Commercial Boiler Market Size, Share, Trends and Forecast by Fuel Type, Technology, Capacity, End User, and Region, 2025-2033

Commercial Boiler Market Size and Share:

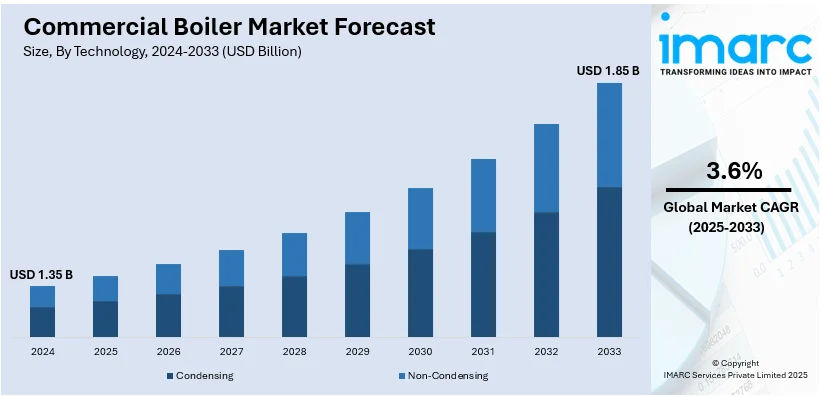

The global commercial boiler market size was valued at USD 1.35 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.85 Billion by 2033, exhibiting a CAGR of 3.6% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 40.0% in 2024. An increasing demand for energy-efficient heating systems, the rising focus on reducing carbon emissions, and stringent regulations incorporated by the government of various nations to adopt advanced commercial boilers represent some of the key factors increasing the commercial boiler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.35 Billion |

|

Market Forecast in 2033

|

USD 1.85 Billion |

| Market Growth Rate (2025-2033) | 3.6% |

Several factors, including the increasing demand for energy-efficient and sustainable heating solutions in commercial buildings, drive the commercial boiler market. Rising awareness of environmental concerns has led to a shift toward boilers with lower emissions and higher efficiency ratings. The need for reliable heating systems in industries such as hospitality, healthcare, and manufacturing further contributes to market growth. Additionally, the growing trend of industrial automation and smart heating technologies, such as IoT-enabled boilers, enhance system performance and reduce operational costs. Government regulations promoting the use of energy-efficient appliances and the replacement of outdated systems are also key factors. Increasing urbanization and the rise of commercial infrastructure projects globally are expected to further create a positive commercial boiler market outlook.

To get more information on this market, Request Sample

In the United States, several factors are driving the commercial boiler market. The growing demand for energy-efficient solutions in commercial and industrial sectors is a key driver, spurred by economic and environmental concerns. Strict government regulations on emissions and energy efficiency standards, such as those set by the Environmental Protection Agency (EPA), encourage businesses to adopt advanced, eco-friendly boilers. Additionally, rising operational costs push companies to invest in boilers that offer long-term cost savings through lower energy consumption. The increasing demand for reliable heating in large-scale commercial spaces, such as hotels, schools, hospitals, and manufacturing facilities, further represent one of the key commercial boiler market trends. For instance, in May 2024, a leading manufacturer of high-efficiency boilers and water heaters, Lochinvar, recently announced the release of their LECTRUS Light Commercial Electric Boiler. This cutting-edge technology supports the industry-wide shift to electrification and decarbonization while offering consumers choice. The shift toward smart technologies and automation in building systems further accelerates market adoption, as businesses seek more efficient and connected solutions.

Commercial Boiler Market Trends:

Adoption of Energy-Efficient Technologies

The rise in global sustainability and energy efficiency has motivated the adoption of new heating technologies in the commercial boiler market. The condensing boiler, which has the advantage of recovering heat from exhaust gases, is very popular. Traditional non-condensing boilers cannot compare with these systems since they can attain efficiency levels of up to 90% or higher and, thus consume much less energy and reduce operational costs. U.S. Department of Energy also allows tax incentives on high-efficiency systems, such as condensing boilers, to further push their implementation. In addition, with increased stringent energy standards, many businesses upgrade their heating systems to achieve compliance. Greenhouse gas reduction and cost-cutting measures fit the corporate sustainability strategy, and hence, savings will be realized in the long run. Integration of advanced technologies such as modulating burners and intelligent controls makes these boilers work better with the least energy wastage, indicating a transformative shift in the commercial boiler industry.

