Computer Vision Market Size, Share, Trends and Forecast by Component, Product Type, Application, Vertical, and Region, 2025-2033

Computer Vision Market Size and Share:

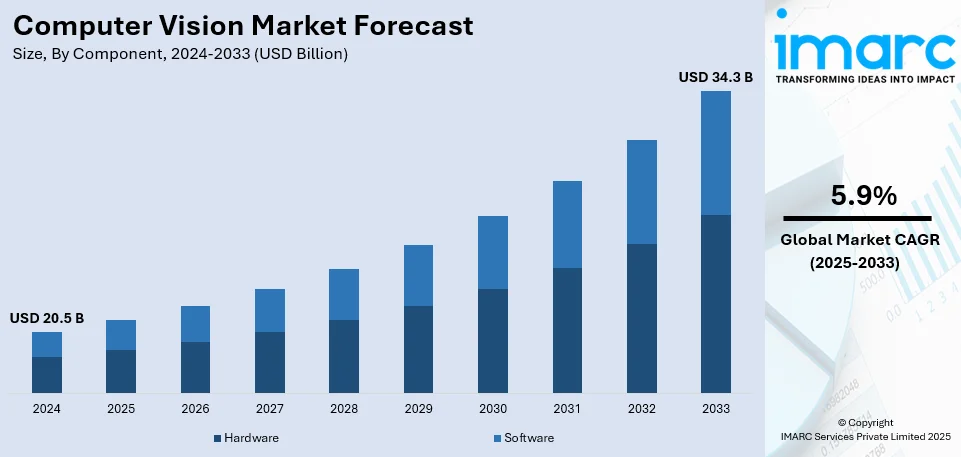

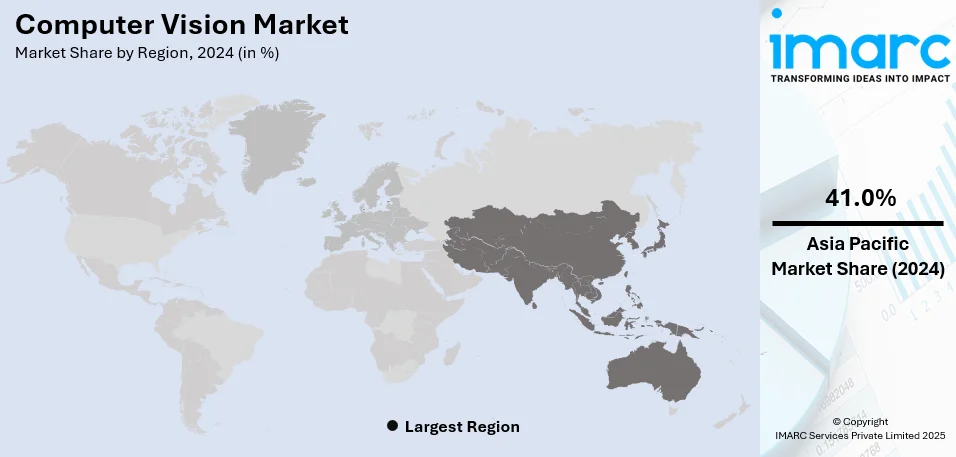

The global computer vision market size was valued at USD 20.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 34.3 Billion by 2033, exhibiting a CAGR of 5.9% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 41.0% in 2024. The market is driven by rising automation in various industries, advancements in hardware components, rapid progress in artificial intelligence and machine learning, the expanding role of surveillance technologies, and the development of self-driving vehicles. .

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 20.5 Billion |

|

Market Forecast in 2033

|

USD 34.3 Billion |

| Market Growth Rate (2025-2033) | 5.9% |

One of the key drivers of the computer vision market is the growing use of artificial intelligence (AI) and deep learning algorithms in industries. Companies are embedding AI-driven computer vision (CV) solutions to increase automation, optimize operational efficiency, and facilitate advanced analytics. Industries like healthcare, automotive, retail, and manufacturing are applying AI-based image and video analysis to uses such as medical diagnosis, autonomous transport, facial recognition, and product inspection. For example, in 2025, Nvidia introduced GeForce RTX 50 Series GPUs at CES, featuring Blackwell architecture for enhanced generative AI performance, advanced video encoding, and support for multi-camera 4K/60p video editing in leading applications. The rapid advancements in AI models, coupled with the availability of high-performance computing infrastructure and large datasets, are further accelerating computer vision market growth. This trend is fostering innovation, reducing human intervention, and enhancing decision-making capabilities across sectors.

