Connected Car Market Size, Share, Trends and Forecast by Technology, Connectivity Solution, Service, End Market and Region, 2025-2033

Connected Car Market Size and Share:

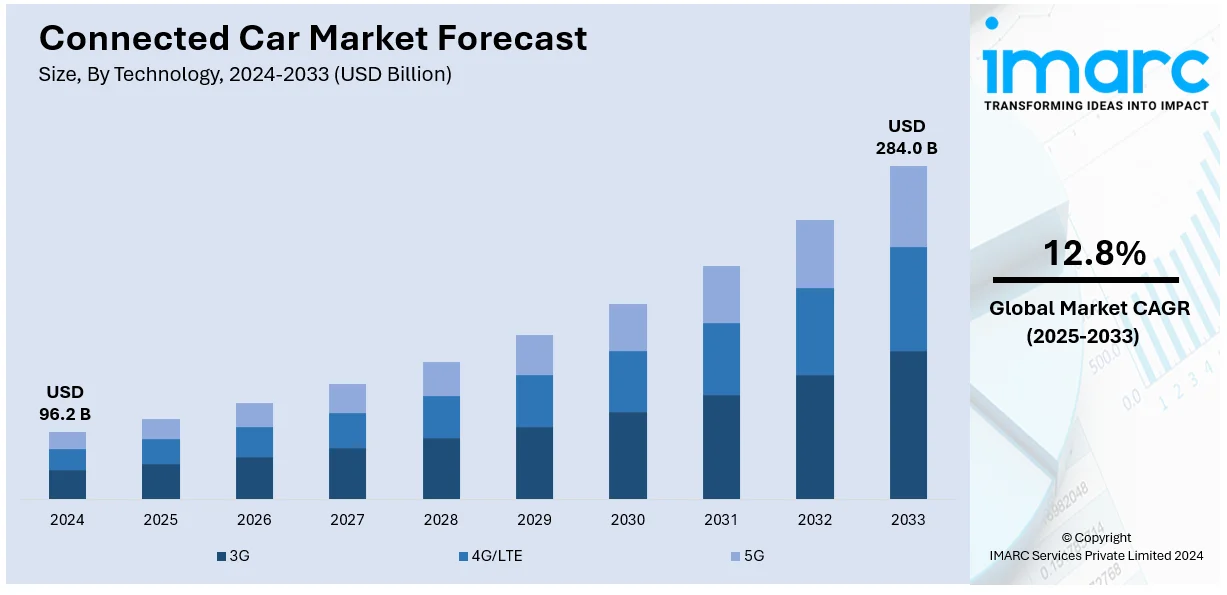

The global connected car market size was valued at USD 96.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 284.0 Billion by 2033, exhibiting a CAGR of 12.8% from 2025-2033. North America currently dominates the market, holding a market share of over 39.8% in 2024. The market is driven by rapid advancements in 5G, V2X, and IoT technologies, enabling seamless vehicle connectivity, real-time data exchange, and enhanced navigation. Growing consumer expectations for safety, personalized in-car experiences, and telematics-powered services further accelerate adoption, supported by regulatory mandates promoting autonomous driving and eco-friendly mobility. The convergence of autonomous vehicle development, usage-based insurance models, and cloud-based telematics continues to expand applications by 2032, further augmenting the connected car market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 96.2 Billion |

|

Market Forecast in 2033

|

USD 284.0 Billion |

| Market Growth Rate 2025-2033 | 12.8% |

At present, advancements in technology, such as 4G/5G networks, the Internet of Things (IoT), and cloud computing, enable real-time communication, navigation, and data sharing. Besides this, the rising demand for enhanced safety, convenience, and in-car experiences encourages the adoption of connected features like remote diagnostics, and driver assistance systems. Government agencies also play a key role through regulations promoting safety features, autonomous driving, and environmental standards, which promote the integration of linked technologies. Additionally, the rise of autonomous vehicles that rely on robust connectivity for real-time data processing and vehicle-to-vehicle communication drives the demand for connected cars. Apart from this, telematics, which provides valuable insights into vehicle health and performance, supports the growth of the market.

