Cold Chain Logistics Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Cold Chain Logistics Market Size, Share Analysis & Industry Forecast:

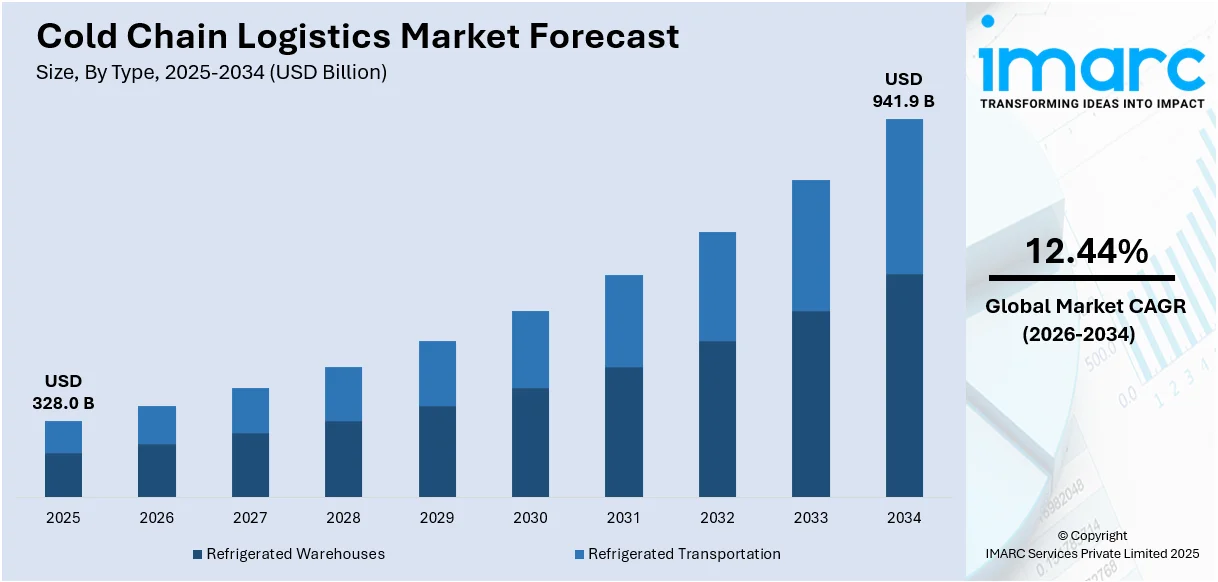

The global cold chain logistics market size was valued at USD 328.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 941.9 Billion by 2034, exhibiting a CAGR of 12.44% from 2026-2034. North America currently dominates the market, holding a market share of 38.6% in 2025. The region’s cold chain logistics market share is driven by advanced cold chain infrastructure, rising demand for perishable goods, increasing pharmaceutical needs, and strict regulatory compliance for food safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 328.0 Billion |

| Market Forecast in 2034 | USD 941.9 Billion |

| Market Growth Rate (2026-2034) | 12.44% |

The increasing demand for fresh produce, dairy items, frozen goods, and seafood is fueling the necessity for effective cold chain logistics to maintain quality, minimize waste, and prolong shelf life. Moreover, the growing number of online grocery and pharmaceutical delivery services is heightening the demand for dependable cold chain systems. Individual demand for prompt delivery of perishable products is encouraging businesses to invest in localized cold storage solutions and cutting-edge logistics technologies. Additionally, the enforcement of stringent worldwide policies for food safety and pharmaceutical storage is urging companies to invest in strong cold chain systems. Adhering to these standards plays a pivotal role in preserving product quality and satisfying market needs. In addition to this, improvements in refrigeration, real-time temperature tracking, and automation are transforming cold chain logistics, enhancing operational efficiency and reducing the chances of spoilage. These advancements are promoting wider acceptance in various sectors.