Expansion of Commercial Infrastructure

Increased demand for heating solutions is highly correlated with the increasing commercial infrastructure. With the construction of new buildings in health, education, and hospitality sectors, effective and efficient heating systems will be essential in-service operations. For instance, according to data presented by the U.S. Census Bureau, private non-residential construction spending hit a record high at USD 556.8 billion in 2022, further denoting growth commercial spaces. This growth is accompanied by increasing urbanization and economic activity, which fuels the demand for advanced heating solutions. Public sector investments in infrastructure, including schools and hospitals, further drive the adoption of commercial boilers. As urban centers expand, there is also a need for retrofitting older buildings with modern, energy-efficient heating systems to meet updated energy codes. The continued development of commercial properties points out that efficient heating technologies are essential to meeting the commercial boiler market demand of growing urban areas.

Technological Advancements and Integration

The commercial boiler industry is in a technological revolution that has greatly increased the design and functionality of this equipment. Advanced boilers are digitally designed to allow high precision in the monitoring and regulation of their activities to ensure maximum efficiency and reliability. For example, smart technologies that include IoT integration enable remote diagnostics and performance optimization, which have reduced downtime and maintenance costs. The U.S. Environmental Protection Agency (EPA) is reducing energy consumption by 10-15% in systems that have advanced digital controls. Manufacturers are also focusing on easy installation and compact designs to fit the space-constrained commercial setting. Innovations in materials and combustion technology further enhance the life and operational efficiency of these boilers. The adoption of these advanced systems not only caters to the increasing demand for smarter energy solutions but also supports sustainability goals, thus making technological integration a cornerstone of the commercial boiler market's evolution.

Commercial Boiler Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global commercial boiler market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on fuel type, technology, capacity, and end user.

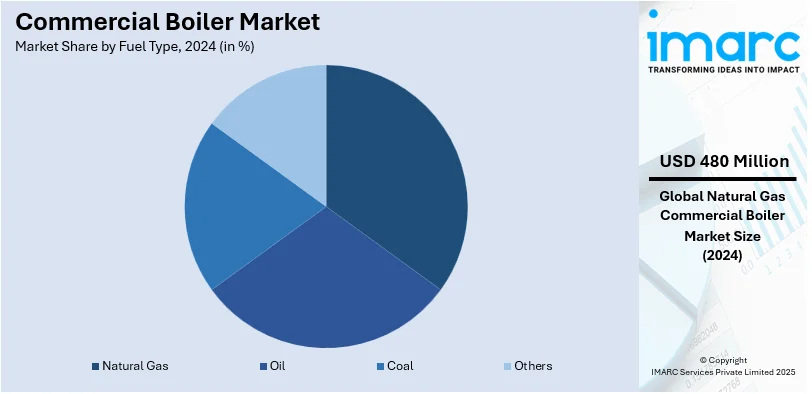

Analysis by Fuel Type:

- Natural Gas

- Oil

- Coal

- Others

Natural gas the market with around 35.4% of market share in 2024. Natural gas holds the largest share of the commercial boiler market due to its cost-effectiveness, availability, and relatively lower carbon emissions compared to other fossil fuels. It provides a reliable and efficient energy source for heating systems in various commercial sectors, including hospitality, healthcare, and manufacturing. The infrastructure for natural gas is well-established in many regions, making it an accessible and practical choice for businesses. Additionally, natural gas boilers typically offer high performance, quick heat-up times, and lower operational costs, making them attractive to commercial establishments aiming to balance efficiency with budget constraints while meeting regulatory standards.

