Compact Cars Market Size, Share, Trends and Forecast by Fuel Type, Application, and Region, 2025-2033

Compact Cars Market 2024, Size and Trends:

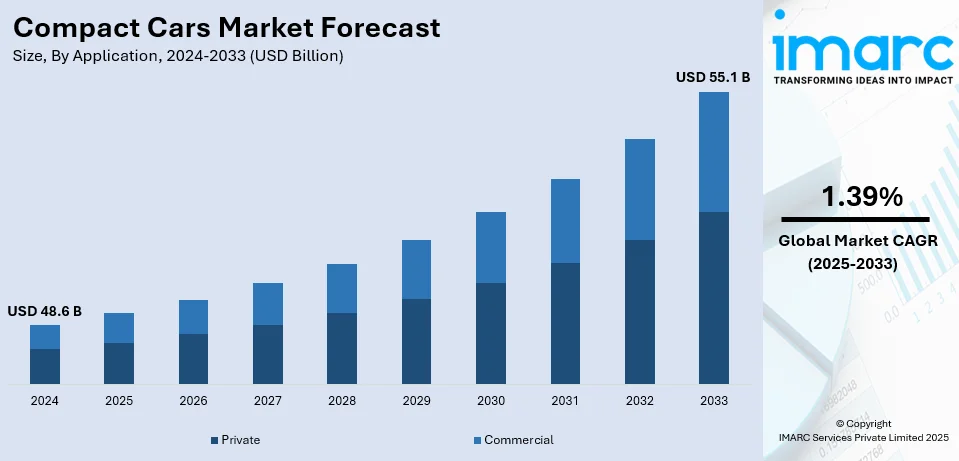

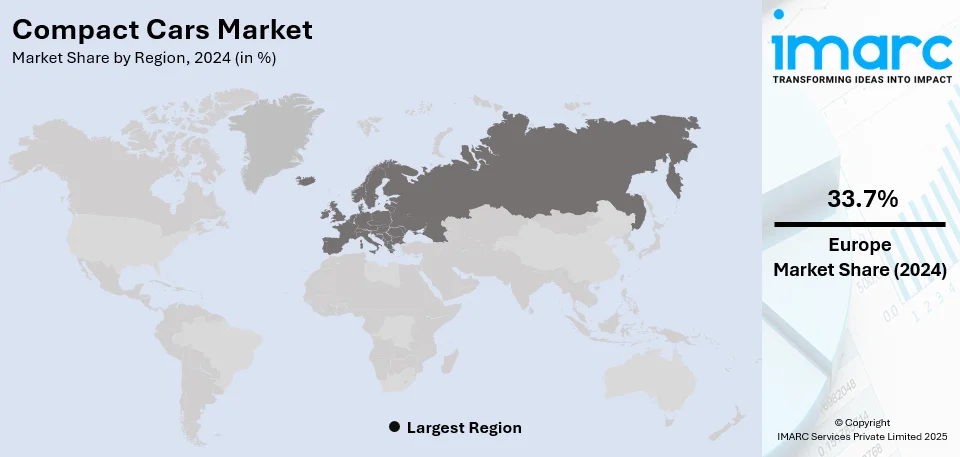

The global compact cars market size was valued at USD 48.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 55.1 Billion by 2033, exhibiting a CAGR of 1.39% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 33.7% in 2024. This dominance is attributed to high demand for fuel-efficient vehicles, stringent environmental regulations, and advanced automotive technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 48.6 Billion |

|

Market Forecast in 2033

|

USD 55.1 Billion |

| Market Growth Rate (2025-2033) | 1.39% |

The growing demand for cost-effective and fuel-efficient automobiles is a major driver in the compact cars market. With rising fuel prices, increasing environmental awareness, and the need to save on fuel costs and cut carbon emissions, consumers prefer smaller, more energy-efficient cars to reduce their operating costs and environmental impact. Compact cars can provide an ideal balance between affordability, performance, and lower maintenance costs, hence attracting urban commuters and first-time buyers. Compact cars have also gained through improved technology, enhanced features, and safety that compete favorably with large-sized cars. For instance, the Toyota bZ4X, set to launch in early 2025, features a reduced MSRP by up to $6,000, introduces the Nightshade edition, and includes enhanced driver assistance technologies like Traffic Jam Assist and Front Cross Traffic Alert. Moreover, the trend toward compact urban living and congested city environments further supports the growing preference for this vehicle segment.

