Commercial Real Estate Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Commercial Real Estate Market Size and Outlook:

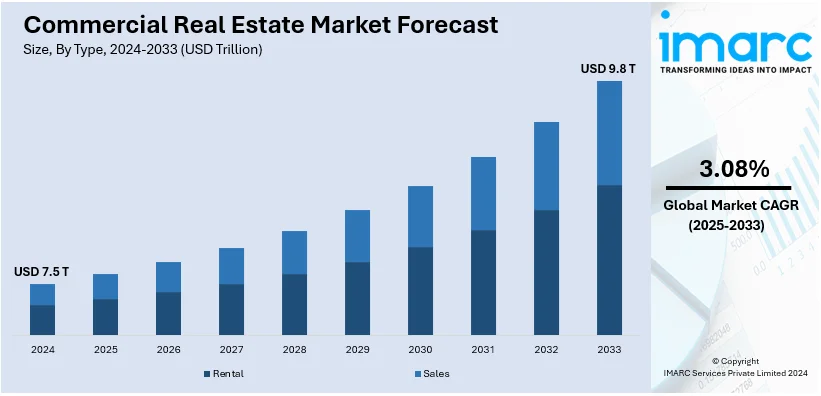

The global commercial real estate market size was valued at USD 7.5 Trillion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.8 Trillion by 2033, exhibiting a CAGR of 3.08% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 36.7% in 2024. The commercial real estate market share is primarily driven by the favorable economic conditions, the emerging trend of urbanization, the rising middle class, the ongoing technological advancements, and the expanding tourism and hospitality sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.5 Trillion |

|

Market Forecast in 2033

|

USD 9.8 Trillion |

| Market Growth Rate 2025-2033 | 3.08% |

The commercial real estate market demand is propelled by a strong economy leading to increased business activity, higher employment rates, and more consumer spending. These factors contribute to higher demand for commercial spaces like offices, retail stores, and industrial facilities. Economic expansion also attracts both domestic and international investors looking for profitable opportunities in real estate. For instance, in March 2024, private equity firm PAG lead a group of investors to announce an investment of $8.3 billion for a 60% stake in Dalian Wanda's mall unit, which will retain 40% of Newland Commercial Management. CITIC Capital, the Abu Dhabi Investment Authority, Mubadala Investment Company, and Ares Management Corporation were also joint investors in the deal. Interest rates play a critical role in shaping commercial real estate demand. Lower interest rates reduce the cost of financing, making it more attractive for investors to purchase properties. Higher rates, conversely, can reduce the demand as borrowing becomes more expensive. Interest rate fluctuations also impact the profitability of existing investments.

The commercial real estate market growth in the United States is driven by several factors. Economic expansion stimulates economic activity, which raises the demand for shops, office buildings, and industrial real estate. Interest rates significantly affect financing costs; lower rates encourage investments, while higher rates may reduce demand. For instance, in March 2024, Goldman Sachs Asset Management announced that it will resume "actively investing" in the United States commercial real estate as the prices of US offices and other commercial properties, such as multi-family apartment blocks, have fallen sharply in the face of higher interest rates and vacancy rates for offices that have increased far more than elsewhere since the pandemic. The demand for commercial real estate in metropolitan areas is rising due to urbanization and population expansion. Industrial real estate is affected by the growing demand for warehouses and distribution facilities brought on by e-commerce. Property values and tenant preferences are impacted by technological developments, such as smart building systems and environmental initiatives. Government initiatives like infrastructure projects, zoning laws, and tax breaks also influence market trends by encouraging investment and growth in important industries.

Commercial Real Estate Market Trends:

The Expanding Economic Growth

The strong economic growth across various countries is propelling the need for industrial, residential, office, and public spaces, which are among the major trends boosting the commercial real estate share. Besides this, numerous factors, such as GDP growth, employment rates, and consumer spending are also positively influencing the market growth. For instance, in 2021, foreign investments in the European commercial real estate market accounted for half of the capital investments in that region, which is almost EUR 130 Million (USD 137 Million). Furthermore, the development of new business hubs, office spaces, retail outlets, industrial facilities, etc., is also catalyzing the market growth.

