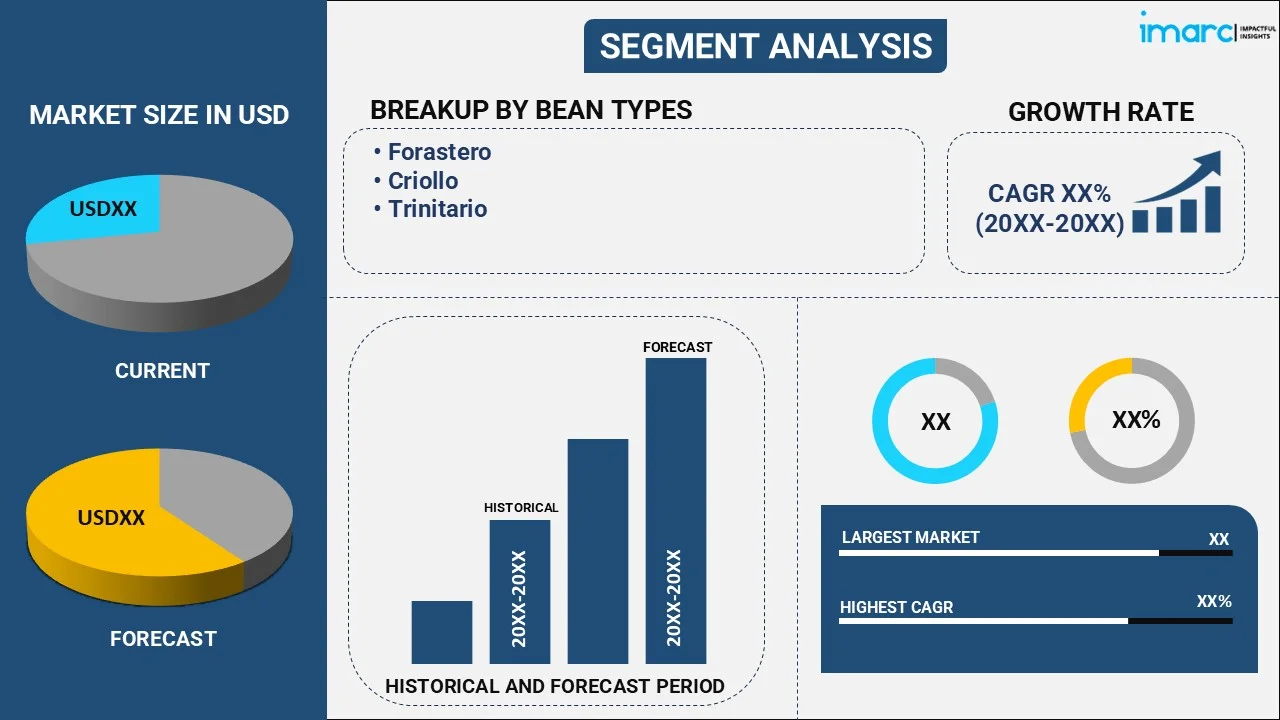

Cocoa Processing Market Report by Bean Type (Forastero, Criollo, Trinitario), Product Type (Cocoa Butter, Cocoa Liquor, Cocoa Powder), Application (Confectionary, Bakery, Beverages, Pharmaceuticals, and Others), and Region 2026-2034

Market Overview:

The global cocoa processing market size reached USD 15.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 16.6 Billion by 2034. The shift towards healthier chocolate formulations, the increasing awareness of the bean-to-bar concept, the rising utilization of cocoa trade and supply chains, the growing artisanal and craft chocolate production, and the incorporation of cocoa in savory dishes are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 15.6 Billion |

|

Market Forecast in 2034

|

USD 16.6 Billion |

Cocoa processing encompasses techniques that transform cocoa beans into diverse products, including cocoa butter, cocoa powder, and chocolate. The process unfolds through multiple stages: sorting, roasting, winnowing, grinding, refining, and conching. During sorting, undesired elements like sticks, leaves, and stones are eliminated from the cocoa beans. Roasting follows, enhancing the beans' flavor and aroma. Post-roasting, winnowing eliminates shells and husks, leaving the nibs. These nibs are then ground into a paste known as cocoa liquor. Further refinement of this liquor may involve alkali addition to lower acidity, pressing to separate cocoa butter from solids, and grinding into cocoa powder. The final phase, conching, amalgamates, aerates, and refines chocolate with diverse ingredients, enhancing its flavor, texture, and shelf life. As a result, this process, celebrated globally, provides an unparalleled taste experience cherished by chocolate enthusiasts.

