Companion Animal Health Market Size, Share, Trends and Forecast by Animal Type, Product, End User, and Region, 2025-2033

Companion Animal Health Market Size and Share:

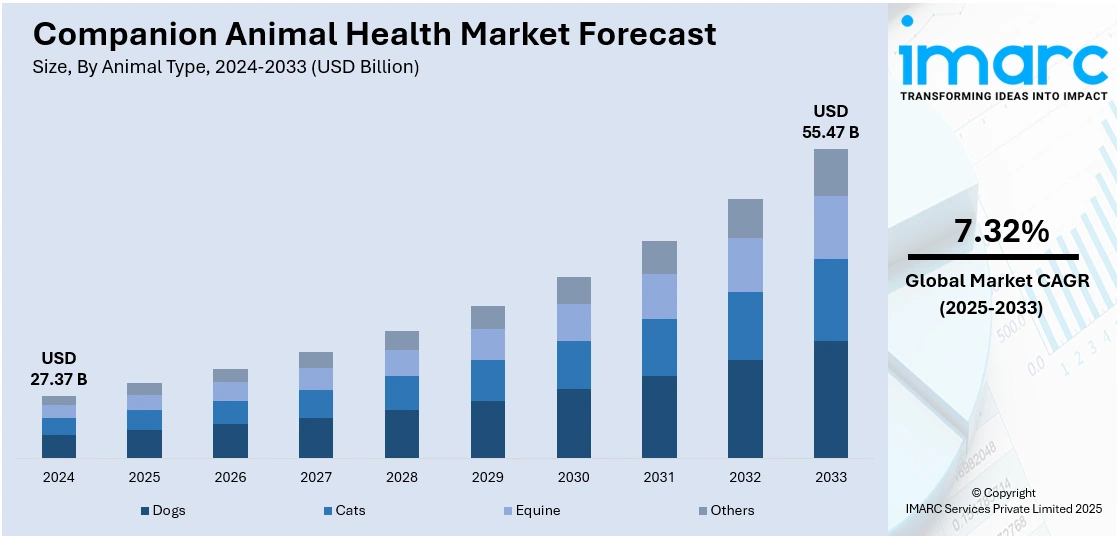

The global companion animal health market size was valued at USD 27.37 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 55.47 Billion by 2033, exhibiting a CAGR of 7.32% from 2025-2033. North America currently dominates the market, holding a market share of over 47.8% in 2024. The companion animal health market share is expanding, owing to the rising pet ownership rates worldwide, continuous advancements in veterinary healthcare, and heightened awareness of zoonotic diseases, leading to increased demand for animal health products and services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 27.37 Billion |

|

Market Forecast in 2033

|

USD 55.47 Billion |

| Market Growth Rate 2025-2033 | 7.32% |

A significant market driver includes an increase in the pet population globally, especially within urban houses. This increase can be seen particularly through increasing pet adoptions, driven by changes in social dynamics, increased disposable incomes, and a growing affinity for emotional companionship. The humanization of pets has also influenced market dynamics, as pet owners increasingly treat their pets as if they belonged to the human family. This trend is improving the premium pet healthcare services, preventive care, and advanced medical treatments that are leading to significant investments in veterinary diagnostics and pharmaceuticals. Companies in the companion animal health market are therefore developing new drugs, vaccines, and diagnostic tools to cater to the growing emphasis on pet wellness.

To get more information on this market, Request Sample

The United States has become a key area in the companion animal health market due to various reasons. The way pets are viewed as family, along with advancements in veterinary technology, is creating a positive companion animal health market outlook, resulting in substantial investments in healthcare products, insurance, and digital health services. Another important emerging trend in veterinary medicines is the ongoing research in pain management, antimicrobial resistance, and anticancer agents for animals. Monoclonal antibody therapies are currently being developed for applications like canine osteoarthritis and feline hyperthyroidism. Furthermore, an increase in companion animal vaccines supports the market growth since pet owners increasingly opt for preventive vaccination against infectious diseases like rabies, distemper, and parvovirus. In 2024, Bioveta, a.s. collaborated with Vetina Healthcare LLP to launch the Biocan NOVEL vaccine line, which would offer protection against several dangerous canine infections.

