Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2026-2034

Commercial Insurance Market Size and Share:

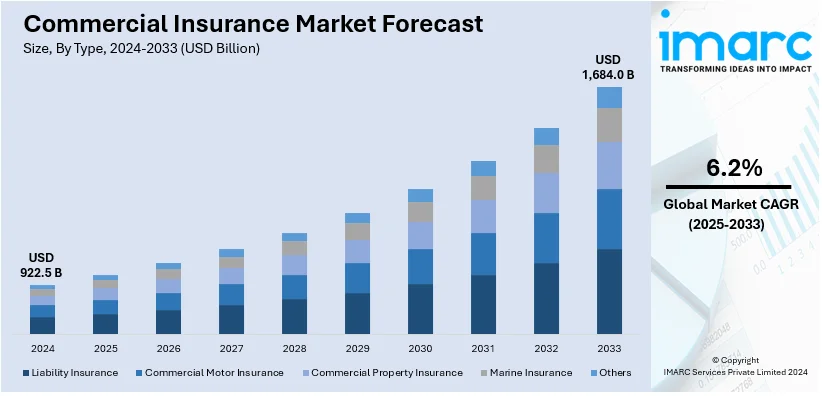

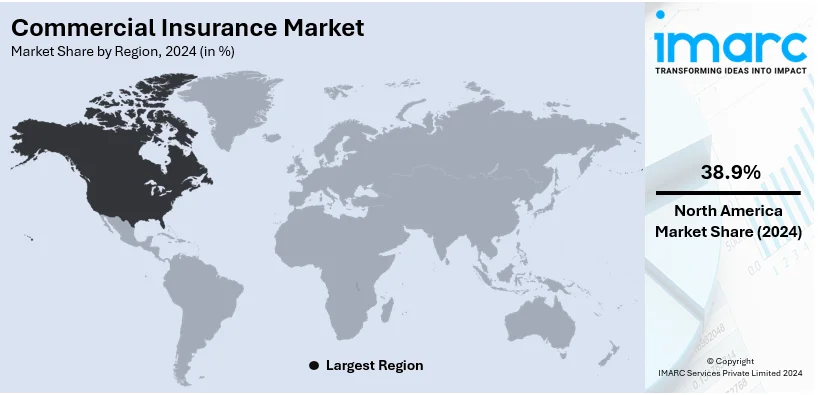

The global commercial insurance market size was valued at USD 922.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,684.0 Billion by 2034, exhibiting a CAGR of 6.2% from 2026-2034. North America currently dominates the market with 38.9% in 2024. Increasing awareness of business risks, stringent and changing regulatory requirements, the rise of technology-enabled risk assessment, the growing impact of natural disasters and climate change, and the rise in cyber threats are influencing the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 922.5 Billion |

| Market Forecast in 2034 | USD 1,684.0 Billion |

| Market Growth Rate (2026-2034) | 6.2% |

The commercial insurance market is expanding due to increasing business operations across sectors and rising awareness of safeguarding assets against liabilities like cyber threats and natural disasters. For instance, on March 26, 2024, HSB launched Cyber for Auto coverage to protect connected vehicles from cyber-attacks, ransomware, and identity theft, addressing consumer concerns about vehicle cybersecurity. Continual advancements in technology, such as AI-driven risk assessments and data analytics, enable insurers to provide tailored policies, boosting demand. Regulatory mandates requiring insurance for specific business operations and the growing complexity of global supply chains further offer a favorable commercial insurance market outlook. Economic recovery and investments in small and medium enterprises (SMEs) also contribute significantly to market expansion.

