Colostrum Market Size, Share, Trends and Forecast by Form, Distribution Channel, and Region, 2025-2033

Colostrum Market Size and Share:

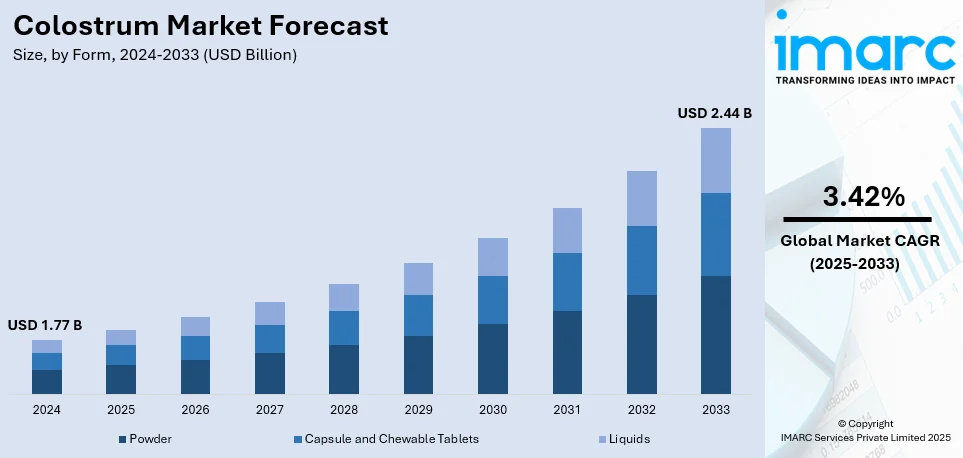

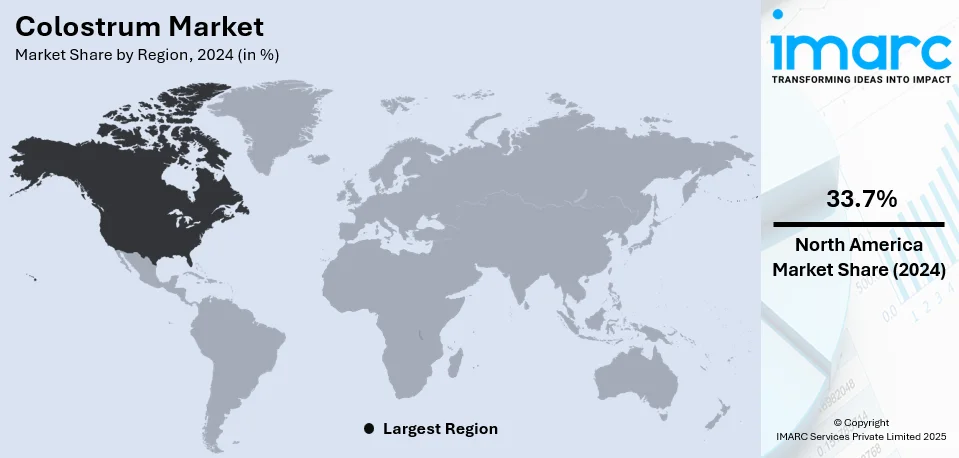

The global colostrum market size was valued at USD 1.77 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.44 Billion by 2033, exhibiting a CAGR of 3.42% from 2025-2033. North America currently dominates the market, holding a market share of over 33.7% in 2024. The colostrum market share is expanding driven by the increasing consumer awareness of the health benefits of colostrum, diverse product applications across industries, innovative product developments, regulatory support for quality standards, and the growing preferences for natural and nutritional health products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.77 Billion |

| Market Forecast in 2033 | USD 2.44 Billion |

| Market Growth Rate (2025-2033) | 3.42% |

The colostrum industry has seen a big uptick, due to health trends and changing preferences. One of the main reasons driving the market is that more people now know about how colostrum can boost health. Packed with immune-boosting proteins, growth-promoting elements, and active ingredients, colostrum can improve the immune system, improve gut health, and help promote overall wellness. This knowledge has led to higher demand from folks looking for natural supplements to stay healthy and ward off sickness. The shift towards staying ahead of health issues has also sparked more interest in colostrum products, as buyers look for natural ways to support their health in the long run, thereby driving the colostrum market demand.