The United States caters to the compact cars market by utilizing superior manufacturing capabilities, innovative design, and strict regulatory standards that emphasize fuel efficiency and safety. U.S. automakers have been focusing on incorporating leading-edge technologies, such as hybrid and electric powertrains, to meet the evolving needs of environmentally conscious consumers. For instance, in August 2024, Ford announced plans to shift to hybrid three-row SUVs, abandoning all-electric models, incurring $400 million for equipment write-downs and potentially $1.5 billion in costs due to this strategic change. In addition, growth in urban population and rising demand for economic, space-efficient vehicles boost demand for compact cars. Moreover, a well-established dealer network and attractive financing options ease accessibility into the market. As an investment in research and development, U.S. auto producers continuously improve compact cars with regard to performance, value for money, and appeal as conditions change in the automotive sector.

Compact Cars Market Trends:

Growing Fuel Efficiency and Environmental Concerns

The main driving factor in the global compact cars market is the emphasis on fuel efficiency and environmental sustainability. Compact cars have gained huge popularity in light of climate change issues and the general shift towards greener options for transportation. Due to their inherent small size and weight, these vehicles are more fuel-efficient by design, and hence attractive both to environmentally conscious consumers and regulatory bodies. In response to strict emission rules, car manufacturers have spent heavily on research and development to make compact cars fuel-efficient. This has culminated in innovations, including hybrid and electric compact cars that offer zero-emission driving options. For example, Skoda has announced a fully electric SUV priced at around USD 27,300; this model, which has been named Epiq, is due to hit European markets next year and is slated to measure only 4.1 meters in length. Moreover, improvements in internal combustion engines have led to smaller but more potent engines that achieve excellent miles per gallon. The sum of all these factors makes compact cars a viable option for the consumer and a vital business segment for manufacturers for decades to come.

Rapid Urbanization and Elevating Congestion Levels

Urbanization is another driving force fueling the global compact cars market revenue. As more individuals move to urban areas, traffic congestion, and limited parking spaces become significant challenges. According to the World Bank, approximately 56% of the global population, or 4.4 Billion people, reside in urban areas. Compact cars, with their smaller footprint, are ideally suited for navigating crowded city streets and squeezing into tight parking spots. In densely populated cities, the compact cars maneuverability and agility offer a practical solution to mobility challenges. This is primarily affecting the compact cars market demand. Additionally, these vehicles are often provided with features, such as park-assist technology, which further ease urban driving. For instance, the 2023 Ford Escape comes with a self-parking system that can automatically perform parallel and perpendicular parking maneuvers for drivers. As cities continue to grow, the compact cars market revenue is likely to rise, particularly across urban places, where dwellers are seeking convenient and space-efficient transportation options.

Affordability and Cost of Ownership

Affordability remains a driving factor in the global compact cars market. Many consumers, especially in emerging markets, are seeking cost-effective transportation solutions. Compact cars usually have a lower initial purchase price compared to larger vehicles, making them accessible to a broader demographic. Beyond the purchase price, compact cars often offer competitive fuel economy, resulting in lower long-term operating costs. For example, compact cars, such as the Nissan Sentra, Toyota C-HR, Nissan Versa, Honda Civic, and Mitsubishi Mirage, all have average 10-year costs of only around USD 5,000. This cost-effectiveness extends to maintenance and insurance, further enhancing their appeal. As economic considerations continue to influence consumer choices, compact cars are positioned to meet the demand for budget-friendly yet reliable transportation.

Continuous Technological Advancements

Rising technological integration is the trend propelling the global compact car market. The car companies are equipping compact cars with advanced features such as infotainment systems, ADAS, and connectivity options. This technological upgradation enriches the driving experience and is in line with the developing taste of technology-conscious buyers. McKinsey projects the global automotive software and electronics market will reach USD 462 Billion by 2030, growing at a 5.5% CAGR from 2019 to 2030. Apart from entertainment and convenience, safety innovations are also very important. Compact cars are benefiting from the adoption of autonomous emergency braking, lane-keeping assist, and adaptive cruise control systems, contributing to increased safety on the road. Moreover, this car is a technological shift toward electric powertrains. This will suit the recent trend of new sustainable solutions for mobility across the entire globe. For example, Nissan's e-POWER electric-drive powertrain uses motor control technology, powertrain integration technology, and energy management technology. Changes in the combination of an electric-drive motor and the power-generation engine enable a quiet drive with optimal responses in compact cars.

