Coffee Beans Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2026-2034

Coffee Beans Market Size and Share:

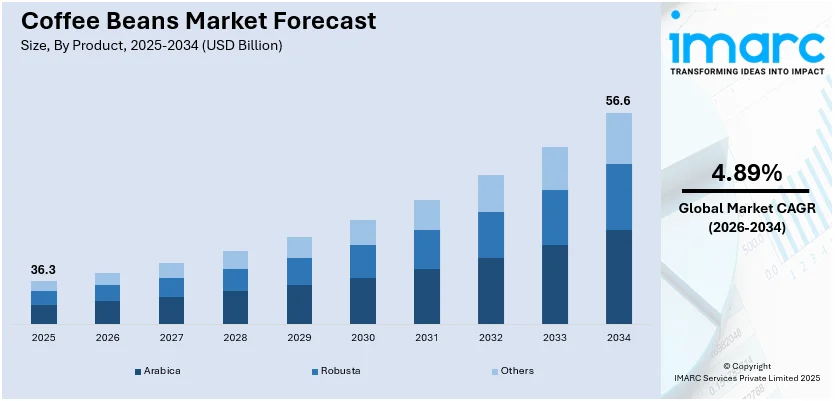

The global coffee beans market size was valued at USD 36.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 56.6 Billion by 2034, exhibiting a CAGR of 4.89% during 2026-2034. North America currently dominates the market, holding a significant market share of over 36.7% in 2025. The rising demand for specialty blends, health benefits, ethical sourcing, and convenient brewing options are some of the major factors fueling the coffee beans market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 36.3 Billion |

|

Market Forecast in 2034

|

USD 56.6 Billion |

| Market Growth Rate 2026-2034 | 4.89% |

The market for coffee beans is driven by several key factors. Rising global coffee consumption, particularly among millennials and urban populations, fuels constant demand. The growing popularity of specialty coffee, café culture, and premium blends also supports market growth. Health benefits linked to moderate coffee intake, such as improved focus and antioxidants, attract health-conscious consumers. The growth of e-commerce platforms combined with easier international coffee variety accessibility has driven overall business volume up. Technological improvements in roasting machines and brewing technology create better quality products while expanding their variety. The market receives continuous market impetus from emerging economies combined with new sustainable farming practices that adopt organic principles.

To get more information on this market Request Sample

The market for coffee beans in the United States is driven by rising consumer demand for premium, specialty, and ethically sourced coffee. A strong coffee culture, fueled by widespread café chains and home brewing trends, continues to boost consumption. Millennials and Gen Z prefer gourmet and organic options, encouraging innovation and variety. Health-conscious consumers are also drawn to coffee for its antioxidants and cognitive benefits. Additionally, the expansion of e-commerce platforms has made high-quality beans more accessible. Sustainability and traceability concerns further influence buying decisions, prompting growth in fair trade and eco-friendly coffee production across the U.S. market. For instance, in September 2024, Krispy Kreme® launched a complete range of over twenty types of hot, frozen, and iced coffees that are entirely new, crafted with richer roasts and superior beans.

Coffee Beans Market Trends:

Growing Global Coffee Consumption

The global increase in coffee consumption, especially in developing countries and urban centers, is a significant driver of the coffee beans market. According to exclusive consumer research released by the National Coffee Association (NCA), the percentage of American adults who had coffee the previous day has risen by 37% since 2004, marking the highest level of past-day coffee consumption in over two decades. Rising disposable incomes, changing lifestyles, and the influence of Western café culture have led to an increasing number of people incorporating coffee into their daily routines. The growing popularity of specialty drinks, such as lattes, cold brews, and flavored coffees, further supports this trend. With coffee being both a social and functional beverage, demand spans across age groups and demographics, boosting the consumption of various coffee bean types, Arabica and Robusta, across retail, food service, and online platforms. As a result, the coffee beans market price has seen an upward trend, reflecting the increased demand and higher consumption rates globally.

Rising Demand for Specialty and Premium Coffee

Consumers are increasingly seeking high-quality, single-origin, and specialty coffee experiences, driving demand for premium coffee beans. Factors like unique flavor profiles, artisanal roasting methods, and third-wave coffee culture have pushed producers and retailers to offer more curated and traceable options, creating a positive coffee beans market outlook. Specialty cafés, roasteries, and subscription boxes are gaining popularity, particularly among millennials and Gen Z. This shift toward craft and gourmet coffee has encouraged innovations in farming, processing, and packaging, giving rise to niche markets. As a result, producers are focusing more on quality and sustainability, which in turn elevates global interest in specialty-grade coffee beans. For instance, in March 2025, Coffeeverse, a high-end specialty coffee brand, unveiled the launch of its online shopping platform. After the acknowledgment of its Roastery Cultúr café in Ahmedabad, Coffeeverse is preparing to deliver single-origin Arabica coffees from Chikmagalur, Coorg, and Tamil Nadu directly to coffee enthusiasts across the country. Offering a smooth shopping journey, a thoughtfully chosen range of coffee beans, ground coffee, and instant brews, along with an expanding assortment of brewing tools and trendy merchandise, Coffeeverse aims to transform how India enjoys coffee.

