Composite Preforms Market Size, Share, Trends and Forecast by Product Type, Fiber Type, End Use Industry, and Region, 2025-2033

Composite Preforms Market 2024, Size and Trends:

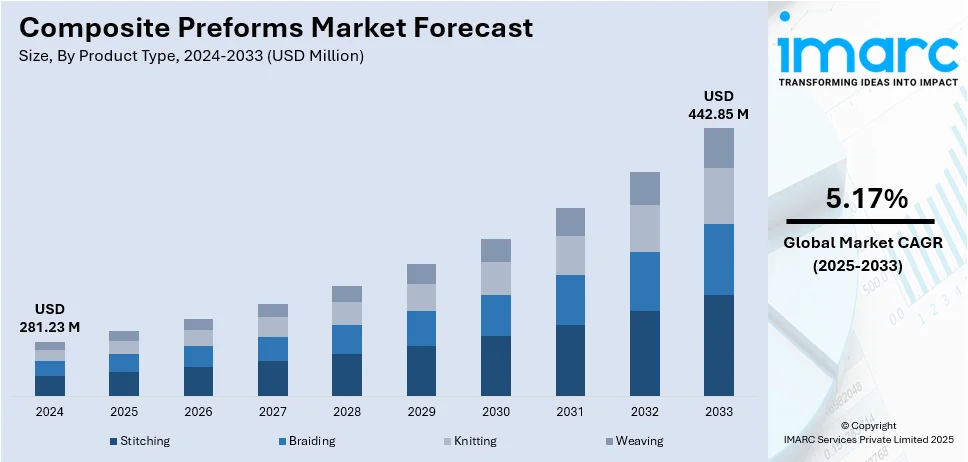

The global composite preforms market size was valued at USD 281.23 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 442.85 Million by 2033, exhibiting a CAGR of 5.17% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40% in 2024. The significant growth in the aerospace industry, growing product demand in the automotive industry, and the integration of three-dimensional (3D) printing technology represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 281.23 Million |

| Market Forecast in 2033 | USD 442.85 Million |

| Market Growth Rate (2025-2033) | 5.17% |

The composite preforms market growth is fueled by the rising demand for lightweight and high-strength materials across industries like automotive, aerospace, wind energy, and defense. In aerospace, the focus on fuel efficiency and reduced emissions accelerates the adoption of advanced composites. The automotive sector emphasizes lightweight to meet regulatory requirements for fuel economy and sustainability. Additionally, advancements in manufacturing processes, like 3D weaving, braiding, and automated performing, improve production efficiency and cost-effectiveness, fueling market growth. The renewable energy sector, particularly wind energy, also drives demand for durable and lightweight composite preforms. Increasing investments in modern infrastructure and defense applications further contribute to market growth, alongside heightened awareness of the benefits of composites in achieving performance and sustainability goals. The factors, collectively, are creating a composite preforms market outlook across the globe.

The composite preforms market in the United States is driven by advancements in aerospace, defense, automotive, and renewable energy sectors. The aerospace industry, a key contributor, demands lightweight and high-strength materials to enhance fuel efficiency and performance in aircraft and space exploration projects. The defense sector emphasizes advanced composites for durable, lightweight applications in armor, drones, and missiles. In the automotive industry, the push for lightweight vehicles to meet fuel efficiency and emissions regulations accelerates the adoption of composite preforms. Additionally, the U.S. is a leader in wind energy, driving demand for high-performance materials in turbine blades. Investments in R&D, automation in manufacturing, and government initiatives supporting sustainable and advanced materials further propel market growth in the country. For instance, in September 2024, L&L Products announced the introduction of its exclusive InsituCoreTM foaming materials to produce lightweight composites. With the help of these new materials, production procedures can be streamlined, producing a lightweight net-shaped part or performing with the desired density and strength.

