS, and smart algorithms integrated into an autonomous drone make it viable to accomplish complex missions with minimal human intervention. Demand for autonomous drones increases while operating in agriculture, surveying, and search and rescue industries as they achieve the optimal level of efficiency and precision.

Semi-autonomous drones tend to strike a balance between user control and automated functions. Users are still able to guide the drone while availing of features such as stabilization and collision avoidance. This is, therefore, more user-friendly, appealing both to novices and experienced professionals seeking to exercise more control over their flights.

Remotely controlled drones are revolutionizing the consumer drone market through solutions that are user-friendly, ideal for photography and videography, and recreational purposes. They also offer precise control, live transmission, and GPS navigation as well as obstacle avoidance with automated flight modes. Through accessibility and affordability, they enable hobbyists and professionals alike to capture dynamic aerial perspectives, driving demand across a very diverse consumer segment.

Analysis by Distribution Channel:

- Online

- Offline

The online distribution channel is crucial for driving the market. The e-commerce sites provide easy accessibility for researching, comparing, and even purchasing drones from the comfort of their homes. Furthermore, they have numerous models, both low-budget and high-end ones, that suit all kinds of needs. The same online channels allow the examination of customer reviews and opinions from experts to ensure proper decisions for purchases.

The offline channel is the brick-and-mortar and specialty retailers, where one can get a feel of the product. Consumers can feel the drones, get expert advice, and see demonstrations, which helps in building confidence in the purchase. In addition, offline stores also act as repair hubs, technical support, and additional accessories.

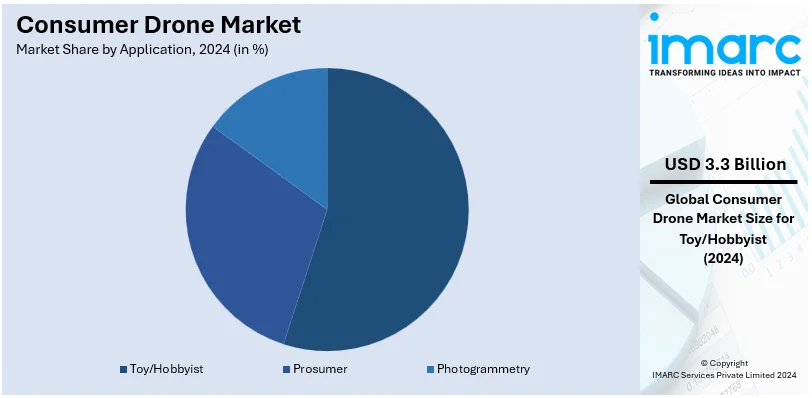

Analysis by Application:

- Toy/Hobbyist

- Prosumer

- Photogrammetry

Toy/Hobbyist leads the market with around 64.3% of the market share in 2024. The toy and hobbyist category impacts the development of market demand by involving enthusiasts, newcomers, and people who make hobby usage. These drones are designed with ease of operation, low priced, and are for enjoyment. Such devices make customers start learning basic flying abilities and exposure to aerial photography and capture of video. Moreover, toy and hobbyist drones are entry points for potential users. The interests of users tend to shift towards professional applications and industries. Such drones are more affordable and approachable to a large section of people, thereby expanding the user base. Additionally, it offers a recreative and skill development ground to the toy and hobbyist drone segment that creates growth and extends market reach by germinating future technology enthusiasts as well as professionals.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.6%. Major regions that significantly drive driving the expansion of consumer drones lie in North America. Hubs of technological innovation, a robust manufacturing ecosystem, and a tech-savvy population are fueling consumer drone adoption in this region. The vast number of industries in entertainment, agriculture, and surveillance demand multiple application drones. Besides that, positive regulations and other regulatory efforts, for instance, the Federal Aviation Administration's Part 107, within the United States set the environment right for increasing the adoption of drones both by recreational and commercial uses, which in turn gives market growth a push even more. The region has other major consumer drone manufacturing firms and other tech companies which lead to innovation and setting standards within the industry. Additionally, their product offerings and strategic initiatives contribute to growth in the market, with the region becoming a source of consumer drone advancements.

