Cone Crushers Market Size, Share, Trends and Forecast by Type, Offering, Power Source, Application, and Region, 2025-2033

Cone Crushers Market Size and Share:

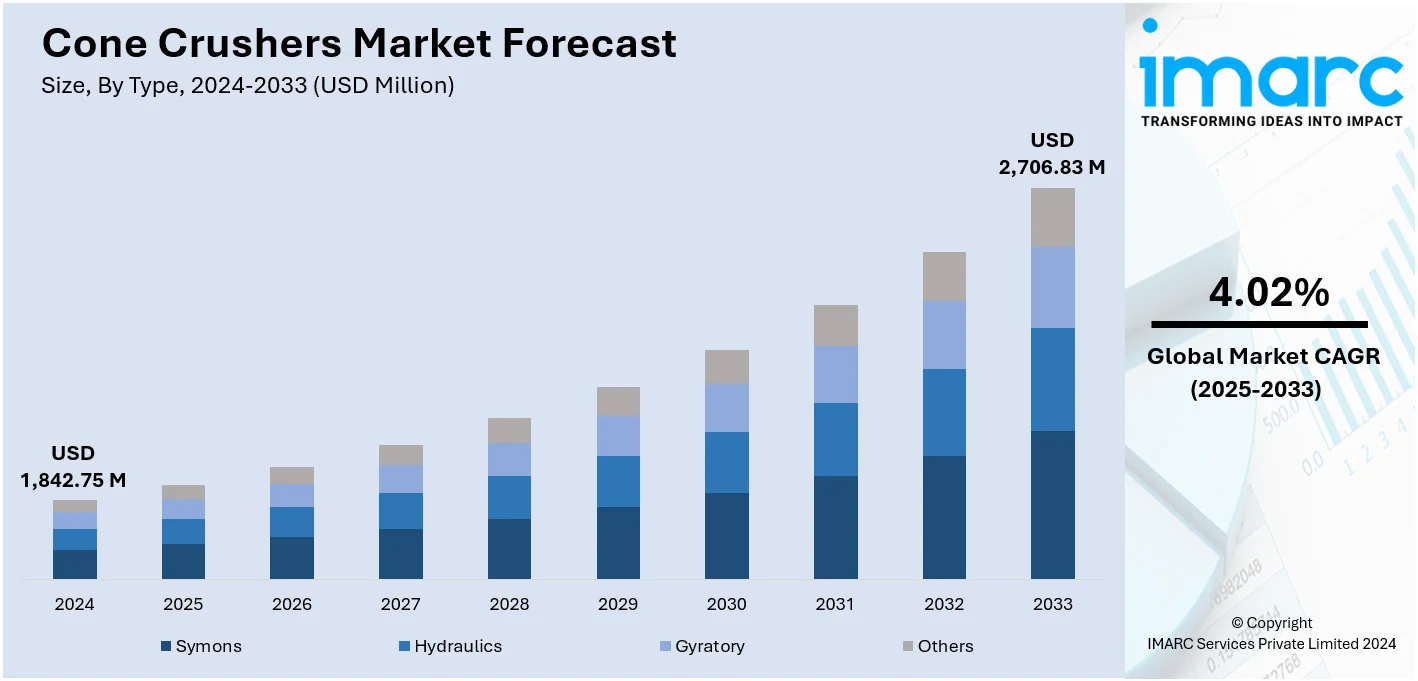

The global cone crushers market size was valued at USD 1,842.75 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,706.83 Million by 2033, exhibiting a CAGR of 4.02% from 2025-2033. North America currently dominates the market, holding a market share of over 38.6% in 2024. Key drivers in the cone crushers market include growing demand for efficient crushing solutions in construction and mining, advancements in automation and technology enhancing performance, and increased infrastructure development worldwide. These factors contribute to a rise in product adoption for material processing, leading to significant cone crushers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,842.75 Million |

|

Market Forecast in 2033

|

USD 2,706.83 Million |

| Market Growth Rate (2025-2033) | 4.02% |

One of the major drivers in the cone crushers market is the growing demand for construction and mining activities, which require efficient crushing equipment. With the growth of infrastructure development worldwide, particularly in emerging economies, the demand for high-performance cone crushers to process aggregates and minerals has risen. These crushers are favored for their capability to handle tough materials, produce consistent particle sizes, and minimize downtime. Additionally, technological advancements, such as automation and remote monitoring, have enhanced the operational efficiency and safety of cone crushers, further driving their adoption across various industries, including mining, construction, and aggregates.