Analysis by Technology:

- Condensing

- Non-Condensing

Condensing boilers are expected to hold the largest share in the commercial boiler market due to their high energy efficiency. They recover heat from exhaust gases, allowing them to achieve efficiency levels exceeding 90%. This results in lower energy consumption and reduced operational costs. With increasing energy prices and a focus on sustainability, businesses are increasingly adopting condensing boilers to meet regulatory standards and reduce their carbon footprint, making them a popular choice for energy-conscious commercial operations.

Non-condensing boilers continue to hold a significant share in the commercial market due to their affordability and simplicity. They are less complex than condensing models, requiring lower upfront investment and maintenance costs. While less energy-efficient, non-condensing boilers remain attractive to businesses where budget constraints are a priority. Their long-established presence in the market and reliability in less demanding applications, such as smaller commercial spaces, contribute to their continued popularity despite the shift toward higher-efficiency options.

Analysis by Capacity:

- Less Than 10 MMBtu/Hr

- 10-50 MMBtu/Hr

- Others

Boilers with a capacity of less than 10 MMBtu/hr hold the largest share of the commercial boiler market due to their widespread use in small to medium-sized commercial establishments, such as schools, small offices, and restaurants. These units offer sufficient heating power for moderate heating demands while remaining cost-effective and energy-efficient. Their lower initial investment and reduced operational costs make them an attractive option for businesses with less intensive heating needs. Additionally, their compact size and ease of installation in existing infrastructure further contribute to their popularity, driving the majority of market demand in this segment.

Analysis by End User:

- Offices

- Hospitals

- Educational Institutions

- Lodging

- Others

Offices hold the largest share of the commercial boiler market due to their high demand for consistent, efficient heating to ensure employee comfort and productivity. Boilers are essential for maintaining optimal temperature levels in office buildings, especially during colder months. The growing number of office spaces in urban areas, combined with a focus on energy efficiency and sustainability, drives the adoption of modern, high-performance heating systems. Additionally, many office buildings are retrofitted with boilers that meet regulatory standards for energy consumption and emissions, further reinforcing the demand for reliable, efficient heating solutions in office environments.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 40.0%. Commercial boiler market in Europe is operated steadily, driven primarily by energy costs increases, strict environmental regulation, and increased demand for efficiency in energy production. According to the European Commission, energy consumption by the commercial buildings in Europe covers about 40% of the total energy consumptions in the entire region, showing the significance of the installation of efficient heating systems. This increases the demand towards efficiency energy consumption in commercial buildings. Major contributors from the U.K., Germany, and France involve high-efficiency boilers and alternatives like heat pumps and hybrid solutions. Such technologies aim at aligning with the needs of sustainability in line with reducing carbon emissions because governments enforce various regulations for green energy sources. Companies such as Viessmann and Baxi are advancing more low-emission or renewable solutions, in turn combating these challenges faced by regulation and environmental demands.

Key Regional Takeaways:

North America Commercial Boiler Market Analysis

In North America, several factors are driving the commercial boiler market. Increasing demand for energy-efficient heating systems due to rising energy costs is a key driver, as businesses seek solutions to lower operational expenses. Stringent government regulations, such as energy efficiency standards and emissions reduction mandates, are pushing industries to adopt cleaner, more efficient technologies. Additionally, the growth of commercial infrastructure, including office buildings, hotels, and healthcare facilities, fuels demand for reliable and scalable heating solutions. The rise of sustainable building practices and the shift toward electrification and decarbonization also contribute to market growth. Technological advancements in smart boilers and IoT integration enhance operational efficiency, making these systems more attractive to commercial users. The aging boiler infrastructure prompts businesses to replace outdated systems with modern, high-efficiency alternatives.

United States Commercial Boiler Market Analysis

In 2024, the United States accounted for the largest market share of over 40.0% in North America. Increasing demands in various industries, such as healthcare, hospitality, and manufacturing sectors, are fuelling the growth of the U.S. commercial boiler market. The U.S. Energy Information Administration reported that, in 2023, commercial buildings accounted for about 17.2% of the nation's total energy consumption, while boilers are largely contributing to heating and energy efficiency. Energy-efficient and eco-friendly condensing and modular boilers are increasing the pace of growth in this market. The leading brands in the business are Cleaver-Brooks and Burnham Commercial, supplying sustainable solutions under stringent environmental laws. Moreover, the increasing requirements for heating system installation in newly constructed commercial developments and retrofitting of existing constructions are also witnessing steady market growth.