To get more information on this market Request Sample

The global market is majorly driven by the increasing demand for chocolate products. In line with this, the rising consumer preference for premium chocolates is significantly contributing to the market. Furthermore, the expanding applications in the food industry and the inflating disposable incomes are positively influencing the market. Apart from this, the rapid technological advancements in cocoa processing machinery and the growing adoption of sustainable and eco-friendly processing methods are catalyzing the market. The growth of the confectionery industry and the emergence of new and innovative chocolate flavors are offering numerous opportunities for the market. Moreover, the escalating popularity of functional and organic chocolates and the increasing demand for cocoa-derived ingredients in cosmetics and pharmaceuticals are catalyzing the market. Besides, the expansion of the bakery and pastry sector and the growing trend of cocoa-based beverages are propelling the market. Additionally, the escalating demand for specialty chocolates for gifting purposes and the increasing use of cocoa powder in health and wellness products are providing a boost to the market.

Cocoa Processing Market Trends/Drivers:

Increasing demand for ethically sourced and certified cocoa

The escalating demand for ethically sourced and certified cocoa is stimulating market growth. Consumers are increasingly conscious of the social and environmental impact of their purchases, prompting a shift towards products that uphold ethical practices. Ethically sourced and certified cocoa assures consumers that the raw material has been produced responsibly and sustainably, encompassing fair labor practices, environmentally friendly cultivation methods, and avoiding child labor. In response to this demand, cocoa processing companies actively seek partnerships with certified producers and adhere to stringent ethical standards. These practices align with consumer values and allow companies to access premium markets and showcase their commitment to social responsibility. As ethical considerations become integral to purchasing decisions, the preference for ethically sourced and certified cocoa drives market expansion, fostering positive industry changes and setting a course for sustainable growth.

Growth of the chocolate tourism industry

The growth of the chocolate tourism industry is creating a positive outlook for the market. Chocolate tourism capitalizes on individuals' fascination with chocolate-making, from cocoa beans to delectable treats. Travelers seek immersive experiences that allow them to witness the intricate stages of cocoa processing firsthand, often including visits to cocoa plantations, processing factories, and chocolate museums. As this trend gains momentum, it fuels greater interest in cocoa and its journey to becoming chocolate. The demand for high-quality, ethically sourced, and expertly processed cocoa rises with the interest in chocolate tourism. This growing market segment propels cocoa processors to maintain the highest production and quality standards, as visitors' experiences directly influence their preferences and purchasing decisions. The symbiotic relationship between chocolate tourism and cocoa processing ensures that the latter continually strives for excellence, innovation, and sustainable practices. This dynamic interplay contributes significantly to the market, meeting the evolving expectations of travelers while nurturing an appreciation for the intricate craft of chocolate production.

Development of innovative cocoa-based snacks and confections

The development of innovative cocoa-based snacks and confections is offering numerous opportunities for the market. Consumers' ever-evolving preferences for novel and indulgent experiences have spurred the creation of various cocoa-infused products beyond traditional chocolates. From energy bars and protein bites to cocoa-dusted nuts and gourmet truffles, cocoa-based snacks and confections continue diversifying. This trend fuels the demand for high-quality cocoa ingredients, challenging cocoa processors to ensure consistent supply and maintain rigorous standards. The pursuit of creating unique flavors, textures, and formats keeps cocoa processors at the forefront of innovation, propelling advancements in cocoa processing techniques and technologies. Moreover, these innovative cocoa-based snacks and confections tap into growing health-conscious and premium markets. As consumers seek healthier alternatives and exquisite treats, the cocoa processing market responds by producing products that align with these preferences. The symbiotic relationship between evolving consumer desires and creative product development stimulates market growth, fostering culinary creativity while expanding the industry's horizons.

Cocoa Processing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global cocoa processing market report, along with forecasts at the global and regional levels from 2026-2034. Our report has categorized the market based on bean type, product type, and application.

