Commercial Kitchen Cleaning Services Market Size, Share, Trends and Forecast by Type, Services, Application, and Region, 2025-2033

Commercial Kitchen Cleaning Services Market Size and Share:

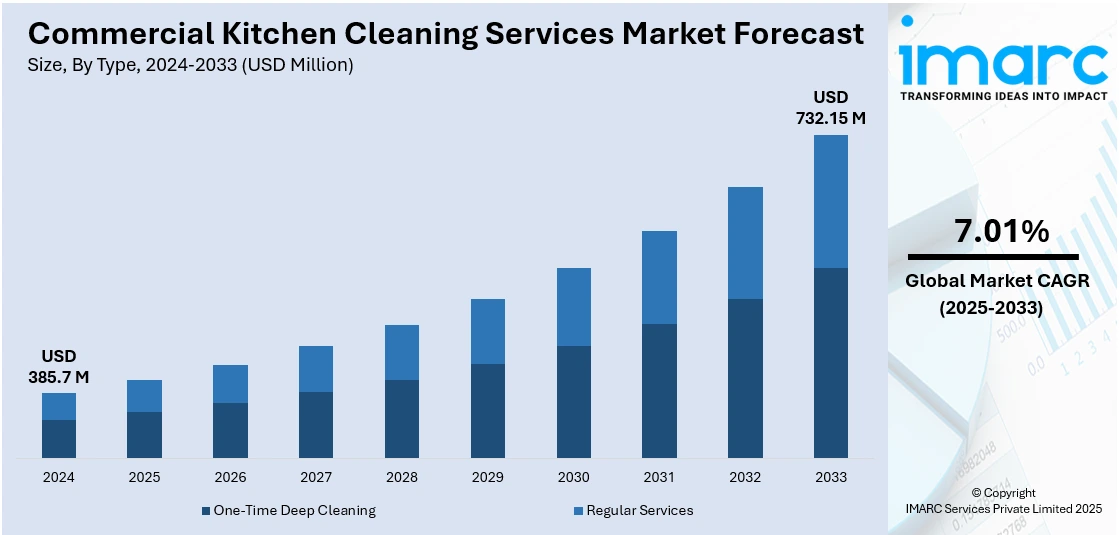

The global commercial kitchen cleaning services market size was valued at USD 385.7 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 732.15 Million by 2033, exhibiting a CAGR of 7.01% during 2025-2033. North America currently dominates the market, holding a significant market share of over 38.7% in 2024. Strict health regulations, rising awareness of food safety, increasing fire risk from grease buildup, growth in food service establishments, labor shortages in hospitality, and the adoption of eco-friendly cleaning solutions and advanced cleaning technologies are some of the major factors fueling the commercial kitchen cleaning services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 385.7 Million |

|

Market Forecast in 2033

|

USD 732.15 Million |

| Market Growth Rate 2025-2033 | 7.01% |

The market for commercial kitchen cleaning services is fueled by increasing food safety regulations, rising awareness of hygiene standards, and the growing number of food service establishments. Strict compliance requirements from health authorities push businesses to outsource cleaning to certified professionals. High risks of fire from grease buildup and cross-contamination further highlight the need for deep cleaning. Additionally, the expansion of restaurants, cloud kitchens, and catering services fuels demand. Labor shortages in the hospitality industry also lead operators to seek outsourced cleaning solutions. Technological advancements, such as eco-friendly cleaning agents and digital monitoring, enhance service quality and efficiency, attracting more clients. The importance of maintaining brand reputation and customer trust encourages regular professional cleaning to ensure a clean, safe, and appealing kitchen environment.

The commercial kitchen cleaning services market forecast points toward a strong demand trajectory in the United States due to strict health and safety regulations, growing consumer awareness about food hygiene, and expanding the food service industry. For instance, in February 2025, the state-of-the-art Commercial Kitchen Exhaust Hood Cleaning Certification Program was launched by MFSTradeSchool.com, which is widely acknowledged as the leading expert in cleaning training for commercial and restaurant kitchens. Businesses are facing increasing pressure to maintain pristine cooking facilities as new laws and strict fire safety rules are implemented throughout the food service and hotel industries. The growing need for appropriately qualified personnel who can satisfy changing compliance requirements and reduce the rising hazards of grease-related kitchen fires is addressed by this extensive educational program. Restaurants, cloud kitchens, and catering services face high pressure to maintain sanitary conditions to avoid fines and closures. Additionally, the increasing demand for eco-friendly, non-toxic cleaning solutions aligns with broader sustainability trends.