To get more information on this market, Request Sample

The United States has emerged as a major region in the connected car market owing to many factors. The market is experiencing growth on account of advancements in communication technologies like 4G/5G, IoT, and cloud computing, which enable real-time data exchange and vehicle-to-everything communication. Additionally, people seek enhanced driving experiences, with features like advanced navigation, infotainment, driver assistance systems, and remote vehicle monitoring. Moreover, the need for safety and security promotes the adoption of technologies, such as collision detection, lane-keeping assistance, and automatic emergency braking. Apart from this, the increasing shift towards autonomous driving relies heavily on connected car solutions for real-time data processing and communication. The expansion of infrastructure, including 4G/5G networks and smart city initiatives, further catalyzes the demand for connected cars. In the United States, automakers are integrating modern tools like smartphone keys into their models, offering users more convenience, efficiency, and personalization. In January 2025, Keyvault, a cloud service provider, secured USD 1M funding to launch its smartphone car key, K1, for motorists in the US. The device can transform any car into a vehicle that is operated by a smartphone. Designed for extensive compatibility and exceptional security, the K1 substitutes traditional car keys, offering drivers a seamless and high-tech alternative.

Connected Car Market Trends:

Significant Advancements in Connectivity Technologies

The continuous evolution of connectivity technologies represents one of the key factors positively influencing the market. The shift from traditional standalone vehicles to interconnected smart cars is enabled by the integration of high-speed internet, 4G and 5G networks, and advanced communication protocols. Reports indicate that by the end of June 2024, Europe had approximately 190 million 5G subscriptions. These technologies allow for smooth communication between cars and the wider transport infrastructure, enabling real-time data sharing. Connected vehicles capitalize on these developments to offer various features such as real-time traffic information, remote diagnosis, over-the-air software upgrades, and improved navigation systems. One of the most significant drivers of market growth is increasing integration with IoT platforms, which improve data gathering and remote control. Furthermore, the use of edge computing is considerably broadening market growth by allowing the processing of data at a faster pace in vehicles and enhancing system response. Additionally, strategic partnerships among automakers and telecommunication providers are pushing connectivity deployment at a faster pace, thus fueling market growth. With these technologies becoming better, connected vehicles become capable of delivering a more immersive and secure driving experience.

Rising Emphasis on Safety and Security

Safety and security considerations are key factors strengthening the connected car market growth. The introduction of advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication is a fundamental influence in maximizing road safety. Connected cars utilize sensors, cameras, and communication modules to gather and relay information about the environment around the vehicle, existing risks, and traffic situations. This information is not only utilized by the vehicle to make intelligent decisions but also shared with other linked vehicles and infrastructure to create an interconnected safety network. Apart from this, growth in urban accident rates is contributing to significant market growth for connected vehicles with ADAS capability. Additionally, telematics-based insurance policies are fueling connected car uptake by providing financial rewards to safe drivers. In addition, connected vehicles usually have high-level cybersecurity to ensure that they are secure against cyber-attacks, maintaining the integrity and confidentiality of information that is shared between vehicles and external systems. It has been reported that 50% of UK businesses were hit by some form of cyber-attack in 2023.

Evolving Regulatory Landscape

Governments and regulatory bodies worldwide are actively contributing to the growth of the market through the formulation and implementation of supportive policies. In line with this, the introduction of stringent regulations mandating the inclusion of certain safety features and connectivity capabilities in new vehicles, such as the European Union's eCall regulation requiring all new cars to be equipped with an emergency call system, is bolstering the market growth. Government incentives and funding for connected and electric vehicle innovation are significantly expanding market development. Also, a significant growth-inducing factor for the market is the cross-border regulatory alignment, particularly in Europe, which supports the seamless integration of connected systems across regions. Such regulations drive the adoption of connected car technologies and create a standardized framework that encourages interoperability and compatibility among different vehicles and infrastructure components, providing an impetus to the connected car market growth. Moreover, companies become more aware about this and hence include compliant features in cars.

Changing User Preferences and Expectations

The rising demand for a more connected, personalized, and convenient driving experience is favoring the connected car market outlook. Connected cars cater to these changing preferences by offering features, such as in-car infotainment systems, voice-controlled assistants, and integration with smartphones and smart home devices. Based on the reports, the total number of smartphone users is expected to reach 6 billion worldwide by 2027. The ability to control and monitor almost everything in the vehicle, from climate settings to vehicle diagnostics, from a distance resonates very well with modern users who seek increased control, aiding in the expansion of the market. The concept of connected mobility, which involves services such as ridesharing, predictive maintenance, and automated parking, is also taking hold with the increasing tech-savviness of users and their accustomedness to the conveniences that come with connectivity.