Sustainability and Ethical Sourcing Trends

Environmental and social responsibility are increasingly influencing consumer choices, driving demand for ethically sourced and sustainably grown coffee beans. Consumers want assurance that their purchases support fair labor practices, biodiversity, and climate-conscious farming. Certifications such as Fair Trade, Rainforest Alliance, and Organic are gaining importance. Brands that promote transparency in sourcing and environmentally friendly packaging are preferred. These values resonate strongly with younger, environmentally aware demographics. As a result, producers and companies are investing in traceable supply chains, sustainable agriculture, and farmer support programs, factors that are reshaping how coffee beans are cultivated, marketed, and consumed worldwide. For instance, in October 2024, Minneapolis-based Peace Coffee launched an Organic and Fair Trade Peace Coffee Premium Concentrate for cold or iced espresso-based drinks in response to the obvious dominance of cold espresso-based beverages in coffee consumer preference. Food service and wholesale customers may now purchase the shelf-stable, ready-to-use product, which is prepared with Peace Coffee's ethically and sustainably sourced Yeti Blend beans.

Coffee Beans Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global coffee beans market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, distribution channel, and end user.

Analysis by Product:

- Arabica

- Robusta

- Others

Arabica filters stand as the largest component in 2025, holding around 58.9% of the market due to its superior taste, lower bitterness, and smoother flavor profile compared to other varieties like Robusta. It contains less caffeine, which contributes to its milder and more nuanced flavor, making it the preferred choice for specialty and premium coffee segments. Arabica beans are often grown at higher altitudes, which enhances their quality and aroma. With rising consumer demand for high-quality, artisanal coffee experiences, Arabica's reputation for excellence has driven its popularity globally. Its dominance is also supported by widespread use in cafés, gourmet products, and home brewing solutions.

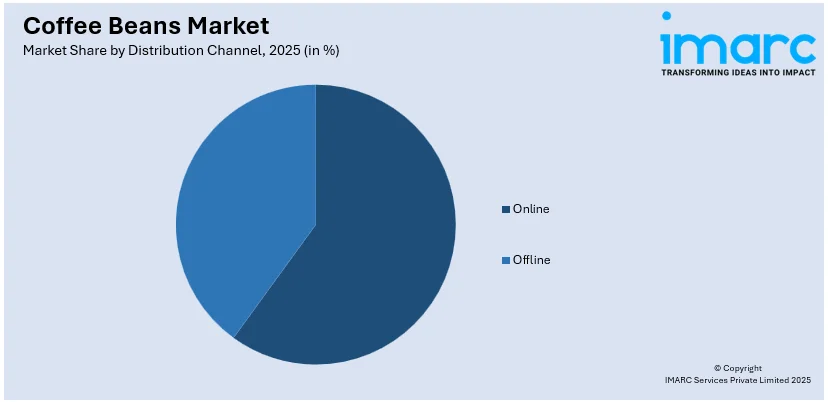

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The online market for coffee beans is expanding due to the growing popularity of e-commerce platforms, direct-to-consumer (DTC) brands, and subscription-based coffee services. Consumers prefer online shopping for accessibility, variety, and convenience, enabling them to explore premium, organic, and specialty coffee from global sources. The rise of digital retail, doorstep delivery, and personalized recommendations further boost sales. Additionally, social media marketing and influencer promotions have fueled awareness, making online platforms a key driver of the coffee beans market.

The offline market remains dominant due to the presence of supermarkets, hypermarkets, cafés, and specialty coffee shops. Consumers prefer physical stores for quality assurance, sensory experiences, and immediate product availability. Coffeehouses and retail chains like Starbucks and Dunkin' contribute significantly to offline sales. Additionally, gourmet stores and local roasteries play a crucial role in promoting premium and artisanal coffee varieties, keeping offline distribution a major revenue-generating channel in the coffee beans market.

Analysis by End User:

- Personal Care

- Food and Beverages

- Pharmaceutical

Food & beverages leads the market with around 76.7% of market share in 2025 due to the high global consumption of coffee in households, cafés, restaurants, and commercial establishments. The increasing demand for specialty coffee, cold brews, and ready-to-drink beverages has fueled market growth. Major coffee chains like Starbucks, Costa Coffee, and Dunkin' Brands contribute significantly by driving innovation in coffee-based drinks. Additionally, the rise in home brewing culture, instant coffee, and premium blends further boost demand. The integration of coffee in desserts, beverages, and functional drinks within the food industry cements its dominant position in the coffee market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 36.7%. The coffee beans demand in North America is driven by a strong coffee-drinking culture, especially in the U.S. and Canada, where daily coffee consumption is high. Increasing demand for specialty, organic, and ethically sourced coffee is fueling premiumization. The rise of home brewing, single-serve machines, and cold brew trends is further boosting consumption. Millennials and Gen Z are driving interest in gourmet and sustainable products. Additionally, innovations in coffee-based beverages and the expansion of café chains contribute to market growth. E-commerce and subscription models also enhance accessibility and variety, supporting the region’s robust coffee-bean demand.