Commercial Kitchen Cleaning Services Market Trends:

Stringent Health and Safety Regulations

Government agencies enforce strict health codes and sanitation standards for commercial kitchens to prevent foodborne illnesses and ensure public safety. According to the WHO, unsafe food leads to 600 million cases of foodborne illnesses and 420,000 deaths worldwide annually. Children under 5 account for 30% of these deaths. Similarly, unsafe food is responsible for an estimated 33 million healthy life years lost globally each year. These regulations mandate regular deep cleaning of kitchen equipment, exhaust systems, and food preparation areas. Non-compliance can result in fines, closures, or damaged reputations, prompting businesses to seek professional cleaning services. Service providers ensure adherence to protocols like HACCP and local fire codes, giving clients peace of mind, thereby creating a positive impact on the commercial kitchen cleaning services market outlook. As regulations become more rigorous and inspections more frequent, demand for specialized cleaning services rises, positioning them as a vital partner in maintaining safe, compliant kitchen environments across the foodservice industry.

Fire Risk Management from Grease Build-up

Grease accumulation in commercial kitchen hoods, ducts, and exhaust systems is a major fire hazard. According to fire safety authorities, poorly maintained exhaust systems are among the leading causes of restaurant fires. Professional cleaning services specialize in removing flammable grease deposits, reducing fire risk and ensuring compliance with NFPA 96 and other fire codes. Regular deep cleaning helps prevent dangerous incidents and reduces insurance premiums. As awareness of these risks increases, especially among insurers and regulatory bodies, commercial kitchens are investing in scheduled exhaust and equipment cleanings to protect assets, staff, and customers—fueling demand for specialized cleaning providers. For instance, in April 2023, the Riverside Company (Riverside), a global private equity firm concentrating on the lower segment of the middle market, invested in Green Guard Services (Green Guard), a company that offers commercial kitchen exhaust cleaning (KEC) along with associated services and products vital for fire prevention and control. This funding is the newest enhancement to Riverside’s portfolio company, EverSmith Brands (EverSmith), a robust and expanding platform of franchised brands.

Expansion of the Food Service Industry

The global rise in restaurants, cloud kitchens, and catering services significantly are boosting commercial kitchen cleaning services demand. These establishments generate high volumes of food waste, grease, and bacteria, necessitating frequent and thorough cleaning. New businesses, particularly in urban centers, are often subject to initial and recurring inspections, requiring spotless operations from day one. Additionally, fast-paced service environments leave little time for in-house deep cleaning, making outsourcing more appealing. As the food service sector continues to grow—fueled by changing consumer habits and delivery trends—so does the need for reliable, professional cleaning solutions to support ongoing kitchen hygiene and safety. For instance, in February 2024, London's Commercial Kitchen Cleaning, a newly established cleaning firm focused on commercial kitchen cleaning, officially began offering its services. The company, comprising skilled and knowledgeable professionals, seeks to deliver high-quality cleaning services to restaurants and food establishments in London. The introduction of Commercial Kitchen Cleaning London occurs at a moment when the food sector is experiencing heightened inspection and regulations regarding cleanliness and hygiene.

Commercial Kitchen Cleaning Services Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global commercial kitchen cleaning services market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, services, and application.

Analysis by Type:

- One-Time Deep Cleaning

- Regular Services

One-time deep cleaning stands as the largest type in 2024, holding around 58.6% of the market due to their critical role in ensuring hygiene compliance and preventing fire hazards. Restaurants and food service establishments often schedule deep cleans to meet health inspection standards or prepare for audits. These services address hard-to-reach areas like exhaust hoods, grease traps, and behind equipment—tasks not covered in daily maintenance. The high demand from new openings, ownership changes, or post-renovation cleanups further drives growth. Businesses prefer outsourcing these intensive tasks to professionals for efficiency and regulatory compliance, making one-time deep cleaning a dominant and recurring necessity in the market.