Connected Car Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global connected car market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, connectivity solution, service, and end market.

Analysis by Technology:

- 3G

- 4G/LTE

- 5G

4G/LTE dominates the market since it provides an ideal mix of speed, dependability, and affordability for immediate communication. It enables rapid data transfer, essential for offering in-car functionalities, such as navigation, entertainment, vehicle diagnostics, and over-the-air updates. With 4G/LTE, vehicles can effortlessly access the internet, support streaming platforms, and facilitate features, such as live traffic alerts or remote vehicle tracking without noticeable delays. 4G/LTE features broad coverage, particularly in urban and suburban regions, allowing easy access for drivers. It is a recognized and reliable technology that manufacturers and service providers incorporate into their systems. Consequently, 4G/LTE continues to be the most dependable and effective choice for linking cars at present, offering the connectivity that motorists depend on for an improved driving experience.

Analysis by Connectivity Solution:

- Integrated

- Embedded

- Tethered

Integrated represents the largest segment. Integrated connectivity solutions provide a smooth experience for drivers by linking a vehicle's internal systems to external services, such as cloud platforms and mobile applications. These combined solutions enable car manufacturers to provide functionalities like real-time navigation, remote diagnostics, and over-the-air software updates. By integrating various communication technologies such as 4G/LTE, Wi-Fi, and Bluetooth, they guarantee that vehicles remain linked to the internet and other devices, improving the driving experience. For producers, utilizing integrated solutions streamlines the implementation procedure. Rather than handling various distinct technologies, car manufacturers can utilize a unified platform to oversee all aspects, from in-vehicle entertainment to driver support functions. This helps to speeds up the process and lower costs. Due to the increased demand for connected functionalities like safety notifications, streaming, and remote controls, integrated solutions are crucial for delivering a dependable and uniform user experience across various car models and brands, positioning them as the preferred option for automakers.

Analysis by Service:

- Driver Assistance

- Safety

- Entertainment

- Vehicle Management

- Mobility Management

- Others

Driver assistance holds 36.8% of the market share. Driver assistance services significantly improve safety, convenience, and the overall driving experience. Features like lane-keeping assist, automatic emergency braking, adaptive cruise control, and collision warnings are being sought after by users. These services make driving easier, especially for those who want extra support on long trips or in busy traffic, reducing stress and improving road safety. As safety becomes a top priority for users and regulators, automakers are incorporating more advanced driver assistance features into their vehicles. These systems aid in avoiding accidents while also establishing the groundwork for future autonomous driving innovations. Many vehicles come equipped with a suite of driver assistance tools, making them more attractive to buyers. With the growing awareness about the benefits of these services and encouragement from government agencies to improve road safety, driver assistance systems are driving the demand for connected cars.