To get more information on this market Request Sample

The United States significantly impacts the market, driven by the growing demand for fresh fruits and vegetables, frozen meals, and dairy goods, alongside a heightened inclination towards organic and less processed products. In addition, the creation of extensive cold storage facilities in strategically beneficial locations is supporting the expansion of the market. These advancements boost logistical efficiency, promote sustainability, and enhance access to essential markets, allowing quicker and more dependable distribution of temperature-sensitive items to satisfy the increasing demands of consumers and industries. In 2024, CJ Logistics America revealed its intention to establish a 291,000-square-foot cold storage facility in New Century, Kansas, aiming for completion by Q3 2025. The building, linked to Upfield's manufacturing facility through a conveyor bridge, improves logistics efficiency and sustainability for storing plant-based foods. Its strategic Midwest location offers excellent transportation access, serving up to 85% of the US within two days.

Cold Chain Logistics Market Trends:

Rapid Growth in the Pharmaceutical Industry

The increasing need for effective solutions in the transport of high-value pharmaceutical products through the distribution network is driving the of the cold chain logistics market growth. IBEF mentions that the market size of global pharmaceutical products had grown to more than USD 1 trillion in 2023. It is huge in terms of its impact on cold chain logistics market demand. The increase in the production of biologics, including hormone therapies, vaccines, and complex proteins, has increased the need for accurately controlled temperature logistics and storage to ensure product quality and efficacy. Additionally, strict regulatory requirements for the storage and distribution of pharmaceuticals underscore the need to maintain stable conditions throughout the supply chain. Growth in specialized logistics firms and airlines offering tailored pharmaceutical transport services, as well as technological innovations in real-time tracking and energy-saving refrigeration, is fueling growth in the market. The need for improved cold chain systems is expected to increase with growing pharmaceutical advancements, especially in biologics and precision medicine.

Increase in Cold Storage Spaces and Refrigerated Warehouses

Advanced heavy-duty refrigeration systems are used in modern warehouse management to maintain ideal temperature conditions during the transportation and storage of goods. Businesses are now heavily investing in improving their cold chain operations to establish effective, efficient, and reliable processes for storing temperature-sensitive products and eliminate weak links in the system. This has led to the increased use of cold storage areas and cold warehouses, thus boosting the growth of the cold chain logistics market. In addition, the growing sales of processed foods and perishable products like dairy products, fruits, vegetables, and flowers require optimal infrastructure of cold chain logistics in order to prevent the spoilage and wastage of the products. The global dairy market size has reached USD 991.5 Billion in 2024. Looking forward, the market is expected to reach USD 1,505.8 Billion by 2033.

Technological Advancements in Logistics

Advanced monitoring systems send instant alerts for anomalies, thereby minimizing the likelihood of spoilage and ensuring that the products are kept in good condition. AI and ML are used to optimize routing, improve warehouse operations, and minimize operational costs. Automation in cold storage facilities through robotic handling systems accelerates inventory management and minimizes human error. These innovations enhance the effectiveness of cold chain logistics. Companies can accurately meet the rising demand for high-quality perishable goods with higher precision. In 2024, SSI Schaefer and Noatum Logistics Middle East formed a partnership to design the largest mobile racking system for deep-freeze storage in the UAE. This is located at the AD Ports Group's KLP21 warehouse hub within the Khalifa Economic Zone Abu Dhabi (KEZAD). The system has increased storage capacity by more than 90%, increased cooling efficiency, and streamlined logistics for healthcare and FMCG sectors.

Cold Chain Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cold chain logistics market, along with forecast at the global, regional, and country levels from 2034. The market has been categorized based on type and application.

