Confectionery and Bakery Packaging Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Confectionery and Bakery Packaging Market Size and Share:

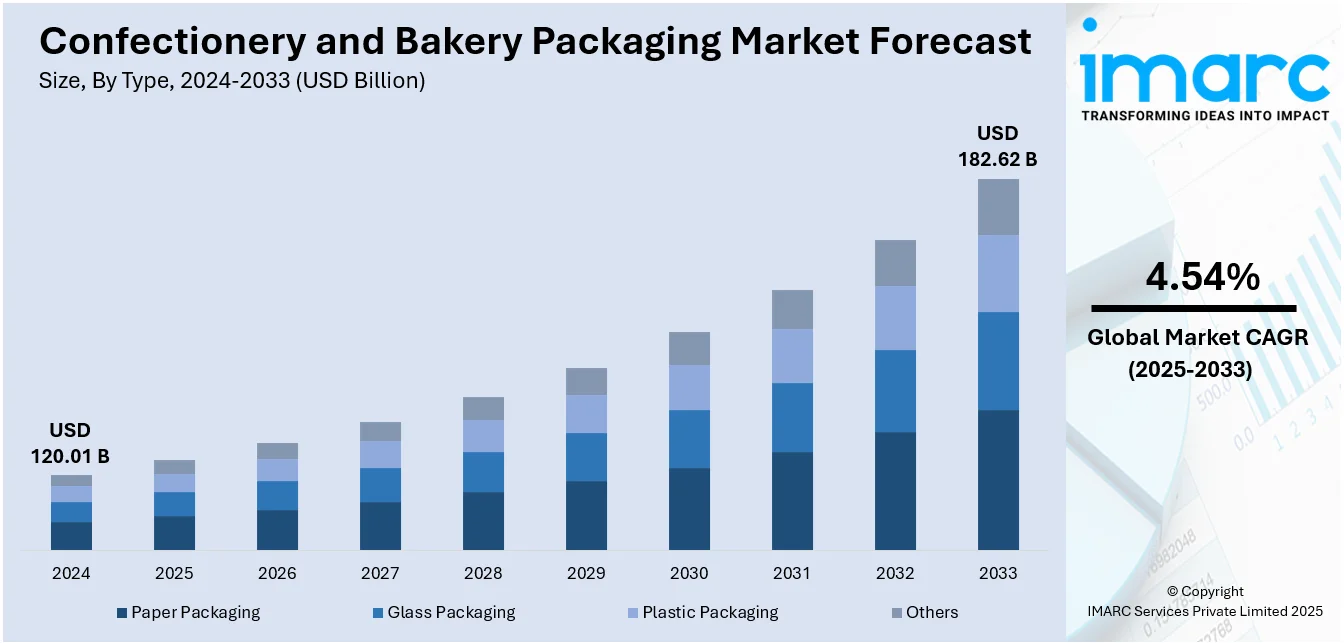

The global confectionery and bakery packaging market size was valued at USD 120.01 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 182.62 Billion by 2033, exhibiting a CAGR of 4.54% during 2025-2033. North America currently dominates the market, holding a market share of over 33.8% in 2024. The increasing demand for convenience foods, a surge in environmental sustainability concerns, advancements in packaging technologies, growth in online food retailing, the implementation of stringent food safety regulations, rising popularity of premium products, and growing disposable incomes are some of the factors stimulating the confectionary and bakery packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 120.01 Billion |

|

Market Forecast in 2033

|

USD 182.62 Billion |

| Market Growth Rate 2025-2033 | 4.54% |

The expansion in online food selling is strongly affecting the confectionery and bakery packaging market requirement. With growth in e-commerce and online purchase, there exists a growing requirement for packaging to be able to sustain the process of shipping and handling without destroying the quality and integrity of foods. As per the Brick Meets Click/Mercatus Grocery Shopper Survey, the American online grocery market finished 2023 with a total of USD 95.8 billion in sales, a drop of 1.2% from 2022. Online retail packaging needs to be strong enough to ensure that the products are secure against physical damage during the transit process and from environmental elements like temperature and humidity. This has resulted in the creation of lightweight yet rugged packaging solutions, which reduce transportation costs while also guaranteeing the safety of products. Moreover, with the onset of online shopping, there came the demand for aesthetically pleasing and brand-oriented packaging because packaging is playing a significant part in the experience of unboxing, which is a key source of customer satisfaction while shopping online.