Analysis by Services:

- Structural Deep Cleaning

- Equipment Deep Cleaning

- Worktop and Storage Deep Cleaning

- Extraction Cleaning

Structural deep cleaning is expected to hold a large market share as it addresses critical areas, such as walls, ceilings, floors, and ventilation systems that accumulate grease, dust, and bacteria over time. These surfaces are essential for maintaining a safe and compliant kitchen environment but are often overlooked in daily cleaning. Regular structural cleaning helps prevent pest infestations, odors, and contamination, ensuring long-term hygiene. Food safety regulations increasingly mandate such comprehensive cleaning, making it a vital and recurring service.

Equipment deep cleaning is a major segment due to the heavy use and grease buildup in ovens, fryers, grills, and refrigerators. Improperly cleaned equipment can lead to health code violations, equipment malfunction, or fire hazards. As kitchen appliances are central to food preparation, ensuring their cleanliness boosts operational efficiency and food safety. Professional services offer specialized tools and expertise to clean internal components, extending equipment life and reducing maintenance costs—making this an essential, high-demand cleaning category in commercial kitchens.

Worktop and storage deep cleaning commands a large share because these surfaces are in constant contact with food and utensils, making hygiene critical. Cross-contamination risks are high if these areas are not thoroughly cleaned and sanitized. Deep cleaning services ensure all surfaces, including shelves, cutting areas, and drawers, are free from residues, bacteria, and pests. With increasing regulatory scrutiny and the importance of maintaining food quality, restaurants and food service providers prioritize regular deep cleaning of these zones to meet safety standards and customer expectations.

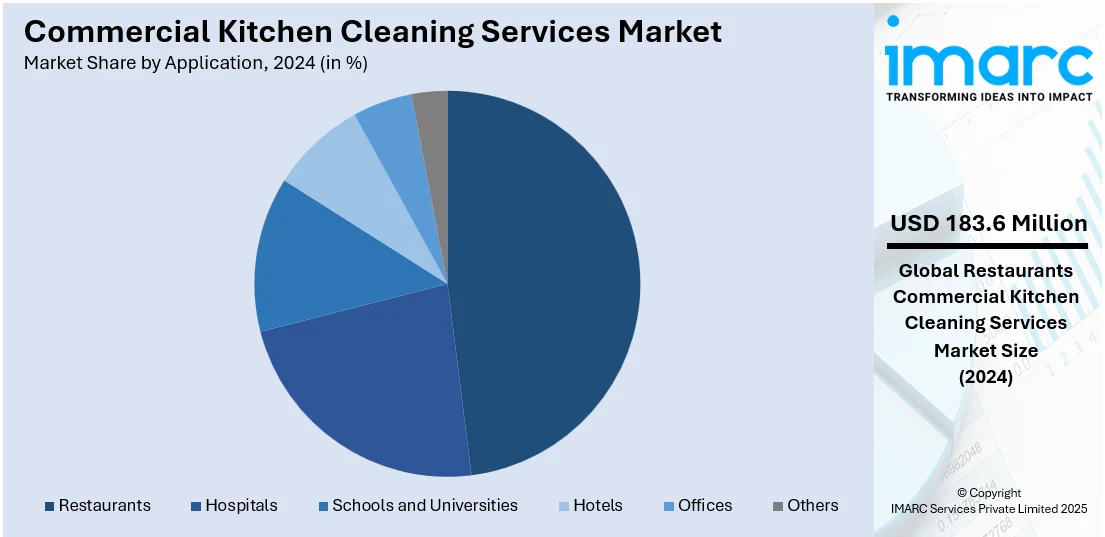

Analysis by Application:

- Hospitals

- Restaurants

- Quick Service Restaurants

- Full-Service Restaurants

- Fast Casual Restaurants

- Schools and Universities

- Hotels

- Offices

- Others

Restaurants leads the market with around 47.6% of market share in 2024 due to their high operational frequency, strict health regulations, and need for consistent cleanliness. With daily food preparation and heavy equipment use, grease and residue build up quickly, increasing the risk of contamination and fire hazards. To meet health codes and avoid penalties, restaurants frequently rely on professional cleaning services for deep cleaning tasks beyond the scope of their staff. The large number of restaurants, especially in urban areas, combined with their need for both regular maintenance and periodic deep cleans, drives their dominant demand in this service market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.7%. The commercial kitchen cleaning services market in North America is driven by stringent health and fire safety regulations, especially in the U.S. and Canada, where compliance with codes such as NFPA 96 is mandatory. Increasing awareness of food hygiene and public safety pushes restaurants and food service providers to invest in regular professional cleaning. The high volume of food preparation leads to rapid grease buildup, creating fire and contamination risks. Additionally, the expansion of quick-service restaurants, cloud kitchens, and hospitality businesses fuels demand for outsourced cleaning services. Labor shortages in the hospitality sector further encourage reliance on external cleaning providers. The adoption of eco-friendly cleaning solutions and digital platforms for scheduling and compliance tracking also supports the commercial kitchen cleaning services market growth across the region.

Key Regional Takeaways:

United States Commercial Kitchen Cleaning Services Market Analysis

In 2024, the United States accounted for over 88.80% of the commercial kitchen cleaning services market in North America. The United States commercial kitchen cleaning services market is primarily driven by the increasing regulatory scrutiny by health and safety authorities. In line with this, rising awareness about food safety and the prevention of contamination compelling food service establishments to adopt stringent sanitation protocols, is fostering the market expansion. Similarly, growth in the number of food outlets, including cloud kitchens and quick-service restaurants, is expanding the customer base for specialized cleaning providers. According to IBIS World, the number of fast-food restaurant businesses in the U.S. reached 213,155 in 2024, reflecting a 1.5% growth compared to 2023. Furthermore, rising labor shortages in the hospitality sector, pushing operators to outsource non-core tasks like cleaning, is strengthening market demand. A survey by the American Hotel & Lodging Association (AHLA) found that 76% of hotels are facing staffing shortages, with 13% reporting severe understaffing that impacts operations. Additionally, numerous corporate sustainability goals supporting the shift toward eco-friendly cleaning practices are impelling the market. Besides this, increased focus on customer perception and brand image reinforcing the importance of visibly clean kitchen environments are shaping the market trends.

Europe Commercial Kitchen Cleaning Services Market Analysis

The European market is influenced by strict enforcement of European Union hygiene regulations, prompting food service businesses to invest in professional cleaning solutions. Similarly, the expansion of institutional catering in sectors, such as healthcare and education, along with increasing demand for routine kitchen maintenance, is augmenting market development. The rapid urbanization and the rise of centralized food production units requiring high standards of cleanliness, are bolstering the market reach. Industry analysis indicates that Europe is one of the most urbanized regions globally, with nearly 5% of its land allocated for urban purposes. Furthermore, the growing popularity of open-kitchen formats in restaurants elevating the need for visibly clean environments to maintain customer trust, is propelling market growth. The heightened adoption of HACCP (Hazard Analysis and Critical Control Points) compliance frameworks is encouraging higher service engagement. Additionally, the growing emphasis on allergen control and cross-contamination prevention, supporting the need for specialized sanitation, is influencing market expansion. Moreover, the emerging trend of outsourcing non-core operations is providing an impetus to the market.

Asia Pacific Commercial Kitchen Cleaning Services Market Analysis

The commercial kitchen cleaning services market in Asia-Pacific is shaped by rapid growth in the hospitality and foodservice sectors, particularly across emerging economies. In addition to this, rising consumer expectations around food hygiene encouraging restaurants to adopt more rigorous sanitation practices, is impelling the market. Furthermore, increasing foreign investment in the regional food industry bringing global compliance standards is necessitating a higher uptake of specialized cleaning services. The expansion of organized retail food chains contributing to the rising need for standardized kitchen maintenance is augmenting market demand. The National Restaurant Association of India (NRAI) reports that India will be home to over 500,000 restaurants in 2025, encompassing a mix of independent outlets and chain establishments nationwide. Similarly, the rise in government-led food safety campaigns and inspections strengthening regulatory compliance across the sector, are expanding the market reach. Moreover, heightened awareness of how hygiene affects productivity, driving businesses to outsource kitchen cleaning services, is creating lucrative market opportunities.

