Coconut Water Market Size, Share, Trends and Forecast by Type, Flavor, Form, Packaging, Distribution Channel, and Region, 2026-2034

Coconut Water Market 2025, Size and Trends:

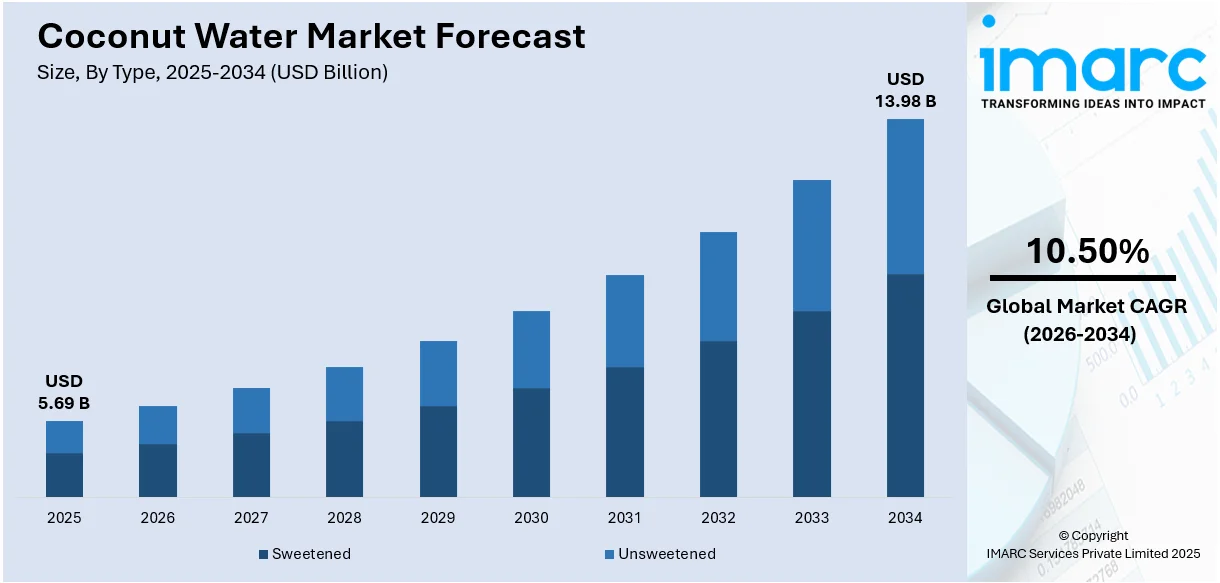

The global coconut water market size was valued at USD 5.69 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 13.98 Billion by 2034, exhibiting a CAGR of 10.50% during 2026-2034. North America currently dominates the market, holding a significant coconut water market share of over 28.9% in 2025. The market is primarily driven by increasing expenditure on healthy beverages, growing export opportunities, and increasing health awareness among consumers, who prefer natural and organic hydration options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5.69 Billion |

|

Market Forecast in 2034

|

USD 13.98 Billion |

| Market Growth Rate (2026-2034) | 10.50% |

The global coconut water market is mainly propelled by magnifying customer inclination towards health-oriented and natural beverages, boosted by increasing awareness regarding its nutritional profile and hydration benefits. Notable elevation disposable incomes and rapid magnification of urbanization significantly bolster demand, specifically in emerging nations. Furthermore, the market also profits from the accelerating shift toward plant-derived substitutes, catering to the emerging vegan as well as fitness trends. Moreover, proliferating distribution networks, encompassing e-commerce segments, improve both purchase and availability. In addition, advancements in packaging and product augmentation, such as fortified or flavored options, appeal to broader customer base. These factors collectively support the expansion of coconut water market size across global regions.

