Cold Chain Packaging Market Size, Share, Trends and Forecast by Product, End User, and Region, 2025-2033

Cold Chain Packaging Market Size and Share:

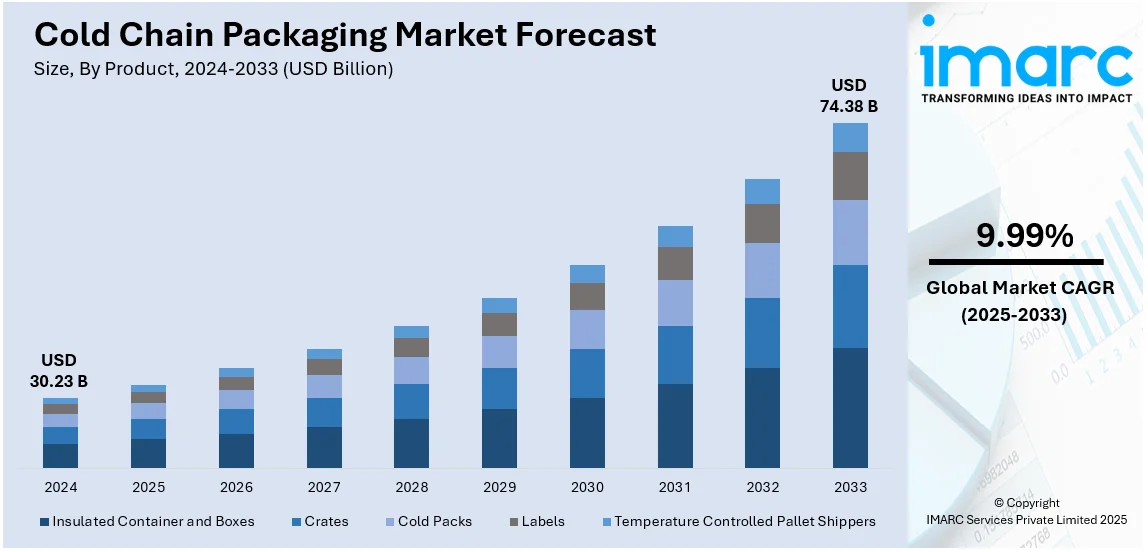

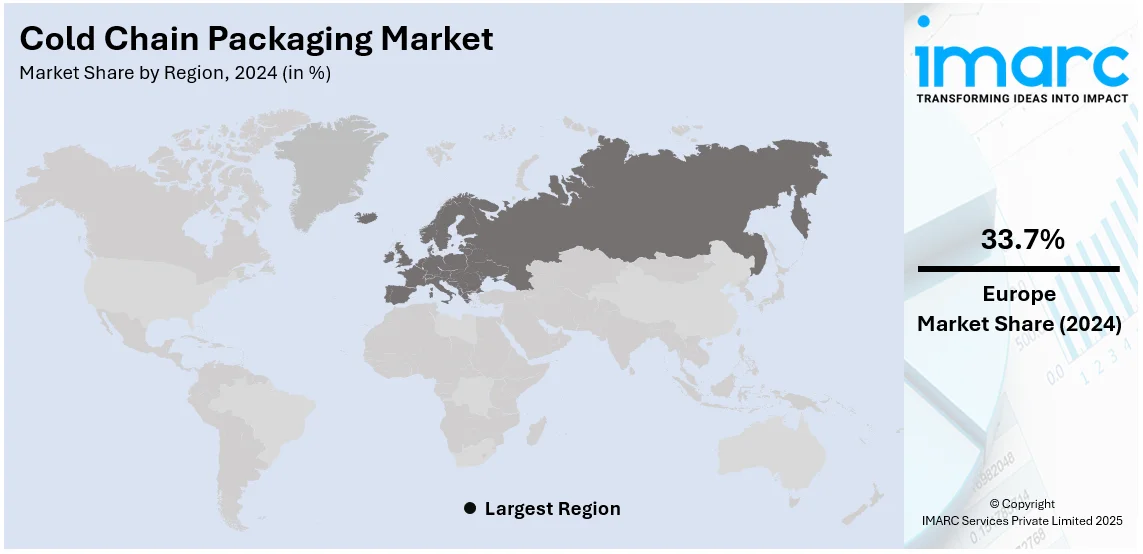

The global cold chain packaging market size was valued at USD 30.23 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 74.38 Billion by 2033, exhibiting a CAGR of 9.99% from 2025-2033. Europe currently dominates the market, holding a market share of 33.7% in 2024. The growth of the European region is driven by the strict food safety regulations, pharmaceutical expansion, e-commerce growth, sustainability initiatives, advanced logistics infrastructure, and increasing demand for temperature-sensitive goods. Rising investments in innovative thermal insulation and temperature-controlled solutions are further driving the cold chain packaging market share across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 30.23 Billion |

| Market Forecast in 2033 | USD 74.38 Billion |

| Market Growth Rate (2025-2033) | 9.99% |

The growing demand for fresh, organic, and frozen foods, including a significant shift toward e-commerce for groceries, is driving the demand for cold chain packaging. Consumers are becoming more health-conscious and seeking fresh produce and other perishable items, which require cold chain packaging to maintain product quality and safety during transit. Additionally, governing bodies and regulatory agencies are implementing stringent mandates concerning the transport and storage of temperature-sensitive items, particularly in the pharmaceutical and food and beverage industries. These regulations ensure that cold chain packaging solutions meet specific standards to preserve product safety and quality. Besides this, new technologies, such as global positioning systems (GPS) tracking, internet of things (IoT)-enabled packaging, and smart packaging, are enhancing the efficiency and effectiveness of cold chain packaging. These innovations help monitor and maintain optimal temperature conditions in real-time, minimizing the risk of product spoilage.

