Construction Camera Market Size, Share, Trends and Forecast by Product Type, Power, Application, Distribution Channel, and Region, 2025-2033

Construction Camera Market Size and Share:

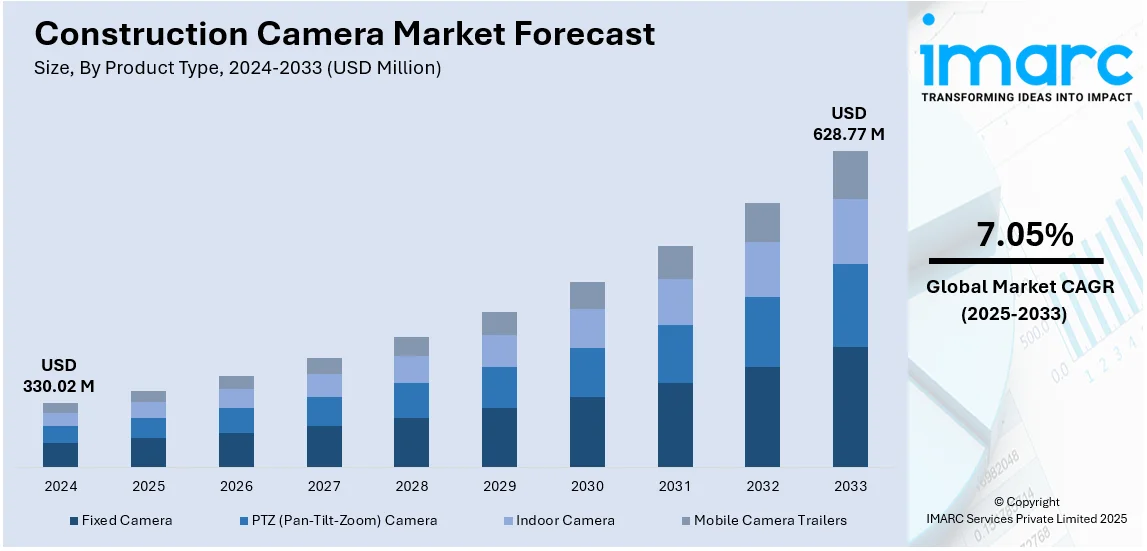

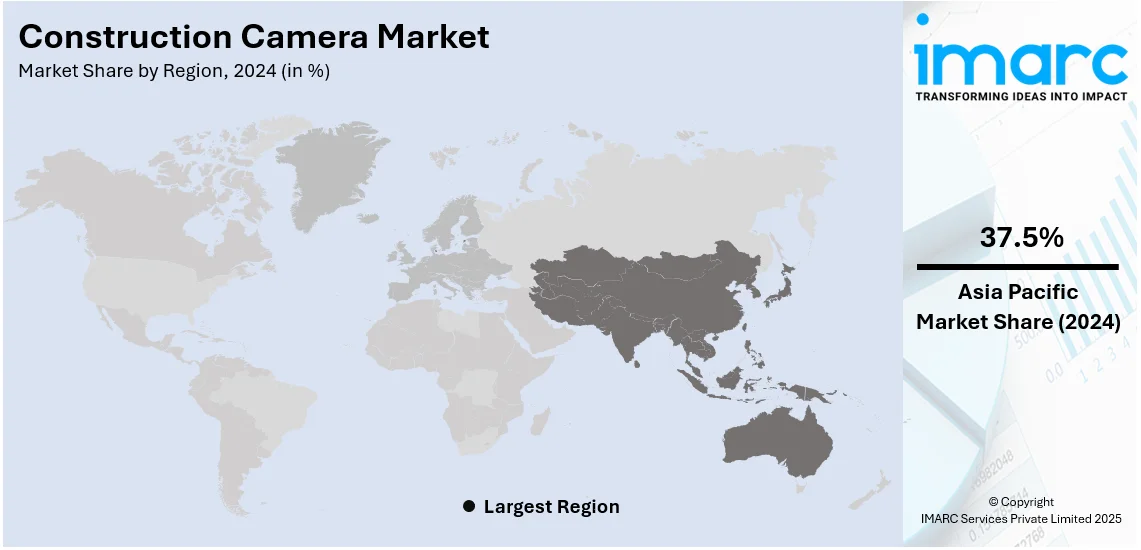

The global construction camera market size was valued at USD 330.02 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 628.77 Million by 2033, exhibiting a CAGR of 7.05% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 37.5% in 2024. The increasing complexity and scale of construction projects, the rising usage of digital technologies and connectivity, enhancement of site safety and security, widespread product adoption for marketing and promotional purposes are some of the major factors positively impacting the construction camera market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 330.02 Million |