Companion Animal Health Market Trends:

Increasing Pet Ownership Rates

Companion animal health is one of the fastest-evolving markets globally. Global pet ownership rates have been rising, and an estimated 66% of U.S. households have a pet as of 2024, reports Autotrader. This may be attributed to the fact that people now consider pets family. This emotional attachment to pets is focusing more attention on their health and well-being, thus significantly driving demand for various animal health products and services. All these factors, coupled with others such as the urbanization of lifestyles and expanding consumer disposable incomes, contribute to this increasingly powerful trend. As pet parents are becoming more informed, they are seeking better healthcare, nutrition, and wellness products for their pets, which in turn is fueling the growth of the market.

Advancements in Veterinary Healthcare

The companion animal health market demand is driven by the continuous development in veterinary healthcare. This includes diagnostics, therapeutics, and preventive care. Further, the development of new vaccines, pharmaceuticals, and diagnostic tools has allowed for more effective and efficient treatment of various animal diseases. Other important technological advances in veterinary practices include telemedicine and mobile health applications. In 2024, Florida signed an unusual bill into law that would allow vets to maintain a Veterinary-Client-Patient Relationship (VCPR) through telemedicine. The new technologies also enhance the quality of care rendered to companion animals and facilitate better accessibility and convenience of veterinary services to pet owners. This factor is fundamental in strengthening the growth of the market as it directly impacts the ability to provide timely and effective healthcare solutions for pets.

Growing Focus on Zoonotic Diseases

The rising recognition and necessity to tackle zoonotic diseases, which are illnesses transmitted from animals to humans, serves as another significant growth driver for the market. The WHO reports that 60% of the globally reported emerging infectious diseases are regarded as zoonoses. Over the past thirty years, over 30 human pathogens have been identified, with 75% of them coming from animals. Consequently, there is an increase in the focus on tracking and stopping these diseases in pet animals. This trend is encouraging considerable investments in the research and development (R&D) of vaccines and therapies aimed at zoonotic pathogens. In addition, regulatory authorities and animal health agencies around the globe are increasingly becoming concerned about creating strict norms and preventive practices that are propelling the companion animal health market growth.

Companion Animal Health Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global companion animal health market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on animal type, product, and end user.

Analysis by Animal Type:

- Dogs

- Cats

- Equine

- Others

Dogs hold 51.7% of the market share. The dogs segment holds the largest share in the market for companion animal health, because dogs are the most commonly kept pets around the world. This is an important factor because emotional attachment is high between dogs and their parents, thus making considerable expenditures on health care, nutrition, and wellness products. Sales are also encouraging more dog owners to engage in preventive healthcare, routine check-ups, and high-end treatments for their pets, thereby driving demand for pharmaceuticals up to specialized diets. Advanced therapeutics and diagnostics also top the list of innovative developments in the domain of canine health. Because of the trend of humanization of pets, the owners are managing their dogs as if they are part of the family. Therefore, the quality of healthcare and lifestyle products is maintained.

Analysis by Product:

- Vaccines

- Pharmaceuticals

- Feed Additives

- Diagnostics

- Others

Preventative measures against the various infectious diseases in pets depend on vaccines. This market has been driven by increasing recognition of the significance of regular vaccination for pets along with the launch of new vaccines that are potent and more efficient. Advances in vaccine technology are improving the potency and safety of these products like recombinant vaccines and DNA vaccines. The demand is also being driven by strict legislations and vaccination recommendations by animal veterinary bodies about the need to vaccinate because vaccinations are regarded as a tool of preventive veterinary care for the companion animals.

The pharmaceuticals sector represents the largest portion of the market, encompassing a variety of products such as anti-infectives, anti-inflammatories, and treatments for chronic diseases. This sector is expanding because of the increasing occurrence of different health problems in pets, including arthritis, diabetes, and heart conditions. This sector is also being propelled by the creation of innovative and more efficient medications, in addition to the movement towards personalized medicine. Furthermore, the rise in pet insurance and expenditures on veterinary services is enabling pet owners to access these pharmaceutical therapies, thereby driving the expansion of this sector.

Feed additives are a key component of the market, where the focus is on improving nutrition and overall health in pets. This segment ranges from vitamins, minerals, amino acids, and probiotics to other essential items for the proper growth, development, and health maintenance of companion animals. The growing demand for high-end and specialty pet foods, combined with the increasing awareness about the role of nutrition in animal health, is promoting the growth of this segment. Further, the emergence of new and innovative feed additives that specifically target health issues such as digestive health or immune support is also contributing to market growth.

