Compressor Oil Market Size, Share, Trends and Forecast by Compressor Type, Base Oil, Application, End Use Industry, and Region, 2025-2033

Compressor Oil Market Size and Forecast:

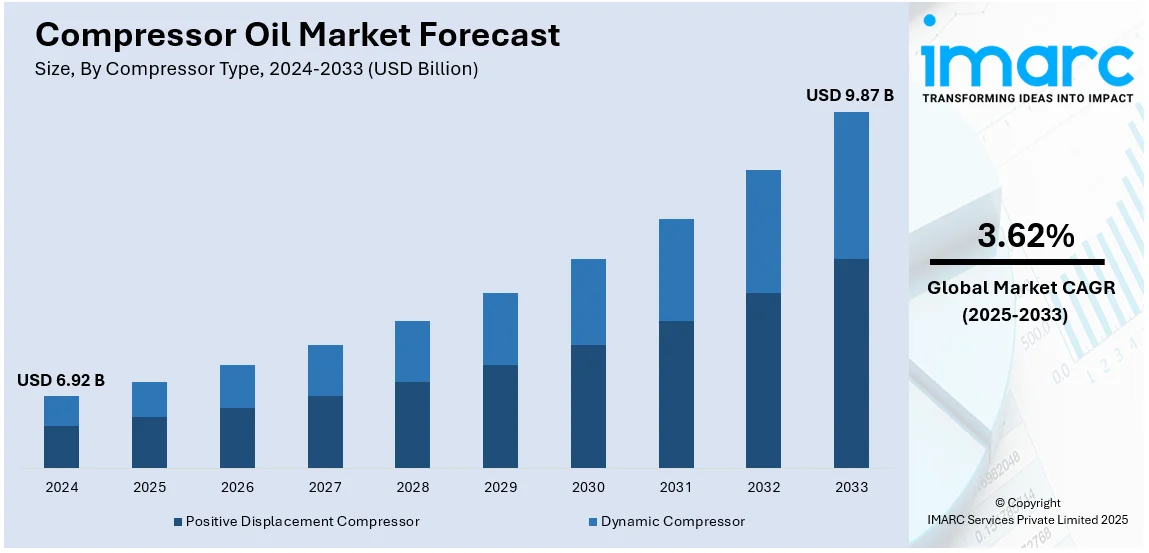

The global compressor oil market size was valued at USD 6.92 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.87 Billion by 2033, exhibiting a CAGR of 3.62% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 45.0% in 2024. The market is experiencing steady growth driven by the increasing industrialization and automation across sectors, stringent environmental regulations favouring eco-friendly compressor oils, the expanding heating, ventilation, and air conditioning (HVAC) industry, the demand for compressors in various applications, and research-driven innovation in compressor oil formulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.92 Billion |

|

Market Forecast in 2033

|

USD 9.87 Billion |

| Market Growth Rate (2025-2033) | 3.62% |

The compressor oil market is influenced by innovation across industrial applications, increase in awareness of environmental impact, and energy diversification. Increased manufacturing and rising usage of compressors in automotive, construction, and HVAC systems boost the volume of high-performance lubricants. Synthetic compressor oils are increasingly being used because of their high thermal stability and long service life, which therefore reduce maintenance expenses. Meanwhile, the increasing inclination for bio-based oils underlines the development of the industry in response to the arising environmental legislation and emphasis on minimization of the carbon footprints. The requirement for energy efficiency and operational dependability in industrial machinery continues to foster the development of innovative lubricant formulations designed to address specific performance needs.

