Commercial Seaweeds Market Size, Share, Trends and Forecast by Product, Form, Application, and Region, 2025-2033

Commercial Seaweeds Market Size and Share:

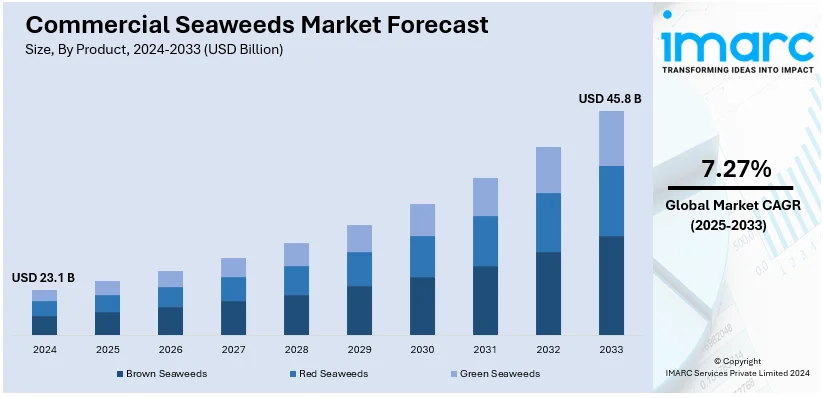

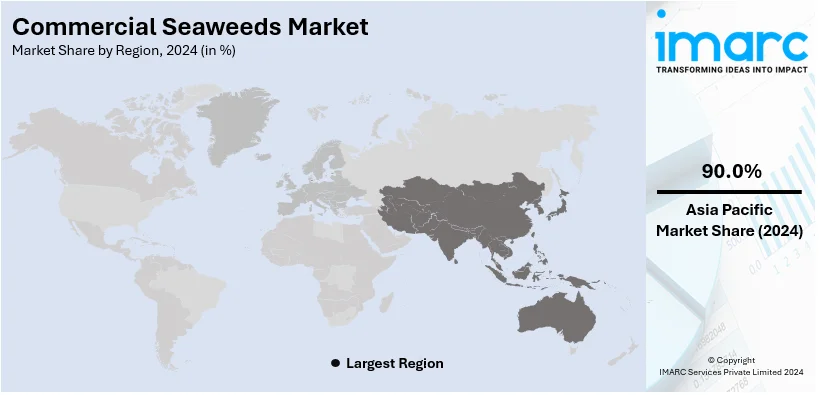

The global commercial seaweeds market size was valued at USD 23.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 45.8 Billion by 2033, exhibiting a CAGR of 7.27% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 90.0% in 2024. The market is driven by the long history of seaweed consumption in countries like China, Japan, and South Korea. Apart from this, the region’s favorable climate and marine conditions make it ideal for large-scale seaweed farming and production. The market is further propelled by the growing trend of vegan and plant-based diets, where seaweed serves as an essential and versatile ingredient. This shift is significantly contributing to the expansion of the commercial seaweeds market share, as seaweed offers a sustainable and nutrient-rich alternative to animal products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 23.1 Billion |

| Market Forecast in 2033 | USD 45.8 Billion |

| Market Growth Rate (2025-2033) | 7.27% |

The advanced methods of seaweed cultivation increase output and improve the effectiveness of the production procedure. Innovative farming techniques like vertical farming, allow for the growth of seaweed in more confined areas. This has minimized land utilization, rendering seaweed cultivation more sustainable and efficient in small spaces. Moreover, modern harvesting technologies enhance the extraction process, lowering expenses and improving efficiency. Innovative processing techniques for seaweed, such as drying and extraction methods, enhance the quality and longevity of the products. These enhancements render seaweed more adaptable and usable across various sectors including cosmetics and pharmaceuticals. Furthermore, the development of automated systems and intelligent technologies in seaweed cultivation has enhanced operational efficiency. Automation can better monitor and manage the growth conditions of seaweed, which can optimize production. Genetically improved strains of seaweed are also under research, which can give a better yield and growth rate. The application of bioactive compounds extracted from seaweed is increasing the usage of this crop in functional food and medicine, which is facilitated by advancements in biotechnology.

