Connected Mining Market Size, Share, Trends and Forecast by Component, Equipment Type, Software and Services Type, Mining Type, Solution Type, and Region, 2025-2033

Connected Mining Market Size & Share:

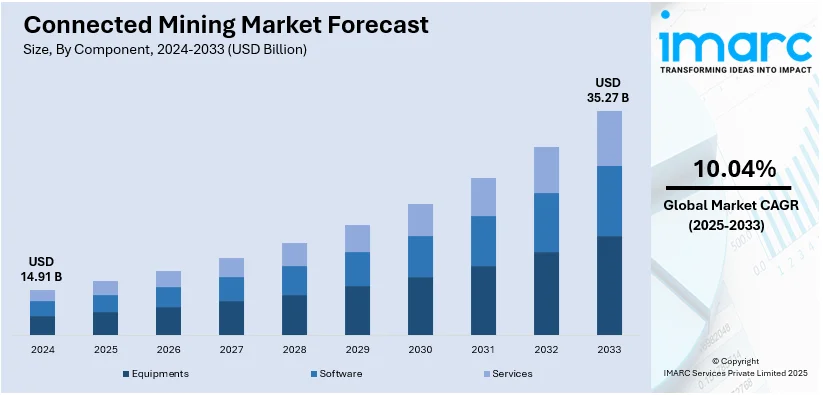

The global connected mining market size is anticipated at USD 14.91 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 35.27 Billion by 2033, exhibiting a CAGR of 10.04% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 37.5% in 2024. Substantial utilization of innovative technologies, heightening mining operations, and amplifying industrialization are some of the factors positively influencing the connected mining market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2025

|

USD 14.91 billion |

|

Market Forecast in 2033

|

USD 35.27 billion |

| Market Growth Rate 2025-2033 | 10.04% |

The global connected mining market is mainly propelled by magnifying requirement for safety in mining operations and superior operational efficacy. Enhancements in cloud computing, IoT, and artificial intelligence (AI) technologies facilitate improved resource management, real-time assessment, and predictive maintenance, lowering both costs and downtime. Escalating global mineral need, combined with the demand for automated sustainable and automated services, is further bolstering adoption. Moreover, stricter regulatory needs for environmental adherence as well as worker safety are incentivizing heavy investments in connected technologies. In addition, the incorporation of automation and analytics in mining applications aids in decision-making, upgrading both profitability and productivity across the industry, thereby aiding in connected mining market growth.

The United States is a crucial player in the global connected mining market, actively utilizing cutting-edge technologies to improve sustainability, safety, and operational efficacy in the mining segment. With a well-structured mining sector and substantial reserves of certain rare earth metals, coal, copper, and gold, the nation has constantly leveraged data analytics, IoT, or automation to advance resource management as well as extraction. For instance, according to the U.S. Energy Information Administration, as of January 1, 2024, the demonstrated reserve base was estimated at 469 billion short tons of coal, making U.S. coal reserves more abundant than the nation’s remaining oil and natural gas resources. In addition, the robust establishment of technology providers and beneficial regulatory policies further boost advancements and deployment of connected services. Furthermore, the U.S. market heavily profits from increasing investments in digital infrastructure, establishing it as a key country in modernizing mining operations across the world.

Connected Mining Market Trends:

Technological Advancements in Mining Operations

A primary factor propelling the connected mining market share is the rapid advancement in technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML). According to the government of UK, the firms providing machine learning-based services or products across industries has elevated to 35% in 2023 from 21% in 2022. These technologies play a pivotal role in transforming traditional mining operations into more efficient, automated, and data-driven processes. The integration of IoT devices allows for real-time monitoring of equipment and environmental conditions, leading to improved safety and productivity. AI and ML algorithms enable predictive maintenance, reducing downtime and operational costs. Additionally, advanced data analytics tools are used for optimizing resource allocation and enhancing decision-making processes. As mines become more digitized, the demand for cybersecurity solutions to protect sensitive data and operations also increases, further driving technological investments in the mining sector, thus creating a positive connected mining market outlook.

