Commercial Telematics Market Size, Share, Trends and Forecast by Type, System Type, Provider Type, End Use Industry, and Region, 2026-2034

Commercial Telematics Market Size and Share:

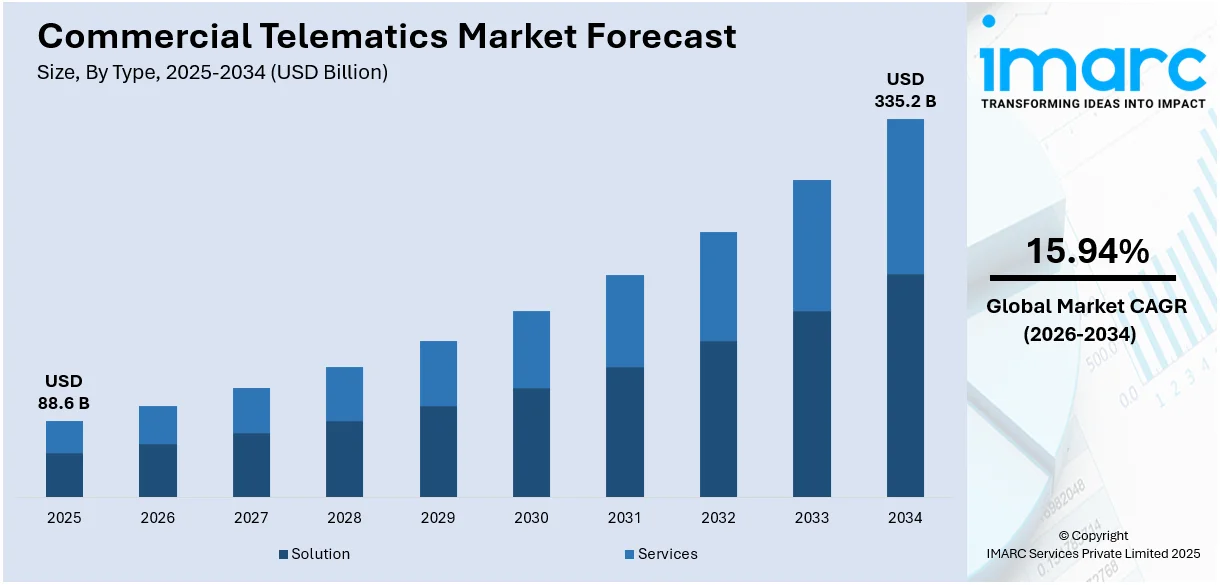

The global commercial telematics market size was valued at USD 88.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 335.2 Billion by 2034, exhibiting a CAGR of 15.94% during 2026-2034. North America currently dominates the market, holding a significant market share of over 37.8% in 2025. The market is seeing strong growth fueled by an increasing demand for fleet optimization, enhanced vehicle safety, and the need for real-time data analytics. These factors contribute to improved operational efficiency and better-informed business decisions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 88.6 Billion |

| Market Forecast in 2034 | USD 335.2 Billion |

| Market Growth Rate (2026-2034) | 15.94% |

The commercial telematics market is driven by the rising demand for fleet management solutions, increasing adoption of connected vehicle technology, and advancements in data analytics for predictive maintenance. Regulatory mandates for improved vehicle safety and emissions control are further boosting adoption. The integration of IoT in telematics systems enhances operational efficiency offering real time tracking and monitoring. For instance, in September 2024, a collaboration between Cummins, Bosch Global Software, ETAS, and KPIT was revealed to introduce Eclipse CANought, an open-source telematics initiative, as part of the Eclipse Software Defined Vehicle project. This collaboration aims to standardize and secure access to vehicle ECUs enabling efficient over-the-air updates and reducing development costs for commercial vehicle applications. Additionally, growing demand for usage-based insurance and cost optimization in logistics are fueling market expansion, especially in the transportation and logistics sectors.

To get more information on this market Request Sample

The United States commercial telematics market is expanding due to the growing need for efficient fleet management solutions and real-time vehicle monitoring systems. For instance, in June 2024, Geotab and Rivian unveiled their collaboration to provide a unified telematics solution for Rivian's commercial fleet across North America. This collaboration aims to enhance fleet productivity, safety, and compliance by leveraging Rivian's embedded telematics and Geotab's fleet management platform providing fleet managers with valuable insights and analytics. Stringent government regulations on vehicle safety and emissions alongside the adoption of electronic logging devices (ELDs) are accelerating market growth. Rising fuel costs are prompting businesses to invest in telematics for cost optimization and route planning. Additionally, the increasing adoption of usage-based insurance and the growing demand for last-mile delivery services in e-commerce are further driving the market growth.