The United States is a vital part of the market, owing to the development and adoption of reusable cold chain technologies, which offer more sustainable and cost-effective solutions. These innovations allow for extended temperature control over longer periods without relying on traditional cooling methods like dry ice, which reduces both shipping costs and environmental impact. Additionally, the integration of features like real-time GPS tracking and temperature monitoring enhances efficiency, providing greater reliability and visibility during transit. In 2024, Candor Expedite, a company in the US, introduced Candor Food Chain, a cold chain sector utilizing Cool Chain's reusable technology to maintain the temperature of shipments for as long as nine days without dry ice. This temperature-managed solution accommodates frozen, refrigerated, and ambient products in a single truck, lowering costs and emissions. Real-time GPS monitoring and temperature tracking improve shipping effectiveness and eco-friendliness.

Cold Chain Packaging Market Trends:

Growing demand for perishable goods

Consumers are looking for fresh and frozen items, including fruits, vegetables, dairy, meat, and seafood, resulting in an increased demand for the cold chain packaging market. Moreover, the change in consumer preferences towards healthier and more convenient food choices necessitates a dependable and effective cold chain to maintain the quality and safety of these items, thereby enhancing market expansion. Reports indicate that 50% of consumers value healthy eating, whereas 33% also view sustainable eating as a significant concern. Additionally, the expanding middle-class demographic and the rising appetite for foreign and exotic perishable goods signify another key driver of growth. It guarantees that these products arrive at their destinations while maintaining their quality. In addition, the enforcement of strict food safety regulations and quality standards is increasing the demand for sophisticated packaging solutions, while rising investments in cutting-edge packaging technologies and climate-controlled storage facilities are driving market expansion.

