Composite Packaging Market Size, Share, Trends and Forecast by Material, End Use, and Region, 2025-2033

Composite Packaging Market Size and Trends:

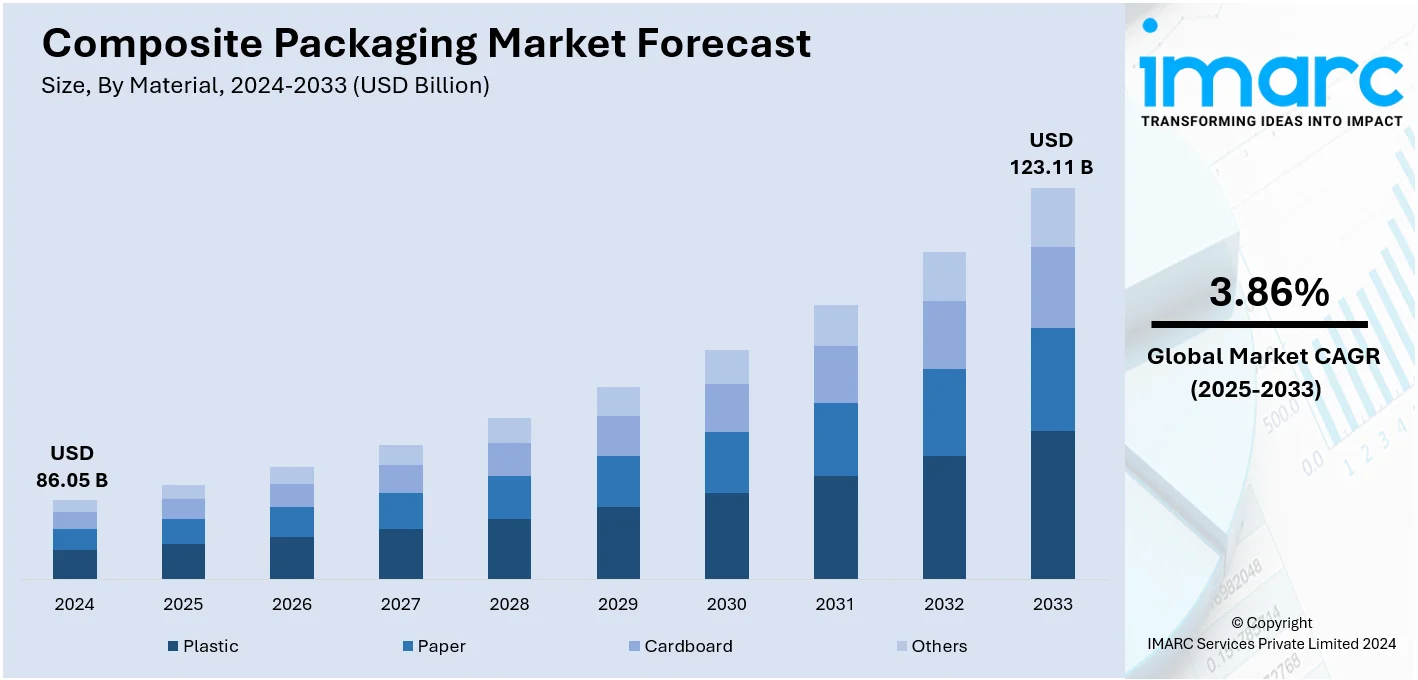

The global composite packaging market size was valued at USD 86.05 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 123.11 Billion by 2033, exhibiting a CAGR of 3.86% from 2025-2033. North America currently dominates the market, holding a composite packaging market share of over 32.0% in 2024. The rapid growth of e-commerce, increasing preference for eco-friendly packaging solutions, extensive use in food and beverage (F&B) applications, advanced manufacturing technologies, and strong consumer awareness about sustainability are some factors driving the composite packaging market share in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 86.05 Billion |

|

Market Forecast in 2033

|

USD 123.11 Billion |

| Market Growth Rate (2025-2033) | 3.86% |

The global composite packaging market share is significantly growing due to the increasing demand for lightweight, durable, and sustainable packaging products. In addition, high tendencies in e-commerce promote the need for protective and sustainably flexible packaging, aiding the market growth. Whereas the F&B sector seeks protective characteristics of composite packaging, including the preservation of quality and elongation of shelf life, contributing to the market expansion. Moreover, continuous technological developments, particularly in developing new and efficient models, are impelling the market growth. Furthermore, increased customer knowledge and the implementation of tough environmental laws encourage manufacturers to create reclamation and eco-friendly goods, which is providing an impetus to the market. Apart from this, the pharmaceutical and cosmetics industries focus on the security and attractiveness of the packing material, which aligns with the industry trends and customer requirements, thereby propelling the market forward.