Commercial Telematics Market Trends:

Increasing Emphasis on Fleet Management

The market is largely influenced by the demand for improved efficiency in fleet management. Fleet operators are consistently looking for ways to enhance fuel efficiency, decrease idle times and optimize route planning. Telematics systems provide real-time data analysis that empowers operators to make well-informed decisions leading to reduced operational costs and increased productivity. Moreover, these systems deliver vital information regarding vehicle health which aids in preventive maintenance and cuts down on downtime. According to Geotab, a Canadian technology firm, fleets using telematics can achieve up to a 30% reduction in operational costs with studies indicating that such companies experience fuel savings around 15% and a 25% reduction in vehicle idle time. Furthermore, by offering insights into vehicle health these systems can lower downtime by as much as 20% resulting in additional savings and enhanced productivity. By boosting efficiency telematics also play a role in decreasing carbon footprints supporting sustainability objectives.

Technological Advancements

The rapid growth of the Internet of Things and connected technologies has significantly driven the expansion of the commercial telematics sector. Telematics devices leverage IoT to link vehicles with external networks enabling data exchange between vehicles and central systems. This technology allows for the real time monitoring of vehicle location, condition and driver behavior. The incorporation of advanced sensors and machine learning algorithms enhances telematics solutions making them more precise and dependable. These technological improvements have broadened the applications of telematics beyond conventional tracking to include complex analytics for informed decision making. For example, a study predicts that the implementation of telematics solutions featuring integrated machine learning and predictive analytics could boost fleet efficiency by up to 25% and lower operational costs by 15%. These innovations have extended telematics beyond standard tracking by providing sophisticated analytics that aid businesses in making informed decisions.

Escalating Demand for Real Time Data Analytics

There is an increasing need for real time data analysis and reporting within the commercial vehicle industry. Telematics solutions offer extensive data regarding vehicle performance, driver conduct and logistics management. For example, the U.S. commercial vehicle sector experienced a 14% rise in registrations in 2023 reaching over 1.6 million vehicles according to an industry report. The ability to evaluate this data instantaneously allows businesses to make quick and informed decisions that can greatly enhance operational efficiency and improve customer satisfaction. This demand for practical insights derived from vehicle data is a significant factor driving the adoption of telematics technology in commercial fleets.

Stringent Regulations

According to the European Commission the EU introduced a regulation in 2020 that mandates the installation of advanced driver assistance systems (ADAS) in all new commercial vehicles promoting telematics integration to monitor driving behavior and improve safety. In the U.S., the Federal Motor Carrier Safety Administration (FMCSA) has mandated the use of electronic logging devices (ELDs) in over 3.4 million commercial trucks to track driving hours and ensure compliance with safety standards. Additionally, regulations in countries like India and China are encouraging telematics adoption to reduce fuel consumption and emissions with the goal of cutting down carbon emissions by 20% in the next decade. These regulations are driving the commercial telematics market leading to increased demand for solutions that enhance safety, optimize fleet management and support sustainability efforts.

Commercial Telematics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on type, system type, provider type and end use industry.

Analysis by Type:

- Solution

- Fleet Tracking and Monitoring

- Driver Management

- Insurance Telematics

- Safety and Compliance

- V2X Solutions

- Others

- Services

- Professional services

- Managed services

Solution leads the market with around 82.8% of the market share in 2025. The solution segment accounts for the largest share. This category includes a variety of hardware and software solutions that constitute the backbone of telematics systems. Solutions cover GPS tracking devices, onboard diagnostics (OBD) tools, in-cab cameras, sensors, and software platforms that facilitate data collection, transmission, and analysis. These solutions are crucial for real time vehicle tracking, remote diagnostics, fuel monitoring and fleet management. The increasing demand for these solutions is fueled by the necessity for actionable data and insights to optimize fleet operations, enhance vehicle safety and improve overall efficiency.

Analysis by System Type:

- Embedded

- Tethered

- Smartphone Integrated

The embedded segment occupies the largest share of the market and is characterized by the integration of telematics hardware and software directly into vehicles during the manufacturing process. These systems provide continuous and reliable connectivity allowing for real-time tracking, remote diagnostics, and interaction with fleet management systems. They are especially favored by large fleets and automotive manufacturers because of their robust and trustworthy telematics solutions which include a variety of features such as advanced driver assistance systems (ADAS) and predictive maintenance. Embedded telematics systems ensure constant connectivity even in locations with weak network coverage making them the preferred choice for industries like logistics, transportation, and construction.

