Consumer Cloud Subscription Market Size, Share, Trends and Forecast by Type, Storage Subscription, Platform, Application, and Region, 2025-2033

Consumer Cloud Subscription Market Size and Share:

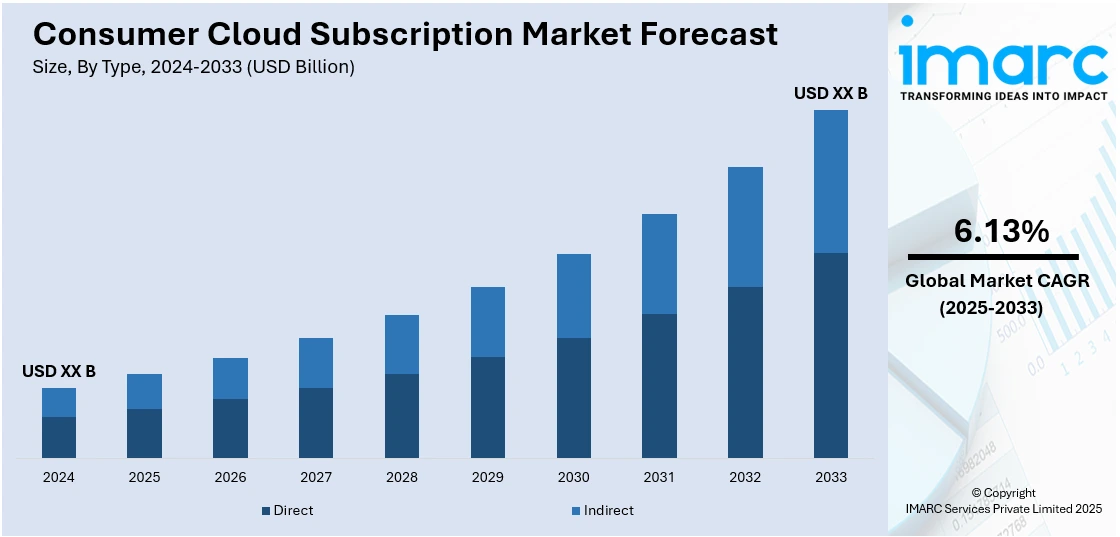

The global consumer cloud subscription market size is expected to exhibit a CAGR of 6.13% from 2025-2033. North America currently dominates the market, holding a market share of over 44.6% in 2024. The consumer cloud subscription market share is expanding, driven by the escalating demand for scalable and cost-effective storage solutions, the increasing reliance on cloud-based applications across the globe, and continuous technological innovations in machine learning (ML) and artificial intelligence (AI).

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate (2025-2033) | 6.13% |

The increasing demand for digital storage, entertainment, and productivity equipment is impelling the market growth. More people depend on cloud services for streaming music, movies, and gaming, thereby enhancing subscription rates of cloud-enabled streaming platforms. Besides this, the shift towards remote work and online learning creates the need for reliable and effective cloud-based productivity tools. Additionally, improved internet access and faster speeds make cloud services more accessible and available. Individuals also prefer cloud storage solutions to keep their data secure across devices. Furthermore, subscription-based models offer convenience, regular updates, and cost savings compared to one-time purchases.

The United States has emerged as a major region in the consumer cloud subscription market owing to many factors. The increasing reliance on digital services for entertainment, productivity, and storage is fueling the consumer cloud subscription market growth. Streaming sites attract subscribers looking for on-demand content. Additionally, the rise of remote work in the country encourages the adoption of cloud-based subscription tools. As per the information given on the official website of the US Bureau of Labor Statistics, the total number of individuals who telecommuted or worked from home in December 2024 in the United States hit 36,216,000. Besides this, faster internet speeds and 5G expansion improve cloud service accessibility and performance. People also prefer cloud storage solutions for secure and cross-device access to their data.

Consumer Cloud Subscription Market Trends:

Increasing digital content usage

The growing adoption of digital content is one of the significant factors positively influencing the market. Industry reports indicate that, as of October 2024, 5.52 Billion people worldwide were using the Internet, representing 67.5% of the total population. Along with this, there is an escalating need for scalable cloud storage and computing solutions due to the rising number of individuals utilizing on-demand services, such as streaming, online gaming (cloud), and digital publications. In addition, the proliferation of network connections and devices that provide users with the ability to utilize content at all times is enabling a reliance on cloud services. The companies that carry their subscription models are based on large content libraries residing locally.