The diagnostics sector is growing in the market, especially due to an increase in advanced diagnostic techniques in the identification of illnesses in pets. This includes a variety of diagnostic tools and services, from blood analyses and imaging techniques to molecular diagnostics. The growth of this sector comes from technological advances that make it more accessible and affordable. A greater tendency of pet owners towards preventive health care and the need to check the aging pets frequently have further driven this segment's growth. Advances in digital technologies, including telemedicine, further advance the expansion and accessibility of diagnostic services for companion animal health.

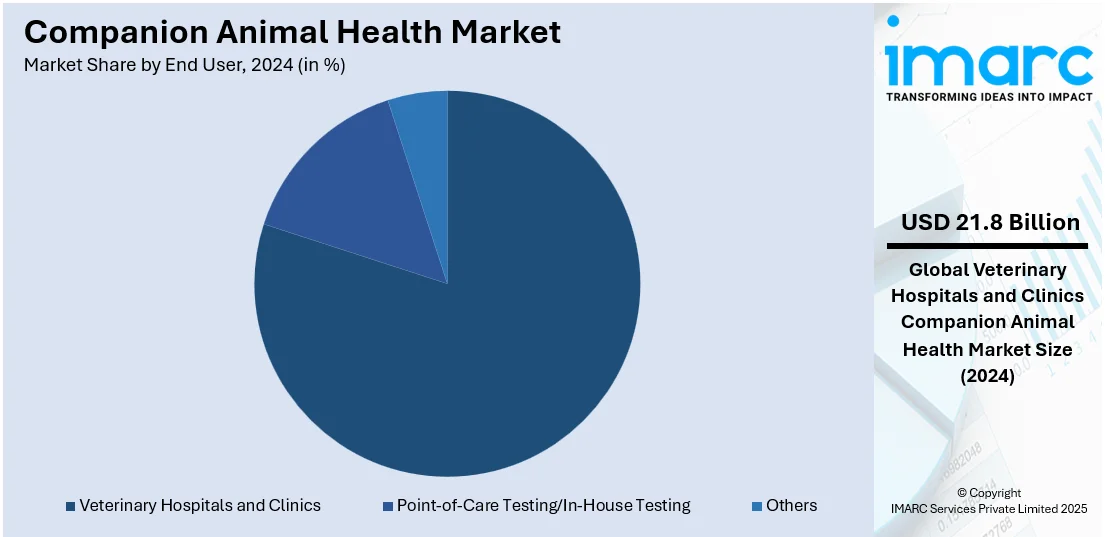

Analysis by End User:

- Point-of-Care Testing/In-House Testing

- Veterinary Hospitals and Clinics

- Others

Veterinary hospitals and clinics lead the market with 79.8% of market share in 2024. Veterinary hospitals and clinics act as the main care providers for pets. This section offers a wide variety of services, including regular check-ups and immunizations, as well as complex surgical operations and urgent care. The supremacy of this sector is due to the thorough treatment these establishments offer, supported by experienced veterinary staff and state-of-the-art medical technologies. Veterinary hospitals and clinics play a crucial role in identifying and treating more intricate health issues in pets that cannot be resolved solely by in-house testing. The growing emphasis on preventive health care, combined with the rising occurrence of different animal diseases and conditions, keeps motivating pet owners to pursue professional veterinary services, thus supporting the expansion and importance of this market segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 47.8%. North America has the highest share within this region because of the higher rate of pet ownership and increased spending on animal care as well as well-developed veterinary medical infrastructure in this area. This region is one of the few where pets received heightened focus on preventive care and wellness, thus creating demand for a diverse portfolio of products and services, including vaccines and diagnostic equipment. Another factor that has resulted in this region to be on the top position is the availability of leading market players along with continued spending on R&D in this region. The new pet humanization trend, when pets are treated as members of their family, gives an extra push to the growth of the North America market. The growing expense for veterinary treatment causes a significant hike in pet insurance adoption across the region where parents of pets will look forward to securing protection financially against such emergency medical treatment charges. Mylo introduced its very first pet insurance in 2024, offering coverage for this US with partnership from Safeco. The service gives correct value for pet parents at best possible value.