Increasing Urbanization

The emerging urbanization trends, such as the preference for living and working in urban areas are acting as significant growth-inducing factors. Moreover, the growing popularity of mixed-use developments, including residential, commercial, and recreational spaces are also positively influencing the commercial real estate market share. In addition to this, according to the National Association of Realtors report in April 2023, multifamily commercial real estate witnessed a rise in rent by 2.5% YOY during the first quarter of 2023.

Significant Technological Advancements

As per the commercial real estate market outlook, the continuous advancements in technology, such as the integration of AI and VR techniques are propelling the market growth. Moreover, big data and analytics are the other emerging technologies that use historical and real-time information to provide information on trends, patterns, associations, pricing, and demographic data, which is also catalyzing the global market. For instance, according to Alibaba, more than 5,000 real estate agents from almost 100 locations in China have adopted the live-streaming rooms method, allowing homebuyers to explore homes, and make deals all at home.

Commercial Real Estate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global commercial real estate market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, end use.

Analysis by Type:

- Rental

- Sales

Based on the recent commercial real estate market forecast, rental stand as the largest component in 2024, holding around 49.8% of the market. The changing business landscape and the expanding number of industries are propelling the market growth. The leading companies require office spaces, retail outlets, and industrial facilities to carry out their work and operations effectively. Moreover, the rising entrepreneurship and the growing popularity of startups globally are also positively influencing the commercial real estate industry. Additionally, in 2021, office occupancy experienced robust growth of more than 80% in almost 390 metro cities worldwide. Moreover, 30 Million sq ft (MSF) of office space was absorbed since the third quarter of 2021.

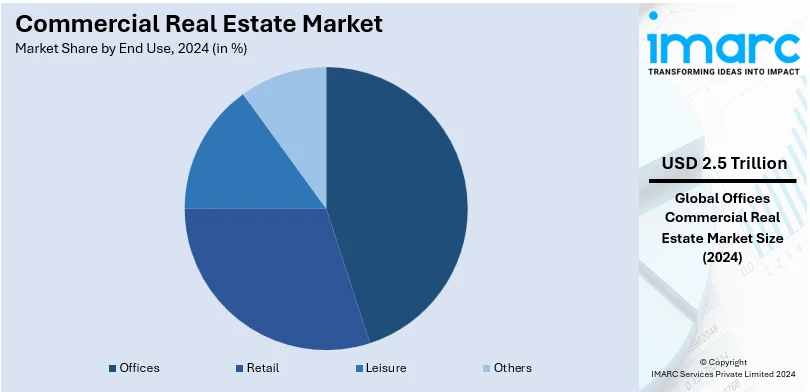

Analysis by End Use:

- Offices

- Retail

- Leisure

- Others

Offices leads the market with around 33.6% of market share in 2024. Office buildings are leased to businesses for conducting operations, administrative work, and professional services. Rental rates for office space are typically based on factors such as location, building quality, amenities, and market demand. Moreover, the shifting preferences of consumers and businesses and the escalating demand for well-designed, aesthetic, and functional offices to accommodate the workforce, foster collaborations, and facilitate business operations are also bolstering the commercial real estate market share. For example, the Asia-Pacific (APAC) region is leading in the office market due to population growth, GDP growth, middle-class consumers, and the working-age population leveraging office demand. Also, the APAC region contributes more than 50% of office construction in the global market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 36.7%. Asia Pacific increasing infrastructure development activities drive its growth. Apart from this, the inflating consumer spending capacities and the rising infrastructure development are propelling the market growth. For instance, according to JLL’s May 2023 report, the Asia Pacific region witnessed a decline in commercial real estate investment by 30% YOY in the first quarter of 2023 reaching the total investment of USD 27 Billion in the region. Asia-Pacific's commercial property market is gaining from swift industrialization and urban growth, bolstered by governmental efforts to enhance infrastructure and smart cities. For instance, over 90% of projects under India’s Smart Cities Mission, launched in 2015 to transform 100 cities with robust infrastructure and efficient services, are complete, enhancing urban living standards and driving growth in commercial real estate by boosting demand for modern office spaces, retail hubs, and mixed-use developments. Emerging economies within this area are experiencing a rise in foreign direct investments, especially in the retail and logistics industries. The demand for high-quality office spaces in financial centers is increasing due to the expansion of multinational corporations setting up regional headquarters. The expanding middle class is fueling growth in the retail sector, while advancements in technology are heightening the requirement for data centers. Furthermore, free trade agreements and special economic zones are luring businesses to invest in commercial real estate. The post-pandemic recovery is additionally speeding up the market as companies restart expansion strategies across various sectors.