Composite Preforms Market Trends:

Growing Demand for Lightweight Materials

The prime thrust for composite preforms mainly arises from the demand for lightweight materials. Automotive, aerospace, and construction industries are emphasizing the demand for lightweight components to improve fuel efficiency, reduce carbon emissions, and enhance the performance of their products. In the automotive industry, the U.S. government set a target of reducing vehicle weight by 25% by 2030 to improve fuel efficiency and reduce emissions. For the aerospace sector, the lightweight components reduce fuel efficiency and enhance payload capacity. As composite preforms possess high strength at low weights, they have gained preference in making components for the sectors. Given increasing regulatory pressure towards environmental sustainability, and with an increase in the demand of the consumer towards energy-efficient products, the need for light composite preforms is bound to keep increasing in the future. This is driving manufacturers to innovate and adopt composite materials across various industrial applications, representing one of the key composite preforms market trends.

Advancements in Manufacturing Technologies

The development of manufacturing technologies has significantly increased the capability of composite preforms to produce and lower costs. RTM, compression molding, and AFP technologies have been able to refine the precision and speed of composite preform production. According to the U.S. Department of Energy’s (DOE) Office of Energy Efficiency and Renewable Energy, the use of automated manufacturing systems in the production of composite materials can reduce energy consumption by up to 25% compared to traditional methods. They make faster production time and consistent material availability with minimal wastage possible and hence can use composite preforms in mass production, too, in an economic way. For example, RTM can be used to produce highly complex composite shapes with high accuracy and minimal material waste, thus minimizing both the costs of operation and environmental impact. AFP technology further provides for automated fiber placement, making it easier to scale up the production process and maintain quality control. These developments are not only opening up growth in established sectors but also making composite preforms more accessible to emerging industries, such as renewable energy, electronics, and consumer goods. Manufacturers are increasingly adopting these technologies to meet the growing demand for composite preforms in various applications.

Sustainability and Eco-Friendly Materials

With increased awareness of sustainability, the demand for eco-friendly materials in composite preforms is gaining momentum, thus representing the major composite preforms market trend. Industries and governments are focusing on minimizing environmental impacts, and the use of renewable, recyclable, and biodegradable materials by composite preform manufacturers is gaining momentum. Composite preforms made from natural fibers like flax, hemp, and jute are being used to replace synthetic fibers and minimize the overall environmental footprint. In 2021, the U.S. Department of Energy launched a project to develop bio-based composite materials that could reduce carbon footprints by up to 30% compared to conventional materials. Moreover, recyclable thermoplastics are gaining rapid developments as recyclables can convert waste into product which is essentially one of the criteria of a circular economy model. The surge for 'green products' is gaining steam due to consumer pressure from stringent regulations forcing various industries from automobiles to buildings, to create and use composite material that minimizes carbon content and is sustainably sourced and applied. Because of these needs, the composite preform manufacturers are developing newer ways of sustainable production methods as well as source materials that may have minimal effects on the environment while not losing its performance.

Composite Preforms Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global composite preforms market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, fiber type, and end use industry.

Analysis by Product Type:

- Stitching

- Braiding

- Knitting

- Weaving

Stitching is expected to dominate the composite preforms market due to its ability to enhance structural integrity and provide superior mechanical performance. This method effectively binds layers of fabric or fibers together, creating a durable and lightweight material. It also reduces delamination risks and ensures uniform load distribution. The process is versatile, cost-efficient, and suitable for producing complex geometries, making it ideal for aerospace, automotive, and wind energy applications, where high-performance and reliability are critical.

Braiding is a key method in the composite preforms market because of its ability to create seamless, continuous, and highly durable structures. This technique allows for producing complex shapes with exceptional tensile strength, impact resistance, and design flexibility. Braiding is particularly advantageous for tubular and cylindrical components, such as pipelines, aircraft wings, and automotive frames. Its automated production process ensures cost-effectiveness and precision, driving its widespread adoption in industries demanding lightweight and high-strength materials.

Knitting holds a significant share in the composite preforms market due to its flexibility in producing intricate 3D shapes and tailored fiber orientations. This method offers excellent drapeability, adaptability, and improved stress distribution, making it suitable for advanced applications in aerospace, automotive, and construction. Knitting allows for precise control over fiber alignment, resulting in superior mechanical properties and reduced material waste. Its efficient production process, combined with its ability to meet customized requirements, drives its popularity.