| Market Forecast in 2033 | USD 628.77 Million |

| Market Growth Rate 2025-2033 | 7.05% |

The market is expanding due to increasing integration with artificial intelligence (AI) and machine learning (ML) for real-time analytics, anomaly detection, and predictive maintenance. Additionally, the growing demand for high-resolution imaging, including 4K and thermal cameras, is rising to enhance progress tracking and safety monitoring. The growing adoption of building information modeling (BIM) is encouraging the use of time-lapse cameras for project documentation, which is providing an impetus to the construction camera market growth. Additionally, stringent government regulations on workplace safety and compliance are driving investments in surveillance solutions, which is reinforcing the adoption of construction cameras across large-scale infrastructure projects. For instance, effective June 2024, Singapore mandates video surveillance systems at construction sites for projects valued at USD 5 Million or more to enhance workplace safety. The objectives of these systems are to identify health hazards, ensure safety at work, discourage risky conduct, and assist with incident investigations. This action fits into larger initiatives to lower occupational fatalities and serious injuries, especially in high-risk industries.

The market in the United States is driven by increasing investments in public infrastructure projects, including highways, bridges, and smart cities, necessitating advanced surveillance solutions. According to an industry report, there are plans to repair more than 20,800 bridges and more than 356,300 miles of roads in the United States by the end of 2026. This extensive redevelopment underscores the need for construction cameras to enhance site security, monitor project progress, and ensure regulatory compliance. In line with this, the adoption of 5G technology is enhancing real-time video streaming capabilities and improving site monitoring and security. Besides this, the rising concerns over theft and vandalism at construction sites are prompting greater demand for high-end surveillance systems with motion detection and night vision. Also, the emphasis on sustainable construction practices is propelling the need for cameras that support energy-efficient monitoring, which is a growing construction camera market trend. Furthermore, rising labor shortages are accelerating the deployment of automated site monitoring solutions, ensuring efficient resource management and adherence to project timelines.

Construction Camera Market Trends:

Increasing complexity and scale of construction

The increasing complexity and scale of construction projects increase construction camera market demand to ensure efficiency, accountability, and seamless project execution. Large-scale infrastructure developments, high-rise buildings, and multi-phase projects involve numerous stakeholders, including architects, engineers, contractors, and regulatory bodies. Coordinating these teams while maintaining project timelines and budgets requires continuous oversight, which traditional manual tracking methods struggle to achieve. The rapid expansion of the construction industry, with a forecasting of USD 4.2 Trillion increase in global construction work over the next 15 years, underscores the growing need for advanced monitoring solutions. Construction cameras provide real-time visual data, enabling project managers and stakeholders to remotely monitor the construction site, make informed decisions, and address any potential problems promptly. The ability to capture high-resolution images or videos at regular intervals helps document the entire construction process, facilitating project management, communication, and analysis.

Significant rise in using digital technologies and connectivity

Continual advancements in digital imaging, remote access, and cloud storage are leading to powerful and efficient construction cameras, which are positively influencing the construction camera market outlook. Digital technologies enable construction cameras to capture high-resolution images or videos, offering superior visual documentation of construction projects. According to the UN Trade & Development, internet of things (IoT) devices is projected to surge 2.5 times from 2023 to 39 Billion by 2029. The availability of remote access and connectivity allows stakeholders to monitor construction sites in real time from any location, improving project management and decision-making. Additionally, cloud storage enables easy and secure storage of construction data, facilitating seamless collaboration and sharing among project teams. The integration of digital technologies and connectivity enhances the functionality and convenience of construction cameras, thus accelerating their adoption worldwide.