Significant expansion in the pharmaceutical industry

The rising need for temperature-sensitive medications and biologics is a key element driving market expansion. Moreover, creating sophisticated medications and vaccines necessitates exact temperature regulation to preserve their effectiveness, thereby increasing the need for dependable cold chain packaging options. Additionally, pharmaceuticals like mRNA vaccines and some biologics are temperature-sensitive, necessitating specialized packaging to maintain their integrity during distribution, which serves as another significant factor for growth. The worldwide market for mRNA vaccines and therapies attained a size of US$ 57.7 Billion in 2023. In addition, pharmaceutical companies are now functioning on a worldwide level, necessitating the transportation of their products internationally, which boosts the need for improved cold chain logistics and packaging solutions to protect the efficacy of these delicate items. Additionally, the extensive use of sophisticated cold chain packaging technologies, such as temperature-monitoring devices, insulated boxes, and enhanced data tracking, is further contributing to the growth of the market.

Technological advancements in cold chain packaging

The incorporation of Internet of Things (IoT) sensors into cold chain packaging solutions to enhance functionality is supporting the market growth. The worldwide internet of things (IoT) market value hit USD 1,022.6 Billion in 2024. These sensors offer immediate tracking of temperature, humidity, and various environmental conditions, guaranteeing that items, particularly perishable goods like pharmaceuticals and food products, stay within the designated temperature range, thus safeguarding the quality and safety of the items while improving adherence to regulatory standards. Additionally, various improvements in insulation materials are enhancing thermal protection efficiency, which serves as another significant factor driving growth. In addition, contemporary insulating materials are very efficient in sustaining temperature consistency while lowering transportation expenses and environmental effects, thereby driving market expansion. Additionally, the implementation of automated packaging systems enhances efficiency and minimizes the likelihood of human errors throughout the packing process, thereby streamlining operations, which results in cost savings and enhanced reliability, subsequently impacting the cold chain packaging market growth.

Cold Chain Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cold chain packaging market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and end user.

Analysis by Product:

- Insulated Container and Boxes

- Large

- Medium

- Small

- X-Small

- Petite

- Crates

- Dairy

- Pharmaceutical

- Fisheries

- Horticulture

- Cold Packs

- Labels

- Temperature Controlled Pallet Shippers

Insulated containers and boxes (large, medium, small, x-small, and petite) represent the largest segment, holding a share of 43.2%, driven by their ability to maintain a stable internal temperature, shielding perishable items from temperature fluctuations. In addition, it is essential for products such as vaccines, drugs, and fresh produce, where even slight temperature deviations can compromise efficacy or spoilage, thus contributing to the market growth. Furthermore, these containers are available in various sizes and configurations, accommodating numerous products, from small, single-use insulated boxes for individual shipments to large, reusable containers for bulk transport, thus propelling the market growth. Along with this, it is durable which is constructed from enhanced materials, and built to withstand the rigors of transportation, ensuring the contents remain unscathed which offers cost-effectiveness over the long term, as these containers can be reused multiple times, thus creating a positive cold chain packaging market outlook.

Analysis by End User:

- Food

- Dairy

- Pharmaceutical

- Others

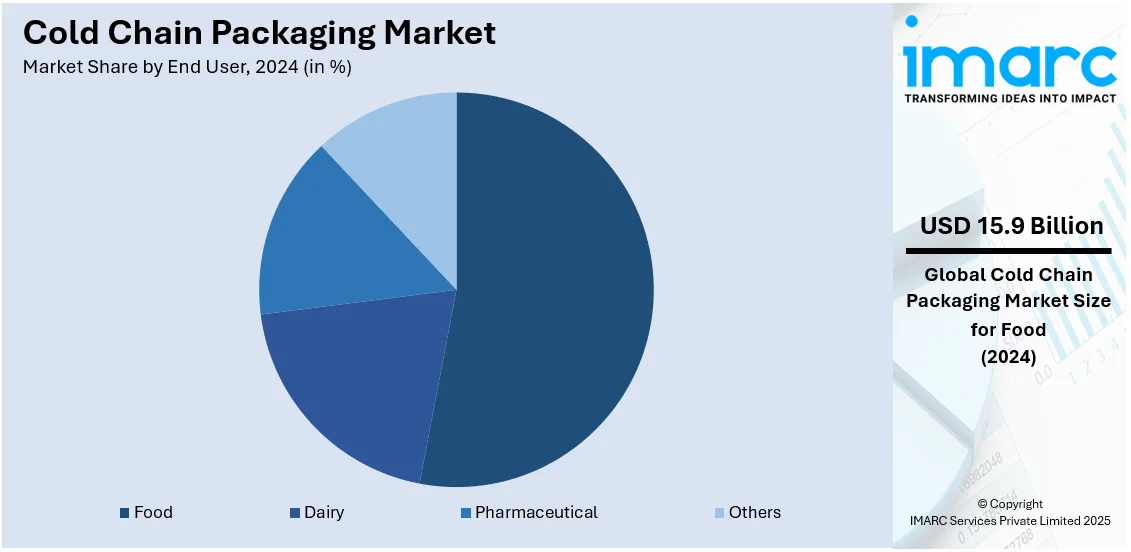

Food dominates the market, accounting for a share of 52.7%, owing to the rising demand for cold chain packaging solutions in the food and beverage (F&B) sector. In addition, food items require strict temperature control to maintain their quality and safety. This necessity has spurred innovation in packaging materials and technology to ensure that food remains fresh and uncontaminated throughout the supply chain. Moreover, the food supply chain has grown increasingly complex due to factors such as globalization, changing consumer preferences, and the need for longer shelf lives. Consequently, cold chain packaging solutions are indispensable for preserving the integrity of food products during transportation and storage. Furthermore, the integration of insulated containers and refrigerated trucks into specialized packaging materials such as temperature-controlled thermal liners and gel packs is catering to the unique demands of the food sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe dominates the market, holding a share of 33.7% because of the robust infrastructure that underpins the packaging industry. Moreover, sophisticated transportation systems, refrigeration units, and storage capabilities guarantee the secure and efficient management of temperature-sensitive products, an essential necessity for sectors like pharmaceuticals, food, and chemicals, thereby impacting market expansion. In addition, the enforcement of strict quality standards and regulatory compliance by the European Union to ensure product integrity and safety during transportation is driving market growth. In 2024, PCI Pharma Services revealed a $365 million investment in cold chain packaging and the assembly of drug-device combination products throughout the United States and Europe. Significant expansions encompass a 545,000-square-foot Center of Excellence located in Rockford, Illinois, along with a new pharmaceutical packaging plant close to Dublin, Ireland, both equipped with temperature-regulated storage. These investments improve cold chain packaging options for injectables, biologics, and sophisticated drug delivery systems.

Key Regional Takeaways:

United States Cold Chain Packaging Market Analysis

The cold chain packaging market in the United States holds a share of 87.80%, primarily driven by the escalating need for temperature-sensitive products in different sectors like biotechnology, pharmaceuticals, food and beverage (F&B). The expanding e-commerce industry plays a crucial role, with the global count of e-commerce websites almost tripling from 2019 to 2023, exceeding 26.5 million, according to Digital Commerce 360. This surge in online shopping has intensified the requirement for efficient cold chain logistics, particularly for perishable goods like frozen foods and vaccines. The expansion of the healthcare industry, especially in vaccine distribution and personalized medicine, has also created a robust demand for cold chain packaging solutions. Furthermore, regulatory pressures, such as the stringent guidelines set by the FDA regarding temperature control during transport, have accelerated the adoption of advanced packaging materials. Additionally, the trend toward sustainable packaging solutions is prompting manufacturers to innovate with eco-friendly cold chain materials. Technological advancements, including IoT-enabled sensors for real-time tracking, are also enhancing operational efficiency and reducing waste. As consumers increasingly seek high-quality, fresh, and safe products, these factors collectively drive the demand for advanced cold chain packaging in the US.