Changing Lifestyles and Mobility Preferences

Compact car market statistics are seeing the influence of shifting consumer lifestyles and mobility preferences. The generation that is more focused on living in cities prioritize experiences over car ownership. It has resulted in shared mobility services and subscription-based models where compact cars have emerged as ideal choices because they are efficient and perfect for short trip. For example, Volkswagen has a subscription-based ownership program specifically tailored for its Taigun compact SUV wherein customers can subscribe to the model for 24, 36 or 48 months. The COVID-19 pandemic also has helped with the increasing acceptance of flexible schedules and remote work, reducing the daily commuting of people. This has made compact cars very appealing for use and weekend drives, which is in line with the ever-changing needs of this changing workforce.

Compact Cars Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global compact car market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on fuel type and application.

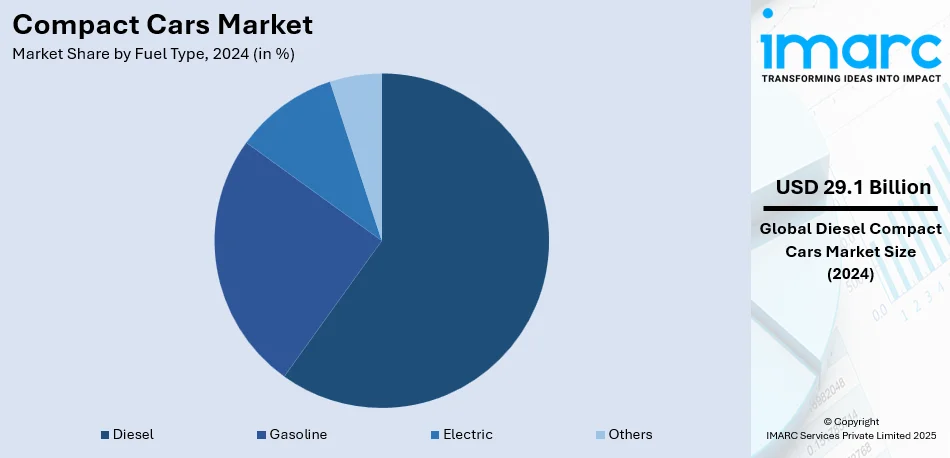

Analysis by Fuel Type:

- Gasoline

- Diesel

- Electric

- Others

Diesel stands as the largest fuel type in 2024, holding around 59.8% of the market. Diesel compact cars were traditionally popular in Europe with their excellent fuel economy and their torque characteristics. The automobile is fitted with a diesel engine, which is known to drive further and emit less CO2, compared to petrol engines. Diesel compact cars are great for those seeking good mileage for highway usage. Furthermore, diesel engines provide good mileage, making them perfect for long commutes and travels. Moreover, turbocharged diesel engines provide good low-end torque, which is an excellent driving performance. As such, consumers usually prefer diesel options over electric vehicles for long-distance travel, especially in countries with weak or still developing infrastructures for electric vehicles. For example, in India, compact SUVs such as Nexon, Venue, XUV300, and Sonet are still available with diesel engines.

Analysis by Application:

- Private

- Commercial

The private-use segment within the global compact cars market holds a massive share in the industry. Compact cars have remained the most opted for both the individual user and the family unit across generations owing to their ease of purchase, fuel economy, and general utility value. The private sector requires compact cars based on some key driving factors. Moreover, compact cars are very popular among urban and suburban dwellers who need efficient transportation for daily commuting, grocery shopping, and other personal errands. Their compact size makes them agile in navigating city traffic and easy to park in crowded areas, addressing the needs of urban lifestyles. In addition, compact cars are often chosen by budget-conscious consumers who seek cost-effective ownership. These vehicles generally have lower up-front purchase prices, competitive fuel economy, and reduced maintenance costs, making them more appealing to individuals and families seeking to maximize their savings.

The commercial usage segment in the global compact cars market is gaining importance because of various factors that satisfy business and fleet requirements. Traditionally, compact cars have been associated with private usage, but their unique advantages are now finding them new applications in the commercial applications, driven by their compact design, affordability, and fuel efficiency. These attributes make them preferable for purposes demanding cost-efficient and flexible transportation services, including ride-sharing services, corporate fleets, and last-mile delivery. The amplifying focus on sustainability further fuels the sales of compact cars in commercial settings, as many models are currently featuring fully electric or hybrid variants, catering to the global environmental aims and lowering operational costs. In addition, innovations connectivity and telematics improve fleet management efficacy, making compact cars a feasible option for enterprises. This trend underscores the amplifying diversification of the compact car market, proliferating its appeal beyond traditional private usage.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 33.7%. The compact car market in Europe is influenced by several key drivers, with environmental concerns and government regulations playing a major role. According to the European Urban Initiative (EUI), around 75% of the European Union's 447 Million inhabitants live in urban areas, making it one of the most urbanized regions globally. This high level of urbanization increases the demand for compact cars, which are preferred for their ability to navigate congested city streets and limited parking spaces. Stricter emissions standards and growing environmental awareness have further accelerated the shift towards smaller, fuel-efficient vehicles. Government incentives for low-emission cars, along with the rising adoption of electric vehicles (EVs), are helping to drive the growth of the compact car segment. Additionally, as cities become more crowded, the need for practical, space-saving vehicles continues to rise. The demand for compact EVs, equipped with advanced safety features and infotainment systems, is also growing in line with consumer preferences for eco-friendly and connected options. The increasing popularity of shared mobility services in urban areas further supports the demand for compact cars as alternatives to traditional car ownership.