Better site safety and security offered by construction cameras

Construction cameras act as a deterrent to theft, vandalism, and unauthorized access, thereby enhancing site security. They also enable real-time monitoring of construction sites, allowing for early detection and response to safety hazards or emergencies. The industry reports revealed that 70% of construction workers witness theft on-site every year, causing delays to at least one-third of projects. In addition to security, these cameras help towards a safer work environment by promoting proactive safety control. Live streaming enables project managers to observe activities on-site while away from the site, ensuring observance of safety procedures and anticipating dangerous conditions that may lead to accidents. With the ability to record potential risks, unsafe habits, or deviations from compliance rules, these cameras promote accountability in that companies can instil safety requirements effectively. The assurance of a safer working environment attracts construction companies and project stakeholders to invest in construction cameras.

Construction Camera Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global construction camera market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, power, application, and distribution channel.

Analysis by Product Type:

- Fixed Camera

- PTZ (Pan-Tilt-Zoom) Camera

- Indoor Camera

- Mobile Camera Trailers

Fixed cameras play a crucial role in the construction camera market by providing continuous surveillance of specific areas. They are stationary and offer a fixed field of view, making them suitable for monitoring critical locations like entrances, exits, and construction sites. Fixed cameras are cost-effective, easy to install, and require minimal maintenance, making them widely adopted in construction projects for site security and monitoring purposes.

PTZ (Pan-Tilt-Zoom) cameras are highly versatile and offer flexible coverage of construction sites. They can pan, tilt, and zoom, allowing operators to remotely control the camera's movement and adjust the field of view. PTZ cameras provide wide coverage and the ability to focus on specific points of interest, making them ideal for tracking activities, capturing detailed footage, and monitoring large construction sites.

Indoor cameras are specifically designed for surveillance within indoor environments, such as construction offices, storage areas, or workshops. They are compact, discreet, and offer high-resolution video capture. Indoor cameras are crucial for monitoring activities in confined spaces, ensuring safety compliance, and preventing theft or unauthorized access to construction equipment and materials.

Analysis by Power:

- AC (Alternating Current) Power Driven

- DC (Direct Current) Power Driven

- Solar Power Driven

AC power, also known as alternating current, drives the construction camera market by providing a reliable and consistent power source for camera systems. AC power is readily available in most construction sites through electrical outlets, allowing cameras to operate continuously without the need for frequent battery changes. It ensures uninterrupted surveillance and data capture, making it a popular choice for construction camera installations.

DC power, or direct current, is commonly used in construction camera systems that require flexibility and portability. DC-powered cameras can be powered by batteries, making them suitable for remote or temporary construction sites where access to AC power may be limited. They offer the advantage of being easily deployable and not reliant on an external power source, enhancing their versatility and enabling surveillance in various locations.

Solar power plays a significant role in the construction camera market by providing a sustainable and environment-friendly power solution. Solar-powered construction cameras utilize solar panels to convert sunlight into electricity, allowing them to operate independently without the need for grid power or batteries. This reduces the reliance on traditional power sources, lowers operational costs, and enables surveillance in off-grid or environment-sensitive areas.

Analysis by Application:

- Jobsite Progress Monitoring

- Security and Surveillance

- Marketing and Promotion

Security and surveillance lead the market with around 44.8% of market share in 2024. Construction sites are susceptible to equipment theft, unauthorized entry, and safety risks, and surveillance cameras are necessary for risk reduction. High-definition cameras with night vision, motion detection, and remote access capabilities enable project managers to monitor site activity 24/7. Such cameras also act as excellent evidence during disputes or accidents, ensuring regulatory compliance and responsibility. Moreover, the combination of artificial intelligence (AI) and cloud-based analytics provides more effective proactive security features by identifying anomalies and triggering real-time alerts. As smart construction technologies gain greater adoption, security, and surveillance uses are increasingly becoming the drivers for investment in construction camera systems. Their capacity to enhance site productivity, labor safety, and project openness makes them an essential part of contemporary construction site management