The United States is a key regional market, primarily driven by growing economic activities, business expansions, and a focus on risk mitigation. Emerging risks like cybercrime and climate-induced disasters are increasing demand for specialized solutions. Technological advancements, such as blockchain and predictive analytics, enhance underwriting accuracy and policy customization, broadening the customer base. Regulatory mandates and the rise in e-commerce further strengthen demand for liability and cybersecurity insurance. Additionally, mergers and acquisitions create opportunities for tailored offerings. For instance, on September 12, 2024, Akur8 partnered with Heritage Insurance to enhance pricing analytics using machine learning-powered risk modeling. The platform accelerates model building, improves predictive accuracy, and supports data-driven underwriting, enabling Heritage to deliver sophisticated, affordable insurance products across its multi-state footprint.

Commercial Insurance Market Trends:

Role of Advanced Technologies in Driving Commercial Insurance Demand

The adoption of advanced technologies such as telematics, internet of things (IoT), artificial intelligence (AI), data analytics, and machine learning is significantly driving the demand for commercial insurance across various industries. These technologies enhance data collection, enabling businesses to assess risks more effectively and predict potential disruptions. For instance, in the automotive and construction sectors, AI-powered tools can identify equipment malfunctions before they occur, mitigating operational downtime. In healthcare, telematics and IoT devices enable continuous monitoring, helping insurers track health-related risks in real-time. Additionally, data analytics allow businesses to customize insurance policies based on precise risk profiles, improving the overall customer experience and providing more accurate coverage. As a result, industries are increasingly turning to commercial insurance solutions that leverage these technologies to better manage risk and improve operational resilience.

Increasing Awareness of Business Risks

The increasing consciousness of the multiple risks that companies face today is one of the biggest drivers in the global commercial insurance market. The more a company expands and gets complex, the more it faces umpteen risks like natural disasters, cyberattacks, supply chain disruptions and regulatory changes. For example, a security magazine report reveals that in 2023, cyberattacks skyrocketed to a never-before level for the United States, as over 420 million incidents were recorded between January and December, with a rate of 13 attacks per second on average. That represents a 30% increase compared to the same period the previous year. As people become increasingly alert, businesspeople demand to cover all operations and assets under all-inclusive insurance policies. In addition, the awareness of the financial loss that unexpected events can cause is leading to the use of insurance as a risk management tool. Large and small businesses alike are becoming more proactive in identifying their vulnerabilities and obtaining the right insurance policies to mitigate these risks, which is driving the steady growth of the commercial insurance sector.

Globalization of Businesses

The globalization of businesses is reshaping the overall commercial insurance landscape. According to UNCTAD data, global trade patterns improved in the initial quarter of 2024, with the value of goods trade rising approximately 1% from the previous quarter and services by roughly 1.5%. Companies are expanding their operations across borders, exposing themselves to a host of new risks, including currency fluctuations, varying regulatory environments, and political instability. As a result, businesses require insurance coverage that can address these unique international challenges. Multinational corporations, in particular, rely on global insurance programs to provide consistent coverage across multiple countries, ensuring their assets and operations are protected regardless of their geographical spread. This trend is leading to the development of specialized international insurance products and increased competition among insurers to offer comprehensive global coverage, making the globalization of businesses a key driver in the commercial insurance market. This evolving landscape aligns with commercial insurance industry trends, as insurers innovate tailored policies, expand digital underwriting capabilities, and enhance risk management solutions to meet the growing demand for global coverage.

Regulatory Changes and Compliance Requirements

The continually changing regulatory landscape is a critical driver shaping the commercial insurance market. Governments and regulatory bodies worldwide introduce and amend laws and regulations that often mandate or recommend specific insurance coverage for businesses. Compliance with these requirements is not only a legal obligation but also essential for risk management. Compliance costs are high in healthcare as a business must follow strict regulations that include the HIPAA rule in the U.S., and there may be tremendous investment for the business in order to be compliant with legal and regulatory requirements. For example, in industries such as healthcare and finance, strict regulations necessitate various forms of liability insurance to protect against legal claims and fines. Additionally, changes in employment laws may require businesses to provide workers' compensation insurance. As regulations continue to shift, businesses must adapt their insurance portfolios to remain compliant, leading to increased demand for specialized insurance products and coverage tailored to specific regulatory needs. This dynamic regulatory environment thus plays a pivotal role in shaping the commercial insurance market.