Key Regional Takeaways:

United States Coffee Beans Market Analysis

In 2025, the United States accounted for over 87.60% of the coffee beans market in North America. United States is witnessing a surge in coffee beans adoption, driven by the expanding personal care sector. For instance, in 2021, the American beauty industry saw record-breaking investments with 388 deals and USD 3.3 Billion in venture capital raised. Coffee extracts are increasingly incorporated into skincare and hair care products due to their antioxidant properties, supporting demand from beauty and wellness brands. The rising consumer preference for natural and sustainable ingredients fuels its presence in exfoliants, face masks, and anti-aging formulations. Personal care brands are capitalizing on coffee beans’ caffeine content for cellulite reduction and skin rejuvenation, further propelling their usage. The focus on eco-friendly and organic beauty solutions encourages product innovation, strengthening the integration of coffee derivatives into self-care routines. The growing awareness of dermatological benefits increases consumer inclination toward coffee-infused serums and shampoos. Skincare and haircare manufacturers continue to develop formulations enriched with coffee beans, elevating their demand across retail and specialty segments. The rising influence of premium and artisanal personal care brands amplifies the expansion of coffee-based products.

Asia Pacific Coffee Beans Market Analysis

Asia-Pacific is experiencing notable coffee beans adoption, driven by increasing investment in the pharmaceutical industry. According to the India Brand Equity Foundation, the total FDI equity inflow in the drugs and pharmaceuticals sector amounts to USD 22.52 billion from April 2000 to March 2024, roughly 3.4% of the overall inflow collected across all sectors. Coffee bean-derived compounds are widely studied for their anti-inflammatory, neuroprotective, and metabolic health benefits, attracting pharmaceutical firms toward research and development. The rising demand for functional ingredients enhances the utilization of coffee-based extracts in formulations targeting cognitive health and cardiovascular support. Pharmaceutical manufacturers are exploring coffee-derived polyphenols and chlorogenic acids for potential therapeutic applications, reinforcing their role in medicinal innovations. The surge in consumer inclination toward herbal and plant-based supplements accelerates their incorporation into nutraceuticals. The regional pharmaceutical sector’s growing interest in caffeine’s potential for metabolic regulation strengthens the market for coffee bean-based pharmaceutical products.

Europe Coffee Beans Market Analysis

Europe is experiencing heightened coffee beans adoption, influenced by the expanding food and beverages sector. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages. Coffee-derived ingredients are gaining popularity in dairy, confectionery, and ready-to-drink products, enhancing the appeal of premium and specialty offerings. The demand for natural flavouring agents increases the utilization of coffee extracts in syrups, yogurts, and dessert toppings. Food manufacturers are developing coffee-infused formulations to meet consumer demand for indulgent yet functional ingredients. The growing preference for gourmet and specialty food products encourages the use of coffee-based elements in artisanal baked goods and beverages. Coffee beans are increasingly integrated into plant-based alternatives, supporting innovation in non-dairy lattes and protein-enriched food items. The evolving demand for high-quality and ethically sourced ingredients strengthens the presence of coffee-derived components in sustainable food offerings.

Latin America Coffee Beans Market Analysis

Latin America is witnessing an increasing adoption of coffee beans, supported by the expanding online ecommerce sector. According to reports, the Latin America market currently boasts over 300 Million digital buyers. Digital platforms provide broader market access for coffee-based products, fuelling demand across specialty and artisanal categories. The availability of direct-to-consumer distribution channels strengthens sales of coffee-infused beverages, confectionery, and skincare items. Subscription-based models and digital storefronts enable brands to showcase premium coffee variants, boosting customer engagement. The rise in online retailing accelerates exposure to diverse coffee-based product lines, enhancing consumer accessibility.

Middle East and Africa Coffee Beans Market Analysis

Middle East and Africa is experiencing increasing coffee beans adoption, supported by their widespread use in chocolates, body scrubs, muffins, cookies, and cakes, alongside a growing tourism sector. For instance, Dubai welcomed 14.96 Million overnight visitors from January to October 2024, marking an 8% increase compared to the same period in 2023, highlighting a strong growth in tourism. The expansion of artisanal confectionery fuels demand for coffee-infused chocolates, enhancing product diversity. Skincare brands incorporate coffee extracts in exfoliants and body treatments, reinforcing their presence in beauty and wellness categories. The bakery industry leverages coffee-based elements to enhance flavour profiles in muffins and cakes, appealing to gourmet preferences. The growing influx of international tourists strengthens demand for coffee-inspired culinary offerings, supporting expansion across hospitality segments.

