Consumer Credit Market Report by Credit Type, Service Type, Issuer, Payment Method, and Region 2025-2033

Consumer Credit Market Size and Share:

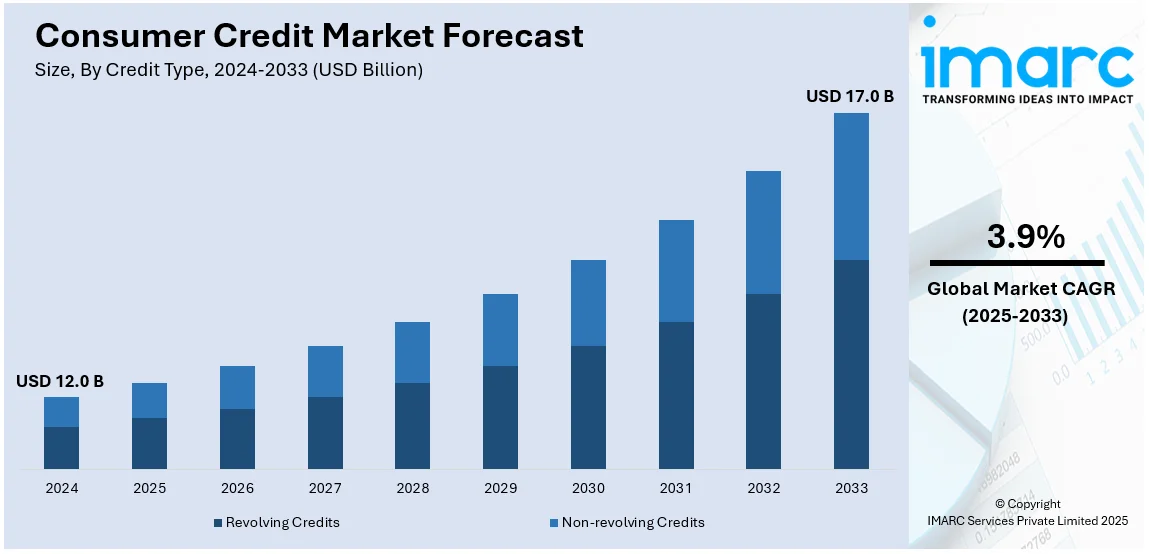

The global consumer credit market size was valued at USD 12.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.0 Billion by 2033, exhibiting a CAGR of 3.9% from 2025-2033. North America currently dominates the market, holding a market share of over 35% in 2024. Improving economic conditions of consumers, rising number of micro, small and medium enterprises in the developing countries, and expanding prevalence of financial management services, are some of the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.0 Billion |

|

Market Forecast in 2033

|

USD 17.0 Billion |

| Market Growth Rate (2025-2033) | 3.9% |

The growth of the global consumer credit market is stimulated by economic growth, urbanization, and the digital transformation of financial services. Expanding middle-class populations in emerging markets drive demand for credit products that will help support higher standards of living. Innovations in financial technology, such as artificial intelligence (AI)-driven credit scoring and seamless digital platforms, have enhanced accessibility and enabled underserved populations to participate in formal credit systems. With growing global e-commerce, buy now, pay later (BNPL) services have also been adopted and further diversified the offerings of credit. For example, in November 2024, Visa's Flexible Credential launched with the Affirm Card, allowing users to seamlessly choose payment methods, including debit and Buy Now, Pay Later, enhancing payment flexibility. Meanwhile, the governments and financial institutions emphasize the concept of financial inclusion, making policies to provide more access to credit in the rural and remote areas. Credit solutions are also increasingly integrated into consumers' lives through mobile banking and digital payment systems, and the market grows rapidly. Moreover, changing consumer tastes toward customized financial products have prompted credit providers to offer bespoke solutions that are backed up by advanced data analytics. This fluidity creates regional competition and sustains innovation, propelling steady growth within the global markets.

In the United States, growth of consumer credit markets is supported through high usage of credit cards, strong economic activity, and strong consumer confidence. The adoption of banking via digital means and fintech innovations has made credit access easier, making BNPL services and personal loans much in demand. For instance, in December 2024, Hypercard, backed by notable investors, launched its first consumer credit card on the American Express network, combining employee benefits with exclusive travel, lifestyle, and wellness rewards. Moreover, the housing market contributes significantly as low mortgage rates and home equity loans create an opportunity in market expansion. Younger demographics, such as millennials and Gen Z, are seeking more flexible forms of credit to pursue education, travel, and lifestyle opportunities. Embedded finance helps retail and online platforms seamlessly incorporate credit into consumer transactions while enabling credit usage. Regulations promote credit market accessibility and consumer trust by providing greater transparency and consumer protection. The increasing focus on financial literacy programs continues to empower consumers to make informed decisions, thus driving sustained growth in the US credit sector.

