Commercial Property Insurance Market Report by Type (Buildings Insurance, Contents Insurance, Flood Insurance, Earthquake Insurance, and Others), Enterprise Size (Small and Medium-sized Enterprises, Large-Scale Enterprise), Application (Open Perils, Named Perils), and Region 2026-2034

Global Commercial Property Insurance Market:

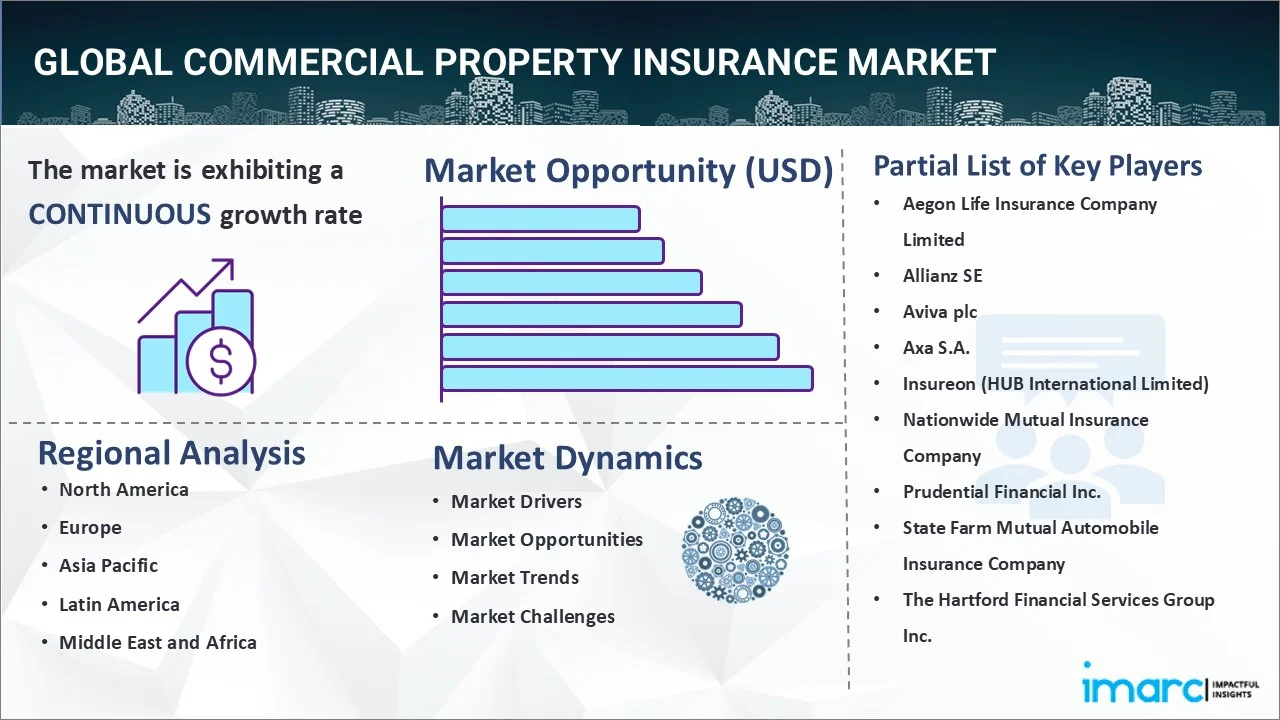

The global commercial property insurance market size reached USD 332.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 711.4 Billion by 2034, exhibiting a growth rate (CAGR) of 8.57% during 2026-2034. The increasing ownership of commercial properties, rising cases of natural disasters, thefts, and frauds, and the growing levels of digitalization in the insurance sector are some of the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 332.1 Billion |

|

Market Forecast in 2034

|

USD 711.4 Billion |

| Market Growth Rate 2026-2034 | 8.57% |

Commercial Property Insurance Market Analysis:

- Major Market Drivers: Rising incidents of catastrophic events, burglary, and theft are primarily driving the growth of the market. In addition to this, the expanding corporate sector, resulting in increased ownership of commercial property, is also creating a positive outlook for the overall market.

- Key Market Trends: The growing complexity of businesses is augmenting the demand for specialty insurance products that provide protection against cyber threats and frauds. Moreover, digitalization in the insurance sector to facilitate an easy underwriting process is also propelling the commercial property insurance market recent price.

- Geographical Landscape: According to the report, Europe currently dominates the global market. The growth of the region can be attributed to the expanding real estate sector. Moreover, the presence of leading insurance providers is also contributing to the market growth. In addition to this, various market players in the region are introducing insurance policies with vast coverage to attract more buyers.