Commercial Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global commercial insurance market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, enterprise size, distribution channel, and industry vertical.

Analysis by Type:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

Liability insurance leads the market, holding a share of 14.5%, influenced by ongoing regulatory changes. As laws and regulations evolve, businesses are compelled to adapt their liability insurance policies to remain compliant. Additionally, the economic environment significantly impacts this segment. Economic stability or downturns can affect the types and extent of liability risks faced by businesses, thus influencing their insurance needs. Another crucial factor is the nature of the business itself. Different industries have varying levels of liability exposure, with sectors like healthcare and construction often requiring extensive coverage. Furthermore, emerging risks, such as cyber liability, have gained prominence in recent years, necessitating specialized insurance solutions. Besides this, the competitive landscape and insurance market dynamics continually shape the availability and pricing of liability insurance products.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

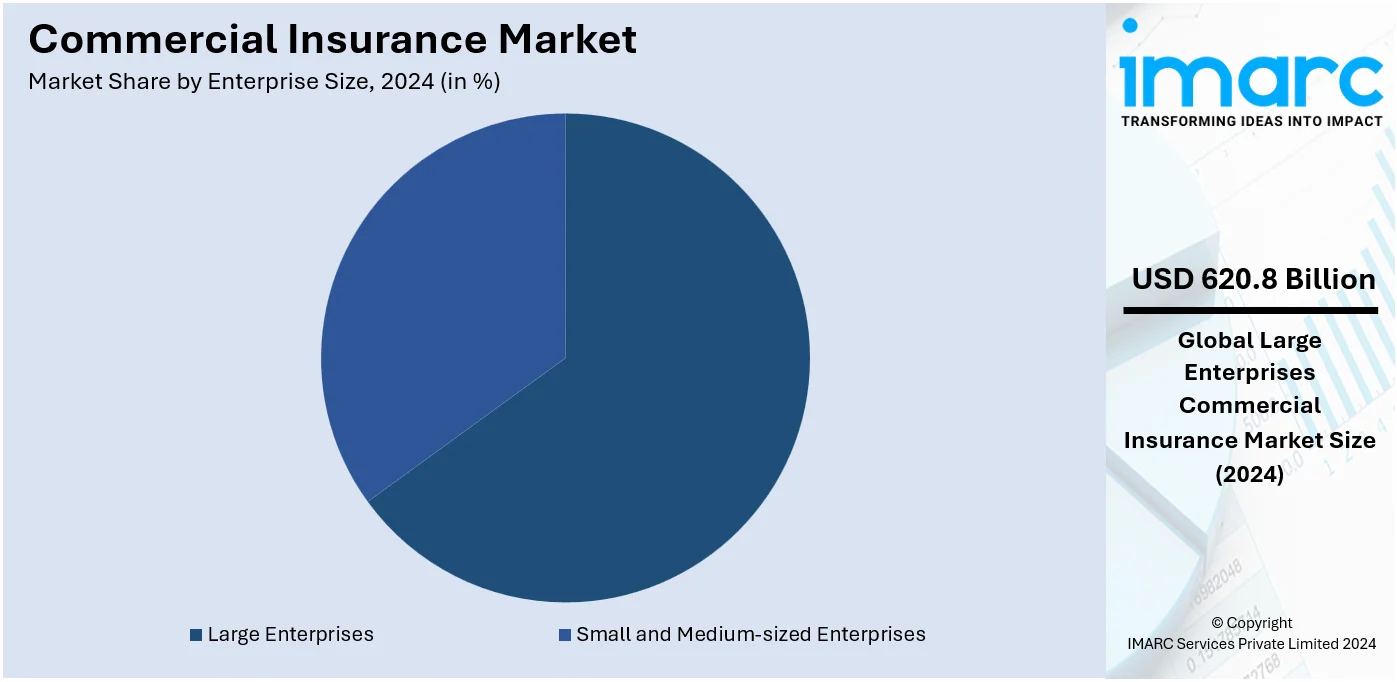

Large enterprises represent a leading share the market, holding a share of 67.3%, driven by regulatory compliance and risk management. Large enterprises often face complex regulatory requirements, necessitating comprehensive insurance coverage to mitigate potential financial liabilities. Moreover, the size and scale of large enterprises expose them to higher risks, such as catastrophic events or cyber threats. Consequently, these organizations seek robust insurance solutions to safeguard their assets and operations. In line with this, globalization, and the expansion of large enterprises into diverse markets require flexible insurance policies that can adapt to varying business landscapes. Additionally, the increasing awareness of environmental and social responsibilities has driven the demand for insurance products addressing sustainability concerns. Furthermore, advancements in data analytics and technology have allowed insurers to tailor policies, providing large enterprises with more personalized coverage options.

Analysis by Distribution Channel:

- Agents and Brokers

- Direct Response

- Others

Agents and brokers dominate the commercial insurance market share in 2024. The growth of the segment in the commercial insurance market can be attributed to the increasing complexity in insurance products and regulations, which has driven businesses to seek expert guidance. Agents and brokers provide this expertise, helping clients navigate the intricate landscape of commercial insurance. Moreover, the emphasis on risk management has grown substantially. Businesses are recognizing the importance of tailored insurance solutions to mitigate risks effectively. Agents and brokers excel in assessing a company's unique needs and sourcing appropriate policies. In line with this, digitalization has enabled agents and brokers to streamline their operations and provide efficient services. Online platforms and digital tools have made it easier for businesses to connect with insurance professionals and obtain quotes swiftly. Additionally, the agents and brokers segment benefits from its role in fostering competition among insurers, ensuring clients access competitive pricing and comprehensive coverage.

