Commercial Display Market Report by Product Type (Digital Signage, Display Monitor, Display TVs), Technology (LCD, LED, and Others), Component (Hardware, Software, Services), Panel Type (Flat Panel, Curved Panel, and Other Panel), Size (Below 32 inches 32 to 52 inches, 52 to 75 inches, Above 75 inches), Application (Retail, Hospitality, Entertainment, Stadiums & Playgrounds, Corporate, Banking, Healthcare, Education, Transportation), and Region 2026-2034

Commercial Display Market Size:

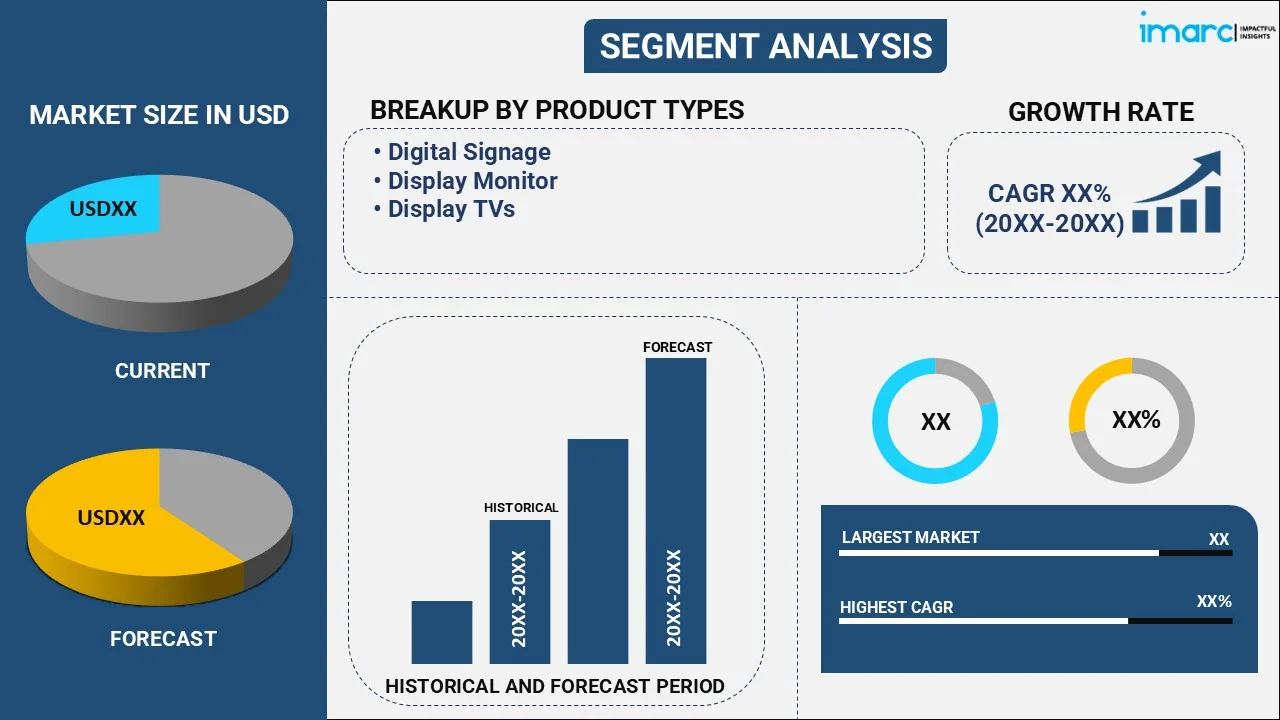

The global commercial display market size reached USD 60.8 Billion in 2025. Looking forward, the market is expected to reach USD 106.0 Billion by 2034, exhibiting a growth rate (CAGR) of 6.37% during 2026-2034. The market is experiencing steady growth driven by the growing focus on digital advertising to gain the attention of a wider consumer base, rising need to create in-store immersive experiences, and introduction of 4K and 8K resolutions to deliver enhanced clarity and detail.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 60.8 Billion |

|

Market Forecast in 2034

|

USD 106.0 Billion |

| Market Growth Rate 2026-2034 | 6.37% |

Commercial Display Market Analysis:

- Market Growth and Size: The market is witnessing moderate growth, driven by the increasing demand for immersive in-store experience among individuals, along with the rising focus on digital advertising.