Breakup by Bean Type:

To get detailed segment analysis of this market Request Sample

- Forastero

- Criollo

- Trinitario

Forastero dominates the market

The report has provided a detailed breakup and analysis of the market based on the bean type. This includes forastero, criollo, and trinitario. According to the report, forastero represented the largest segment.

Forastero beans, known for their robustness and high yields, constitute a substantial portion of global cocoa production. Their ability to thrive in various climates and resist diseases makes them a preferred choice for cocoa cultivation in many regions. As the demand for cocoa and cocoa-based products continues to increase, the Forastero bean type stands out due to its reliable production capacity and accessibility. Cocoa processors actively source and process Forastero beans to meet the increasing global demand for chocolate and related products. Moreover, technological advancements in processing techniques allow cocoa processors to extract the best qualities from Forastero beans, ensuring the production of high-quality cocoa ingredients.

Breakup by Product Type:

- Cocoa Butter

- Cocoa Liquor

- Cocoa Powder

Cocoa liquor dominates the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cocoa butter, cocoa liquor, and cocoa powder. According to the report, cocoa liquor represented the largest segment.

Cocoa liquor, or cocoa mass or paste, is a fundamental ingredient in chocolate products and confections. Its versatile nature enables its use in traditional and innovative recipes, making it a cornerstone of the chocolate industry. It results from the initial grinding and refining stages of cocoa processing, where cocoa nibs are transformed into a smooth paste. This paste becomes the foundation for creating a wide range of chocolate products, from bars and truffles to beverages and bakery items. Its consistency and flavor profile are critical factors in determining the final chocolate product's taste, texture, and quality.

The sustained demand for high-quality cocoa liquor underscores its importance in meeting the diverse preferences of consumers. As the chocolate market evolves to cater to health-conscious, premium, and unique flavor-seeking consumers, cocoa processors continually refine their processing methods to ensure the excellence and consistency of cocoa liquor. This unwavering focus on cocoa liquor quality contributes significantly to the market growth by enabling the creation of a wide array of delightful and indulgent chocolate products.

Breakup by Application:

- Confectionary

- Bakery

- Beverages

- Pharmaceuticals

- Others

Confectionary dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes confectionary, bakery, beverages, pharmaceuticals, and others. According to the report, confectionary represented the largest segment.

Confectionery, which includes a wide range of sweet treats like chocolates, truffles, pralines, and more, heavily relies on high-quality cocoa ingredients to deliver indulgent flavors and textures. Cocoa processing plays a pivotal role in providing the foundation for confectionery creations. The transformation of cocoa beans into cocoa liquor, cocoa butter, and cocoa powder forms the basis for producing various confectionery delights. Cocoa liquor contributes to the rich, smooth taste of chocolates, while cocoa butter lends a luxurious mouthfeel, and cocoa powder adds depth of flavor.

As consumer tastes evolve and diversify, the confectionery sector responds with innovative products that cater to different dietary preferences, premium experiences, and unique flavors. Cocoa processing companies adapt to these trends by ensuring the availability of specialized cocoa ingredients that meet the demands of confectionery manufacturers.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- Europe

- Africa

- North America

- Latin America

- Asia Pacific

Europe exhibits a clear dominance, accounting for the largest market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Europe, Africa, North America, Latin America, and Asia Pacific. According to the report, Europe was the largest market for cocoa processing.

Europe has a rich history of chocolate consumption and confectionery craftsmanship, making it a significant hub for cocoa processing and production. The region's influence on the cocoa processing industry is substantial, with numerous renowned chocolate brands and a deep-rooted appreciation for quality and tradition.

European consumers have consistently demonstrated a penchant for premium and artisanal chocolate products. This demand has prompted cocoa processors in the region to continuously innovate and refine their techniques to meet the evolving preferences of their customer base. The European chocolate industry's commitment to quality and authenticity drives the need for superior cocoa ingredients, propelling the cocoa processing market forward.

Furthermore, the region's emphasis on sustainability, ethical sourcing, and organic production aligns well with modern consumer values. Cocoa processors in Europe actively partner with cocoa farmers and invest in sustainable practices to ensure a responsible supply chain.

As the confectionery market remains a global benchmark for quality and innovation, the cocoa processing market finds a strong foothold in this region. The interaction between Europe's rich chocolate heritage, evolving consumer preferences, and commitment to sustainability drives the industry's growth.