Growing demand for remote work solutions

The worldwide shift towards remote work is offering a favorable consumer cloud subscription market outlook. The COVID-19 pandemic escalated the shift towards remote work and remote work and hybrid models, which is driving the demand for collaboration, file sharing, or communication. A survey finds that 35% of US workers who can work remotely are doing full-time from home, nearly three years after the COVID-19 pandemic in 2023. Cloud services are witnessing an increase in subscriptions that are critical to businesses and employees who require less traditional office solutions that provide portability. They give necessary features, such as data storage with security protocols and accessibility to important work applications needed for remote operations. For numerous organizations, this trend is a response to immediate demands and serves as part of their long-term strategic play to reinforce agility and resilience. According to the consumer cloud subscription market forecast, with remote work emerging as the norm in the new workforce operations landscape, more organizations will likely look to contribute to the market with 24/7 availability of versatile and scalable solutions for working remotely.

Advancements in cloud technology and infrastructure

The rapid rise in cloud technology and infrastructure is propelling the market growth. New technologies, such as better data security, edge computing, and AI incorporation have significantly updated the performance of cloud services. Adoption of cloud solutions comes with greater reliability, as these innovations have matured, leading to a better user experience, which is already relied on for everything from personal information storage through home automation to automotive use cases. The global cloud system management market size reached USD 22.6 Billion in 2024. In response to user fears of data privacy and cyber threats, better security practices, including zero-trust architectures (ZTAs) and multi-factor authentication, are being implemented which are also contributing to the market growth. Furthermore, edge computing advances the speed of data processing and cuts latency levels, which in turn optimizes overall user experience standards for real-time applications like online gaming to video streaming.

Consumer Cloud Subscription Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global consumer cloud subscription market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, storage subscription, platform, and application.

Analysis by Type:

- Direct

- Indirect

Direct consumer cloud subscriptions grow, as companies offer services directly to users through their platforms. People subscribe to streaming, storage, and productivity tools from providers without third-party involvement. Direct subscriptions also allow companies to build stronger customer relationships, offer personalized plans, and provide exclusive content. Many firms employ direct billing and subscription models to retain users and maximize revenue.

Indirect consumer cloud subscriptions increase through third-party platforms, bundling services with other products. Telecom providers, internet service companies, and retail platforms offer cloud subscriptions as part of package deals. For example, mobile carriers bundle cloud storage or streaming services with data plans. Additionally, retailers may provide cloud gaming or software subscriptions as add-ons. Indirect subscriptions attract many people by offering convenience and cost savings.

Analysis by Storage Subscription:

- 50 GB-999 GB

- 1 TB - 9.99 TB

- More than 10 TB

50 GB – 999 GB storage range attracts casual users who need cloud storage for personal files, photos, and documents. Services offer affordable plans in this range, making it ideal for individuals and small businesses. Many people choose this option for syncing files across multiple devices without taking up local storage. Streaming and app backups also promote the employment of this storage plan.

1 TB – 9.99 TB storage subscription segment appeals to professionals, content creators, and businesses that handle large files, including high-resolution images, videos, and project data. Cloud providers offer expanded storage with collaboration tools, making it essential for remote work and team projects. Subscription plans in this range provide more flexibility and enhanced security features. People needing extensive backups and seamless file sharing across multiple devices choose these plans.

More than 10 TB section serves enterprises, media professionals, and heavy data users who require massive cloud storage for large-scale projects. Companies dealing with video production, AI, and big data analysis depend on high-capacity subscriptions from cloud-based firms. These plans offer advanced security, automation, and remote access features, making them essential for data-intensive operations.

Analysis by Platform:

- Android

- IOS

- OS X

- Windows

Android platforms are popular, as people depend on cloud storage, streaming, and productivity services for seamless access across devices. The channel’s flexibility supports various cloud applications, allowing users to store files, back up data, and sync content easily. Many cloud-based entertainment and gaming services integrate with Android, enhancing customer experience. The affordability and accessibility of Android devices contribute to rising cloud subscriptions, especially in mobile-first markets.