- Technological Advancements: The introduction of innovative display technologies, such as light emitting diode (LED), organic light emitting diode (OLED), and higher resolutions like 4K and 8K, are strengthening the market growth. Moreover, there is an increase in the demand for rollable and transparent displays.

- Industry Applications: Commercial displays find applications in the retail, hospitality, healthcare, education, transportation, and entertainment sectors. They serve purposes like advertising, collaboration, education, and public information dissemination.

- Geographical Trends: North America leads the market, driven by the increasing focus on advertising, branding, and enhancing the experience of individuals. However, Asia Pacific is emerging as a fast-growing market on account of the rising need for commercial displays in educational institutions for smart classrooms.

- Competitive Landscape: Key players are investing in research and development (R&D) activities to advance display technologies by developing higher resolution panels, such as 4K and 8K, improving color accuracy, and enhancing energy efficiency.

- Challenges and Opportunities: While the market faces challenges, such as ensuring display durability, it also encounters opportunities in the development of smart cities.

- Future Outlook: The future of the commercial display market looks promising, with the rising focus on developing eco-friendly displays. Additionally, the integration of the Internet of Things (IOT) is expected to bolster the market growth.

To get more information on this market Request Sample

Commercial Display Market Trends:

Technological advancements

Key players are increasingly incorporating advanced technologies to meet the rising demands of individuals and industries. In line with this, the rising employment of light emitting diode (LED) and organic light emitting diode (OLED) displays due to their superior visual quality, energy efficiency, and durability is contributing to the growth of the market. Moreover, these displays offer vibrant colors, high contrast ratios, and flexibility in design, making them ideal for various applications. Apart from this, the introduction of 4K and 8K resolutions assist in delivering enhanced clarity and detail. Furthermore, the growing demand for high-quality commercial displays in sectors like entertainment and gaming, where high-definition (HD) visuals are paramount, is propelling the market growth. In addition, the incorporation of touchscreen capabilities into commercial displays benefits in expanding their utility. Besides this, interactive displays enable organizations to create engaging presentations, interactive catalogs, and immersive digital signage, which is impelling the market growth.

Rising focus on digital advertising

The increasing shift from traditional advertising to digital signage and interactive displays is propelling the growth of the market. Businesses across industries recognize the effectiveness of digital advertising in capturing and retaining consumer attention. Commercial displays play a pivotal role in this transformation by providing a dynamic platform for advertising and information dissemination. Digital signage allows for real-time updates, targeted messaging, and interactive features that engage people and enhance brand visibility. Whether it is promoting products in retail stores, displaying menu items in restaurants, or providing information in transportation hubs, businesses are harnessing the power of commercial displays to deliver their messages effectively. This trend is further amplified by the ability to measure and analyze the impact of digital advertising campaigns, enabling businesses to refine their strategies for better results. As a result, the adoption of commercial displays for advertising purposes is set to continue its upward trajectory.

Increasing need to create immersive in-store experience

The expansion of the retail sector, both online and offline, is a key driver of the commercial display market. In brick-and-mortar stores, commercial displays are employed for a multitude of purposes, ranging from showcasing products and promotions to creating immersive in-store experiences. With the rise of e-commerce, physical retailers are leveraging technology to compete effectively and provide consumers with compelling reasons to visit their stores. Moreover, the need for contactless shopping experiences, leading to the deployment of touchless kiosks and displays for ordering, payment, and information access. These displays not only enhance safety but also streamline the shopping process. In the e-commerce realm, businesses are using commercial displays for virtual try-ons, interactive product catalogs, and augmented reality (AR) experiences. As the retail sector is evolving, driven by consumer expectations and changing market dynamics, commercial displays are indispensable in delivering engaging and informative content to shoppers, both online and in-store.

Commercial Display Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on product type, technology, component, panel type, size, and application.

Breakup by Product Type:

To get detailed segment analysis of this market Request Sample

- Digital Signage

- Display Monitor

- Display TVs

Digital signage accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes digital signage, display monitor, and display TVs. According to the report, digital signage represented the largest segment.

Digital signage is specifically designed for the purpose of conveying information, advertising, or interactive content in a dynamic and visually appealing manner. It encompasses a wide range of products and technologies, such as digital signage displays, interactive touchscreens, outdoor digital signage, digital menu boards, and video walls. In addition, digital signage displays are large-format screens typically used for advertising and information dissemination in public spaces, retail stores, and transportation hubs. They are available in various sizes, ranging from small kiosks to massive video walls.