Key Regional Takeaways:

United States Compact Cars Market Analysis

US accounts for 84.4% of the market share in North America. The compact car market in the United States is primarily driven by a combination of economic, environmental, and consumer behavior factors. As of 2023, 83.3% of the U.S. population resides in urban areas, according to the World Bank, which increases the demand for compact vehicles that are easy to maneuver and park in congested city environments. Rising fuel costs and growing concerns over carbon emissions have led consumers to favor smaller, fuel-efficient vehicles. Additionally, stricter government regulations on vehicle emissions have pushed automakers to produce more eco-friendly models. The increasing preference for affordable and practical transportation, particularly among younger buyers and urban dwellers, supports the growth of the market. Technological advancements, such as improved safety features, infotainment systems, and electric vehicle options, further enhance the appeal of compact cars. Furthermore, the rise of shared mobility services like car rentals and ride-hailing has led to an increased demand for compact vehicles, particularly in cities. These factors, coupled with favorable financing options and the expansion of electric vehicle infrastructure, are expected to drive continued growth in the U.S. compact car market.

North America Compact Cars Market Analysis

The North American compact cars market has experienced significant shifts due to evolving consumer preferences and market dynamics. Compact cars, known for their fuel efficiency and affordability, historically appealed to urban and budget-conscious consumers. However, growing demand for crossovers and SUVs has led to a decline in compact car sales, prompting manufacturers to adjust strategies. Key players such as Toyota, Honda, and Chevrolet continue to dominate the segment with models like the Corolla, Civic, and Malibu. For instance, sales of Toyota's U.S. Corolla, a compact car series, have risen by 25% to nearly 122,000 units, with twice as many Corollas sold compared to the Corolla Cross SUV, highlighting the compact cars' strong demand. Meanwhile, electric vehicle manufacturers, including Tesla, are reshaping the compact category with innovations like the Model 3. Despite market challenges, compact cars remain relevant, particularly among younger buyers and those prioritizing environmental sustainability. As automakers focus on hybrid and electric offerings, the segment is poised to retain a niche in North America's evolving automotive landscape.

Asia Pacific Compact Cars Market Analysis

In the APAC region, the compact car market is driven by rising urbanization, increasing disposable income, and growing environmental awareness. According to UN ESCAP, between 1999 and 2015, 1.2 Billion people moved into the Asia-Pacific middle class, with its share of the total population tripling from 13% to 39%. This expanding middle class is fueling demand for affordable, fuel-efficient compact cars. Urbanization, particularly in countries like India and China, further supports this trend, as compact vehicles are ideal for crowded cities due to their maneuverability and lower parking requirements. Additionally, government incentives for low-emission vehicles and growing eco-consciousness are driving consumers to opt for smaller, energy-efficient cars. Technological advancements, including electric and hybrid models, are also gaining popularity, especially in markets like Japan and South Korea, where there is strong demand for eco-friendly alternatives. These factors contribute to the sustained growth of the compact car market in the region.

Latin America Compact Cars Market Analysis

In Latin America, the compact car market is driven by economic factors, rising urbanization, and the need for affordable transportation solutions. According to the UN, Latin America and the Caribbean are among the most urbanized regions, with 81% of the population residing in urban areas. This trend increases the demand for compact vehicles, which are ideal for navigating crowded city streets and limited parking. Additionally, rising fuel prices and a growing middle class are fueling the shift toward smaller, fuel-efficient cars. Government initiatives promoting eco-friendly vehicles also support the growth of the compact car market in the region.