Composite packaging market demand in the United States is surging, driven by the increasing adoption of composite packaging. Consumers and packaging manufacturers seek light, durable, and environmentally friendly packaging solutions in key sectors such as F&B, pharmaceuticals, and e-commerce, boosting the market demand. Moreover, with the increasing popularity of online shopping, industries require functional and reliable protective packaging materials, which is catalyzing the market growth. According to the U.S. Census Bureau, retail e-commerce sales for Q3 2024 were estimated at $300.1 billion, accounting for 16.2% of total retail sales. Additionally, the increasing concern for environment-friendly packaging solutions is allowing producers to leverage recycled and bio-degradable materials for packaging, boosting the market demand. Furthermore, the emerging material science associated with innovative appealing, and effective packaging options is enhancing the looks and utility of products, aiding the market growth. Apart from this, the strict environmental and corporate regulations along with the policies governing sustainability are significantly contributing to the market expansion.

Composite Packaging Market Trends:

Rising demand for eco-friendly packaging

The widespread awareness of sustainability is fueling the demand for eco-friendly composite packaging solutions. The consumers prefer environmentally friendly packaging which encourages manufacturers to utilize packaging that is recyclable, biodegradable, and renewable. Moreover, legal requirements and sustainability objectives set by governments and organizations are supporting the adoption of green packaging. For instance, the European Parliament's Packaging and Packaging Waste Directive (PPWD) aims to recycle 70% of the waste by 2030. Furthermore, bio-degradable, reusable, natural fiber-based packaging materials, biopolymers, and other sustainable materials give strength, utility as well as sustainability. Concurrent with this, the trend to remove plastics and minimize carbon emissions supports the use of eco-friendly composite packaging, further aiming to add value to packaging, which is impelling the market growth.

Growth in e-commerce

The growth of e-commerce is significantly expanding the demand for composite packaging, as companies are looking for a method that can guarantee the safety of their products during transportation. For instance, the global e-commerce market size reached USD 26.8 Trillion in 2024. In addition, this is beneficial during the transportation of goods because of impacts, such as moisture and contamination that are severe threats to the safety of the merchandise. Besides this, the use of e-shoppers, along with the growing trend of home deliveries, is boosting the requirement for flexible and lightweight packaging. Concurrently, retailers and logistics providers are using composite packaging for its convenience to cut down the shipping costs, the ability to preserve the quality of the products, and meet the increasing demands of the customer, thereby impelling the market growth.

Advancements in material science

Ongoing technological advancements in material science are revolutionizing composite packaging, resulting in the creation of modern composite packaging solutions. For example, the Bureau of Indian Standards (BIS), standard IS 17753:2021 defines quality benchmarks for paper-based multilayer composite cartons used in liquid food packaging, supporting both aseptic and non-aseptic processing. Moreover, advanced materials with better mechanical properties provide flexibility and thermal stability. This further makes them suitable for various applications in food processing, pharmaceutical industries, and many other fields. Besides this, continuous technology innovation is allowing avenues to make efficient production and options to customize the composite packaging. Furthermore, the increasing use of other smart technologies like sensors for tracking freshness information utilizes a good amount of composite packaging. These innovations enable manufacturers to address new customer needs and enhance sustainability and product differentiation in the market, thus strengthening the market share.

Composite Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global composite packaging market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material and end use.

Analysis by Material:

- Plastic

- Paper

- Cardboard

- Others

Plastic leads the composite packaging market by 52.1%. Moreover, its lightweight, durability, and relatively low cost make it appropriate in F&B, pharmaceuticals, and personal care industries. In addition, the features of its design and enhanced barrier properties guarantee product protection and flexible packaging, aligning with the rising demands of e-commerce and retail customers. Besides this, sustainability concerns regarding plastic such as biodegradable and recycled plastics promote the growth of polymer technology. At the same time, paper-based composite packaging is emerging as a popular material due to the growing trend towards the use of biodegradable and renewable resources. The growth of paper composites is rapidly advancing especially in the food, cosmetics, and e-commerce sectors through innovations in sustainable solutions along with improvement in plastics-based composite packaging, thereby propelling the market forward.