To get more information on this market Request Sample

The United States plays a pivotal role in the global coconut water market, driven by increasing consumer demand for natural, low-calorie, and health-focused beverages. With its well-established distribution channels and innovative product offerings, the country serves as a significant market for both domestic and imported coconut water brands. The rising popularity of plant-based hydration and functional beverages further boosts demand. Additionally, robust marketing strategies and endorsements by health influencers contribute to expanding consumer awareness. Moreover, the U.S. market benefits from a steady influx of premium and flavored options, catering to diverse consumer preferences and solidifying its position in the global market. For instance, in March 2024, 100 Coconuts, a U.S.-based coconut water brand, launched its latest 100% pure coconut water in cans of 16.6 fluid ounce. This bigger size is developed to offer consumers with more quantity of hydrating coconut water.

Coconut Water Market Trends:

Increasing Health Consciousness

One of the primary coconut water market trends is the growing health consciousness among customers has affected what they eat, as seen by the increasing popularity of coconut water. According to the Centers for Disease Control and Prevention (CDC), alarming statistics in 2022, every U.S. state and territory recorded an obesity rate of over 20%, indicating that more than one in five persons were afflicted by obesity and related health concerns. For instance, the regions with the greatest obesity rates were the Midwest (35.8%) and South (35.6%), followed by the Northeast (30.5%) and West (29.5%). This has led customers to actively look for drinks that provide nutritional value without having too many calories like coconut water, which is naturally low in calories and high in electrolytes, thus increasing coconut water market growth.

Rising Consumer Spending on Healthy Beverages

According to the Bureau of Economic Analysis (BEA), the rising consumer spending particularly increased by USD 39.1 Billion, showing a 0.2% gain in April 2024. Additionally, personal income rose by USD 65.3 Billion in April, indicating a 0.3% gain from March 2024. There was a USD 40.2 billion, or 0.2%, increase in disposable personal income (DPI). This is a result of shifting consumer behavior brought about by increased awareness regarding the health advantages of natural and organic products like coconut water. As people become more aware of the nutritional value of their food and how it affects their long-term health and fitness, they are spending on healthy beverages like coconut water leading to a positive coconut water market outlook.

Growing Export Opportunities

According to the Philippine Coconut Authority, the primary market for coconut water was the United States, which accounted for 81,646.40 metric tons (MT), representing 58.45% of total global exports in 2022. Closely followed by the United Kingdom with 21,020.63 MT, Canada with 10,892.03 MT, the Netherlands with 7,827.44 MT, and Australia with 5,938.23 MT. Thus, this spike is due to the growing consumer awareness among consumers worldwide regarding the health advantages of coconut water. Globally, as people's awareness of their health increases, they are looking for natural substitutes for artificial hydrators and sugary drinks. Along with this, coconut water is regarded as a great hydration choice due to its natural electrolytes, low-calorie content, and lack of chemical additions. Hence, with this increased local demand and recognition, coconut water is now seen as a viable export good.

Coconut Water Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global coconut water market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, flavor, form, packaging, and distribution channel.

Analysis by Type:

- Sweetened

- Unsweetened

Sweetened coconut water dominates the type segment, appealing to customers seeking a more enhanced taste profile that goes well with the naturally mild flavor of coconut water. It is immensely gaining traction among younger audiences and individuals with sweeter palates. Additionally, producers also add different tastes and sweeteners, which boosts the product's attractiveness and encourages customers to choose it over unsweetened versions, which are usually targeted at consumers who are health-conscious and seeking a natural, low-calorie hydration choice. Furthermore, the differentiation between these categories affects product development and marketing tactics in the larger coconut water sector as customer tastes change.

Analysis by Flavor:

- Plain

- Flavored

Flavored coconut water has emerged as a leading segment and is widely preferred by consumers, particularly among younger populations, for a wider variety of unusual tastes. In addition, flavored coconut water is frequently blended with a variety of other tropical fruits including lime, mango, and pineapple, offering a delightful and refreshing substitute for the more conventional plain coconut water. Moreover, flavored coconut water is becoming popular in established and emerging economies due to health-conscious customers looking for natural, low-calorie beverage alternatives that taste good and provide hydration benefits. Besides, key players are introducing innovative product variants to meet these needs. For instance, in April 2023, B Natural Juices & Beverages, a well-regarded brand under ITC Ltd., introduced packaged Tender Coconut Water throughout India. It comprises no added sugar and no artificial flavors. This introduction aims to offer consumers a refreshing and natural hydration option for the upcoming summer season thus aiding the coconut water market demand.

