Commercial Aircraft Carbon Brakes Market Size, Share, Trends and Forecast by Aircraft Type, Material, Manufacturing Process, End User, and Region, 2025-2033

Commercial Aircraft Carbon Brakes Market Size and Share:

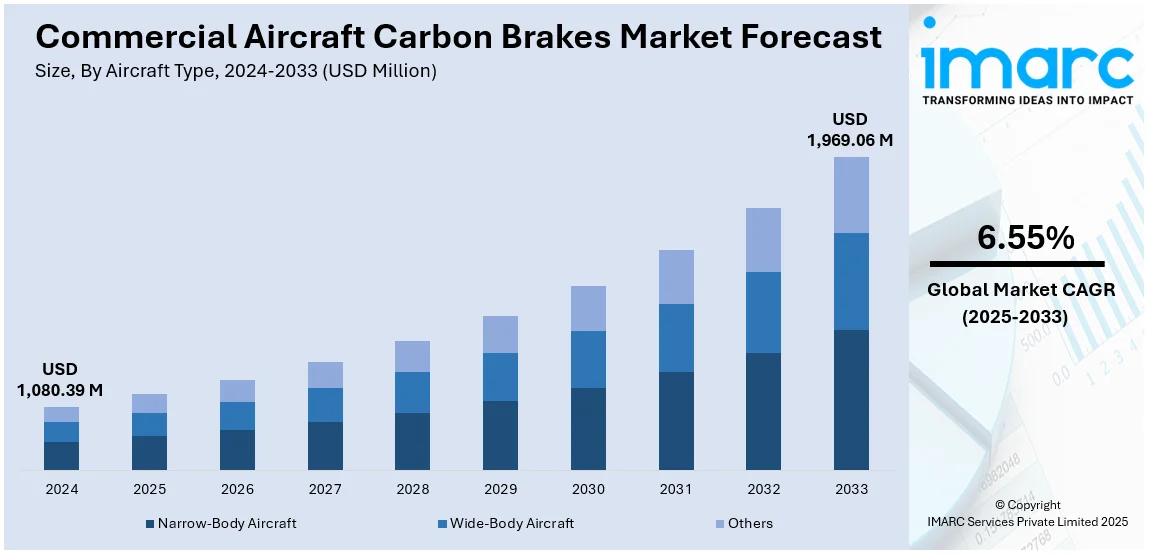

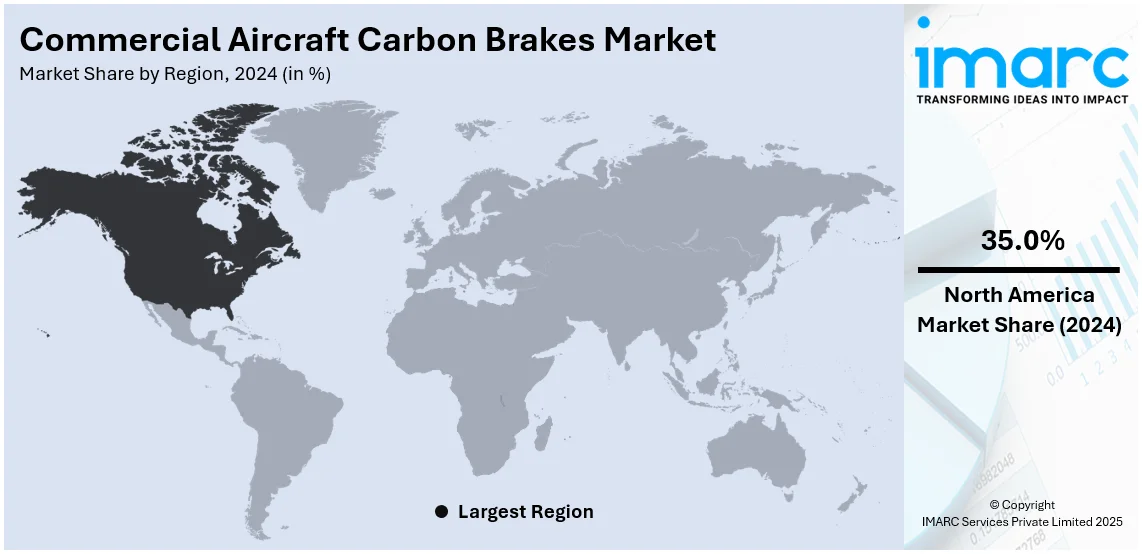

The global commercial aircraft carbon brakes market size was valued at USD 1,080.39 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,969.06 Million by 2033, exhibiting a CAGR of 6.55% from 2025-2033. North America currently dominates the market, holding a market share of over 35.0% in 2024. The significant growth in commercial aircraft production, heightened demand for fuel efficiency and sustainability, rapid technological advancements in brake materials, and ongoing growth in air traffic and fleet expansion are some of the major factors bolstering the commercial aircraft carbon brakes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,080.39 Million |

|

Market Forecast in 2033

|

USD 1,969.06 Million |

| Market Growth Rate (2025-2033) | 6.55% |

The commercial aircraft carbon brakes market growth is strongly tied to the production levels of leading aircraft manufacturers. In 2024, Airbus delivered 766 commercial aircraft, slightly below its revised target of 770, due to supply chain disruptions, particularly in engine production. Despite these challenges, Airbus aims to increase production by at least 10% in 2025, potentially achieving 850 deliveries, with plans to reach a monthly production rate of 75 A320 and A321 aircraft by 2027. According to the International Air Transport Association (IATA), the airline industry reached 2019 levels of Revenue Passenger Kilometers (RPKs) by February 2024. The total RPKs for the year are projected to grow by 11.6%, reflecting strong demand for air travel. This sustained demand for new aircraft directly influences the market for carbon brakes, as manufacturers and airlines seek advanced braking systems to equip their expanding fleets.