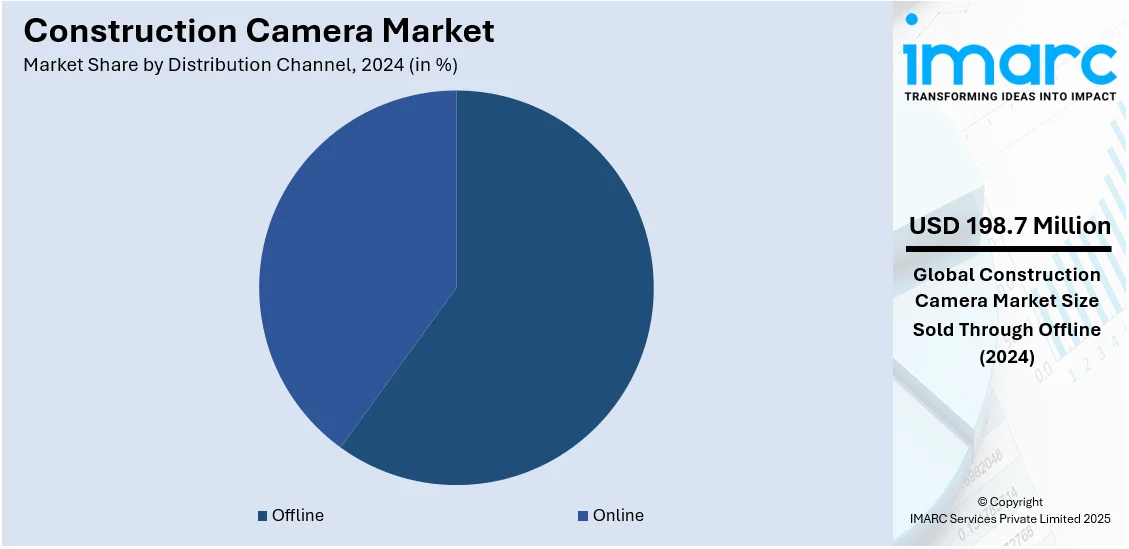

Analysis by Distribution Channel:

- Online

- Offline

Offline leads the market with around 60.2% of market share in 2024. Offline distribution channels, such as physical stores and authorized dealers, remain significant in the construction camera market. These channels provide a tangible experience for customers to interact with the cameras, seek expert advice, and make informed purchasing decisions. Offline channels also offer the advantage of immediate availability, allowing customers to obtain the product instantly without the need for shipping or waiting periods. The offline distribution also supports bulk buying, tailor-made solutions, and after-sales services. Furthermore, direct contact with vendors also provides buyers with access to installation services, warranty advantages, and technical assistance, which are not always ensured through online channels. Though digital channels are expanding, offline distribution retains its dominance in markets where trust, dependability of services, and tangible demonstration play an important role in decision-making in procurement.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 37.5%. The region is experiencing significant infrastructure development, with numerous construction projects in sectors such as residential, commercial, industrial, and transportation. The demand for construction cameras to monitor and document these projects is consequently high. Additionally, rapid urbanization, population growth, and economic expansion in countries like China, India, and Southeast Asian nations are driving construction activities. Construction cameras are essential for ensuring project efficiency, safety, and quality, thus contributing to their widespread adoption. Moreover, advancements in technology, increasing digitalization, and the availability of affordable and reliable internet connectivity in many parts of Asia Pacific have facilitated the adoption of construction cameras. These factors are propelling the region to become the largest market for construction cameras, catering to the needs of a vibrant and expanding construction industry.

Key Regional Takeaways:

United States Construction Camera Market Analysis

The United States holds a substantial share of the North America solar freezer market with 86.70% in 2024. The market is experiencing strong growth due to the increasing adoption of advanced surveillance and project management solutions. Rising infrastructure development, including commercial, residential, and industrial projects, is driving demand for high-resolution construction cameras. The integration of AI, cloud computing, and IoT-based solutions in cameras has revolutionized the market by enabling real-time monitoring, security enhancement, and project efficiency through time-lapse recording and remote access features. Additionally, the growing focus on reducing project delays and optimizing workflow has increased the adoption of 360-degree cameras and drone-based surveillance solutions. The U.S. Department of Energy states that USD 97 Billion has been funded by the Infrastructure Investment and Jobs Act and Inflation Reduction Act, prioritizing infrastructure renewal, manufacturing, job creation, and competitiveness. This large-scale investment is driving demand for advanced construction technologies, including surveillance solutions, to ensure project efficiency and safety compliance. The expansion of smart city initiatives and government investments in public infrastructure are further fueling demand. Construction companies are also leveraging AI-powered analytics to monitor job sites, detect safety hazards, and prevent unauthorized access.