The United States stands out as a key market disruptor, driven by a rise in awareness among consumers of health issues related to diet. The market currently holds a share of 87.60%. This leads to the noticeable shift toward healthier, low-sugar, and organic confectionery and bakery products, consequently favoring demand for packaging that not only preserves product quality but also communicates its health benefits effectively. For example, transparent packaging is becoming popular as it allows consumers to see the contents, making them feel more confident about the product's ingredients and nutritional content. Eco-friendly packaging is also on the rise, with brands focusing on materials that align with consumers' environmental values. As per an industry survey, around half of US consumers are willing to pay more for sustainable packaging. This growing emphasis on health and sustainability is pushing packaging companies to innovate and offer solutions that cater to both health-conscious and eco-aware consumers, contributing to the expansion of confectionary and bakery packaging market share.

Confectionery and Bakery Packaging Market Trends:

Increasing Consumer Demand for Convenience Foods

The surge in consumer demand for convenience foods significantly drives the global confectionery and bakery packaging market growth. In today's fast-paced world, there is an increasing preference for ready-to-eat (RTE) and easy-to-prepare food items, including bakery and confectionery products. This trend is not just confined to urban areas but is also evident in suburban and rural settings. According to the U.S. Department of Agriculture (USDA), the U.S. packaged food market reached approximately USD 1.1 trillion in 2023, with convenience foods being a major driver. Consumers seek products that offer ease of consumption, portability, and minimal preparation time, factors that are vital in their busy lifestyles. Consequently, packaging companies are innovating to create solutions that not only maintain product freshness and quality but also provide convenience. Furthermore, packaging that enables extended shelf life, while maintaining the taste and texture of the products, is increasingly in demand.

Escalating Focus on Environmental Sustainability

Environmental sustainability is a critical driver of the global confectionery and bakery packaging market trends. There is a growing awareness and concern among consumers about the environmental impact of packaging waste, particularly plastic. This awareness is driving demand for eco-friendly packaging solutions that are biodegradable, recyclable, or made from renewable resources. According to the European Environment Agency (EEA), over 41% of plastic packaging waste in the EU was recycled in 2022, reflecting an increasing push for sustainability. Manufacturers are responding by exploring alternative materials like paper, bioplastics, and plant-based materials that have a lower carbon footprint and are less harmful to the ecosystem. Additionally, there is a focus on reducing the overall amount of packaging used and increasing the use of post-consumer recycled materials. Governments and regulatory bodies worldwide are also implementing stricter regulations on packaging waste, further compelling companies to adopt sustainable practices.

Advancements in Packaging Technologies

Based on the confectionery and bakery packaging market forecast, advancements in packaging technologies are a major factor propelling the growth of the market. Innovations in this field are focused on enhancing product shelf life, maintaining quality, and improving user experience. According to the Food and Agriculture Organization (FAO), nearly 14% of global food production is lost before reaching retail, largely due to inadequate packaging and supply chain inefficiencies. Active and intelligent packaging technologies are at the forefront of these innovations. These technologies are crucial for bakery and confectionery products, which are often susceptible to spoilage due to factors like moisture and microbial growth. Improved packaging technologies ensure that these products remain fresh and safe for consumption over a longer period, thereby reducing food waste.

Confectionery and Bakery Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global confectionary and bakery packaging market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Paper Packaging

- Glass Packaging

- Plastic Packaging

- Others

As per the confectionery and bakery packaging market outlook, the paper packaging segment represents the largest market share with 47.8%. It is driven by the increasing emphasis on sustainability and eco-friendliness. The segment benefits from a rising consumer preference for biodegradable and recyclable materials, in response to growing environmental concerns and stringent regulations against plastic waste. Innovations in paper packaging, such as improved barrier properties and durability, are making it more competitive with traditional materials. Additionally, the aesthetic appeal and ease of customization of paper packaging make it a preferred choice in sectors like food and beverages, personal care, and healthcare.