As reflected by the global trends and preferences in the USA, the market for compressor oil emphasizes the regulation of the industry and energy-saving solutions. The continuously growing oil and gases industry, chemical processing industry, and power generation industry ensures constant demand for high-quality lubricants. As industrial automation becomes more widespread, there is increasing reliance on compressors for uninterrupted operations, creating a consistent requirement for reliable oils. Moreover, investments in advanced HVAC systems, driven by infrastructure development and residential upgrades, add to the market's growth potential, making the U.S. a key player in shaping the future of compressor oil innovation. For instance, in December 2024, Mitsubishi Electric announced a USD 143.5 million investment to retrofit its Kentucky factory for variable-speed compressors, supporting efficient HVAC systems, with USD 50 million in DOE funding to meet growing U.S. demand.

Compressor Oil Market Trends:

Increasing demand for compressors

The primary driver propelling the global compressor oil market share is the increasing demand for compressors across various industries. According to IMARC reports, the global air compressor market size reached USD 18.5 Billion in 2023. Compressors are key components in a wide range of applications, from manufacturing and automotive to oil & gas and HVAC systems. As industries expand and modernize their operations, the need for compressors to facilitate processes like air compression, refrigeration, and gas handling grows in tandem. This heightened demand directly impacts the market for compressor oils, which are crucial for ensuring the efficient and smooth functioning of these machines. With the globalization of markets and the constant quest for higher productivity, industries worldwide are embracing advanced technologies that rely on compressors. This, in turn, fuels the requirement for high-quality compressor oils. Manufacturers and suppliers of compressor oils are focusing on developing products that not only lubricate but also enhance the performance and longevity of compressors. Consequently, the increasing demand for compressors remains a pivotal driver in the growth of the global compressor oil market.

Stringent environmental regulations

Another significant driver influencing the global compressor oil market is the stringent environmental regulations imposed by governments worldwide. These regulations aim to curb emissions, enhance energy efficiency, and reduce the environmental footprint of industrial processes. According to the IEA, energy-related CO2 emissions increased by 0.9% in 2022, surpassing 36.8 Gigatons. In response to these mandates, industries are transitioning towards eco-friendly and sustainable practices, including the adoption of environmentally compliant compressor oils. Compressor oils play a crucial role in minimizing energy consumption and emissions in compressor operations. This has led to a growing demand for compressor oils with improved environmental credentials, such as low toxicity and biodegradability. According to the compressor oil market forecast, market players are investing in research and development to formulate compressor oils that not only meet these environmental standards but also provide high-performance lubrication.

Rise of industrial automation and HVAC expansion

The global compressor oil is further influenced by the rise of industrial automation and the expansion of the HVAC (Heating, Ventilation, and Air Conditioning) industry. Automation is becoming increasingly prevalent in manufacturing and industrial processes, leading to a higher demand for compressors to support automated systems. Compressor oils are essential for maintaining the efficient operation of these automated compressors. Additionally, the HVAC industry is experiencing significant growth due to urbanization, rising living standards, and climate control needs. According to the UN, around two-thirds of the population is expected to live in urban areas by 2050. Compressor oils are in constant demand as HVAC systems depend on compressors to regulate temperature and air quality. The growth of the HVAC industry, especially in emerging economies, plays a significant role in driving the compressor oil market.

Compressor Oil Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global compressor oil market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on compressor type, base oil, application, and end use industry.

Analysis by Compressor Type:

- Positive Displacement Compressor

- Dynamic Compressor

The dynamic compressor segment is witnessing robust growth driven by rapid industrialization and the increasing adoption of automated systems across various industries. These machines are essential for maintaining efficient and reliable pneumatic and hydraulic operations, thus becoming integral components of automated processes. In line with this, stringent environmental regulations have prompted industries to seek more energy-efficient solutions, which is supporting segment growth. Dynamic compressors, with their capacity for higher compression ratios and greater energy efficiency, are becoming the preferred choice in this context. Additionally, the growth of the HVAC industry, driven by urbanization and rising living standards, has led to increased demand for dynamic compressors for air conditioning and refrigeration applications. Moreover, technological advancements and innovations in dynamic compressor design and materials are enhancing their performance, durability, and versatility, further fueling compressor oil market share. Furthermore, globalization and expanding industrial operations in emerging economies are creating opportunities for dynamic compressor manufacturers. Apart from this, ongoing research and development efforts to optimize dynamic compressor designs and capabilities ensure a promising outlook for this segment in the foreseeable future.