The United States is driving the computer vision market through technological innovation, robust investment, and a strong ecosystem of AI-focused companies and research institutions. Leading technology firms are advancing deep learning models and high-performance computing, accelerating computer vision applications across industries. The country’s well-established semiconductor and cloud infrastructure supports AI-powered vision solutions, enhancing adoption in healthcare, automotive, retail, and security. For instance, in 2024, Cognex Corporation enhanced its In-Sight SnAPP vision sensor with an AI-enabled counting tool, automating assembly verification and quantity checks for complex parts with improved accuracy and ease of use. Government initiatives, research funding, and collaboration between academia and industry are further strengthening the sector. Additionally, the increasing deployment of computer vision in defense, smart cities, and automation is solidifying the U.S. market leadership.

Computer Vision Market Trends:

Advancements in Generative AI Technologies

The integration of generative AI, especially generative adversarial networks (GANs), is accelerating innovation in CV by significantly enhancing image-related capabilities. GANs enable the creation of highly realistic synthetic images, which are increasingly used for data augmentation—expanding training datasets without the need for costly and time-consuming data collection. This leads to more robust and accurate CV models. Additionally, generative AI facilitates domain adaptation by helping algorithms perform consistently across varied environments and visual contexts, such as adapting a model trained on lab images to work in real-world factory settings. For instance, Ambient.ai launched "Ambient Intelligence," in December 2024, an advanced AI platform integrating natural language processing (NLP) and CV to revolutionize physical security. This system delivers human-level, contextual understanding of security camera footage, enabling proactive threat detection and incident prevention. It significantly reduces false alerts by categorizing incidents by severity, allowing security teams to focus on critical threats. Such advancements are unlocking new applications in sectors like healthcare, automotive, entertainment, and security, thereby, fueling the adoption of CV across a broad range of industries.

Increase in Industrial Automation

Industries like manufacturing and logistics are increasingly adopting CV to optimize processes. Automation powered by CV enables real-time quality control, defect detection, and inventory management. This not only enhances production efficiency but also reduces human errors, leading to cost savings and improved product quality. For instance, CV-powered systems in manufacturing can reduce defect rates by up to 30%, leading to cost savings and improved product quality. Logistics companies leverage CV for automated sorting, package tracking, and warehouse management, improving accuracy and speed. The increasing demand for precision and efficiency is driving widespread CV adoption.

Rise in Autonomous Systems

The rise of autonomous systems, including self-driving cars, drones, and industrial robots, is significantly driving the computer vision market value. These systems rely on advanced CV algorithms to process visual data, enabling real-time decision-making, obstacle detection, and safe navigation. In 2023, the number of industrial robots installed in the U.S. increased by 12% to 44,303 units, highlighting the growing adoption of automation across industries. As industries prioritize safety, efficiency, and precision, the need for high-performance CV solutions continues to rise. Enhanced AI-driven vision technologies are being developed to improve object recognition, depth perception, and situational awareness, ensuring greater reliability in autonomous operations across transportation, logistics, manufacturing, and defense sectors.

Growing Optimization of E-commerce and Retail Sectors

The growing optimization of e-commerce and retail sectors through computer vision (CV) is transforming operations and customer engagement. CV-powered visual search enables consumers to find products using images, improving the shopping experience. Retailers are leveraging AI-driven vision technologies for automated inventory management, shelf monitoring, and loss prevention, enhancing operational efficiency. Personalization is another key benefit, as CV-based recommendation systems analyze consumer behavior and preferences, leading to a 10-15% increase in sales, according to an industry report. By streamlining inventory tracking, reducing stockouts, and enhancing targeted marketing, CV is improving customer satisfaction and boosting revenue. As e-commerce and retail evolve, the integration of CV is becoming essential for competitive advantage and seamless shopping experiences.

Computer Vision Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global computer vision market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, product type, application, and vertical.

