Commercial Vehicles Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, End Use, and Region, 2025-2033

Commercial Vehicles Market Size and Share:

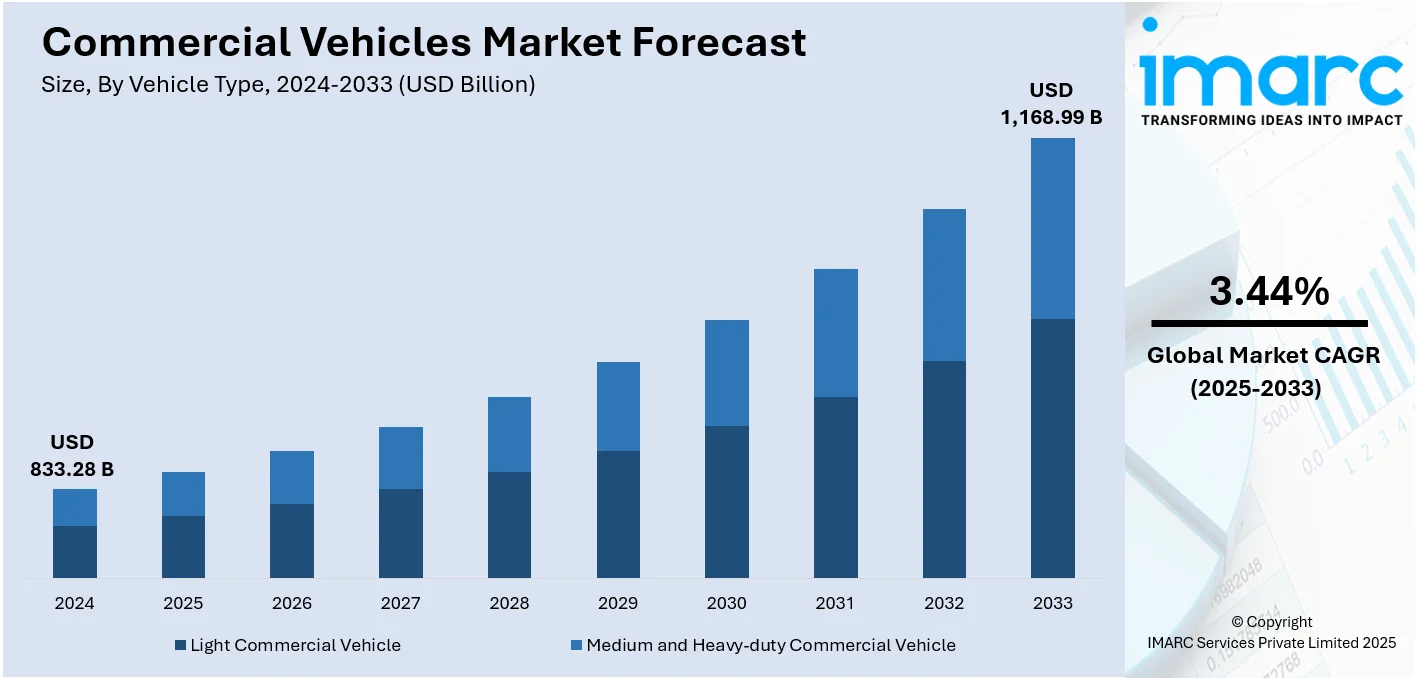

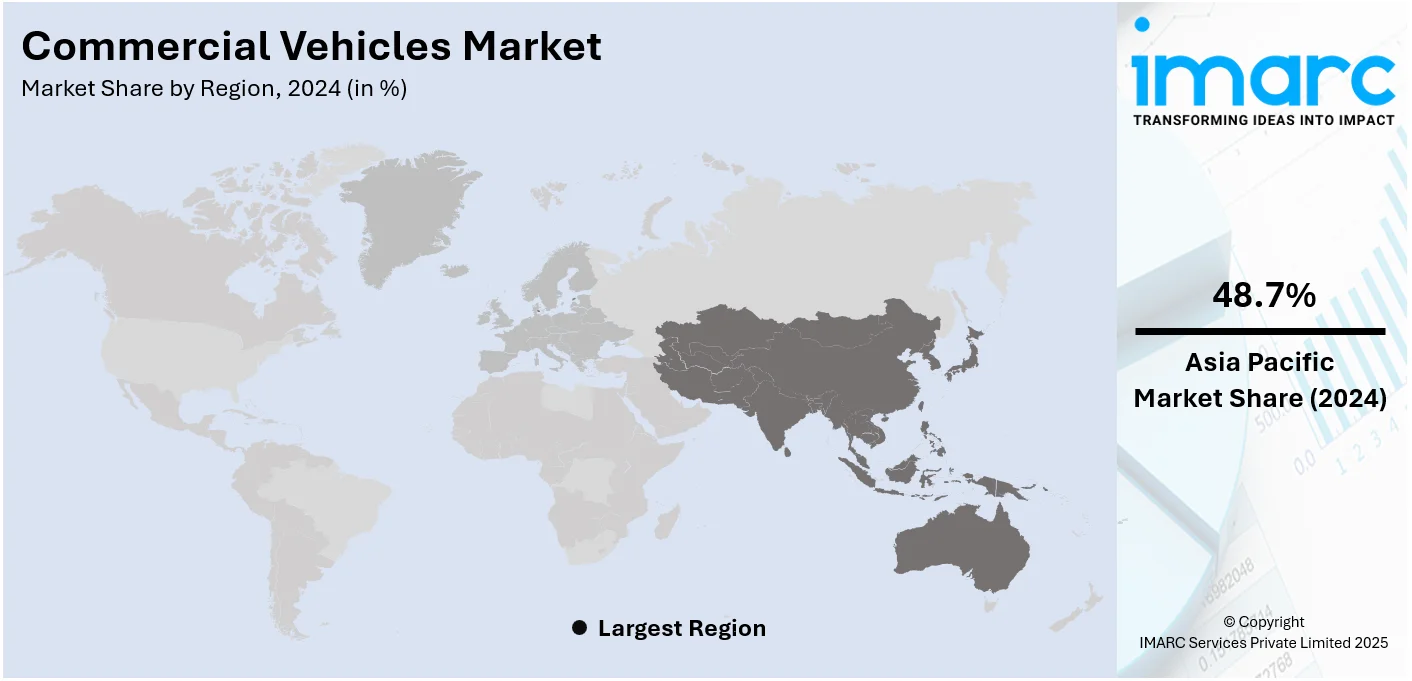

The global commercial vehicles market size was valued at USD 833.28 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,168.99 Billion by 2033, exhibiting a CAGR of 3.44% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 48.7% in 2024. The market is propelled by economic growth, the implementation of infrastructure projects, and the expansion of e-commerce and logistics, which create heightened demand for commercial vehicles. Financing is crucial, as lenders offer their unique products to help finance vehicle acquisitions. There are also many new trends, including the implementation of electric commercial vehicles and a move towards sustainable transportation, or green options. These trends are changing the industry's outlook and further augmenting the commercial vehicles market share, particularly as companies seek to implement sustainable solutions and innovative new vehicle technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 833.28 Billion |

|

Market Forecast in 2033

|

USD 1,168.99 Billion |

| Market Growth Rate (2025-2033) | 3.44% |

The commercial vehicles market share is impelled by increased demand in logistics, construction, and e-commerce. High-speed growth of the e-commerce market has upped the stakes in last-mile delivery efficiency and pushed the LCV market as a result. For example, in September 2024, Volvo Trucks also announced the unveiling of its next generation FH Electric truck, which comes with a maximum range of 600 km when fully charged for long-distance and zero-emissions transport. Moreover, there is infrastructure development as a drive for HCVs in countries, such as construction materials and machineries' transportation in newly emerging economies. The policies of the government, providing incentives for more fuel-efficient and environment-friendly vehicles, with subsidies for electric and hybrid models, motivate fleet operators to shift towards ecofriendly options. Telematics and fleet management systems continue to evolve in efficiency for operations, downtime reduction, and fuel optimization, making commercial vehicles even more desirable for business applications. Urbanization and globalization result in accelerated transportation demands for securing goods, in addition to more innovative vehicle designs, such as autonomy and connectivity functionalities, which drive the markets.