Middle East and Africa Compact Cars Market Analysis

In the Middle East and Africa, the compact car market is driven by urbanization, rising fuel prices, and the demand for affordable, efficient transportation. According to PwC, the GCC is one of the most highly urbanized regions globally, with 85% of the population currently living in cities, a figure expected to rise to 90% by 2050. This rapid urban growth increases the demand for compact vehicles, which are well-suited for navigating congested city streets and limited parking. Additionally, the shift toward fuel-efficient and eco-friendly cars, driven by rising fuel costs and environmental concerns, supports market growth in the region.

Competitive Landscape:

The compact cars market has an intense competitive landscape as the market is primarily led by global and regional players in light of shifting consumer preferences and technological developments. Competitions among the key players arise through the provision of new features, such as fuel efficiency, advanced safety systems, and connectivity options. Increasing competition from electric vehicle manufacturers launching compact electric models to meet environmental goals further amplifies the market rivalry. Aggressive pricing, diversified model portfolios, and R&D investments also characterize the competitive play. In addition, partnerships and collaborations shape the market significantly, allowing car makers to increase production efficiency and technological integration. For instance, in November 2024, Ford announced European restructuring plans to address passenger vehicle losses, adapt to electrification, and tackle new competition, aiming for cost efficiency and long-term business sustainability in the region.

The report provides a comprehensive analysis of the competitive landscape in the compact cars market with detailed profiles of all major companies, including:

- Ford Motor Company

- General Motors

- Hyundai Motor Group

- Renault Group

- Stellantis N.V

- Suzuki Motor Corporation

- Toyota Motor Corporation

- Volkswagen AG (Porsche Automobil Holding SE)

Latest News and Developments:

- October 2024: Toyota and Suzuki are developing a compact EV, the bZ, set for global release in 2025. Built on Toyota’s e-TNGA platform, it will offer over 300 km of range, with a 118bhp front-wheel drive motor. Its dimensions include a length of 3700mm, width of 1700mm, and height of 1530mm. Toyota is also planning a new SUV below the Fortuner sharing the same platform.

- October 2024: Skoda will launch the Kylaq, a new sub-4 meter compact SUV, in India next year to compete with models like the Maruti Suzuki Brezza and Hyundai Venue. The company has invested EUR 250 Million (USD 260 Million) in the project, increasing production capacity at its Chakan plant. The sub-4 meter segment now makes up nearly 30% of India's annual passenger vehicle sales.

- March 2024: Ford is refocusing on a new platform for affordable, compact EVs, with a crossover launching in late 2026 starting at USD 25,000. The platform will also support a small truck, possibly an electric Maverick, and a ride-hailing vehicle. This change comes as low-cost Chinese EVs enter the European market, likely expanding to the U.S.

- March 2024: Hyundai has received recognition in the 2024 Best Cars for Families awards by U.S. News & World Report. The 2024 Hyundai Tucson was named Best Compact SUV for Families for the third year in a row, while the 2024 Hyundai IONIQ 5 earned Best Electric Vehicle for Families due to its safety ratings and spacious interior.

- February 2024: Skoda will launch its compact SUV in India by March 2025, built on the MQB A0-IN platform. The sub-four-meter SUV will feature a compact design with a larger appearance due to new headlights and grille. Skoda aims to compete in the mainstream market by aligning price, size, and features with local expectations, following the success of the Slavia and VW Virtus.

Compact Cars Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Gasoline, Diesel, Electric, Others |

| Applications Covered | Private, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ford Motor Company, General Motors, Hyundai Motor Group, Renault Group, Stellantis N.V, Suzuki Motor Corporation, Toyota Motor Corporation, Volkswagen AG (Porsche Automobil Holding SE), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the compact cars market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global compact cars market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the compact cars industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A compact car is a small car built to provide efficiency, practicality, and affordability. Compact cars usually have an upper limit of five passengers and limited cargo space. These are often preferred for commuting in cities because of the efficiency, maneuverability, and easy parking, thus it's economical.

The compact cars market was valued at USD 48.6 Billion in 2024.

IMARC estimates the global Compact Car market to exhibit a CAGR of 1.39% during 2025-2033.

The market is driven by rising urbanization, demand for fuel-efficient vehicles, and affordability. This industry is attracting cost-conscious consumers and the growing environmental regulations call for smaller, efficient engines and hybrid options. Technological advances and increasing popularity in emerging markets further boost their global demand.

According to the report, diesel represented the largest segment by fuel type, driven by its higher fuel efficiency, better torque output for heavy loads, and widespread use in commercial and long-distance vehicles.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global Compact Car market include Ford Motor Company, General Motors, Hyundai Motor Group, Renault Group, Stellantis N.V, Suzuki Motor Corporation, Toyota Motor Corporation, Volkswagen AG (Porsche Automobil Holding SE), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)