Commercial Seeds Market Size, Share, Trends and Forecast by Conventional Seeds, Genetically Modified Seeds, and Region, 2025-2033

Commercial Seeds Market Size and Share:

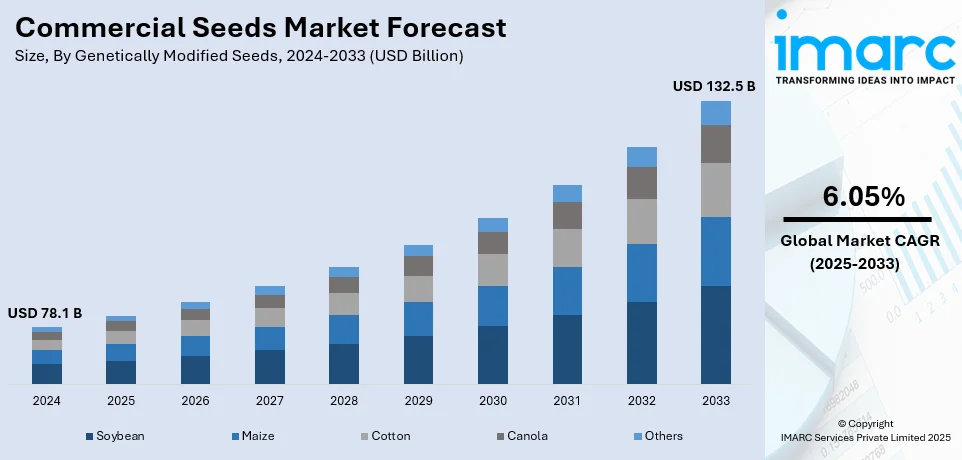

The global commercial seeds market size was valued at USD 78.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 132.5 Billion by 2033, exhibiting a CAGR of 6.05% from 2025-2033. North America currently dominates the market, holding a market share of over 33.6% in 2024. The growing food demand across the globe, rising demand for genetically modified (GM) feeds, increasing investment in hybrid seed development, and elevating demand for organic and non-GMO seeds, are some of the factors bolstering the commercial seeds market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 78.1 Billion |

|

Market Forecast in 2033

|

USD 132.5 Billion |

| Market Growth Rate (2025-2033) | 6.05% |

The world's population has continued to grow at a steady rate. It stood at about 8.2 billion in 2024, with projections estimating it to reach 9.7 billion by 2050. This trend is expected to continue but at a decelerating rate. In 2025, the annual increase is estimated to be at 0.85%. Such demographic expansion hugely affects food demand, hence a need for greater agricultural productivity in ensuring food security. In response to this increased demand, the use of commercial seeds has become a norm. Such seeds are genetically modified to be more productive, nutritious, and resistant to attacks from insects or diseases. For example, GM seeds have been developed to resist particular environmental stresses, stabilizing food supply chains. Such advanced seed technologies integrated into farming help farmers produce more food per unit area, effectively addressing the challenges posed by a growing global population.

The commercial seeds market demand in the United States is experiencing growth driven by several key factors. The market currently holds a total share of 82%. In 2025, seed expenses are projected to increase by $1.1 billion (4.2 percent) to $27.7 billion, largely due to projected changes in planted acreage. The U.S. Department of Agriculture (USDA) continues to support agricultural innovation through research and development initiatives. For example, in fiscal year 2024, the USDA's Agricultural Research Service (ARS) demonstrated the feasibility of growing peanuts with partial kernels, reducing seed input costs while maintaining crop yields. The USDA's Agricultural Projections for 2024 to 2033 forecast an average annual real GDP growth of 1.9 percent in the U.S. during this period. This economic growth is expected to drive increased demand for agricultural products, including seeds. Together, these factors support the U.S. commercial seeds market growth, establishing the country as a leader in agricultural innovation and sustainability.

Commercial Seeds Market Trends:

Growing Demand for Genetically Modified (GM) Seeds

The commercial seed market share is gaining more significance toward GM seeds because of their improved traits, such as increased yield potential, pest and disease resistance, and tolerance to herbicides. GM seeds save more for farmers through a reduction in the use of pesticides and time efficiency in weed control. Industry reports also indicate GM crop cultivation has reached above 206.3 million hectares as of 2023, with the biggest players accounting for the U.S., Brazil, and Argentina. As mentioned above, a rising global population with demanding food security requirements fuels more demand for these genetically modified seeds, especially in countries where land is scarce and arable areas become scarce. Moreover, improvements in biotechnology also help seed companies launch better varieties of GM seeds, such as climate resilience and nutritional value. However, regulatory challenges and consumer resistance in some regions, particularly in Europe, continue to be significant. Despite this, the increased use of precision farming techniques and government support for biotech crops are expected to support the continued growth of GM seed adoption.