Several important factors drive the growth of the commercial aircraft carbon brakes market demand in the United States, which holds 91.20% share. The Federal Aviation Administration (FAA) is actively modernizing the National Airspace System (NAS) through initiatives like NextGen, which aims to enhance safety and efficiency. The FAA's NextGen Annual Report highlights the expansion of the aerospace ecosystem, including the integration of advanced air mobility and unmanned aircraft systems. This modernization supports the adoption of advanced technologies, such as carbon brakes, in commercial aircraft. Additionally, the FAA's emphasis on sustainability is promoting environmentally friendly practices, including the use of sustainable aviation fuels and measures to reduce carbon emissions. This emphasis corresponds with the industry's move towards lighter and more efficient components, driving up the demand for carbon brakes. Furthermore, the FAA's commitment to safety and innovation, as outlined in the National Aviation Research Plan (NARP) for FY 2020–2025, encourages the development and integration of advanced materials and technologies in aviation. This environment fosters the growth of the carbon brakes market as manufacturers seek to meet evolving safety standards and technological advancements.

Commercial Aircraft Carbon Brakes Market Trends:

Increasing Demand for Fuel Efficiency and Sustainability

Carbon brakes are light in weight, so they operate better and help save fuel, as well as costs for the airlines to run. Aviation with increased demands for its sustainability and less carbon emission policies has resulted in carbon brakes being integral parts of eco-friendly and fuel efficiency strategies. Airlines are keenly adopting the use of carbon brakes to gain environmental compliance along with effective operation. According to IATA, each new generation of aircraft is 20% more fuel-efficient than the one it replaces. With this improved fuel efficiency, combined with the long lifespan and low maintenance requirements of carbon brakes, operational costs decrease further, fueling the growth of the commercial aircraft carbon brakes market share. As the industry pushes to make improvements in the environmental-friendly aspects, the carbon brake remains the core and integral component toward bettering fuel efficiency as well as toward sustainability in air travel.