Key Regional Takeaways:

United States Companion Animal Health Market Analysis

The United States possesses a 95.20% stake in North America. The U.S. market is propelled by various elements, mainly shaped by the rising number of pet parents, changing perceptions of pet care, and progress in veterinary technology. The increasing prevalence of pet-owning households, particularly those with dogs and cats, is greatly enhancing the demand for pet healthcare products and services. In this regard, pet owners are increasingly aware of their pets' health, looking for top-notch medical care, preventative measures, and nutrition. This is resulting in the growth of veterinary services and a rise in the uptake of pet insurance, which additionally boosts the market. The 2024 State of the Industry Report by NAPHIA indicates that the total pet insurance premium in the U.S. reached USD 3.9 Billion in 2023. The overall count of pets covered by insurance in the U.S. by the end of 2023 reached almost 5.7 million, marking a 17% rise compared to 2022. In addition to this, advancements in veterinary diagnostics, therapies, and medications are offering better care choices, enhancing the effectiveness and accessibility of pet healthcare. Innovations such as minimally invasive (MI) surgery, regenerative medicine, and cutting-edge laser therapy are enhancing the standard of care. MI procedures, including laparoscopic surgeries, provide shorter recovery periods and decreased pain for animals, improving their overall well-being. Additionally, the growing awareness of zoonotic diseases and the heightened emphasis on pet health and longevity are likely to keep fueling growth in this sector.

Europe Companion Animal Health Market Analysis

Europe is a leading market for companion animal health, with several factors driving its growth. The high level of pet parents across Europe, particularly in countries like France, Germany, and the UK, is one of the main contributors. Pet parents in this region are increasingly focused on providing the best healthcare for their pets, leading to higher demand for advanced veterinary services and products. According to the FEDIAF report (published in June 2024), a healthy growth of pet parents with 166 Million homes (50%) in Europe owning one or more of Europe’s 352 Million pets was witnessed. Yearly sales of pet food items now stands at USD 31,224 Million and the volume is around 9.9 Million tons. Besides this, rising concerns about zoonotic diseases and pet wellness are making preventative health measures, including vaccinations, deworming, and specialized diets, essential. Additionally, the trend toward pet humanization, where animals are seen as family members, has increased the spending on pet healthcare. Moreover, growing awareness about the benefits of pet insurance is encouraging owners to invest in better care options for their animals. Furthermore, technological innovations in veterinary practices, such as telemedicine and mobile health apps for pets, are also expected to contribute significantly to the market’s growth in Europe, alongside the ongoing demand for high-quality pet medications and health supplements.

Asia Pacific Companion Animal Health Market Analysis

The Asia-Pacific market is experiencing robust growth on account of rapid urbanization, increasing disposable incomes, and growing pet adoption, especially in countries like China, Japan, and India. Urbanization is leading to a shift in lifestyle, where more people are adopting pets as companions. This, combined with an increasing awareness of the importance of pet health, is creating a growing demand for veterinary services, nutritional products, and preventive healthcare solutions. As per the Press Information Bureau (PIB), it is expected that by 2030, more than 40% of the population of India will live in metropolitan areas. In line with this, the growing middle-class population with higher disposable income is enabling pet parents to spend more on pet care. Pet insurance is also gaining popularity in some regions, offering owners an added incentive to invest in their pets' well-being. Pet insurance is becoming increasingly popular, particularly in regions with growing middle-class populations and rising disposable incomes. It offers pet owners financial security by covering veterinary expenses for unexpected illnesses, accidents, and preventive care. This reduces the financial burden of costly treatments and encourages pet owners to seek timely medical attention for their pets, improving overall pet health. Moreover, the increasing focus on animal welfare and the spread of veterinary care knowledge across urban and rural areas is expected to further boost the market growth.

Latin America Companion Animal Health Market Analysis

In Latin America, the market is fueled by a rise in pet adoption, particularly in urban areas, and increasing awareness of pet health. As per the CIA, urban population in Brazil was 87.8% of total population in 2023. In addition, the growing middle class and higher disposable incomes in countries like Brazil and Mexico are enabling pet parents to spend more on quality healthcare products for their pets. Veterinary services are expanding, with a focus on preventive healthcare and nutritional products. Moreover, a shift toward treating pets as family members has led to higher demand for premium healthcare products, including specialized diets and advanced treatments. The rising recognition of zoonotic diseases also contributes to the demand for vaccinations and other preventive services.