Analysis by Component:

- Hardware

- Software

Hardware leads the market with around 72.7% of the market share in 2024. The demand for high-performance processors, cameras, sensors, and edge computing devices is driving growth across industries such as manufacturing, automotive, healthcare, and security. Companies are investing in advanced GPUs, FPGAs, and AI accelerators to support real-time image processing and deep learning applications. The proliferation of high-resolution cameras and LiDAR technology in autonomous vehicles, industrial automation, and smart surveillance further strengthens hardware adoption. Edge computing advancements are enabling faster data processing with reduced latency, making on-device AI more efficient. The increasing deployment of robotics, IoT-enabled vision systems, and smart factory solutions continues to fuel the market's reliance on hardware components.

Analysis by Product Type:

- Smart Camera-based

- PC-based

PC-based leads the market with around 62.9% of the market share in 2024. These systems offer high processing power, flexibility, and scalability, making them the preferred choice across industries such as manufacturing, healthcare, automotive, and retail. PC-based solutions support complex deep learning models, high-resolution imaging, and real-time data analysis, enabling precise defect detection, automated quality control, and intelligent decision-making. The availability of powerful GPUs, cloud integration, and AI-driven software is further enhancing performance. Companies are investing in PC-based vision systems for tasks requiring extensive data processing and AI inference. The growing adoption of Industry 4.0, smart factories, and automated inspection systems is further driving the dominance of PC-based solutions in the market.

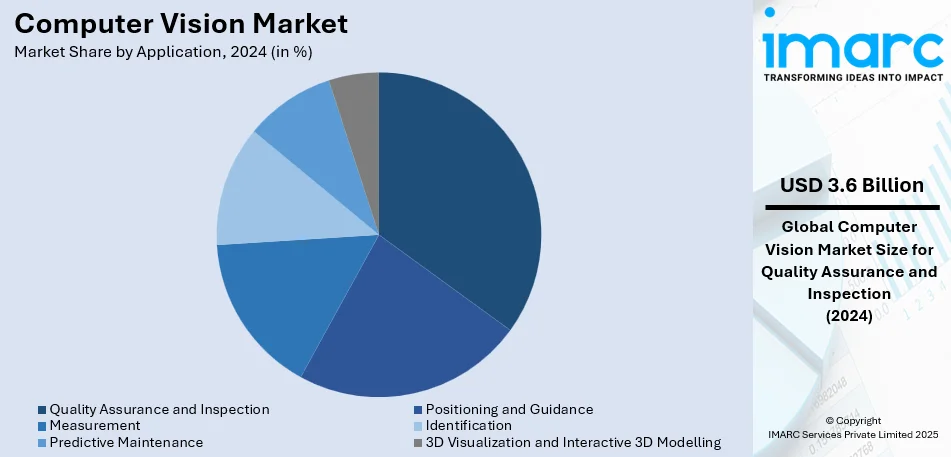

Analysis by Application:

- Quality Assurance and Inspection

- Positioning and Guidance

- Measurement

- Identification

- Predictive Maintenance

- 3D Visualization and Interactive 3D Modelling

Quality assurance and inspection leads the market with around 17.3% of market share in 2024. Industries such as manufacturing, automotive, electronics, and pharmaceuticals are increasingly deploying AI-driven vision systems to enhance defect detection, ensure product consistency, and improve operational efficiency. Automated quality control solutions reduce human error, lower production costs, and accelerate throughput, making them essential in modern industrial processes. Advancements in deep learning, high-resolution imaging, and edge computing are further enhancing real-time inspection capabilities. The demand for precision, regulatory compliance, and predictive maintenance is driving widespread adoption, particularly in sectors requiring high accuracy and stringent quality standards. As a result, computer vision is becoming a critical component of industrial automation strategies.