Analysis by Form:

- Coconut Water

- Coconut Water Powder

Coconut water, accounting for the dominant form, is gaining immense popularity as a natural, hydrating beverage with minimal processing. Consumers prefer coconut water for its immediate consumption convenience, perceived health benefits, and natural electrolytes, which are marketed as an ideal drink for hydration and sports recovery. Ready-to-drink coconut water is also a popular option for casual drinking at yoga studios and gyms due to its ease. Moreover, its health advantages contribute to its growing popularity, which has led to a large amount of shelf space in supermarkets and health food stores worldwide. For instance, on 12 June 2023, the Vita Coco Company, Inc. and Bluestone Lane, presented their newest Coconut Water Cold Brew to celebrate the spirit of long summer days, which is exclusively available at the Bluestone Lane cafes and coffee shops.

Analysis by Packaging:

- Carton

- Bottles

- Others

Carton leads the market with around 52.2% of coconut water market share in 2025. Cartons have emerged as the dominant packaging due to their eco-friendly properties and effective preservation qualities that help maintain the freshness and natural flavor of coconut water. Additionally, the lightweight nature and ease of recycling cartons also appeal to environmentally conscious consumers, enhancing their popularity. Moreover, cartons are cost-effective for manufacturers and convenient for consumers, offering benefits like portability and ease of storage. Hence, this combination of environmental and practical benefits has propelled cartons to the forefront of coconut water packaging preferences, making them the preferred choice over bottles and other packaging options.