Technological Advancements in Brake Materials

Ongoing advancements in materials and manufacturing techniques, particularly with carbon-carbon composites, greatly improve the performance, durability, and reliability of carbon brakes. Innovations in braking technologies ensure that these systems can tolerate greater temperatures, thus providing better resistance to wear while enhancing aircraft safety. Such benefits have increased carbon brakes' popularity among aircraft manufacturers and operators alike, further leading to an expanding commercial aircraft carbon brakes market. Global air traffic is another aggressive growth factor of the market. Industry reports reflect that, globally, air traffic passenger demand surpassed by more than 36 percent in 2023 as compared to the same period of last year. Such a passenger traffic boom creates the demand for higher aircraft utilization with regard to requirements for advanced, reliable, efficient braking systems, thus leading to an even greater adoption rate in commercial aviation of carbon brakes. With the continued recovery and growth of air travel, the demand for high-performance carbon brakes is anticipated to increase.

Growth in Air Traffic and Aircraft Fleet Expansion

The growth of air travel across the globe, especially in emerging markets, has created a demand for new commercial aircraft. Such demand requires high-performance, durable braking systems like carbon brakes. Besides the new aircraft fleet, the replacement of older models with more fuel-efficient ones also fuels the demand for advanced braking solutions. New and old aircraft will be the major components of a large commercial fleet that are installed with enhanced brakes. In its report, International Air Transport Association has estimated the total units to be operational for narrow body aircraft across the globe by 2032, totaling 24,285 units. This will raise the number of aircraft significantly and boost demand for carbon brakes even more, since airlines and operators seek lighter, stronger, and higher-performance braking systems to accommodate growing air traffic.

Commercial Aircraft Carbon Brakes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global commercial aircraft carbon brakes market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on aircraft type, material, manufacturing process, and end user.

Analysis by Aircraft Type:

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Others

As per the latest commercial aircraft carbon brakes market outlook, narrow-body aircraft dominate the market, holding 68.1% share. This is largely due to the increasing demand for short- to medium-haul flights and expansion of low-cost carriers (LCCs). These aircraft are favored due to their fuel efficiency, as well as the ability to serve high-frequency routes, which explains how they are popular across different airline fleets. Recent industry data indicate that narrow-body aircraft deliveries account for the largest share of global commercial aircraft production. Primary models include the Airbus A320neo and Boeing 737 MAX, for which both companies are now investing in and raising their production volumes. Carbon brakes have lightweight and high durability, which matches the requirements for narrow-body aircraft both in operational usage and performance, with reduced maintenance and fuel use. This segment is expected to remain dominant, with growth supported by increasing air travel in emerging markets and airlines' efforts to update fleets with more fuel-efficient aircraft.

Analysis by Material:

- Petroleum Pitch

- Polyacrylonitrile

According to the recent commercial aircraft carbon brakes market forecast, polyacrylonitrile (PAN)-based carbon materials hold the largest share of 58.5% in the market due to their superior mechanical and thermal properties. PAN-derived carbon fibers offer exceptional strength, high heat resistance, and reduced wear during high-temperature braking conditions. These properties are critical in ensuring reliable and efficient performance in modern aircraft braking systems. Additionally, improvements in PAN-based composites have boosted their durability and cost-efficiency, making them the material of choice for carbon brake manufacturers. Industry trends indicate a shift towards using PAN as a standard in the aviation sector, supported by stringent safety regulations and the increasing adoption of lightweight materials to improve fuel efficiency. In 2024, PAN-based materials accounted for the majority of the shares of the carbon brake market, with leading suppliers investing heavily in research and development (R&D) to optimize production processes and further improve material performance.

Analysis by Manufacturing Process:

- Chemical Vapor Infiltration

- Liquid Phase Infiltration

Chemical vapor infiltration (CVI) is the dominant manufacturing process in the commercial aircraft carbon brakes market, accounting for a share of 68.4%. This is due to its capability to produce high-density carbon-carbon composites with exceptional thermal stability. The CVI process allows for precise control over material properties, resulting in brakes that are lightweight, durable, and capable of withstanding extreme braking forces. Although the process is time-intensive and costly, the superior quality of the end product justifies its widespread adoption. Technological advancements in CVI techniques, such as optimized infiltration cycles and advanced gas-phase deposition methods, have improved production efficiency and reduced costs. The aviation industry's focus on safety, performance, and durability ensures that CVI remains the preferred choice for manufacturing carbon brake systems, particularly for high-performance commercial aircraft.