Consumer Credit Market Trends:

Digitalization in Consumer Credit

The lending landscape has undergone significant transformation over the years, driven by the rapid adoption of digitization in the banking, financial services, and insurance (BFSI) sector. Additionally, evolving consumer expectations and behavior, driven by the numerous advantages of digitizing banking and financial services, are also fueling market growth. Customers from diverse backgrounds may seek loans for various purposes, including personal loans, SME financing, home loans, and more. A study by IDC, commissioned by Razorpay, reveals that, on average, SMEs spend approximately 816 hours and ₹32 lakh annually on banking. Besides this, the implementation of favorable government policies is also augmenting the increase in digital behavior. For instance, in January 2023, the Reserve Bank of India declared the constitution of a working group on digital credit through online platforms and mobile apps. This committee will provide the specific regulatory measures for suggestion. The move marks the latest of the central bank's attempts to regulate fly-by-night lending apps that are offering all kinds of digital loans to underprivileged customers. Additionally, the integration of next-generation technologies, including Artificial Intelligence, Machine Learning, and Cloud Computing with banking platforms is benefiting banks and fintech, which is further propelling the consumer credit market share. This data and information aids in managing individual credit cases, real-time pricing and capital management of multi-asset portfolios and minimizing firm-wide risks through consistency, automation, and transparency.

Growth of Micro, Small, and Medium Enterprises

High economic growth for micro-enterprises, especially in developing nations, is also providing a boost to the market growth. Banks and other financial institutions are investing in micro, small, and medium enterprises (MSMEs) to minimize the credit gap with local vendors. Microbusinesses often require credit to cover operational expenses, such as inventory purchases or equipment upgrades. Additionally, access to credit enables them to expand their business, manage seasonal fluctuations, and seize growth opportunities. Consequently, the expanding number of micro-enterprises is positively impacting the consumer credit market outlook. MSMEs generated 120 Million jobs across all industries in India. Due to this, micro and small enterprises are highly important for the economy and account around 33% for India's GDP. On the other hand, medium-sized enterprises are comprised only of 1% of MSMEs in contrast to 4.5% to micro firms and over 90% of MSMEs. With this view, the rising trends of startups are also enhancing a positive market view. India has experienced rapid growth in startups. As per the Ministry of Commerce and Industry, recent startups of approximately 10,000 were sanctioned in 156 days in opposition to the initial 10,000, which got sanctioned in 808 days. Tier-2 and Tier-3 cities in India are reported to contribute to 49% of the startups. Similarly, according to the US Census Bureau's "Statistics about Business Size (Including Small Business)" and the US Census Bureau's "Nonemployer Statistics, approximately 92% of US businesses are microbusinesses.

Increasing Use of Social Media Platforms by Consumer Credit Agencies

The increasing utilization of social media platforms by consumer credit agencies for better market connectivity and penetration is catalyzing the consumer credit market demand. Moreover, social media allows banks to connect with their existing or potential customers, increase touchpoints, build trust, and offer value without compromising on quality and security. Various well-established banks are increasingly investing in creating their online presence on social media and making consumers aware of their credit consumer services and benefits. For example, in July 2017, a new mobile-only bank, kakaobank, was opened in Korea. Within 24 hours, this attracted more than 300,000 subscribers. After fifteen days, it crossed two Million subscribers, with a savings of ₩1 Trillion (USD 930 Million) and lending worth ₩770 Billion (USD 701 Million). Today, it is well on the way to having 10 Million customers, in a country of just over 50 Million people (economically active population is 25 Million). Similarly, numerous US banks, including Bank of America, Citibank, Varo, Current, and Chase, are also present on Instagram, with a massive following and excellent engagement rate. Such initiatives are anticipated to propel the consumer credit market revenue in the coming years.

Consumer Credit Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global consumer credit market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on credit type, service type, issuer, and payment method.