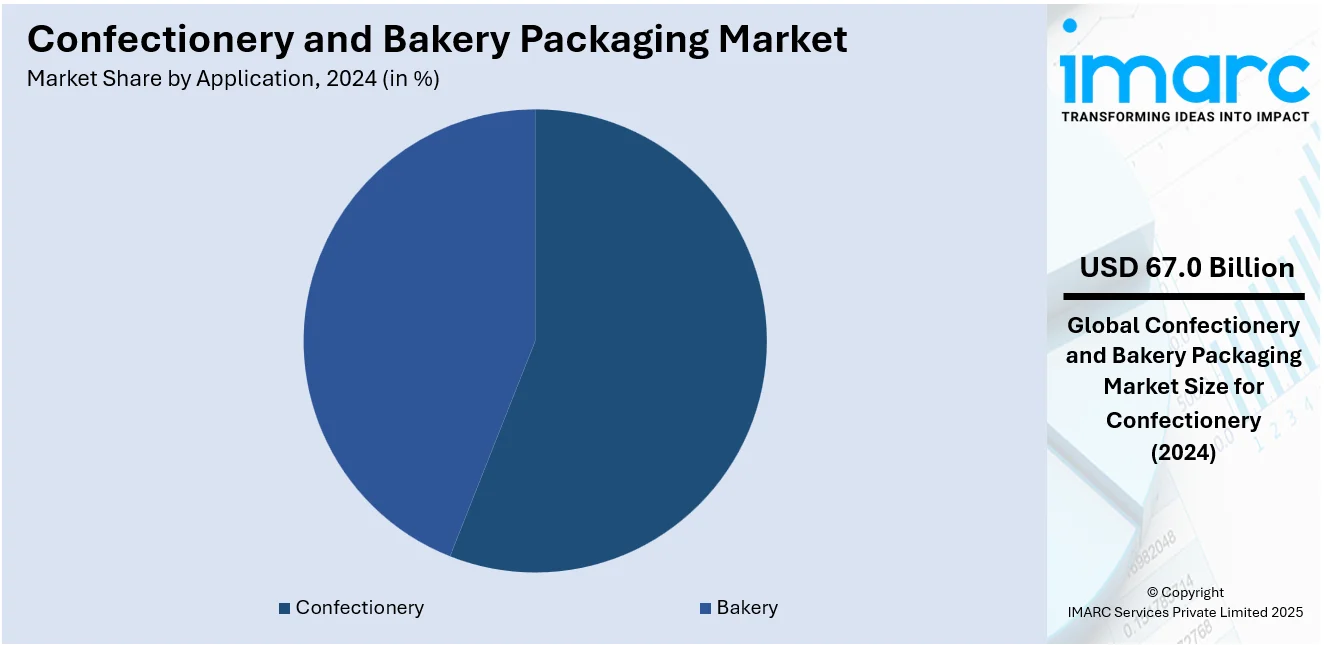

Analysis by Application:

- Confectionery

- Bakery

The confectionery segment is leading the market share in 2024 with 55.8%. It is driven by the increasing demand for innovative and diverse flavors that cater to evolving consumer palates. As consumers become more adventurous with their taste preferences, manufacturers are experimenting with unique flavor combinations, leading to a broader variety of confectionery products. This diversification necessitates specialized packaging to maintain flavor integrity, appeal to aesthetic sensibilities, and differentiate products on retail shelves. Additionally, the health-conscious trend is prompting a surge in demand for sugar-free and low-calorie options, influencing packaging to highlight health benefits and ingredient transparency.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.8%. The North America confectionery and bakery packaging segment is driven by the increasing demand for convenience and premium packaging solutions. The region, with its high consumer spending power, shows a strong preference for innovative and convenient packaging, such as resealable and easy-to-open options, that cater to on-the-go lifestyles. Additionally, there is a growing interest in artisanal and gourmet products, which require premium and aesthetically appealing packaging. Environmental concerns also play a significant role, as there is a rising demand for sustainable and eco-friendly packaging options in this region.