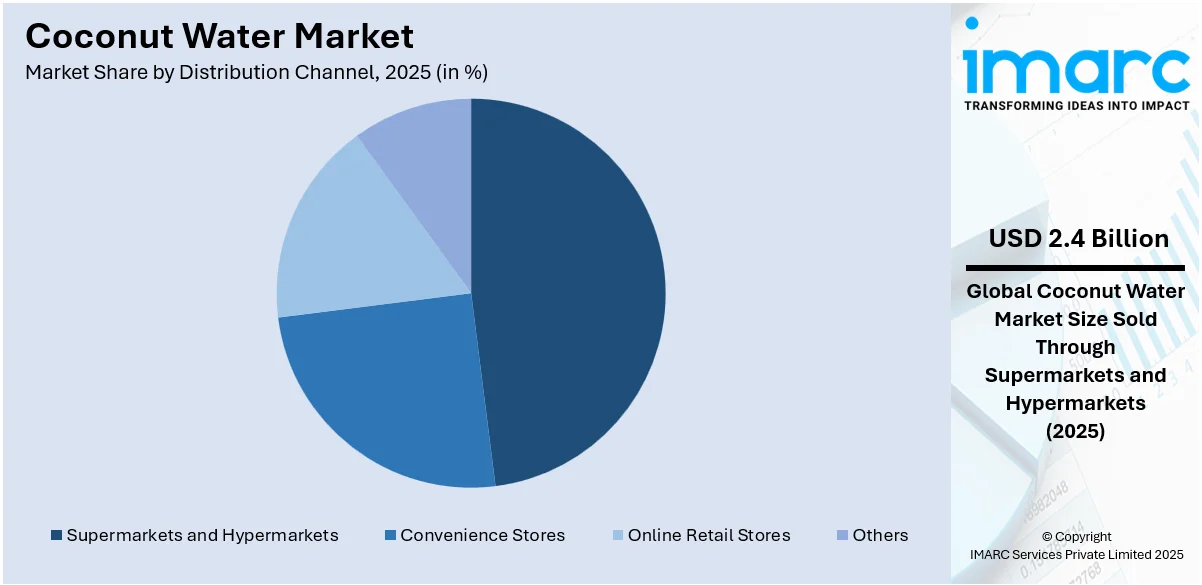

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others

Supermarkets and hypermarkets lead the market with around 47.8% of market share in 2025. This is attributed to the widespread availability and convenience it offers to consumers looking for varied selections of coconut water brands under one roof. Additionally, supermarkets and hypermarkets often provide competitive pricing and frequent promotional deals, enhancing their appeal among price-sensitive consumers. As a result, supermarkets and hypermarkets have become pivotal in determining coconut water brands' market reach and visibility. For instance, in March 2023, Coconutea introduced a new line of six beverages to the coconut water market in the UK, filling a gap they identified for premium offerings. The product lineup includes six flavors, lemon, peach, pineapple, passionfruit, strawberry, and soursop, each offered at a recommended retail price (RRP) of £3.49 per bottle. Vivo Tea Company, the distributor and brand proprietor, introduced its brand to the UK market in March 2023, targeting various formats such as multiple retail outlets, independent luxury retailers, farm shops, delicatessens, and the hospitality and food service sectors.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, based on the coconut water market forecast, North America accounted for the largest market share of over 28.9%. North American market is attributed to the growing consumer preference for healthy, natural beverages over sugary drinks in countries like the United States and Canada. Additionally, the increasing awareness of the health benefits associated with coconut water, such as hydration, high electrolyte content, and low-calorie count, has significantly boosted its popularity. Moreover, the presence of key players in the North American market actively promoting coconut water as a trendy lifestyle choice furthers its appeal, making it a staple in many consumers' diets. This trend is supported by the expansive distribution networks and aggressive marketing strategies that cater to the health-conscious consumer base across the region. For instance, on 1 February 2023, NEW YORK, N.Y., Vita Coco and Captain Morgan launched their eagerly anticipated ready-to-drink lineup nationwide, promising to infuse summer vibes with three enticing flavors. The collaboration between the top-selling spiced rum brand and the leading coconut water brand introduces Vita Coco Spiked with Captain Morgan, a blend of flavorful Captain Morgan rum and refreshing Vita Coco coconut water, guaranteed to add a tropical twist to any occasion. Vita Coco Spiked with Captain Morgan is available in three tempting rum-based cocktails including Pina Colada, Strawberry Daiquiri, and Lime Mojito, each designed to be enjoyed straight from the chilled can.

Key Regional Takeaways:

United States Coconut Water Market Analysis

In 2025, United States accounted for the 85.30% of the market share in North America. This country is exhibiting significantly steady growth in the global coconut water market. Such notable growth takes place through rising consumer consciousness of its health benefits coupled with demand for natural drinks. In 2023, according to an industrial report, coconut water market share in the United States would amount to approximately USD 2.5 Billion with a compound annual growth rate (CAGR) of about 6.5 percent between 2023 to 2028. One key factor is the inclination toward healthy alternatives to liquid sugars. Furthermore, the leading companies, like Vita Coco and Zico, dominate the market, supported by a high distribution rate in grocery stores and convenience outlets. Moreover, the sustainability trend has become a key influencing factor for innovations in packaging, with several firms striving to eliminate plastic use. Retail growth, with increased retail and online sales, reflects consumer preferences towards functional drinks. In addition, contributing to the growing trend trajectory of the market is this fitness-conscious and health-oriented consumer.

Europe Coconut Water Market Analysis

The European market for coconut water is indeed growing intensely due to increasing preferences of consumers toward a healthier and functional beverage. According to Centre for the Promotion of Imports from developing countries (CBI), consumption of coconut water in the last five years grew in Europe with an average annual increase of 15-20% on top of which, for the next five years, there may be an expectation for even an annual increase of 10%. European consumption represents about 10% of sales worldwide, that is approximately 60-70 million liters per year. Import volumes are estimated at 30-40 million liters annually indicating the rising demand of coconut water in retail as well as ingredient applications. In terms of consumption, UK stands alone as the highest consumer whereby consumption reached the peak to more than 25 million liters in 2016 and expected increase in years ahead. Brands such as Vita Coco, which targets sales of 150 million liters worldwide in 2019, have driven the UK market, which is still a key focus for suppliers. As European consumers seek healthy, low-sugar, and hydrating products, coconut water is gaining traction across the continent, offering promising opportunities for growth.