Key Regional Takeaways:

North America Commercial Real Estate Market Analysis

The commercial real estate market in North America is influenced by several factors. Business expansion is fueled by economic growth, which raises demand for retail establishments, office space, and industrial facilities. The demand for mixed-use projects and multifamily housing is increased by urbanization and population growth. Warehouses and distribution facilities are in high demand due to the growth of e-commerce. The adoption of smart buildings is encouraged by technological developments, which improve tenant experiences and efficiency. Government incentives encourage energy-efficient and environmental developments, and low interest rates encourage investment. The industry is further shaped by changes in workplace patterns, such as flexible and hybrid office formats. Foreign investments and regional infrastructure initiatives also support growth.

United States Commercial Real Estate Market Analysis

In 2024, the United States accounted for the market share of over 88.90%. The commercial real estate market in the United States is witnessing strong growth owing to urbanization trends and a rising need for mixed-use developments that combine residential, retail, and office areas. The growth of technology centers throughout cities is additionally driving the requirement for commercial spaces designed for innovation-driven companies. The surge in e-commerce has heightened the demand for warehouses and distribution centers, especially in areas with established logistics systems. For instance, U.S. e-commerce sales reached USD 1.119 Trillion in 2023, accounting for 22% of total retail sales, marking a 7.6% growth from 2022. This surge is driving demand for commercial real estate, particularly in warehousing and logistics, to support the expanding online retail ecosystem. The focus on sustainability and green building certifications is motivating developers to implement energy-efficient designs, which are appealing to environmentally aware tenants. Institutional investments and real estate investment trusts are further promoting market activity by providing substantial capital flow. The increase in coworking and flexible office spaces mirrors the evolving workplace landscape, influenced by startups and businesses seeking versatile solutions.

Europe Commercial Real Estate Market Analysis

Europe’s commercial real estate market is flourishing because of the growth of urban regeneration initiatives and a heightened emphasis on sustainable practices. A strong need for logistics and industrial properties has arisen from the expansion of online shopping, with prime locations near urban areas being especially desired. For instance, Germany, a leading logistics hub in Europe, absorbed 2.05 Million square meters of warehousing space in H1 2023, despite a 58% year-on-year decline due to limited supply and speculative properties. High logistics demand underscores commercial real estate's potential, supported by Germany's strategic location, advanced infrastructure, and increasing lease extensions driven by supply constraints. Financial services continue to be a significant force in major cities such as London, Frankfurt, and Paris, driving the need for high-quality office spaces. Cross-border investments are thriving owing to stable regulatory conditions and appealing returns relative to other regions. Business parks and innovation districts are becoming more popular as centers for technology and research-focused companies. Additionally, the revival of tourism is boosting the need for hotel developments in leading cities and popular tourist destinations.

Latin America Commercial Real Estate Market Analysis

In Latin America, the commercial real estate market is being driven by growing investments in retail properties to accommodate an expanding consumer market. For instance, Brazil's consumer spending reached approximately USD 347.84 Billion in Q4 2023, up from USD 336.32 Billion in Q3 2023, with an average of USD 133.01 Billion from 1996 to 2024. This sustained growth, driven by a robust labor market and increased government social programs, Brazilian reports bolstered demand for retail and commercial spaces, thereby enhancing the commercial real estate sector's performance. Economic recovery in several countries is creating a demand for industrial spaces to support manufacturing and export-oriented activities. Increasing urbanization is prompting developers to focus on office and mixed-use developments, particularly in cities with rising middle-class populations. Infrastructure modernization projects are also opening opportunities for logistics and distribution centers to support regional trade.

Middle East and Africa Commercial Real Estate Market Analysis

The Middle East and Africa are experiencing growth in commercial real estate fuelled by urban development and government-led diversification initiatives. The hospitality industry is flourishing, with funding in hotels and resorts to support tourism growth. Retail spaces are growing in response to an influx of international brands entering the market. For instance, the UAE's retail sector, increasing at 5% each year, is stimulating demand for commercial real estate and facility management services, with the industry assessed at around USD 2.08 Billion in 2024 and expected to climb to USD 2.87 Billion by 2029, growing at a CAGR of 6.68%. Sustainable practices and smart city projects further enhance this market. Infrastructure improvements, such as new transport hubs, are driving demand for commercial developments. The focus on innovation and technology is encouraging the emergence of business parks and tech hubs in key urban areas.