Increasing Focus on Safety and Sustainability

The growing emphasis on safety and environmental sustainability in mining operations is resulting in connected mining market demand. Connected technologies enable real-time monitoring of mine sites, improving worker safety by predicting hazardous situations and reducing accident risks. These technologies also facilitate remote operations, which can minimize the need for human presence in dangerous environments. Moreover, sustainability concerns are leading to the adoption of systems that can monitor and reduce the environmental impact of mining activities. For example, technologies that track energy consumption and emissions help in adhering to environmental regulations and reducing carbon footprints. According to the IEA, energy-related CO2 emissions increased by 0.9% in 2022, surpassing 36.8 Gigatons. The use of connected technologies in water and waste management ensures more sustainable resource usage. Governments and regulatory bodies are increasingly mandating the use of such technologies, which further drives the connected mining market demand.

Operational Efficiency and Cost Reduction

The pursuit of operational efficiency and cost reduction is another major factor enhancing the connected mining market outlook. Connected mining technologies offer significant improvements in operational efficiency by enabling better resource management, optimizing mine planning, and reducing wastage. Real-time data collection and analysis lead to more informed and timely decisions, streamlining various mining processes. Automation of repetitive and routine tasks not only increases efficiency but also reduces labor costs and minimizes human errors. Additionally, predictive analytics help in anticipating equipment failures and scheduling maintenance, thereby avoiding costly unplanned downtimes. In an industry where profit margins can be significantly impacted by operational costs, these technologies provide a competitive advantage by enhancing productivity and reducing expenses, making them an essential investment for mining companies. For instance, as per industry reports, geospatial data analytics is a crucial component of the connected mining ecosystem, that can aid in significant 10%-15% costs reduction.

Connected Mining Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, equipment type, software and services type, mining type, and solution type.

Analysis by Component:

- Equipments

- Software

- Services

Equipments stand as the largest component in 2024, holding around 64.4% of the market. The dominance of this segment is chiefly fueled by the growing adoption of advanced machinery integrated with IoT sensors and automation technologies. This segment includes mining trucks, drills, loaders, excavators, and other essential machinery, which are now equipped with real-time monitoring systems to improve operational efficiency. Moreover, the integration of sensors allows for predictive maintenance, reducing downtime and enhancing the lifecycle of critical assets. Additionally, the application of automation technologies enables mines to autonomously operate, reducing human intervention and enhancing safety. As mining companies increasingly prioritize the optimization of equipment performance, the demand for sophisticated connected equipment continues to rise. As per the connected mining market forecast, the growing requirement to mitigate labor shortages, enhance safety standards, and reduce operational costs, will position equipment as a key contributor to the connected mining market growth.

Analysis by Equipment Type:

- Automated Mining Excavators

- Load Haul Dump

- Drillers and Breakers

- Others

The demand for automated mining excavators is propelled by their ability to increase efficiency and productivity while reducing operational costs. These excavators operate with precision and consistency, minimizing human error and enhancing safety in hazardous mining conditions. They are integral to achieving remote and autonomous mining operations, reducing the need for human presence in dangerous underground environments. Furthermore, their integration with digital systems allows for real-time data analysis, optimizing excavation processes and resource allocation.

On the other hand, load haul dump units in connected mining are crucial for efficient material handling and transportation within mining sites. Enhanced with connectivity, these vehicles can be remotely operated, reducing the risk to human operators in hazardous conditions. The integration of LHDs with IoT and data analytics optimizes their routing and scheduling, enhancing operational efficiency.

Moreover, drillers and breakers equipped with advanced technology, are essential for efficient and precise resource extraction. Connectivity allows for real-time monitoring of drilling and breaking operations, ensuring optimal performance and reducing resource wastage. These tools also contribute to enhanced safety by providing immediate feedback on operation conditions and potential hazards.