Analysis by Type:

- Refrigerated Warehouses

- Refrigerated Transportation

- Railways

- Airways

- Roadways

- Waterways

Refrigerated warehouses hold the biggest cold chain logistics market share of around 65.0% because of their essential function in maintaining the quality and safety of temperature-sensitive goods in various sectors. These facilities offer stable temperature-regulated environments, vital for prolonging the shelf life of perishable items like food, medicines, and chemicals. The rising need for frozen and fresh goods, propelled by urban growth and evolving consumer tastes, is leading to a greater demand for effective refrigerated storage options. Improvements in warehouse technology, such as automated systems and real-time monitoring, are boosting operational efficiency and reliability, which further solidifies the market standing of refrigerated warehouses. Regulatory mandates for upholding strict temperature management and safeguarding product safety have resulted in substantial investments in enhancing cold storage facilities. The growth of e-commerce, especially in grocery and pharmaceutical deliveries, is additionally driving the need for localized refrigerated storage options to guarantee prompt distribution. These factors collectively underscore the dominance of refrigerated warehouses in the market.

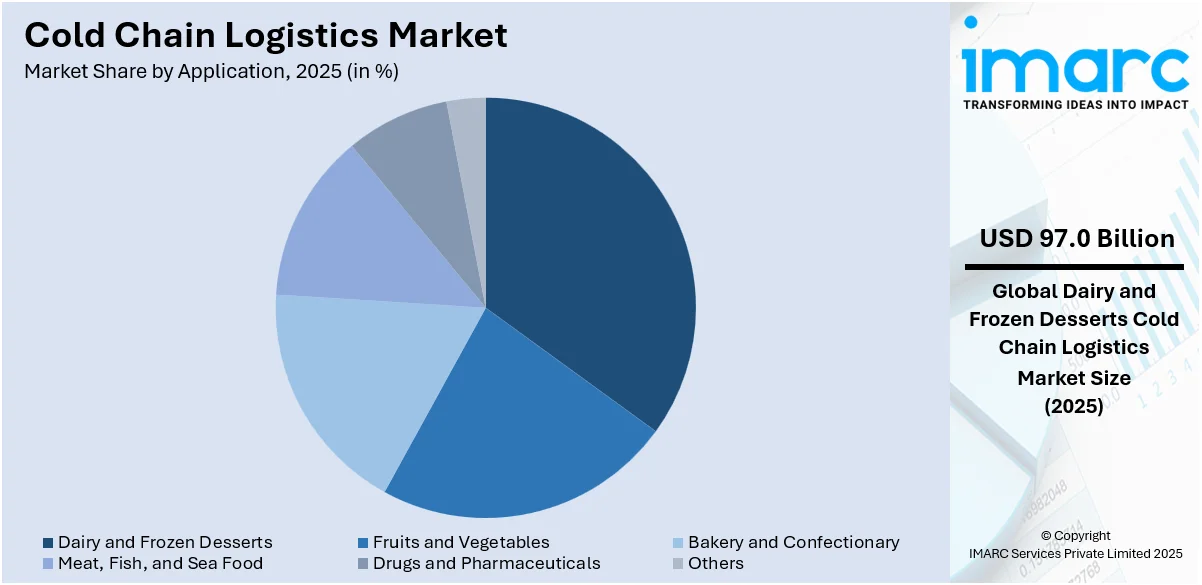

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Fruits and Vegetables

- Bakery and Confectionary

- Dairy and Frozen Desserts

- Meat, Fish, and Sea Food

- Drugs and Pharmaceuticals

- Others

The largest segment is represented by dairy and frozen desserts, holding a share of 33.2%, which require steady refrigeration since they are very sensitive to temperature changes, affecting their quality and safety. An increased demand for premium dairy items and frozen treats requires the expansion of a cold chain system for an efficient delivery. The increasing urban population, changing food trends, and increased disposable incomes are elevating demand for such products, requiring their supply by robust logistics systems. Strict temperature controls imposed on the entire supply chain ensure the safety and durability of dairy items and frozen treats, where advanced cold chain solutions feature. The use of advanced storage and transportation technologies, along with real-time monitoring systems, is improving the overall efficiency and reliability of cold chain operations in this industry. Growing to sustain constant development, increasing the importance of sustainable practices in a dairy and frozen dessert cold chain.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the market, accounting for a share of 38.6%, because of its advanced infrastructure, technological capabilities, and strong focus on regulatory compliance. The region's well-established networks of refrigerated storage and transport systems ensure seamless handling of temperature-sensitive products across various industries. Robust supply chain management practices and the integration of monitoring technologies are enhancing efficiency, ensuring the preservation of product quality. Regulatory frameworks mandating strict adherence to temperature control standards are further solidifying the region’s leadership in the market. The growing focus on reducing waste and maintaining sustainability is resulting in the adoption of energy-efficient refrigeration systems and innovative packaging solutions. Moreover, the rising demand for perishable goods and healthcare products is leading to significant investment in expanding and upgrading cold chain facilities. In 2024, CJ Logistics America announced a 270,000-square-foot state-of-the-art cold storage warehouse in Gainesville, Georgia, set to enhance its Southeast logistics operations. Equipped with Alta EXPERT Refrigeration and QFM blast freezing, the facility caters to diverse storage needs and supports the poultry production region. Its strategic location provides direct access to highways, railways, and the future Northeast Georgia Inland Port.