Europe Construction Camera Market Analysis

The European construction camera market is experiencing steady growth due to infrastructure investments and digital monitoring solutions. These cameras enhance project security, track progress, and improve efficiency. Companies are using high-resolution cameras with AI-powered analytics for site monitoring time-lapse photography and remote access features for site management. Additionally, the rise of smart cities and large-scale infrastructure projects is boosting demand for cloud-based and IoT-enabled construction cameras. The integration of AI in surveillance systems allows for automated safety alerts, unauthorized access detection, and predictive analytics to mitigate risks. Theft remains a major concern for the construction industry, with industry estimating an annual cost of £800 Million (USD 1022.6 Million) due to theft. This has led to increased adoption of security-focused construction cameras with motion detection and remote monitoring capabilities. The construction camera market is expected to experience sustained growth due to increased awareness about sustainability and energy-efficient practices, as well as increased investment in public infrastructure and renewable energy projects.

Asia Pacific Construction Camera Market Analysis

The Asia Pacific construction camera market is growing rapidly due to increasing urbanization, infrastructure development, and smart city initiatives. The rising number of large-scale residential, commercial, and industrial projects has heightened the demand for advanced surveillance solutions. Construction companies are adopting high-resolution cameras with time-lapse recording, AI-driven analytics, and remote monitoring capabilities to enhance security and productivity. The expansion of 5G networks and cloud-based storage solutions is further improving real-time site monitoring. Additionally, governments in the region are heavily investing in transportation, energy, and housing projects, driving the need for enhanced construction monitoring solutions. India’s infrastructure sector, for example, is set for robust growth, with planned investments of USD 1.4 Trillion by 2025, according to the India Brand Equity Foundation. The adoption of drone-based surveillance and AI-powered safety compliance tools is gaining momentum, reducing risks and improving efficiency. With increasing concerns about theft, unauthorized site access, and worker safety, construction firms are integrating automated security cameras.

Latin America Construction Camera Market Analysis

The Latin America construction camera market is expanding due to increasing construction activities in residential, commercial, and industrial sectors. The demand for high-resolution construction cameras is rising as companies seek to improve site security, monitor progress, and prevent unauthorized access. Government investments in large infrastructure projects, including transportation and energy sectors, are further driving adoption. The use of AI-based analytics, time-lapse recording, and remote monitoring solutions is gaining traction, improving efficiency and safety compliance. Additionally, the growing adoption of drone surveillance for large-scale projects is enhancing site visibility. With Brazil’s construction market reaching USD 150.0 Billion in 2024 and projected to grow at a CAGR of 4% to USD 211.4 Billion by 2033, demand for advanced monitoring solutions is expected to rise, ensuring greater security and operational efficiency in the region.

Middle East and Africa Construction Camera Market Analysis

The Middle East and Africa construction camera market is experiencing growth due to infrastructure development and urban expansion, with large-scale projects like smart cities, commercial buildings, and transportation networks driving demand for advanced cameras, AI-powered surveillance, and real-time monitoring. Government investments in mega projects and public infrastructure initiatives are further supporting market growth. With Saudi cities expanding, reports predict a doubling of residential and commercial floor space by 2060, while Riyadh aims to double its population to 15-20 Million by 2030, increasing demand for construction monitoring solutions. Additionally, the adoption of cloud-based and solar-powered construction cameras is rising in remote areas, ensuring continuous site monitoring. With ongoing technological advancements, the market is expected to see steady expansion.

Competitive Landscape:

The market is characterized by a moderate level of competition and a moderate threat of new entrants. The market is dominated by several established players selling a variety of construction camera solutions, including software and hardware aspects. The players have well-developed distribution networks, brand identities, and customers, which constitute barriers to market entry for the new entrants. Furthermore, the construction camera industry is dynamic and changing, with advances in technology consistently influencing the sector. This provides room for new players with novel solutions or specialty products to acquire market share. The development of digital technologies, including high-definition imaging, cloud storage, and remote access, further creates opportunities for new entrants to provide sophisticated features and functionality. Also, the rising need for construction cameras, fueled by project complexity, safety needs, and documentation requirements, provides space for new entrants to target niche market segments or meet emerging customer needs. The industry's increased emphasis on digitization and connectivity further the market potential for new entrants with innovative solutions.