The commercial vehicles market growth in the U.S. is driven by the expansion of e-commerce and infrastructure development. The rise in demand for last-mile delivery of online shopping has resulted in an amplification in need for light commercial vehicles that transport goods efficiently. On the other hand, infrastructure projects across the nation, including road construction and urbanization, have escalated the need for heavy commercial vehicles to transport materials. Government incentives and policies to encourage the use of cleaner, more fuel-efficient vehicles like electric and hybrid commercial trucks also support market growth. Advanced telematics and fleet management systems have optimized the performance of the vehicle, cut costs, and improved efficiency. All these are reasons that encourage fleet owners to upgrade their vehicles. The United States is experiencing increased urbanization and globalization that necessitate efficient transportation solutions. For example, in October 2024, Freightliner introduced the Fifth Generation Cascadia, enhancing safety, efficiency, and profitability with advanced safety systems, improved aerodynamics, and innovative business intelligence tools for the commercial vehicle market. Further, these factors combined ensure continued growth and innovation in the U.S. commercial vehicle market.

Commercial Vehicles Market Trends:

Demand for Electric Commercial Vehicles

The increasing usage of electric commercial vehicles, owing to the elevating levels of carbon emissions, is primarily driving the growth of the market. For instance, global EV sales witnessed a robust 10.82% growth in 2022 compared to 2021, as per industry reports. Sales projections for electric passenger cars are predicted to exceed 5 million at the end of 2025, representing nearly 15% of total vehicle sales. Furthermore, various leading manufacturers and organizations, like the London Metropolitan Police & Fire Service, are actively pursuing their electric mobility strategies. For example, they have planned to have zero-emission by 2025, with targets to electrify 40% of their vans before 2030 and full electrification by 2040. Such initiatives are propelling the commercial vehicles market share. Besides this, the government authorities of various nations are also taking necessary steps to promote the production and adoption of commercial electric vehicles. For instance, in September 2021, the government of India introduced a Production Linked Incentive (PLI) scheme for electric vehicles. Under this scheme, a direct subsidy to EV buyers is also provided.

Expanding E-commerce Sector

The rising number of more diverse and faster shipping options is providing a thrust to the market. Commercial vehicles play a crucial role in the e-commerce sector by facilitating efficient logistics and delivery operations. They ensure timely and reliable transportation of goods, thereby supporting the rapid growth of online shopping and last-mile deliveries. According to the commercial vehicles market forecast, the shift towards online commerce is compelling logistics companies to enhance their distribution networks and integrate advanced technologies for real-time tracking and efficient handling of goods, which is bolstering the commercial vehicle market demand. For instance, logistics industry statistics stated that sales via online stores reached 22% of global retail sales in 2023, compared to 14.1% in 2019. Additionally, according to IMARC, the global e-commerce market size reached USD 21.1 Trillion in 2023. Looking forward, IMARC Group expects the market to reach USD 183.8 Trillion by 2032, exhibiting a growth rate (CAGR) of 27.16% during 2024-2032. Furthermore, commercial vehicles in e-commerce enable businesses to optimize their supply chains, reduce transportation costs, and scale operations effectively to meet fluctuating demand, thereby playing a pivotal role in the dynamic and competitive landscape of online retail.

Technological Advancements

Technological advancements in commercial vehicle manufacturing are revolutionizing the industry by integrating innovations, such as novel telematics for real-time fleet management, autonomous driving capabilities for enhanced safety and efficiency, and lightweight materials for improved fuel efficiency. Electric and hybrid technologies are rapidly evolving, which, in turn, is offering alternatives to traditional combustion engines. Additionally, advancements in battery technology and vehicle electrification are positively impacting the commercial vehicles market outlook. For instance, in May 2020, Kia Motors Europe announced its "Plan S," signaling a strategic shift toward electrification. Kia has set ambitious goals to launch 11 electric vehicle models worldwide by 2025 covering different categories such as passenger cars, SUVs and MPVs. The company aims to achieve annual global sales of approximately 500,000 EVs by 2026. Furthermore, in August 2023, Toyota Kirloskar Motor launched the all-new MPV Vellfire strong hybrid electric vehicle (SHEV) with enhanced safety features. The market is also experiencing significant growth, driven by accelerating demand for energy-efficient and environmentally friendly options. Additionally, several forces are driving the market, including the demand for reduced emissions, advancements in green technologies, and the adoption of smart fleet management systems. Infrastructure projects and e-commerce globally are driving the demand for more effective logistics and transportation operations. These developments are contributing to the growth of the commercial vehicle market and demand for electric and hybrid vehicles.