Competitive Landscape:

Top companies are bolstering market growth through strategic initiatives, technological advancements, and commitment to sustainability. These industry leaders invest extensively in research and development to enhance cocoa processing techniques, resulting in higher yields, superior quality, and innovative products. By optimizing processing methods, they cater to the evolving demands of consumers for ethically sourced, organic, and unique cocoa-based offerings. Furthermore, these companies prioritize sustainable practices, partnering with cocoa farmers to improve cultivation techniques, promote fair labor conditions, and minimize environmental impact. This ensures a consistent supply of high-quality cocoa and resonates with conscientious consumers. In addition to these efforts, their global reach and distribution networks facilitate the dissemination of processed cocoa products to diverse markets. The top companies engage with consumers through branding, marketing, and education initiatives, raising awareness about the journey from bean to bar.

The report has provided a comprehensive analysis of the competitive landscape in the cocoa processing market. Detailed profiles of all major companies have also been provided.

- Guan Chong Berhad

- Ecom Agroindustrial Corp. Limited

- Nestlé SA

- Barry Callebaut Group

- Blommer Chocolate Company

- Mondelez International

- Cargill Incorporated

- Olam Group Limited

- Touton S.A.

Recent Developments:

- July 2025: Cote d’Ivoire announced the launch of a $233 million cocoa processing factory, marking a major step in boosting local value addition. The facility aims to transform more of the country's cocoa domestically instead of exporting raw beans. This move supports economic growth and job creation in Africa's top cocoa-producing nation.

- June 2025: Cocoa farmers in Kyela District, Tanzania, launched a project to build a local cocoa processing plant funded by farmer contributions to add value and increase revenues. The initiative aims to reduce raw cocoa exports and improve farmers' earnings by processing cocoa locally. The government supports the project, encouraging land acquisition and market development for processed products.

- February 2025: Nigerian cocoa processor Johnvents secured $40.5 million from the UK’s British International Investment to expand its processing capacity to 30,000 metric tons annually. The investment will fund factory upgrades in Ondo State and support sustainability goals. By 2027, 90% of its cocoa is expected to be Rainforest Alliance certified.

- January 2025: Malaysia announced the Malaysian International Cocoa Fair (MICF) 2025, set for May 24-27 in Sabah, a key cocoa production region. The event aims to promote Malaysia’s cocoa industry globally through exhibitions, conferences discussing cocoa processing technology, and networking. Supported by international organizations, MICF 2025 seeks to revive Malaysia’s role as a leading cocoa hub in Asia.

Cocoa Processing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Bean Types Covered | Forastero, Criollo, Trinitario |

| Product Types Covered | Cocoa Butter, Cocoa Liquor, Cocoa Powder |

| Applications Covered | Confectionary, Bakery, Beverages, Pharmaceuticals, Others |

| Regions Covered | Europe, Africa, North America, Latin America, Asia Pacific |

| Companies Covered | Guan Chong Berhad, Ecom Agroindustrial Corp. Limited, Nestlé SA, Barry Callebaut Group, Blommer Chocolate Company, Mondelez International, Cargill Incorporated, Olam Group Limited, Touton S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the cocoa processing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global cocoa processing market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the cocoa processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global cocoa processing market was valued at USD 15.6 Billion in 2025.

The rising demand for cocoa-based food products owing to their numerous health benefits in improving metabolism, maintaining blood pressure levels, enhancing cognitive health, etc., is primarily driving the global cocoa processing market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of cocoa-based products.

Based on the product type, the global cocoa processing market has been divided into cocoa butter, cocoa liquor, and cocoa powder. Among these, cocoa butter currently exhibits a clear dominance in the market.

Based on the application, the global cocoa processing market can be bifurcated into confectionary, bakery, beverages, pharmaceuticals, and others. Currently, confectionary holds the largest market share.

On a regional level, the market has been classified into Europe, Africa, North America, Latin America, and Asia Pacific.

Some of the major players in the global cocoa processing market include Guan Chong Berhad, Ecom Agroindustrial Corp. Limited, Nestlé SA, Barry Callebaut Group, Blommer Chocolate Company, Mondelez International, Cargill Incorporated, Olam Group Limited, Touton S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)