Analysis by Vertical:

- Industrial

- Non-Industrial

Industrial leads the market in 2024, driven by increasing automation, robotics adoption, and advancements in AI-powered quality control systems. Manufacturers are integrating computer vision into production lines for defect detection, predictive maintenance, and process optimization, enhancing efficiency and reducing operational costs. The growing use of machine vision in industrial robotics, automated assembly lines, and logistics is further strengthening market dominance. Industries such as automotive, electronics, and semiconductor manufacturing are leveraging high-precision imaging and deep learning algorithms to improve product quality and reduce downtime. Additionally, the expansion of smart factories and Industry 4.0 initiatives, supported by government funding and private investments, is accelerating the adoption of computer vision in industrial applications.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest computer vision market share of over 41.0%, driven by rapid technological advancements, increasing industrial automation, and strong government support for AI development. Countries such as China, Japan, South Korea, and India are heavily investing in AI-driven vision technologies across industries, including manufacturing, automotive, retail, and healthcare. China, in particular, is a key contributor, leveraging AI-powered surveillance, smart city initiatives, and industrial automation. The presence of major electronics and semiconductor manufacturers further strengthens the region’s leadership. Additionally, rising demand for robotics, IoT, and edge computing solutions is accelerating adoption. Expanding 5G networks and increasing investments in AI infrastructure are further fueling growth across the Asia Pacific market. For instance, according to a report published by GSMA in September 2023, titled ‘How 5G is transforming APAC’, the mobile industry drives economic growth in the Asia-Pacific (APAC) region, with projections nearing USD 1 trillion by 2030. 5G adoption, just 4% of mobile connections in 2022, is expected to reach 41% by 2030. This shift will significantly boost productivity and economic prosperity, adding over USD 133 billion to the APAC economy in 2030, reinforcing the transformative impact of widespread 5G deployment.

Key Regional Takeaways:

United States Computer Vision Market Analysis

US accounts for 87.5% share of the market in North America. The computer vision market in the U.S. is booming as innovation in AI continues to progress and grows with demand in multiple industries. According to an industrial report, over 50% of U.S. companies that have more than 5,000 employees already employ AI, while for organizations that have more than 10,000 employees, it is at 60%. More importantly, 42% of enterprise businesses having more than 1,000 employees use AI, demonstrating healthy adoption in large-scale enterprises. Key sectors like healthcare, retail, and automotive are driving demand, while autonomous vehicles and facial recognition systems are increasingly finding adoption. Leading players like NVIDIA and Intel remain on top with advanced GPUs and AI processors, leading to more efficiency and accuracy in computer vision applications. Federal support in terms of AI research funding and the creation of a regulatory framework for data privacy continues to foster an enabling environment for innovation. Strategic partnerships among established tech giants and emerging startups are also contributing to the advancement of sophisticated solutions, ensuring the U.S. leadership in the computer vision landscape around the world.

North America Computer Vision Market Analysis

North America is a key player in the computer vision market, driven by strong investments in AI, deep learning, and automation across industries. The region benefits from the presence of leading technology firms, including NVIDIA, Microsoft, and Intel, which are advancing AI-powered vision solutions. High adoption in healthcare, automotive, retail, and manufacturing is fueling market growth, with applications in medical imaging, autonomous vehicles, facial recognition, and quality inspection. For instance, in 2024, Cognex Corporation launched the In-Sight L38 3D Vision System, integrating AI, 2D, and 3D vision for inspection, with AI-powered 3D tools enabling setup in minutes using just 5-10 labeled images. Government funding for AI research, along with increasing demand for smart surveillance and industrial automation, is further strengthening the market. The expansion of cloud computing, edge AI, and 5G networks is enhancing real-time data processing, positioning North America as a leader in computer vision innovation and adoption.

Europe Computer Vision Market Analysis

Computer vision in Europe is growing since the governments and private organizations invest heavily in AI due to a significant need to advance innovation and increase economic growth. According to ECA, the EU set aside €20 billion (USD 24.5 billion) public-private AI investment over 2018-2020, which they continue setting yearly at €20 billion (USD 24.5 billion) during the next decade. The European Commission also doubled funding for research and innovation; over 2018-2020, they put aside €1.5 billion (USD 1.8 billion) and are setting yearly funds at €1 billion (USD 1.2 billion) during 2021-2027. AI adoption is bringing productivity gains in sectors such as healthcare, automotive, and retail while addressing challenges in society. According to an industrial report, the global AI market is forecasted to increase annually by 15.8% from 2024 to 2030, reaching USD 739 billion (€680 billion) by 2030, making Europe the global leader. Countries like Germany, France, and the UK spearhead adoption, leveraging initiatives to drive innovation and enhance efficiency across industries.