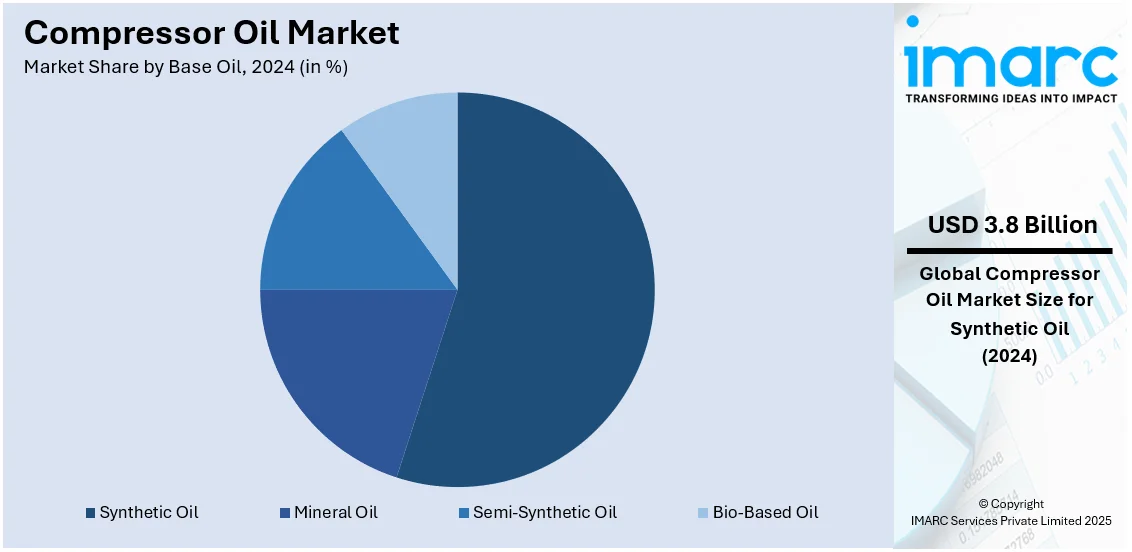

Analysis by Base Oil:

- Synthetic Oil

- Mineral Oil

- Semi-Synthetic Oil

- Bio-Based Oil

Synthetic oil stands as the largest component in 2024, holding around 54.3% of the market. The synthetic oil segment is witnessing robust growth in the global compressor oil market, primarily driven by the surging demand for high-performance lubricants capable of withstanding extreme operating conditions. Synthetic compressor oils are engineered to offer exceptional thermal stability, oxidation resistance, and reduced volatility, making them ideal for compressors operating at elevated temperatures and pressures. In line with this, stringent environmental regulations are pushing industries towards more environmentally friendly solutions. Synthetic compressor oils, with their low toxicity and biodegradability, align with these regulations and are increasingly favored over conventional mineral-based oils. Furthermore, the growing trend of industrial automation and the need for compressor oils that can provide consistent lubrication and protection in automated systems are boosting the demand for synthetic variants. Additionally, advancements in synthetic oil formulations, driven by ongoing research and development efforts, are continually improving their performance characteristics.

Analysis by Application:

- Gas Compressor

- Air Compressor

The growth of the air compressor, leading application segment in the global market, is primarily driven by the expansion of industries, such as manufacturing, automotive, construction, and oil & gas relies. This sustained industrialization is fueling the demand for air compressors. This is further supported by the increasing awareness of energy efficiency and environmental concerns, which is promoting the adoption of more advanced and energy-efficient air compressors. Moreover, strict regulations as well as emission standards have forced the industries to change their old and non-green compressors into new and eco-friendly ones. Furthermore, this growing trend of automation in manufacturing and industrial processes compels the use of air compressors thereby driving their demand. Similarly, rapid advancement in the construction industry especially in developing economies, will ideally mean the need for air compressors to perform tasks such as drilling or excavation. Research and evolution history are likely to contribute further to the reliability and efficiency of the air compressor, thereby creating a type of user that has come to demand enhanced performance and lower operation costs.