Analysis by Industry Vertical:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

Transportation and logistics hold the biggest share in the market and is influenced by several key factors, which includes the overall economic conditions, as they impact the volume of goods transported and the demand for logistics services. Additionally, regulatory changes and safety standards, particularly in response to shifting technologies and environmental concerns, significantly affect this segment. Furthermore, the rising incidents of cargo theft and accidents emphasize the importance of comprehensive insurance coverage. The globalization of supply chains and the expansion of e-commerce have led to increased reliance on efficient transportation and logistics, amplifying the need for specialized insurance solutions. In line with this, the ongoing digital transformation within the industry, including the adoption of telematics and data analytics, is reshaping risk assessment and pricing models.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest commercial insurance market share of 38.9%. The expansion of the commercial insurance sector in North America can be linked to various important elements, including a rise in awareness and comprehension of risk management strategies among companies. Additionally, regulatory adjustments and compliance obligations have driven companies to pursue extensive insurance options. Fulfilling these regulatory requirements has emerged as a priority, boosting the need for insurance services. In this regard, technological innovations have changed the insurance sector. The implementation of data analytics, artificial intelligence, and automation has simplified underwriting procedures, resulting in more efficient and cost-effective services, which in turn draws in more businesses. Additionally, the evolving nature of cyber threats and the demand for cybersecurity protection have significantly contributed to the expansion of commercial insurance. The rising occurrence and complexity of cyberattacks have prompted companies to recognize the necessity of protecting their digital resources.

Key Regional Takeaways:

United States Commercial Insurance Market Analysis

In 2024, the US accounted for around 88.10% of the total North America commercial insurance market. As reported by the National Association of Insurance Commissioners, the U.S. insurance market earned more than USD 1.3 Trillion in premiums in 2022. The increasing corporate liability, property, and health insurance demand are driving this market as companies face evolving regulatory frameworks and economic uncertainty. Furthermore, climate-related risks and cyber-attacks accelerate the demand for niche products of insurance. Industry leaders, including State Farm and Berkshire Hathaway, continue to dominate the market. Digital platforms also redefine the market, making access more accessible to customers and increasing the efficiency of claims. In addition, innovations in parametric insurance and growing InsurTech also keep the market moving forward.