Analysis by Credit Type:

- Revolving Credits

- Non-revolving Credits

Non-revolving credits stand as the largest component in 2024, this refers to a type of loan in which the borrower receives a fixed amount of money upfront, usually for a specific purpose, and repays it in fixed installments over an agreed-upon period. Unlike revolving credit, such as credit cards, where the available credit replenishes as payments are made, non-revolving credit does not replenish once it's paid off. Examples include installment loans for cars, education, or home improvements. Consumer credit market statistics indicate that the increasing number of auto and education loans is primarily driving the growth of this segment. For instance, according to the Reserve Bank of India, vehicle loans from banks have witnessed an impressive 137% increase over the past three years, reaching Rs 5.08 lakh crore. Similarly, on average, Americans took out USD 55.0 Billion in new auto loans each month in the fourth quarter of 2023. Such a massive inclination towards owning a vehicle and opting for higher education is anticipated to propel the consumer credit market recent price in the coming years.

Analysis by Service Type:

- Credit Services

- Software and IT Support Services

Credit services, which encompass providing loans, various forms of credit, and credit-related information to individuals and businesses, led the market in 2024. The increasing number of people seeking loans to complete their education, own a vehicle, buy/renovate a house, etc., catalyzing the growth of this segment. For instance, in 2020, an estimated 9.43 Million people in Great Britain had a loan. Similarly, 58% of American adults (18-29 years) have student loan debt. Moreover, according to a survey by Saral Credit, a fintech platform, 67% of Indians rely on personal loans for funding needs.

Analysis by Issuer:

- Banks and Finance Companies

- Credit Unions

- Others

Banks and finance companies leads the market in 2024 as these are institutions that provide financial services, such as lending, borrowing, and investing. They offer benefits like secure storage of money, access to credit for personal and business needs, and opportunities for wealth growth through various investment vehicles. Additionally, they facilitate transactions, both domestically and internationally, fostering economic activity.

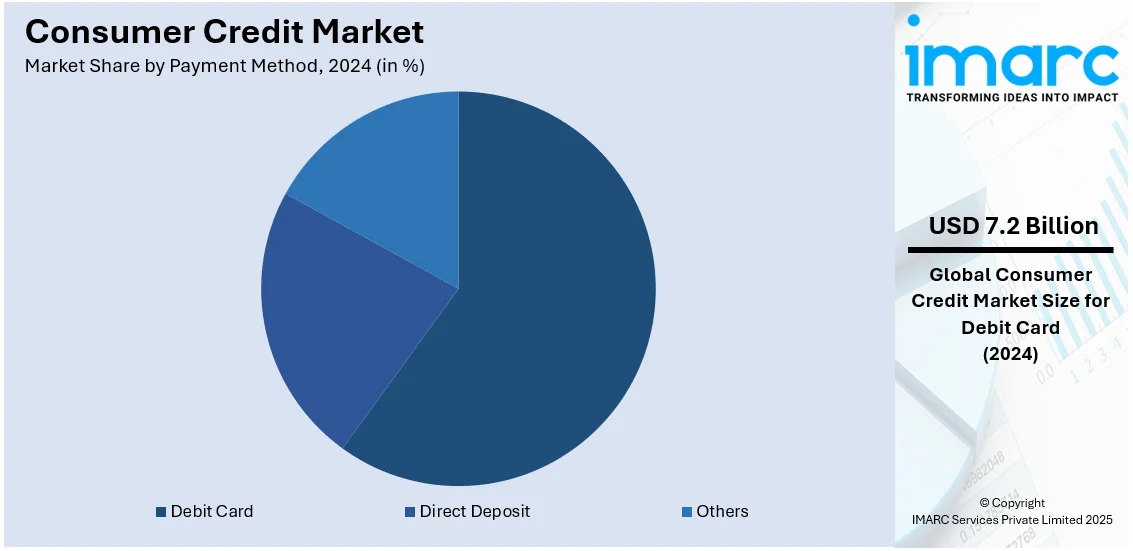

Analysis by Payment Method:

- Direct Deposit

- Debit Card

- Others

Debit card leads the market with around 60.0% of market share in 2024. One can easily pay EMIs with debit cards with low-interest rates. Various banks are offering EMI services on debit cards, either with no-cost EMI options for a shorter duration or with minimal interest rates if the loan is borrowed for a longer duration. For instance, HDFC bank, one of India’s leading private banks, offers EASYEMI, in which a customer can shop in full and pay in parts by converting transactions into easy installments. It can be used for purchases made both online and in physical stores. Moreover, the debit card maintenance charge is quite low compared to credit cards.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35%. The growth of the region can be attributed to the rise in the adoption of consumer credit in small & medium enterprises to ensure an effective flow of financial activities. Moreover, as per the consumer credit market overview, the increasing number of individuals opting for loans for personal use in North America is significantly high. For example, the total loans in the United States reached USD 12,305.379 billion as of March 2024. Additionally, the presence of well-established banks in the region, such as Citi Bank, Bank of America, Goldman Sachs, Morgan Stanley, etc., is also creating a positive outlook for the market. Additionally, these banks are increasingly investing in expansion and increasing their customer base. For instance, in January 2024, Citigroup announced its plans to deepen its involvement in China’s financial markets with the launch of an investment banking unit in the country.