IOS platforms are adopted due to their seamless integration with mobile devices, ensuring automatic backups, cross-device synchronization, and secure data storage. Individuals depend on cloud-based productivity tools, entertainment services, and subscription-based applications for enhanced digital experiences. Cloud storage options help to manage photos, documents, and app data efficiently. The platform’s strong focus on security and encryption encourages customers to store sensitive information confidently.

OS X platforms cater to people who need reliable cloud storage, file synchronization, and remote access. Cloud-based productivity tools assist professionals and students in collaborating on projects while cloud storage services provide essential backup solutions. Many creative users depend on cloud platforms for secure storage and sharing of large files, including design, video, and music projects. Cloud-based applications ensure seamless integration across multiple devices, enhancing workflow efficiency.

Windows platforms expand because individuals adopt cloud storage, productivity, and entertainment services for work and personal use. Cloud storage solutions help users to manage large amounts of data, ensuring remote accessibility and security. Subscription-based productivity tools enhance collaboration, allowing seamless document editing and file sharing. Cloud gaming services have also become popular, offering people the ability to play without high-end hardware.

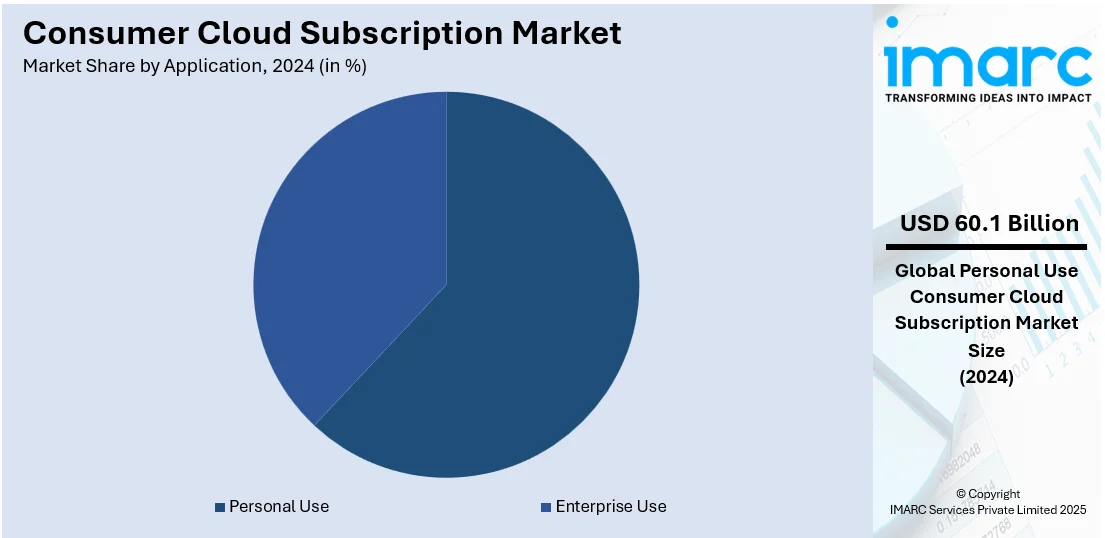

Analysis by Application:

- Personal Use

- Enterprise Use

Personal use holds a significant portion of the market. People rely on cloud services for entertainment, storage, and convenience. Individuals employ cloud subscription platforms to store photos, documents, and backups across devices. Streaming services also attract millions of subscribers looking for on-demand content. Cloud-based productivity tools further support students and remote workers.

Enterprise use of consumer cloud subscription solutions is increasing, as businesses are adopting cloud solutions for storage, collaboration, and security. Companies rely on cloud-based platforms for efficient data management and remote access. Cloud-oriented collaboration tools allow teams to connect effortlessly from various locations. Businesses also employ cloud services for cybersecurity, backup, and AI-driven analytics.

Regional Analysis:

- North America

- United States

- Canada

- Asia- Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 44.6%, enjoys the leading position in the market. It has a highly developed digital infrastructure, strong internet penetration, and high user spending on digital services. With widespread access to high-speed internet and 5G networks, people can seamlessly stream content, store data, and employ cloud-based applications. The region is also noted for the presence of major tech companies, which dominate the cloud industry and continuously wager on innovations. Additionally, Americans have a strong preference for subscription-based models, driving the demand for entertainment, productivity, and storage services. Besides this, modern cybersecurity measures and data protection regulations ensure trust in cloud services. Moreover, government agencies spend resources on AI and ML to enhance the utilization of cloud-based sites. In March 2024, The FY2025 budget proposal from the Biden administration allocated USD 3 Billion to agencies for the responsible development, testing, procurement, and integration of transformative AI applications throughout the federal government. It seeks to improve cybersecurity measures as part of a larger initiative to foster US leadership and innovations.