Competitive Landscape:

As per the emerging commercial real estate market trends, competitive landscape is driven by diverse players including property developers, real estate investment trusts (REITs), brokers, and institutional investors. Key competitors focus on strategic property acquisitions, sustainable developments, and advanced technologies like AI and IoT for efficient property management. Global firms compete by leveraging strong financial portfolios, expansive property networks, and tailored services. Local and regional players capitalize on niche markets and area expertise. Rising demand for flexible workspaces and mixed-use developments intensifies competition. Additionally, economic trends, evolving tenant preferences, and regulatory changes continuously reshape the competitive landscape, requiring agility and innovation to maintain market relevance. For instance, in July 2024, Realty major DLF announced to focus on expanding its business to develop residential and commercial projects and enter new markets in Mumbai and Goa to tap into growth opportunities. With the goal to expand businesses in both residential and commercial sectors. The residential business continued its growth momentum, they witnessed an uptick in new sales bookings, coupled with record sales collections.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Boston Commercial Properties Inc.

- Brookfield Asset Management

- Dalian Wanda Group

- DLF Ltd.

- Link Asset Management Limited

- MaxWell Realty Canada

- Prologis Inc.

- RAK Properties PJSC

- Shannon Waltchack LLC

Latest News and Developments:

- December 2024, Partners Group, to acquire Empira Group, a premier real estate platform with a portfolio valued at approximately USD 15.2 Billion in Gross Development Value. This acquisition aligns with Partners Group's strategy to deepen expertise in key real estate sectors, strengthening its global presence during a critical phase for the industry. The deal, set to close in H1 2025, underscores a shift toward operational excellence in real estate investing.

- October 2024, Private equity investments in India's residential real estate surpassed USD 1 Billion in the first nine months of 2024, indicating robust demand for urban housing projects. The inflows are driven by increasing institutional interest in high-quality developments across major cities. The trend underscores growing confidence in the sector, as developers focus on timely project deliveries and consumer-centric strategies.

- June 2023, Prologis, Inc. finalized the acquisition of approximately 14 Million square feet of industrial properties from Blackstone-affiliated opportunistic real estate funds for USD 3.1 Billion. This strategic move strengthens Prologis’ portfolio in high-demand logistics and industrial markets. The transaction highlights continued investor confidence in the industrial real estate sector's growth potential.

- September 2022: Aden Group finalized a plan to launch a smart, low-carbon industrial park project for Li Auto paired with an operations plant to maximize efficiency. The industrial park will develop and manufacture the new generation of Li Auto's range extenders; it will also drive a group of related enterprises to settle in the park and promote the integrated and coordinated development of the local automobile industry, further improving the industry chain and accelerating the high-quality development of Mianyang High-Tech Industry Development Zone.

- November 2022: Colliers CAAC, a regional entity with exclusive sublicenses from Colliers International for Central America, the Caribbean, and select Andean regions, expanded its operations. The company announced the acquisition of a Costa Rican real estate consultancy to strengthen its presence in the region. This move aligns with Colliers CAAC's strategic growth and regional market penetration goals.

Commercial Real Estate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Trillion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rental, Sales |

| End Uses Covered | Offices, Retail, Leisure, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Boston Commercial Properties Inc., Brookfield Asset Management, Dalian Wanda Group, DLF Ltd., Link Asset Management Limited, MaxWell Realty Canada, Prologis Inc., RAK Properties PJSC, Shannon Waltchack LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global commercial real estate market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the commercial real estate industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial real estate market was valued at USD 7.5 Trillion in 2024.

IMARC estimates the commercial real estate market to exhibit a CAGR of 3.08% during 2025-2033.

The key trends driving the commercial real estate market include economic growth, interest rates, population trends, urbanization, and business expansion. Technological advancements, government policies, and demand for sustainable spaces also influence the market. Investor confidence, infrastructure development, and changes in consumer behavior further shape supply, demand, and property valuations.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the commercial real estate market include Boston Commercial Properties Inc., Brookfield Asset Management, Dalian Wanda Group, DLF Ltd., Link Asset Management Limited, MaxWell Realty Canada, Prologis Inc., RAK Properties PJSC, Shannon Waltchack LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)