Analysis by Software and Services Type:

- Data/Operations/Asset Management and Security Software

- Support and Maintenance Services

- System Integration and Deployment Services

- Others

Data/operations/asset management and security software lead the market with around 35.6% of market share in 2024. This type plays a pivotal role in the market by enabling real-time data analysis, streamlining operations, and improving asset management. These software tools enable the consolidation of data from diverse sources, delivering valuable insights into equipment efficiency, upkeep timelines, and operational workflows. Through advanced analytics, mining companies can optimize operational workflows, reduce costs, and make informed decisions about resource allocation. Furthermore, asset management solutions ensure that equipment is tracked and maintained effectively, extending its lifespan and minimizing costly breakdowns. As the industry transitions towards smart mines, the ability to harness big data and automate processes becomes crucial. Consequently, demand for sophisticated data management software is expected to grow rapidly, with companies focusing on maximizing productivity, enhancing safety, and ensuring compliance with environmental standards.

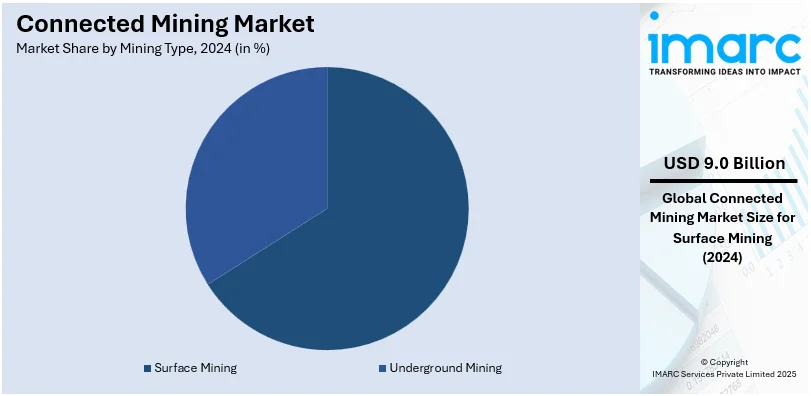

Analysis by Mining Type:

- Surface Mining

- Underground Mining

Surface mining leads the market with around 66.4% of market share in 2024, driven by the comprehensive utilization of leading-edge technologies in open-pit and strip mining operations. This method typically involves the extraction of minerals from the earth’s surface, where the use of automated and connected equipment offers significant benefits in terms of efficiency, safety, and cost reduction. Connected technologies such as remote monitoring, autonomous haul trucks, and smart drilling systems are increasingly deployed in surface mining to enhance productivity and reduce human error. Moreover, surface mining operations tend to be large-scale and capital-intensive, which further drives the adoption of connected solutions to optimize asset utilization and improve overall operational performance. In addition, the growing focus on minimizing environmental impact and improving resource extraction efficiency continues to propel surface mining as the dominant segment in the connected mining market, attracting substantial investments in digital transformation technologies.

Analysis by Solution Type:

- Connected Assets and Logistics Solutions

- Connected Control Solutions

- Connected Safety and Security Solutions

- Remote Management Solutions

- Others

Connected assets and logistics solutions lead the market with around 32.6% of market share in 2024. The connected assets and logistics solutions segment is primarily propelled by the growing awareness regarding the importance of real-time tracking and management of mining assets. Connected solutions enable efficient logistics, optimizing the movement of materials and equipment within the mining site. Moreover, they provide critical data for predictive maintenance, reducing equipment downtime and extending their operational life. Furthermore, these solutions enhance overall supply chain efficiency, crucial in a sector where timely delivery of materials can significantly impact productivity. In addition, the integration of advanced analytics and AI further refines decision-making, while automated systems improve precision in resource allocation. This contributes to cost savings and boosts operational resilience across mining projects.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 37.5%. The connected mining market in Asia Pacific is witnessing significant growth due to the rising adoption of advanced IoT solutions in mining operations, enabling real-time monitoring and predictive maintenance. According to the Ministry of Mines, in the fiscal year 2023-24, the Wholesale Price Index (WPI) for metallic minerals reached 204.2, reflecting an increase from 191.7 recorded in 2022-23 in India. Governments in countries like China and India are increasingly focusing on the modernization of mining operations to improve safety standards, reduce environmental damage, and promote sustainable mining practices. Furthermore, the APAC region is characterized by large, remote mining sites, which makes connected technologies crucial for real-time monitoring, fleet management, and remote operation to overcome geographic and logistical challenges. The amplifying utilization of electric vehicles (EVs) and the demand for battery minerals such as lithium and cobalt are also driving the need for more efficient and connected mining solutions.