The United States has become a significant area in the colostrum market due to various reasons. A major factor behind this market growth is the rising recognition among users about the health benefits of colostrum. Packed with antibodies, growth factors, and bioactive substances, colostrum is thought to aid immune function, improve gut health, and foster overall wellness. The US sports nutrition industry has likewise played a role in the increasing need for colostrum. Athletes and fitness fans are progressively opting for colostrum supplements, drawn by promises of better muscle recovery, boosted performance, and stronger immunity. The existence of growth factors in colostrum, which could support tissue repair and muscle development, renders it an attractive supplement for sports nutrition plans. This is resulting in the creation of protein powders and supplements enriched with colostrum designed specifically for athletes. In 2025, Vital Proteins, a company that specializes in collagen peptide supplements, launched Vital Proteins Colostrum Capsules, made with bovine colostrum from US cows, aimed at supporting immune and gut health.

Colostrum Market Trends:

Increasing awareness about health benefits of colostrum

The increased recognition of various health advantages of colostrum is driving the market expansion. Colostrum is a nutrient-dense material that significantly contributes to enhancing health and well-being. It is particularly noted for its elevated levels of antibodies, mainly immunoglobulins, which are crucial for boosting the immune system. The worldwide immunoglobulin market was assessed at USD 16.45 Billion in 2024. Additionally, it offers passive immunity to infants, safeguarding them against different illnesses. Moreover, colostrum supplements are thought to provide comparable immune-enhancing advantages, which contributes to their popularity in the dietary supplement market. Additionally, it contains various growth factors, such as insulin-like growth factors, transforming growth factors, and epithelial growth factors, which are essential for healing, tissue repair, and stimulating the development of muscle, bone, and cartilage. In addition to this, the inclusion of prebiotics and probiotics in colostrum supports gut health, which is essential for proper digestion and nutrient absorption.

The rising product application in various industry

The adaptability of colostrum regarding its uses in different industries is a key element propelling market expansion. Correspondingly, it is commonly found in dietary supplements, including capsules, tablets, powders, and liquid forms, addressing various consumer preferences. Moreover, colostrum is extensively used in sports nutrition because of its growth factors and natural hormones, which are thought to support muscle development, lessen recovery duration, and enhance bone health. As stated in a 2023 article from the University of Saskatchewan, for intense exercise (approximately 1-3 hours of high-intensity workouts each day), it is advised to intake 6-10g/kg BW/d. Consequently, a person weighing 70kg needs between 420g and 700g of carbohydrates daily. This regulator helps athletes control their everyday carbohydrate intake. Moreover, colostrum is extensively used in the infant formula sector because of its nutrient-dense composition that closely resembles that of human colostrum. In addition to this, colostrum is widely utilized in the animal feed sector to guarantee that cattle obtain sufficient immunity and nutrition during their early life stages. Moreover, the widespread product adoption in the pharmaceutical industry for treating specific health conditions is supporting the colostrum market growth.

Growing consumer awareness and preferences

The increasing consumer knowledge and preference for natural and nutritional health products driven by the heightened awareness of immunity's significance is fueling the market expansion. Consumers are becoming increasingly informed about the particular advantages of different nutritional supplements, thanks to the readily accessible information on the internet and the educational marketing efforts by health-related companies. The size of the global nutraceuticals market hit USD 500.0 Billion in 2024. In this regard, colostrum is viewed as a natural, non-artificial alternative to numerous other supplements, matching consumer demand for 'clean' and 'green' items. Moreover, the increase in particular health trends, like the emphasis on gut health, individualized nutrition, and proactive healthcare, has generated a specialized market for colostrum-derived products, serving as another catalyst for growth. Additionally, consumers are looking for specific remedies for immunity, digestive wellness, and nutrition, which is increasing the demand for colostrum as an effective supplement.

Colostrum Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global colostrum market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on form and distribution channel.