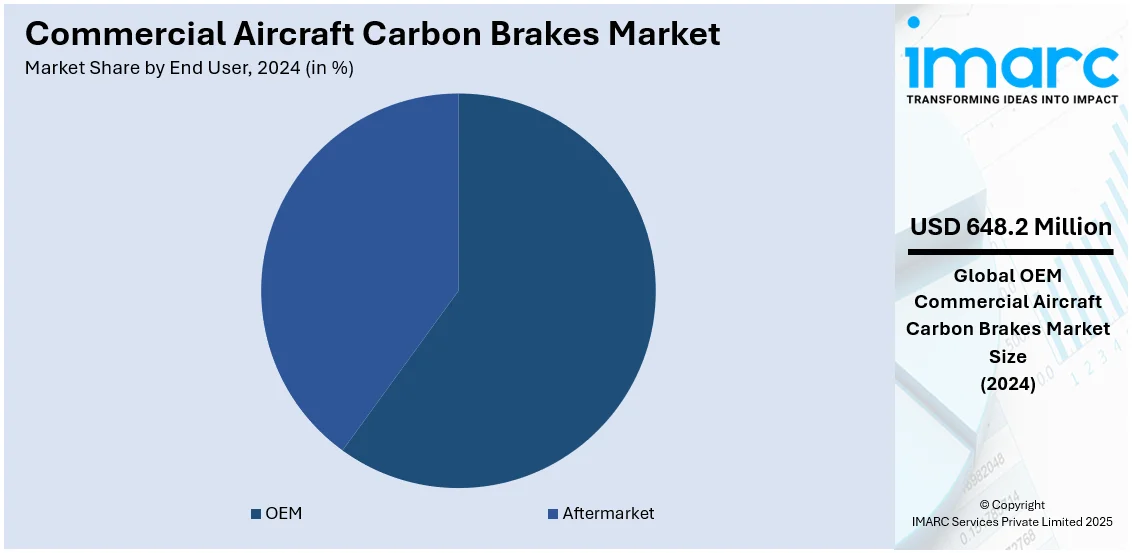

Analysis by End User:

- OEM

- Aftermarket

Original equipment manufacturers (OEMs) dominate the commercial aircraft carbon brakes market with a share of 60.0%, fueled by the rising demand for new aircraft and the incorporation of advanced braking systems during manufacturing. OEMs work closely with carbon brake manufacturers to ensure that braking systems meet stringent safety and performance standards. Key players such as Airbus and Boeing prioritize lightweight and durable carbon brakes to enhance fuel efficiency and reduce operational costs. Furthermore, the trend toward longer maintenance intervals and increased reliability has increased demand for OEM-installed brakes. With airlines expanding their fleets and governments investing in next-generation aviation infrastructure, the dominance of OEMs in this segment is expected to persist.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the majority share of 35.0% in the commercial aircraft carbon brakes market, driven by its well-established aviation industry and high aircraft production rates. The region is home to leading manufacturers like Boeing and prominent suppliers of advanced braking systems, creating a robust supply chain for the market. Additionally, the United States leads in air passenger traffic, contributing significantly to the demand for commercial aircraft and maintenance services. Apart from this, the Federal Aviation Administration (FAA) and other regulatory bodies pushing for innovations in safety and performance are further boosting the dominance of North America in this sector. The rise of domestic and international air travel, coupled with increasing investment in lightweight and fuel-efficient technologies, further cements North America's position as a key market. The presence of major Maintenance, Repair, and Overhaul (MRO) hubs also drives the region’s dominance in carbon brake adoption.