Asia Pacific Computer Vision Market Analysis

The computer vision market in Asia Pacific is expanding rapidly due to AI advances and strategic government initiatives. China takes the lead, establishing over 50 national and industrial AI standards by 2026 to direct the high-quality development of the sector. China's core AI industry has scaled to 578 billion yuan, or USD 81 billion, by 2023, according to the Ministry of Industry and Information Technology, which recorded a year-on-year growth of 13.9%. China hosts over 4,500 AI companies, promoting technological advancement through initiatives such as AI Plus, which looks to expand the digital economy and modernize manufacturing. Intelligent products and industrial applications are targeted areas for standardization. India's "Digital India" and Japan's robotics leadership further enhance the region's position. This Asia Pacific is thus emerging as the dominant force in the global computer vision industry due to the ever-increasing adoption in healthcare, manufacturing, and retail and through government-backed R&D.

Latin America Computer Vision Market Analysis

Latin America is witnessing growth in the computer vision market, with Brazil at the helm of regional AI advancements. In 2021, the Ministry of Science, Technology, and Innovation launched the Brazilian AI Strategy (EBIA) to stimulate research and innovation in AI solutions. Building on this, Brazil released its National Plan for AI in 2024, setting aside around USD 4 billion for business innovation projects and the development of AI infrastructure. The proposal of AI regulation via (Bill No. PL 2338/2023) is to protect fundamental rights and ensure safe, reliable AI systems that conform to the democratic principles and scientific development. As of September 2024, the bill is still being reviewed by the Senate, which reflects devotion to establishing robust frameworks for AI integration in Brazil. Brazil's efforts favor the healthcare, agriculture, and manufacturing sectors and thereby attract international collaboration. Latin America, with focus on regulation and investment, is positioning itself well in the world of computer vision as a competitive player and pushes through AI for economic and industrial transformations.

Middle East and Africa Computer Vision Market Analysis

The Middle East's computer vision market is expanding as AI adoption accelerates across industries. According to a recent white paper by MIT Sloan Management Review Middle East and Astra Tech, nearly 45% of UAE companies now use advanced language models, indicating the region's leadership in AI integration. Across the Middle East, 27% of businesses are exploring AI, 36% are in early adoption, 13% have achieved deep integration, and 13% are pioneering innovative applications. In the UAE, the main applications of AI are information retrieval (46%), customer support (33%), personalized recommendations, and retail mainly utilizing AI to create shopping experiences that are customized for each customer. Regional compliance is driving a few companies to build proprietary AI models that work in house, ensuring adherence to regional compliance. Localization becomes key in bringing the AI solutions up to cultural and legal standards of a region. This puts the Middle East in an excellent position for global innovation in computer vision.

Competitive Landscape:

The leading companies are incorporating deep learning that can automatically learn and extract complex features from images, which enables tasks like object detection, image segmentation, and even generating realistic images and improved the accuracy and efficiency of many CV applications. They are also integrating augmented reality (AR), virtual reality (VR), and edge computing in CV that reduces latency and bandwidth requirements, which makes real time decision making possible without relying heavily on cloud resources. Edge devices, such as cameras and sensors, can process and analyze visual data locally, which enables faster response times. For instance, in 2024, Basler AG acquired a 25.1% stake in Roboception GmbH, strengthening its position in intelligent 3D sensor technology for flexible automation through strategic investment and capital expansion in image processing solutions. These advancements create immersive and interactive environments for gaming, training, education, and more by tracking and interpreting the surroundings of the user.

The computer vision market report provides a comprehensive analysis of the competitive landscape in the with detailed profiles of all major companies, including:

- Basler AG

- Baumer Optronic

- CEVA Inc.

- Cognex Corporation

- Intel Corporation

- Jai A/S

- Keyence Corporation

- Matterport Inc.

- Microsoft Corporation

- National Instruments

- Sony Corporation

- Teledyne Technologies Inc.

