Construction 4.0 Market Size, Share, Trends and Forecast by Solution, Technology, Application, End User, and Region, 2025-2033

Construction 4.0 Market Size and Share:

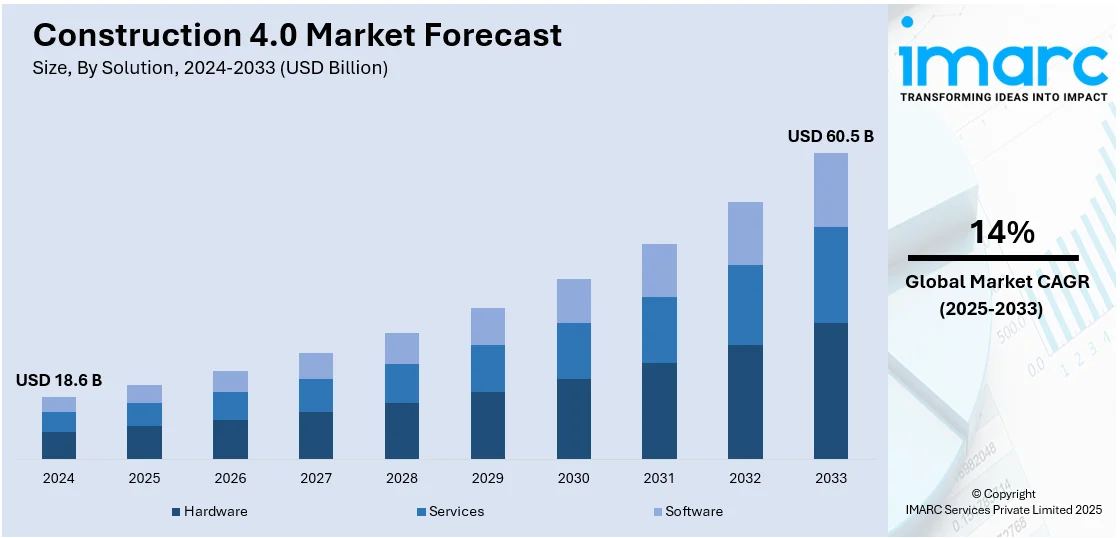

The global construction 4.0 market size was valued at USD 18.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 60.5 Billion by 2033, exhibiting a CAGR of 14% during 2025-2033. North America currently dominates the market, holding a significant market share of over 44.9% in 2024. The growing adoption of advanced technologies to improve efficiency, rising demand for enhanced collaboration and communication, and increasing focus on sustainability and resource optimization in various industries are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 18.6 Billion |

|

Market Forecast in 2033

|

USD 60.5 Billion |

| Market Growth Rate (2025-2033) | 14% |

The increasing adoption of the Internet of Things (IoT) devices across various sectors is one of the major factors propelling the construction 4.0 market growth. Moreover, the growing reliance of IoT devices, such as smart home gadgets, wearable technology, industrial sensors, and automated vehicles, on seamless wireless communication is fostering market growth. For instance, in 2024, Qualcomm introduced the 8-core Snapdragon X Plus chip, offering 45 TOPs AI performance with Oryon CPU architecture, delivering power efficiency, all-day battery life, and enabling $700 Copilot+ PCs. In this context, RF front-end modules enable these devices to connect and communicate effectively over wireless networks by managing signal amplification, filtering, and switching. This trend is further amplified by advancements in wireless communication standards like Wi-Fi 6 and Bluetooth Low Energy, which enhance the performance of IoT applications. Along with this, the development of new RF front-end technologies that offer better power efficiency, integration capabilities, and performance characteristics is favoring market growth. Consequently, the adoption of IoT devices and advancements in wireless communication technologies directly contribute to the digital transformation in construction.