Key Regional Takeaways:

United States Confectionary and Bakery Packaging Market Analysis

The U.S. confectionery and bakery packaging market is growing due to increasing demand for convenience foods as well as environmentally friendly packaging. The trend toward resealable, recyclable, and biodegradable packaging is gaining ground, thereby encouraging innovation in this area. Smart packaging- QR codes showing ingredient transparency are also becoming a norm. As mentioned by the American Bakers Association, U.S. baking businesses operate across 50 states, the District of Columbia, and Puerto Rico; employ approximately 800,000 skilled employees; generate more than USD 42 billion in direct wages; and contribute over USD 186 billion in total economic impact. These include market leaders such as Amcor and Mondi investing in sustainable materials. Regulatory bodies keep pushing down for reduced usage of plastics. Demand for protective and lightweight packaging will further gain strength as consumers are increasingly moving towards e-commerce.

Europe Confectionary and Bakery Packaging Market Analysis

As reported by Confectionery Packaging Europe, robust growth has boosted production across various end-user markets, such as candy, chocolate, and fresh produce. The growing need for user-friendly products that are light and easily transportable is a key reason for Europe's substantial market share in the global confectionery packaging sector. The main factors influencing the examined market are the growing emphasis on sustainability, the heightened demand for longer product shelf life, higher hygiene standards, and customer priorities on convenience. The UK sweets market is growing as producers create innovative ways to entice British consumers to satisfy their cravings for sugar. A large variety of products accessible to UK shoppers at retail is growing due to the rising consumer appetite for innovation. As stated in a report on confectionerynews.com from November 2020, consumers have allegedly purchased GBP 50 million (USD 65 million) more in chocolates compared to 2019, primarily influenced by the buying of multipacks and sharing bars at supermarkets during the lockdown period. The grocers additionally disclosed that the interest in well-known brand sharing bars increased by 37%, while sales for its own labels surged by 20%. Rising trends in demand within the confectionery sector are expected to boost the need for packaging solutions nationwide.

Asia Pacific Confectionary and Bakery Packaging Market Analysis

The confectionery and bakery packaging market in the Asia Pacific is booming with the booming food sector of the region coupled with growing urbanization. Sustainable and functional packaging solutions are rising in demand that is changing industry trends. According to an industrial report, China, which is home to over 600,000 bakeries as of 2023, is primarily composed of local companies, thereby raising demand for new and economical packaging solutions. This number includes more than 2,000 organized and semi-organized bakeries that contribute to packaging demand in vast and fragmented dimensions. E-commerce is growing significantly, and bakery delivery through these channels requires packages that are protected and durable during transit. These players, namely Huhtamaki and UFlex, also invest in research and development through biodegradable materials and the development of 'smart' packages that are used to meet demands for changing customer preferences. Government regulations promoting reduced plastic use also encourage industry players to develop sustainable alternatives, ensuring steady market growth in the region.

Latin America Confectionary and Bakery Packaging Market Analysis

The confectionery and bakery packaging market in Latin America is growing driven by higher consumption of baked products and increasing demand for cost-effective solutions for packaging. Available data for the Brazil region reports over 2.5 million small establishments across 2023 - it included bakeries, clearly illustrating the importance of local establishments as a driving factor for demand in packaging. There is increased momentum toward biodegradable and flexible packaging solutions due to the increasing policy of sustainability regulations in the region. Packed bakery products are also showing growth in Mexico and Argentina, which shall fuel demand for new packaging forms. The leading packaging companies would invest in new materials to up the shelf life and cater to consumers looking for convenience. The demand for protective and lightweight packaging solutions is driven by the growth of e-commerce and food delivery services, leading to consistent market expansion.

Middle East and Africa Confectionary and Bakery Packaging Market Analysis

Confectionery and bakery packaging in the Middle East and Africa is picking up, attributed to the surge in demand for packaged food items and a growth in preference towards more sustainable forms of packaging. The UAE Food & Beverage Business Group's Annual UAE Food Industry Report for 2023 suggests that the country accommodates more than 2,000 manufacturing companies of food and beverages and annually generates approximately USD 7.63 billion (AED 28 billion). This sector accounts for around 25% of the country's manufacturing GDP, which is the second largest after oil and gas, indicating the important role of packaged food in the region. The increasing government regulations on plastic reduction and a shift towards biodegradable materials are shaping packaging innovations. Saudi Arabia and South Africa are also growing in packaged bakery products, driving demand for advanced packaging solutions. The growth of e-commerce and food delivery services further accelerates the demand for strong and lightweight packaging, ensuring sustained market growth.