Key Regional Takeaways:

United States Commercial Aircraft Carbon Brakes Market Analysis

Inbound long-haul travel in the United States is expected to grow by a significant amount, with industry reports projecting 37 million annual visitors by 2030. Air travel is expected to experience significant growth, leading to an increased demand for new commercial aircraft. This means there will be an increased requirement for advanced, high-performance braking systems such as carbon brakes. Carbon brakes are light in weight and offer superior performance. They will help airlines reduce fuel consumption and improve operational efficiency. As air travel continues to expand, especially in the long-haul sector, airlines will prioritize fuel efficiency, operational cost reduction, and sustainability—factors that carbon brakes effectively address. The increasing deliveries of newly manufactured aircraft and old aircraft being upgraded with contemporary brake facilities will result in constant growth in the demand for commercial aircraft carbon brakes within the United States. This is consistent with the broader industry trend: growing aspirations within the aviation sector to conserve water resources, become eco-friendly, and handle more passengers on an annual basis.

Europe Commercial Aircraft Carbon Brakes Market Analysis

British Airways had recently won an order to acquire six new Boeing 787-10 aircraft by September 2023. Demand for modern and fuel-efficient commercial aircraft is going up in Europe, as a larger trend where air travel volumes are recovering towards pre-pandemic levels in the region. Between January and March 2024, the European Union carried about 198 million passengers, representing a minimal decline of 0.81% from 2019, according to the European Commission. This increase in air traffic, combined with the introduction of newer aircraft models such as the Boeing 787-10, is fueling the demand for advanced braking systems, including carbon brakes. With this carbon brake type, airlines could save fuel while enhancing operational efficiency and meeting the sustainability goals required by the end-users. Europe's commercial aircraft carbon brakes market is expected to grow further on the back of increased fleet renewal and retrofitting of older aircraft as demand increases for more environmental-friendly and efficient aviation solutions.

Asia Pacific Commercial Aircraft Carbon Brakes Market Analysis

As IBEF reports, the country focuses on adding more wide-body aircraft to its fleet and beefing up direct international routes to make its country one of the top aviation hubs in the world ahead of India's projected rise in domestic air traffic to 164-170 million passengers by March 2025. With the changing nature of air travel, the advancement and performance of commercial aircraft and their parts, such as braking systems, are in great demand for higher performance and durability. Carbon brakes are light in weight and offer excellent performance, thus becoming the airline choice for those flying in Asia-Pacific. Increasing aircraft purchases and fleet upgrades lead airlines in the region to more frequently use carbon brakes to lower fuel consumption, enhance operational efficiency, and achieve sustainability goals. The commercial aircraft carbon brakes market in the Asia-Pacific region is projected to grow, driven by the rising demand for advanced braking solutions, such as carbon brakes, as India and other countries in the region continue to develop their aviation industries.

Latin America Commercial Aircraft Carbon Brakes Market Analysis

The 4.7% growth in passenger traffic at Latin American and Caribbean airports during the first half of 2024 reflects a strong recovery of the aviation sector, according to industry reports. This growth in air traffic has been driving the demand for new commercial aircraft, and consequently, for high-performance braking systems, such as carbon brakes. Carbon brakes have a lighter weight, which reduces fuel consumption, increases fuel efficiency, and improves resistance to heat, making them the best option for the ever-growing fleet of aircraft in the region. Carbon brake systems are also becoming popular among airlines in Latin America, who are updating their fleets with new, fuel-efficient aircraft. Moreover, increased attention towards sustainability and fuel efficiency will enhance the demand for carbon brakes since it contributes to cost reduction and lowering of CO2 emissions. Given the robust growth in the region's aviation sector, demand for high-end braking solutions such as carbon brakes will be witnessed in Latin America, thereby boosting market growth.