Commercial Vehicles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global commercial vehicles market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on vehicle type, propulsion type, and end use.

Analysis by Vehicle Type:

- Light Commercial Vehicle

- Medium and Heavy-duty Commercial Vehicle

Light commercial vehicle leads the market with around 76.8% of market share in 2024. The light commercial vehicle segment, encompassing vans, minitrucks, and pickups, is witnessing heightened demand due to the growth of e-commerce, urban deliveries, and last-mile logistics. As consumer preferences shift towards online shopping, there is an increase in the need for efficient vehicles that can navigate urban environments and accommodate smaller loads. For instance, according to a data report, this segment reached 6,042,081 units in 2023, showcasing a remarkable growth trajectory. Moreover, the versatility and maneuverability of light commercial vehicles make them vital for urban logistics and local transportation, driving their market growth. Additionally, various leading market players are also introducing light commercial vehicles to attract a wider consumer base, which is anticipated to augment the commercial vehicles market size in the coming years. For instance, in May 2022, Tata Motors announced plans to deliver 20,000 light electric trucks to six major e-commerce players.

Analysis by Propulsion Type:

- IC Engine

- Electric Vehicle

The market is dominated by the IC engine. The demand of the diverse requirements of the industries for long haul, heavy loads, and a large range of travel for their vehicles powered by conventional gasoline or diesel engines continues to shape the evolution of this segment towards more sustainable and environment-friendly solutions and cleaner, efficient technologies for the future.

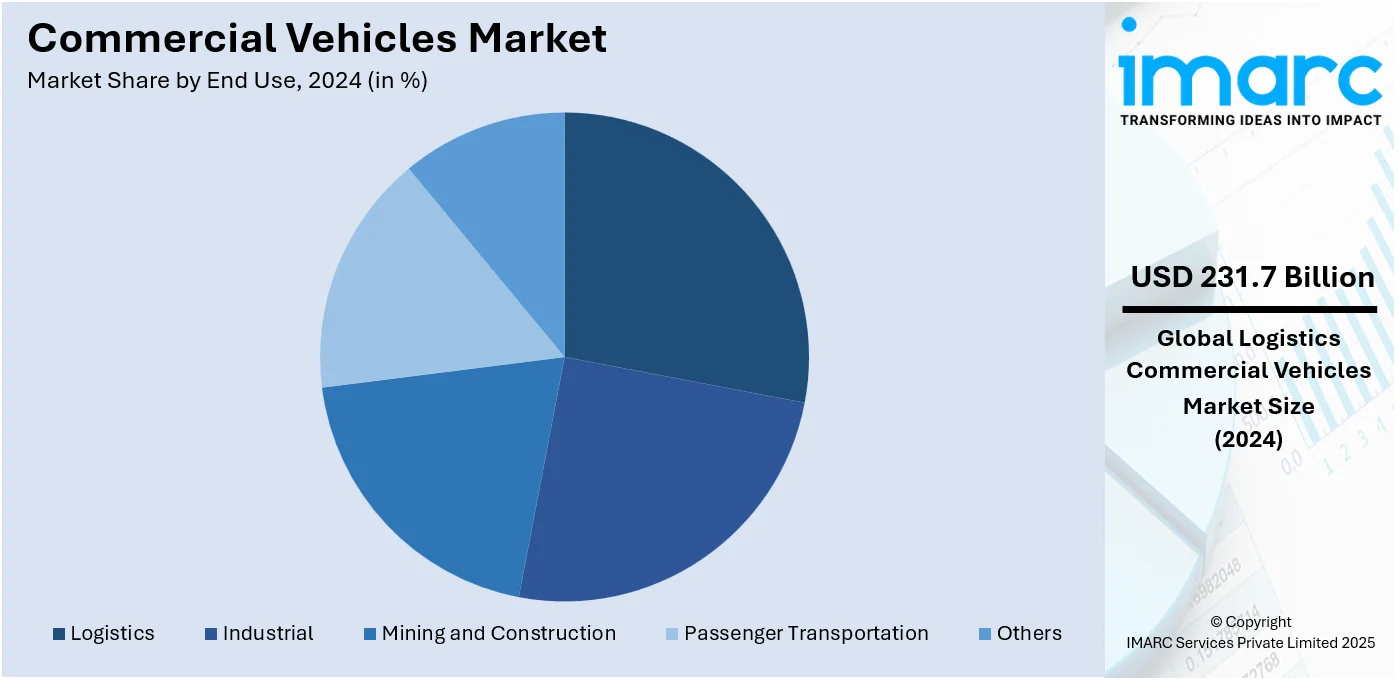

Analysis by End Use:

- Industrial

- Mining and Construction

- Logistics

- Passenger Transportation

- Others

Logistics leads the market with around 27.8% of market share in 2024. The logistics segment caters to the increasing need for efficient and timely movement of goods. With the rise of e-commerce and global trade, commercial vehicles in this category, including delivery vans and long-haul trucks, ensure seamless supply chains and effective distribution networks. According to the report by IMARC, the global logistics market size reached US$ 5.4 Trillion in 2023. Looking forward, IMARC Group expects the market to reach US$ 7.9 Trillion by 2032, exhibiting a growth rate (CAGR) of 4.1% during 2024-2032. Moreover, as per the commercial vehicles market statistics, the elevating levels of globalization of trade among companies are compelling logistics providers to navigate a complex web of customs regulations and trade agreements, which is acting as another significant growth-inducing factor for the market. In line with this, government authorities across the world are launching favorable policies to support the growth of international trade. For instance, the UK government teamed up with Amazon Marketplace, where international customers can discover a wide range of items from small UK businesses and artisans as well as prominent British brands.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 48.7%. The expansion of e-commerce, manufacturing, and infrastructure projects has led to significant demand for diverse commercial vehicles, from delivery vans to heavy-duty trucks. This is augmenting the market in Asia Pacific. Additionally, China witnessed about 2.90% rise in electric car sales in 2022 compared to 2021, while Japan experienced an 11.11% increase during the same period. This trend is being influenced by increasing environmental awareness, strict regulations and the benefits of electric vehicles including improved fuel efficiency reduced maintenance expenses and zero carbon emissions. Government subsidies support the uptake of electric vehicles in countries throughout the Asia Pacific region. Moreover, regulatory authorities in the region are projected to invest US$ 26 Trillion in infrastructure by 2030, thereby significantly bolstering the transportation of construction materials and machinery.

Key Regional Takeaways:

North America Commercial Vehicles Market Analysis

North America is significant part of the global commercial vehicles market due to rapid demand across sectors such as logistics, transport, and construction. In recent years, the aggressive growth of e-commerce has also required last-mile delivery services, which have led to an increase in demand for LCVs. HCVs are also required to transport construction materials and heavy machinery for large-scale infrastructure projects in the region. Government initiatives and regulations towards embracing electric and hybrid vehicles besides offering incentives for fuel efficiency models are furthering the growth. Improvements in telematics and fleet management systems have helped reduce the operating costs, further improved the efficiency of vehicles, and enabled companies to optimize their fleets. Support for the U.S. market comes from strong innovative focus, as there has been an increase in adopting autonomous and connected commercial vehicles. In conclusion, all the infrastructural structure of North America, their technology advancement, and various governmental policies help sustain commercial vehicles.

United States Commercial Vehicles Market Analysis

The United States commercial vehicles market is growing at a remarkable rate due to massive investments from the federal government, along with changing transportation demands. The 2021 Infrastructure Investment and Jobs Act (IIJA) appears to be one of the key drivers, aiming at upgrading transit systems and helping in reducing transportation emissions around the country. According to the Environmental and Energy Study Institute (EESI), the IIJA directs USD 590 Billion toward transportation funding, of which USD 91.9 Billion is specifically dedicated toward upgrading public transit systems. This infusion of capital is supporting the adoption of advanced commercial vehicles, and especially those using alternative fuels and electric powertrains, in alignment with goals of public and private sustainability. Also, investments for transit modernization are providing demand for heavy-duty buses, light commercial vans and specialized vehicles tailored for the urban mobility. Coupled with strong growth in e-commerce, construction, and freight sectors, the funding reflects a transformative period for the U.S. commercial vehicles market that promises to deliver sustainable and efficient transportation solutions.