Key Regional Takeaways:

United States Consumer Cloud Subscription Market Analysis

The United States hold 90.50% of the market share in North America. The market is experiencing growth due to the highly digitalized economy, extensive internet penetration, and a tech-savvy population. A significant driver is the country’s leadership in AI innovations, which directly enhances cloud-based services. According to Edge Delta, the US has consistently been a hub for AI startups, with 4,633 startups introduced between 2013 and 2022. In 2022, 524 AI startups were initiated, attracting USD 47 Billion in non-governmental funding. These advancements in AI are integral to improving cloud solutions, offering features like predictive analytics, automated data management, and personalized user experiences. Additionally, the adoption of connected devices, streaming platforms, and virtual collaboration tools rises owing to the post-pandemic shifts towards remote work and hybrid models. People prioritize data security and scalability, creating the demand for robust and premium cloud solutions. Big firms wager on user-friendly interfaces and competitive subscription models. The US market’s expansion is also supported by innovations in edge computing and 5G networks, ensuring increased speed and availability of cloud services.

Europe Consumer Cloud Subscription Market Analysis

The market is driven by advanced digital infrastructure and a rising shift towards digital solutions for personal and professional use. A key factor contributing to this growth is the increasing integration of Internet of Things (IoT) devices. According to reports, 29% of EU enterprises employed IoT devices in 2021, primarily for securing their premises. This widespread adoption of IoT technology highlights the demand for cloud solutions that can support data storage, monitoring, and management. High broadband penetration in countries, such as Germany, France, and the United Kingdom facilitates the seamless adoption of cloud-based services. Individuals are increasingly engaging with digital platforms for entertainment, remote productivity, and secure data storage. Post-pandemic trends of hybrid work models have further created the requirement for cloud subscriptions. The area’s stringent data privacy regulations have also encouraged providers to offer secure and compliant solutions, enhancing user trust. Furthermore, the popularity of cloud-based gaming and streaming services is high, supported by higher disposable incomes and digital literacy.

Asia-Pacific Consumer Cloud Subscription Market Analysis

The market is experiencing significant growth in the Asia-Pacific region, driven by rapid digitalization, rising smartphone adoption, and advancements in 5G technology. Nations like South Korea and China are leading the region's 5G revolution. According to GSMA, as of 2023, South Korea had 31.3 Million 5G connections, representing over 48% of its mobile connections, while China boasted over 700 Million 5G connections, accounting for 41% of its total. These advancements enable seamless streaming, gaming, and cloud-based services, fostering large scale usage. Developing regions, such as India and Vietnam, are also contributing to the market growth through increasing internet penetration and tech-savvy populations. Government initiatives promoting digital economies and affordable and localized subscription models further promote their employment. As 5G networks broaden, people gain from better speed and connectivity, enhancing their reliance on cloud platforms for entertainment, productivity, and data storage.

Latin America Consumer Cloud Subscription Market Analysis

Latin America is one of the fastest-growing mobile markets, with mobile internet users increasing from 326 Million in 2018 to an anticipated 422 Million by 2025, according to MGR. This rapid expansion is fueled by rising smartphone penetration and improved internet connectivity, particularly in urban centers across Brazil, Mexico, and Argentina. The region’s high number of users is driving the demand for cloud-based services for entertainment, data storage, and collaboration. Affordable subscription plans and the large scale adoption of mobile-first solutions further promote cloud employment while regional efforts to enhance digital inclusion position the market as a key area for growth.

Middle East and Africa Consumer Cloud Subscription Market Analysis

The Middle East is witnessing rapid advancements in mobile technology, with Saudi Arabia leading the region in 5G adoption. According to reports, By the end of 2022, Saudi Arabia boasted over 11.2 Million 5G subscriptions, representing over a quarter of the entire mobile industry. This growth is complemented by increasing smartphone penetration and government-led digital transformation initiatives across the Gulf Cooperation Council (GCC) countries. The requirement for cloud-based services, particularly in gaming, streaming, and productivity, is on the rise, driven by a youthful and tech-savvy population and tailored subscription models that ensure accessibility for diverse user segments.