Innovation in eco-friendly food substitutes is greatly influencing the market in the United States. As people look for sustainable and healthy choices, seaweed is rising as an essential component. Its abundant nutritional composition featuring vitamins, minerals, fiber, and antioxidants, renders it an excellent substitute for conventional food items. Seaweed is becoming popular in plant-based diets, providing a sustainable protein source and being low in calories. With growing innovation in food products, seaweed is being integrated into an array of items. For example, in March 2024, Umaro Foods in Berkeley secured $3.8 million to expand its production of meatless bacon. The company seeks to develop sustainable substitutes for conventional bacon through seaweed, in harmony with environmentally conscious food trends. These consist of snacks, drinks, dietary supplements, and plant-derived meat substitutes, targeting health-minded consumers. Seaweed cultivation is viewed as eco-friendly because it demands fewer resources and offers advantages for carbon sequestration. This renders seaweed an appealing alternative in contrast to traditional agricultural products that frequently depend on fertilizers. Advancements in seaweed farming and processing methods are improving production efficiency, lowering expenses, and increasing accessibility.

Commercial Seaweeds Market Trends:

Rising health consciousness among the masses

The market is growing significantly due to the increasing health awareness among people across the globe. The health and wellness boom, in confluence with the popularity of natural and organic products, is fueling the demand for seaweeds. According to one study, certified organic products' sales in the U.S. reached USD 70 Billion in 2023. These sea vegetables contain high amounts of crucial nutrients, and thus they can be regarded as an integral constituent of today's balanced diet. Seaweeds are low-calorie food stuffs and contain minerals, vitamins, dietary fibers, proteins, and bioactive compounds in ample amounts and possess numerous health benefits. They facilitate maintaining cardiovascular health, maintaining blood sugar levels, enhancing digestion, boosting immunity, and promoting the general well-being of the body. It appeals to healthy-conscious individuals. Additionally, large-scale R&D along with constant innovations in F&B industries pave the way for the incorporation of seaweed into various health products.

Increasing demand for effective skincare products with natural ingredients

Currently, the need for efficient skincare products that are made using natural ingredients is stimulating the market growth. According to the report of the IMARC Group, the global skin care products market reached USD 166.35 Billion in 2024. Seaweeds, or marine macroalgae, are well-recognized for their rich nutrient profile, consisting of essential vitamins, minerals, amino acids, antioxidants, and fatty acids. Their bioactive compounds are rich in antioxidants, anti-inflammatory, and anti-aging properties, all of which are essential for maintaining healthy skin. The global skincare industry is also responding to this growing preference by infusing a variety of seaweed species into a range of skincare products. From facial cleansers, toners, masks, and serums to moisturizers and body lotions, seaweed is emerging as a favored ingredient. Besides, extracts from seaweeds can shield the skin from stressors in the environment, such as pollutants and UV radiation, major contributors to early aging of the skin. Increasing awareness of the benefits is likely to drive more demand for products based on seaweed in the skincare market and thus propel further growth in this market.

Growing utilization in biofuels

Currently, the increasing use of biofuel as a renewable energy source is what fuels the need for seaweeds. Biofuels are bio-based, coming from living organisms or metabolic by-products, making them a great answer to increasing energy needs. The quest for alternative green energies is driven by two main goals: reducing the release of greenhouse gases and reducing dependence on fossil fuels. As per the International Energy Agency, global energy-related carbon dioxide (CO2) emissions increased by 1.1% in 2023, adding 410 Million tonnes (Mt) to the record high of 37.4 Billion tonnes (Gt). In this regard, seaweed-derived biofuels, also referred to as seaweed bioenergy, is becoming an option. Extensive R&D is going into the process of optimization for biofuel production from seaweed, and it affects the dynamics of the market. Improvements in biotechnology and genetic engineering increase the yield from seaweed, thereby enhancing its commercial viability. Consequently, the cultivation methods, harvesting techniques, and the process of bioconversion have been optimized to increase efficiency and reduce the cost of seaweed biofuel production.

Commercial Seaweeds Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global commercial seaweeds market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, form, and application.