Asia Pacific Commercial Boiler Market Analysis

The Asia Pacific market for commercial boilers is growing rapidly due to industrialization, infrastructure development and an increasing amount of demand for energy efficiency. According to industrial reports, in China, for example, public buildings use 40% of all energy consumed in buildings within 2023. Public buildings are, therefore, recommended to adopt more energy-efficient heating. In India, commercial buildings use almost 8.29% of the electricity utilized within the country. This percentage is likely to increase as the building sector is constantly expanding. It projects India's electricity consumption of its commercial sector will grow from 59% in 2015 to 65% in 2040. It will boast the world's highest annual growth rate at 5.4%. India has added 300,000 square feet of commercial floor space per day in a period that was simply remarkable in real estate development in commercial buildings. It thus places high demands for modern and efficient boilers with sustainable characteristics to go along with those ideals. Companies like Babcock & Wilcox and Thermax are now focusing on delivering cost-efficient and eco-friendly solutions to the growing demand for energy-efficient heating systems in the region.

Latin America Commercial Boiler Market Analysis

The commercial boiler market in Latin America is witnessing stable growth with the boom in industrial expansions, the urge for energy-saving solutions, and supporting regulations. For instance, commercial buildings make up around 15.7% of total electricity demand in Brazil, thereby making energy-efficient solutions for commercial heating systems important, as per reports. According to the Inter-American Development Bank, Brazil leads the region with a projected growth rate of 3.4% from 2024 to 2032, driven by industrialization and government initiatives focused on sustainability. The world's largest energy consumers are Brazil and others, but Brazil alone takes 2.0% of the global consumption of energy, has a renewable electricity matrix, with hydropower accounting for 64.9% of the energy generated in 2019, as per industry reports. However, water scarcity hampers hydropower development, and energy generation is turned over to fossil-fueled generation. In this regard, demand for an energy-efficient boiler system that could reduce reliance on fossil fuels grows. Companies like Grupo Roca and Ideal Boilers are ready to take up the challenge of rising demand for boiler systems based on conventional as well as renewable energy sources.

Middle East and Africa Commercial Boiler Market Analysis

The Middle East and Africa commercial boiler market is gaining pace due to growing industrialization, construction activities, and energy-efficient systems. According to industry reports, commercial and domestic buildings consume 78% of the electrical energy of the United Arab Emirates, showing that efficient heating solutions play a very important role in reducing energy consumption. Saudi Arabia and South Africa will invest in energy-efficient boiler technologies to meet increasing demand for energy and to meet the requirement for sustainability. Notable governments in the region are advising on the adoption of more sophisticated heating systems that can reduce carbon emissions. Local manufacturers, such as Bosch and Daewoo, are beginning to expand their facilities to provide innovative solutions to the growing market and stricter environmental requirements in the Middle East and Africa.

Competitive Landscape:

The commercial boiler market is highly competitive, with key players like Bosch Thermotechnology, Viessmann, and Lennox International dominating the landscape. These companies focus on innovation, offering a range of high-efficiency, energy-saving boilers to meet the growing demand for sustainable heating solutions. Market players are increasingly investing in smart technologies, such as IoT-enabled boilers, to enhance system efficiency and operational performance. The market also sees strong competition from regional and local players offering affordable and flexible solutions, especially in mobile and rental boiler services. Strategic acquisitions and partnerships are common as companies expand their offerings and strengthen market presence, particularly in energy-efficient and environmentally friendly technologies. For instance, in July 2024, Viessmann Climate Solutions UK launched the Vitocrossal 200 CI3, a highly efficient commercial gas condensing boiler designed for space-saving applications. This model features a 55% smaller footprint than previous versions, with eight output sizes ranging from 80-640 kW and integrated-control cascade operation up to 5120 kW. It boasts a seasonal efficiency of up to 94.8% and low NOx emissions below 27 mg per kWh. The boiler's advanced technology includes a dual modulating burner and self-calibrating O₂ sensor, enhancing performance and operational safety.