Competitive Landscape:

The coffee beans market is highly competitive, featuring a mix of global giants and regional players. Key companies such as Nestlé, Starbucks, JDE Peet’s, The Kraft Heinz Company, and Lavazza dominate through extensive product portfolios and strong distribution networks. These brands invest heavily in innovation, sustainability, and premium offerings to attract health-conscious and quality-driven consumers. Specialty roasters and direct-to-consumer startups are gaining traction, emphasizing traceability and unique flavors. The rise of e-commerce, private labels, and café chains has intensified competition, driving companies to differentiate through organic certifications, ethical sourcing, and customized blends to capture diverse consumer preferences and maintain market share.

The report provides a comprehensive analysis of the competitive landscape in the coffee beans market with detailed profiles of all major companies, including:

- Backyard Beans Coffee Company

- Caribou Coffee Company Inc.

- Coffee Bean Direct LLC

- Death Wish Coffee Co.

- Gold Coffee Company

- Hawaiian Isles Kona Coffee Co.

- illycaffè S.p.A.

- La Colombe Coffee Roasters

- Luigi Lavazza S.p.A.

- Starbucks Coffee Company

- The Coffee Bean Company

- The East India Company Ltd.

Latest News and Developments:

- December 2024: The Coffee Bean & Tea Leaf™ signed a Master Franchise Agreement with Ekaagra Ostalaritza to expand in India. Ekaagra Ostalaritza secured exclusive rights to develop 250 cafés over five years. This partnership marked a major step in the brand’s global expansion strategy. The move reinforced its commitment to India’s rapidly growing coffee and tea market.

- October 2024: Starbucks expanded its coffee innovation efforts by adding new farms in Guatemala and Costa Rica to protect the future of coffee beans. The company planned further investments in Africa and Asia to support farmers and enhance climate resilience. These initiatives aimed to improve productivity, increase profitability, and mitigate climate change impacts on coffee beans.

- October 2024: Press Coffee acquired a 70-hectare coffee farm in Panama to enhance its single-origin coffee sourcing. The purchase strengthened its control over the supply chain and expanded its ‘Allocation’ subscription service. Located in Volcan Valley, the farm’s high elevation and rich soil fostered exceptional coffee beans. The Arizona-based company reaffirmed its commitment to a farm-to-cup coffee experience.

- May 2024: Lavazza completed the acquisition of Stirlingshire Vending (Scotland) Limited. This move aimed to expand Lavazza Professional’s coffee vending machine business. The acquisition reinforced Lavazza’s market presence in automated coffee solutions. It marked a strategic step in strengthening its vending operations in the UK.

- April 2024: Lavazza revealed plans to acquire vending machine maker IVS. The deal was intended to enhance IVS’s vending machine business across Europe. Lavazza aimed to consolidate its presence in the European automated coffee market. This acquisition aligned with its strategy to expand in the vending sector.

Coffee Beans Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Arabica, Robusta, Others |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Personal Care, Food and Beverages, Pharmaceutical |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Backyard Beans Coffee Company, Caribou Coffee Company Inc., Coffee Bean Direct LLC, Death Wish Coffee Co., Gold Coffee Company, Hawaiian Isles Kona Coffee Co., illycaffè S.p.A., La Colombe Coffee Roasters, Luigi Lavazza S.p.A., Starbucks Coffee Company, The Coffee Bean Company, The East India Company Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the coffee beans market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global coffee beans market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the coffee beans industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The coffee beans market was valued at USD 36.3 Billion in 2025.

The coffee beans market is projected to exhibit a CAGR of 4.89% during 2026-2034, reaching a value of USD 56.6 Billion by 2034.

The coffee beans market is driven by rising demand for specialty and premium coffee, increasing café culture, growing home brewing trends, and a preference for ethically sourced and organic beans. Additionally, e-commerce expansion, health benefits, convenience-focused innovations, and sustainability initiatives are fueling market growth across both online and offline retail channels.

North America currently dominates the coffee beans market due to rising specialty coffee demand, café culture, home brewing trends, ethical sourcing preferences, and e-commerce growth.

Some of the major players in the coffee beans market include Backyard Beans Coffee Company, Caribou Coffee Company Inc., Coffee Bean Direct LLC, Death Wish Coffee Co., Gold Coffee Company, Hawaiian Isles Kona Coffee Co., illycaffè S.p.A., La Colombe Coffee Roasters, Luigi Lavazza S.p.A., Starbucks Coffee Company, The Coffee Bean Company, The East India Company Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)