Analysis by End Use Industry:

- General Manufacturing

- Construction

- Oil and Gas

- Mining

- Chemical and Petrochemical

- Power Generation

- Others

General manufacturing segment is the dominant industry, primarily driven by technological advancements, as automation, robotics, and Industry 4.0 concepts are increasingly integrated into manufacturing processes, enhancing efficiency and productivity. Additionally, the globalization of supply chains and markets opens new opportunities for manufacturers to expand their reach and tap into diverse customer bases. Moreover, sustainability has become a driving force in manufacturing, with companies adopting eco-friendly practices to meet consumer and regulatory demands. It includes the employment of green materials, energy-efficient processes, and reduced waste generation. Furthermore, the changing consumer preferences in terms of customization and the shorter lead times besides soaring e-commerce are pushing manufacturers to operate more agilely and flexibly. Advancement in materials science, combined with government policies and incentives for local manufacturing, seems to spark growth. Concomitantly, greater research and development focus promote innovation in designing products and processes toward general expansion in the manufacturing segment.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest compressor oil market share of over 45.0%. The Asia Pacific region is witnessing robust growth in the compressor oil market, primarily driven by the region's rapid industrialization and urbanization, which are generating significant demand for compressors across diverse industries, including manufacturing, construction, and automotive. As these sectors expand and modernize their operations, the need for efficient compressor systems, and consequently, high-quality compressor oils, is on the rise. In addition, the rigorous environmental regulations imposed on industries in countries such as China, India, and Japan are rapidly pushing them toward adopting green compressor oils that minimize emission and fulfill environmental compliance. Thus, regulatory pressure acts to propel the pace toward sustainable lubrication solutions and hence creates a surge in demand for environmentally compliant compressor oils. Moreover, the expanding HVAC market in the Asia Pacific area due to the rise of the middle-class populations and high temperatures also depend on compressors as well as compressor oils for the proper indoor environment.

Key Regional Takeaways:

United States Compressor Oil Market Analysis

In 2024, United States accounted for 78.90% of the market share in North America. The compressor oil market in the United States is experiencing significant growth due to several key drivers. Increasing industrialization and the expansion of manufacturing sectors are driving the demand for compressor oils, as these oils are essential for the efficient operation of various machinery. Companies are focusing on improving energy efficiency and reducing operational costs, which is boosting the adoption of high-performance compressor oils. The rising demand for air conditioning systems, particularly in the automotive and residential sectors, is further fueling market growth. According to the EIA, approximately 88% of households in the U.S. utilize air conditioning (AC), with two-thirds of these households relying on central AC systems or central heat pumps as their primary cooling solution. Technological advancements in compressor oil formulations are enhancing product performance, leading to a shift toward more sustainable and environmentally friendly oils. Moreover, strict government regulations regarding emissions and energy consumption are pushing industries to adopt better lubricants.

North America Compressor Oil Market Analysis

The North American market for compressor oil is driven by the progressive industrialization, technology innovation, and rising demand for energy-efficient solutions. Industries such as manufacturing, oil and gas, and chemical processing segments form the main market driving force, as their operations demand consistent and efficient lubricants due to highly demanding working environments. For instance, in April 2024, Copeland, introduced its first Vilter-branded industrial CO2 compressor unit, designed for transcritical and subcritical applications, serving industries such as cold storage, food, beverages, pharmaceuticals, and industrial processing in North American market. Furthermore, stringent environment protections compel synthetic and bio-based oils to meet sustainability goals. As such, the adoption of HVAC systems continues to rise, thus further fueling the market expansion into residential, commercial, and industrial levels. In addition, investments in advanced machinery and automation push the demand for high-quality compressor oils that are efficient and effective in extending a compressor's lifetime. This region’s focus on innovation and regulatory compliance ensures steady market growth.