Analysis by Form:

- Powder

- Whole Colostrum Powder

- Skimmed Colostrum Powder

- Specialty Colostrum Powder

- Capsule and Chewable Tablets

- Liquids

Powder (whole, skimmed, and specialty colostrum powders) holds 39.8% of the market share. The powder form of colostrum constitutes the largest segment due to its versatility, ease of use, and long shelf life, thereby offering a favorable colostrum market outlook. Colostrum powder is created by drying liquid colostrum, typically through methods such as freeze-drying or spray drying, which aid in maintaining the nutritional value and bioactive elements. Additionally, it is greatly preferred in the dietary supplement sector because of its convenience in packaging, storage, and transport. Moreover, consumers are attracted to powder form because it can be easily mixed into different food and beverage (F&B) items, like protein shakes, smoothies, and health bars, which makes it a flexible choice for everyday consumption. Additionally, the powdered format serves various market applications including infant nutrition, sports nutrition, and overall wellness.

Analysis by Distribution Channel:

- B2B

- Dietary Supplements

- Sports Nutrition

- Functional Foods

- Animal Nutrition

- Cosmetics

- Infant Formula

- Pharmaceuticals

- B2C

- Store-Based Retail

- Online Retailing

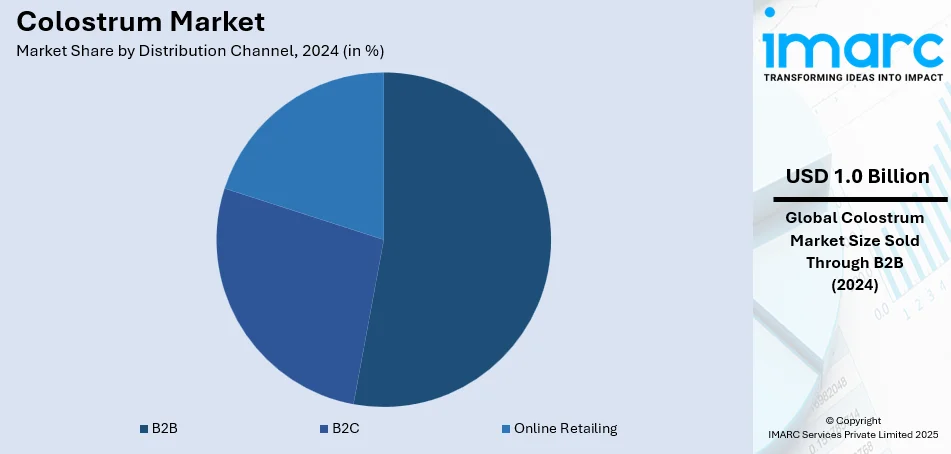

B2B (dietary supplements, sports nutrition, functional foods, animal nutrition, cosmetics, infant formula, and pharmaceuticals) holds 52.8% of the market share. The business-to-business (B2B) segment is dominating the market owing to the significant interplay between manufacturers, suppliers, and various industries utilizing colostrum. It involves transactions between businesses, such as colostrum producers and companies in the pharmaceutical, nutraceutical, dietary supplements, sports nutrition, and infant formula sectors. Furthermore, the B2B segment caters to large-scale demands, offering bulk quantities of colostrum in various forms, such as powder and liquid, to be further processed or integrated into finished products. Additionally, it benefits from long-term contracts and steady demand, providing a stable revenue stream for colostrum producers. Moreover, the B2B segment is characterized by stringent quality control and regulatory compliance, as businesses must adhere to various industry-specific standards and regulations.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 33.7%. The significant increase in health and wellness consciousness among consumers in the North American region due to rising levels of education and access to information is propelling the market growth. Additionally, there is an increase in the number of consumers investing in health and wellness products, including dietary supplements like colostrum. Besides this, the rising cultural emphasis on natural remedies in many regional countries is facilitating product demand, owing to its role in a holistic health approach. Furthermore, the region is experiencing significant demand for infant formula, where colostrum is often incorporated to enhance its nutritional profile. In addition, the imposition of supportive policies by regional governments promoting health and wellness and ensuring product quality and safety is strengthening the market growth. In 2024, ARMRA, the wellness brand established by physicians that leads the way in whole-body vitality using bovine colostrum, announced its debut at all Sprouts Farmers Market locations across US.