Europe Cold Chain Packaging Market Analysis

The market for cold chain packaging in Europe is influenced by multiple factors, such as the rising need for temperature-sensitive products in sectors like food and beverages, pharmaceuticals, and chemicals. The pharmaceutical industry, especially with the increasing need for biologics, vaccines, and temperature-sensitive medications, demands strict temperature regulation during storage and transport. As of January 1, 2023, reports estimate the EU population at 448.8 million, with over one-fifth (21.3%) being 65 years or older, which increases the demand for healthcare products like vaccines and medical treatments that need cold chain solutions. Regulatory frameworks throughout the EU, such as GDP (Good Distribution Practice) guidelines, are also advocating for improved standards in temperature-sensitive logistics. The food sector is essential, as increasing consumer interest in fresh, frozen, and organic products requires sophisticated packaging methods to ensure food safety and quality. Furthermore, the growth of e-commerce throughout Europe, particularly after the COVID-19 pandemic, has heightened the need for cold chain packaging to guarantee the secure transport of perishable goods. Sustainability is a significant trend, as producers develop eco-conscious materials to satisfy consumer demands and comply with environmental guidelines. These elements collectively propel the cold chain packaging industry in Europe.

Asia Pacific Cold Chain Packaging Market Analysis

The cold chain packaging sector in the Asia-Pacific (APAC) area is seeing strong expansion, driven by the increasing need for perishable items like food, medicines, and vaccines. The swift growth of e-commerce platforms, especially in nations such as China and India, has intensified the demand for dependable cold chain logistics. The World Bank indicates that the East Asia and Pacific area is the quickest urbanizing region in the world, experiencing an average annual urbanization rate of 3%, which amplifies the demand for temperature-controlled packaging to maintain the quality of fresh food and healthcare products. Moreover, growing consumer awareness about food safety is promoting the use of cold chain packaging solutions. Government efforts aimed at improving cold chain infrastructure in developing economies are also aiding market expansion. Additionally, the need for sustainable, eco-conscious packaging options is driving manufacturers to create and provide environmentally friendly substitutes for conventional cold chain materials, thereby influencing the future of the regional market.

Latin America Cold Chain Packaging Market Analysis

In Latin America, the market for cold chain packaging is growing owing to the rising need for perishable items like food, vaccines, and pharmaceuticals. Studies show that urbanization in Latin American countries is currently around 80%, exceeding that of numerous other areas, which is driving the rising demand for temperature-controlled logistics in urban centers. The growth of e-commerce, especially in nations such as Brazil and Mexico, is also fueling the demand for effective cold chain solutions. Government efforts to enhance cold chain infrastructure additionally bolster market expansion, along with an increasing emphasis on food safety and adherence to regulations.

Middle East and Africa Cold Chain Packaging Market Analysis

In the Middle East and Africa, the cold chain packaging market is driven by the rising need for temperature-sensitive products, especially in the food and pharmaceutical industries. The World Bank reports that the Middle East and North Africa (MENA) region has reached a 64% urbanization rate, creating an increasing demand for effective cold chain logistics in urban and rural locales. The growth of e-commerce, especially in the UAE and South Africa, is driving the need for cold chain packaging solutions to secure the safe transportation of perishable goods. Moreover, the expanding pharmaceutical sector is also propelling market growth.

Competitive Landscape:

Major market players are broadening their product ranges with cutting-edge insulation materials, phase-change innovations, and IoT-integrated tracking solutions. They are allocating funds to research and development to improve temperature stability, decrease material weight, and enhance cost effectiveness. Strategic mergers, acquisitions, and collaborations are enhancing global distribution systems and manufacturing capabilities. Businesses are focusing on eco-friendly packaging by creating recyclable, compostable, and reusable options. Digitization initiatives, such as live tracking and forecast analysis, are improving supply chain effectiveness and adherence to regulations. Growth in emerging markets is fueling localized production and distribution approaches. Tailored and modular designs are enhancing packaging flexibility for pharmaceuticals, food products, and specialty chemicals. In 2024, IFCO introduced Marina, a digitally enhanced reusable fish crate aimed at improving sustainability and efficiency in the seafood supply chain. Incorporating track-and-trace Bluetooth tags and double-wall insulation, it enhances cold chain management and substitutes for single-use EPS boxes. The IFCO SmartCycle pooling system allows for reuse as many as 120 times, minimizing waste and environmental effects.