The U.S. plays a significant role in the cone crushers market with 87.60% market share, driven by robust demand across industries such as construction, mining, and aggregates. The country's extensive infrastructure development and increasing focus on urbanization fuel the need for efficient material processing equipment. Furthermore, research indicates that in 2024, the U.S. construction industry saw substantial growth, with a 10% increase in nominal value added and a 12% rise in gross output. Alongside this, the U.S. mining sector requires cone crushers to extract minerals and crushed stone, vital for construction projects. Technological advancements, including the integration of automation and AI in crushers, have made them more efficient, precise, and cost-effective. Furthermore, the U.S. government’s investments in public infrastructure and mining initiatives support the continued growth of the cone crushers market. Leading manufacturers in the U.S. are also focusing on product innovation to cater to the diverse needs of these industries.

Cone Crushers Market Trends:

Increasing Demand for High-Efficiency Cone Crushers

High-efficiency cone crushers are ever-growing in demand because of growing industry requirements and optimization of the production process within a low-operational cost scope. As asserted by the U.S. Department of Energy, an increase of 10-30% in the level of energy efficiency of mining machinery, such as crushers, should be translated to the level of operational costs reduced. Advanced automated and control devices significantly enhance the efficiency and consumption of operating power of highly efficient crushers. These innovations are critical in the mining industry that calls for heavy machinery for processing heavy tons of materials. The U.S. mining industry alone, according to the U.S. Geological Survey, annually crushes more than 1.3 Million tons of stone that drives up demand for effective crushers. Construction activities that need crushed aggregates add on to these demands. With the growing importance of cost-effective and environmentally sustainable operations in industries, high-efficiency cone crushers have become essential for meeting such requirements while also maximizing production rates and energy savings.

Growth in Mining and Construction Sectors

The mining and construction sectors are responsible for significant growth in the market of cone crushers. As mentioned in the U.S. Bureau of Labor Statistics, in the construction industry more than 7 million individuals were working. The projection suggests that growth from 2022 to 2032 will increase the number at an annual growth rate of 5%. Growth implies a rise in demand for these construction materials with aggregates including crushed stone, gravel, and sand, important aspects of infrastructures. Thus, the U.S. According to Geological Survey, the country produced 1.5 Million metric tons of crushed stone in 2022, showing continuous growth in the construction industry. In addition, the U.S. government has set aside USD 1.2 trillion in infrastructural investments in the next decade, which would further spur the demand for construction materials, in turn requiring higher efficiency and robust crushing equipment such as cone crushers. This demand will be high in the form of reliable, high-capacity crushers to cater to the rising construction projects, meeting the required material processing thus positively impacting the cone crushers market outlook.

Technological Advancements in Cone Crushers

Automation and remote monitoring systems are the innovations transforming the cone crushers market. The advancements are set to help in the optimization of crusher performance, increase safety, and minimize the costs incurred during maintenance. According to the U.S. Department of Energy, automation in mining operations will boost energy efficiency by 20-30%, thus benefitting various industries relying on crushers. Real-time monitoring and changes in crushing parameters like speed and pressure helps in cone crushers, output is produced more uniformly, and control of the process becomes better. Energy efficiency is encouraged by the U.S. Environmental Protection Agency (EPA) in industrial sectors, to which advanced technologies are implemented. This means that the application of automation by operators reduces downtime, optimizes resource use, and maximizes the equipment lifespan. Integration of automated and energy-efficient solutions in cone crushers is expected to drive growth for the market, given the productivity improvements sought while remaining sustainable by the industries.

Cone Crushers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cone crushers market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, offering, power source, and application.

Analysis by Type:

- Symons

- Hydraulics

- Gyratory

- Others

Hydraulic stands as the largest component in 2024, holding around 40.2% of the market as they are crucial for enhancing the functionality of cone crushers by providing improved force control and ease of operation. These systems enable automated adjustments of the crusher's settings, reducing downtime and ensuring consistent crushing performance. Additionally, hydraulic stands facilitate the adjustment of the crusher's gap, which improves product uniformity and allows for easier maintenance. The increasing demand for high-efficiency equipment in mining and construction, coupled with the need for minimal downtime, contributes to the cone crushers market demand.

Analysis by Offering:

- Mobile Crushers

- Portable Crushers

- Stationary Crushers

Mobile crushers leads the market with around 49.3% of market share in 2024 driven by their flexibility and mobility, which allow them to be used across various applications in construction, mining, and demolition projects. These crushers are highly portable, allowing them to be easily moved between job sites, eliminating the need for fixed plant installations and offering cost-effective solutions for on-site material processing. Mobile crushers also deliver high efficiency and flexibility, capable of processing a variety of materials with minimal setup time. The growing demand for portable and compact equipment in industries requiring flexible, on-the-go crushing solutions further bolstering the cone crushers market growth.