Latin America Commercial Kitchen Cleaning Services Market Analysis

The Latin America commercial kitchen cleaning services market is supported by increasing tourism and hospitality investments in countries like Mexico and Brazil. In accordance with this, rising food safety concerns, particularly in urban centers, prompting stricter hygiene enforcement in foodservice operations, are fostering market expansion. Similarly, growth in franchised restaurant chains, contributing to demand for standardized cleaning protocols, is bolstering market reach. For instance, Firehouse Subs plans to enter Brazil in 2025, aiming to open over 500 restaurants in the next 10 years. Furthermore, the emergence of affordable local service providers, prompting small and mid-sized food businesses to outsource kitchen cleaning, is impelling the market.

Middle East and Africa Commercial Kitchen Cleaning Services Market Analysis

The market in the Middle East and Africa is experiencing growth due to the expansion of luxury hospitality and fine dining sectors, especially in Gulf nations. Similarly, growing international tourism prompting stricter hygiene adherence across food establishments, is propelling market growth. The World Travel & Tourism Council’s 2024 report shows the UAE’s tourism sector reached new heights, with international visitor spending rising nearly 40% in 2023 to exceed AED 175 billion, 12% higher than pre-pandemic levels, highlighting the country's strong global tourism appeal. Furthermore, rising health awareness among consumers, encouraging foodservice operators to invest in professional cleaning solutions, is strengthening market demand. Apart from this, favorable regulatory initiatives by municipal bodies in urban centers, reinforcing the need for routine inspections and compliance with food safety and cleanliness standards in commercial kitchens, are positively influencing the market.

Competitive Landscape:

The commercial kitchen cleaning services market is highly fragmented, with a mix of national players and regional specialists. Key competitors include Ecolab, Jani-King, and Coverall, which offer comprehensive cleaning and sanitation solutions. Smaller, local providers compete on price and personalized service, while larger firms leverage scale, standardized protocols, and regulatory expertise. Differentiation is driven by service quality, compliance with food safety standards (e.g., HACCP), and the ability to handle grease removal, exhaust hood cleaning, and deep sanitization. Technological integration, such as real-time monitoring and eco-friendly products, is becoming a competitive edge. Market entry barriers remain moderate, but retaining clients demands consistent performance, certifications, and responsive customer support. Price competition is intense, especially in urban areas with dense food service establishments.

The report provides a comprehensive analysis of the competitive landscape in the commercial kitchen cleaning services market, with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: Ever Brite merged with New Green Services to expand its commercial cleaning and property maintenance services across the Southeast of England. The partnership offers comprehensive solutions, including cleaning, gardening, and grounds maintenance.

- February 2025: MFS Trade School launched its Commercial Kitchen Exhaust Hood Cleaning Certification Program, addressing rising fire safety regulations and grease fire risks.

- September 2024: First Compliance Group acquired Duct Hygiene Ltd, a ventilation, fire safety, and kitchen cleaning specialist based in Wrexham, UK.

- April 2024: Kitchen Guard signed its first franchise agreement with Ryan Kleve in Denver, Colorado. The commercial kitchen exhaust cleaning franchise, backed by EverSmith Brands, offers fire safety and compliance services to restaurants and businesses.

Commercial Kitchen Cleaning Services Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | One-Time Deep Cleaning, Regular Services |

| Services Covered | Structural Deep Cleaning, Equipment Deep Cleaning, Worktop and Storage Deep Cleaning, Extraction Cleaning |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial kitchen cleaning services market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global commercial kitchen cleaning services market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the commercial kitchen cleaning services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial kitchen cleaning services market was valued at USD 385.7 Million in 2024.

The commercial kitchen cleaning services market is projected to exhibit a CAGR of 7.01% during 2025-2033, reaching a value of USD 732.15 Million by 2033.

The commercial kitchen cleaning services market is driven by strict health and fire safety regulations, increasing food safety awareness, and the rise in foodservice establishments. Labor shortages push outsourcing, while demand for eco-friendly solutions and digital service platforms enhances efficiency, compliance, and appeal across restaurants, cloud kitchens, and catering services.

North America currently dominates the commercial kitchen cleaning services market due to strict regulations, fire risk, food safety concerns, labor shortages, and growing foodservice establishments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)