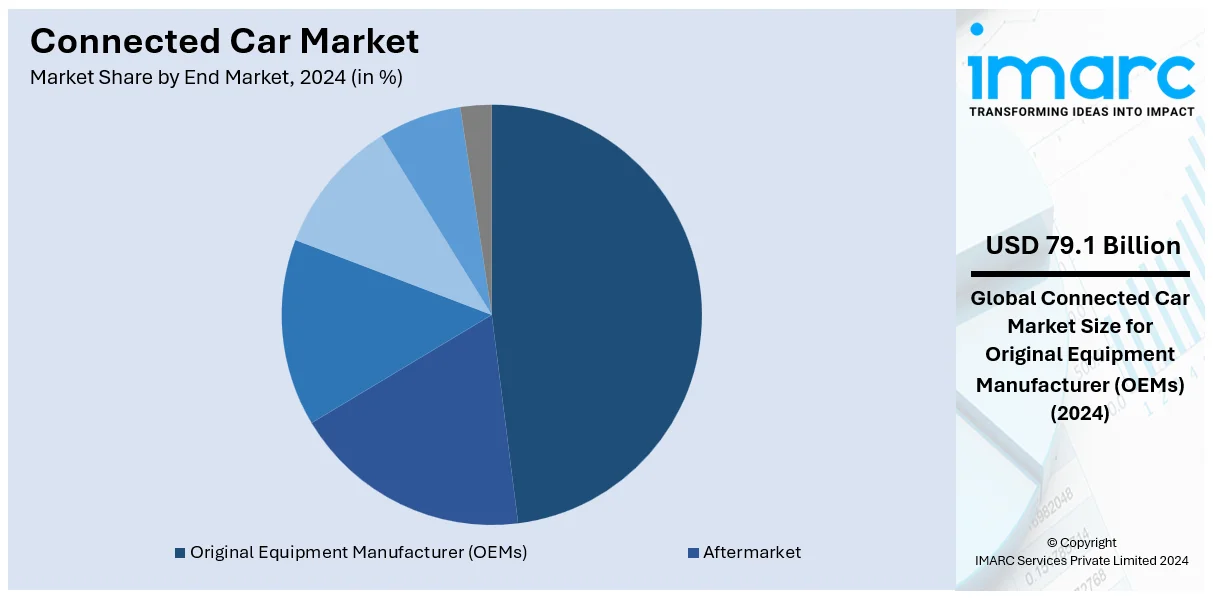

Analysis by End Market:

- Original Equipment Manufacturer (OEMs)

- Aftermarket

Original equipment manufacturer (OEMs) accounts for 82.2% of the market share. OEMs are the primary suppliers of vehicles equipped with advanced connectivity features. They are utilized for designing and assembling vehicles and overseeing the integration of interconnected technologies, including telematics, infotainment systems, and driver-assistance features. By incorporating these technologies directly into their cars, OEMs offer a seamless experience for consumers, thereby boosting sales. Moreover, OEMs possess the capabilities to create, evaluate, and implement connected car solutions across various models and areas. They work with technology partners to integrate software and hardware that enable real-time data sharing, vehicle diagnostics, and multiple connected services. With the rising demand for connectivity in vehicles, people are likely to choose cars from well-known brands that offer these technologies directly from the manufacturer. This gives OEMs a significant edge in capturing a large segment of the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 39.8% share, enjoys the leading position in the market. The market is driven by various key factors. Technological advancements in 4G/5G connectivity, cloud computing, and the IoT enable real-time data exchange, vehicle-to-vehicle communication, and improved driver experiences. Besides this, the need for enhanced safety features like lane-keeping assistance, and autonomous driving capabilities encourages the adoption of connected cars. Additionally, government regulations promoting vehicle safety, emissions control, and autonomous driving technology are catalyzing the connected car market demand. Apart from this, the expansion of 4G/5G networks and smart city infrastructure is also improving connectivity, supporting the integration of connected car solutions. Moreover, North American automakers assimilate these technologies into their vehicles, making them more attractive to users seeking modern and connected experiences while driving. The need for safety, convenience, and improved in-car features like infotainment, navigation, and driver assistance systems contributes to a rise in the production of connected cars. In July 2024, Hyundai Motor Group, a recognized car manufacturer, joined forces with Bell Canada, a telecom provider, to improve and expand in-car infotainment offerings for customers in Canada. They intend to incorporate extra functionalities, including Wi-Fi hotspots and enhanced interactive in-car services like music and video streaming.

Key Regional Takeaways:

United States Connected Car Market Analysis

The United States hold 82.00% of the market share in North America. Modern drivers seek seamless integration of their digital lives into their vehicles. This includes real time navigation, entertainment options, and advanced telematics, enhancing the overall driving experience. Moreover, technological advancements, particularly in the IoT, are enabling vehicles to connect with external devices and networks, facilitating data exchange that supports features like predictive maintenance and driver assistance systems. Besides this, governing agencies of the nation are implementing regulations to improve road safety, which is propelling the connected car market growth. Mandates promoting the adoption of connected vehicle technologies are encouraging automakers to integrate these systems, thereby enhancing vehicle safety and efficiency. Furthermore, the expansion of 5G networks is another significant driver, offering faster and more reliable internet connectivity. According to Ericsson, in 2023, 5G held 59% of smartphone subscriptions in North America, with 53% of subscribers in the US and 37% in Canada expressing satisfaction with their 5G services. This advancement supports real time data transmission, which is essential for the functionality of connected car features, including autonomous driving capabilities. Additionally, there is a rise in the sales of electric and autonomous vehicles in the country. These vehicles often come equipped with advanced connectivity features, meeting user expectations for modern, tech-equipped transportation options.