The report provides a comprehensive analysis of the competitive landscape in the construction camera market with detailed profiles of all major companies, including:

- Brinno Incorporated

- CamDo Solutions Inc.

- Digilant (Moreton Bay Systems)

- EarthCam Inc

- Ecamsecure (Garda World)

- Enlaps

- iBEAM Systems Inc.

- OxBlue Corporation (Hexagon AB)

- Sensera Systems

- TrueLook Construction Cameras

- US Relay Corporation

Latest News and Developments:

- December 2024: EarthCam announced new features for its SolsticeCam, a budget-friendly, solar-powered construction camera with AI object detection, analytics, and continuous video recording. The upgraded model offered improved battery capacity, live streaming, encrypted storage, and project management integration. Designed for unpowered job sites, it enhanced security, safety, and productivity with advanced monitoring capabilities.

- October 2024: ECAMSECURE introduced three upgraded Mobile Surveillance Units (MSUs) at GSX 2024. The new products included digital signage with AI-driven messaging, a hybrid MSU with a methanol generator for uninterrupted power, and a police department-spec MSU designed with LAPD. These innovations enhanced security, resilience, and AI-powered threat detection capabilities.

- September 2024: Enlaps launched the Tikee 4, a high-tech time-lapse camera for professionals. Featuring dual 4K lenses, a 220° field of view, solar power, and 4G LTE connectivity, it offers remote monitoring and weather resistance. Ideal for construction, environmental studies, and filmmaking, it supports up to 6K resolution and seamless cloud integration.

- December 2024: Sensera Systems introduced AI-powered updates to SiteCloud, enhancing job site monitoring and decision-making. The cloud-based software converts visual data into actionable insights, improving safety, security, and efficiency. AI processes large amounts of imagery, reducing the need for physical site visits, increasing visibility, and ensuring projects stay on schedule, within budget, and meet specifications.

- October 2024: TrueLook introduced TrueShield, an advanced security system for builder’s risk insurance. It features multi-camera setups, infrared imaging, audiovisual deterrents, real-time talk-down communication, and a tamper-proof battery backup. Available in three configurations, TrueShield enhances job site protection. CEO Roger Yarrow emphasized its role in providing peace of mind and meeting industry security standards.

Construction Camera Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Fixed camera, PTZ (pan-tilt-zoom) camera, Indoor camera, Mobile camera trailers |

| Powers Covered | AC (alternating current) power driven, DC (direct current) power driven, solar power driven |

| Applications Covered | Jobsite progress monitoring, security and surveillance, marketing and promotion |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Brinno Incorporated, CamDo Solutions Inc., Digilant (Moreton Bay Systems), EarthCam Inc., Ecamsecure (Garda World), Enlaps, iBEAM Systems Inc., OxBlue Corporation (Hexagon AB), Sensera Systems, TrueLook Construction Cameras, US Relay Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the construction camera market from 2019-2033.

- The construction camera market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the construction camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The construction camera market was valued at USD 330.02 Million in 2024.

The construction camera market is projected to exhibit a CAGR of 7.05% during 2025-2033, reaching a value of USD 628.77 Million by 2033.

The market is driven by increasing adoption of remote project monitoring, rising demand for real-time surveillance to enhance site security, advancements in artificial intelligence (AI)-powered analytics, integration with BIM and cloud-based solutions, and regulatory compliance for safety. Growing infrastructure projects further accelerate market growth.

Asia Pacific currently dominates the construction camera market, accounting for a share of 37.5% in 2024. The dominance is fueled by rapid urbanization, large-scale infrastructure projects, smart city initiatives, government investments in construction safety, and widespread adoption of AI-driven surveillance and IoT-enabled monitoring solutions.

Some of the major players in the construction camera market include Brinno Incorporated, CamDo Solutions Inc., Digilant (Moreton Bay Systems), EarthCam Inc., Ecamsecure (Garda World), Enlaps, iBEAM Systems Inc., OxBlue Corporation (Hexagon AB), Sensera Systems, TrueLook Construction Cameras, and US Relay Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)