- Competitive Landscape: Some of the leading commercial property insurance market companies are Aegon Life Insurance Company Limited, Allianz SE, Aviva plc, Axa S.A., Insureon (HUB International Limited), Nationwide Mutual Insurance Company, Prudential Financial Inc., State Farm Mutual Automobile Insurance Company, and The Hartford Financial Services Group Inc., among others.

- Challenges and Opportunities: The commercial property insurance market grapples with challenges like climate change risks, increasing claim severity, and evolving cyber threats. Yet, it presents opportunities to expand coverage for emerging risks, leveraging data analytics for risk assessment, and developing tailored solutions, fostering resilience and growth in the insurance sector.

To get more information on this market Request Sample

Commercial Property Insurance Market Trends:

Increasing Ownership of Commercial Property

Large enterprises usually own multiple buildings due to the vast operations of the business. This, in turn, increases the need for commercial property insurance to protect buildings from unforeseen circumstances, reduce business risk, and improve goodwill for being a responsible business enterprise. Moreover, the expanding corporate sector is resulting in the rise in ownership of commercial real estate, which in turn is augmenting the market for commercial property insurance. For instance, the commercial real estate market worldwide is projected to reach a staggering value of US$ 118.80 Trillion by 2024. Additionally, this market is expected to show an annual growth rate (CAGR 2024-2028) of 2.96%, leading to a market value of US$ 133.50 Trillion by 2028. Such an increasing ownership of commercial properties is anticipated to propel the commercial property insurance market demand in the coming years.

Rising Incidents of Catastrophic Events and Thefts

With the rising incidents of catastrophic events, burglary, and theft, various general stores, restaurants, and small and medium-sized enterprises (SMEs) are relying on commercial property insurance to reduce their financial risk. This, in turn, is positively impacting the commercial property insurance market outlook. For instance, insured losses from natural catastrophes totaled US$ 130 Billion, 76% above the 21st-century average and 18% higher than in 2020, according to the 2021 Weather, Climate and Catastrophe Insight report from Aon. Besides this, asset misappropriation is the most common type of employee theft (ACFE). Approximately 86% of all employee fraud cases involve some form of asset misappropriation, such as stealing cash or inventory and running elaborate billing or payroll schemes. Employee theft costs businesses around US$ 50 Billion each year. Moreover, significant growth in export and trade activities is positively influencing the adoption of commercial property and inland marine policies that provide the insured with mono-line coverage for their business locations and equipment.

Increasing Product Offerings

Commercial property insurance providers are expanding their product offerings to meet evolving client needs and market demands. Moreover, insurance providers are also offering coverage for emerging risks like cyber threats, environmental damages, and business interruption due to pandemics, which is anticipated to propel the commercial property insurance market share. By offering comprehensive and customizable policies, insurers aim to provide greater value and protection to businesses, fostering stronger client relationships and competitive advantage in the market. For instance, in May 2024, Janover launched a new insurtech to revolutionize commercial insurance. Janover, an AI-enabled platform for commercial real estate transactions, launched Janover Insurance, its new insurtech subsidiary for commercial property insurance and more. Moreover, in the same month, DUAL Australia announced its plan to launch a new business line in the Asia Pacific region through its specialized title insurance team, DUAL Asset. The product lineup includes coverage for real estate titles, providing the option to address identified issues or defects, as well as title insurance for securities (such as shares, units, etc.), also offering coverage for identified issues or defects. Additionally, the lineup includes fundamental warranty top-up insurance. The addition of such assets in a commercial real estate insurance policy is anticipated to propel the commercial property insurance market revenue in the coming years.

Global Commercial Property Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global commercial property insurance market report, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on type, enterprise size, and application.

Breakup by Type:

To get detailed segment analysis of this market Request Sample

- Buildings Insurance

- Contents Insurance

- Flood Insurance

- Earthquake Insurance

- Others

Buildings insurance exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes buildings insurance, contents insurance, flood insurance, earthquake insurance, and others. According to the report, buildings insurance exhibits a clear dominance in the market.

Building insurance provides essential protection for businesses against various risks associated with their physical properties. It covers damages caused by events such as fire, vandalism, natural disasters, and theft, ensuring financial security for property owners. Commercial property insurance market overview by IMARC indicates that the increasing cases of natural catastrophes are prompting property owners to opt for building insurance. For instance, insured losses from natural catastrophes totaled US$ 130 Billion, 76% above the 21st-century average and 185 higher than in 2020, according to the 2021 Weather, Climate and Catastrophe Insight report from Aon. Such a significant rise in uncertain events and natural calamities is augmenting the growth of the market.