Middle East and Africa Commercial Aircraft Carbon Brakes Market Analysis

IATA reports that Dubai International Airport (DXB) became the world's busiest hub for international traffic in the third quarter of 2023, handling 22.9 million passengers, the highest quarterly traffic since 2019. This 40% increase in passenger traffic reflects the region's rapid recovery and growing demand for air travel. With the ever-growing aviation industry in the Middle East and Africa, airlines are investing in new, fuel-efficient aircraft to keep up with growing passenger volume. This surge in demand for new and upgraded aircraft is creating a need for advanced braking systems, including commercial aircraft carbon brakes. Carbon brakes have a lightweight structure, better performance, and reduced fuel consumption; hence, these are the ideal choice for the airlines to decrease operational costs and emissions. As the airlines in this region continue their fleet modernization, the carbon brake systems would be in increased demand, thereby further driving the commercial aircraft carbon brakes market in the Middle East and Africa region.

Competitive Landscape:

As per the emerging commercial aircraft carbon brakes market trends, key players are concentrating on innovation, forming strategic partnerships, and expanding globally to enhance their market presence. They are making significant investments in R&D to boost the performance, durability, and efficiency of carbon brake systems. This includes advancements in material science, such as the development of more robust polyacrylonitrile (PAN)-based composites and enhanced chemical vapor infiltration (CVI) techniques to produce high-quality carbon-carbon composites. Moreover, leading players are utilizing digital technologies to streamline production processes and enhance supply chain efficiency. Furthermore, strategic collaborations with major aircraft manufacturers are a critical focus area, allowing these companies to align their products with next-generation aircraft models. Numerous leading manufacturers are also increasing their presence in emerging markets, where air travel is experiencing rapid growth. This includes setting up manufacturing facilities and service centers to cater to the increasing demand.

The report provides a comprehensive analysis of the competitive landscape in the commercial aircraft carbon brakes market with detailed profiles of all major companies, including:

- Collins Aerospace

- Crane Aerospace & Electronics, Inc.

- Honeywell International Inc.

- Meggitt Plc (Parker-Hannifin Corporation)

- Mersen

- Safran S.A.

Latest News and Developments:

- April 2024: Safran Landing Systems presented a new generation of lightweight carbon brake discs with the objective of saving fuel in aircraft and cutting down CO2 emissions.

- March 2024: Meggitt PLC expanded the size of its manufacturing facility in Singapore to increase production capacity for high-performance carbon brake discs, responding to the growing demand in the Asia-Pacific region.

- February 2024: Honeywell Aerospace purchased a majority share in one of the well-known carbon brake disc manufacturers for building up the portfolio of products as well as expertise in the technologies being used.

- January 2024: Collins Aerospace formed a strategic partnership with a European aerospace company to jointly develop next-generation carbon brake technology.

Commercial Aircraft Carbon Brakes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Aircraft Types Covered | Narrow-body Aircraft, Wide-body Aircraft, Others |

| Materials Covered | Petroleum Pitch, Polyacrylonitrile |

| Manufacturing Processes Covered | Chemical Vapor Infiltration, Liquid Phase Infiltration |

| End Users Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Collins Aerospace, Crane Aerospace & Electronics, Inc., Honeywell International Inc., Meggitt Plc (Parker-Hannifin Corporation), Mersen, Safran S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the commercial aircraft carbon brakes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global commercial aircraft carbon brakes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the commercial aircraft carbon brakes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial aircraft carbon brakes market was valued at USD 1,080.39 Million in 2024.

IMARC estimates the commercial aircraft carbon brakes market to exhibit a CAGR of 6.55% during 2025-2033, reaching USD 1,969.06 Million by 2033.

The significant growth in commercial aircraft production, heightened demand for fuel efficiency and sustainability, rapid technological advancements in brake materials, and ongoing growth in air traffic and fleet expansion are some of the major factors bolstering the commercial aircraft carbon brakes market share.

North America currently dominates the market due to its well-established aviation sector and high aircraft production levels. The region hosts major manufacturers such as Boeing and key suppliers of advanced braking systems, fostering a strong supply chain for the market.

Some of the major players in the commercial aircraft carbon brakes market include Collins Aerospace, Crane Aerospace & Electronics, Inc., Honeywell International Inc., Meggitt Plc (Parker-Hannifin Corporation), Mersen, Safran S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)