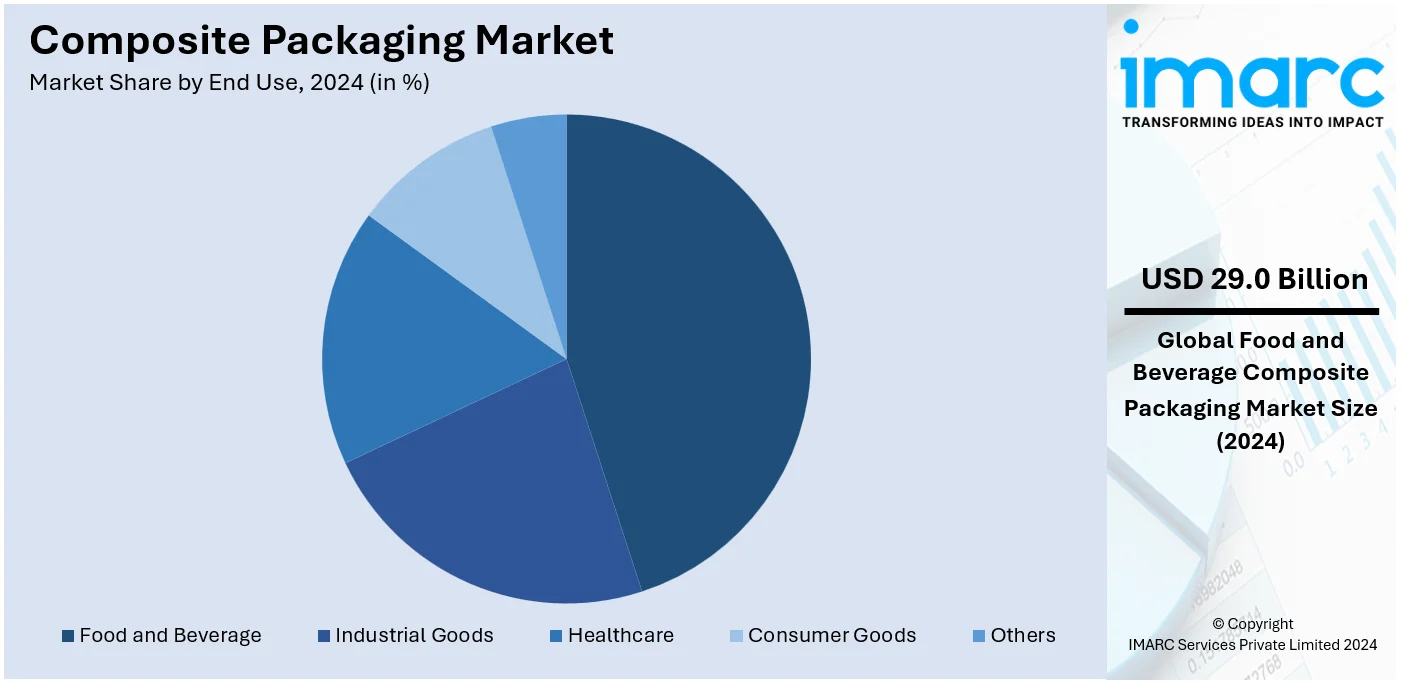

Analysis by End Use:

- Food and Beverage

- Industrial Goods

- Healthcare

- Consumer Goods

- Others

The food and beverage industry dominates the composite packaging market with a share of 33.7%. This is fueled by the need for lightweight, durable, and protective packaging material that enhances product shelf-life and protects products such as perishable foods, and convenience F&B. This segment is further driven by increasing consumer demand for convenience and portable products. Also, the global trend of adopting sustainable and renewable packaging materials is fostering new generations to use recoverable and bio-degradable composites. On the other hand, the pharmaceutical sector is significantly growing the end-use market due to the increasing demand for secure and anti-tampering packaging requirements of various sensitive medications. Apart from this, composites provide enhanced protection against contamination, fulfilling the increasing global need for sound healthcare packaging, which is contributing to the market expansion.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the largest market share of 32.0% in the composite packaging market. This is primarily due to the rising demand for recyclable, lightweight, and durable packaging products across industries such as F&B, pharma, and retail more especially the e-commerce industry. Besides this, the growing awareness of consumers and advanced manufacturing technologies, about the environment are resulting in high demands for these packaging. Additionally, online retail packaging needs flexible and safeguarded packaging to enhance the use of composite packaging. Apart from this, the Asia-Pacific region is robustly expanding due to industrialization, urbanization, and the growing population of middle-income earners. Moreover, the rising disposable income and changing consumer trends encourage companies to adopt packaged goods. Also, the expanding e-commerce and retail industries strengthen the requirement for unique packaging, significantly catalyzing the market growth.