Analysis by Fiber Type:

- Carbon

- Glass

- Others

Carbon holds the largest share in the composite preforms market due to its exceptional strength-to-weight ratio, stiffness, and durability. These properties make it indispensable for industries such as aerospace, automotive, wind energy, and sports equipment, where high performance and weight reduction are critical. Carbon fibers offer superior fatigue resistance, thermal stability, and corrosion resistance, ensuring reliability in demanding environments. Furthermore, advancements in manufacturing processes, such as automated fiber placement and 3D weaving, have improved cost-efficiency and scalability. The growing demand for lightweight, high-strength materials to meet sustainability and fuel efficiency goals further drives carbon's dominance in the composite preforms market.

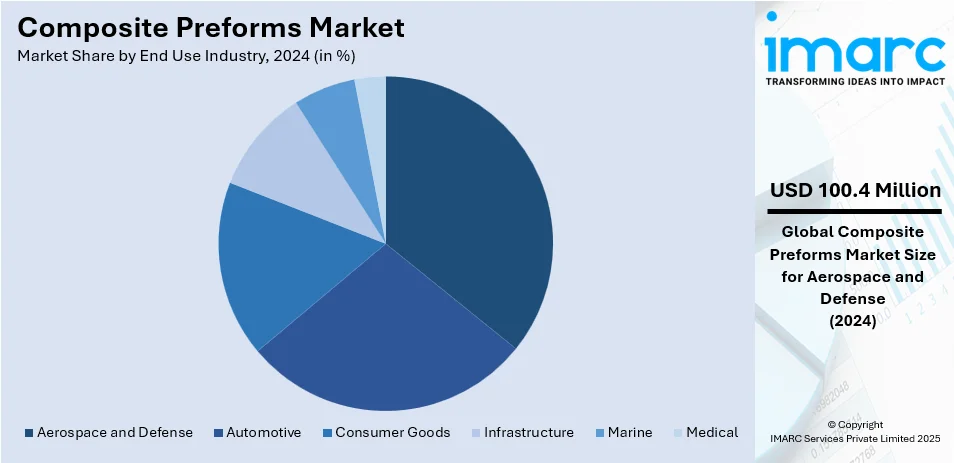

Analysis by End Use Industry:

- Automotive

- Consumer Goods

- Infrastructure

- Marine

- Medical

- Aerospace and Defense

Aerospace and defense leads the market with around 35.7% of the composite preforms market share in 2024. The aerospace and defense sector holds the largest share in the composite preforms market due to its high demand for lightweight, durable, and high-performance materials. Composite preforms, especially those made from carbon and glass fibers, are widely used in aircraft structures, such as fuselage, wings, and engine components, to reduce weight and improve fuel efficiency. These materials also enhance strength, fatigue resistance, and thermal stability, meeting stringent safety and performance standards. In defense, composite preforms are used in armor, missiles, and drones for superior durability and agility. Increasing investments in modern aviation and defense technologies further drive the market's growth.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40%. The composite preforms market in North America is driven by a robust aerospace and defense sector, which demands lightweight, high-strength materials for aircraft, missiles, and defense equipment to improve performance, fuel efficiency, and durability. The automotive industry's push for lightweight vehicles to meet stringent fuel economy and emissions standards also significantly contributes to the composite preform market growth. Additionally, the region's leadership in renewable energy, particularly wind energy, drives demand for composite preforms in the production of durable, lightweight turbine blades. Advancements in manufacturing processes, such as automated fiber placement, 3D weaving, and braiding, enhance efficiency and scalability, further supporting the market. Increased investments in R&D by major players and government initiatives promoting sustainable, high-performance materials boost innovation and adoption. North America's well-established infrastructure, skilled workforce, and technological leadership position the region as a key driver of composite preform demand across various industries, including aerospace, automotive, construction, and renewable energy.