Key Regional Takeaways:

United States Connected Mining Market Analysis

In 2024, United States accounted for 61.70% of the market share in North America. The connected mining market in the United States is currently experiencing growth driven by the adoption of advanced IoT solutions tailored to enhance real-time monitoring and predictive maintenance across mining operations. According to the Bureau of Labor Statistics, in 2023, the mining sector accounted for approximately 606.9 Thousand jobs, representing 0.5% of the total nonfarm workforce, while contributing 1.4% to the national GDP. Mining companies are actively integrating automation technologies, including autonomous vehicles and drones, to optimize resource extraction and improve safety standards. The deployment of advanced analytics platforms is enabling the continuous analysis of operational data, helping to reduce equipment downtime and improve decision-making processes. Companies are increasingly leveraging edge computing solutions to manage and process data in remote mining locations with limited connectivity. Additionally, stringent environmental regulations are pushing firms to adopt connected solutions that monitor emissions and ensure compliance. The rising demand for mineral resources essential for clean energy technologies, such as lithium and cobalt, is encouraging the integration of connected systems to maximize yield and operational efficiency in critical mining projects.

North America Connected Mining Market Analysis

In North America, the market is driven by the region's advanced technological infrastructure and the presence of major mining companies. The United States and Canada, with their vast mineral resources, are increasingly adopting these solutions to enhance operational efficiency and worker safety. For instance, according to the Government of Canada, the nation leads the world in potash production and is among the top 5 global producers of diamonds, uranium, gemstones, niobium gold, platinum group metals, indium, and titanium concentrate. Additionally, it ranks as the 4th largest producer of primary aluminum globally. In addition, the focus on sustainable mining practices, along with stringent regulations regarding environmental conservation, is pushing the mining industry towards smart and connected solutions. Moreover, significant investments in R&D by major players in the region are leading to innovations in mining technology, further propelling the market's growth.

Europe Connected Mining Market Analysis

The connected mining market in Europe is witnessing notable growth due to various specific drivers. Mining companies are increasingly adopting advanced IoT and AI technologies to monitor equipment health and optimize operational efficiency in real-time. According to the European Commission, the mining and quarrying sector within the European Union achieved a net turnover of €101.9 Billion (USD 105.7 Billion) in 2021, reflecting a significant growth of nearly 40% compared to the previous year. Governments are implementing stringent regulations on environmental sustainability, encouraging mining operators to deploy connected solutions for emission monitoring and waste management. Companies are integrating predictive maintenance tools, minimizing downtime and amplifying the lifespan of critical machinery. The industry is actively leveraging 5G connectivity to enhance communication and data transfer between remote mining sites and central control hubs. Additionally, the rising focus on worker safety is driving the adoption of wearable devices and connected monitoring systems that detect hazardous conditions.

Latin America Connected Mining Market Analysis

The connected mining market in Latin America is witnessing growth due to mining companies actively adopting IoT solutions for real-time monitoring of equipment and resource usage. According to the International Trade Administration, the revenue of Brazil's mining sector experienced a significant growth of 62% in 2021. Operators are deploying advanced connectivity technologies, such as LTE and 5G networks, to improve operational efficiency in remote mines. In addition to this, governments are implementing regulations to ensure sustainable mining practices, encouraging digital adoption.

Middle East and Africa Connected Mining Market Analysis

The connected mining market in the Middle East and Africa is growing due to the increasing adoption of IoT solutions to optimize resource extraction and equipment performance. Moreover, companies are leveraging advanced analytics for real-time monitoring for mining activities to improve safety and lower downtime. According to the UAE Ministry of Energy and Infrastructure, the government launched the first Mineral Resources Strategy in the UAE. It aims to raise the number of mining companies in the UAE. Additionally, governments are actively promoting digital transformation in the mining bolster both sustainability and efficacy. Furthermore, rising investments in autonomous vehicles and smart machinery are addressing labor shortages and improving operational precision across key mining projects.