Key Regional Takeaways:

United States Colostrum Market Analysis

The United States holds 85.80% share in North America. The US market is experiencing significant growth, driven by an increasing consumer preference for natural, health-enhancing products. With 129 Million Americans suffering from at least one major chronic disease such as heart disease, cancer, diabetes, obesity, or hypertension, according to the U.S. Department of Health and Human Services, there is a rising demand for supplements like colostrum, known for its immune-boosting and gut-health benefits. Additionally, as the aging population grows and more people become health-conscious, colostrum's natural properties for supporting overall wellness and fighting inflammation have gained traction. The U.S. market also benefits from a thriving sports nutrition industry, where colostrum is sought after for its recovery and performance-enhancing benefits. Moreover, a shift toward preventive healthcare is encouraging consumers to invest in immune-supporting products, further driving market growth. The presence of key players and an established distribution network ensures product availability across various sectors. Continuous innovation and R&D activities are opening new opportunities, making the U.S. one of the largest and fastest-growing markets for colostrum-based supplements.

Europe Colostrum Market Analysis

In Europe, the market is expanding due to an increasing demand for natural, organic, and functional foods. The aging population plays a significant role in this demand, with 21.3% of the EU population aged 65 and older, as of January 2023, according to reports. This demographic is particularly concerned with immune support and maintaining overall health, leading to a rising interest in colostrum supplements. The increasing awareness of the health benefits of colostrum, including immune enhancement, anti-aging properties, and gut health support, is further driving market growth. Additionally, Europe’s strong regulatory framework ensures high product safety standards, which boosts consumer confidence in colostrum-based supplements. The region's growing focus on sustainability, clean-label products, and preventive healthcare is contributing to a steady demand for high-quality colostrum products. The sports nutrition sector in Europe is also expanding, where colostrum-based products are being increasingly used for performance enhancement and post-workout recovery. As scientific research into the health benefits of colostrum continues to evolve, the European market is expected to experience further growth, with a shift toward more innovative and effective formulations.

Asia Pacific Colostrum Market Analysis

The market in Asia-Pacific is expanding due to increasing health awareness and the aging population. The number of older individuals in the region is projected to more than double, from 630 Million in 2020 to about 1.3 Billion by 2050, according to reports. This demographic shift is driving the demand for products that support immune function and overall health, with colostrum being a popular choice. Additionally, rising disposable incomes and changing consumer lifestyles are fostering demand for dietary supplements. The growing sports and fitness sectors in countries like China and India are also contributing to the adoption of colostrum, further propelling market growth. Consumers are becoming more knowledgeable about colostrum’s potential health benefits, increasing its appeal as part of a preventive healthcare approach.

Latin America Colostrum Market Analysis

In Latin America, the market is driven by the rising prevalence of chronic diseases, with Brazil seeing an estimated 928,000 deaths annually due to such conditions, as reported in industry reports. As people are becoming more health-conscious, need for immune-boosting and anti-aging products like colostrum is increasing. The region's expanding middle class with higher disposable incomes further supports the adoption of health supplements. Additionally, the growing sports nutrition sector is contributing to the demand for colostrum-based products, particularly for their role in enhancing athletic performance and supporting overall wellness.

Middle East and Africa Colostrum Market Analysis

In the Middle East and Africa, the market is gaining momentum due to rising chronic disease prevalence. In the UAE, 23% of the population reports chronic diseases, with obesity, diabetes, and asthma being the most common. This trend is driving the demand for immune-supporting and anti-inflammatory products like colostrum. Furthermore, as the region embraces fitness and wellness trends, there is an increasing interest in sports nutrition supplements. Colostrum-based products are being sought after for their potential to enhance recovery and performance, making them increasingly popular among health-conscious consumers.