The report provides a comprehensive analysis of the competitive landscape in the commercial boiler market with detailed profiles of all major companies, including:

- A. O. Smith

- AERCO International, Inc. (Watts Water Technologies)

- Ariston Holding N.V.

- Bosch Industriekessel GmbH

- Cleaver-Brooks

- Cochran Ltd

- Energy Kinetics

- Fulton

- Parker Boiler

- PB Heat LLC. (NORITZ Corporation)

- Vaillant Group

- WM Technologies LLC

Recent Developments:

- November 2024: Vaillant Group announced that they have opened a new electronics factory in Remscheid, starting production. It will produce 5 million electronic components annually with the possibility of further expansion. It will be supplied to all Vaillant Group sites for their heat pump and gas heating systems.

- June 2024: Superior Boiler has recently established new representative partnerships in multiple states. The new partnerships will be used to continue to meet changing customer needs while continuing to grow Superior's reputation for quality products and customer service, with an emphasis on responding to technological change in the boiler industry.

- May 2024: Cleaver-Brooks announced acquisition by Miura Co., Ltd., the focus for which is in developing sustainable boiler room solutions. Biological safety testing is not mentioned but it is a collaboration that aims to improve service and engineering in industries reliant on heat as a production resource.

- February 2024: WM Technologies, LLC, leader in hydronic comfort heating solutions, extended its Stainless Vertical Firetube (SVF™) boiler family. The Weil-McLain SVF line has been supplemented by new BTU sizes: 500, 600, 725, 850, and 1000 MBH besides the ones that already existed.

- April 2021: Mestek Inc. acquired the assets of Slant/Fin's baseboard. Tim Markel, president of Mestek's distributor products group, said, "We are thrilled to continue the legacy of hydronic baseboard from both companies, and proud to carry on the Slant/Fin Baseboard brand."

Commercial Boiler Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Natural Gas, Oil, Coal, Others |

| Technologies Covered | Condensing, Non-Condensing |

| Capacities Covered | Less Than 10 MMBtu/Hr, 10-50 MMBtu/Hr, Others |

| End Users Covered | Offices, Hospitals, Educational Institutions, Lodging, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A. O. Smith, AERCO International, Inc. (Watts Water Technologies), Ariston Holding N.V., Bosch Industriekessel GmbH, Cleaver-Brooks, Cochran Ltd, Energy Kinetics, Fulton, Parker Boiler, PB Heat LLC. (NORITZ Corporation), Vaillant Group, WM Technologies LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial boiler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global commercial boiler market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the commercial boiler industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial boiler market was valued at USD 1.35 Billion in 2024.

The commercial boiler market is projected to exhibit a CAGR of 3.6% during 2025-2033, reaching a value of USD 1.85 Billion by 2033.

Key factors driving the global commercial boiler market include rising demand for energy-efficient heating solutions, stringent environmental regulations, increasing urbanization, and growth in commercial infrastructure. Technological advancements, such as IoT-enabled systems, and the push for sustainable, low-emission solutions further fuel market expansion as industries prioritize cost savings and eco-friendly operations.

Europe currently dominates the commercial boiler market, accounting for a share of 40% in 2024. Increased energy costs, strict environmental regulation, and increased demand for efficiency in energy production represents some of the key factors driving the commercial boiler market in the European region. The market is further driven by the strategic acquisitions and partnerships are common among the key players, as companies expand their offerings and strengthen market presence, particularly in energy-efficient and environmentally friendly technologies.

Some of the major players in the commercial boiler market include A. O. Smith, AERCO International, Inc. (Watts Water Technologies), Ariston Holding N.V., Bosch Industriekessel GmbH, Cleaver-Brooks, Cochran Ltd, Energy Kinetics, Fulton, Parker Boiler, PB Heat LLC. (NORITZ Corporation), Vaillant Group and WM Technologies LLC.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)