Latest News and Developments:

- March 2025: Yum! Brands partnered with NVIDIA to deploy advanced computer vision in its restaurants, using NVIDIA-powered AI to optimize drive-thru efficiency and back-of-house labor management through real-time analytics and alerts. This technology, integrated into Yum!’s Byte by Yum! Will be piloted in select locations, with plans for broader rollout across KFC, Taco Bell, Pizza Hut, and Habit Burger.

- March 2025: IQGeo announced its plan to acquire Deepomatic, an AI computer vision software developer, to enhance its geospatial network lifecycle solutions for telecom and utility operators. Deepomatic’s AI technology analyzes field engineers’ photos to ensure quality control, reducing errors and costs while improving workflow efficiency. Already integrated with IQGeo’s software, this acquisition will boost network intelligence, enabling predictive, proactive management and data-driven digital twins.

- March 2025: HP and Reincubate formed a multi-year strategic partnership to enhance on-device AI video and video conferencing experiences on next-generation AI PCs. Leveraging Reincubate’s advanced AI video conferencing technology optimized for HP’s neural processing units (NPUs), this collaboration enables secure, low-latency, and offline AI processing directly on devices. This integration improves video quality, privacy, and efficiency while minimizing CPU/GPU load, extending battery life. The partnership aims to deliver immersive, personalized digital collaboration tools for hybrid work, advancing HP’s leadership in AI-powered personal computing.

- January 2025: Ipsotek launched VISense, an innovative addition to its VISuite platform that integrates Vision Language Models (VLMs) to revolutionize real-time video analytics. VISense enables detailed scene understanding and contextual insights, allowing users to ask natural language questions about unusual events and receive precise, actionable responses. Key benefits include zero-configuration deployment, high contextual accuracy, and scalability across thousands of cameras for diverse industries. VISense enhances operator decision-making and safety, marking a significant step in Generative AI-powered video analytics, with further advancements planned for 2025.

- January 2025: Ceva and Edge Impulse announced the availability of improved computer vision capabilities for Ceva-NeuPro-Nano NPUs, which are backed by NVIDIA's TAO toolkit. The combination, which incorporates Edge Impulse Studio, speeds up AI development with little to no coding required, supporting NPN32 and NPN64 NPUs. NeuPro-Nano architecture allows for AI inference, DSP workloads, and feature extraction in audio, voice, and vision applications.

- September 2024: Teledyne launched a dedicated website for its Vision Solutions group. The new platform brings together imaging technologies from Teledyne DALSA, e2v CMOS sensors, FLIR IIS, and many more, thus providing an integrated portfolio for industries in machine vision, medical, aerospace, and intelligent transportation.

Computer Vision Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Product Types Covered | Smart Camera-based, PC-based |

| Applications Covered | Quality Assurance and Inspection, Positioning and Guidance, Measurement, Identification, Predictive Maintenance, 3D Visualization and Interactive 3D Modelling |

| Verticals Covered | Industrial, Non-Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Basler AG, Baumer Optronic, CEVA Inc., Cognex Corporation, Intel Corporation, Jai A/S, Keyence Corporation, Matterport Inc., Microsoft Corporation, National Instruments, Sony Corporation, Teledyne Technologies Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the computer vision market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global computer vision market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the computer vision industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The computer vision market was valued at USD 20.5 Billion in 2024.

IMARC estimates the computer vision market to reach USD 34.3 Billion by 2033, exhibiting a CAGR of 5.9% during 2025-2033.

Key factors driving the computer vision market include increasing adoption of AI and deep learning, rising demand for automation in industries, advancements in edge computing, growth of autonomous systems, expanding applications in healthcare and retail, improved hardware capabilities, and government investments in AI-driven surveillance, smart cities, and industrial automation.

Asia Pacific currently dominates the market with 41.0% share, driven by rapid industrial automation, AI adoption, and strong semiconductor manufacturing. Countries like China, Japan, and South Korea are investing in smart technologies, autonomous systems, and AI-driven surveillance, fueling demand for computer vision across manufacturing, healthcare, automotive, and retail sectors.

Some of the major players in the computer vision market include Basler AG, Baumer Optronic, CEVA Inc., Cognex Corporation, Intel Corporation, Jai A/S, Keyence Corporation, Matterport Inc., Microsoft Corporation, National Instruments, Sony Corporation, Teledyne Technologies Inc. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)