Cold Chain Logistics Market Regional Takeaways:

United States Cold Chain Logistics Market Analysis

The United States cold chain logistics market is a crucial component in the supply chain infrastructure of the country, holding a share of 87.30%, driven by the growing demand for pharmaceuticals and biotechnology products. Reports indicate that the production of pharmaceuticals in the US is anticipated to grow by 2.9% in 2024 and by 2.5% in 2025. Consumers are preferring fresh and frozen products on account of an increasing emphasis on food safety regulations. Apart from this, technological advancements are transforming the cold chain logistics sector, with innovations, such as IoT-enabled tracking devices, temperature sensors, and automation in warehouses, ensuring precise temperature control and minimizing product spoilage. The implementation of blockchain for traceability and transparency is further enhancing operational efficiency and compliance with stringent safety standards. Furthermore, the food and beverage industry remain the dominant segment, supported by a rising preference for convenience foods and organic produce. Simultaneously, the pharmaceutical industry has become a key growth driver, as the storage and distribution of vaccines, biologics, and specialty drugs require advanced cold chain solutions. Factors such as government support for infrastructure development and private investments in refrigerated transportation and storage facilities are also contributing to the cold chain logistics market outlook. Besides this, companies are adopting green practices such as energy-efficient refrigeration systems and renewable energy integration.

Europe Cold Chain Logistics Market Analysis

Europe’s stringent food safety and pharmaceutical regulations, coupled with rising consumer expectations for high-quality food items, is catalyzing the demand for advanced cold chain solutions. Technological advancements are leading the way in the growth of the industry. Monitoring devices enabled by IoT, systems for real-time tracking, and automated storage solutions guarantee optimal temperature management and reduce waste. Blockchain technology is becoming more widely adopted to improve traceability, especially in the food and pharmaceutical sectors. The focus on sustainability is motivating businesses to implement eco-friendly refrigeration systems and energy-saving methods. Major markets such as Germany, France, and the United Kingdom lead the sector because of their developed infrastructure and robust export-focused industries. Germany, for example, excels in pharmaceutical cold chains, gaining from its strong healthcare system. Reports indicate that sales in the pharmaceutical sector in Germany increased by 5.7% in 2023. In the meantime, the UK and France serve as vital centers for frozen food logistics, fueled by strong consumer interest in ready-to-eat and organic items. Consequently, elements such as the growing trade of perishable products, heightened demand for online grocery deliveries, and the expansion of biopharmaceuticals are driving market growth.