Competitive Landscape:

One of the most significant strategies employed by key market players in the colostrum industry is product innovation. To meet the growing demand for health and wellness products, many companies are diversifying their offerings beyond traditional colostrum supplements. Companies are also introducing products in various forms, including powders, capsules, liquid supplements, bars, and beverages, making colostrum more accessible to a broader consumer base. Many key players are teaming up with research institutions, healthcare organizations, and other stakeholders to enhance the credibility of their products and support ongoing innovation. These partnerships allow companies to tap into valuable expertise and resources, facilitating the development of scientifically-backed products that meet the growing demand for evidence-based health solutions. Technological advancements in the manufacturing process are another key focus for players in the market. Innovations in processing techniques are enabling companies to produce high-quality colostrum products more efficiently and sustainably.

The report provides a comprehensive analysis of the competitive landscape in the colostrum market with detailed profiles of all major companies, including:

- Biostrum Nutritech Pvt. Ltd

- Biotaris B. V.

- Colostrum BioTec GmbH

- Cuprem Inc.

- Cure Nutraceutical Pvt. Ltd.

- Deep Blue Health NZ.

- Good Health New Zealand

- Ingredia SA (La Prosperite Fermiere Societe Cooperative Agricole)

- NOW Foods

- Pantheryx Inc.

- Sterling Technology

- TechMix LLC

- The Saskatoon Colostrum Company Ltd.

Latest News and Developments:

- November 2024: Biochem revealed its latest product designed to assist during the initial essential days of life. Colo-Ig is an extremely tasty and effective immunity support colostrum product for newborn calves, lambs, kids, piglets, and foals. Colo-Ig is rich in bovine immunoglobulins and includes a prebiotic that can attach harmful bacteria for both defense and assistance.

- October 2024: ARMRA has entered a nationwide retail partnership with Sprouts Farmers Market, marking its expansion from a digital-first brand to national in-store availability. This collaboration enhances consumer access to ARMRA Colostrum™, a bovine colostrum concentrate formulated to support immune health, gut function, and metabolic performance.

- July 2024: Erewhon introduced colostrum-infused smoothies, featuring bovine colostrum supplements to support immune and gut health. The launch generated significant consumer interest, with continued expansion in wellness offerings.

- August 2023: PanTheryx has introduced Life’s First Naturals PRO ColostrumOne® Extra Strength, an advanced colostrum-based supplement for healthcare practitioners. Utilizing proprietary technology, the formulation enhances immune bioactive availability, nearly doubling that of the original version.

Colostrum Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered |

|

| Distribution Channels Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Biostrum Nutritech Pvt. Ltd, Biotaris B. V., Colostrum BioTec GmbH, Cuprem Inc., Cure Nutraceutical Pvt. Ltd., Deep Blue Health NZ., Good Health New Zealand, Ingredia SA (La Prosperite Fermiere Societe Cooperative Agricole), NOW Foods, Pantheryx Inc., Sterling Technology, TechMix LLC, The Saskatoon Colostrum Company Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the colostrum market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global colostrum market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the colostrum industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The colostrum market was valued at USD 1.77 Billion in 2024.

The colostrum market is projected to exhibit a CAGR of 3.42% during 2025-2033, reaching a value of USD 2.44 Billion by 2033.

Key drivers of the colostrum market include increasing consumer awareness of its health benefits, rising demand for natural supplements, diverse product applications across various industries, innovations in product formulations, and growing preferences for immune-boosting and gut-health products.

North America currently dominates the colostrum market, accounting for a share of 33.7%. This is driven by growing health consciousness, particularly in the US, where demand for immune-boosting and sports nutrition products is rising.

Some of the major players in the colostrum market include Biostrum Nutritech Pvt. Ltd, Biotaris B. V., Colostrum BioTec GmbH, Cuprem Inc., Cure Nutraceutical Pvt. Ltd., Deep Blue Health NZ., Good Health New Zealand, Ingredia SA (La Prosperite Fermiere Societe Cooperative Agricole), NOW Foods, Pantheryx Inc., Sterling Technology, TechMix LLC, The Saskatoon Colostrum Company Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)