The United States is a key market disruptor, with the widespread expansion of fifth-generation (5G) network infrastructure. The increasing investment by telecom providers in deploying 5G technology to meet consumer demand for faster data speeds and improved connectivity is fostering market growth. For instance, in 2024, T-Mobile acquired US Cellular for $4.4 billion, including customers, stores, and assets, to add 5G coverage in rural areas and cut phone plan prices. In this context, construction 4.0 plays a critical role in supporting multiple 5G devices and infrastructure through the efficient transmission and reception of signals at higher frequencies.

Construction 4.0 Market Trends:

Rising adoption of advanced technologies to improve efficiency

The rising adoption of advanced technologies, such as building information modeling (BIM) and data analytics, is contributing to the growth of the market. Additionally, BIM enables comprehensive digital representation of a construction project and facilitates better planning, coordination, and visualization. It also optimizes resource allocation, minimizes errors, and enhances project efficiency. For instance, in November 2021, Building Information Modeling (BIM) adoption in the U.S. reached nearly 80%, with over 98% of large architecture firms utilizing it, signaling the industry’s maturation, as noted by Geoffrey Jennings, Director of BIModular. The hybrid transition of combining 2D and 3D methods continues, driven by automation, customization, and tools like Agacad's Revit add-ons, thereby fostering innovation and efficiency in construction processes. On the other hand, data analytics provides insights into project performance and allows for informed decision-making and risk mitigation. Stakeholders are rapidly seeking enhanced operational efficiency and cost-effective solutions in the construction industry. As a result, these technologies help smoothen out project timelines and scale down the overall costs of a business.

Growing demand for enhanced collaboration and communication

The increasing demand for digitalization in construction due to the rising number of complexities in construction projects is offering a positive market outlook. For instance, a 2020 IFS survey revealed that over 75% of construction companies planned to increase their digital transformation investments, aiming to enhance efficiency and competitiveness. Moreover, there is an increase in the demand for improved collaboration and communication among stakeholders. Digital platforms and the Internet of Things (IoT) devices play an essential role in enabling real-time information sharing and seamless coordination among various teams and disciplines. In addition, these solutions benefit in enhancing transparency, reducing misunderstandings, and improving decision-making processes by connecting project members remotely and on-site. Furthermore, the ability to collaborate effectively promotes smoother project execution, fewer delays, and improves overall project outcomes.

Increasing focus on sustainability and resource optimization

The rising focus on sustainability and resource optimization in the construction industry is supporting the growth of the market. In addition, there is a rapid integration of advanced technologies that maintain environmental sustainability while reducing carbon emissions in the environment. For instance, sustainable construction, driven by Construction 4.0 technologies, aims to optimize resources and drastically reduce embodied carbon, which accounts for 15% of global greenhouse gas emissions. With cities projected to house 70% of the population by 2050, embracing low-carbon materials like timber and bamboo, alongside innovative practices, is critical to mitigate the construction sector's significant environmental footprint, which consumes 50% of raw materials globally. Apart from this, smart sensors and energy-efficient systems are integrated into buildings and construction processes to monitor energy consumption, water usage, and waste generation, and enhance resource optimization. This data-driven approach allows for the identification of areas where resources can be conserved, which further leads to cost savings and reduced environmental impact. Furthermore, the rising demand for these solutions among investors to maintain sustainability goals and address resource scarcity is positively influencing the market.

Construction 4.0 Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global construction 4.0 market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on solution, technology, application, and end user.

Analysis by Solution:

- Hardware

- Services

- Software

Hardware stands as the largest solution in 2024, holding around 42.1% of the market share. Hardware refers to tangible technological devices and equipment that are integrated into construction processes to enable digital transformation. This includes a wide range of devices, such as sensors, drones, three-dimensional (3D) printers, robots, and wearable technology. They are crucial in gathering real-time data, facilitating automation, enhancing communication, and optimizing resource utilization. Moreover, sensors and drones provide accurate data for monitoring progress and identifying potential issues. In addition, 3D printers and robots assist in automating tasks and improving efficiency and precision while wearable technology enhances worker safety and productivity.