Asia Pacific Cold Chain Logistics Market Analysis

Rapid urbanization and shifting consumption patterns of an individual are led to higher demand for frozen and chilled food product. It is reported by the Press Information Bureau (PIB) that more than 40% people will be living in the urban areas in the state of India by the year 2030. Alongside, the pharmaceutical sector has hiked up its reliance on temperature- controlled logistics for biologics as well as vaccines. Additionally, technology has a lot to do with the progress of the cold chain in this field. Systems of real-time tracking, sensors with the power of IoT, and automated storage solutions are made easier by proper temperature control and lessened waste. This is also helping sectors such as food and healthcare with enhanced traceability and transparency. The leading forces in the market are China and India, which owe their impetus to government initiatives supporting the development of cold storage infrastructure and private sector investments in refrigerated transport. For instance, China's "National Cold Chain Logistics Development Plan" is designed to improve efficiency in storage and transportation of perishable products. India is also developing cold chain infrastructure with initiatives like the Pradhan Mantri Kisan Sampada Yojana to reduce agricultural losses. The growing e-commerce sector, especially for grocery and pharmaceutical delivery, and the increasing exports of seafood, meat, and tropical fruits are providing a positive outlook for the cold chain logistics market in the region.

Latin America Cold Chain Logistics Market Analysis

The ever-growing adoption of cold chain logistics that is induced by the increasing demand for perishable foods, such as dairy, meat, fish, and fruits and vegetables, in the region has also been a positive market forecast. Furthermore, while Brazil's agricultural exports such as meat and fruits rely greatly on effective cold chain systems, Mexico's pharmaceutical industries require sophisticated temperature control for biologics and vaccines. Reports suggest that Brazilian agribusiness exports reached a record high in 2023 at USD 166.55 billion. This is consistent with the trend of the growth of the e-commerce sector, which is driving the need for temperature-regulated storage and transportation. The region's growth is being led by major markets such as Brazil, Mexico, and Chile, which are supported by government efforts to improve cold storage facilities.

Middle East and Africa Cold Chain Logistics Market Analysis

The market is expanding because of higher demand for food items as well as temperature-sensitive pharmaceuticals. Rising urbanization and a shift towards healthier diets are also boosting the demand for cold storage and transportation solutions. In addition, the burgeoning e-commerce sector in the region is contributing to the market growth. Saudi Arbia’s e-commerce industry generated USD 10 Billion in revenue in 2023, as per reports. Key players like the UAE, Saudi Arabia, and South Africa are leading the market, supported by investments in logistics infrastructure and government initiatives. For instance, the UAE’s strong focus on food security and vaccine distribution has accelerated cold chain advancements. Furthermore, companies are leveraging renewable energy solutions and IoT-enabled systems for efficient temperature control and monitoring.

Leading Cold Chain Logistics Companies:

Major participants in the market are concentrating on technological progress, strategic collaborations, and capacity growth to improve their market visibility and operational effectiveness. Investing in groundbreaking solutions like real-time temperature tracking, automation, and energy-efficient cooling systems is facilitating improved control and sustainability in cold chain operations. Firms are additionally broadening their international presence via mergers and acquisitions to enhance their networks and satisfy the increasing need for temperature-sensitive products. Focus on adhering to changing regulatory standards and implementing eco-friendly practices is influencing their long-term strategies. Moreover, companies are adapting to the growing e-commerce trend by creating localized storage and distribution systems to provide quicker and more dependable services for perishable goods. In May 2024, Celcius Logistics, a startup focused on cold-chain solutions, obtains USD 4.8 Million in funding, led by IvyCap Ventures. Celcius Logistics links shippers with transporters, providing a comprehensive solution for all cold-chain needs and facilitating last-mile and hyperlocal delivery for every participant involved.

The report provides a comprehensive analysis of the competitive landscape in the cold chain logistics market with detailed profiles of all major companies, including:

- Americold Realty Trust Inc.

- Burris Logistics Co.

- Cold Box Express Inc.

- Conestoga Cold Storage

- Congebec Inc.

- Lineage Logistics Holdings LLC (Bay Grove Capital Group LLC)

- Nichirei Logistics Group Inc. (Nichirei Corporation)

- Snowman Logistics Ltd.

- Tippmann Group

- United States Cold Storage Inc. (John Swire & Sons Ltd.)

- VersaCold Logistics Services

Latest News and Developments:

- October 2025: CN and Congebec announced a partnership to build a state-of-the-art cold storage facility at CN’s Calgary Logistics Park, enhancing the handling of temperature-sensitive goods. The facility will integrate cold storage, transloading, and first- and last-mile services, improving efficiency and reliability for perishable cargo transport. This project strengthens Canada’s food distribution network and advances sustainable cold chain logistics in Western Canada.