Analysis by Provider Type:

- OEM

- Aftermarket

Aftermarket leads the market with around 69.4% of market share in 2025. The aftermarket sector has the largest share of the market. It encompasses telematics solutions that can be added to vehicles after they are purchased. These systems are retrofitted into existing vehicles rather than being installed at the factory. Aftermarket telematics solutions provide versatility and can be integrated into a broad range of commercial vehicles regardless of their make or model. They include features such as GPS tracking, monitoring of driver behavior and data analysis. This segment is favored by fleet operators looking to enhance their current vehicles with telematics functionalities or those managing a diverse fleet that includes vehicles from various manufacturers. Aftermarket telematics companies provide either easy to install devices or professionally installed options allowing businesses to select the choice that best meets their requirements.

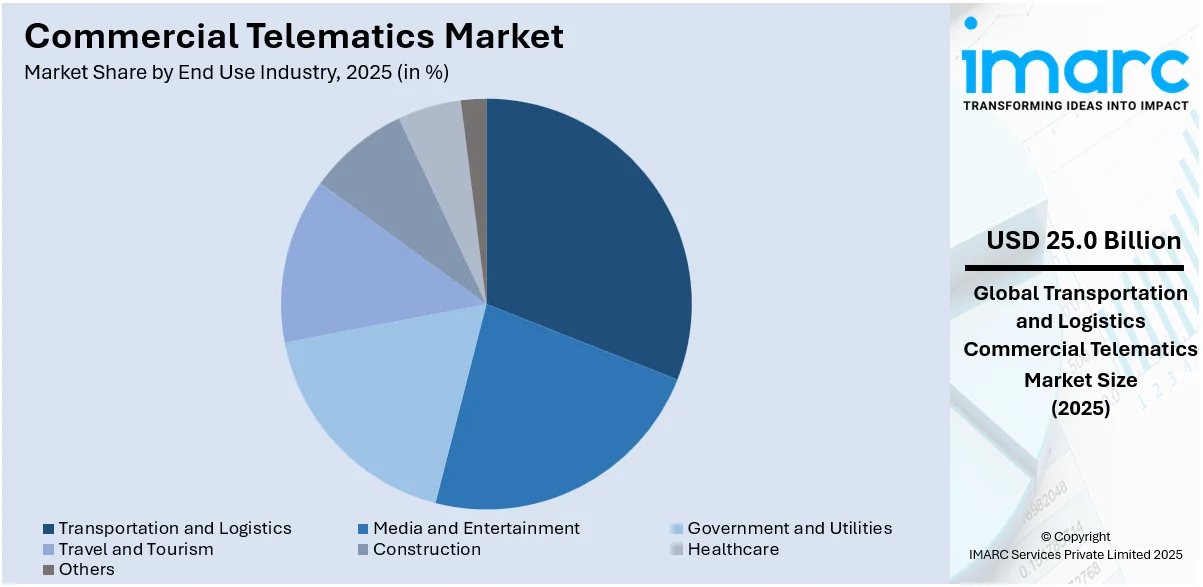

Analysis by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Transportation and Logistics

- Media and Entertainment

- Government and Utilities

- Travel and Tourism

- Construction

- Healthcare

- Others

Transportation and logistics leads the market with around 32.7% of market share in 2025. The transportation and logistics sector represents the largest portion of the market fueled by the essential requirement for effective fleet management, route optimization and real time monitoring. Telematics solutions allow businesses in this field to enhance fuel efficiency, lower operational expenses, accelerate delivery schedules and maintain the safety of their assets and drivers. The incorporation of GPS technology, sensors and data analytics is crucial in optimizing logistics operations making it an essential tool for companies engaged in the movement of goods and services.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 37.8%. North America leads the commercial telematics market due to its developed transportation and logistics sector, strict regulatory standards and an emphasis on enhancing fleet efficiency and safety. The region exhibits a high uptake of advanced telematics technologies such as GPS tracking, real time monitoring and predictive maintenance across industries like transportation, construction and delivery services. Companies in North America frequently invest in telematics to boost operational effectiveness, lower fuel expenses and improve vehicle safety establishing it as the largest and most developed segment in the market.