Analysis by Power Source:

- Electric Connection

- Diesel Connection

- Dual Connection

In 2024, diesel connection accounts for the majority of the market at around 53.2% due to the preferred sectors such as mining, construction, and aggregate production due to their robust performance and mobility. These crushers are ideal for operations in remote or off-grid areas where electricity access may be limited. Diesel engines supply the required power for heavy-duty tasks, ensuring high throughput and efficiency when crushing tough materials. Their ability to operate in challenging environments, combined with their reliability and cost-effectiveness, makes diesel-powered cone crushers a dominant choice for industries requiring flexible and durable crushing solutions.

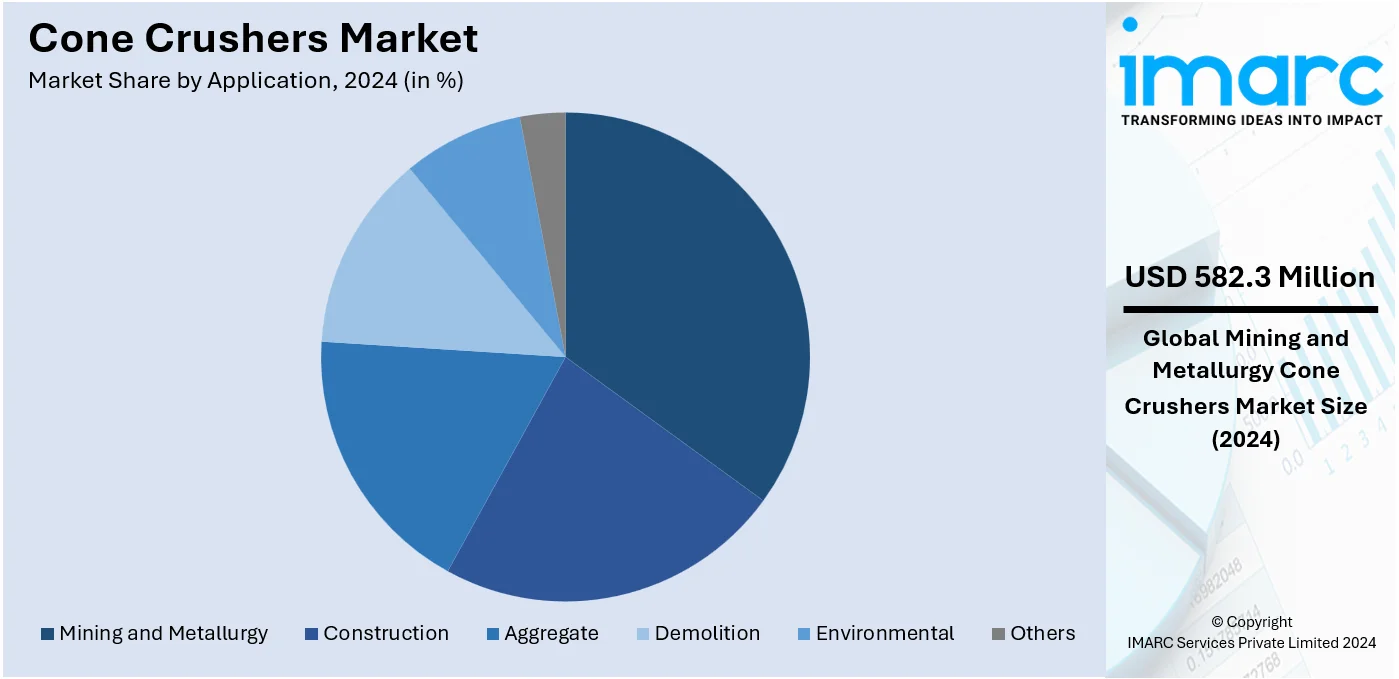

Analysis by Application:

- Mining and Metallurgy

- Construction

- Aggregate

- Demolition

- Environmental

- Others

Mining and metallurgy represented the leading market segment, holding 31.6% of the total share due to the critical role cone crushers play in the extraction and processing of minerals, ores, and metals. Mining operations rely on cone crushers to break down hard materials like stone, metal ores, and minerals, providing consistently sized material for further processing. The growing demand for mineral resources, coupled with advancements in extraction technologies, fuels the need for high-performance crushers. Additionally, the metallurgy industry benefits from these crushers in refining metal ores and ensuring efficient material handling, further contributing to their significant cone crushers market share.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Based on the cone crushers market forecast North America accounted for the largest market share of over 38.6% driven by the region's robust construction, mining, and infrastructure development activities. The U.S. and Canada, in particular, are making substantial investments in large-scale infrastructure projects, driving up the demand for high-performance equipment such as cone crushers. Additionally, the region benefits from a mature mining sector, where crushers are essential for mineral processing and resource extraction. Technological innovations, including automation and energy-efficient solutions, are further fueling market growth. The presence of leading manufacturers, along with a growing focus on product innovation and customer support, further strengthens North America’s position in the cone crushers market.