Rising Investments in Hybrid Seed Development

Seeds and other seed production companies are investing heavily in developing hybrid seeds because these seeds tend to improve productivity, crop resilience, and the adaptation of the crop to change in climate. Hybrid seeds involve the selective breeding techniques that come along with higher yield, tolerance to droughts, and pest- and disease-resistant characteristics. According to industrial data, over 60% of commercial seed sales derive from hybrid seeds in the most significant agricultural areas, and with substantial adoption in crops such as maize, rice, and vegetables. An intensification of the demand for high-performance hybrid seeds has resulted from increasing global food demand and shrinking arable land, leading companies to invest in research and development. Major agribusinesses are also adopting more advanced breeding technologies, such as gene editing and molecular markers, to accelerate the innovation of hybrid seeds. Improvements in hybrid seed usage are particularly strong in developing economies as they look for higher profitability. However, the high price of hybrid seeds compared to traditional varieties continues to hinder its adoption among small-scale farmers.

Expansion of Organic and Non-GMO Seed Demand

Organic and non-GMO food consumption by consumers contributes to an increasingly rising demand in the market for certified organic and non-GMO seeds. Customers have become aware of the level of food safety, environmental stewardship, and potential health concerns with GMO. Such a concern has resulted in tightened regulations that now govern labeling and certification procedures regarding GMO; thus, these forces are pressurizing agriculture towards organic as well as non-GMO use. According to industry estimates, the market for organic seeds is expected to grow at over 10% CAGR over the next several years, owing to increasing organic food sales and government incentives in favor of sustainable farming. Firms are enlarging their portfolios of organic seed with improved resistance to diseases and stability in yield. Still, challenges such as lower yields than conventional seeds, higher production costs, and less availability of certified organic seeds exist. Consumer-driven demand is, however expected to continue driving long-term growth in the organic and non-GMO seed market.

Commercial Seeds Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global commercial seeds market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on conventional seeds and genetically modified seeds.

Analysis by Conventional Seeds:

- Maize

- Soybean

- Vegetable

- Cereals

- Cotton

- Rice

- Canola

- Others

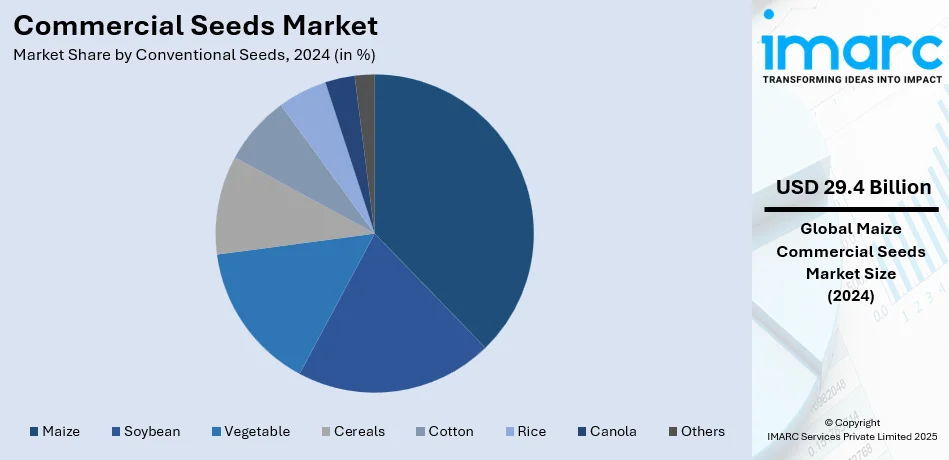

As per the latest commercial seeds market outlook, maize is the dominant crop in the conventional seed segment, accounting for 37.6% of the total market share. This is largely driven by its importance as a staple food crop, animal feed, and industrial product. Conventional maize varieties are particularly favored for their adaptability to a range of climates and soil types, making them a go-to choice for farmers across diverse regions. The versatility of maize in various industries, such as food, biofuels, and textiles, has cemented its importance in global agriculture. Furthermore, maize's high yield potential and its ability to grow in regions with less fertile soil contribute to its market dominance. With advancements in seed technology, the maize segment within the conventional seeds market continues to grow, meeting increasing demand for both food security and economic development in emerging markets.