- October 2025: ONE and DP World launched India’s first dedicated reefer rail freight service connecting Hyderabad to Nhava Sheva Port, enhancing cold chain logistics for pharmaceutical exporters. The weekly service transports up to 43 refrigerated containers per trip with real-time temperature monitoring, offering a reliable and sustainable alternative to road transport. This initiative improves schedule control, reduces carbon emissions, and strengthens intermodal connectivity in India’s pharma export sector.

- October 2025: Celcius Logistics announced a ₹100 crore investment to deploy 350 refrigerated 3.5-ton electric trucks in partnership with Switch Mobility, launching the 'Celcius Green' zero-emission cold logistics network. The fleet will support temperature-sensitive goods transport across major Indian cities, aiming to reduce diesel dependency in cold-chain logistics. Celcius also plans further investments to expand EV reefer fleets and build EV-ready cold storage and charging infrastructure.

- July 2025: Maersk launched a new integrated packing and cold storage hub in Olmos, northern Peru, to support the region’s growing fruit export sector. The facility offers advanced cold chain services including sorting, packing, and refrigerated storage for fruits like avocados, blueberries, and mangoes. This initiative aims to enhance export efficiency, reduce waste, and support Peru’s agro-export growth.

- May 2025: Ethiopia's Ministry of Transport and Logistics and EHPEA held a high-level meeting in Addis Ababa to fast-track cold chain infrastructure for the horticulture sector. State Minister Dhenge Boru urged farms to invest in temperature-controlled logistics, with government backing. Stakeholders agreed to form a public-private platform to improve cold chain systems across horticulture, dairy, and pharmaceuticals.

- May 2025: Maersk invited South African exporters to preview its upcoming cold storage facility at Belcon Logistics Park in Cape Town. The facility, part of a network of three cold storage sites, aims to improve logistics for perishable goods like fruits. It aligns with Maersk’s goal of achieving net-zero emissions by 2040.

Cold Chain Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered | Fruits and Vegetables, Bakery and Confectionary, Dairy and Frozen Desserts, Meat, Fish, and Sea Food, Drugs and Pharmaceuticals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Americold Realty Trust Inc., Burris Logistics Co., Cold Box Express Inc., Conestoga Cold Storage, Congebec Inc., Lineage Logistics Holdings LLC (Bay Grove Capital Group LLC), Nichirei Logistics Group Inc. (Nichirei Corporation), Snowman Logistics Ltd., Tippmann Group, United States Cold Storage Inc. (John Swire & Sons Ltd.), VersaCold Logistics Services, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cold chain logistics market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global cold chain logistics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cold chain logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cold chain logistics market was valued at USD 328.0 Billion in 2025.

IMARC estimates the cold chain logistics market to exhibit a CAGR of 12.44% during 2026-2034, reaching a value of USD 941.9 Billion by 2034.

The market is driven by the rising demand for perishable goods, including fresh produce, dairy, seafood, and frozen foods, along with increasing pharmaceutical needs, advancements in cold chain technologies like real-time monitoring, and strict regulatory compliance for food and pharmaceutical safety.

North America currently dominates the cold chain logistics market, accounting for a share of 38.6%. This dominance is fueled by advanced cold chain infrastructure, strong regulatory frameworks, and growing demand for temperature-sensitive products in sectors like food and pharmaceuticals.

Some of the major players in the cold chain logistics market include Americold Realty Trust Inc., Burris Logistics Co., Cold Box Express Inc., Conestoga Cold Storage, Congebec Inc., Lineage Logistics Holdings LLC (Bay Grove Capital Group LLC), Nichirei Logistics Group Inc. (Nichirei Corporation), Snowman Logistics Ltd., Tippmann Group, United States Cold Storage Inc. (John Swire & Sons Ltd.), and VersaCold Logistics Services, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)