Key Regional Takeaways:

United States Cone Crushers Market Analysis

The U.S. cone crushers market is witnessing significant growth, driven by massive investments in infrastructure and mining. The Federal Highway Administration (FHWA) has committed USD 550 Million over fiscal years 2022–2026 for infrastructure projects through the Bipartisan Infrastructure Law, which will boost demand for aggregates and, consequently, cone crushers used in aggregate processing. Ongoing growth within construction, including further road construction or bridge development is also raising more demand for the aggregate crushing plant. Lastly, the production, which continues normally in the area of mineral mines and extraction enhances crushers demand. With these developments, the manufacturers are looking to innovate energy-efficient designs and automated technologies for mining, aided by the programs of the Department of Energy, to make it more sustainable in nature. This all combines to establish the U.S. as one of the significant players in the global cone crushers market.

Europe Cone Crushers Market Analysis

The European cone crushers market is developing due to high investments in both the construction and mining sectors, of which the greatest contributions come from Germany and Sweden. The European Commission stated that the EU had already allocated EUR 7 Million (USD 7.7 Million) in 2023 for construction infrastructure projects, and this, therefore, impacts demand for aggregates that are processed using cone crushers. Increased modernization in the mining sector of Germany, particularly on efficient, eco-friendly crushers, is another trend in the region. Strong environmental regulations in Europe are also forcing the development of greener technologies. Manufacturing cone crushers has still been rising steadily with the innovative designs in crusher design, including automation and energy efficiency to date. The European market, therefore, reinforces the position of being a global leader in manufacturing cone crushers across the region.

Asia Pacific Cone Crushers Market Analysis

Asia Pacific cone crushers market is growing fast with robust growth in infrastructure and mining sectors. Particularly in China and India, has experienced rapid growth in the mining sector. The construction and development sectors in China have also been increasing steadily. In 2023, investments in China's infrastructure sector reached USD 942 Million, an industrial report stated. As a result, the aggregate processing demand increases. All these factors propel the adoption of more sophisticated crushing technologies in this region, especially in Australia, China, and India. Government-sponsored schemes such as the Belt and Road Initiative in China and "Make in India" initiated by the Indian government promote innovation and domestic production of crushing equipment in various countries. All these factors make India and other Asia Pacific countries pivotal players in the global cone crushers market.

Latin America Cone Crushers Market Analysis

Latin America is the fastest-growing region in terms of investments in mining and construction, where cone crushers will thrive. According to an industry report, the mining sector of Brazil expects to see USD 64.5 Million in private investment from 2024 to 2028, in the fields of logistics, environmental standards, and development of critical minerals. The enhanced processes for mineral extraction will result in considerable demand for cone crushers for handling large-scale aggregate and ore processing. Additionally, the DNIT of Brazil has set aside USD 10.3 Million for road infrastructure development in 2023, which would increase demand for construction aggregates. Chile and Peru are also progressing in mining modernization, where the government-backed projects are centered on copper and lithium extraction. Technological advances and partnerships among local and global players in the region boost the adoption of eco-friendly and efficient crushing equipment, positioning Latin America as a growing hub for the cone crushers market.

Middle East and Africa Cone Crushers Market Analysis

Infrastructure and mining activities attract significant investments in the Middle East and African cone crushers market. In 2022, Saudi Arabia had military expenditure of USD 75 Million, which was 16% higher than for the fiscal year 2021, an industrial report stated. A part of this investment is into infrastructure development for strategic projects. Large infrastructures are also being developed under the Saudi Vision 2030 initiative in the form of NEOM and new mining exploration activities. Other countries, including South Africa, are also augmenting mining operations, with their focus on precious metals and minerals upping the stakes for advanced crushing equipment. Other growth drivers of the market are government-backed investments in the mining and construction industries, as well as increasing energy-efficient and automated crushers adoption. The region's focus on sustainable and eco-friendly technologies is further accelerating the market, as international manufacturers collaborate with local players to meet evolving industry demands and regulatory standards.