Europe Commercial Vehicles Market Analysis

The European commercial vehicles market is growing with significant value, driven by robust support from regulations and increasing demand for sustainable transport solutions. In 2023, the European Union implemented a robust set of proposals to reorient its climate, energy, transport, and taxation policies, all in pursuit of aligning with the ambitious net reduction target of at least 55% by 2030, compared with 1990 levels. This policy framework has created a shift toward cleaner commercial vehicles mainly in the light commercial vehicle (LCV) parts. The European Automobile Manufacturers' Association, ACEA, reported that two of this region's biggest markets experienced drastic growth in 2023, with Germany increasing their LCV registrations by 19.0% and followed closely by Spain, that recorded a 12.4% rise. Other investments that enable this transition include low emissions zones, subsidies, and incentives for taxes. These factors, combined with technological advancements in vehicle efficiency and infrastructure improvements, are creating a favourable environment for the growth of Europe's commercial vehicles market.

Asia Pacific Commercial Vehicles Market Analysis

The Asia-Pacific commercial vehicles market is highly growing and driven by the adoption of electric vehicles and supportive government policies. In China, more than 95% of heavy-duty trucks produced in 2021 were fitted with Lithium Iron Phosphate (LFP) batteries, preferred for their robustness, economy, and capacity to meet the demands of commercial mileage, according to the International Energy Agency (IEA). Meanwhile, India's Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) scheme, which is investing USD 1.4 Billion over three years, is boosting EV adoption in commercial markets. The program aims at a figure of 1.6 million hybrid and electric vehicles - of which buses and trucks constitute a significant share-which also encourages domestic manufacturing. Such endeavors are hastening the adoption of ecofriendly vehicles in the region and promoting a growth spurt in commercial vehicle markets. The combination of cost-effective EV technologies and strong governmental support will propel the market forward.

Latin America Commercial Vehicles Market Analysis

Commercial vehicles growth has been significant in Latin America, mainly through an increasingly number of electric vehicles, also known as green transports, promoted by the governments and people. In 2023, electric cars sales are close to nearly 90,000, as per an industry report. Brazil, Colombia, Costa Rica, and Mexico rank on top. In Brazil, for example, registrations of electric cars almost tripled year-on-year to above 50,000 units, taking the market share to 3%, according to International Energy Agency (IEA). Electric commercial vehicles are a new area of demand based on this increase in electric vehicle adoption, especially from businesses and fleets to reduce emissions and costs. Moreover, this shift is further being accelerated in the commercial vehicles market as well by government policies that encourage low-emission and sustainable modes of transportation, such as tax benefits and subsidies to reduce emissions. As environmental concern and infrastructure development grow across Latin America, the commercial vehicles market is predicted to experience significant growth during the next few years.

Middle East and Africa Commercial Vehicles Market Analysis

The Middle East and Africa commercial vehicle market is growing highly due to government initiatives and the shift towards sustainable transportation. One significant development can be witnessed in Saudi Arabia, as the country targets to achieve the goal where 30% of all vehicles that move on roads in its capital city must be electric by the end of 2030. This would fall within a broad strategy towards decreasing carbon emission and ensuring an eco-friendly alternative to carbon-emitting transportation alternatives. The growth is being led by electric commercial vehicles in the light and heavy-duty segments, further driven by such initiatives. Moreover, countries in this region are expanding electric vehicle infrastructure by making increased investments in charging stations and providing incentives to the buyers of electric vehicles. This combination of regulatory support, infrastructure development, and growing environmental awareness will be the driving factor in the adoption of electric commercial vehicles, which should accelerate the growth of the Middle East and Africa market.

Competitive Landscape:

Top companies are strengthening the market through their strategic initiatives and innovative approaches. These industry leaders consistently invest in research and development to design and manufacture vehicles that align with evolving customer needs, regulatory requirements, and technological advancements. They focus on incorporating cutting-edge technologies such as electric and hybrid powertrains, autonomous driving capabilities, and advanced telematics to enhance vehicle performance, safety, and efficiency. By leading the charge in adopting sustainability practices and developing eco-friendly commercial vehicles, these companies are catering to the increasing demand for environmentally conscious transportation solutions. Moreover, top companies are forging collaborations with technology partners, suppliers, and competitors to drive innovation and accelerate the development of next-generation vehicles. Their commitment to quality, safety, and customer satisfaction ensures continuous improvement and market-driven innovation that strengthens the market's growth trajectory. Through innovation, sustainable practices, and strategic partnerships, these companies shape and propel the market toward a dynamic and transformative future.