A display monitor is designed for commercial use and offers features like high resolution, color accuracy, and durability. In line with this, the rising employment of display monitors in offices, control rooms, and for digital signage applications where a smaller screen size is required is propelling the market growth.

Display TVs are optimized for extended use in business environments. Moreover, the increasing utilization of display TVs in hospitality for in-room entertainment, conference rooms, and public spaces where broadcasting information or entertainment is required is contributing to the growth of the market.

The report has provided a detailed breakup and analysis of the commercial display market based on the product type. This includes digital signage, display monitor, and display TVs. According to the report, digital signage represented the largest segment.

Breakup by Technology:

- LCD

- LED

- Others

LCD holds the largest share in the industry

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes LCD, LED, and others. According to the report, LCD accounted for the largest market share.

Liquid crystal display (LCD) involves LCD panels, monitors, TVs, and interactive displays. LCD panels are the core components of LCD displays. They utilize liquid crystals to control the passage of light through individual pixels, resulting in images and text. LCD panels are available in various sizes and resolutions, catering to different display requirements. In addition, LCD monitors are widely used in office settings, control rooms, and as display solutions for personal computers. They offer sharp image quality, color accuracy, and are available in different screen sizes.

Light-emitting diode (LED) offers enhanced brightness, energy efficiency, and durability. In addition, LED video walls are constructed by tiling multiple LED display panels together, creating a seamless and high-impact visual experience. They are used in applications, such as command centers, retail environments, and event stages. Furthermore, LED displays utilize individual LEDs as pixels to create images. LED displays are known for their vibrant colors, high brightness levels, and suitability for outdoor and indoor use. They are commonly used in digital billboards, stadiums, and large-scale signage.

Breakup by Component:

- Hardware

- Software

- Services

Hardware represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services. According to the report, hardware represented the largest segment.

Hardware encompasses the physical elements that make up the display systems. It includes display panels, media players, mounting and installation hardware, connectivity and input devices, and control and management systems, which are essential for the functioning and display of content. Media players are hardware devices that play and manage content on commercial displays. In addition, they can be standalone devices or integrated into the display itself.

Software components in the commercial display market provide the intelligence and functionality that enable content creation, management, and delivery. It includes content management systems (CMS), digital signage software, operating systems, and interactive software. In addition, CMS software is used to create, schedule, and manage the content displayed on commercial displays. It allows users to design layouts, upload media files, and control when and where content is shown.

Services encompass various offerings that support the implementation, maintenance, and optimization of display systems. It comprises installation and integration services, content creation and design services, maintenance and support services, and training and education services. Installation and integration services involve the setup, installation, and integration of display systems into specific environments.

Breakup by Panel Type:

- Flat Panel

- Curved Panel

- Other Panel

Flat panel exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the panel type. This includes flat panel, curved panel, and other panel. According to the report, flat panel represented the largest segment.

Flat panel has a flat and two-dimensional (2D) screen surface and is known for its versatility and suitability for various applications. It includes LCD, LED, and organic light emitting diode (OLED) flat panels. LCD flat panels are known for their affordability and availability in various sizes. LED flat panels combine LED backlighting with LCD technology to offer improved brightness, energy efficiency, and contrast as compared to traditional LCD panels. OLED flat panels are known for their improved color accuracy and contrast ratios.

Curved panel provides an immersive viewing experience to individuals. It comprises curved LCD displays and curved LED displays. Curved LCD displays are often used in gaming monitors and immersive entertainment setups. Besides this, curved LED displays are used in digital signage and retail settings to create unique and attention-grabbing installations.

Breakup by Size:

- Below 32 inches

- 32 to 52 inches

- 52 to 75 inches

- Above 75 inches

32 to 52 inches represents the biggest market share

The report has provided a detailed breakup and analysis of the market based on the size. This includes below 32 inches, 32 to 52 inches, 52 to 75 inches, and above 75 inches. According to the report, 32 to 52 inches represented the largest segment.

Displays ranging between 32 to 52 inches are often considered mid-sized displays. These displays offer a balance between screen real estate and space efficiency. They are commonly used in retail environments for product promotion, advertising, and information displays. They are placed strategically near checkout counters, aisles, and product shelves to engage individuals. Besides this, meeting rooms in companies have mid-sized displays for presentations, video conferencing, and collaborative work. These displays offer a clear view to all meeting participants without overwhelming the space.