Asia Pacific Coconut Water Market Analysis

Asia-Pacific region has significant activities in the production and exports of coconut water in the global scenario. In the region, the top exporting country is India. During March 2023 to February 2024, (TTM) period, Volza's India Export data mentioned 1,874 consignments of coconut water shipment. This shows an international growing demand for the healthy and natural beverage coconut water. Other major players in the region, such as Thailand, the Philippines, and Indonesia, also play an important role in supplying globally. The functional and plant-based drinks preference of global consumers has further opened this opportunity. Moreover, the health benefits attributed to coconut water are its hydration and natural electrolytes with a low-calorie count. In addition, the demand is driven by the increasing exports to regions such as Europe and North America, where coconut water has been gaining popularity as a prime ingredient in beverages and wellness products and increasing traditional consumption in coconut-producing countries.

Latin America Coconut Water Market Analysis

The coconut water market in Latin America is notably booming, mainly due to the region's leading position concerning coconut production. Brazil holds the position of the greatest producer of coconuts within the region and is significantly contributing to the global coconut water supply. According to industry reports, in 2023, Brazil produced over 1 million coconuts, with key producing states including Ceará, Bahia, and Pernambuco. This increased production has, directly contributed to the expansion of coconut water exports. Exports by Brazil are primarily headed towards the United States, Spain, and Argentina among other destinations, as evidence of this increasing demand worldwide for coconut water. With strong production and export growth, Latin America will be in a position to maintain its leading position in the coconut water market, feeding the rising consumer demand for healthy, natural beverages.

Middle East and Africa Coconut Water Market Analysis

The coconut water market is expected to boom significantly in the Middle East and Africa. According to industrial reports, the market of the Middle East is expected to rise above USD 1,549.5 Million by the end of 2028. In fact, this growth corresponds to a rising demand for natural and healthy beverages. It falls under one category, given the fact that people care more than ever about being healthy and keeping themselves well hydrated. Consumers in this region are more aware about the benefits coconut water has, which makes this market grow strongly. Apart from that, volume import growth in key coconut-producing nations also stimulates growth for this market. Organic coconut water is gaining acceptance and is further increasing the distribution channels in the region, which enhances the prospects of robust growth. As health-consciousness is increasing, there will be an increased demand for coconut water, both in the retail and foodservice sectors that offer sizeable opportunities.

Competitive Landscape:

Key players in the coconut water market are actively bolstering market growth through strategic collaborations and acquisitions to expand their global footprint. They invest heavily in marketing to educate consumers about the health benefits of coconut water, positioning it as a superior hydration alternative to traditional sports drinks. Additionally, they focus on product innovation, introducing flavored varieties and combination beverages that blend coconut water with other health-centric ingredients. This approach diversifies their product offerings and caters to evolving consumer tastes and preferences, further driving market expansion. For instance, in March 2023, Harmless Harvest Inc. launched an organic coconut water infused with aloe pulp, formulated without any additional sugar.

The report provides a comprehensive analysis of the competitive landscape in the coconut water market with detailed profiles of all major companies, including:

- Amy & Brian Naturals

- C2o Pure Coconut Water, LLC

- Celebes Coconut Corporation

- EQUATOR Beverage Company

- Goya Foods, Inc.

- Harmless Harvest Inc.

- Navita International

- PepsiCo Inc.

- Taste Nirvana International, Inc.

- The Vita Coco Company, Inc. (All Market Inc.)

- Wichy Plantation Company (Pvt) Ltd.

- ZICO Rising, Inc.