Key Regional Takeaways:

United States Composite Preforms Market Analysis

The US composite preforms market is experiencing growth because of a strong industrial base, applications in defense, and growing demands in aerospace and automotive sectors. As per the US Department of Defense, its budget for 2023 was approximately USD 816 billion, which accounted for major chunks of funding advanced composite materials. In the automotive sector, usage of composite materials has also gone up as car manufacturers have begun using lightweight materials for better fuel efficiency. Composite preforms sales drove about 15.5 million vehicle sales in the year 2023, as per reports. With growing investments into sustainable production methodologies and improvements of manufacturing technologies, the market has seen a continuous growth. Such market leaders have been Owens Corning and Hexcel Corporation among others, in that they offer higher performance solutions towards aerospace, automobile, and renewable energy industries. U.S.-based manufacturers are also cashing in on export opportunities, putting the country at the top of the list in the global composite preforms market.

Europe Composite Preforms Market Analysis

The composite preforms market is gaining momentum in Europe due to high demand from aerospace, automotive, and renewable energy sectors. This growth is particularly from Germany's aerospace and automotive industries, where Airbus and BMW invest extensively in composite materials to cut down on weight and increase energy efficiency. In contrast, the defense budget of Europe, according to reports released by the European Commission, has grown to €326 billion (USD 360 billion) projected this 2024; it was specifically allocated by governments for employing advance composite material applications. Higher take-up applications can also be credited to enhanced integration in wind power, headed by Denmark, among others like UK, by making them increase in the turbines manufacturing. The development of carbon fiber and thermoplastic preforms is prominent, with companies such as Solvay and SGL Carbon spearheading innovation. Europe’s focus on sustainability and regulatory frameworks surrounding material efficiency further encourage the use of composite preforms across various industries.

Asia Pacific Composite Preforms Market Analysis

This composite preforms market in the Asia Pacific is gaining momentum with rapid industrial demand in aerospace, automotive, and construction. According to an industry report, China's defense budget in 2022 alone was USD 230 billion and is investing a lot in advanced materials, composites included. As per an industry report, the Indian automotive sector is expected to see significant growth and will be backed by a projected 2023-2024 defense budget of USD 72.6 billion for the country, which would promote the usage of composites in military and defense technologies. Japan and South Korea are also strengthening their manufacturing facilities for lightweight, high-strength composite materials. The region is experiencing growth in wind energy sectors also, due to increased renewable energy investments. Major companies, Toray Industries, and Mitsubishi Chemical are promoting carbon fiber and composite preform development for these sectors. In recent times, Asia Pacific is becoming the focal point of manufacturing composite preform globally.

Latin America Composite Preforms Market Analysis

The composite preforms market in Latin America is growing. A growing requirement in aerospace, automotive, and renewable energy sectors for lightweight, yet durable materials has led to this growth. According to an industry report, Brazil's automotive sector is growing with a focus on lighter vehicles for better fuel efficiency. So, the demand for composite preforms in this industry is also expected to grow in Brazil. In the aeronautical branch, Embraer is investing in advanced materials for its aircraft such as composites. Mexico and Argentina are increasing their renewable energy sectors, with added wind and solar energy projects also increasing the use of composites in these segments. According to a survey of the Latin American Composite Materials Association, even though composites revenues went down, the revenues in Brazil increased by 3.9%. The growing infrastructure development in the region further accelerates the market, with government incentives and international partnerships driving the production capacity. The companies such as Braskem of Brazil are major composite material producers in the country, thereby helping Brazil become the market leader in Latin America.

Middle East and Africa Composite Preforms Market Analysis

The demand for composite preforms has increased in the Middle East and Africa due to their requirement in defense, aerospace, and infrastructure sectors. According to an industry report, military spending by Saudi Arabia recorded an estimated level of USD 75.0 billion in 2022, surging by 16 percent from 2021, and some part of this expenditure would go towards advanced materials like composite preforms in defense. In the UAE, where the aerospace industry is very well developed, investments are being made into high-performance composite materials for aircraft and satellite manufacture. In South Africa, its automotive sector is growing, which is increasing composite material usage to produce lightweight vehicles. The region is also becoming increasingly involved in renewable energy, specifically in wind power generation, thus upping the ante in demand for composite material. Other such companies include those in South Africa, like Denel, manufacturing composite materials locally for the domestic markets and internationally to position the region as a burgeoning force in the global composite preforms market.