Breakup by Enterprise Size:

- Small and Medium-sized Enterprises

- Large-Scale Enterprise

The commercial property insurance market report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises and large-scale enterprise.

Large-scale enterprises often have more assets, including expansive properties, expensive equipment, and valuable inventory, which require greater protection against potential risks such as fire, theft, natural disasters, and liability claims. Additionally, the financial stakes are quite high for larger enterprises, making comprehensive insurance coverage a critical aspect of their risk management strategy.

Breakup by Application:

- Open Perils

- Named Perils

The report has provided a detailed breakup and analysis of the market based on the application. This includes open perils and named perils.

Open perils coverage in commercial property insurance provides protection against all risks except those specifically excluded in the policy. This comprehensive approach offers broader coverage, addressing a wide range of potential perils that could damage or destroy property. Named perils coverage, on the other hand, only protects against specific risks explicitly listed in the insurance policy. These perils typically include events like fire, theft, vandalism, and certain natural disasters. While named perils policies may offer lower premiums, they provide narrower protection, leaving businesses vulnerable to risks not mentioned in the policy.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe currently dominates the global market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe currently dominates the global market.

The growth of the region can be attributed to the expanding real estate sector. For instance, according to the European Public Real Estate Association, the European Union's commercial real estate sector contributed a combined GDP of more than US$ 15.3 Trillion in 2021. The sector had 177 REITs, with a combined market cap of US$ 133 Billion, and 261 non-REITs, with a combined market cap of US$ 308 Billion. Moreover, the presence of leading insurance providers is also contributing to the market growth. In addition to this, commercial property insurance market statistics by IMARC, various market players in the region are introducing insurance policies with vast coverage to attract more buyers. For instance, in July 2022, Hanover Insurance introduced the Hanover i-on Sensor program to reduce business debt. Hanover Insurance Group is a leading non-life insurance company. Through strategic partnerships, Hanover's i-on-sense program provides business owners and organizations with a comprehensive suite of technology services to help prevent theft, property damage, workplace injuries, and other losses.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Aegon Life Insurance Company Limited

- Allianz SE

- Aviva plc

- Axa S.A.

- Insureon (HUB International Limited)

- Nationwide Mutual Insurance Company

- Prudential Financial Inc.

- State Farm Mutual Automobile Insurance Company

- The Hartford Financial Services Group Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Commercial Property Insurance Market Recent Developments:

- May 2024: Janover, an AI-enabled platform for commercial real estate transactions, announced the launch of Janover Insurance, its new insurtech subsidiary for commercial property insurance and more.

- May 2024: DUAL Australia launched a new business line in the Asia Pacific region through its specialized title insurance team, DUAL Asset. The product lineup includes coverage for real estate titles, providing the option to address identified issues or defects, as well as title insurance for securities (such as shares, units, etc.), also offering coverage for identified issues or defects.

- June 2023: Chubb, the publicly traded property and casualty insurance company, launched an aviation hub in Singapore. This strategic move serves to bolster the company's general aviation and aerospace business, demonstrating its commitment to growth and innovation in the sector.

Global Commercial Property Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Buildings Insurance, Contents Insurance, Flood Insurance, Earthquake Insurance, Others |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large-Scale Enterprise |

| Applications Covered | Open Perils, Named Perils |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aegon Life Insurance Company Limited, Allianz SE, Aviva plc, Axa S.A., Insureon (HUB International Limited), Nationwide Mutual Insurance Company, Prudential Financial Inc., State Farm Mutual Automobile Insurance Company, The Hartford Financial Services Group Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial property insurance market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global commercial property insurance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the commercial property insurance industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial property insurance market was valued at USD 332.1 Billion in 2025.

We expect the global commercial property insurance market to exhibit a CAGR of 8.57% during 2026-2034.

The rising need for commercial property insurance to protect buildings from unforeseen circumstances, reduce business risk, and improve goodwill for being a responsible business enterprise, are some of the commercial property insurance market recent opportunities, driving the market growth.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries, thereby negatively impacting the global market for commercial property insurance.

Based on the type, the global commercial property insurance market can be bifurcated into buildings insurance, contents insurance, flood insurance, earthquake insurance, and others. Currently, buildings insurance exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa. According to the commercial property insurance market forecast by IMARC, Europe currently dominates the global market.

Some of the major players in the global commercial property insurance market include Aegon Life Insurance Company Limited, Allianz SE, Aviva plc, Axa S.A., Insureon (HUB International Limited), Nationwide Mutual Insurance Company, Prudential Financial Inc., State Farm Mutual Automobile Insurance Company, and The Hartford Financial Services Group Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)