Analysis by Product:

- Brown Seaweeds

- Red Seaweeds

- Green Seaweeds

In 2024, red seaweeds represent the biggest share of the market, accounting for approximately 47.8%. They are utilized in a variety of products, including food, cosmetics and pharmaceuticals. The increasing need for functional foods and natural components is fueling the market growth for red seaweeds. They serve as an important source of carrageenan, which is commonly utilized as a thickening agent. This multifunctional compound is commonly used in food processing, particularly in dairy items. The need for carrageenan has greatly enhanced the expansion of the red seaweed sector. They are also employed in conventional medicine because of their health advantages. Their capability to thrive in different marine settings allows for easy commercial harvesting. With a growing awareness about sustainable living, products made from red seaweed are gaining momentum as an environmentally friendly option. The growing utilization of red seaweeds in the pharmaceutical industry for their antioxidant and anti-inflammatory benefits reinforces their market leadership.

Analysis by Form:

- Liquid

- Powdered

- Flakes

The liquid form of seaweeds is greatly favored because of their adaptability and convenience. Liquid extracts are absorbed by the body more readily, making them suitable for multiple uses. These extracts are widely utilized in the food and beverage (F&B) sector for enhancing flavor and providing functional benefits. Liquid seaweeds are frequently incorporated in cosmetic products, providing moisture and nourishment to the skin. Their capacity to be integrated into liquid formulations is broadening their market reach. Liquid seaweeds are also employed in agricultural products, such as fertilizers and soil amendments, because of their nutrient-dense composition. The growing tendency for sustainable and environmentally friendly farming methods is impacting the demand for liquid form of seaweeds. In addition, liquid seaweeds are easier to store and transport that assists in lowering logistics expenses. Their use in biofuels also adds to the rising demand for liquid seaweed products. Liquid seaweeds are extensively utilized in biotechnology for research objectives, increasing their significance across multiple industries.

Analysis by Application:

- Agriculture

- Animal Feed

- Human Consumption

- Others

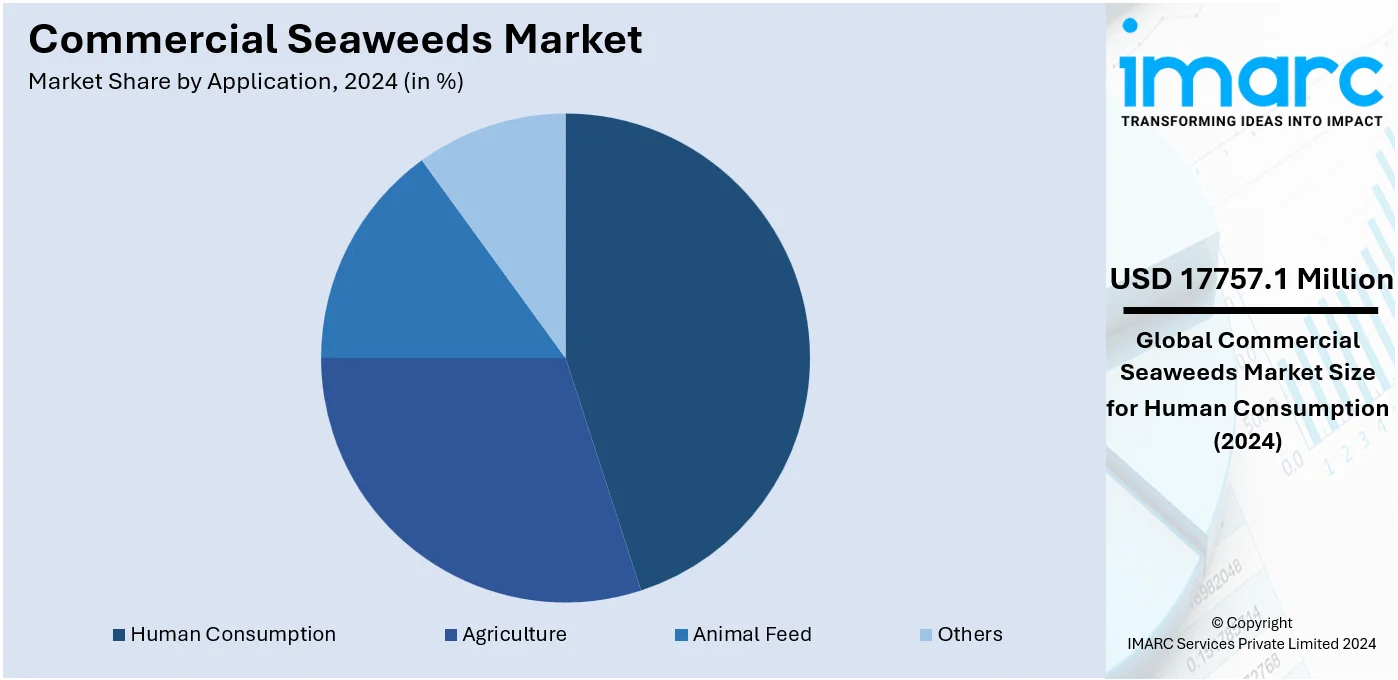

In 2024, human consumption leads the market, accounting for approximately 76.8% of its share. More individuals are shifting to seaweed-based products due to their high content of vital nutrients and minerals. Seaweed is recognized for its rich levels of vitamins, antioxidants, and omega-3 fatty acids, all of which are advantageous for health. The rising interest in plant-based and vegan diets is influencing the commercial seaweeds market demand as an essential ingredient. In addition, seaweed offers low-calorie and high-fiber alternatives to traditional food components, making it ideal for health-focused people. Consequently, seaweed is included in numerous food items, ranging from snacks to health-oriented drinks. The increasing fascination with Asian cuisines, which feature seaweed as a fundamental ingredient, is supporting the market growth for seaweed-based products across the globe. Moreover, seaweed is recognized for its potential to strengthen sustainable food systems, making it a favorable choice for environmentally aware individuals.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 90.0%. Countries like China, Japan, and South Korea have historically relied on seaweed as a key ingredient in their cuisine. As a result, these countries have established strong domestic markets for seaweed-based products. The region's vast coastline and favorable environmental conditions also support large-scale seaweed farming. Asia Pacific is home to a large number of seaweeds processing industries, facilitating market growth. The increasing export of seaweed products from this region to international markets is further driving its dominance in the international markets. With rising global interest in Asian cuisine, especially seaweed-rich dishes, demand is expanding beyond traditional markets. The growing trend toward plant-based diets and natural products is also contributing to Asia Pacific’s leadership in the seaweed industry. Additionally, governments in the region are supporting the development of seaweed farming due to its economic and environmental benefits. In May 2024, The UN Global Compact Network Indonesia (UNGCN) and the Coordinating Ministry for Maritime Affairs signed an MoU. This agreement focuses on establishing the International Tropical Seaweed Research Center (ITSRC) in Indonesia. The center aims to advance tropical seaweed research, sustainability, and innovation for sector growth and global collaboration. This initiative is expected to enhance the commercial seaweed market in Asia-Pacific, particularly in seaweed exports and job creation.

Key Regional Takeaways:

United States Commercial Seaweeds Market Analysis

Seaweed, an environment-friendly resource, is highly required in increasing markets. Low environmental footprint and very less consumption of water in using seaweed makes it highly eye-catching in times when individuals have become conscious towards the environment. Due to high adoption towards the consumption of plant-based diets, there is high application of seaweed in the F&B industry. Packed with vitamins, minerals, and antioxidants, seaweed is used in items like snacks, drinks, and dietary supplements. Another vital fact is the rising awareness of the usage of seaweed in various industries. It is used in cosmetics and personal care products because of its moisturizing and anti-aging properties. Further, seaweed is researched as an environmentally friendly material in textiles and biodegradable packaging. As per the National Council of Textile Organizations (NCTO), US textile shipments were at USD 64.8 billion in 2023. Improvements in technology for seaweed farming, such as better cultivation and processing methods, are propelling the commercial seaweeds market growth. As the efficiency of harvesting and processing improves, the cost of producing seaweed is significantly decreasing. This makes seaweed a more viable competitor against traditional agricultural products.