Asia Pacific Connected Car Market Analysis

The demand for advanced safety features and in-car connectivity is rising, with drivers seeking real time navigation, entertainment, and vehicle diagnostics to enhance their driving experience. Besides this, technological advancements, particularly the rollout of 5G networks, are enabling faster and more reliable communication between vehicles and infrastructure. This development supports features like V2X communication, which enhances road safety and traffic management. In line with this, government initiatives promote smart city infrastructure and intelligent transportation systems. Investments in these areas facilitate the assimilation of connected vehicles into urban environments, improving traffic flow and reducing emissions. Apart from this, the high adoption of electric and autonomous vehicles in the region drives the demand for connectivity in cars. As per the India Brand Equity Foundation (IBEF), sales of electric vehicles (EVs) in India rose by 20.88%, totaling 1.39 million units in May 2024. These vehicles often come equipped with advanced connectivity features, meeting user expectations for modern and tech-equipped transportation options.

Europe Connected Car Market Analysis

The connected car market in Europe is expanding rapidly, driven by several key factors. People prefer vehicles with advanced safety features, infotainment systems, and seamless connectivity, encouraging manufacturers to integrate sophisticated technologies into vehicles. In addition, technological advancements, particularly the deployment of 5G networks, assist in enhancing vehicle communication capabilities. This development supports real time data exchange, enabling features like V2X communication, which improves road safety and traffic efficiency. Apart from this, government regulations aimed at reducing emissions and enhancing road safety propel the market growth. The European Union is setting stringent CO2 emission targets, promoting the adoption of hybrid and electric vehicles (HEVs) equipped with connected technologies to monitor and optimize performance. In addition, the automotive industry's shift towards electric and autonomous vehicles further contributes to market growth. According to the IEA, in 2023, new electric vehicle registrations in Europe approached 3.2 million, marking an increase of almost 20% compared to 2022. Connected technologies are essential for the operation and optimization of these vehicles, facilitating high performance functions, such as battery management, and over-the-air (OTA) updates.

Latin America Connected Car Market Analysis

There is a rise in the demand for enhanced safety, security, and infotainment feature in cars. Manufacturers in the region focus on integrating advanced technologies into vehicles. High rates of vehicle theft in the region also lead to higher adoption of security-related connected car applications, allowing real time tracking and emergency assistance. Technological advancements, particularly in telecommunication infrastructure, help to improve connectivity, enabling features like real time navigation and vehicle diagnostics. As per the IMARC Group, Brazil telecom market is projected to exhibit a CAGR of 5.64% during 2024-2032. In line with this, government initiatives promoting intelligent transportation systems and smart city projects drives the demand for connected cars, encouraging the integration of connected vehicle innovation to enhance urban mobility and reduce traffic congestion.

Middle East and Africa Connected Car Market Analysis

The connected car market in the Middle East and Africa is characterized by different key factors. The demand for advanced safety features and seamless connectivity is high, encouraging manufacturers to integrate sophisticated technologies into vehicles. Besides this, technological advancements, particularly the deployment of 4G and 5G networks, enhance vehicle communication capabilities. In the MENA region, according to reports, as of November 2023, there were 30 million 5G connections. This development supports real-time data exchange, enabling new features like V2X communication, which improves road safety and traffic efficiency. In addition, government initiatives aimed at developing intelligent transportation systems and smart city projects catalyze the demand for connected cars. Investments in these areas also facilitate the integration of connected vehicles into urban environments, improving traffic flow and reducing emissions.

Competitive Landscape:

Key players, including automakers, technology companies, telecom providers, and government agencies, are playing an important role. Automakers integrate connected technologies, such as infotainment systems and telematics into vehicles, enhancing safety, convenience, and user experience. Big companies wager on developing and deploying these features across various models. Additionally, technology firms provide the hardware and software that enable real-time communication, data analytics, and autonomous driving capabilities. Telecom providers also ensure connectivity through robust 4G/5G networks, facilitating seamless communication between vehicles and infrastructure. Government agencies, through regulations and incentives, promote the adoption of connected vehicle technologies, particularly in safety and environmental standards. Moreover, key players team-up with international brands to create and support new solutions for connected cars. For instance, in February 2024, Cisco, a worldwide technology leader, partnered with and TELUS, a publicly traded holding company based in Canada, to unveil new 5G capabilities in North America and address IoT applications across various industry sectors, emphasizing connected vehicles. The network offers to act as a basis to enable drive testing for 5G Connected Car and work to improve customer experiences and profit margins for manufacturers.