Europe Commercial Insurance Market Analysis

European commercial insurance markets are growing due to business and regulatory changes. According to EIOPA, total European premiums exceeded EUR 1.2 Trillion (USD 1.28 Trillion) in the 2022 period. Natural disasters and cyber risks are two of the factors where demand for property and casualty coverage is increasing. Other pressures include ESG factors, which are increasingly impacting insurance policies and driving more sustainable practices. The key markets in this area are the UK, Germany, and France, and the leading players in both traditional and innovative insurance solutions are Allianz and Lloyd's. Regulators are constantly updating, including the EU's Solvency II directive, to ensure a stable yet competitive environment.

Asia Pacific Commercial Insurance Market Analysis

The Asia Pacific commercial insurance market is recording significant growth due to the pace of economy growth and business risks which have been rising. Notably, higher industrialization levels in China and India lead to significant demand for property, casualty, and liability insurance; while geopolitical tensions, climate, and cyber-attacks present threats, they also escalate the demand for specialty coverage. Additionally, growing awareness regarding employee benefits and healthcare insurance in countries like Japan and South Korea further propel the market. In Asia Insurance Review, it has been reported that China remained the world's second-largest insurance market during 2023 and witnessed total premiums of USD 724 Billion, which forms 10% of global market share. International insurers such as AIG and Zurich, have sought to team up with local players to explore this rapidly growing market.

Latin America Commercial Insurance Market Analysis

Growth within Latin American commercial insurance is being reported, driven by increasing investment from corporate and the resultant demand for comprehensive coverage solutions. According to a report released by MAPFRE, 2022 saw the regional insurance market reach a total premium volume of USD 173.7 Billion, accounting for a 15.9 percent growth from the previous year. The growing importance of risk management for key industries like agriculture, energy, and technology along with the rising number of small and medium-sized enterprises are driving demand. Moreover, the increasing expansion of digital insurance platforms is assisting in further penetration in the markets that had traditionally remained underinsured. Interest in property, business interruption, and catastrophe insurance continues to be fuelled by frequent natural disasters as well as economic and political instability. This is dominated by the contribution of local insurers, including Grupo Nacional Provincial or GNP and Porto Seguro.

Middle East and Africa Commercial Insurance Market Analysis

Commercial insurance market in the Middle East and Africa is constantly changing with the increase in infrastructure development and business risks. As per the Aon report, commercial insurance premiums for the region reached over USD 30 Billion in 2022. Demand is seen rising in all sectors but has grown mainly in construction, energy, and healthcare. Economic growth in the UAE and Saudi Arabia, along with the major infrastructure projects - NEOM city initiative, is driving demand for complete property and liability insurance in those markets. Political risks, along with terrorism-related products, are on the rise in the North African region. There is significant adoption of InsurTech; new digital platforms will help improve efficiency and render these products more accessible, opening up traditionally underserved markets like Sub-Saharan Africa. For instance, the market remains dominated by leading regional players like Dubai Insurance and Old Mutual.

Competitive Landscape:

The commercial insurance market's competitive environment is a dynamic and intricate field marked by different participants providing a diverse range of insurance products and services to companies. Reinsurance firms are vital in this system, offering risk-sharing solutions to primary insurers. Their financial resilience and ability greatly influence the competitive dynamics of the market. Insurance brokers and agents act as intermediaries connecting businesses in need of coverage with insurers. They assist clients in maneuvering through the intricate insurance options, introducing an additional level of competition while striving to connect clients with the most appropriate insurance providers. New InsurTech firms are bringing forward technological advancements, such as digital platforms and AI-based underwriting, which are transforming the competitive environment. These innovative startups are competing with established companies by improving customer experiences and optimizing processes.

The commercial insurance market report provides a comprehensive analysis of the competitive landscape with detailed profiles of all major companies, including:

- Allianz SE

- American International Group Inc.