Key Regional Takeaways:

United States Commercial Telematics Market Analysis

In 2025, United States accounted for a share of 73.50% of the North America market. The growth of U.S. commercial telematics has been driven by quick uptake of connected vehicles and fleet management solutions. According to an industrial report, in 2023, more than 40% of all vehicles in the United States carried in built telematics devices that help enhance navigation, safety and operation efficiency. Fleet management solutions monitor more than 12 million vehicles in the United States thereby enabling businesses to cut down their routes, minimize fuel consumption and enhance driver behavior. For example, Verizon Connect had over 200,000 active fleet management users in 2023, with logistics companies integrating telematics to monitor over 1.5 million fleet vehicles in real-time. Geotab and Fleet Complete are some of the major players that are using AI and predictive maintenance tools to enhance operational efficiency. E-commerce and logistics demand continues to rise and companies like Amazon make use of telematics for tracking purposes in a large fleet of over 20,000 delivery vehicles.

Europe Commercial Telematics Market Analysis

In Europe, the commercial telematics market is booming due to the increasing adoption of connected vehicles and fleet management solutions. According to Telematics Wire, more than 6 million fleet vehicles in Europe were connected with a telematics system mainly for real-time tracking, route optimization and fuel management by 2023. Companies such as Deutsche Post DHL have applied telematics to more than 10,000 fleet vehicles in Germany thereby improving the efficiency of deliveries. France and the UK are major adopters too where more than 500,000 connected vehicles are on roads. Advancements in the European markets were also reported in fleet management of electric vehicles wherein several companies adopted telematics systems for monitoring their energy consumption and optimizing charge schedules. For example, a city in Amsterdam integrated a telematics system with 1,200 units of electric vehicles in 2023 for smart charging as well as operational monitoring.

Asia Pacific Commercial Telematics Market Analysis

Asia Pacific is witnessing fast adoption of telematics in both fleet management and connected vehicles. As per an industrial report, in 2023, more than 5 million fleet vehicles in China were using telematics systems which was fueled by increasing government incentives for connected vehicle technology. India has also witnessed a significant increase in the use of telematics with over 500,000 vehicles in the logistics sector adopting fleet management platforms for real-time tracking and driver behavior monitoring ACMA stated. An industry report revealed that major logistics companies in Japan such as Yamato Holdings implemented telematics in 10,000 vehicles to optimize delivery routes and minimize fuel consumption. Telematics is gaining popularity in South Korea where most of the country's 234,000 commercial fleet vehicles are now utilizing telematics solutions to enhance operational efficiency. More so, companies such as Socar offering ride-sharing services with fleets of over 20,000 vehicles are adopting telematics for real-time tracking, maintenance monitoring and fleet management, reports Seoulz. Electric vehicle fleets are also gaining momentum in this region where a number of companies are utilizing telematics systems to monitor energy consumption as well as optimize charging times.

Latin America Commercial Telematics Market Analysis

Telematics adoption for fleet management in Latin America is increasing particularly in Brazil and Mexico. A report by IFC stated that Brazil leads the region with over 350,000 fleet vehicles that have been using telematics systems in 2023 for performance tracking, fuel management and maintenance. The largest logistics provider in the country Correios has installed over 10,000 delivery vehicles with telematics to enhance operational efficiency. Mexico's demand is increasing, according to Global Fleet and exceeds 100,000 vehicles in its fleet. That uses telematics not only to track the way drivers operate their vehicle to reduce fuel consumption but also to optimize route planning in Argentina and Chile with a total of over 50,000 vehicles integrating tracking systems with the purpose of reduced downtimes. With the growth of e-commerce in the region more and more businesses are using telematics to ensure on-time delivery and enhance customer experience.

Middle East and Africa Commercial Telematics Market Analysis

The telematics market in the Middle East and Africa region is growing at a tremendous rate. Recent data by one of the leading consulting firms shows that the growth rate of the UAE's telematics market was 14.7% in 2020 mainly due to demands for better customer service, easier vehicle tracking and improved connectivity through 5G and 4G networks. Moreover, the uptake of telematics enhances fleet management which leads to advantages such as reduced cost faster routes, emergency alerts and monitoring of speed. The growth is not only seen in the UAE but also in other countries across the region, which with the growing demand for telematics are rapidly increasing the market.