Competitive Landscape:

The composite preforms market is highly competitive, driven by advancements in manufacturing technologies and increasing demand across aerospace, automotive, and wind energy sectors. Key players focus on innovations, such as 3D weaving, braiding, and automated fiber placement, to enhance production efficiency and material performance. Prominent companies include Albany International, SGL Carbon, A&P Technology, and Bally Ribbon Mills, offering diverse preform solutions. Strategic partnerships, R&D investments, and mergers are common to expand product portfolios and global reach. Emerging players are targeting cost-effective production methods and customized preforms to gain market share. The regional competition is influenced by industrial growth, with North America and Europe leading due to robust aerospace and automotive industries, while Asia-Pacific shows rapid expansion potential.

The report has also analysed the competitive landscape of the composite preforms market with some of the key players being:

- A&P Technology Inc.

- Albany International Corp

- Axis Composites Limited

- Bally Ribbon Mills

- C & J Antich

- Eurocarbon B.V.

- Kümpers Composites (Kangde Composites Co., Ltd.)

- SAERTEX Group

- Sigmatex

- T.E.A.M., Inc.

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Recent Developments:

- November 2024: Biesterfeld Group has partnered with Saertex GmbH to distribute its composites in Germany. The agreement covers Saertex’s preforms, including glass and carbon fiber noncrimp fabrics, SAERfix, SAERflow, and SAERcore, supporting lightweight construction advancements.

- October 2024: According to The Composite Sky, advanced composites have become central to modern aerospace engineering. Featuring high-strength fibers and polymer matrices, these materials enhance aircraft performance, safety, and efficiency.

- August 2024: Sigmatex has increased weaving capacity at its Orangeburg, South Carolina, facility by 50% through a new production cell. This investment targets growth in aerospace, space, and defense sectors over the next five years, leveraging innovative technologies.

- July 2024: A&P Technology's QISO® triaxial braided structure is changing the composite manufacturing game by adding stability, managing thermal, and creating structural integrity. Simplifying production reduces 40% scrap but also enables complex shapes without cutting or overlapping.

Composite Preforms Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Stitching, Braiding, Knitting, Weaving |

| Fiber Types Covered | Carbon, Glass, Others |

| End Use Industries Covered | Automotive, Consumer Goods, Infrastructure, Marine, Medical, Aerospace and Defense |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A&P Technology Inc., Albany International Corp, Axis Composites Limited, Bally Ribbon Mills, C & J Antich, Eurocarbon B.V., Kümpers Composites (Kangde Composites Co., Ltd.), SAERTEX Group, Sigmatex, T.E.A.M., Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the composite preforms market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global composite preforms market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the composite preforms industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The composite preforms market was valued at USD 281.23 Million in 2024.

The composite preforms market is projected to exhibit a CAGR of 5.17% during 2025-2033, reaching a value of USD 442.85 Million by 2033.

The composite preforms market is driven by demand for lightweight, high-strength materials in aerospace, automotive, and renewable energy sectors. Key factors include fuel efficiency, emissions regulations, wind energy expansion, and advancements in manufacturing processes like 3D weaving and braiding. Increased R&D investments and sustainability goals further create a positive composite preforms market outlook.

North America currently dominates the composite preforms market, accounting for a share of 40%. The composite preforms market in North America is driven by aerospace, automotive lightweighting, renewable energy growth, and advanced manufacturing technologies.

Some of the major players in the global composite preforms market include A&P Technology Inc., Albany International Corp, Axis Composites Limited, Bally Ribbon Mills, C & J Antich, Eurocarbon B.V., Kümpers Composites (Kangde Composites Co., Ltd.), SAERTEX Group, Sigmatex, T.E.A.M., Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)