Below 32 inches are considered small-sized displays that are compact and suitable for specific applications where space is limited. In line with this, small displays are used in locations with limited wall space, such as elevators, waiting rooms, and narrow corridors, to convey information, advertising, and announcements. They are also used for point-of-sale (POS) systems in retail settings, displaying pricing, product information, and promotions at cash registers and checkout counters.

52 to 75 inches are ideal when a larger screen is required for impactful content delivery. In addition, these displays are used in conference rooms and boardrooms to facilitate presentations, video conferencing, and collaborative discussions to ensure clear visibility for all participants. Large venues, such as shopping malls, airports, and sports arenas, employ these displays for digital signage, wayfinding, and advertising due to their visibility in spacious areas.

Above 75 inches are considered extra-large or giant-sized displays. These displays are typically used for applications requiring a significant visual impact. They are utilized as digital billboards in high-traffic areas, along highways, and in urban centers to capture the attention of a large individuals with dynamic advertising.

Breakup by Application:

- Retail

- Hospitality

- Entertainment

- Stadiums & Playgrounds

- Corporate

- Banking

- Healthcare

- Education

- Transportation

Retail holds the largest market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes retail, hospitality, entertainment, stadiums and playgrounds, corporate, banking, healthcare, education, and transportation. According to the report, retail represented the largest segment.

The rising usage of digital signage in the retail applications for advertising, promoting products, and enhancing the in-store experience is propelling the market growth. Displays located at entrances, checkout counters, and throughout the store engage individuals with dynamic content. Interactive kiosks assist individuals with finding products, checking prices, and accessing additional information. They improve the shopping experience and reduce the need for staff intervention.

In the hospitality sector, displays are employed in guest rooms for in-room entertainment, providing guests with access to TV channels, streaming services, and hotel information. In line with this, in hotel lobbies and common areas, digital signage displays offer information about events, amenities, and local attractions. They create a welcoming and informative environment for guests.

The rising usage of displays for entertainment purposes, such as gaming and watching movies, is contributing to the market growth. In addition, these displays provide a cinematic experience to individuals. Besides this, displays with high refresh rates and low input lag are favored by gamers for console and personal computer (PC) gaming.

Stadiums and playgrounds have large LED displays to deliver live game coverage, replays, and advertising, enhancing the experience of individuals. In line with this, playgrounds and amusement parks use outdoor displays for information, ride announcements, and advertising. These displays can withstand outdoor conditions and deliver high-quality content.

Corporate is widely utilizing displays in conference rooms to enable presentations, video conferencing, and collaborative work. In addition, the rising adoption of high-resolution displays to enhance communication and decision-making is supporting the market growth.

The increasing employment of displays in the banking sector to inform individuals about services, interest rates, and promotions is strengthening the market growth. These displays contribute to a professional and user-friendly atmosphere. In addition, banking institutions use screens for account information and security alerts.

Breakup by Region:

.webp)

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest commercial display market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of the rising focus on advertising, branding, and enhancing the experience of individuals. In the United States and Canada, large retail chains, shopping malls, and boutique stores are increasingly adopting high-quality displays to engage more consumer base. In line with this, the growing adoption of commercial displays for corporate communication, collaboration, and presentations is offering a positive market outlook.

Asia Pacific stands as another key region in the market, driven by the increasing demand for commercial displays, including smart TVs, digital signage, and interactive kiosks, among the masses. In addition, the rising employment of commercial displays for advertising and brand promotion is supporting the market growth in the region. Moreover, there is an increase in the need for commercial displays in educational institutions for smart classrooms, digital whiteboards, and e-learning platforms.

Europe maintains a strong presence in the market on account of the growing demand for smart TVs in households among the masses. In line with this, people are seeking premium displays that enhance their overall watching experience. Furthermore, the rising utilization of commercial displays to enhance the in-store experience of people is impelling the growth of the market.

Latin America exhibits growing potential in the commercial display market due to the increasing deployment of displays in museums, galleries, and historical sites, to offer engaging multimedia experiences and educational content to visitors. Besides this, the rising focus on developing eco-friendly and energy-efficient displays is strengthening the market growth.

The Middle East and Africa region shows a developing market for commercial displays, primarily driven by the increasing number of hotels, resorts, and tourist destinations. Apart from this, the rising usage of commercial displays for advertising in shopping malls is contributing to the growth of the market.