Latest News and Developments:

- In September 2024, The Central Plantation Crops Research Institute (CPCRI) will launch its almond-flavored ready-to-drink coconut beverage, Kalpa Bliz, on September 2 during the World Coconut Day event. The drink, rich in lauric acid, minerals, and folate, is the result of over two years of research. CPCRI Director K.B. Hebbar highlighted its preservative-free formulation and readiness for technology transfer, with multiple inquiries already received for commercial production.

- In August 2024: PepsiCo revealed its acquisition of Amacoco, Brazil's largest coconut water company. Known for its market-leading brands, Kero Coco and Trop Coco, Amacoco holds a dominant position in Brazil's coconut water sector. The acquisition also includes two manufacturing plants and exclusive supply contracts. This move is aligned with PepsiCo's broader plan to invest more than $3.3 billion in Latin America, following earlier acquisitions in the region.

- In July 2024, Yu, an omni-channel consumer foods brand, has expanded into the beverage segment with 100% Natural Coconut Water and two fruit juice variants, Tropical Punch and Berry Blast. This marks Yu's second category since launching Instant Foods in 2021. The brand plans to introduce 3-4 more juice flavors this year, complementing its portfolio. These products will be available through offline, quick commerce, e-commerce, airlines, and export channels.

- March 2024: Harmless Harvest proudly announces that their coconuts, essential for their refreshing beverages and smoothies, have achieved Bronze Level certification under the Regenerative Organic Certified program.

- February 2024: Inter Miami CF has unveiled a new partnership with 100 Coconuts, marking the club’s inaugural official coconut water collaboration. This collaboration aims to enhance the experience for fans by offering premium, nutrient-rich beverages.

- April 2023: TC's B Natural has launched packaged tender coconut water across India. The product will be sold in supermarkets, hypermarkets, mini-markets and in e-commerce channels.

Coconut Water Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sweetened, Unsweetened |

| Flavors Covered | Plain, Flavored |

| Forms Covered | Coconut Water, Coconut Water Powder |

| Packagings Covered | Carton, Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retail Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amy & Brian Naturals, C2o Pure Coconut Water, LLC, Celebes Coconut Corporation, EQUATOR Beverage Company, Goya Foods, Inc., Harmless Harvest Inc., Navita International, PepsiCo Inc., Taste Nirvana International, Inc., The Vita Coco Company, Inc. (All Market Inc.), Wichy Plantation Company (Pvt) Ltd., ZICO Rising, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the coconut water market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global coconut water market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the coconut water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Coconut water is a natural, nutrient-rich beverage extracted from young, green coconuts. It is valued for its hydrating properties, low-calorie content, and essential electrolytes, making it a popular choice in the health and wellness market. Its global demand is growing due to increasing awareness of its health benefits.

The report covers industry trends, forecasts, and dynamics of the coconut water market from 2020-2034.

The coconut water market was valued at USD 5.69 Billion in 2025.

The market is driven by rising consumer demand for natural and healthy beverages, growing awareness of its hydration and nutrient benefits, and increasing adoption of plant-based diets. Expanding availability through e-commerce and innovative packaging solutions further accelerates market growth globally.

According to the report, sweetened represented the largest segment by type, driven by consumer preference for taste-enhanced beverages.

Flavored leads the market by flavor, driven by increasing demand for innovative options.

Coconut water is the leading segment by form, driven by its versatility and convenience.

Cartons is the leading segment by packaging, driven by durability and convenience.

Supermarkets and hypermarkets are the leading segment by distribution channel, driven by wide availability and accessibility.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global coconut water market include Amy & Brian Naturals, C2o Pure Coconut Water, LLC, Celebes Coconut Corporation, EQUATOR Beverage Company, Goya Foods, Inc., Harmless Harvest Inc., Navita International, PepsiCo Inc., Taste Nirvana International, Inc., The Vita Coco Company, Inc. (All Market Inc.), Wichy Plantation Company (Pvt) Ltd., ZICO Rising, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)