Key Regional Takeaways:

United States Composite Packaging Market Analysis

The US composite packaging market growth is driven by several key factors, including the growing demand for sustainable and eco-friendly packaging solutions. As consumers increasingly seek lightweight, durable, and high-performance packaging, composite materials, which combine the benefits of paper, plastic, and aluminum, are becoming more popular. The expansion of the e-commerce sector, particularly in food, beverages, and consumer goods, is another significant driver. According to reports, the number of e-commerce users in the US is expected to grow by 60 million by 2029, marking a 21.94% increase and reaching a record high of 333.5 million after nine years of steady growth. This surge in online shopping highlights the need for robust packaging solutions that ensure product protection during transit, which is provided by composite materials. Furthermore, rising regulatory pressures aimed at reducing plastic waste and promoting recycling are driving innovation in the packaging industry. Additionally, the need for improved product shelf life and safety, especially in food and pharmaceuticals, continues to boost the demand for composite packaging. These factors position the US as a key market for composite packaging, with sustained growth expected across various sectors.

Europe Composite Packaging Market Analysis

The composite packaging market outlook in Europe is significantly influenced by the region's strong focus on sustainability and environmental conservation. With stringent waste management and recycling regulations, European countries are increasingly adopting composite materials that offer recyclability and reduced environmental impact. In addition to the growing demand for eco-friendly packaging, the need for innovative, cost-efficient, and durable packaging solutions is rising, particularly in the food and beverage industries. The e-commerce sector, which has seen substantial growth in recent years, further boosts the demand for composite packaging. In 2023, the European e-commerce market size reached USD 3.4 Billion, highlighting the increasing need for packaging that ensures product protection during transportation while remaining lightweight and space-efficient. Furthermore, innovations in packaging technology, including biodegradable composites, are contributing to the growth of the market. The emphasis on enhancing consumer experience and differentiating brands is also pushing companies toward adopting composite packaging for its flexibility in design and functionality. With these combined factors, the European composite packaging market is poised for continued expansion, driven by both regulatory pressures and consumer demands for sustainable, innovative solutions.

Asia Pacific Composite Packaging Market Analysis

The composite packaging market trends in the APAC region is primarily driven by the rapid growth of the manufacturing and consumer goods sectors. Countries like China, India, and Japan are increasingly adopting composite packaging solutions due to their cost-effectiveness and superior performance. Consumer demand for sustainable packaging is a key factor propelling market growth. According to industry reports, nearly half (44.9%) of APAC consumers prioritize purchasing sustainably made or environmentally friendly products, a notable increase from 43.3% in 2022. This growing eco-consciousness, combined with the region’s booming e-commerce sector, is accelerating the adoption of composite packaging that meets both functional and environmental needs.

Latin America Composite Packaging Market Analysis

The composite packaging market in Latin America is driven by the rising demand for durable, cost-effective, and sustainable packaging solutions. The region's strong urbanization, with Latin America and the Caribbean being one of the most urbanized areas globally at 81% according to the UN, is accelerating the need for efficient packaging, particularly in food and beverage industries. As urban populations grow, there is an increasing emphasis on packaging that offers product protection and extended shelf life. Additionally, the growing awareness of environmental issues is encouraging the shift toward eco-friendly composite packaging alternatives, further driving market growth.

Middle East and Africa Composite Packaging Market Analysis

The composite packaging market forecast in the Middle East is expanding due to rapid urbanization, increasing demand for food and beverage products, and the rise of e-commerce. The beverage packaging market in the region, for example, is projected to grow at a CAGR of 4.27% from 2024 to 2032. This growth reflects a broader shift toward more sustainable and efficient packaging solutions, with composite materials offering benefits like durability and reduced environmental impact. Additionally, heightened consumer awareness of sustainability is encouraging the adoption of eco-friendly packaging, further driving demand for innovative composite solutions across various industries in the region.

Competitive Landscape:

Stakeholders in the composite packaging sector are keen on diversification and environmentally friendly values to meet the expectations of consumers and the government. The automotive industry in particular is improving recyclable and biodegradable composites that fit the environmental regulations and decrease the use of plastics. Moreover, alliances and collaborations are growing and enabling several firms to seize new opportunities to incorporate sophisticated technologies and grow their market share. Additionally, they are deploying automation and sophisticated manufacturing processes to raise the efficiency and profitability of production. Furthermore, product differentiation including customizable and smart packaging types is growing, aligning with the industry demands.

The report provides a comprehensive analysis of the competitive landscape in the composite packaging market with detailed profiles of all major companies, including:

- Amcor plc

- Crown Holdings Inc.

- DS Smith plc

- EnviroCore Composites (Pty) Ltd.