Key Regional Takeaways:

United States Consumer Credit Market Analysis

The growing adoption of consumer credit in the United States has been significantly influenced by the increasing use of social media platforms. According to reports, the number of social media users in the US is expected to grow from 2020 through 2025, reaching a total growth of 14.3% and at an average annual growth rate of 2.7%. As social media becomes a growing tool of communication and marketing, there is consequently an influence on a more connected and informed consumer market.Through online interactions and targeted advertising, individuals are becoming more aware of various credit options available to them. Platforms that facilitate peer-to-peer recommendations, influencer endorsements, and promotional campaigns contribute to the rising interest in credit products. The accessibility of financial products through social media channels allows consumers to make more informed choices, often leading to higher adoption rates of consumer credit. Furthermore, discussions on these platforms have led to the creation of credit-conscious communities that encourage more individuals to explore credit options they may have otherwise been unaware of.

Asia Pacific Consumer Credit Market Analysis

In the Asia-Pacific region, the expansion of small and medium-sized enterprises (SMEs) has led to an increase in consumer credit adoption. According to India Brand Equity Foundation, the number of MSMEs in the country is estimated to increase from 6.3 crore to around 7.5 crore at a CAGR of 2.5%. As these businesses expand, the need for credit that flows freely manifests. Entrepreneurs and small business owners require financial products to scale their operations, and they, in turn, create opportunities for the general public to access credit through their growing networks. As SMEs establish themselves and contribute to economic development, their employees and associated customers also gain better access to credit, fostering an environment where financial products are increasingly utilized. With rising economic activity and demand for consumer goods, access to credit becomes integral in supporting this growth trajectory, ultimately boosting the adoption of consumer credit within the region.

Europe Consumer Credit Market Analysis

In Europe, the expansion of the banking sector, along with the increasing number of available banking facilities, has played a crucial role in the growing adoption of consumer credit. According to reports, in 2021, the EU had 784 foreign bank branches, which were 619 from other EU Member States and 165 from third countries. More banks are offering tailored credit products to meet diverse consumer needs, making credit products more accessible to a wider audience. This growth in banking facilities encourages financial inclusivity and enhances customer access to various lending options. As more financial institutions adopt digital banking models, consumers can easily apply for and receive credit, which in turn fosters higher consumer confidence in utilizing credit. The integration of advanced technologies such as mobile banking and online loan applications further facilitates the growth of consumer credit. With these developments, the adoption of consumer credit has become more commonplace in many European countries.

Latin America Consumer Credit Market Analysis

In Latin America, the growing disposable income of consumers has been a key factor in the increased adoption of consumer credit. For example, total disposable income in Latin America is going to accelerate by almost 60% in real terms over the period 2021-2040. When people enjoy better conditions for household budgets and savings, it is easier for them to obtain credit for big-ticket purchases or financing personal projects.The rise in disposable income has expanded consumer spending power, making it easier for consumers to manage credit repayments. As more people enjoy higher income levels, the demand for consumer credit rises, supporting a more dynamic consumer credit market. This shift in financial capabilities has resulted in more individuals turning to credit products to improve their standard of living and to take advantage of financial opportunities that were previously out of reach.

Middle East and Africa Consumer Credit Market Analysis

The Middle East and Africa have seen a notable increase in the adoption of consumer credit driven by significant investment in software and IT support services. For example, spending on information and communications technology (ICT) as a whole for the Middle East, Türkiye, and Africa will reach USD 238 Billion this year, a boost of 4.5% over 2023. As digitization and the pursuit of innovation become increasingly prominent in the global environment, it becomes easier for the consumer to avail credit through IT expansion. The availability of secure online platforms for credit applications, coupled with better customer service through IT support, has made lending easier. Moreover, these technological advancements have helped establish trust between consumers and financial institutions, promoting the use of credit. As more investments flow into these sectors, the accessibility and efficiency of consumer credit products continue to improve, fostering wider adoption among consumers across the region.