The report provides a comprehensive analysis of the competitive landscape in the cold chain packaging market with detailed profiles of all major companies, including:

- Cascades Inc.

- Chill-Pak

- Cold Chain Technologies Inc.

- CoolPac

- Creopack Inc.

- Cryopak Industries Inc.

- DGP Intelsius Ltd.

- Pelican Products, Inc.

- Sealed Air Corporation

- Sofrigam

- Softbox Systems Ltd. (CSafe Global LLC)

- Sonoco Products Company

Latest News and Developments:

- November 2024: Jones Family of Companies Inc. and ECO Fiber Inc. have established a partnership to enhance their footprint in the sustainable cold chain packaging industry. The new initiative, ECO Fiber Packaging, merges ECO Fiber’s packaging knowledge with the Jones Family’s 90 years of experience in textiles and sustainability. This partnership seeks to provide creative, eco-friendly packaging solutions to address the increasing needs of the industry.

- October 2024: BioCare has collaborated with AeroSafe Global to improve its cold chain processes using a reusable, temperature-regulated shipping solution. The partnership will employ AeroSafe’s insulated containers to guarantee the secure transport of temperature-sensitive items while minimizing waste and carbon output. BioCare seeks to reduce emissions by 65%, decrease landfill waste by 90%, and attain a 98.6% packaging return rate, enhancing its dedication to sustainable cold chain practices.

- September 2024: Tower Cold Chain and CRYOPDP have formed a partnership to enhance their product offerings in the pharmaceutical supply chain, particularly in clinical research. The collaboration aims to provide a comprehensive range of advanced temperature-controlled solutions, including CRYOPDP’s dry vapor shippers for cryogenic goods and Tower’s KTEvolution range of reusable boxes for smaller payloads. This partnership enables both companies to expand their product range, offering sustainable, cryogenic-level solutions and reusable containers for temperature-sensitive logistics, ultimately supporting better patient outcomes.

- March 2023: Ranpak Holdings Corp. has launched the RecyCold® climalinerTM, an efficient, sustainable paper-based thermal liner designed for Cold Chain shipping. The liner maintains ideal temperatures for up to 48 hours, offering recyclability and sustainability. It is thinner and more flexible than existing technologies, allowing for multiple configurations and reducing food waste while improving cost and sustainability.

Cold Chain Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End Users Covered | Food, Dairy, Pharmaceutical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cascades Inc., Chill-Pak, Cold Chain Technologies Inc., CoolPac, Creopack, Cryopak Industries Inc., DGP Intelsius Ltd., Pelican Products Inc., Sealed Air Corporation, Sofrigam, Softbox Systems Ltd. (CSafe Global LLC), Sonoco Products Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cold chain packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cold chain packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cold chain packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cold chain packaging market was valued at USD 30.23 Billion in 2024.

IMARC estimates the cold chain packaging market to exhibit a CAGR of 9.99% during 2025-2033, reaching a value of USD 74.38 Billion by 2033.

The cold chain packaging market is driven by the growing demand for perishable goods, increased global trade, advancements in temperature-controlled packaging technology, and stricter regulations in industries like pharmaceuticals and F&B. Additionally, rising user preference for fresh and organic products, along with environmental concerns, further support the market growth.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the market.

Some of the major players in the cold chain packaging market include Cascades Inc., Chill-Pak, Cold Chain Technologies Inc., CoolPac, Creopack, Cryopak Industries Inc., DGP Intelsius Ltd., Pelican Products Inc., Sealed Air Corporation, Sofrigam, Softbox Systems Ltd. (CSafe Global LLC), Sonoco Products Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)