Europe Compressor Oil Market Analysis

The compressor oil market in Europe is experiencing significant growth due to several factors. Industries are increasingly focusing on enhancing the performance and longevity of compressors, driving the demand for high-quality compressor oils. Companies are adopting advanced compressor technologies, which are requiring specialized oils to ensure efficiency and reduce wear and tear. As industries such as manufacturing, automotive, and energy are expanding, the consumption of compressor oils is rising to meet the operational needs of equipment. According to the Office for National Statistics, in 2018, motor vehicle manufacturing companies in the United Kingdom employed more than 169,000 individuals, accounting for 0.5% of the country's total workforce. The growing emphasis on sustainability is also encouraging the development of eco-friendly compressor oils, contributing to market growth. Moreover, the increasing use of compressors in refrigeration and air conditioning systems is further boosting the demand. Regulatory changes aimed at reducing emissions are prompting the adoption of high-performance oils that comply with environmental standards, fueling the market’s expansion.

Asia Pacific Compressor Oil Market Analysis

The compressor oil market in Asia Pacific is experiencing significant growth due to several key drivers. Industries are increasingly demanding high-performance oils for compressors to enhance operational efficiency and reduce downtime. The growing industrialization in emerging economies is driving the need for reliable compressor systems, thus fueling the market. Manufacturers are continuously improving their products, introducing advanced formulations to cater to diverse compressor applications. There is a rising focus on energy-efficient technologies, pushing industries to adopt high-quality oils that ensure optimal performance and energy savings. Additionally, the expansion of the automotive sector is contributing to the demand for compressor oils in air conditioning systems. According to the Ministry of Heavy Industries, the automotive sector accounts for 6% of India's overall GDP and 35% of its manufacturing GDP.

Latin America Compressor Oil Market Analysis

The compressor oil market in Latin America is experiencing growth due to increasing industrialization, which is driving the demand for efficient machinery lubrication. Companies are investing in high-quality compressor oils to enhance equipment performance and extend lifespan. The region is also witnessing expanding manufacturing sectors, which are boosting the need for compressors. According to the ITA, Mexico ranks as the world’s seventh-largest producer of passenger vehicles, manufacturing 3.5 Million units annually. A significant 88% of these vehicles are exported, with 76% directed to the United States market.

Middle East and Africa Compressor Oil Market Analysis

The compressor oil market in the Middle East and Africa is experiencing significant growth due to increasing industrialization, expanding manufacturing sectors, and rising demand for air compressors across various industries. Additionally, growing automotive and HVAC sectors are driving the adoption of compressor oils. According to the World Economic Forum, the UAE's manufacturing production increased by 8.7% and Saudi Arabia's manufacturing activity increased by 18.5% in December 2022 compared to the previous year. Rising awareness of energy efficiency and the need for high-performance lubricants are further contributing to the market's expansion in the region.

Competitive Landscape:

The compressor oil market is intensely competitive where the leading companies are focused on innovating their product portfolios, pursuing sustainability, and forming strategic partnerships in order to strengthen their competitive position. Companies have heavily invested in research and development to make improvements in the performance of a product, its energy efficiency, and meeting even stringent environmental regulations. For instance, in July 2024, Edwin James Group acquired Pettits and subsidiary Motivair Compressors to expand its portfolio, strengthen competitiveness, and enter new markets, supported by Aliter Capital’s investment. In addition, increasing need for environmentally friendly and bio-based oils has initiated change towards sustainable practices for the delivery of different stages of lubricant formulations and developing new technologies. Smaller firms and the regional players increasingly project targeting specific niche markets, further amplifying competition. The emphasis on extending equipment lifespan and minimizing operational costs continues to shape strategies, as manufacturers aim to cater to the diverse requirements of industrial applications.