Analysis by Technology:

- IoT

- Artificial Intelligence

- Industrial Robots

- Others

IoT leads the market with around 78.5% of market share in 2024. IoT is a network of interconnected devices and objects that collect, exchange, and analyze data through the internet. In construction, IoT plays a vital role by enabling real-time monitoring, automation, and data-driven decision-making. IoT devices, such as sensors and wearable technology, are embedded within construction sites and equipment to collect valuable information on factors, such as temperature, humidity, equipment performance, and worker activities. This data is then transmitted and processed to offer insights that enhance project management, resource allocation, and safety protocols.

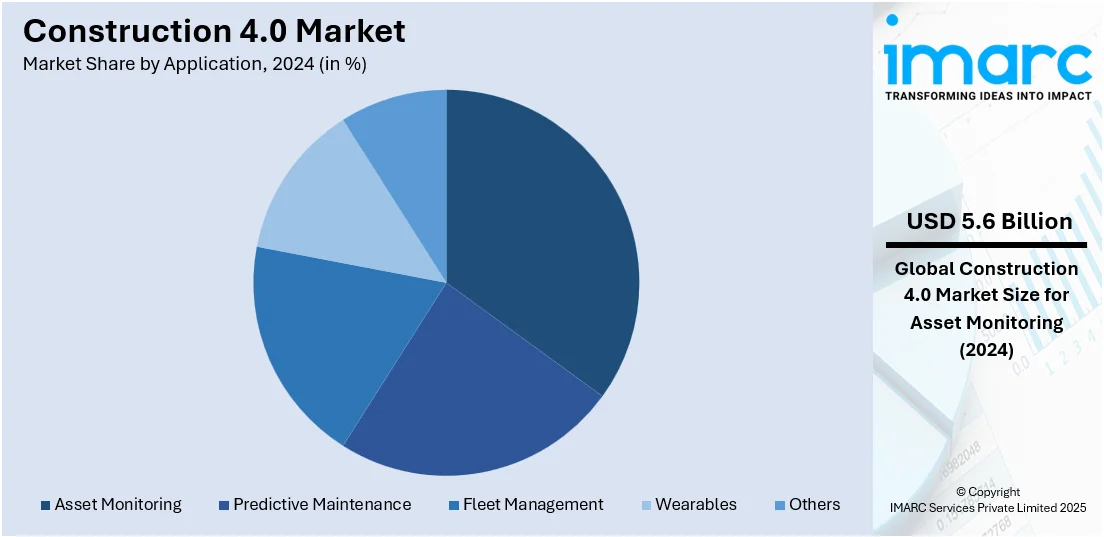

Analysis by Application:

- Asset Monitoring

- Predictive Maintenance

- Fleet Management

- Wearables

- Others

Asset monitoring leads the market with around 30.1% of the market share in 2024. Asset monitoring involves the continuous surveillance and analysis of physical assets throughout their lifecycle, ranging from construction equipment and machinery to complete structures. This practice comprises various technologies, such as sensors, a global positioning system (GPS), and data analytics, to track asset performance, location, and condition in real time. In line with this, it enhances operational efficiency by enabling predictive maintenance, optimizing resource utilization, and preventing downtime. It also aids in inventory management and improving asset lifespan. Apart from this, it minimizes operational disruptions, lowers maintenance costs, and enhances the overall project cost-effectiveness by offering insights into asset utilization patterns and potential issues.

Analysis by End User:

- Residential

- Non-residential

Non-residential leads the market with around 57.9% of the market share in 2024. Non-residential buildings include commercial, industrial, institutional, and infrastructure development. These entities require diverse construction solutions that align with their specific operational needs. In commercial projects, construction 4.0 optimizes space utilization and energy efficiency. In industrial settings, it enhances production facilities through smart manufacturing processes. Apart from this, it aids in creating smart educational and healthcare facilities in the institutional sphere. Additionally, for infrastructure development, it benefits in creating intelligent transportation systems and sustainable utilities. Furthermore, it enhances project outcomes, operational efficiency, and sustainability.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 44.9%. The region leads the construction 4.0 market due to its early adoption of advanced technologies, significant investments in digital transformation, and strong presence of key technology providers. The region's well-established construction sector integrates IoT, robotics, AI, and BIM to improve efficiency and project outcomes. Supportive government initiatives, such as smart city development programs, further accelerate the adoption of construction 4.0 solutions. Additionally, North America benefits from a high concentration of skilled professionals and advanced infrastructure, enabling seamless implementation of these technologies. The region's focus on sustainability and productivity enhancements also drives demand for innovative solutions in construction processes.

Key Regional Takeaways:

United States Construction 4.0 Market Analysis

US accounts for 88.9% of the market share in North America. The adoption of Construction 4.0 is positioning the United States as a leader in modernizing the construction industry. Leveraging advanced methodologies such as modular construction, 3D printing, and Building Information Modeling (BIM), the U.S. is driving efficiency, reducing project timelines, and minimizing material wastage. Key states like California and Texas are leading in implementing these technologies, particularly in urban centers where infrastructure demands are high. For instance, according to the Associated General Contractors (AGC) of America, Inc., the U.S. construction industry, with over 919,000 establishments, 8 Million employees, and USD 2.1 Trillion in annual output, is a cornerstone of Construction 4.0, driving innovation in manufacturing, mining, and service integration. Its scale and economic influence position it as a key enabler of advanced digital and automated construction practices. The advantages for the United States are significant: first, improved sustainability practices are reducing environmental impacts, making the country a global leader in green construction; second, the workforce benefits from enhanced safety standards through digital simulations and predictive planning; third, local economies across various regions are experiencing growth as smart construction projects generate employment opportunities and attract investments. With innovative approaches transforming the landscape, the U.S. is setting a benchmark for countries aiming to integrate Construction 4.0 into their development strategies.

Asia Pacific Construction 4.0 Market Analysis

The adoption of Construction 4.0 in Asia-Pacific is revolutionizing the region's infrastructure development through innovative practices and advanced technologies. This approach is fostering sustainable construction, enabling energy-efficient designs and minimizing environmental impact. Key advancements include the integration of smart machinery and automation, which streamline operations and enhance productivity across diverse geographical terrains. For instance, according to the United Nations Population Fund (UNFPA), the Asia and the Pacific region account for 60% of the world’s population, representing approximately 4.3 Billion people. This region includes the world's two most populous nations, China and India, which together drive significant demand for infrastructure development, urbanization, and housing projects. This demographic pressure not only necessitates large-scale construction activities but also fuels the growth of Construction 4.0. These advancements, supported by government spending and recovery from COVID-19 setbacks, position the region as a leader in smart construction technologies and digital transformation. Asia-Pacific’s strategic position as a manufacturing and industrial hub provides access to essential resources and skilled labor, supporting large-scale implementation of modern construction techniques. Countries like China, India, Japan, and Australia are leveraging this innovation to accelerate urbanization and improve regional connectivity. Three advantages stand out: enhanced project efficiency, reduced operational costs, and improved safety standards on construction sites. This transformative shift is solidifying Asia-Pacific’s leadership in modern construction, offering a blueprint for global infrastructure evolution.

Europe Construction 4.0 Market Analysis

The Europe is embracing Construction 4.0, revolutionizing the industry through advanced digital tools and innovative methodologies. The region stands out due to its proactive adoption of sustainable building practices, robust infrastructure development policies, and a skilled workforce equipped to adapt to modern technologies. According to Robotnik, Europe's construction sector, comprising 3.4 Million companies and employing 12.7 Million people with an added value of approximately USD 574.8 Billion in 2022, is advancing through Construction 4.0. This digital transformation leverages robotics, BIM, and advanced technologies to address challenges like productivity, safety, and sustainability, as highlighted by initiatives like the EU-funded BIMprove project. Construction 4.0 is enhancing efficiency, reducing costs, and promoting eco-friendly solutions across countries like Germany, France, and Italy. Regions like Scandinavia are leading with green construction, while Central Europe leverages precision engineering to achieve excellence. The continent benefits from enhanced cross-border collaboration, streamlined construction workflows, and reduced environmental footprints. Europe’s strong regulatory frameworks, emphasis on training programs, and commitment to renewable energy integration position it as a global leader in the smart construction ecosystem. This transition is strengthening urban development while ensuring resilience and sustainability in the built environment.