Competitive Landscape:

Key players work on developing new solutions to meet the high consumer cloud subscription market demand. Big companies wager on creating cloud storage, streaming, and productivity tools. Streaming services attract millions of subscribers with exclusive content and personalized recommendations. Besides this, tech companies invest in AI and ML to enhance cloud services, making them faster and more efficient. Subscription-based productivity tools further support remote work and collaboration. They come up with strong cybersecurity measures and regular updates to build user trust. These companies also expand partnerships and bundle services to entice people. As competition grows, key players keep evolving their consumer cloud subscription offerings, ensuring continued growth in the market. For instance, in November 2023, Box Inc., the top Content Cloud platform, teamed up with Google Cloud to revolutionize cloud work for businesses. Box partnered with Vertex AI to create advanced AI features that enable customers to efficiently handle and analyze data stored within the Box Content Cloud, which is now available for purchase and use directly through Google Cloud Marketplace.

The report provides a comprehensive analysis of the competitive landscape in the consumer cloud subscription market with detailed profiles of all major companies, including:

- Amazon.com Inc.

- Apple Inc.

- Box Inc.

- Carbonite Inc. (OpenText Corporation)

- Dropbox

- Google LLC (Alphabet Inc.)

- Mediafire

- Microsoft Corporation

- Nextcloud

- pCloud AG

- SoundCloud

- Sync.com Inc.

Latest News and Developments:

- November 2024: Qlik introduced a cloud region in Mumbai to fulfill the need for local data storage, compliance, and AI services. The updated infrastructure, constructed on AWS, enables Qlik to provide its complete AI functionalities to clients in India. This initiative seeks to improve the company's services in the area, adapting to regional business requirements.

- May 2024: Oracle Communications introduced a cloud service that facilitates rapid product and offer rollouts via a centralized design interface. It enables companies to establish offers, packages, pricing, and guidelines, subsequently distributing them to ordering channels and billing systems. It intends to enable customer-focused innovations and increase revenue.

- April 2024: Google LLC (Alphabet Inc.) teamed up with Broadcom Inc. to focus on optimizing Broadcom VMware workloads for the cloud, collaborative initiatives in market engagement, expanding their services on Google Cloud Marketplace while integrating generative AI features into their solutions from Google Cloud through TensorFlow.

- March 2024: Gupshup released ‘Conversation Cloud’, a SaaS toolkit aimed at improving business-to-consumer engagement via AI-driven voice and text communication. The platform presents two essential modules- 'Converse,' which facilitates two-way communication and commerce functions, such as payment processing, catalog access, and human or automated support, and 'Advertise,' which assists marketers in acquiring and converting clients.

Consumer Cloud Subscription Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Direct, Indirect |

| Storage Subscriptions Covered | 50 GB-999 GB, 1 TB - 9.99 TB, More than 10 TB |

| Platforms Covered | Android, IOS, OS X, Windows |

| Applications Covered | Personal Use, Enterprise Use |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Amazon.com Inc., Apple Inc., Box Inc., Carbonite Inc. (OpenText Corporation), Dropbox, Google LLC (Alphabet Inc.), Mediafire, Microsoft Corporation, Nextcloud, pCloud AG, SoundCloud, Sync.com Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the consumer cloud subscription market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global consumer cloud subscription market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the consumer cloud subscription industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The consumer cloud subscription market is projected to exhibit a CAGR of 6.13% during 2025-2033.

The rising adoption of work from home setups is driving the demand for cloud-based subscription tools. Besides this, the increasing usage of cloud storage is creating the need for these solutions so that people can access data from multiple devices. Moreover, faster Internet and 5G connectivity are making cloud-based applications more reliable and efficient.

North America currently dominates the consumer cloud subscription market, accounting for a share of 44.6% in 2024, driven by advanced digital infrastructure, high internet penetration, and rising user demand for streaming, storage, and productivity services. Major tech companies wager on innovations while widespread smartphone and smart device adoption increases cloud usage.

Some of the major players in the consumer cloud subscription market include Amazon.com Inc., Apple Inc., Box Inc., Carbonite Inc. (OpenText Corporation), Dropbox, Google LLC (Alphabet Inc.), Mediafire, Microsoft Corporation, Nextcloud, pCloud AG, SoundCloud, Sync.com Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)