The report provides a comprehensive analysis of the competitive landscape in the connected car market with detailed profiles of all major companies, including:

- AT&T Inc.

- Audi AG

- BMW AG

- Continental AG

- Ford Motor Company

- Mercedes-Benz Group AG

- Qualcomm Incorporated

- Robert Bosch GmbH

- Samsung Semiconductor, Inc

- Sierra Wireless

- Tesla Inc.

- TomTom International BV.

- Valeo

- Verizon Communications Inc.

- Vodafone Limited

Latest News and Developments:

- May 2025: Hyundai India has launched a digital vehicle passport for its Bluelink-connected vehicles, providing data on performance, service history, and accident history, as well as real-time vehicle health monitoring. Costing INR 399 per quarter, this data-driven solution aims to improve fleet transparency and enable proactive maintenance, which is essential for commercial vehicle operators. With over 700,000 connected Hyundai vehicles sold since 2019, this introduction marks Hyundai's global introduction of this feature, encouraging smarter and safer mobility through analytics.

- March 2025: Toyota partnered with NTT DATA's Transatel to equip its LATAM vehicles with multi-network (e)SIMs, rolling out connected services such as telematics and Wi-Fi in Brazil and Argentina, with seven more countries set to follow in 2025. Backed by Transatel's extensive network of over 250 carriers and regional Points of Presence (POPs) in São Paulo and Rio, this solution provides scalable 4G/5G in-vehicle connectivity optimized for regional compliance. This deployment streamlines commercial fleet management by providing real-time access to data, over-the-air (OTA) updates, and a single customer engagement application, thereby enhancing operational efficiency across various markets.

- April 2024: Hyundai Motor, a leading automaker in South Korea, along with its subsidiary Kia, collaborated with Baidu, an international technology firm, to create innovations for connected vehicles. By partnering strategically with Baidu, the company aims to build the ecosystem for connected vehicles within the Chinese market.

- March 2024: Vero collaborated with Privacy4Cars to deliver privacy solutions and identity safeguarding services for connected car owners. The new Identi-FI system addresses the removal of data from linked vehicles and the restoration after identity theft.

- February 2024: HARMAN, a worldwide leader in connected vehicle technologies, showcased its newest products prepared for the road aimed at making automotive connectivity accessible at Mobile World Congress (MWC) 2024. The offerings, such as the HARMAN Ready Connect 5G Telematics Control Unit, are prepared for the market and offer additional benefits for car manufacturers, including a decrease in total implementation costs while providing automotive-grade customer experiences.

Connected Car Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | 3G, 4G/LTE, 5G |

| Connectivity Solutions Covered | Integrated, Embedded, Tethered |

| Services Covered | Driver Assistance, Safety, Entertainment, Vehicle Management, Mobility Management, Others |

| End Markets Covered | Original Equipment Manufacturer (OEMs), Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | AT&T Inc., Audi AG, BMW AG, Continental AG, Ford Motor Company, Mercedes-Benz Group AG, Qualcomm Incorporated, Robert Bosch GmbH, Samsung Semiconductor, Inc, Sierra Wireless, Tesla Inc., TomTom International BV., Valeo, Verizon Communications Inc., Vodafone Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the connected car market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global connected car market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the connected car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The connected car market was valued at USD 96.2 Billion in 2024.

The connected car market is projected to exhibit a CAGR of 12.8% during 2025-2033, reaching a value of USD 284.0 Billion by 2033.

The market is primarily driven by the ongoing innovations in 4G/5G, IoT cloud computing are enabling real-time communication, data sharing, remote vehicle monitoring, the rapid shift towards self-driving cars that rely heavily on connected systems for real-time communication and data processing, and stringent safety and environmental regulations.

North America currently dominates the market, accounting for a share of around 39.8%. The dominance is driven by ongoing advancements in connectivity technologies, the rising emphasis on safety and security, and the growing user preferences towards personalized and convenient driving experiences.

Some of the major players in the connected car market include AT&T Inc., Audi AG, BMW AG, Continental AG, Ford Motor Company, Mercedes-Benz Group AG, Qualcomm Incorporated, Robert Bosch GmbH, Samsung Semiconductor, Inc, Sierra Wireless, Tesla Inc., TomTom International BV., Valeo, Verizon Communications Inc., and Vodafone Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)