Competitive Landscape:

The credit services market was highly competitive due to technology advancements, shifting customer preferences, and regulatory changes. The primary differentiator here was digital transformation, wherein the providers made use of AI and machine learning for better credit scoring, fraud detection, and more personalized offerings. Fintech platforms gained the upper hand as they provided an easier interface and quicker loan approval to the tech-savvy customers. Traditional players continued to expand their digital footprint in an effort not to lose market share and meet consumer expectations of seamless experiences. Embedded finance helped credit integrate into non-financial platforms, making it more accessible and convenient. Innovative credit products, including buy now, pay later (BNPL) services and flexible repayments, appealed more to younger demographics. Sustainability has become a factor as providers look to become ESG compliant with lending and related practices. Amidst economic uncertainties, maintaining profitability and a customer trust in such an environment required the development of sound risk management strategies and strong credit evaluation processes.

The report provides a comprehensive analysis of the competitive landscape in the consumer credit market with detailed profiles of all major companies, including:

- Bank of America

- Barclays

- BNP Paribas

- China Construction Bank

- Citigroup

- Deutsche Bank

- HSBC

- Industrial and Commercial Bank of China (ICBC)

- JPMorgan Chase

- Mitsubishi UFJ Financial

- Wells Fargo

Latest News and Developments:

- December 2024: Axis Bank has announced 'Primus,' a super-premium credit card, in collaboration with Visa, for ultra-high-net-worth individuals in India. This invitation-only card offers bespoke global privileges under Visa Infinite Privilege, rewriting the book on luxury and convenience for some Axis Bank customers.

- December 2024: The bank and Times Internet have collaborated to introduce the super-premium 'Times Black ICICI Bank Credit Card' targeted at high-net-worth individuals. This is a metal card powered by Visa, offering luxuries such as unlimited lounge access at 1,300+ global airports, club memberships, visa services at home, and helicopter rides. The card provides 2.5% reward points on international spends and 2% on domestic transactions, alongside access to elite events hosted by The Times Group.

- October 2024: General Motors and Barclays U.S. Consumer Bank agree on a long-term partnership that will result in Barclays exclusively issuing the GM Rewards Mastercard and GM Business Mastercard in the United States starting this summer. The partnership aims to enhance loyalty among GM's large customer base; it has led the U.S. automaker as the U.S. automaker leader in loyalty for nine consecutive years. Card members can earn and redeem rewards on GM vehicles, including electric models, and enjoy exclusive benefits.

- September 2024: CARD91 launched its first 3-in-1 card platform during the Global Fintech Fest 2024 by integrating ID, access, and a prepaid card with NCMC. The card is designed for both corporate employees and students but caters to various needs such as event management, medical institutions, and shopping malls with minimum hassle-free transactions, increased security, and convenience.

- August 2024: Visa showcased future payment innovations at Global Fintech Fest 2024 to advance digital payment usage in India. Key launches have been HDFC Bank's one-stop POS, Paytm NFC Card Soundbox and Axis Bank Neo app for merchants. Visa is also working with PayU on a Push Provisioning platform and with IDFC First Bank on the premium Ashva Metal Credit Card - advanced consumer credit solutions and convenient transactions.

Consumer Credit Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Credit Types Covered | Revolving Credits, Non-revolving Credits |

| Service Types Covered | Credit Services, Software and IT Support Services |

| Issuers Covered | Banks and Finance Companies, Credit Unions, Others |

| Payment Methods Covered | Direct Deposit, Debit Card, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bank of America, Barclays, BNP Paribas, China Construction Bank, Citigroup, Deutsche Bank, HSBC, Industrial and Commercial Bank of China (ICBC), JPMorgan Chase, Mitsubishi UFJ Financial, Wells Fargo. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the consumer credit market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global consumer credit market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the consumer credit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The consumer credit market was valued at USD 12.0 Billion in 2024.

IMARC Group estimates the market to reach USD 17.0 Billion by 2033, exhibiting a CAGR of 3.9% from 2025-2033.

Key factors driving the consumer credit market include rising disposable incomes, increased consumer spending, digitalization of financial services, and widespread adoption of credit cards and BNPL services. Additionally, easier access to credit through fintech platforms, evolving lifestyles, and growing demand for personal and home loans fuel market growth.

North America currently dominates the market due to the growing adoption of consumer credit by small and medium enterprises to maintain an efficient flow of financial operations.

Some of the major players in the consumer credit market include Bank of America, Barclays, BNP Paribas, China Construction Bank, Citigroup, Deutsche Bank, HSBC, Industrial and Commercial Bank of China (ICBC), JPMorgan Chase, Mitsubishi UFJ Financial, Wells Fargo, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)