- Mondi plc

- Sealed Air Corporation

- Smurfit Kappa Group plc

- Sonoco Products Company

- Tetra Pak International SA

- Zipform Packaging

Latest News and Developments:

- September 2024: Pakka has introduced a new range of flexible compostable packaging for the food and beverage sector, including the M1, M3, and NM1 options. These eco-friendly, paper-based structures offer strong barrier properties, and heat seal-ability, and are compatible with various printing technologies. Certified for food contact and composability, they are suitable for packaging products like chocolates, granola bars, and tea.

- June 2024: Innventure LLC announced that AeroFlexx has partnered with Chemipack, a Poland-based supplier of liquid concentrates, to introduce a sustainable flexible packaging solution to the European market. AeroFlexx's packaging, designed as an alternative to rigid bottles, reduces virgin plastic use by up to 85% and is curbside recyclable. This partnership seeks to address the increasing demand for sustainable packaging and is in line with the European Union’s goal of minimizing packaging waste and phasing out single-use plastics by 2030.

- May 2024: Saperatec has opened a new facility in Dessau, Germany, to recycle composite packaging waste into secondary plastic and aluminum. Using a proprietary process with water-based washing fluids, the facility separates and purifies materials like beverage cartons, producing reusable polyethylene and aluminum. This initiative supports sustainable packaging and material circularity.

- December 2023: Walkers has introduced new Sunbites packaging made with 50% recycled plastic using a mass balance approach, reducing 200 Tons of fossil-based plastic by 2025. This aligns with PepsiCo’s goal to eliminate virgin fossil-based plastic by 2030. Advanced recycling technologies are crucial to supporting a circular economy for composite packaging in the UK.

- June 2022: Global beer brand Corona has launched a 100% biodegradable and compostable six-pack in India, made entirely from barley straw. This eco-friendly packaging eliminates the need for virgin wood, aligning with Corona’s commitment to sustainability and the World Environment Day theme, "Only One Earth."

- November 2023: Sonoco announced the acquisition of Amcor Packaging’s composite can operations at an undisclosed price. This purchase will strengthen Sonoco's presence in the Asia Pacific market by adding Amcor's composite can plants.

- July 2023: The Mitsubishi Chemical Group, Toppan Inc., and Kyoeisha Chemical Co., Ltd. entered into an agreement to collaboratively develop a material recycling production process. The technology they aim to create will enable the separation and extraction of resins from plastic composite packaging materials, allowing them to be peeled and deinked.

- June 2022: Corona India introduced an innovative 100% biodegradable composite packaging made from barley straw. This new packaging solution supports the company's larger goal of protecting and preserving nature through sustainable practices.

- September 2020: SABIC, a global leader in chemicals, launched a sustainable packaging solution for frozen food. The solution combines a new polyethylene (PE) grade with cutting-edge film production technology.

- March 2019: Rapak, a part of DS Smith Plastics, invested in a new bag-in-box production line in northeast Bulgaria. The investment enhanced manufacturing flexibility, improved operational efficiencies, and eliminated ordering lead times for its customers.

Composite Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Plastic, Paper, Cardboard, Others |

| End Uses Covered | Food and Beverage, Industrial Goods, Healthcare, Consumer Goods, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amcor plc, Crown Holdings Inc., DS Smith plc, EnviroCore Composites (Pty) Ltd., Mondi plc, Sealed Air Corporation, Smurfit Kappa Group plc, Sonoco Products Company, Tetra Pak International SA, Zipform Packaging, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the composite packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global composite packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the composite packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Composite packaging refers to a type of packaging made from two or more materials combined to enhance durability, functionality, and aesthetics. It is widely used to protect products across industries like food, beverages, pharmaceuticals, and e-commerce. This packaging offers lightweight, cost-effective, and sustainable solutions tailored to specific requirements.

The composite packaging market was valued at USD 86.05 Billion in 2024.

IMARC estimates the global composite packaging market to exhibit a CAGR of 3.86% during the forecast period of 2025-2033.

Key trends driving the market demand are the growing demand for lightweight, durable, and sustainable packaging solutions, rising e-commerce activities, the rising demand for extended product shelf life, continuous advancements in material technology, and increasing consumer preference for eco-friendly packaging.

In 2024, plastic represented the largest segment by material, driven by its cost-effectiveness, durability, lightweight nature, and widespread use in packaging, particularly for food, beverages, and consumer goods.

Food and beverage lead the market by end use owing to the growing demand for convenient, sustainable, and protective packaging solutions that preserve food quality and extend shelf life while meeting consumer preferences.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global composite packaging market include Amcor plc, Crown Holdings Inc., DS Smith plc, EnviroCore Composites (Pty) Ltd., Mondi plc, Sealed Air Corporation, Smurfit Kappa Group plc, Sonoco Products Company, Tetra Pak International SA, Zipform Packaging, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)