Analysis by Genetically Modified Seeds:

- Soybean

- Maize

- Cotton

- Canola

- Others

In the genetically modified (GM) seeds segment, soybean is the leading crop, commanding the largest market share due to its widespread use and importance in food, feed, and industrial applications. These genetically modified soybeans are engineered for pest resistance, herbicide tolerance, and improved yield, making them highly attractive to farmers looking to optimize production while minimizing costs. The global demand for soybeans has surged, driven by the growing need for plant-based proteins, biodiesel production, and livestock feed. As global consumption of soy-based products continues to rise, especially in Asia and Europe, the demand for genetically modified seeds that offer higher resilience to environmental stress and pests is expected to grow.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Based on the recent commercial seeds market forecast, North America is the largest market, holding a 33.6% share due to its advanced agricultural infrastructure, high demand for both conventional and genetically modified seeds, and large-scale farming operations. The region's emphasis on research and development, coupled with strong regulatory frameworks that support biotech advancements, has led to North America’s dominance in the seed market. Moreover, the increasing trend toward sustainable farming practices, precision agriculture, and climate-resilient crops further boosts the demand for commercial seeds in the region. Additionally, North America's share is expected to remain robust, with continued investments in seed technology ensuring that the region remains a leader in both seed production and agricultural innovation globally.

Key Regional Takeaways:

United States Commercial Seeds Market Analysis

Advancements in biotechnology and increasing demand for high-yield crops are driving the U.S. commercial seeds market. According to the U.S. Department of Agriculture, in 2023, the total value of planted crop acreage was around 320 million acres, with a large portion using genetically modified (GM) seeds. Biotech seed adoption remains high, with more than 92% of corn and soybean crops grown from GM varieties. Domestic market leaders are companies such as Corteva, Bayer, and Syngenta that focus on traits for pest and drought resistance, among others. Precision farming and digital agriculture require improved seed varieties. The presence of domestic production ensures stable supply chains, but export opportunities into Latin America and Asia are likely to strengthen further market expansion. Government policies towards sustainable agriculture as well as funds for research towards seed innovation push the market upward.

Europe Commercial Seeds Market Analysis

Increasing demand for high-quality, sustainable crop varieties is growing the European commercial seeds market. Eurostat statistics indicate that in 2020, about 157 million hectares of farmland were cultivated in the EU, with significant adoption of hybrid seeds to enhance yield. Strict regulations by the EU, including banning certain genetically modified seeds, have been driving innovation in conventional and organic seed breeding. Seed production leaders include France, Germany, and the Netherlands, whose companies such as Limagrain and KWS concentrate on developing crop varieties resistant to climate changes. The implementation of policies related to sustainable agriculture, research funds on plant breeding, and subsidies also contribute to seeds being environmentally and yield efficiency compliant. Additionally, demand for vegetable and fruit seeds has also risen because of organic consumerism in this region. Such strong export growth, especially in hybrid and organic seeds, sets Europe as a business leader on the global commercial seeds scene.

Asia Pacific Commercial Seeds Market Analysis

With an increasing rate of food demand, coupled with agricultural reforms encouraged by the government, the commercial seeds market of the Asia Pacific region is thriving at a higher growth rate. China's National Bureau of Statistics shows that, as of 2023, grain output increased above 695.41 million metric tons due to hybrid rice and GM seed utilization for boosting output. According to IMARC group, India’s seed industry was valued at about USD 7 billion in 2023, driven by high adoption of hybrid seeds in maize, rice, and vegetables. The region is witnessing massive investment in seed technology, with China, India, and Australia making strides in biotech crop research. Domestic seed production is increasing under initiatives such as India's "Self-Reliant Agriculture" program, which promotes local seed innovation. Further market growth is supported by regional and multinational seed companies' collaborations. Asia Pacific dominates the global seed industry.

Latin America Commercial Seeds Market Analysis

The commercial seeds market in Latin America is growing with rising agricultural production and great demand for higher yield and genetically modified seeds. Brazil, the South American nation and the largest agricultural producer in that region of the world, sowed about 44 million hectares of soybeans in the 2022/23 crop season, more than 90% of which are genetically modified varieties, Conab, Brazil's National Supply Company reported. Already, Bayer's Intacta2 Xtend GM soybean variety alone accounts for about 10% of total soybean area in 2022/23, and projects to reach as high as 30% of the total by the 2024/25 season. GM seeds are used in Argentina and Paraguay mainly to boost production and export competitiveness. Government-aided research and collaboration with international seed firms are promoting genetics innovation in the seed. In addition, digital agriculture is increasingly being adopted, which improves seed use efficiency and crop yield. These trends make Latin America a key participant in the international commercial seeds market.