Competitive Landscape:

Key players in the commercial telematics industry are actively pursuing various strategic efforts to strengthen and broaden their market presence. These efforts include ongoing innovation and product enhancement, forming strategic partnerships and collaborations, engaging in mergers and acquisitions, and expanding into new geographical areas. They aim to improve their telematics solutions by leveraging cutting edge technologies such as artificial intelligence and machine learning for predictive analytics enhancing cybersecurity to tackle data privacy issues and integrating with IoT ecosystems to provide comprehensive connectivity options. Furthermore, they are growing their customer base by establishing strategic alliances with leading commercial vehicle manufacturers and fleet operators to facilitate wider adoption of their telematics products.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AirIQ Inc.

- Bridgestone Corporation

- Continental AG

- Geotab Inc.

- GM Envolve

- MICHELIN Connected Fleet

- MiX Telematics (Powerfleet, Inc)

- Octo Telematics S.p.A.

- Platform Science, Inc.

- Solera Holdings, LLC

- Verizon Communications Inc.

Recent Developments:

- October 2024: Bridgestone announced collaboration with Geotab. Its partnership with Geotab integrates data from 4.5 million connected vehicles to optimize fleet operations. Bridgestone's Mobility Solutions business leverages fleet trends for efficiency, sustainability and decarbonization insights advancing telematics-driven innovations.

- October 2024: Geotab and EROAD have teamed up to launch EROAD Locate in Australia and New Zealand - an affordable telematics offering for light commercial vehicle customers. Focusing on currently underserved fleets the partnership will combine the inexpensive hardware from Geotab with the sophisticated fleet management platform offered by EROAD appealing to businesses that require complex fleets yet have opportunities to capitalize on substantial growth potential.

- September 2024: Platform Science acquired global transportation telematics units from Trimble, which it aims to use in order to optimize fleet efficiency and improve driver experience. The company will be a shareholder integrating its solutions with Platform Science's Virtual Vehicle Marketplace. It supports innovation and provides broad access to applications that enhance fleet performance.

- June 2024: Continental and telematics provider Samsara now offer data-driven fleet solutions based on a partnership. The in-tire sensor data provided by Continental will be linked with the trailer data by Samsara to make available comprehensive trailer status information and thus enable efficient and sustainable fleet management. The first joint appearance of the two companies was at the "Samsara Beyond" event in Chicago, USA, towards the end of June. Clarisa Doval, Head of Digital Solutions at Continental Tires stated that the partnership has the aim to deliver user-centric solutions to enrich the overall fleet customer experience.

- June 2024: AirIQ Inc. announced a strategic partnership with Teltonika to strengthen its IoT telematics solutions in North America. Together, leveraging Teltonika's devices and AirIQ's software, it will attempt to increase offerings and market share.

Commercial Telematics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| System Types Covered | Embedded, Tethered, Smartphone Integrated |

| Provider Types Covered | OEM, Aftermarket |

| End-use Industries Covered | Transportation and Logistics, Media and Entertainment, Government and Utilities, Travel and Tourism, Construction, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Turkey, Saudi Arabia, South Africa |

| Companies Covered | AirIQ Inc., Bridgestone Corporation, Continental AG, Geotab Inc., GM Envolve, MICHELIN Connected Fleet, MiX Telematics (Powerfleet, Inc), Octo Telematics S.p.A., Platform Science, Inc., Solera Holdings, LLC, Verizon Communications Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial telematics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global commercial telematics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the commercial telematics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Commercial telematics involves the use of technology to monitor and manage fleet vehicles, providing real-time data on location, driver behavior, vehicle performance, and maintenance needs. This technology enhances operational efficiency, safety, and decision-making in industries like transportation and logistics.

The commercial telematics market was valued at USD 88.6 Billion in 2025.

IMARC estimates the global commercial telematics market to exhibit a CAGR of 15.94% during 2026-2034.

The market is driven by the need for fleet optimization, regulatory mandates for safety, advancements in IoT, and demand for real-time data analytics to improve efficiency and reduce operational costs.

In 2025, the solution segment represented the largest segment by type, driven by the demand for GPS tracking and fleet management systems.

The embedded segment leads the market by system type, owing to its seamless connectivity and advanced telematics capabilities.

Aftermarket segment is the leading segment by provider type, driven by its flexibility and applicability to various commercial vehicles.

The transportation and logistics segment is the leading segment by end-use industry, driven by the need for route optimization and real-time tracking.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global commercial telematics market include AirIQ Inc., Bridgestone Corporation, Continental AG, Geotab Inc., GM Envolve, MICHELIN Connected Fleet, MiX Telematics (Powerfleet, Inc), Octo Telematics S.p.A., Platform Science, Inc., Solera Holdings, LLC, Verizon Communications Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)