Latin America Construction 4.0 Market Analysis

The Latin American construction sector is experiencing a significant transformation through the adoption of Construction 4.0 technologies, which integrate advanced digital tools to enhance efficiency, sustainability, and project outcomes. Key drivers of this evolution include the implementation of Building Information Modeling (BIM), the Internet of Things (IoT), and Artificial Intelligence (AI), all of which are revolutionizing resource optimization and project management. Brazil and Mexico are at the forefront of this technological shift. In Brazil, the Ministry of Development, Industry, Trade, and Services (MDIC) has launched the Construa Brasil Project, introducing comprehensive guides that detail the integration of Industry 4.0 technologies into construction practices. These guides offer valuable insights for construction companies and technology developers, aiming to enhance productivity, efficiency, and sustainability.

Middle East and Africa Construction 4.0 Market Analysis

The adoption of Construction 4.0 is revolutionizing the Middle East and Africa, fostering improved project efficiency, sustainability, and safety across diverse regions. Advanced technologies are enabling real-time collaboration among key stakeholders, ensuring seamless project execution in countries like the UAE, Saudi Arabia, South Africa, and Nigeria. Innovations in digital modeling and automation are addressing labor shortages while reducing environmental impact. For instance, according to RAKEZ, the UAE construction sector is undergoing a digital transformation, with the adoption of Construction 4.0 technologies like AI, robotics, and 3D printing driving innovation. Supported by government initiatives to digitize 1,000 services and deploy 20,000+ Wi-Fi hotspots, the market is set for rapid growth, enhancing sustainability and competitiveness in a USD 333 Billion industry. Strategic positioning near global trade hubs enhances resource access and connectivity. The Middle East and Africa benefit from enhanced infrastructure development, reduced operational costs, and accelerated project timelines, driving economic growth and urbanization across states and cities in these regions.

Competitive Landscape:

The competitive landscape of the construction 4.0 market is characterized by a mix of established players and innovative startups leveraging advanced technologies to transform the construction sector. Key players include major technology firms, construction software providers, and equipment manufacturers integrating IoT, AI, robotics, and BIM solutions. Companies are increasingly focusing on digital tools, while startups are driving innovation in 3D printing, modular construction, and AI-powered solutions. Strategic partnerships, mergers, and acquisitions are common as firms seek to expand capabilities. The competitive environment is shaped by rapid technological advancements and a growing emphasis on sustainability and productivity. For instance, in November 2024, ABB announced the completion of a second strategic investment in Pratexo, a U.S.-based edge-to-cloud software provider, to co-develop advanced digital solutions. This partnership focuses on enhancing real-time analytics for electrical infrastructure, improving reliability, cost-efficiency, and sustainability across industrial, utility, and infrastructure sectors. The collaboration aims to launch new solutions by 2025, enabling faster decision-making and extended asset lifespans.

The report has also analysed the competitive landscape of the market with some of the key players being:

- ABB Ltd.

- Autodesk Inc

- Brickeye

- CalAmp Corp.

- Hexagon AB

- Hilti Corporation

- Mitsubishi Electric Corporation

- Oracle Corporation

- Topcon Corporation

- Trimble Inc.

Latest News and Developments:

- In October 2024, Caterpillar Inc. and Trimble have extended their long-standing joint venture, Caterpillar Trimble Control Technologies (CTCT), to enhance the distribution of grade control solutions in the construction sector. Established in 2002, CTCT has been instrumental in delivering products that improve jobsite safety and productivity. The renewed agreement aims to broaden the availability of interoperable grade control solutions through a flexible platform accessible to Caterpillar, Trimble, and other technology providers and equipment manufacturers.