Competitive Landscape:

The market is witnessing substantial expansion, driven by the active incorporation of leading-edge technologies, generally encompassing big data analytics, IoT, and AI, into mining operations. This incorporation significantly improves decision-making abilities, operational efficacy, and safety. Leading companies are actively emphasizing on offering integrated, extensive solutions customized to the particular demands of the mining sector. In addition to this, the market is highlighted by a blend of emerging companies specialized in digital services, established technology providers, and mining equipment producers. Moreover, acquisitions and collaborations are also being witnessed increasingly that are positively influencing the competitiveness. For instance, in July 2024, BHP, a leading mining firm that actively leverages connected mining solutions for its operations, and Lundin Mining Corporation announced the strategic acquisition of Filo Corp.'s 100% common share collaboratively. Upon the completion, Lundin Mining and BHP will establish a 50/50 joint venture. Consequently. the competitive landscape is spontaneous, with various firms striving to provide cutting-edge solutions that enhance both sustainability and productivity in mining applications.

The connected mining market research report provides a comprehensive analysis of the competitive landscape in the connected mining market with detailed profiles of all major companies, including:

- ABB Group

- Accenture Plc

- Alastri

- Cisco Systems Inc.

- Hexagon AB

- Intellisense.Io

- Rockwell Automatio

- SAP SE

- Symboticware Inc.

- Trimble Inc.

Latest News and Developments:

- September 2024: At MINExpo 2024, Komatsu unveiled its new Modular ecosystem, building on the success of its industry-leading DISPATCH fleet management system. This innovative suite of interconnected platforms and products is designed to streamline current workflows while establishing a forward-thinking approach to mine site optimization and data utilization.

- April 2023: Axceta, a leader in Internet of Things (IoT) solutions and data visualization, and Point Laz, a specialist in 3D scanning for mining shafts, have announced the launch of a pioneering project aimed at transforming the mining industry. This initiative aligns with the Autonomous Mine Mission – 2030, a strategic initiative by the MISA Group. The project focuses on developing an advanced solution to automate the inspection and ensure the integrity and safety of mining shafts.

- July 2021: AVEVA and Wood have formed a strategic alliance to drive digital transformation across key industries, encompassing mining, energy, power, and chemicals. This collaboration introduced the Connected Build solution, a critical component of their Digital Twin offering, aimed at enhancing operational efficiency and accelerating digital innovation within these sectors.

Connected Mining Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Equipments, Software, Services |

| Equipment Breakup by Types Covered | Automated Mining Excavators, Load Haul Dump, Drillers and Breakers, Others |

| Software And Services Breakup by Types Covered | Data/Operations/Asset Management and Security Software, Support and Maintenance Services, System Integration and Deployment Services, Others |

| Mining Types Covered | Surface Mining, Underground Mining |

| Solution Types Covered | Connected Assets and Logistics Solutions, Connected Control Solutions, Connected Safety and Security Solutions, Remote Management Solutions, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Group, Accenture Plc, Alastri, Cisco Systems Inc., Hexagon AB, Intellisense.Io, Rockwell Automation, SAP SE, Symboticware Inc. Trimble Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the connected mining market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global connected mining market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the connected mining industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The connected mining market size is anticipated at USD 14.91 Billion in 2025.

IMARC estimates the market to reach USD 35.27 Billion by 2033, exhibiting a CAGR of 10.04% during 2025-2033.

Key drivers include the amplifying utilization of both automation technology and IoT, escalating need for better operational efficacy and safety in mining operations, enhancements in data analytics, and heightening investments in sustainable mining methods to cater to the environmental and regulatory policy frameworks.

Asia Pacific currently dominates the connected mining market, accounting for a share exceeding 37.5%. This dominance is fueled by its mega-scale mining operations, technological innovations, and heavy investments pertaining to digital transformation.

Some of the major players in the connected mining market include ABB Group, Accenture Plc, Alastri, Cisco Systems Inc., Hexagon AB, Intellisense.Io, Rockwell Automation, SAP SE, Symboticware Inc. Trimble Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)