Europe Commercial Seaweeds Market Analysis

Europe is experiencing remarkable growth in its demand for sustainable, health-oriented, and functional food ingredients. As a result, the demand for seaweed has witnessed an immense expansion in the global market due to its nutritional profile, including being rich in vitamins, minerals, fiber, and antioxidants, which are gradually being incorporated in products like snacks, soups, salads, and supplements all over Europe. This region's keen focus on sustainability complements well with the green factors associated with the culture of seaweed farming since they do not need water and utilize neither fertilizers nor pesticides. In the world outside of food and beverages (F&B), interest in this ingredient is being found within the cosmetic and pharmaceuticals realms and in biodegradable packaging. European Cosmetics Market from IMARC Group valued USD 108.5 Billion by 2024.

Latin America Commercial Seaweeds Market Analysis

Among the major growth-enabling factors in the market, increasing demand from the food and beverage sector for seaweed can be stated as one. Rich in vitamins, minerals, and antioxidants, seaweed finds high application in functional foods, snacks, and dietary supplements. Seaweed farming can easily take place on vast coastal land, especially within marine conditions such as in countries like Chile and Brazil. Latin America is increasingly adopting seaweed farming as a sustainable and eco-friendly agricultural practice. Increased plant-based diets and veganism constitute yet another driver for the use of seaweed-based products in the region. Secondly, the current interest shown in non-food applications of seaweed in cosmetics, pharmaceuticals, and bio-packaging opens broader market opportunities for it. According to a research report, the Brazilian Drug Market Regulation System (CMED) published a report in which the country's pharmaceutical market peaked at a turnover of around USD 28.49 Billion in 2023.

Middle East and Africa Commercial Seaweeds Market Analysis

The escalating demand for eco-friendly and sustainable products in Middle East and Africa is offering a favorable commercial seaweeds market outlook. The increasing awareness of natural, plant-based ingredients in food and cosmetics is fueling market expansion. The region's coastal areas, particularly in countries like Morocco and South Africa, offer potential for seaweed cultivation. Seaweed farming in the region is being explored as a sustainable agricultural practice, helping to address food security concerns. The expanding aquaculture industry in the region drives demand for seaweed-based feed additives, which enhance the growth and health of marine species. Seaweed's potential as a biofuel and its use in bioremediation technologies offer opportunities in renewable energy and environmental sustainability. Saudi Arabia biodiesel market size is projected to exhibit a CAGR of 1.40% during 2024-2032, as per a report published by the IMARC Group. Governments in the region are beginning to recognize seaweed's potential as a sustainable resource, further supporting its commercial use.

Competitive Landscape:

Key contributors play a crucial role in driving the global market through various methods. They make significant investments in research and development (R&D) to create innovative seaweed-based products for different industries. This includes food, cosmetics, pharmaceuticals, and agriculture, responding to the increasing customer demand for sustainable choices. Companies focus on improving seaweed cultivation techniques, such as vertical farming and automated harvesting systems, to increase production. These advancements help improve the overall production efficiency, ensure a consistent supply of premium seaweed and reduce costs. Key contributors also forge strategic partnerships with local farmers and cooperatives to improve their sourcing capabilities. This approach improves their supply chain and supports the earnings of seaweed farmers. They emphasize sustainability through the use of eco-friendly practices and promoting seaweed as a renewable resource. Several companies are employing biotechnology to extract valuable compounds from seaweed, increasing its application in functional foods and pharmaceuticals.

The report provides a comprehensive analysis of the competitive landscape in the commercial seaweeds market with detailed profiles of all major companies, including:

- Acadian Seaplants Limited

- Algaia SA (Maabarot Products Ltd.)

- Biostadt India Limited

- BrandT Consolidated Inc.

- Cargill Incorporated

- COMPO Expert GmbH

- CP Kelco U.S. Inc (J.M. Huber Corporation)

- DuPont de Nemours Inc.

- Gelymar S.A.

- Indigrow Ltd.

- Lonza Group AG

- Seasol International Pty. Ltd.

- TBK Manufacturing Corporation

Latest News and Developments:

- October 2024: The Seaweed Cultivation Demonstration Project was launched at Chidiyatapu, Andaman and Nicobar Islands. Under this project, the collaboration of A&N Administration with National Institute of Ocean Technology, the seaweed farming is proposed to be spread out across various sites so that local economic activities and the sustainable development goals are strengthened.