Competitive Landscape:

Key players in the confectionery and bakery packaging market are actively engaging in a variety of strategic initiatives to strengthen their market positions. The scope of research and development is emphasized in the field of introducing innovatively designed attractive, functional, and sustainable packing solutions. Eco-friendly and high-tech packages are also being used for the introduction of products catering to the mounting demand of eco-friendliness among consumers from these companies. Many are expanding through strategic mergers and acquisitions; partnerships with the local companies where they set new manufacturing facilities. They are constantly enhancing their portfolio of products designed to cater for the diverse range of needs ranging from luxury products and artisan to mass-market item. Furthermore, market players are concentrating on customization and personalization in packaging to create a competitive edge, in tune with the current consumer trend toward unique and differentiated products.

The report provides a comprehensive analysis of the competitive landscape in the confectionary and bakery packaging market with detailed profiles of all major companies, including:

- Amcor Plc

- Berry Global Inc (Berry Global Group, Inc)

- Bomarko Inc

- Crown Holdings, Inc

- Huhtamaki Oyj

- Mondi Group

- Sonoco Products Company

- Stanpac Inc

- Westrock Company

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- December 2024: Toppan Holdings announced that they will acquire Sonoco’s Thermoformed & Flexible Packaging business for USD 1.8 billion. The deal strengthens Toppan’s packaging capabilities, integrating Sonoco’s expertise with Toppan’s advanced manufacturing and technical strengths, enhancing offerings in confectionery and bakery packaging.

- November 2024: Amcor Plc announced that they will acquire Berry Global for USD 8.43 billion in an all-stock deal, enhancing its footprint in consumer and healthcare packaging. Berry shareholders will receive USD 73.59 per share, a 9.75% premium. The move aligns with ongoing consolidation in the global packaging industry.

- September 2024: Mondi and packaging supplier Welton, Bibby and Baron introduced recyclable paper-based bread bags in the UK. Made from Mondi’s FunctionalBarrier Paper Reduce, these kraft paper bags offer moisture protection while ensuring recyclability. The brown bag features a glassine window, while the white bag has a detachable film window.

- November 2021: Amcor Plc. launched a groundbreaking advancement in flexible packaging technology with its AmPrima™ PE Plus. This innovation is anticipated to enhance performance and sustainability, meeting the changing demands of the confectionery and bakery industries.

- October 2021: Berry Global Inc. has finalized its acquisition of Quadpack, a prominent provider of packaging solutions for the beauty and personal care sector. Although this acquisition falls outside the confectionery and bakery industries, it highlights Berry Global's dedication to expanding its packaging capabilities.

Confectionery and Bakery Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Paper Packaging, Glass Packaging, Plastic Packaging, Others |

| Applications Covered | Confectionery, Bakery |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor Plc, Berry Global Inc (Berry Global Group, Inc), Bomarko Inc, Crown Holdings, Inc, Huhtamaki Oyj, Mondi Group, Sonoco Products Company, Stanpac Inc, Westrock Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the confectionery and bakery packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global confectionery and bakery packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the confectionery and bakery packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The confectionery and bakery packaging market was valued at USD 120.01 Billion in 2024.

The confectionery and bakery packaging market is projected to exhibit a CAGR of 4.54% during 2025-2033, reaching a value of USD 182.62 Billion by 2033.

The confectionery and bakery packaging market is growing due to rising demand for convenience foods, increasing health consciousness, e-commerce expansion, advancements in sustainable packaging, premiumization trends, and innovations in smart packaging.

North America currently dominates the confectionery and bakery packaging market, due to high consumer demand for convenience foods, strong e-commerce growth, and increasing preference for sustainable packaging.

Some of the major players in the confectionery and bakery packaging market include Amcor Plc, Berry Global Inc (Berry Global Group, Inc), Bomarko Inc, Crown Holdings, Inc, Huhtamaki Oyj, Mondi Group, Sonoco Products Company, Stanpac Inc, Westrock Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)