- Aon plc

- Aviva plc

- Axa S.A.

- Chubb Limited

- Direct Line Insurance Group plc

- Marsh & McLennan Companies Inc.

- Willis Towers Watson Public Limited Company

- Zurich Insurance Group Ltd.

Latest News and Developments:

- May 2025: Chubb, Zurich, and National Indemnity jointly launched a new Excess Casualty Facility, aiming to provide enhanced insurance capacity and solutions for large corporate clients facing complex risks. This collaboration leverages the combined expertise and financial strength of the three industry leaders, offering up to USD 500 million in excess liability coverage. The facility is designed to address growing market demand for higher limits and tailored risk management, supporting clients with comprehensive protection against catastrophic liability exposures.

- April 2025: Marsh launched CyberShore Bermuda, a specialized platform focused on cyber risk insurance. The new CyberShore Bermuda initiative aims to enhance cyber risk solutions by leveraging Bermuda’s strategic position in the insurance market, addressing growing cyber threats, and providing tailored risk management services to clients worldwide. This move strengthens Marsh’s leadership in cyber insurance.

- April 2025: Aon plc launched a specialty insurance product, Plug and Well Exit Liability, to cover liabilities and reduce risk in plugging abandoned oil and gas wells in the U.S. Developed with Tradewater, the product insures well-plugging operations and can include state agencies as insured parties. It supports financial security for buyers and investors in carbon credits from these projects, crucial for funding and sector viability. The initiative addresses growing risks as abandoned and orphaned wells increase, bolstering climate risk mitigation efforts.

- April 2025: Allianz Commercial announced expansion of its U.S. Construction team to strengthen its Master Builder’s Risk portfolio amid growing infrastructure investments. This expansion supports Allianz’s strategic growth in construction insurance, covering sectors such as infrastructure, civil engineering, and manufacturing.

- April 2025: AXA XL implemented a new system designed to streamline and accelerate the policy issuance process. This innovation enhances efficiency by simplifying workflows for underwriters and brokers, enabling faster turnaround times. The system integrates advanced technology to improve accuracy, reduce manual errors, and provide a better user experience. By making policy issuance faster and easier, AXA XL aims to strengthen client relationships, increase operational productivity, and maintain its competitive edge in the insurance and reinsurance markets.

- March 2025: ERGO, part of Munich Re, agreed to fully acquire NEXT Insurance, a leading U.S. digital insurer for small businesses, for USD 2.6 billion. This acquisition allows ERGO to enter the large, underinsured U.S. small business market valued at USD 175 billion. NEXT Insurance, founded in 2016 and serving over 600,000 customers, leverages advanced technology for simple, tailored insurance solutions. The deal enhances ERGO’s global portfolio, promising significant growth and mid-triple-digit million earnings contribution in the medium term.

Commercial Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allianz SE, American International Group Inc., Aon plc, Aviva plc, Axa S.A., Chubb Limited, Direct Line Insurance Group plc, Marsh & McLennan Companies Inc., Willis Towers Watson Public Limited Company, Zurich Insurance Group Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial insurance market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global commercial insurance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial insurance market was valued at USD 922.5 Billion in 2024.

IMARC estimates the commercial insurance market to exhibit a CAGR of 6.2% during 2025-2033, reaching a value of USD 1,684.0 Billion by 2033.

The commercial insurance market is driven by the rising business risks, stringent regulatory requirements, and increasing cyber threats. Growth in global trade, digital transformation, and climate-related liabilities further fuel the demand. Companies seek customized policies for risk mitigation, while technological advancements in underwriting and analytics enhance efficiency, driving market expansion and innovation.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the commercial insurance market include Allianz SE, American International Group Inc., Aon plc, Aviva plc, Axa S.A., Chubb Limited, Direct Line Insurance Group plc, Marsh & McLennan Companies Inc., Willis Towers Watson Public Limited Company, Zurich Insurance Group Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)