Competitive Landscape:

The cone crushers market is highly competitive, with numerous established and emerging players. These companies prioritize product innovation, technological advancements, and strategic partnerships to maintain a competitive advantage. Leading manufacturers are incorporating features such as automation, remote monitoring, and energy efficiency into their cone crushers, catering to the growing demand for advanced, high-performance equipment. In addition, major players are increasing their production capacities and improving customer support services to reinforce their market presence. The market also faces strong competition from regional companies that provide cost-effective solutions tailored to local demands. Partnerships with distributors and continuous research and development efforts further intensify competition, driving companies to improve product quality and meet evolving industry demands.

The report provides a comprehensive analysis of the competitive landscape in the cone crushers market with detailed profiles of all major companies, including:

- Astec Industries Inc.

- FLSmidth & Co. A/S

- Keestrack

- McCloskey International Limited (Neles Oyj)

- Puzzolana

- Sandvik AB

- Terex Corporation

- Tesab Engineering Ltd

- thyssenkrupp AG

- Westpro Machinery Inc.

Latest News and Developments:

- In January 2025, Heidelberg Materials’ Whatley Quarry acquired a new B3 B-Series Cone Crusher from Quarry Manufacturing & Supplies (QMS). Designed for superior performance, reliability, and ease of use, the crusher enhances aggregate production at the Somerset site. Operating since the 1930s, the quarry produces six million tonnes of limestone annually, supporting construction projects across the UK. Spanning 173 hectares, it also includes asphalt and concrete plants, employing over 60 people and supporting local initiatives.

- In November 2024, Cedarapids, a Terex brand, launched the TC1300X, its most advanced static cone crusher. Featuring a 400 hp motor, improved kinematics, and dual eccentric throws, it ensures superior aggregate quality and productivity.

- In October 2024, Metso launched MX for cones, enhancing wear parts for large Nordberg® HP and MP Series™ cone crushers in mining and quarrying. The innovation extends liner wear life up to twofold, reducing maintenance, labor shortages, and personnel risks. MX for cones is 100% recyclable, supporting sustainability. Designed in-house, it ensures optimal wear profiles and meets Metso’s highest quality standards, addressing global demand for durable secondary crushing solutions.

- In September 2024, Astec AME announced that they will be manufacturing the Titan T200 cone crusher locally from 2025 in South Africa. Supporting African industries, it can offer up to 260 tph capacity, better productivity, and easy maintenance. Key features are a hybrid thrust bearing, hydraulic anti-spin system, and compact design, fitting into Astec's strategy of streamlining operations regionally.

- In September 2024, FLS announced that it showcased its advanced gyratory and cone crushers, including the new Mark V, Raptor series, and ERC® Eccentric Roll Crusher, at booth 10775 West Hall.

- In August 2024, Astec Industries reported that the FT300 Cone Crusher has been performing exceptionally well at Hazell Brothers' Raeburn Quarry for more than a decade. Equipped with a CAT C13B engine and featuring a Kodiak Plus design, it delivers high efficiency and low operating costs. The TRAC10 controls and hydraulic cone brake of the crusher enhance safety and ease of operation.

- In March 2024, Sandvik unveiled the new 800i cone crusher series with its advanced ACS-c 5 Automation & Connectivity System. The innovation improves reliability, simplicity, and operating productivity, also providing robust mechanical design and simple, user-friendly automation to increase performance and maintenance efficiency, according to Lifecycle Manager Javier Valdeavellano.

Cone Crushers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Symons, Hydraulics, Gyratory, Others |

| Offerings Covered | Mobile Crushers, Portable Crushers, Stationary Crushers |

| Power Sources Covered | Electric Connection, Diesel Connection, Dual Connection |

| Applications Covered | Mining and Metallurgy, Construction, Aggregate, Demolition, Environmental, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Astec Industries Inc., FLSmidth & Co. A/S, Keestrack, McCloskey International Limited (Neles Oyj), Puzzolana, Sandvik AB, Terex Corporation, Tesab Engineering Ltd, thyssenkrupp AG and Westpro Machinery Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cone crushers market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cone crushers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cone crushers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global cone crushers market cover 2025-2033 along with a value at USD 1,842.75 Million in 2024.

IMARC estimates the market to reach USD 2,706.83 Million by 2033 and exhibit a CAGR of 4.02% during 2025-2033.

Key factors driving the cone crushers market include increasing demand for efficient material processing in construction and mining, technological innovations like automation and remote monitoring, growing infrastructure development, and the need for high-performance equipment. These factors collectively contribute to the market's growth and adoption of advanced cone crushing solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global cone crushers market include Astec Industries Inc., FLSmidth & Co. A/S, Keestrack, McCloskey International Limited (Neles Oyj), Puzzolana, Sandvik AB, Terex Corporation, Tesab Engineering Ltd, thyssenkrupp AG and Westpro Machinery Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)