Key Regional Takeaways:

United States Consumer Drone Market Analysis

US accounts for 83.8% of the market share in North America. A growing number of drones are being used for videography, aerial photography, and recreational purposes, making the US one of the biggest markets for consumer drones. As of 2023, the Federal Aviation Administration (FAA) has estimated more than 1.47 million drones registered, through December 2022. One primary driver is the surge in demand from consumers of high-quality aerial photography for personal purposes and the manufacturing of social media content. The growth of the Drone Racing League (DRL) and other drone racing leagues fuels further demand from hobbyists. The advancement in technological development with the aid of increased camera resolutions by drones, obstacle-avoidance systems, and improved flight times has contributed much to the growth of this market. Because of its usability, companies like DJI and Autel Robotics occupy a larger portion of the market in the United States. Even the entry-level drones are more affordable than earlier, now costing as low as USD 30. A favorable regulatory framework also benefits the United States. The FAA's Remote ID regulations have defined operational rules without compromising safety, which has resulted in more amateurs using drones. Moreover, events like natural disasters have brought about awareness regarding surveillance and personal preparedness through drones which indirectly has increased consumer demand.

Europe Consumer Drone Market Analysis

Consumer drones are gaining momentum in Europe for artistic activities, such as photography and video production, as well as recreation. The UK, Germany, and France are leading markets due to the expanding base of drone enthusiasts and substantial disposable wealth. Streamlined requirements for recreational pilots and the unified drone regulations provided by the European Aviation Safety Agency have created a propitious environment for drone usage. The innovations in drone technology are the major reason; it attracts tech-savvy customers with features like 4K video recording and longer battery life. Further, the growing popularity of drone tourism in beautiful locations like Switzerland and Norway has helped accelerate adoption. Moreover, because the standards for this category have been relaxed, lightweight drones weighing less than 250 grams have emerged as the most preferred option. The increasing acceptance of drones weighing less than 250 grams being exempt from registration by the FAA for recreational use is another factor fuelling its growing popularity. Also, the popularity of the FPV (First Person View) drone racing events, which are spreading all across the continent, is fuelling the European consumer drone business. Sales increase as discount offers are made available on retailers and e-commerce sites regularly.

Asia Pacific Consumer Drone Market Analysis

Asian Pacific markets are witnessing growth in the consumer drone market as a result of growing affordability and technical advancements. According to the China Air Transport Association's 2023-2024 China Drone Development Report, by the end of August 2024, there were an estimated 2 million drones registered in China, a 720,000 rise from the end of 2023.

China's civilian drone production is expected to exceed 200 Billion yuan (USD 27.5 Billion) by 2025, as per industry report. Due to the penetration of smartphones and social networking platforms, young customers in countries like India, Japan, and South Korea are increasingly asking for drones with high camera sophistication. A growing middle class and disposable incomes allow the region to spend more on leisure devices. With FPV drone racing as a new hobby in metropolitan areas, the adoption is being further accelerated. Moreover, low-cost drones are available on websites such as Alibaba and Flipkart. This makes it affordable for consumers with tight budgets.

Latin America Consumer Drone Market Analysis

Due to an increased interest in recreational photography and videography, consumer drones are becoming increasingly popular in Latin America. More than half of the consumer drone sales in the region in 2023 will come from Brazil, making it the largest market. Due to their low cost—entry-level versions start at less than USD 200—drones have becoming more popular among enthusiasts. Demand for airborne photography is driven by natural settings like the Andes Mountains and Amazon Rainforest. Apart from that, sales in Mexico, Argentina, and Chile countries have hiked due to the various e-commerce portals that make available drones with discounts. The market is expanding day by day, as their local drone racing leagues popularity is growing these days.

Middle East and Africa Consumer Drone Market Analysis

The consumer drone market is gradually increasing in the Middle East and Africa due to increasing interest in photography and other leisure activities. Saudi Arabia and the United Arab Emirates lead the market in the Middle East because of the beautiful coastlines and deserts and their high disposable money. Urban drone enthusiasts are increasingly using drone technology, with small drones emerging as a favourite. Drones are now becoming available in African countries such as South Africa due to increased awareness and falling prices. Consumer interest in the area is further increased by occasions like drone festivals.