Middle East and Africa Commercial Seeds Market Analysis

The commercial seeds market in the Middle East and Africa is expanding with increased investments in food security and sustainable agriculture. As stated by the Food and Agriculture Organization, Africa's agricultural land area is around 874 million hectares, and improved seed varieties are increasingly adopted for increased productivity. The countries of Saudi Arabia, the UAE, have been investing in high-tech agriculture, and hydroponic farming entails requiring specialized vegetable seeds. South Africa is leading in hybrid seed adoption, especially maize seed, which takes over more than 50% of cultivated land in that country. Governments have also been involved in initiatives to promote improved seed distribution, such as Ethiopia's Agricultural Transformation Agency program. This growth in the region is driven by collaborations between local and international seed companies, coupled with increasing demand for drought-resistant and heat-tolerant crops.

Competitive Landscape:

Leading players in the global commercial seeds market are focusing on several strategies to maintain and expand their market share, responding to the increasing demand for sustainable and high-yielding agricultural solutions. These companies are heavily investing in research and development (R&D) to create innovative seed varieties that are resistant to pests, diseases, and climate extremes. Genetic modification, hybridization, and precision breeding are key technologies being leveraged to enhance crop resilience and productivity. Additionally, leading seed companies are expanding their portfolios through mergers and acquisitions, strengthening their presence in emerging markets where agricultural demand is increasing. Strategic partnerships with agricultural technology firms are also becoming more common, enabling these companies to integrate data-driven farming solutions with their seed offerings, providing farmers with tools to optimize crop yield.

The report provides a comprehensive analysis of the competitive landscape in the commercial seeds market with detailed profiles of all major companies, including:

- Bayer AG

- Corteva Inc.

- DLF Seeds A/S

- KWS SAAT SE & Co. KGaA

- Land O'Lakes Inc.

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- Sakata Seed South Africa

- Syngenta Group (ChemChina)

- Takii & Co. Ltd.

- Vilmorin & Cie (Groupe Limagrain).

Latest News and Developments:

- November 2024: Corteva announced a proprietary non-GMO hybrid wheat technology, enhancing yield potential by 10% and drought resistance by 20%. The breakthrough accelerates elite germplasm development and commercial scalability. Hybrid Hard Red Winter wheat is expected to launch in North America by 2027.

- September 2024: DLF Seeds A/S and Groupe Florimond Desprez formed United Beet Seeds (UBS), merging their fodder beet, sugar beet, and industrial chicory seed businesses. UBS will focus on research, sustainability, and innovation to address agro-ecological challenges.

- June 2024: Bayer and Solynta have partnered to commercialize true potato seeds in Kenya and India. This initiative enhances sustainability and food security by replacing bulky seed tubers with disease-free hybrid seeds, requiring only 25 grams per hectare. Bayer will leverage its distribution channels for market penetration.

- March 2024: Syngenta Vegetable Seeds inaugurated a state-of-the-art Seed Health Lab in Hyderabad, India, enhancing its global quality control network. The USD 2.4 million facility processes 12,000 virus/bacterial tests annually and aligns with international standards, supporting India's ambition to become a key global seed exporter.

- October 2023: Sakata Seed Corporation signed an agreement to acquire Brazilian seed company Isla Sementes and its holding company for 63.5 million Brazilian real (approx. USD 10.98 Million). The acquisition expands Sakata’s presence in Brazil’s home gardening and smallholder farmer market, estimated at 3 billion yen (USD 19.72 Million).

Commercial Seeds Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Conventional Seeds Covered | Maize, Soybean, Vegetable, Cereals, Cotton, Rice, Canola, Others |

| Genetically Modified Seeds Covered | Soybean, Maize, Cotton, Canola, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bayer AG, Corteva Inc., DLF Seeds A/S, KWS SAAT SE & Co. KGaA, Land O'Lakes Inc., Rijk Zwaan Zaadteelt en Zaadhandel B.V., Sakata Seed South Africa, Syngenta Group (ChemChina), Takii & Co. Ltd., Vilmorin & Cie (Groupe Limagrain), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial seeds market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global commercial seeds market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the commercial seeds industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial seeds market was valued at USD 78.1 Billion in 2024.

IMARC estimates the commercial seeds market to exhibit a CAGR of 6.05% during 2025-2033, reaching USD 132.5 Billion in 2033.

The growing food demand across the globe, rising demand for genetically modified (GM) feeds, increasing investment in hybrid seed development, and elevating demand for organic and non-GMO seeds, are some of the factors bolstering the commercial seeds market share.

North America currently dominates the market, driven by its advanced agricultural infrastructure, high demand for both conventional and genetically modified seeds, and large-scale farming operations.

Some of the major players in the commercial seeds market include Bayer AG, Corteva Inc., DLF Seeds A/S, KWS SAAT SE & Co. KGaA, Land O'Lakes Inc., Rijk Zwaan Zaadteelt en Zaadhandel B.V., Sakata Seed South Africa, Syngenta Group (ChemChina), Takii & Co. Ltd., Vilmorin & Cie (Groupe Limagrain), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)