The commercial vehicles market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- AB Volvo

- Ashok Leyland (Hinduja Group)

- Ford Motor Company

- General Motors Company

- Hyundai Motor Company

- ISUZU Motors Limited

- Mahindra & Mahindra Limited

- Mercedes-Benz Group AG

- Mitsubishi Motors Corporation

- Robert Bosch GmbH

- Tata Motors Limited

- Toyota Motor Corporation

- Volkswagen AG

Latest News and Developments:

- May 28, 2025: Tata Motors, under a joint venture with MTI, launched a whole range of commercial vehicles in Egypt, such as the Tata Xenon, Ultra T.9, Ultra T.7, Prima 3328.K, Prima 4438.S, Prima 6038.S, and LP 613 bus, with an intention to support the country's emerging logistics and infrastructure market segments. With MTI’s strategic service locations, these vehicles will offer unrivaled performance, excellent fuel economy, and strong after-sales service, supported by warranties of up to 5 years or 150,000 km. The launch strengthens Tata Motors’ presence in Egypt, enabling it to establish a significant footprint as a key player in addressing the growing demand for safe and dependable commercial mobility solutions in emerging markets.

- January 07, 2025: Mantra Electric, a Murugappa Group subsidiary, announced the unveiling of its first electric small commercial vehicle (e-SCV) and Electric 3W Super Cargo at the Bharat Mobility Global Expo 2025, aiming to enhance last-mile urban cargo solutions. Both the e-SCV and 3W Super Cargo are targeting India's growing need for green transportation in the logistics sector, capitalizing on Montra's past success with more than 8,000 units of its Super Auto now operating. Mantra will also showcase the Rhino, an electric heavy truck trailer, marking India's first, thus further emphasizing its commitment to leading the development of green commercial mobility solutions.

- June 2024: Mahindra announced its plans to launch light commercial vehicles, which will include five ICE offerings and two EV offerings.

- June 2024: Tata Motors a well-known Indian automobile manufacturer launched Tata Motors Fleet Verse a robust digital platform specifically designed for its commercial vehicles.

- April 2024: Daimler India Commercial Vehicles (DICV), the wholly-owned subsidiary of Germany's Daimler Truck AG (Daimler Truck), developed an all-electric next-generation eCanter.

Commercial Vehicles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Light Commercial Vehicle, Medium and Heavy-duty Commercial Vehicle |

| Propulsion types Covered | IC Engine, Electric Vehicle |

| End Uses Covered | Industrial, Mining and Construction, Logistics, Passenger Transportation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, Ashok Leyland (Hinduja Group), Ford Motor Company, General Motors Company, Hyundai Motor Company, ISUZU Motors Limited, Mahindra & Mahindra Limited, Mercedes-Benz Group AG, Mitsubishi Motors Corporation, Robert Bosch GmbH, Tata Motors Limited, Toyota Motor Corporation, Volkswagen AG., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial vehicles market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global commercial vehicles market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the commercial vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial vehicles market was valued at USD 833.28 Billion in 2024.

The commercial vehicles market is projected to exhibit a CAGR of 3.44% during 2025-2033, reaching a value of USD 1,168.99 Billion by 2033.

The key drivers of the commercial vehicles market across the globe are rising demand for efficient transportation, rapid urbanization, rapidly growing e-commerce, infrastructure development, and vehicle technology advancements, strong environmental regulations, proper cost-effective logistics, and rising freight and passenger transport demand.

Asia Pacific currently dominates the market, accounting for a share of around 48.7%. The dominance is driven by the rapid industrialization, increasing infrastructure development, expanding e-commerce, and the growing demand for both light and heavy commercial vehicles.

Some of the major players in the commercial vehicles market include AB Volvo, Ashok Leyland (Hinduja Group), Ford Motor Company, General Motors Company, Hyundai Motor Company, ISUZU Motors Limited, Mahindra & Mahindra Limited, Mercedes-Benz Group AG, Mitsubishi Motors Corporation, Robert Bosch GmbH, Tata Motors Limited, Toyota Motor Corporation, and Volkswagen AG., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)