Competitive Landscape:

Top companies are strengthening the market through their innovative products and strategic initiatives. These industry leaders invest extensively in research and development, continually enhancing drone capabilities such as extended flight durations, enhanced imaging capabilities, and sophisticated sensors. They create drones catering to recreational users and professional applications by pushing technological boundaries. In addition, effective marketing and educational campaigns initiated by these companies raise awareness about the benefits of consumer drones, expanding their user base. They also focus on user experience, providing intuitive interfaces and user-friendly controls that make drones accessible to a broader audience. For instance, in November 2024, Skydio, a U.S.-based drone manufacturer, secured a USD 170 million extension to its USD 230 million Series E, attracting strategic investors like KDDI and Axon, alongside existing backers such as Linse Capital. Moreover, top companies often collaborate with other industries, such as photography, agriculture, and surveying, to develop specialized solutions. This approach broadens the applications of consumer drones, driving demand from various sectors. By setting industry standards and leading the way in safety regulations, leading companies foster public trust and regulatory acceptance, which is crucial for sustained market growth.

The report provides a comprehensive analysis of the competitive landscape in the consumer drone market with detailed profiles of all major companies, including:

- Autel Robotics

- BETAFPV

- DJI

- Hubsan

- Parrot Drones SAS

- Skydio, Inc.

- Syma International

- Walkera Technology Co., Ltd

- Yuneec International

Recent Developments:

- November 2024: AVPL International announced plans to invest INR 15 crore (USD 1.77 Million) to set up a drone manufacturing facility in Bihar, India. The government's efforts to increase domestic drone production and advance technological skills are in line with this objective. The facility will serve a variety of businesses, including as defense, agriculture, and disaster relief, in line with the expanding need for drones in many fields.

- September 2024: Aiming to promote the expanding domestic drone sector, India's National Test House (NTH) started certifying drones at prices below the going market rates. This program will guarantee adherence to quality and safety standards while assisting manufacturers and operators in cutting expenses. In order to encourage broader drone deployment in industries like agricultural, defence, logistics, and surveillance, the NTH provides reasonably priced certification.

- January 2024: Garuda Aerospace launched the consumer drone named “Droni” which is specifically created for convenience and quality.

- January 2025: DJI launched DJI Flip, which is a brand new series of all-in-one vlog camera drones that can be used to capture impressive 48MP photos and 4K videos.

- July 2024: Optiemus revealed that it will invest INR 140 crore to enhance its drone manufacturing facility and offer it as a service for agriculture, mapping, and related sectors.

Consumer Drone Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Multi-rotor, Nano, Others |

| Technologies Covered | Autonomous Drone, Semi-Autonomous Drone, Remotely Operated Drone |

| Distribution Channels | Online, Offline |

| Applications Covered | Toy/Hobbyist, Prosumer, Photogrammetry |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Autel Robotics, BETAFPV, DJI, Hubsan, Parrot Drones SAS, Skydio, Inc., Syma International, Walkera Technology Co., Ltd, Yuneec International, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the consumer drone market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global consumer drone market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the consumer drone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A consumer drone is a lightweight, unmanned aerial vehicle (UAV) designed for recreational and personal use. It is commonly equipped with cameras, GPS, and user-friendly controls, enabling applications such as aerial photography, videography, and racing. Consumer drones are popular for their accessibility, affordability, and advanced automated flight capabilities.

The consumer drone market was valued at USD 5.2 Billion in 2024.

IMARC estimates the global consumer drone market to exhibit a CAGR of 10.32% during 2025-2033.

Key factors driving the global consumer drone market include rising demand for aerial photography and videography, technological advancements in automation and camera quality, increasing affordability, and growing recreational use. Additionally, enhanced features like GPS navigation, extended battery life, and user-friendly controls are attracting hobbyists and enthusiasts, fueling market growth.

According to the report, multi-rotor represented the largest segment by product, driven by its versatility, ease of control, and suitability for applications like aerial photography, recreational use, and surveillance, along with its affordability and compact design.

Toy/Hobbyist is the leading segment by application, driven by increasing affordability, user-friendly designs, and growing interest in recreational drone flying, photography, and videography among enthusiasts and beginners, particularly in urban areas.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Consumer Drone market include Autel Robotics, BETAFPV, DJI, Hubsan, Parrot Drones SAS, Skydio, Inc., Syma International, Walkera Technology Co., Ltd, Yuneec International, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)