- August 2024: North Sea Farm 1, the world's first commercial seaweed farm functioning within a wind farm, was officially launched in the Hollandse Kust Zuid wind farm close to the Dutch coast. Supported by Amazon's €1.5 million funding, the initiative seeks to investigate seaweed's capacity for carbon capture, eco-friendly products, and expanding worldwide offshore farming. The farm integrates unused wind farm spaces to advance environmental and scientific innovation.

- August 2024: The Niti Aayog had recommended increasing PM-Kisan and PM Fasal Bima Yojana (PMFBY) to cover seaweed farming as well. Insurance schemes to be created for the sector too. The project will increase economic and ecological advantages of seaweed farming in India.

- March 2024: Sea6 Energy has opened a 1-square-kilometer mechanized seaweed farm in Lombok, Indonesia. The aim is to produce biofertilizers and bioplastics to promote sustainability and provide jobs locally. Additionally, Simply Blue Group joined the North Sea Farm 1 Project, integrating seaweed cultivation with offshore wind farms, set to begin operations in fall 2024. These initiatives highlight advancements in sustainable marine resource utilization.

Commercial Seaweeds Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Brown Seaweeds, Red Seaweeds, Green Seaweeds |

| Forms Covered | Liquid, Powdered, Flakes |

| Applications Covered | Agriculture, Animal Feed, Human Consumption, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acadian Seaplants Limited, Algaia SA (Maabarot Products Ltd.), Biostadt India Limited, BrandT Consolidated Inc., Cargill Incorporated, COMPO Expert GmbH, CP Kelco U.S. Inc (J.M. Huber Corporation), DuPont de Nemours Inc., Gelymar S.A., Indigrow Ltd., Lonza Group AG, Seasol International Pty. Ltd., TBK Manufacturing Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial seaweeds market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global commercial seaweeds market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the commercial seaweeds industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Commercial seaweeds are cultivated and harvested for various industrial applications. Their applications include food and pharmaceuticals, alongside cosmetics, biofuels and agriculture. Seaweeds are rich in nutrients, antioxidants and bioactive compounds, making them highly valuable in various industries. They are harvested from marine environments and processed into various forms like powders, extracts and liquids. The growing demand for sustainable, plant-based products is driven the commercial seaweed market across the globe.

The commercial seaweeds market was valued at USD 23.1 Billion in 2024.

IMARC estimates the global commercial seaweeds market to exhibit a CAGR of 7.27% during 2025-2033.

The market is driven by increasing demand for plant-based and sustainable products. Growing awareness among masses about the nutritional and health benefits of seaweeds like high vitamins and antioxidants, is fueling market growth. The demand for natural, eco-friendly ingredients in food, cosmetics and pharmaceuticals is expanding the sales. Technological enhancements in the seaweed farming as well as processing are improving production efficiency. The rising focus on biofuels and biodegradable packaging solutions also supports market growth.

In 2024, red seaweeds represented the largest product segment owing to their substantial levels of bioactive compounds. They include carrageenan, an essential component in the food, cosmetics and pharmaceutical sectors. Red seaweeds provide a variety of health advantages, including essential vitamins and antioxidants. The various uses and nutritional benefits of these products aid their market expansion.

Liquid leads the market by form owing to their easy incorporation into various products. They are highly versatile, making them suitable for various applications in industries like food, cosmetics, agriculture and biofuels. They offer improved absorption of nutrients, which expands their appeal. The growing demand for sustainable, plant-based ingredients further drives the dominance of liquid seaweed products.

Human consumption leads the global commercial seaweeds market due to its nutritional and functional benefits. Seaweeds are rich in minerals, fiber, essential vitamins, and antioxidants, making them ideal for health-focused diets. They are widely used in traditional dishes, snacks, soups, and beverages, especially in Asian cuisines. The rising popularity of plant-based diets further boosts demand for seaweed as a sustainable protein source.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global commercial seaweeds market include Acadian Seaplants Limited, Algaia SA (Maabarot Products Ltd.), Biostadt India Limited, BrandT Consolidated Inc., Cargill Incorporated, COMPO Expert GmbH, CP Kelco U.S. Inc (J.M. Huber Corporation), DuPont de Nemours Inc., Gelymar S.A., Indigrow Ltd., Lonza Group AG, Seasol International Pty. Ltd., TBK Manufacturing Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)