- In November 2022, Trimble and the Hilti Group, a global leader providing innovative tools, technology, software, and services to the commercial construction industry, announced that the Hilti ON!Track asset management system will integrate with Trimble Viewpoint Vista, an ERP solution within the Trimble Construction One suite. This will allow contractors to track and manage their tools and equipment.

- In 2021, CalAmp announced the launch of its iOn™ fleet and asset management software in the U.K. through its subsidiary, Tracker Network (UK) Limited. This innovative software aims to enhance operational efficiency and enable smarter decision-making for fleet operators. The platform integrates real-time data analytics and advanced tracking capabilities to optimize fleet performance and asset utilization.

- In January 2023, Topcon Positioning Systems announced the expanding of compact solutions portfolio with 2D-MC automatic grade control solution for compact track loaders. 2D-MC is a low-cost 2D machine control system that is designed to be installed directly onto select grading attachments and provide simplified operational visibility.

Construction 4.0 Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered | Hardware, Software, Services |

| Technologies Covered | IoT, Artificial Intelligence, Industrial Robots, Others |

| Applications Covered | Asset Monitoring, Predictive Maintenance, Fleet Management, Wearables, Others |

| End Users Covered | Residential, Non-residential |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Autodesk Inc, Brickeye, CalAmp Corp., Hexagon AB, Hilti Corporation, Mitsubishi Electric Corporation, Oracle Corporation, Topcon Corporation, Trimble Inc. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the construction 4.0 market from 2019-2033.

- The construction 4.0 market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the construction 4.0 industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Construction 4.0 is described as the integration of high-tech digital technologies, automation, and data driven solutions in the construction industry, which companies applications such as BIM, IoT, AI, robotics, and 3D printing enabling efficiency, precision, and sustainability and transforming traditional processes of construction into smarter approaches with new innovation.

The global construction 4.0 market was valued at USD 18.6 Billion in 2024.

IMARC estimates the global construction 4.0 market to exhibit a CAGR of 14% during 2025-2033.

Main driving factors in the global construction 4.0 include an increased adoption of digital technologies such as IoT, AI and BIM, rising demand for resource efficiency, increasing infrastructure projects, and enhancing safety and sustainability. In addition to the above mentioned factors, incorporation of robotics and automation leads to further evolution of the old construction methodologies.

According to the report, hardware represented the largest segment by solution due to the broad penetration of advanced machinery, robotics, and IoT-enabled devices. These are some of the most important technologies for automating construction processes, improving operational efficiency, and ensuring precision, so hardware is a cornerstone of digital transformation in the industry.

IoT leads the market by technology as it allows for real-time monitoring, data collection, and connectivity in construction sites, thereby improving efficiency and safety. Its integration makes possible predictive maintenance, asset tracking, and resource optimization and hence reduces costs and delays. The transformative capabilities of IoT make it an integral component of Construction 4.0 advancements.

Asset monitoring leads in the application as it helps track equipment, materials, and construction resources in real time, reducing the operational costs and increases efficiency. Utilizing technology such as IoT and AI, asset monitoring reduces equipment downtime, optimizes resource management, and helps improve a project's timelines, rendering it an essential part of Construction 4.0.

The largest market share by end-user is non-residential. Non-residential covers large infrastructure projects, commercial buildings, and industrial facilities, which adopt the use of Construction 4.0 technologies very widely. Increased efficiency, safety, and sustainability in complex projects fuel demand for advanced solutions like IoT, BIM, and robotics, and hence makes it a leading segment in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global construction 4.0 market include ABB Ltd., Autodesk Inc, Brickeye, CalAmp Corp., Hexagon AB, Hilti Corporation, Mitsubishi Electric Corporation, Oracle Corporation, Topcon Corporation, Trimble Inc. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)