Middle East and Africa Companion Animal Health Market Analysis

The market in the Middle East and Africa is expanding due to increasing pet parents, particularly among the growing affluent population. As more people in urban areas adopt pets, there is a heightened demand for veterinary services and specialized pet healthcare products. Growing awareness about pet health, coupled with rising disposable incomes, allows pet owners to invest more in preventive and treatment services. In addition to this, Saudi Arabia has a notable increase in the number of veterinary clinics. As per reports, there are around 434 clinics and specialized veterinary pharmacies is 1366 in Saudi Arabia. Apart from this, the increasing focus on animal welfare and the spread of veterinary knowledge in the region further fuels the market, with more people seeking high-quality medical care for their pets.

Competitive Landscape:

One of the most critical strategies for market leaders in companion animal health is continuous investment in R&D to develop new pharmaceuticals, vaccines, and biologics. The rise of biologics and gene-based therapies has also gained momentum, with firms developing innovative treatments that offer greater efficacy and fewer side effects than traditional medications. The shift toward telemedicine and virtual veterinary care has accelerated, with companies investing in digital platforms to enhance accessibility and efficiency in pet healthcare. The rising cost of veterinary care has led major market players to partner with pet insurance companies and wellness program providers to increase pet owners’ access to advanced treatments. Mergers, acquisitions, and strategic partnerships have been key strategies for expanding market presence and enhancing product portfolios. In December 2024, Mars Veterinary Health has made a minority investment in Crown Veterinary Services, marking its entry into the Indian veterinary sector.

The report provides a comprehensive analysis of the competitive landscape in the companion animal health market with detailed profiles of all major companies, including:

- Agrolabo S.p.A.

- Boehringer Ingelheim International GmbH

- Ceva Sante Animale

- Dechra

- Elanco

- Greencross Vets

- IDEXX Laboratories, Inc.

- Indian Immunologicals Ltd.

- Norbrook

- Vetoquinol

- Virbac

- Zoetis Services LLC

Latest News and Developments:

- December 2024: Virbac acquired Turkish company Mopsan, concentrated in the supply of petfood and companion animal health products. Through this acquisition, the company is strengthening its proximity to the field to better meet the expectations of the animal health industry. Mopsan brings a team of 47 talented employees who will be largely dedicated to Virbac's companion animal business.

- August 2024: Boehringer Ingelheim India revealed a strategic distribution alliance with Vvaan Lifesciences Private Limited for their Pet Parasiticide range. This partnership, a crucial project within the India Animal Health Accelerated Growth Plan (AGP), represents an important advancement in broadening our presence and improving customer value in the animal health industry.

- February 2024: Tata Trusts launched India’s first state-of-the-art animal hospital in Mumbai. The hospital is unique, covering more than 98,000 square feet across five floors and accommodating over 200 beds.

- January 2025: Love Pet Health Care announced the opening of its flagship veterinary hospital in Chicago to provide comprehensive veterinary service and care for pets.

Companion Animal Health Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Dogs, Cats, Equine, Others |

| Products Covered | Vaccines, Pharmaceuticals, Feed Additives, Diagnostics, Others |

| End Users Covered | Point-of-care Testing/In-house Testing, Veterinary Hospitals and Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agrolabo S.p.A., Boehringer Ingelheim International GmbH, Ceva Sante Animale, Dechra, Elanco, Greencross Vets, IDEXX Laboratories, Inc., Indian Immunologicals Ltd., Norbrook, Vetoquinol, Virbac, Zoetis Services LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the companion animal health market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global companion animal health market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the companion animal health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The companion animal health market was valued at USD 27.37 Billion in 2024.

The companion animal health market is projected to exhibit a CAGR of 7.32% during 2025-2033, reaching a value of USD 55.47 Billion by 2033.

The key drivers of the companion animal health market include rising pet ownership rates, increasing expenditure on veterinary care, advancements in pharmaceuticals and biologics, growing awareness of zoonotic diseases, and the expansion of pet insurance. Additionally, digital health solutions and telemedicine adoption are enhancing accessibility to pet healthcare services, further fueling market growth.

North America currently dominates the companion animal health market, accounting for a share of over 47.8% in 2024. This is driven by high pet ownership rates, significant spending on pet healthcare, advancements in veterinary medicine, and strong pet insurance adoption. The presence of key market players and continuous investment in R&D also contribute to its leading position.

Some of the major players in the companion animal health market include Agrolabo S.p.A., Boehringer Ingelheim International GmbH, Ceva Sante Animale, Dechra, Elanco, Greencross Vets, IDEXX Laboratories, Inc., Indian Immunologicals Ltd., Norbrook, Vetoquinol, Virbac, Zoetis Services LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)