Leading Key Players in the Commercial Display Industry:

Key players in the market are investing in research and development (R&D) activities to introduce advance display technologies with higher resolution panels, such as 4K and 8K. They are also focusing on improving color accuracy, enhancing energy efficiency, and exploring innovative technologies like OLED, microLED, and Mini-LED. Apart from this, many companies are offering customization options to tailor displays as per specific requirements of individuals and industries. They are creating displays with unique sizes, shapes, and specifications to fit various applications, ranging from curved screens to transparent displays. Furthermore, companies are developing displays that respond to touch, gestures, and stylus input, making them suitable for interactive kiosks, whiteboards, and other applications.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Cdw Corporation

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Koninklijke Philips N.V.

- LG Display Co., Ltd.

- NEC Display Solutions.

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Sony Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- March 29, 2023: Samsung Electronics Co., Ltd. unveiled its new interactive display with upgraded features and software solutions at British Educational Training and Technology (Bett) 2023. It helps educators amplify their existing lesson plans while introducing new strategies to enhance content delivery and collaboration with learners.

- November 17, 2022: Sony Corporation partnered with signageOS, a leader in cloud digital signage infrastructure, who will provide streamlined integration to support the professional 4K BRAVIA displays of Sony and create a more connected digital signage and content management system (CMS) framework for the company and their partners across the globe. The new signageOS partnership will nearly double the compatibility of displays of Sony to offer support for close to 60 integrated CMS options.

- August 2022: LG Display Co., Ltd announced a new 97-inch OLED EX TV panel that vibrates to produce 5.1 audio without the help of a built-in speaker. It utilizes the same OLED EX technology found in the latest flagship OLED TVs from LG and others to create a brighter and more accurate image.

Commercial Display Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Digital Signage, Display Monitor, Display TVs |

| Technologies Covered | LCD, LED, Others |

| Components Covered | Hardware, Software, Services |

| Panel Types Covered | Flat Panel, Curved Panel, Other Panel |

| Sizes Covered | Below 32 inches, 32 to 52 inches, 52 to 75 inches, Above 75 inches |

| Applications Covered | Retail, Hospitality, Entertainment, Stadiums & Playgrounds, Corporate, Banking, Healthcare, Education, Transportation |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cdw Corporation, Cisco Systems, Inc., Dell Technologies Inc., Koninklijke Philips N.V., LG Display Co., Ltd., NEC Display Solutions., Panasonic Corporation, Samsung Electronics Co., Ltd., Sharp Corporation, Sony Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial display market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global commercial display market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the commercial display industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

According to the estimates by IMARC Group, the global commercial display market is expected to grow at a CAGR of 6.37% during 2026-2034.

The increasing application of commercial displays in the healthcare, transportation, and education and training sectors, in confluence with the introduction of innovative technologies, represents one of the major drivers bolstering the market growth.

Due to the rising environmental concerns, leading players are introducing energy-efficient commercial displays that are incorporated with organic light-emitting diodes (OLED) and micro-LEDs.

Lockdowns have been implemented by governments of several countries to contain the spread of the coronavirus disease (COVID-19). In line with this, public spaces and transportation systems, including restaurants, airports, metro stations, stadiums and shopping malls, have been closed temporarily. Consequently, sales of commercial displays have declined around the world due to the pandemic.

Based on the product type, the market has been segmented into digital signage, display monitor and display TVs.

On the basis of the technology, the market has been categorized into LCD, LED and others.

On the basis of the component, the market has been segmented into hardware, software and services.

Based on the panel type, the market has been classified into flat, curved and other panels.

On the basis of the size, the market has been segmented into below 32, 32 to 52, 52 to 75 and above 75 inches.

Based on the application, the market has been categorized into retail, hospitality, entertainment, stadiums and playgrounds, corporate, banking, healthcare, education and transportation.

Region-wise, the market has been classified into North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia and others); Europe (the United Kingdom, Germany, France, Italy, Spain, Russia and others); Latin America (Brazil, Mexico and others); and Middle East and Africa.

Leading industry players are CDW Corporation, Cisco Systems, Inc., Dell Technologies Inc., Koninklijke Philips N.V., LG Display Co., Ltd., NEC Display Solutions., Panasonic Corporation, Samsung Electronics Co., Ltd., Sharp Corporation and Sony Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)