The report provides a comprehensive analysis of the competitive landscape in the compressor oil market with detailed profiles of all major companies, including:

- Royal Dutch Shell PLC

- ExxonMobil Corporation

- BP International Limited

- Chevron Corporation

- Total S.A.

- Sinopec Group

- The PJSC Lukoil Oil Company

- Indian Oil Corporation Ltd.

- The Fuchs Group

- Idemitsu Kosan Co. Ltd.

- Petroliam Nasional Berhad (Petronas)

- DuPont de Nemours, Inc. (DuPont)

- Croda International PLC

- Sasol Limited

- The Phillips 66 Company

- Bel-Ray Company LLC

- Morris Lubricants Limited

- Penrite Oil Company

Latest News and Developments:

- October 2024: RSC Bio Solutions launched FUTERRA Compressor Oils, synthetic lubricants meet performance specifications in both the industrial and marine needs but are also identified with sustainability.

- October 2022: Valvoline Cummins Private Limited, a renowned global manufacturer of engine oils and lubricants with 150 years of innovation in advanced lubricant technologies, has introduced Valcomp Compressor Oil Synth 68, a PAO-based full synthetic oil designed specifically for air compressors.

- June 2021: Anderol® SYNcom FG HiPerf 46 is a premium, high-performance food-grade screw compressor oil from Anderol Specialty Lubricants, designed to deliver exceptional longevity. Key advantages of using Anderol® SYNcom FG HiPerf 46 include minimal ash and carbon build-up, superior oxidation and thermal stability, excellent demulsibility, and a broad operating temperature range, ensuring reliable and efficient performance over extended periods.

Compressor Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Compressor Types Covered | Positive Displacement Compressor, Dynamic Compressor |

| Base Oils Covered | Synthetic Oil, Mineral Oil, Semi-Synthetic Oil, Bio-Based Oil |

| Applications Covered | Gas Compressor, Air Compressor |

| End Use Industries Covered | General Manufacturing, Construction, Oil and Gas, Mining, Chemical and Petrochemical, Power Generation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Royal Dutch Shell PLC, ExxonMobil Corporation, BP International Limited, Chevron Corporation, Total S.A., Sinopec Group, The PJSC Lukoil Oil Company, Indian Oil Corporation Ltd., The Fuchs Group, Idemitsu Kosan Co. Ltd., Petroliam Nasional Berhad (Petronas), DuPont de Nemours, Inc. (DuPont), Croda International PLC., Sasol Limited, The Phillips 66 Company, Bel-Ray Company LLC., Morris Lubricants Limited, Penrite Oil Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the compressor oil market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global compressor oil market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the compressor oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The compressor oil market was valued at USD 6.92 Billion in 2024.

The compressor oil market is projected to exhibit a CAGR of 3.62% during 2025-2033, reaching a value of USD 9.87 Billion by 2033.

The compressor oil market is majorly driven by the increasing industrialization, growing demand for efficient machinery, and ongoing advancements in compressor technologies, rising energy needs, expansion in manufacturing and automotive industries, and an enhanced focus on reducing equipment downtime.

Asia Pacific currently dominates the market, accounting for a share of around 45.0%. The dominance is driven by rapid industrialization, expanding manufacturing sectors, infrastructure development, increasing energy demand, technological advancements, and growing investments in oil and gas industries.

Some of the major players in the compressor oil market include Royal Dutch Shell PLC, ExxonMobil Corporation, BP International Limited, Chevron Corporation, Total S.A., Sinopec Group, The PJSC Lukoil Oil Company, Indian Oil Corporation Ltd., The Fuchs Group, Idemitsu Kosan Co. Ltd., Petroliam Nasional Berhad (Petronas), DuPont de Nemours, Inc. (DuPont), Croda International PLC., Sasol Limited, The Phillips 66 Company, Bel-Ray Company LLC., Morris Lubricants Limited, and Penrite Oil Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)